Animal Treatment Market by Animal Type (Dogs, Cats, Horses, Cattle, Pigs, Poultry) & Treatment Type (No Medicalization, Basic Medicalization, Veterinary Care), Country (US, Canada, Germany, UK, France, Spain, Italy, Russia, Austria, Poland, Netherlands, Turkey, Bulgaria, China, India, Japan, Australia, India, South Korea, Thailand, Saudi Arabia) - Global Forecast to 2024

Market Growth Outlook Summary

The global animal healthcare market growth forecasted to transform from ~$40 billion in 2018 to ~$50 billion by 2024, driven by a CAGR of ~6%. The growth of this market can be attributed to increasing government initiatives, which ensure maximum preventive healthcare in animals. A majority of the developed economies have norms that impel owners to have pet insurance.

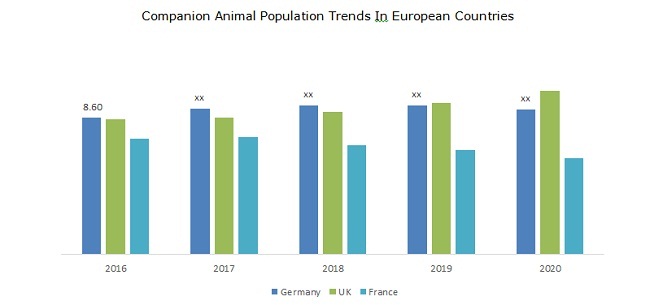

Companion Animal Population Trends In European Countries

To know about the assumptions considered for the study, Request for Free Sample Report

On the basis of animal type, the animal treatment market is segmented into dogs, cats, pigs, poultry, cattle, and horses. The poultry segment will receive maximum veterinary care in the coming years. Earlier, the health of poultry was neglected to a greater extent. Chickens having underlying conditions were discarded without providing any veterinary treatment. However, with various animal cruelty acts in place, the mortality rate in poultry has decreased.

Based on the type of treatment, the animal treatment market is segmented into no medicalization, basic medicalization, and veterinary care. There has been a considerable decline in the percentage of animals receiving no medicalization, due to the rising awareness regarding the availability of reimbursement for veterinary services. As a result, owners have started prioritizing the health of their companion animals.

The market in Europe is expected to witness significant growth during the forecast period. European countries such as Germany, the UK, and France have shown positive trends in terms of companion animals receiving preventive healthcare. The number of dogs and cats receiving vaccination and treatment in these countries has increased. This trend is projected to continue until the end of 2024. Furthermore, in the case of livestock, animal welfare authorities have assigned diligent veterinarians for farms to assure maximum preventive healthcare.

The leading players in the animal treatment market are Zoetis (US), Merck (US), Boehringer Ingelheim (Germany), Elanco (US), Ceva (France), Phibro Animal Health Corporation (US), Abaxis (US), Virbac SA (France), IDEXX Laboratories, Inc. (US), Neogen Corporation (US), and Heska Corporation (US). These players are pursuing various strategies such as mergers, acquisitions, product launches, and geographical expansions to further increase their shares in the animal treatment market.

Scope of the Animal Treatment Industry:

|

Report Metric |

Details |

|

Market Revenue Size in 2018 |

~$40 billion |

|

Projected Revenue Size by 2024 |

~$50 billion |

|

Industry Growth Rate |

Poised to grow at a CAGR of ~6% |

|

Market Driver |

Forthcoming trends |

|

Market Opportunity |

Emerging economies |

The study categorizes the Animal Treatment Market to forecast revenue and analyze trends in each of the following submarkets:

By Animal Type

- Dogs

- Cats

- Cattle

- Pigs

- Horses

- Poultry

By Treatment

- No Medicalization

- Basic Medicalization

- Veterinary Care

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Switzerland

- Spain

- Russia

- Poland

- Austria

- Netherlands

- Turkey

-

Asia Pacific (APAC)

- China

- India

- Japan

- South Korea

- Australia

- Thailand

- Middle East and Africa

- Saudi Arabia

Recent Developments of Animal Treatment Industry

- In June 2016, Abaxis partnered with the American Animal Hospital Association (AAHA) to develop a wellness testing initiative that is focused on improving compliance for blood diagnostic testing.

- In June 2016, IDEXX Laboratories launched a Rapid Visual Pregnancy Test for cattle, a point-of-care test that can detect a cow 28 days post-breeding, improving reproductive efficacy, and profitability.

- In January 2017, Neogen launched the Igenity Brangus profiler, a DNA test for the profiling and selection of commercial replacement heifers, in partnership with the International Brangus Breeders Association (IBBA). This launch helped Neogen to diversify and grow its genomic testing portfolio and services.

- In August 2016, Zoetis acquired Scandinavian Micro Biodevices (SMB, Denmark), a manufacturer of point-of-care (POC) solutions for use in veterinary clinics and farms. This acquisition was valued at USD 80 million.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global animal healthcare market?

The global animal healthcare market boasts a total revenue value of ~$50 billion by 2024.

What is the estimated growth rate (CAGR) of the global animal healthcare market?

The global animal healthcare market has an estimated compound annual growth rate (CAGR) of ~6% and a revenue size in the region of ~$40 billion in 2018.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

2 RESEARCH METHODOLOGY

2.1 SECONDARY RESEARCH

2.2 PRIMARY RESEARCH

2.3 ANALYSIS + OUTPUT

3 ANIMAL HEALTHCARE - KEY INSIGHTS

3.1 COMPANION ANIMAL DIAGNOSTICS MARKET

3.2 VETERINARY VACCINES MARKET

3.3 VETERINARY EQUIPMENT AND DISPOSABLES MARKET

3.4 VETERINARY REFERENCE LABORATORIES MARKET

3.5 VETERINARY IMAGING MARKET

4 ANIMAL HEALTHCARE MEDICALIZATION, BY COUNTRY

4.1 EUROPE

4.1.1 UK

4.1.2 GERMANY

4.1.3 FRANCE

4.1.4 RUSSIA

4.1.5 ITALY

4.1.6 SPAIN

4.1.7 AUSTRIA

4.1.8 TURKEY

4.1.9 POLAND

4.1.10 BULGARIA

4.1.11 NETHERLANDS

4.2 ASIA PACIFIC

4.2.1 INDIA

4.2.2 CHINA

4.2.3 JAPAN

4.2.4 SOUTH KOREA

4.2.5 THAILAND

4.2.6 AUSTRALIA

4.3 NORTH AMERICA

4.3.1 US

4.3.2 CANADA

4.4 SAUDI ARABIA

5 APPENDIX

5.1 KNOWLEDGE STORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

5.2 AUTHOR DETAIL

LIST OF TABLES (67 Tables)

TABLE 1 MARKET DEFINITION

TABLE 2 COUNTRIES COVERED

TABLE 3 EUROPE: PERCENTAGE OF ANIMALS RECEIVING NO MEDICALIZATION

TABLE 4 EUROPE: PERCENTAGE OF ANIMALS RECEIVING BASIC MEDICALIZATION

TABLE 5 EUROPE: PERCENTAGE OF ANIMALS UNDER VETERINARY CARE

TABLE 6 UK: PERCENTAGE OF ANIMALS RECEIVING NO MEDICALIZATION

TABLE 7 UK: PERCENTAGE OF ANIMALS RECEIVING BASIC MEDICALIZATION

TABLE 8 UK: PERCENTAGE OF ANIMALS UNDER VETERINARY CARE

TABLE 9 GERMANY: PERCENTAGE OF ANIMALS RECEIVING NO MEDICALIZATION

TABLE 10 GERMANY: PERCENTAGE OF ANIMALS RECEIVING BASIC MEDICALIZATION

TABLE 11 GERMANY: PERCENTAGE OF ANIMALS UNDER VETERINARY CARE

TABLE 12 FRANCE: PERCENTAGE OF ANIMALS RECEIVING NO MEDICALIZATION

TABLE 13 FRANCE: PERCENTAGE OF ANIMALS RECEIVING BASIC MEDICALIZATION

TABLE 14 FRANCE: PERCENTAGE OF ANIMALS UNDER VETERINARY CARE

TABLE 15 RUSSIA: PERCENTAGE OF ANIMALS RECEIVING NO MEDICALIZATION

TABLE 16 RUSSIA: PERCENTAGE OF ANIMALS RECEIVING BASIC MEDICALIZATION

TABLE 17 RUSSIA: PERCENTAGE OF ANIMALS UNDER VETERINARY CARE

TABLE 18 ITALY: PERCENTAGE OF ANIMALS RECEIVING NO MEDICALIZATION

TABLE 19 ITALY: PERCENTAGE OF ANIMALS RECEIVING BASIC MEDICALIZATION

TABLE 20 ITALY: PERCENTAGE OF ANIMALS UNDER VETERINARY CARE

TABLE 21 SPAIN: PERCENTAGE OF ANIMALS RECEIVING NO MEDICALIZATION

TABLE 22 SPAIN: PERCENTAGE OF ANIMALS RECEIVING BASIC MEDICALIZATION

TABLE 23 SPAIN: PERCENTAGE OF ANIMALS UNDER VETERINARY CARE

TABLE 24 AUSTRIA: PERCENTAGE OF ANIMALS RECEIVING NO MEDICALIZATION

TABLE 25 AUSTRIA: PERCENTAGE OF ANIMALS RECEIVING BASIC MEDICALIZATION

TABLE 26 AUSTRIA: PERCENTAGE OF ANIMALS UNDER VETERINARY CARE

TABLE 27 TURKEY: PERCENTAGE OF ANIMALS RECEIVING NO MEDICALIZATION

TABLE 28 TURKEY: PERCENTAGE OF ANIMALS RECEIVING BASIC MEDICALIZATION

TABLE 29 TURKEY: PERCENTAGE OF ANIMALS UNDER VETERINARY CARE

TABLE 30 POLAND: PERCENTAGE OF ANIMALS RECEIVING NO MEDICALIZATION

TABLE 31 POLAND: PERCENTAGE OF ANIMALS RECEIVING BASIC MEDICALIZATION

TABLE 32 POLAND: PERCENTAGE OF ANIMALS UNDER VETERINARY CARE

TABLE 33 BULGARIA: PERCENTAGE OF ANIMALS RECEIVING NO MEDICALIZATION

TABLE 34 BULGARIA: PERCENTAGE OF ANIMALS RECEIVING BASIC MEDICALIZATION

TABLE 35 BULGARIA: PERCENTAGE OF ANIMALS UNDER VETERINARY CARE

TABLE 36 NETHERLANDS: PERCENTAGE OF ANIMALS RECEIVING NO MEDICALIZATION

TABLE 37 NETHERLANDS: PERCENTAGE OF ANIMALS RECEIVING BASIC MEDICALIZATION

TABLE 38 NETHERLANDS: PERCENTAGE OF ANIMALS UNDER VETERINARY CARE

TABLE 39 INDIA: PERCENTAGE OF ANIMALS RECEIVING NO MEDICALIZATION

TABLE 40 INDIA: PERCENTAGE OF ANIMALS RECEIVING BASIC MEDICALIZATION

TABLE 41 INDIA: PERCENTAGE OF ANIMALS UNDER VETERINARY CARE

TABLE 42 CHINA: PERCENTAGE OF ANIMALS RECEIVING NO MEDICALIZATION

TABLE 43 CHINA: PERCENTAGE OF ANIMALS RECEIVING BASIC MEDICALIZATION

TABLE 44 CHINA: PERCENTAGE OF ANIMALS UNDER VETERINARY CARE

TABLE 45 JAPAN: PERCENTAGE OF ANIMALS RECEIVING NO MEDICALIZATION

TABLE 46 JAPAN: PERCENTAGE OF ANIMALS RECEIVING BASIC MEDICALIZATION

TABLE 47 JAPAN: PERCENTAGE OF ANIMALS UNDER VETERINARY CARE

TABLE 48 SOUTH KOREA: PERCENTAGE OF ANIMALS RECEIVING NO MEDICALIZATION

TABLE 49 SOUTH KOREA: PERCENTAGE OF ANIMALS RECEIVING BASIC MEDICALIZATION

TABLE 50 SOUTH KOREA: PERCENTAGE OF ANIMALS UNDER VETERINARY CARE

TABLE 51 THAILAND: PERCENTAGE OF ANIMALS RECEIVING NO MEDICALIZATION

TABLE 52 THAILAND: PERCENTAGE OF ANIMALS RECEIVING BASIC MEDICALIZATION

TABLE 53 THAILAND: PERCENTAGE OF ANIMALS UNDER VETERINARY CARE

TABLE 54 AUSTRALIA: PERCENTAGE OF ANIMALS RECEIVING NO MEDICALIZATION

TABLE 55 AUSTRALIA: PERCENTAGE OF ANIMALS RECEIVING BASIC MEDICALIZATION

TABLE 56 AUSTRALIA: PERCENTAGE OF ANIMALS UNDER VETERINARY CARE

TABLE 57 US: NUMBER OF VETERINARY VISITS PER HOUSEHOLD, 2018

TABLE 58 US: PERCENTAGE OF ANIMALS RECEIVING NO MEDICALIZATION

TABLE 59 US: PERCENTAGE OF ANIMALS RECEIVING BASIC MEDICALIZATION

TABLE 60 US: PERCENTAGE OF ANIMALS UNDER VETERINARY CARE

TABLE 61 CANADA: NUMBER OF VETERINARY PRACTICES IN CANADA, 2017

TABLE 62 CANADA: PERCENTAGE OF ANIMALS RECEIVING NO MEDICALIZATION

TABLE 63 CANADA: PERCENTAGE OF ANIMALS RECEIVING BASIC MEDICALIZATION

TABLE 64 CANADA: PERCENTAGE OF ANIMALS UNDER VETERINARY CARE

TABLE 65 SAUDI ARABIA: PERCENTAGE OF ANIMALS RECEIVING NO MEDICALIZATION

TABLE 66 SAUDI ARABIA: PERCENTAGE OF ANIMALS RECEIVING BASIC MEDICALIZATION

TABLE 67 SAUDI ARABIA: PERCENTAGE OF ANIMALS UNDER VETERINARY CARE

LIST OF FIGURES (50 Figures)

FIGURE 1 ANIMAL HEALTHCARE - MEDICALIZATION RATE ANALYSIS

FIGURE 2 YEARS CONSIDERED FOR THE STUDY

FIGURE 3 EXPERT INTERVIEWS, BY REGION

FIGURE 4 EXPERT INTERVIEWS, BY SOURCE

FIGURE 5 APPROACH FOLLOWED FOR DETERMINING ANIMAL MEDICALIZATION RATE ANALYSIS

FIGURE 6 GLOBAL COMPANION ANIMAL DIAGNOSTICS MARKET OVERVIEW

FIGURE 7 GEOGRAPHICAL SNAPSHOT OF THE COMPANION ANIMAL DIAGNOSTICS MARKET

FIGURE 8 COMPETITIVE LEADERSHIP MAPPING

FIGURE 9 MARKET SHARE ANALYSIS

FIGURE 10 GLOBAL VETERINARY VACCINES MARKET OVERVIEW

FIGURE 11 GEOGRAPHICAL SNAPSHOT OF THE VETERINARY VACCINES MARKET

FIGURE 12 COMPETITIVE LEADERSHIP MAPPING

FIGURE 13 MARKET SHARE ANALYSIS

FIGURE 14 GLOBAL VETERINARY EQUIPMENT AND DISPOSABLES MARKET OVERVIEW

FIGURE 15 GEOGRAPHICAL SNAPSHOT OF THE VETERINARY EQUIPMENT AND DISPOSABLES MARKET

FIGURE 16 MARKET SHARE ANALYSIS

FIGURE 17 GLOBAL VETERINARY REFERENCE LABORATORIES MARKET OVERVIEW

FIGURE 18 GEOGRAPHICAL SNAPSHOT OF THE VETERINARY REFERENCE LABORATORIES MARKET

FIGURE 19 COMPETITIVE LEADERSHIP MAPPING

FIGURE 20 MARKET SHARE ANALYSIS

FIGURE 21 VETERINARY IMAGING MARKET OVERVIEW

FIGURE 22 GEOGRAPHICAL SNAPSHOT OF THE VETERINARY IMAGING MARKET

FIGURE 23 ANIMAL POPULATION IN THE TOP 5 EU COUNTRIES

FIGURE 24 EUROPE: DOG POPULATION

FIGURE 25 EUROPE: CAT POPULATION

FIGURE 26 EUROPE: ANIMAL MEDICAL EXPENDITURE, 2012?2018

FIGURE 27 EUROPE: ANIMAL HEALTHCARE MARKET, BY PRODUCT, 2018

FIGURE 28 PREVENTIVE HEALTHCARE IN THE UK

FIGURE 29 UK: LIFETIME AVERAGE EXPENDITURE ON COMPANION ANIMALS

FIGURE 30 GERMANY: ESTIMATED TRENDS IN CATTLE POPULATION, 2018?2024 (MILLION)

FIGURE 31 RUSSIA: CATTLE POPULATION, 2010?2018 (MILLION)

FIGURE 32 ITALY: COMPANION ANIMAL POPULATION TRENDS

FIGURE 33 SPAIN: COMPANION ANIMAL EXPENDITURE

FIGURE 34 SPAIN: ANTIMICROBIAL CONSUMPTION IN CATTLE

FIGURE 35 AUSTRIA: ANIMAL POPULATION, 2018 (MILLION)

FIGURE 36 TURKEY: ESTIMATED TRENDS IN CATTLE POPULATION, 2018?2024 (MILLION)

FIGURE 37 POLAND: POULTRY POPULATION TRENDS

FIGURE 38 BULGARIA: MEAT PRODUCTION, 2017

FIGURE 39 BULGARIA: CATTLE POPULATION TRENDS, 2018?2024 (MILLION)

FIGURE 40 NETHERLANDS: CATTLE POPULATION, 2010?2016 (MILLION)

FIGURE 41 NETHERLANDS: CATTLE POPULATION FORECAST, 2017?2024 (MILLION)

FIGURE 42 INDIA: CONTRIBUTION FROM ANIMAL HEALTH PRODUCTS, 2018

FIGURE 43 CHINA: ESTIMATED PIG POPULATION, 2017?2024 (MILLION)

FIGURE 44 JAPAN: REGULATORY FRAMEWORK

FIGURE 45 SOUTH KOREA: ESTIMATED CATTLE POPULATION, 2017?2024 (MILLION)

FIGURE 46 THAILAND: ESTIMATED PIG POPULATION, 2017?2024 (MILLION)

FIGURE 47 AUSTRALIA: ESTIMATED CATTLE POPULATION TRENDS, 2017?2024 (MILLION)

FIGURE 48 AUSTRALIA: TOTAL PET POPULATION, 2019

FIGURE 49 SAUDI ARABIA: TRENDS IN CATTLE IMPORTS, 2007?2015 (MILLION)

FIGURE 50 SAUDI ARABIA: ESTIMATED TRENDS IN CATTLE IMPORTS, 2016?2024 (MILLION)

This study involved the extensive use of both primary and secondary sources. The research process included a study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, key market dynamics, and key player strategies.

Secondary Research

The secondary research process involves the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, companies house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the animal treatment market. It was also used to obtain important information about the key players and market classification and segmentation according to industry trends to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

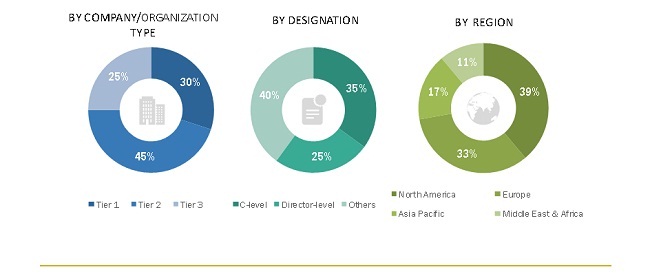

In the primary research process, industry experts from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Industry experts from the supply side include CEOs, presidents, vice presidents, marketing managers, product managers, sales executives, business development executives, and technology and innovation directors of companies providing veterinary care products. A breakdown of primary respondents is provided below:

To know about the assumptions considered for the study, download the pdf brochure

Market Analysis

A robust methodology was utilized while analyzing the animal treatment rate, wherein data was gathered through secondary sources and was further validated through primary interviews. Animal population data, disease prevalence data, and diagnosis trends were studied through government publications and articles released from associations such as OIE. Further, the diagnosis rate and disease prevalence rate in animals was verified by conducting several primary interviews.

Data Triangulation

To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable.

Objectives of the Study

- To analyze the medicalization rate in dogs, cats, horses, pigs, cattle, and poultry

- To provide detailed information about the key factors influencing animal treatment rate (such as country-wise regulatory scenario, animal welfare initiatives, and market entry barriers)

- To analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall animal treatment market

- To analyze market opportunities for stakeholders and provide details of the animal healthcare scenario for various countries

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Animal Treatment Market