Ammonia Refrigerants Market by Type (Purity Above 99% and Purity Above 99.8%), Application (Cold Storages, Super Markets, Heavy Commercial Refrigeration, Transport Refrigeration, Household Refrigeration, and Others) and Region - Global Forecast to 2030

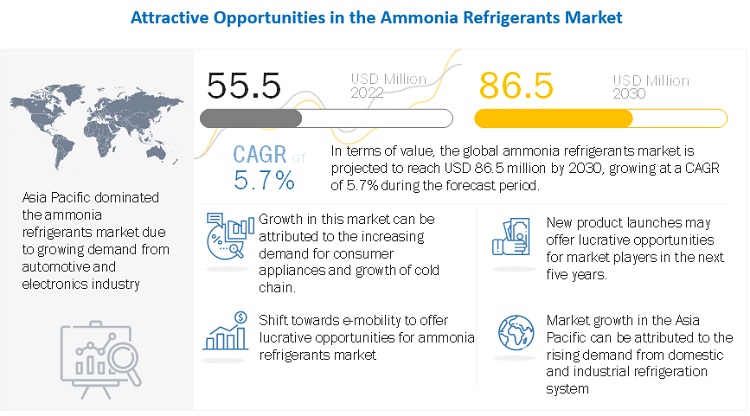

The ammonia refrigerants market is projected to reach USD 86.5 million by 2030, at a CAGR of 5.7% from USD 55.5 million in 2022. Ammonia is one of the most efficient refrigerants available and has a wide range of uses at different temperature and capacity. In addition to being natural the use of ammonia opens up the possibility of reduced energy consumption and secures long-term costs efficiency and sustainability. Ammonia is most commonly used for air conditioning systems and refrigeration systems.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

Driver: Eco-friendly aspect to drive the market

One of the biggest advantages of ammonia gas as the refrigerant is that it is safe to the environment and does not cause any depletion of the ozone layer. Due to this it won’t have to be replaced with any alternative refrigerants as is the case with number of chlorofluorocarbons (CFCs). Ammonia is the oldest of all the refrigerants being used and it will compete with the new refrigerants for a number of years to come. Now, considering the known environmental concerns with newer refrigerants many are returning to refrigerants like ammonia, which have zero environmental impact. The refrigeration process remains the same regardless of the refrigerant used to transfer heat out of the system. This factor will drive the growth of the market in the forecast period.

Restraints: Inflammability of ammonia to pose as a threat for market growth

The downside of ammonia is that it is a toxic refrigerant. It can also be flammable at certain concentrations. For this reason, all ammonia systems need to be designed with safety. Ammonia does not burn without a supporting flame since it has ignition energy 50 times higher than natural gas. It is rated “hardly flammable’ due to its high affinity for atmospheric humidity. Also, it has a characteristic smell which provides clear warning signs of a toxic leak. In addition, ammonia is lighter than air and rises quickly into the atmosphere if well ventilated.

Opportunities: Lower long-term operation costs can drive the growth of market

According to the International Institute of Ammonia Refrigeration (IIAR), ammonia is 3 to 10% more thermodynamically efficient than competitive refrigerants. This allows an ammonia-based refrigeration system to achieve the same cooling effect while using less power. As a result, where ammonia refrigeration is appropriate, it can offer lower long-term operation costs. This factor will drive the growth of the market in the forecast period.

Challenges: Accidental exposure to high concentrations of ammonia to pose as a challenge

Ammonia has always been a popular choice for Industrial Refrigeration, but now with new regulations and environmental concerns over other refrigerants, there is a renewed focus on ammonia-based systems. The biggest risk that may occur is an ammonia leak, which is both a health and safety hazard. The most common health concerns with ammonia are skin burns and difficulty breathing, as well as death only in the rarest cases.

“Purity 99.8% was the largest type of Ammonia refrigerants market in 2021, in terms of value”

Purity 99.8% ammonia is a clear liquid that boils at a temperature of -28°F. In refrigeration systems, the liquid is stored in closed containers under pressure. When the pressure is released, the liquid evaporates rapidly, generally forming an invisible vapor or gas. The rapid evaporation causes the temperature of the liquid to drop until it reaches the normal boiling point of -28°F, a similar effect occurs when water evaporates off the skin, thus cooling it.

“Cold storage was the largest application for Ammonia refrigerants market in 2021, in terms of value”

Cold Storages held the largest share in the ammonia refrigerant market in terms of application. The demand for convenience foods has raised resulted in the construction of millions of square feet of both public and private cold storage facilities. These cold storage warehouses consist of freezers and coolers dependent on ammonia refrigeration systems to control temperatures within the spaces to maintain product quality and freshness until shipped.

“Asia Pacific was the largest market for Ammonia refrigerants in 2021, in terms of value.”

Asia Pacific dominates the ammonia refrigerants market followed by North America and Europe. The economy of Asia Pacific is mainly influenced by the economic dynamics of countries such as China and India, but with growing foreign direct investment for economic development of Southeast Asia, the current scenario is changing. Countries in Southeast Asia are witnessing in dairy sector. Increasing demand for dairy products is driven by the growing population, higher income levels, and rising health consciousness. The rising demand for milk and milk-based ingredients is one of the primary factors supporting the market growth.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The key players in this market Harp International Limited (UK), Aditya Air Products (India), A-Gas International Limited (UK), Hychill Australia (Australia), Danfoss Group (Denmark), Linde plc (UK), National Refrigerants Ltd (UK), Sinochem Corporation (China), The Dehon Group (France), and Tazzetti SPA (Italy). Continuous developments in the market—including new product launches, mergers & acquisitions, agreements, and expansions—are expected to help the market grow. Leading manufacturers of Ammonia refrigerants have opted for new product launches to sustain their market position.

Scope of the Report

|

Report Metric |

Details |

|

Years considered for the study |

2017-2030 |

|

Base Year |

2021 |

|

Forecast period |

2022–2030 |

|

Units considered |

Volume (Kiloton); Value (USD Million) |

|

Segments |

Type, Application, and Region |

|

Regions |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies |

The key players in this market Harp International Limited (UK), Aditya Air Products (India), A-Gas International Limited (UK), Hychill Australia (Australia), Danfoss Group (Denmark), Linde plc (UK), National Refrigerants Ltd (UK), Sinochem Corporation (China), The Dehon Group (France), and Tazzetti SPA (Italy). |

This report categorizes the global Ammonia refrigerants market based on type, application, and region.

On the basis of type, the Ammonia refrigerants market has been segmented as follows:

- Purity Above 99%

- Purity Above 99.8%

On the basis of application, the Ammonia refrigerants market has been segmented as follows:

- Cold Storages

- Super Markets

- Heavy Commercial Refrigeration

- Transport Refrigeration

- Household Refrigeration

- Others

On the basis of region, the Ammonia refrigerants market has been segmented as follows:

- Asia Pacific

- Europe

- North America

- Middle East & Africa

- South America

Frequently Asked Questions (FAQ):

What is the expected growth rate of Ammonia refrigerants market?

The forecast period for Ammonia refrigerants market in this study is 2022-2030. The Ammonia refrigerants market is projected to grow at CAGR of 5.7%, in terms of value, during the forecast period.

Who are the major key players in Ammonia refrigerants market?

Harp International Limited (UK), Aditya Air Products (India), A-Gas International Limited (UK), Hychill Australia (Australia), Danfoss Group (Denmark), Linde plc (UK), National Refrigerants Ltd (UK), Sinochem Corporation (China), The Dehon Group (France), and Tazzetti SPA (Italy).

What is the average selling price trend for Ammonia refrigerants market?

Prices are low in Asian countries (primarily China and India) compared to those in Europe and North America due to the low prices of raw materials and the availability of low-cost workforces in Asia Pacific. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Content

1 Introduction

1.1 Objective of the study

1.2 Market definition

1.3 Market Scope

1.3.1 Years considered for the study

1.4 Currency

1.5 Unit Considered

1.6 Stakeholders

2 Research Methodology

2.1 Research Data

2.2 Secondary Data

2.2.1 Key data from secondary sources

2.3 Primary Data

2.3.1 Key data from primary sources

2.3.2 Breakdown of Primary Interviews

2.4 Market Size Estimation

2.4.1 Bottom-Up Approach

2.4.2 Top-Down Approach

2.5 Data Triangulation

2.6 Assumptions

2.7 Limitations

3 Executive Summary

4 Premium Insights

4.1 Opportunities in Ammonia Refrigerants Market

4.2 Ammonia Refrigerants Market, By Type

4.3 Ammonia Refrigerants Market, By Application

4.4 Ammonia Refrigerants Market, By Region

5 Market Overview and Industry Trends

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.2 Restraints

5.2.3 Opportunities

5.2.4 Challenges

5.3 Supply Chain Analysis

5.3.1 Raw Material Manufacturing

5.3.2 Manufacturers

5.3.3 Distribution

5.3.4 End-Use Industry

5.4 Porter’s Five Forces Analysis

5.4.1 Threat of New Entrants

5.4.2 Threat of Substitutes

5.4.3 Bargaining Power of Buyers

5.4.4 Bargaining Power of Suppliers

5.4.5 Intensity of Competitive Rivalry

5.5 Average Selling Price

5.6 Regulatory Landscape

5.7 Industry Outlook

6 Ammonia Refrigerants Market, By Type

6.1 Introduction

6.2 Purity Above 99%

6.3 Purity Above 99.8%

7 Ammonia Refrigerants Market, By Application

7.1 Introduction

7.2 Cold Storages

7.3 Super Markets

7.4 Heavy Commercial Refrigeration

7.5 Transport Refrigeration

7.6 Household Refrigeration

7.7 Others

8 Ammonia Refrigerants Market, By Region

8.1 Introduction

8.2 Asia Pacific

8.2.1 China

8.2.2 India

8.2.3 Japan

8.2.4 South Korea

8.2.5 Rest of Asia Pacific

8.3 North America

8.3.1 U.S.

8.3.2 Canada

8.3.3 Mexico

8.4 Europe

8.4.1 Germany

8.4.2 France

8.4.3 Italy

8.4.4 U.K.

8.4.5 Spain

8.4.6 Russia

8.4.7 Belgium

8.4.8 Rest of Europe

8.5 Middle East & Africa

8.5.1 UAE

8.5.2 Saudi Arabia

8.5.3 South Africa

8.5.4 Rest of Middle East & Africa

8.6 South America

8.6.1 Brazil

8.6.2 Argentina

8.6.3 Rest of South America

9 Competitive Landscape

9.1 Introduction

9.2 Market Share Analysis

9.3 Company Evaluation Quadrant

9.4 Competitive Situation & Trends

9.4.1 New Product Launches

9.4.2 Contracts & Agreements

9.4.3 Partnerships & Collaborations

9.4.4 Joint Ventures

9.4.5 Expansions

10 Company Profile

10.1 Harp International Limited

10.1.1 Business Overview

10.1.2 Products Offered

10.1.3 Recent Development

10.1.4 MnM View

10.1.4.1 Key Strengths

10.1.4.2 Strategic choices made

10.1.4.3 Threat from competition

10.2 Aditya Air Products

10.3 A-Gas International

10.4 Hychill Australia

10.5 Danfoss Group

10.6 The Linde Group

10.7 National Refrigerants Ltd

10.8 Sinochem Group

10.9 The Dehon Group

10.1 Tazzetti

10.11 List of other key market players

11 Appendix

11.1 Insights from Industry Experts

11.2 Discussion Guide

11.3 Related Reports

The study involved four major activities to estimate the size of ammonia refrigerants market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information for this study. These secondary sources include annual reports, press releases, investor presentations of companies, white papers, certified publications, trade directories, certified publications, articles from recognized authors, gold standard and silver standard websites, and databases.

Secondary research has been used to obtain key information about the value chain of the industry, monetary chain of the market, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, and regional markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The ammonia refrigerants market comprises several stakeholders in the value chain, which include raw material suppliers, manufacturers, distributors, and end users. Various primary sources from the supply and demand sides of the ammonia refrigerants market have been interviewed to obtain qualitative and quantitative information.

The primary interviewees from the demand side include key opinion leaders in end-use sectors. The primary sources from the supply side include manufacturers, associations, and institutions involved in the ammonia refrigerants industry.

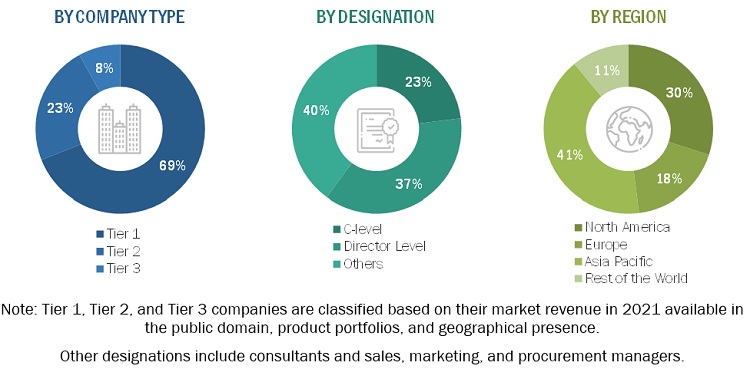

The breakdown of profiles of the primary interviewees is illustrated in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

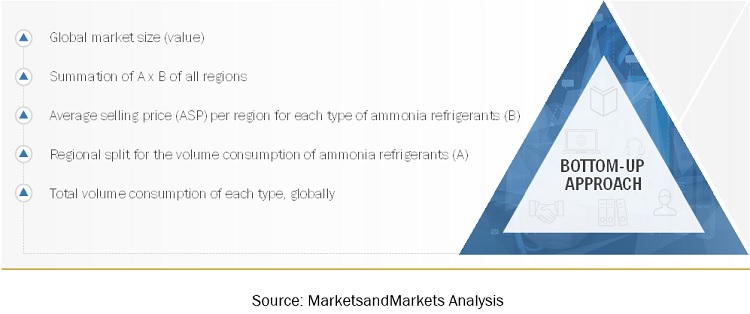

The top-down and bottom-up approaches have been used to estimate and validate the size of the ammonia refrigerants market.

- The key players in the industry have been identified through extensive secondary research.

- The supply chain of the industry has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of the key market players, along with extensive interviews for opinions with leaders such as directors and marketing executives.

Ammonia Refrigerants Market: Bottom-Up Approach 1

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the total market size from the estimation process explained above, the overall market has been split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated by using both the top-down and bottom-up approaches and primary interviews. Hence, for every data segment, there have been three sources—top-down approach, bottom-up approach, and expert interviews. The data was assumed correct when the values arrived from the three sources matched.

Report Objectives

- To define, describe, and forecast the size of the ammonia refrigerants market, in terms of value and volume

- To provide detailed information regarding the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the market

- To estimate and forecast the market size based on type and application

- To forecast the size of the market with respect to major regions, namely, Europe, North America, Asia Pacific, and Middle East & Africa, and South America along with their key countries

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of market leaders

- To track and analyze recent developments such as expansions, new product launches, partnerships & agreements, and acquisitions in the market

- To strategically profile key market players and comprehensively analyze their core competencies2

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis

Further breakdown of a region with respect to a particular country or additional application

Company Information

Detailed analysis and profiles of additional market players

Growth opportunities and latent adjacency in Ammonia Refrigerants Market