Animal Feed Market By Ingredients (Cereals, Cakes & Meals, and By-Products), Additive Type, Form (Mash, Pellets, Crumbles), Livestock (Ruminants, Poultry, Swine, and Aquaculture), Source (Plant-Based and Animal-Based), and Region - Global Forecast to 2029

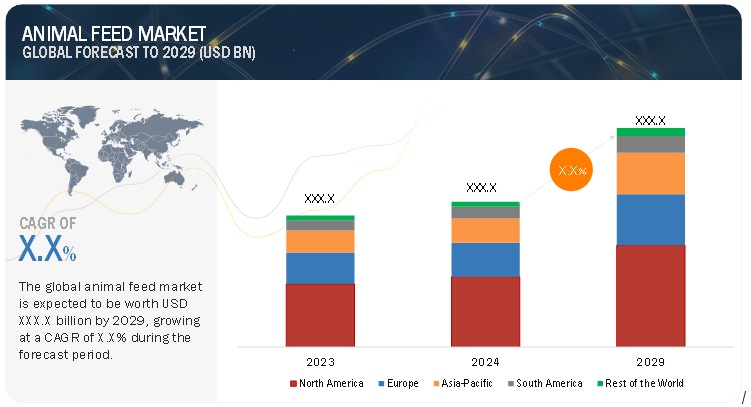

According to MarketsandMarkets, the global Animal feed market size is estimated to be valued at USD XXX.X billion in 2024 and is projected to reach USD XXX.X billion by 2029, recording a CAGR of X.X%.

Global meat production is expected to rise by 14% by 2030, with more effective and nutritious feed being demanded by 2030, according to FAO estimates. Improvements in technologies related to feed additives, such as automated feeding systems and sensors monitoring individual animal needs that will optimize feeding for better productivity, are also lending momentum to the growth in demand. This will further drive the industry to more eco-friendly feed solutions and growing demand for plant-based and alternative protein sources for environmental concerns. Government initiatives to foster the development of livestock and aquaculture by providing subsidies and grants for research studies are drivers for growth.

According to the USDA, over 250 million tons of feed were produced within the United States in the year 2023—a large quantity, considering the livestock industry in the nation is growing. This rise in feed production surely indicates a wider increase in livestock farming activities, fueled by growing consumer demand for meat, dairy, and other animal products. Environmental concerns, coupled with a desire to lessen the ecological footprint of conventional feed sources, are rapidly advancing interest in sustainable practices. This is with respect to the plant-based feeds and alternative proteins, which are a greener route of supply for the feed ingredients, flanking the traditional animal-derived feed ingredients.

The expansion initiatives started by the leaders in the animal feed industry have been able to offer more opportunities for conducting business within the industry. In January 2023, Cargill and BASF extended their joint venture in high-performance enzyme solutions for the US animal feed market. The companies' collaboration utilizes BASF's enzyme research along with Cargill's broad application expertise to increase feed efficiency, sustainability, and productivity for US animal protein producers. Strong growth in animal feed is being driven by the companies' collaborated development and distribution of new enzyme technologies.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

ANIMAL FEED MARKET DYNAMICS

Drivers: Growing demand for animal products for commercial use

According to the FAO, global meat production was valued at 337.2 million tonnes in 2020, and it is expected to grow by 14% by 2030. Though there was a decrease in pig and bovine meat production, there was an increase in the production of poultry and ovine meat. The drop in swine production was due to the outbreak of African swine fever; however, developing countries like China, the Philippines, and Vietnam made a faster recovery. There was an increase in imports and exports of meat between developed and developing countries. The trend that is currently observed is that in developing countries, consumers prefer poultry meat, and in developed nations, the demand is more for red meat due to the high income of the population.

Meat and dairy products are good sources of protein. The consumption of poultry meat has also increased over the past few years due to its low-fat content compared to beef and mutton. Countries such as the US, Mexico, Canada, Brazil, China, Japan, the UK, France, and Germany are the major consumers of processed meat and pork. To obtain good-quality meat and dairy products, the livestock should be free from harmful diseases and ailments. Thus, to reduce risks to human health and the environment, livestock producers focus on providing nutritious feed to their livestock.

Restraints: Lack of awareness about modern feeding methods in developing countries

Traditionally, the feeding of livestock has been practiced predominantly in cow grazing and pasture. Young chicken and poultry are fed a corn-based diet. These products do not meet the nutritional needs of the animal and in turn, cause abnormal weight gain, increase the fat percentage, and cause waste of carcass. Poor nutrition is also a prominent cause of animal disease. Most of the animal rearing in developing countries is small-scale, family-owned businesses, due to which the awareness regarding proper feeding techniques and appropriate animal nutrition is less.

The penetration rate of feed for livestock is relatively low in developing countries owing to the continued reliance on traditional methods of feeding. Countries such as India and China are highly dependent on feeding animals with human food residues and grazed pastures, and the farmers in these countries also choose their own ingredients and prepare their formulations to feed animals. These practices are outdated and result in lower consumption of commercial feeding despite the high population of livestock in these countries. Developed countries such as the US and Russia have a higher penetration rate in terms of feeding animals with commercial feed.

Opportunities: Growing importance of livestock feeding practice in developing economies

Intensive livestock production is booming in emerging countries; however, there are still vast areas where extensive livestock production, especially ruminants, is largely supported by grazed pastures. The only approach to minimize grassland degradation while maintaining the health of the animals is by reducing the animal density. The low productivity of ruminants in developing countries is reflected by high mortality, the poor growth rate of young ones, delay in the onset of puberty, and long intervals between successive parturition, all of which are largely attributed to poor feed resources, feeding, and management. However, high mortality and inadequate milk production by nursing mothers affect the growth rate of those who survive. Therefore, economics strategists and government policies encourage livestock farmers to transform the extensive system of production into semi-intensive systems with additional imported feed inputs. Therefore, it is important to improve the productivity of ruminant livestock through the promotion of early weaning of young ones. Compound feed provides a mix of optimum nutrition to livestock, and it is available in different forms and can be fed to different livestock from an early age. To increase productivity and performance, many farmers are adopting nutrition specifically designed for livestock, which will impact the demand for compound feed in developing nations.

Challenges: Stringent regulatory framework

Animal health is a vital component in the food chain, and the prevention and management of infectious diseases like zoonotic disease are also essential. In 2011, the US FDA and the Association of American Feed Control Officials partnered to develop the Animal Feed Regulatory Program Standards. The feed standards establish a uniform foundation for the design and management of states' programs responsible for the regulation of feed. In the European Union, there are standards for feed materials, compound feed, and others like feed additives. The Commission and the EU countries discuss animal nutrition issues in the Standing Committee on Plants, Animals, Food, and Animal Nutrition. Manufacturers must abide by the regulations and provide proper details of the ingredients used in the manufacturing of compound feed. Manufacturers need to fulfill the requirements regarding the health and safety of the products they manufacture for livestock and their adverse effects on the environment. They are also required to submit the documents for approval from the respective regulatory body, and altogether, it adds up to the overall production cost. These factors contribute to the challenges faced by compound feed manufacturers.

The Animal feed market ecosystem

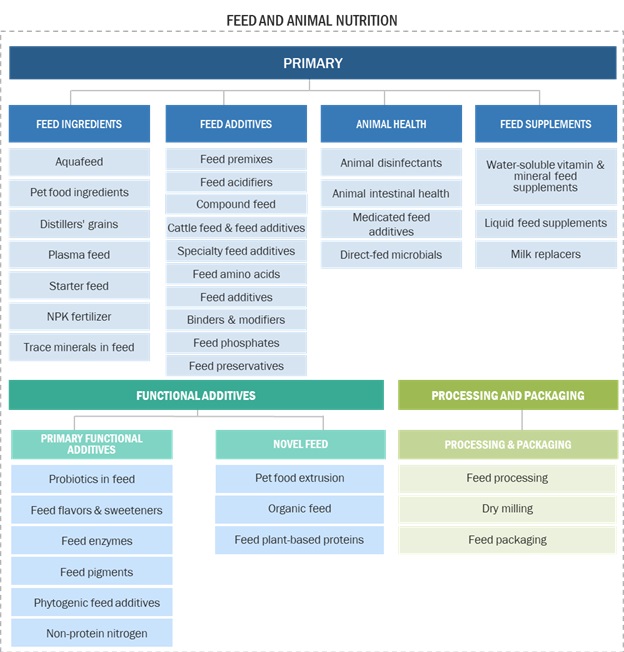

Additives are projected to be the fastest-growing segment in the Animal feed market during the forecast period.

The need for micronutrients for the overall well-being of livestock increases the requirement for supplements, to ensure a proper and optimum diet, it is important to have proper feed supplementation. Feed supplements are phosphate, calcium, and trace mineral mixtures that can be given to grazing animals during the dry or rainy season. The grazing is supplemented when it is deficient in minerals and trace minerals. According to the European Commission, “Feed additives are products used in animal nutrition for purposes of improving the quality of feed and the quality of food from animal origin, or to improve the animals’ performance and health, e.g., providing enhanced digestibility of the feed materials.” The demand for feed additives is increasing globally with the increasing purchasing power. Consumers in developing countries are demanding more quality livestock products.

Plant-based animal feed is projected to experience the fastest growth in the forecasted period

The fastest growth for plant-based animal feed is driven by increasing demand for sustainable and eco-friendly feed solutions. The drive to decrease the ecological footprint created by farming livestock is prompting feed manufacturers to move away from conventional animal-derived ingredients and toward plant-based ones.

Plant-based feed is obtained from plant sources such as oils, vegetables, grains, among others. Amongst various factors driving the growth of plant-based feed, environmental-friendly and nutritional aspects are the two major ones. The environmental impact of plant-based alternatives is perceived as potentially less resource-intensive. Other factors driving the requirement for plant-based products are the low-cost availability of raw materials, sustainability, and increasing awareness about plant-based products. Most products available in the market are currently sourced from a plant, and it has increased application in ruminant nutrition.

Pellets hold a significant share in the animal feed market during the forecast period

Pelleted feeds are preferred because of their improvement in nutritional efficiency and digestibility. Pelleting generally pulverizes raw feed ingredients into a fine powder, which is then heated and pressed into small, regular pellets. Heat treatment during pelleting may further denature anti-nutritional factors and pathogens in the feed, thereby ensuring safer and more digestible feeds. The Feed Research Institute has reported that pelleted feed can improve feed conversion ratios by 5-10% over mash feed, which will yield better growth rates and feed efficiencies.

The uniform size and consistency of pellets contribute to better feed intake and overall animal health. Animals tend to consume pellets more readily than loose or powdered feed, which can improve dietary intake and overall performance. Moreover, the pelleting process can enhance the nutritional value of the feed by ensuring that essential vitamins and minerals are evenly distributed and effectively utilized by the animals. According to a study by the University of Illinois, pelleted feed can lead to a 7% improvement in daily weight gain for livestock due to its higher digestibility and nutrient availability.

Asia Pacific is poised to experience the highest CAGR in the Animal feed market during the forecast period.

The market trend that is seen in the region is that there is an increase in the demand for animal-based products like dairy, eggs, processed meat, fish, etc., which generates demand for compound feed in the region. Furthermore, it can be seen that the number of feed mills is increasing in the region, reflecting the increasing production of feed. This rise is attributed to the need for protein-rich food amongst the population, which gives rise to the demand for meat products. China is the largest producer and consumer of poultry, followed by India, due to an increase in modernization in the feed industry, increasing population, and increase in the disposable income of the population.

The presence of several top feed manufacturers in the region provides consumers with an adequate supply of compound feed in almost every part of the region. The Asia Pacific is home to many key producers of feed; according to Feed International’s World’s Top Feed Companies report, out of 101 major compound feed producers, 47.5% are based in the Asia Pacific region. Additionally, the growing demand for ready-to-cook meat, easy availability of livestock, and low labor costs are other factors contributing to the growth of the compound feed market in the region.

Asia Pacific: Animal feed market SNAPSHOT

Key Market Players

Key players in this market include Cargill, Incorporated (US), ADM (US), Charoen Pokphand Foods (CPF) (Thailand), New Hope Group (China), Land O'Lakes, Inc. (US), Nutreco N.V. (Netherlands), Alltech, Inc. (US), Guangdong Haid Group Co., Ltd. (China), Weston Milling Animal Nutrition (Australia), and Feed One Co. (Japan).

Recent Developments

- In July 2024, Alltech partnered with Tobermore Concrete, CEMCOR, and Road Safety Contracts in the Mid-Ulster Biorefinery and Circular Economy Cluster. This collaboration, supported by the Centre for Advanced Sustainable Energy at Queen’s University Belfast, will focus on constructing a 10-megawatt biomethane facility in Northern Ireland. Alltech will leverage its fermentation expertise to optimize biogas production and promote renewable energy from agricultural waste.

- In June 2024, The Alltech U.S. Pork Team launched Levelset at the World Pork Expo, a new product designed to enhance gut health in pigs. Levelset combines advanced technologies to support natural resistance against diarrhea and improve enteric health across key production stages. Manufactured by Ridley Feed Ingredients, an Alltech company, Levelset aims to reduce reliance on antibiotics and improve pig productivity.

- In January 2023, Cargill expanded its partnership with BASF to introduce advanced enzyme solutions in the U.S. animal feed market. This collaboration integrates BASF’s expertise in enzyme R&D with Cargill’s extensive market reach to enhance feed efficiency and sustainability for U.S. animal protein producers. The expanded agreement builds on their successful international projects, aiming to address productivity and cost challenges while promoting animal wellbeing through innovative feed solutions.

Frequently Asked Questions (FAQ):

What are the key livestock considered in the study for the animal feed market, and which segments within Europe’s animal feed livestock are projected to experience promising growth?

The study focuses on three major livestock: Poultry, Ruminants, Swine, Aquaculture, and Other livestock. Within Europe’s animal feed livestock, the subsegment Poultry emerges as the dominant category, showcasing promising growth potential in the projected market trends.

Is there customizable information available specific to the North American animal feed market, and if so, what details are provided?

Yes, Certainly, customization options are available for the North American animal feed market across different segments, encompassing market size, dynamics, forecasts, competitive landscape, and company profiles. Exclusive insights will be offered for the specified North American countries below:

- US

- Canada

- Mexico

What are the key trends driving the growth of the global animal feed market?

The growth of the animal feed market is driven by several factors, including increasing global demand for animal-based products, rising meat and dairy consumption, advancements in feed technology, and a growing focus on sustainability. Additionally, urbanization, rising incomes, and the expansion of livestock and aquaculture industries contribute to the increasing need for efficient and effective feed solutions.

Among the regions studied, which one is anticipated to exhibit the CAGR for the Animal feed market?

Asia Pacific is the fastest-growing market for animal feed due to expansion in renovating livestock farming has driven the market further. In this region, countries are introducing the best technologies and practices to better feed efficiency and livestock productivity. It includes new feed formulae, new additives in the feed, and optimal management practices for feed nutritional values. Governments' policies also facilitate this through the promotion of sustainable and efficient practices in agriculture. The two together make an interactive environment—such as the animal feed market in Asia-Pacific—having the fastest pace of growth because of the increasing consumer base and progressive developments in the technology for feed.

How is the competitive landscape structured in the Animal feed market?

In the animal feed market, there is a high number of regional and local firms. The level of concentration is medium in this market, with global key players such as Cargill Incorporated, ADM, Charoen Pokphand Foods (CPF), and Nutreco having a firm market share. These key companies compete on the basis of a large distribution network, heavy R&D investments, and high-end technology to maintain competitive advantage while catering to diversified feed demand.

While these bigger players dominate the industry, the market is still fiercely competitive, with hundreds of smaller and regional companies competing in the space. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Growth opportunities and latent adjacency in Animal Feed Market