Analytical Laboratory Services Market by Public Health Organization, - by types of services (Stability, Raw Material, Physical Characterization, Method Validation, Microbial Testing, Environmental Monitoring, Bioanalytical Testing) - Global Forecast to 2022

[68 Pages Report] The global analytical laboratory services market, by public health organization is projected to reach USD 333.8 Million by 2021 from USD 202.8 Million in 2016, at a CAGR of around 10.5% during the forecast period. The overall market, by public health organization is positively impacted by factors such as the growing expenditure on drugs and medical devices by public health organizations, government initiatives to strengthen analytical testing capabilities, increasing number of drug approvals & clinical trials, and rising demand for specialized analytical testing services. However, complex and innovative pharmaceutical products requiring a distinctive analytical testing approach is the major challenge hampering the growth of government support on analytical laboratory services.

On the basis of type of service, the spend assessment is segmented into eight segments, namely, bioanalytical testing, batch release testing, stability testing, raw material testing, physical characterization, method validation, microbial testing, and environmental monitoring.

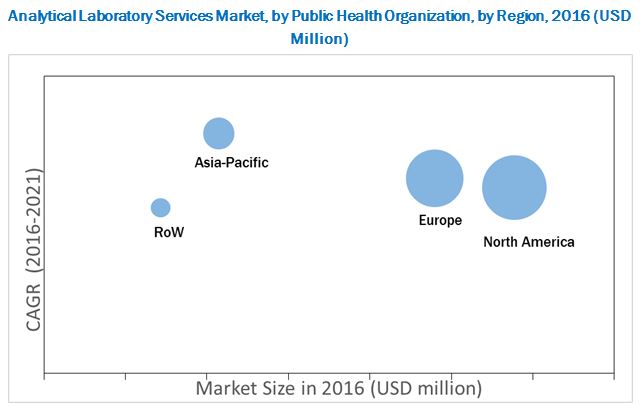

Geographically, the market, by public health organization is segmented into North America, Europe, Asia-Pacific, and the Rest of the World (RoW). In 2015, North America commanded the largest share, followed by Europe, Asia-Pacific, and the RoW. The major share of this region can be attributed to the high expenditure on quality testing, strong regulatory scenario, increasing number of clinical trials, and the well-established federal testing laboratories in the region. Moreover, Asia-Pacific is expected to grow at the highest CAGR during the forecast period. This can be attributed to the fast-growing pharmaceutical industry in this region, increased government expenditure on healthcare, increasing number of highly competitive and extremely fragmented pharmaceutical companies, and increased spending by governments to set up new laboratories in Asian countries.

The major public health organizations for analytical laboratory services include the Food and Drug Administration (U.S.), European Medicines Agency (U.K.), Federal Institute for Drugs and Medical Devices (Germany), Agence française de sécurité sanitaire des produits de santé (France), Agenzia Italiana del Farmaco (Italy), Spanish Medicines and Health Products Agency (Spain), Central Drugs Standard Control Organization (India), China Food and Drug Administration, and Pharmaceuticals and Medical Devices Agency (Japan).

Target Audience

- Government Agencies

- Nonprofit Organizations

- Analytical Laboratories

- Private Analytical Testing Providers

To know about the assumptions considered for the study, download the pdf brochure

Scope of the Report:

The research report categorizes the market, by public health organization into the following segments:

Global Analytical Laboratory Services Market, By Public Health Organization, by Type of Service

- Bioanalytical Testing

- Batch Release Testing

- Stability Testing

- Raw Material Testing

- Physical Characterization

- Method Validation

- Microbial Testing

- Environmental Monitoring

Global Analytical Laboratory Services Market, By Public Health Organization, by Region

-

North America

- U.S.

- Canada

-

Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of the Europe

-

Asia-Pacific

- China

- Japan

- India

- Rest of APAC

-

Rest of the World (RoW)

- Latin America

- Middle East & Africa

The global analytical laboratory services market, by public health organization is projected to reach USD 333.8 Million by 2021 from USD 202.8 Million in 2016, at a CAGR of around 10.5% during the forecast period. The key trends for increase in market, by public health organization are the growing expenditure on drugs and medical devices by public health organizations, steps by the government to build up strong analytical testing abilities, increasing number of drug approvals and clinical trials, and rising demand for specialized analytical testing services. However, complex and innovative pharmaceutical products requiring a distinctive analytical testing approach is the major challenge hampering the growth of government support.

On the basis of type of service, the spend assessment is segmented into eight segments, namely, bioanalytical testing, batch release testing, stability testing, raw material testing, physical characterization, method validation, microbial testing, and environmental monitoring. In 2015, the bioanalytical testing segment accounted for the largest share of the analytical laboratory services market, by public health organization. This growth can be attributed to factors such as the usage and development of a large number of macromolecules and Biosimilars for various therapeutic areas and the growing biopharmaceutical industry across the globe. The spending on batch release testing services is expected to account for the second largest share during the forecast period. The growth can be attributed to the need for checking and validating the process for product development among pharmaceutical & biopharmaceutical companies and the increasing usage of dissolution test in the development and approval of generic solid oral dosage forms.

Geographically, the analytical laboratory services market, by public health organization is segmented into North America, Europe, Asia-Pacific, and the Rest of the World (RoW). In 2015, North America commanded the largest share, followed by Europe, Asia-Pacific, and the RoW. Asia-Pacific represented the fastest-growing region for the market, by public health organization, primarily due to the fast-growing pharmaceutical industry in this region, increased government expenditure on healthcare, increasing number of highly competitive and extremely fragmented pharmaceutical companies, and increased spending by governments to set up new laboratories in Asian countries.

The global Analytical Laboratory Services Market, by public health organization is in the growing phase and characterized by the involvement of government agencies. The major public health organizations spending in analytical laboratory services include the Food and Drug Administration (U.S.), European Medicines Agency (U.K.), Federal Institute for Drugs and Medical Devices (Germany), Agence française de sécurité sanitaire des produits de santé (France), Agenzia Italiana del Farmaco (Italy), the Spanish Medicines and Health Products Agency (Spain), Central Drugs Standard Control Organization (India), China Food and Drug Administration, and Pharmaceuticals and Medical Devices Agency (Japan).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 8)

1.1 Objectives of the Study

1.2 Scope of the Report

2 Research Methodology (Page No. - 10)

2.1 Research Approach

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakdown of Primary Interviews

2.1.2.2 Key Industry Insights

2.1.3 Market Size Estimation

3 Executive Summary (Page No. - 15)

3.1 Healthcare Analytical Testing Services: Overview

3.2 Outsourced Healthcare Analytical Testing Services

3.3 Analytical Laboratory Services, By Public Health Organization

4 Spending Assessment Overview (Page No. - 19)

4.1 Introduction

4.2 Key Trends

4.2.1 Growing Expenditure on Drugs and Medical Devices By Public Organizations

4.2.2 Government Initiatives to Strengthen Analytical Testing Capabilities

4.2.3 Increasing Number of Drug Approvals and Clinical Trials

4.2.4 Rising Demand for Specialized Analytical Testing Services

4.3 Challenges

4.3.1 Complex and Innovative Pharmaceutical Products Requiring A Distinctive Analytical Testing Approach

4.4 Conclusion

5 Analytical Laboratory Services Market, By Public Health Organization: Types of Services (Page No. - 23)

5.1 Introduction

5.2 Bioanalytical Testing

5.3 Batch Release Testing

5.4 Stability Testing

5.5 Raw Material Testing

5.6 Physical Characterization

5.7 Method Validation

5.8 Microbial Testing

5.9 Environmental Monitoring

6 Geographic Analysis (Page No. - 35)

6.1 Introduction

6.2 North America

6.2.1 U.S.

6.2.2 Canada

6.3 Europe

6.3.1 Germany

6.3.2 U.K.

6.3.3 France

6.3.4 Italy

6.3.5 Spain

6.3.6 Rest of Europe

6.4 Asia-Pacific (APAC)

6.4.1 China

6.4.2 Japan

6.4.3 India

6.4.4 Rest of APAC

6.5 Rest of the World (RoW)

6.5.1 Latin America

6.5.2 Middle East and Africa

7 Appendix (Page No. - 62)

7.1 Insights of Key Experts

7.2 Recent Developments

7.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

7.4 Related Reports

7.5 Author Details

List of Tables (37 Tables)

Table 1 Spending on Analytical Laboratory Services Market, By Public Health Organizations, By Region (USD Million)

Table 2 Funding on Human Drugs and Devices By FDA, 2013–2017 (USD Million)

Table 3 Budget Expenditure on Evaluation of Medicinal Products By EMA, 2013–2015 (USD Million)

Table 4 Number of Clinical Trials Authorized By Competent Authorities (2011–2014)

Table 5 Spending on Market, By Public Health Organizations, By Service Type, 2014–2021 (USD Million)

Table 6 Spending on Analytical Laboratory Services Market, By Public Health Organizations, By Country/Region, 2014–2021 (USD Million)

Table 7 Global Spending on Bioanalytical Testing Services By Public Health Organizations, By Country/Region, 2014–2021 (USD Million)

Table 8 Global Spending on Batch Release Testing Services By Public Health Organizations, By Country/Region, 2014–2021 (USD Million)

Table 9 Global Spending on Stability Testing Services By Public Health Organizations, By Country/Region, 2014–2021 (USD Million)

Table 10 Global Spending on Raw Material Testing Services By Public Health Organizations, By Country/Region, 2014–2021 (USD Million)

Table 11 Global Spending on Physical Characterization Services By Public Health Organizations, By Country/Region, 2014–2021 (USD Million)

Table 12 Global Spending on Method Validation Services By Public Health Organizations, By Country/Region, 2014–2021 (USD Million)

Table 13 Global Spending on Microbial Testing Services By Public Health Organizations, By Country/Region, 2014–2021 (USD Million)

Table 14 Global Spending on Environmental Monitoring Services By Public Health Organizations, By Country/Region, 2014–2021 (USD Million)

Table 15 Spending on Analytical Laboratory Services Market, By Public Health Organizations, By Region, 2014-2021 (USD Million)

Table 16 North America: Spending on Market, By Public Health Organizations, By Country, 2014–2021 (USD Million)

Table 17 North America: Spending on Market, By Public Health Organizations, By Service Type, 2014–2021 (USD Million)

Table 18 U.S.: Spending on Analytical Laboratory Services Market, By Public Health Organizations, By Service Type, 2014–2021 (USD Million)

Table 19 Canada: Spending on Market, By Public Health Organizations, By Service Type, 2014–2021 (USD Million)

Table 20 Europe: Spending on Market, By Public Health Organizations, By Country, 2014–2021 (USD Million)

Table 21 Europe: Analytical Laboratory Services Market, By Public Health Organizations, By Service Type, 2014–2021 (USD Million)

Table 22 Germany: Spending on Market, By Public Health Organizations, By Service Type, 2014–2021 (USD Million)

Table 23 U.K.: Spending on Market, By Public Health Organizations, By Service Type, 2014–2021 (USD Million)

Table 24 France: Spending on Analytical Laboratory Services Market, By Public Health Organizations, By Service Type, 2014–2021 (USD Million)

Table 25 Italy: Spending on Market, By Public Health Organizations, By Service Type, 2014–2021 (USD Million)

Table 26 Spain: Spending on Market, By Public Health Organizations, By Service Type, 2014–2021 (USD Million)

Table 27 RoE: Spending on Market, By Public Health Organizations, By Service Type, 2014–2021 (USD Million)

Table 28 Asia-Pacific: Spending on Analytical Laboratory Services Market, By Public Health Organizations, By Country, 2014–2021 (USD Million)

Table 29 Asia-Pacific: Spending on Market, By Public Health Organizations, By Service Type, 2014–2021 (USD Million)

Table 30 China: Spending on Market, By Public Health Organizations, By Service Type, 2014–2021 (USD Million)

Table 31 Japan: Spending on Market, By Public Health Organizations, By Service Type, 2014–2021 (USD Million)

Table 32 India: Spending on Market, By Public Health Organizations, By Service Type, 2014–2021 (USD Million)

Table 33 Rest of APAC: Analytical Laboratory Services Market, By Public Health Organizations, By Type, 2014–2021 (USD Million)

Table 34 RoW: Spending on Market, By Public Health Organizations, By Country, 2014–2021 (USD Million)

Table 35 RoW: Spending on Market, By Public Health Organizations, By Service Type, 2014–2021 (USD Million)

Table 36 Latin America: Spending on Market, By Public Health Organizations, By Service Type, 2014–2021 (USD Million)

Table 37 Middle East and Africa: Spending on Market, By Public Health Organizations, By Service Type, 2014–2021 (USD Million)

List of Figures (7 Figures)

Figure 1 Secondary Research Approach

Figure 2 Primary Research Approach

Figure 3 Market Sizing Approach

Figure 4 Market Sizing Methodology

Figure 5 Bioanalytical Testing Segment to Dominate the Market During the Forecast Period

Figure 6 Geographic Snapshot: Spending on Market, By Public Health Organizations

Figure 7 FDA Budget on Medical Devices and Radiological Health, 2013–2017 (USD Million)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Analytical Laboratory Services Market