Animal Stem Cell Therapy Market by Type (Allogeneic, Autologous), Species (Dog, Cat & Horse), End User (Veterinary Hospital, Research Organization) - Global Forecast to 2027

The global animal stem cell therapy market size is projected to reach USD 0.3 billion by 2027 from USD 0.2 million in 2022, at a CAGR of 5.2% during the forecast period. The growth in the cases of various health issues such as arthritis, degenerative joint disorders, and tendon injuries in animals. This factor is encouraging the development of the global animal stem cell therapy market.

To know about the assumptions considered for the study, Request for Free Sample Report

“Allogeneic Stem Cell Therapy accounted for the largest market share in the animal stem cell therapy by type during the forecast period”

Animal stem cell therapy market is segmented into Allogeneic Stem Cell Therapy and Autologous Stem Cell Therapy. In 2021, Allogeneic Stem Cell Therapy accounted for a sizable market share. This can be attributed to evidencing the mechanisms which enable cells to repair and regenerate injured tissues.

“Dogs accounted for the largest market share in the animal stem cell therapy by spieces during the forecast period”

Based on spieces, the animal stem cell therapy market is segmented into dogs, cats, horse, and other animals. The dog segment accounted for the larger market share in 2021. This segment is also expected to register the highest growth of 9.4% during the forecast period. This can be attributed to the rising number of dogs across the globe, the willingness of owners to spend more on their pets, and the rising adoption of pet insurance.

“Veterinary hospitals accounted for the largest market share in the animal stem cell therapy by end user during the forecast period”

Based on end users, the animal stem cell therapy market is segmented into veterinary hospitals and research organization. Veterinary hospitals are the major end users in the animal stem cell therapy market in 2021. The large share of this segment can primarily be attributed to the growing number of veterinarians, the increasing number of veterinary practices, rising awareness among pet owners regarding routine and preventive care.

“APAC region accounted for the highest CAGR”

Geographically, the animal stem cell therapy market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America accounted for the largest share of the animal stem cell therapy market in 2021. The large share of this region is mainly driven by the increasing adoption of pet animals, the growing pet insurance industry, and the rising veterinary healthcare expenditure in the region. The Asia Pacific region is expected to register the highest CAGR during the forecast period. Growth in pet adoption, increasing awareness about animal health, and growing per capita animal health expenditure, especially in India and China, are contributing to the growth of the APAC animal stem cell therapy market.

To know about the assumptions considered for the study, download the pdf brochure

Competitive Landscape

Key Industry Development:

Boehringer Ingelheim has obtained approval for its Arti-Cell Forte, which is a stem cell-based product for the treatment of lameness in horses. Boehringer Ingelheim, one of the key players in the animal stem cell therapy market, launched a new stem cell therapy that aims to improvise the healing capability of the tendon and suspensory ligament injuries in equines. This product, called RenuTend, was launched in April 2022.

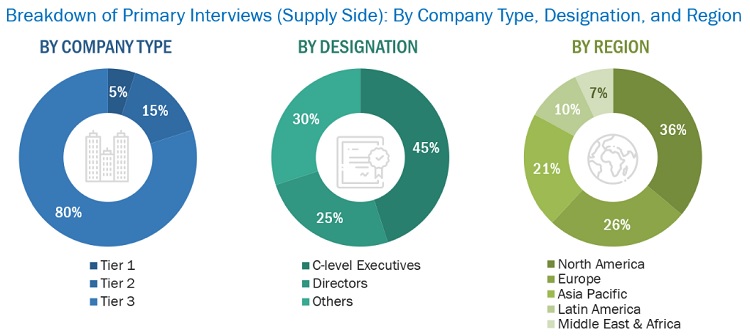

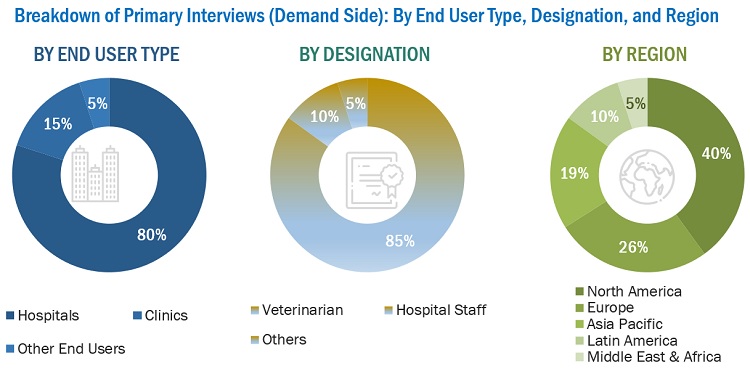

The primary interviews conducted for this report can be categorized as follows:

- By Company Type: Tier 1 - 40%, Tier 2 - 30%, and Tier 3 - 30%

- By Designation: C-level - 27%, D-level - 18%, and Others - 55%

- By Region: North America - 51%, Europe - 21%, Asia Pacific - 18%, Latin America – 6% , and the Middle East & Africa – 4%

Lits of Companies Profiled in the Report:

- Medivet Biologics Llc

- U.S. Stem Cell, Inc

- Vetstem Biopharma

- J-Arm

- Celavet Inc.

- Vetcell Therapeutics

- Kintaro Cells Power

- Magellan Stem Cells

- Aratana Therapeutics, Inc.

- Regeneus Ltd.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 CATEGORY-WISE INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

1.4 YEARS CONSIDERED FOR THE STUDY

1.5 CURRENCY

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 KEY DATA FROM SECONDARY SOURCES

2.1.2 PRIMARY DATA

2.1.2.1 KEY DATA FROM PRIMARY SOURCES

2.1.2.2 KEY INDUSTRY INSIGHTS

2.2 MARKET SIZE ESTIMATION

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

2.4 MARKET SHARE ESTIMATION

2.5 STUDY ASSUMPTIONS

2.6 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.2 RESTRAINTS

5.2.3 OPPORTUNITIES

5.2.4 CHALLENGES

5.3 INDUSTRY TRENDS

5.4 REGULATORY ANALYSIS

5.5 ECOSYSTEM ANALYSIS

5.6 TECHNOLOGY ANALYSIS

5.7 TRADE ANALYSIS

5.8 VALUE CHAIN ANALYSIS

5.9 PORTER’S FIVE FORCES ANALYSIS

5.10 PATENT ANALYSIS

5.11 SUPPLY CHAIN ANALYSIS

5.12 PRICING ANALYSIS

5.13 KEY CONFERENCES AND EVENTS (2022-2023)

5.14 KEY STAKEHOLDERS & BUYING CRITERIA

6 ANIMAL STEM CELL THERAPY MARKET, BY TYPE, 2020-2027 (USD MILLION)

6.1 INTRODUCTION

6.2 ALLOGENEIC STEM CELL THERAPY

6.3 AUTOLOGOUS STEM CELL THERAPY

7 ANIMAL STEM CELL THERAPY MARKET, BY SPECIES, 2020-2027 (USD MILLION)

7.1 INTRODUCTION

7.2 DOG

7.3 CAT

7.4 HORSE

7.5 OTHER SPECIES

8 ANIMAL STEM CELL THERAPY MARKET, BY END USER, 2020-2027 (USD MILLION)

8.1 INTRODUCTION

8.2 VETERINARY HOSPITALS

8.3 RESEARCH ORGANIZATIONS

9 ANIMAL STEM CELL THERAPY MARKET, BY COUNTRY/REGION, 2020-2027 (USD MILLION)

9.1 INTRODUCTION

9.2 NORTH AMERICA

9.2.1 US

9.2.2 CANADA

9.3 EUROPE

9.3.1 GERMANY

9.3.2 UK

9.3.3 FRANCE

9.3.4 SPAIN

9.3.5 ITALY

9.3.6 REST OF EUROPE

9.4 ASIA PACIFIC

9.5 REST OF THE WORLD

10 COMPETITIVE LANDSCAPE

10.1 INTRODUCTION

10.2 REVENUE SHARE ANALYSIS

10.3 MARKET SHARE ANALYSIS OF KEY PLAYERS IN DENTAL CONTOURING MARKET

10.4 COMETITIVE BENCHMARKING

10.5 COMPANY GEOGRAPHIC FOOTPRINT

10.6 COMPANY EVALUATION QUADRANT

10.6.1 STARS

10.6.2 PERVASIVE PLAYERS

10.6.3 EMERGING LEADERS

10.6.4 PARTICIPANTS

10.7 COMPETITIVE SITUATIONS AND TRENDS

10.7.1 PRODUCT/SERVICE LAUNCHES & APPROVALS

10.7.2 DEALS

11 COMPANY PROFILES

(Business Overview, Financials, Recent Developments, MnM View & SWOT Analysis)

11.1 MEDIVET BIOLOGICS LLC

11.2 U.S. STEM CELL, INC

11.3 VETSTEM BIOPHARMA

11.4 J-ARM

11.5 CELAVET INC.

11.6 VETCELL THERAPEUTICS

11.7 KINTARO CELLS POWER

11.8 MAGELLAN STEM CELLS

11.9 ARATANA THERAPEUTICS, INC.

11.10 REGENEUS LTD.

12 APPENDIX

12.1 INSIGHTS OF INDUSTRY EXPERTS

12.2 DISCUSSION GUIDE

12.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.4 AVAILABLE CUSTOMIZATIONS

12.5 RELATED REPORTS

12.6 AUTHOR DETAILS

*The segmentation of the study can be updated during the course of the study based on primary insights and secondary research

*The list of companies mentioned above is indicative only and might change during the course of the study.

*Details on key financials might not be captured in case of unlisted companies.

* SWOT Analysis will be provided for Top-5 companies only.

Growth opportunities and latent adjacency in Animal Stem Cell Therapy Market