Anti-Foaming Agents Market

The global anti-foaming agents market has been estimated to be USD XX billion in 2024 and is projected to grow at XX% between 2024 and 2029. The global market is a critical component of the food processing industry, as it plays a pivotal role in enhancing the quality, texture, and appearance of various food and beverage products. Antifoaming agents are used to reduce or prevent the formation of unwanted foam during food production processes such as mixing, fermentation, and packaging. The demand for these agents is driven by the growing food and beverage industry, particularly in regions such as North America, Europe, and the Asia Pacific. With applications across a wide range of products, including dairy, oils and fats, bakery and confectionery, processed foods, beverages, and sugar processing, the market is witnessing significant growth. Factors such as rising consumer demand for processed foods, increased production efficiency, and the need for improved product consistency are propelling the market forward. The market is also evolving with advancements in product formulations, focusing on natural and sustainable ingredients to meet the demands of health-conscious consumers.

Market Dynamics

Drivers: Growth in the Food & Beverage Sector

The expanding global food and beverage industry significantly drives the demand for anti-foaming agents, especially in developing regions where industrialization and consumption are on the rise. Foam formation can be a major issue during various stages of food and beverage production, such as fermentation, brewing, blending, bottling, and packaging. Excessive foam can reduce the efficiency of these processes, slowing down production, affecting product quality, and leading to ingredient waste. For instance, in fermentation, foaming occurs as a natural byproduct of microbial activity, particularly in the production of beverages such as beer, wine, and soft drinks. The use of anti-foaming agents helps control foam levels, ensuring optimal fermentation conditions and preventing overflow in fermentation vessels.

Similarly, in brewing and bottling, foam can disrupt the filling process, causing spillage and underfilling, which impacts both product consistency and packaging efficiency. Anti-foaming agents streamline these processes, improving throughput and reducing downtime caused by foam-related issues.

Furthermore, with the growing demand for ready-to-eat and processed foods, there is an increasing need for smooth manufacturing processes in food production facilities. Controlling foam is essential for ensuring that liquid-based products, such as sauces, soups, oils, and dairy products, are processed efficiently without contamination or defects caused by foam. This demand is particularly evident in developing markets, where urbanization, rising disposable incomes, and changing lifestyles are boosting the consumption of processed and packaged foods.

Restraints: Potential Health and Environmental Concerns

In the food and pharmaceutical industries, safety is of utmost importance. Some synthetic anti-foaming agents, particularly those containing silicones or mineral oils, may pose health risks if they are not completely removed during processing. For instance, any residues left in food products could potentially harm health if ingested over time. Although these compounds are generally recognized as safe (GRAS) in limited quantities, excessive or improper use can lead to unintended chemical ingestion, raising concerns about long-term health effects.

In the pharmaceutical sector, where products are often ingested or applied directly to the body, even trace amounts of chemical residues from anti-foaming agents can raise toxicity concerns. Consequently, manufacturers in these fields must adhere to strict regulatory standards to ensure that anti-foaming agents used in production are safe for human consumption or use. This has led to a growing interest in developing food-grade, pharmaceutical-grade, and natural alternatives that are both safe and effective.

Opportunities: Increasing Adoption of Bio-based Anti-foaming Agents

Traditional anti-foaming agents, such as those made from silicone or petroleum-based chemicals, often raise environmental concerns due to their non-biodegradable nature and potential to pollute water and soil. In contrast, bio-based defoamers are derived from renewable and biodegradable resources, such as plant oils, vegetable-based compounds, and natural waxes. These agents break down more easily in the environment, which reduces their ecological impact, making them an attractive option for industries looking to lower their carbon footprint. Many countries are tightening regulations to minimize the environmental harm caused by industrial waste, particularly in sectors like agriculture, food and beverages, pharmaceuticals, and personal care. The growing demand for anti-foaming agents that adhere to green chemistry principles—which focus on reducing toxicity and ensuring safety for both the environment and human health—has encouraged companies to adopt bio-based alternatives. These products assist companies in meeting regulatory requirements for wastewater treatment and emission control, helping to ensure compliance with laws designed to limit the release of harmful chemicals into the environment.

The rise in consumer awareness and demand for natural and organic products, especially in the food and beverage and cosmetics sectors, is driving the shift toward bio-based defoamers. Consumers are increasingly scrutinizing product labels for artificial or potentially harmful additives and favoring brands that prioritize clean-label formulations using plant-based ingredients. This preference for natural products has created a lucrative opportunity for bio-based anti-foaming agents, which align with the ethical and sustainability values of both companies and consumers. For example, bio-based defoamers made from vegetable oils or natural fatty acids can be used in food processing applications where foam control is critical, such as in the production of beverages, dairy products, and processed foods. These natural defoamers help reduce foam without introducing synthetic chemicals into the food supply chain, making them an ideal choice for manufacturers aiming to offer healthier, eco-friendly food products.

Challenges: Complex Formulation Requirements

In various industries, particularly in food and pharmaceuticals, anti-foaming agents must adhere to strict regulatory standards and obtain certifications to ensure their safety for use. For instance, in food processing, defoamers must comply with FDA or EFSA regulations, which guarantee that they are safe for direct or indirect contact with food. This compliance can limit the selection of raw materials and additives available for manufacturers when formulating products, making the development process more complex. The challenge intensifies when manufacturers need to create global formulations that meet different regional standards. A product that is deemed safe and effective in one country may require modifications to align with safety regulations in another, thereby increasing the complexity of both the product formulation and the global launch strategy. While customized formulations are crucial to address the specific foam control needs of different industries, manufacturers also face the challenge of balancing performance with cost-effectiveness. Customers expect anti-foaming agents to provide high efficacy, ensure smooth process flow, and minimize production downtime caused by foam-related issues, all while remaining competitively priced. Thus, manufacturers must optimize their formulations to achieve the desired performance without significantly raising costs, which necessitates a careful balance of ingredient selection, manufacturing processes, and supply chain efficiencies.

Market Ecosystem

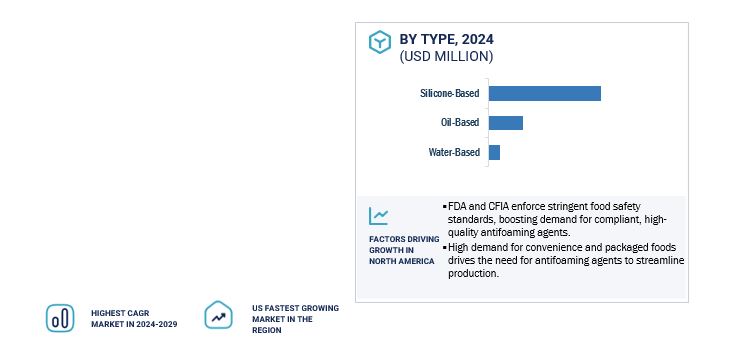

The silicone-based antifoaming agents in the product type segment accounted the largest during the forecast period.

In the food and beverage sector, silicone-based antifoaming agents dominate the market due to their effectiveness in preventing foam formation during food processing and production. These agents are highly efficient at low concentrations and offer stability under varying temperatures, making them ideal for use in industries such as dairy processing, brewing, juice production, and food packaging. The demand for silicone-based antifoaming agents in food and beverage applications is driven by their inert properties, ensuring they do not react with food products, thus maintaining product quality and safety standards. Additionally, their ease of incorporation into various production stages and compliance with food-grade safety regulations further cements their widespread usage in this sector.

In terms of application, beverage segment account for the largest share of the Anti-foaming agents market

In the food and beverage antifoaming agent market, the beverage segment holds the largest market share. This is driven by the high consumption of beverages such as carbonated drinks, fruit juices, and alcoholic beverages, which require antifoaming agents to prevent excessive foam formation during production, bottling, and packaging processes. The need to maintain product consistency, quality, and efficiency in high-volume production processes in the beverage industry further bolsters the demand for antifoaming agents in this segment.

The North America region holds major share in Anti-foaming agents market during the forecast period.

The North American region holds the largest market share, primarily due to the high demand for food and beverage products in countries like the United States and Canada. This region's extensive food processing industry, coupled with the significant consumption of processed foods, dairy products, and beverages, drives the demand for antifoaming agents. Additionally, North America has a well-established food and beverage manufacturing infrastructure, where the need for antifoaming agents is integral to maintaining production efficiency and quality.

Key Market Players

The key players in this market include Evonik Industries AG, BASF SE, Ashland Global Holdings Inc., Clariant AG, The Dow Chemical Company, Wacker Chemie AG, Shin-Etsu Chemical Co., Ltd., Ecolab Inc., Accepta, Synalloy Chemicals, AB Specialty Silicones, Applied Material Solutions, Inc., Chardon Labs, Lonza Consumer Product Ingredients, and Tri-Chem Industries.

Recent Developments

- In October 2023, Evonik introduced a new defoaming agent that represents a major advancement in the industry. This product blends the properties of silicone and bio-based materials, specifically designed for water-based ink and coating applications. The incorporation of innovative mixing technology further enhances the agent's effectiveness, ensuring superior performance in foam suppression.

- In May 2021, Cambridge Commodities released Librifoam, a silicone anti-foaming agent for food and beverages, health and wellness, and sports nutrition.

Frequently Asked Questions (FAQ):

Which region is projected to account for the largest share in the anti-foaming agents market?

North America dominated the anti-foaming agents market, worth USD XX billion in 2024, and is projected to reach USD XX billion by 2029, at a CAGR of XX% during the forecast period.

What is the current size of the global anti-foaming agents market?

The global anti-foaming agents market was valued at USD XX billion in 2024. It is projected to reach USD XX billion by 2029, recording a CAGR of XX% during the forecast period.

Who are the key players in the market?

The key players in this market Evonik Industries AG, BASF SE, Ashland Global Holdings Inc., Clariant AG, The Dow Chemical Company, Wacker Chemie AG, Shin-Etsu Chemical Co., Ltd., Ecolab Inc., Accepta, Synalloy Chemicals, AB Specialty Silicones, Applied Material Solutions, Inc., Chardon Labs, Lonza Consumer Product Ingredients, and Tri-Chem Industries.

What are the factors driving the anti-foaming agents market?

- Rising demand for processed and packaged foods – Increasing consumer preference for ready-to-eat and convenience foods boosts the need for antifoaming agents.

- Growth in the beverage industry – The rising consumption of beverages, including soft drinks, alcoholic beverages, and dairy drinks, drives the use of antifoaming agents.

- Technological advancements – Innovations in antifoaming agent formulations, such as silicone-based and bio-based products, enhance performance and environmental sustainability.

- Need for improved production efficiency – Antifoaming agents help optimize food production processes, reducing wastage and increasing output efficiency.

- Health and wellness trends – Growing consumer demand for clean-label, non-toxic, and sustainable food ingredients influences the adoption of safer, more natural antifoaming solutions.

Which segment accounted for the largest anti-foaming agents market share?

Silicon based anti-foaming agent accounted for the largest market share in the product type in the forecast period.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Growth opportunities and latent adjacency in Anti-Foaming Agents Market