Antiseptics and Disinfectant Market by Type (Quaternary Ammonium Compounds), Product (Enzymatic Cleaners), Sales Channel (Fmcg, B2B), End Suer (Hospitals, Clinics), Region - Forecast to 2027

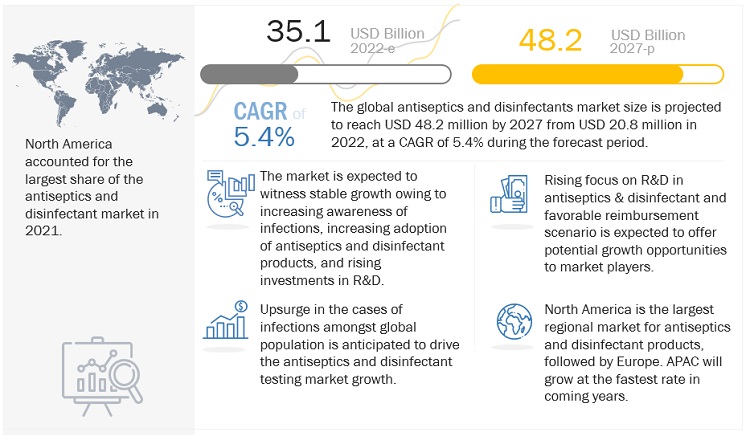

The global antiseptics and disinfectants market size is projected to reach USD 48.2 million by 2027 from USD 35.1 million in 2022, at a CAGR of 10.0% during the forecast period. Market is driven by factors such as global prevalence of infectious diseases, increased incidence of HAIs and the growing awareness for sanitization and infection control. On the other hand, an rising number of adverse effects due to chemical antiseptics and disinfectants is expected to limit market growth to a certain extent in the coming years.

To know about the assumptions considered for the study, Request for Free Sample Report

“The quaternary ammonium compunds accounted for the largest market share in the antiseptics and disinfectants market, type, during the forecast period”

The antiseptics and disinfectants market is segmented into quaternary ammonium coumpunds, chlorine compounds, alcohol / aldehyde, enzyme and others. In 2021, quaternary ammonium coumpunds accounted for a sizable market share. However, HAI infection is expected to increase significantly between which will drive the market growth.

“Medical device disinfectants segment accounted for the largest market share”

Based on product, the antiseptics and disinfectants market is segmented into enzymatic claners, medical device disinfectants and surface disinfectants. The medical device disinfectants segment accounted for the largest market share in 2021. Growing awareness of sanitization and hygiene due spread of diseases like COVID-19 can drive the market.

“B2B segment accounted for the largest market share”

Based on sales channel, the antiseptics and disinfectants market is segmented into FMCG and B2B. The B2B segment accounted for the largest market share in 2021. The market growth can be attributed to the rising demand for infection control measures to curb the occurrence of hospital acquired infections.

“Hospitals segment accounted for the largest market share”

Based on end user, the antiseptics and disinfectantsmarket is segmented into hospitals, clinics and others. The hospitals segment accounted for the largest market share in 2021. The market growth can be attributed to the increasing number of surgical procedures across the globe.

“APAC region accounted for the highest CAGR”

The global antiseptics and disinfectantsmarket is divided into five regions: North America, Asia-Pacific, Europe, Latin America, and the Middle East and Africa. According to the regional analysis, the Asia-Pacific region is likely to retain a significant market growth in 2021 and the future. The Asia-Pacific antiseptics and disinfectantsmarket is being propelled by an increase in the public awareness on infection control, increase in patient care, increased number of medical procedures, and rising initiatives for R&D of anticeptics and disinfectants. North America, on the other hand, will experience significant growth in the coming years due to the presence of key players, the availability of technologically advanced products, and the rising adoption of point of care testing.

The primary interviews conducted for this report can be categorized as follows:

- By Company Type: Tier 1 - 40%, Tier 2 - 30%, and Tier 3 - 30%

- By Designation: C-level - 27%, D-level - 18%, and Others - 55%

- By Region: North America - 51%, Europe - 21%, Asia Pacific - 18%, Latin America – 6% , and the Middle East & Africa – 4%

To know about the assumptions considered for the study, download the pdf brochure

Lits of Companies Profiled in the Report:

- 3M (US)

- RECKITT BENCKISER (UK)

- STERIS PLC (US)

- KIMBERLY CLARK CORPORATION (us)

- BIO-CIDE INTERNATIONAL (US)

- CARDINAL HEALTH (US)

- BECTON DICKINSON AND COMPANY (US)

- JOHNSON & JOHNSON (US)

- PAUL HARTMANN AG (Germany)

- CANTEL MEDICAL CORPORATION (US)

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS OF THE STUDY

1.2.2 MARKETS COVERED

1.2.3 YEARS CONSIDERED FOR THE STUDY

1.3 CURRENCY

1.4 LIMITATIONS

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

2.1 RESEARCH DATA

2.2 RESEARCH APPROACH

2.2.1 SECONDARY DATA

2.2.1.1 Key data from secondary sources

2.2.2 PRIMARY DATA

2.2.2.1 Key data from primary sources

2.2.2.2 Key industry insights

2.3 MARKET SIZE ESTIMATION

2.3.1 BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

2.4 MARKET BREAKDOWN & DATA TRIANGULATION

2.5 ASSUMPTIONS FOR THE STUDY

2.6 GROWTH RATE ASSUMPTIONS

2.7 LIMITATIONS

2.8 RISK ASSESSMENT

2.9 COVID-19 HEALTH ASSESSMENT

2.10 COVID-19 ECONOMIC ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Rising demand for infection control measures to curb the occurrence of hospital acquired infections

5.2.1.2 Growing awareness of sanitization and hygiene due spread of infectious diseases like COVID-19

5.2.1.3 The increasing number of surgical procedures across the globe

5.2.1.3 Increase in R&D expenditure

5.2.2 RESTRAINTS

5.2.2.1 Increasing development of alternative technologies

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing healthcare expenditure and focus in emerging countries

5.2.4 CHALLENGES

5.2.4.1 Rising number of adverse effects of chemical antiseptics and disinfectants

5.4 PRICING ANALYSIS

5.5 PATENT ANALYSIS

5.6 TRADE ANALYSIS

5.7 VALUE CHAIN ANALYSIS

5.8 SUPPLY CHAIN ANALYSIS

5.9 ECOSYSTEM ANALYSIS OF ANTISEPTICS AND DISINFECTANTS MARKET

5.10 PORTER’S FIVE FORCES ANALYSIS

5.11 PESTLE ANALYSIS

5.12 REGULATORY LANDSCAPE

5.13 TECHNOLOGY ANALYSIS

5.14 DISRUPTIVE TECHNOLOGIES IN ANTISEPTICS AND DISINFECTANTS MARKET

6 GLOBAL ANTISEPTICS AND DISINFECTANTS MARKET, BY TYPE (USD MILLION)

6.1 INTRODUCTION

6.2 QUATERNARY AMMONIUM COMPOUNDS

6.3 CHLORINE COMPOUNDS

6.4 ALCOHOL / ALDEHYDE PRODUCTS

6.5 ENZYME

6.6 OTHER ANTISEPTICS AND DISINFECTANTS

7 GLOBAL ANTISEPTICS AND DISINFECTANTS MARKET, BY PRODUCT (USD MILLIONS)

7.1 INTRODUCTION

7.2 ENZYMATIC CLEANERS

7.3 MEDICAL DEVICE DISINFECTATS

7.4 SURFACE DISINFECTANTS

8 GLOBAL ANTISEPTICS AND DISINFECTANTS MARKET, BY SALES CHANNEL

8.1 INTRODUCTION

8.2 FMCG

8.3 B2B

9 GLOBAL ANTISEPTICS AND DISINFECTANTS MARKET, BY END USER

9.1 INTRODUCTION

9.2 HOSPITALS

9.3 CLINICS

9.4 OTHERS

10 GLOBAL ANTISEPTICS AND DISINFECTANTS MARKET, BY REGION

10.1 INTRODUCTION

10.2 NORTH AMERICA

10.2.1 US

10.2.2 CANADA

10.3 EUROPE

10.3.1 GERMANY

10.3.2 UK

10.3.3 FRANCE

10.3.4 ITALY

10.3.5 SPAIN

10.3.6 REST OF EUROPE

10.4 ASIA PACIFIC

10.4.1 CHINA

10.4.2 JAPAN

10.4.3 INDIA

10.4.4 REST OF ASIA PACIFIC

10.5 LATIN AMERICA

10.6 MIDDLE EAST & AFRICA

11 COMPETITIVE LANDSCAPE

11.1 OVERVIEW

11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

11.3 REVENUE SHARE ANALYSIS OF THE TOP MARKET PLAYERS

11.4 MARKET SHARE ANALYSIS

11.5 COMPANY EVALUATION QUADRANT

11.6 COMPANY EVALUATION QUADRANT FOR STARTUPS/SMES (2020)

11.7 COMPETITIVE BENCHMARKING

11.8 COMPETITIVE SCENARIO

12 COMPANY PROFILES

12.1 KEY PLAYERS

(Business Overview, Products and Services Offered, Recent Developments, MnM View, Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) *

12.1.1 3M

12.1.2 RECKITT BENCKISER

12.1.3 STERIS PLC

12.1.4 KINBERLY CLARK CORPORATION

12.1.5 BIO-CIDE INTERNATIONAL

12.1.6 CARDINAL HEALTH

12.1.7 BECTON DICKINSON AND COMPANY

12.1.8 JOHNSON & JOHNSON

12.1.9 PAUL HARTMANN AG

12.1.10 CANTEL MEDICAL CORPORATION

*Details on Business Overview, Products and Services Offered, Recent Developments, MnM View, Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats might not be captured in case of unlisted companies.

13 APPENDIX

13.1 INDUSTRY INSIGHTS

13.2 DISCUSSION GUIDE

13.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.4 AVAILABLE CUSTOMIZATIONS

13.5 RELATED REPORTS

13.6 AUTHOR DETAILS

Growth opportunities and latent adjacency in Antiseptics and Disinfectant Market