Aminophenol Market by Type (p-aminophenol, m-aminophenol, and o-aminophenol), Application (Dye Intermediate, Synthesis Precursor, Fluorescent Stabilizers), End Use Industry, and Geography – Global Forecast to 2027

Updated on : August 28, 2025

Aminophenol Market

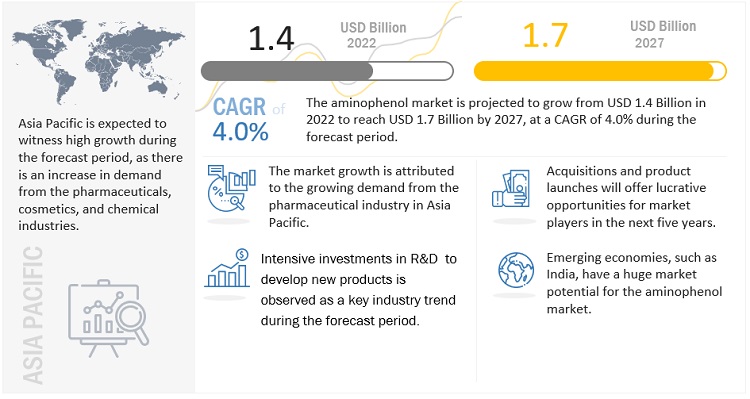

The global aminophenol market was valued at USD 1.4 billion in 2022 and is projected to reach USD 1.7 billion by 2027, growing at 4.0% cagr from 2022 to 2027. The market is growing due to the end-use industries such as pharmaceutical, chemical, cosmetic, and others. Hence, the rapid growth of these industries is expected to contribute to the development of the aminophenol market.

Attractive Opportunities in Aminophenol Market

Note:e-estimated,p-projected.

Source: Expert Interviews, Secondary Sources, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, Request for Free Sample Report

Impact of COVID-19

The outbreak of COVID-19 affected the end-use industries of the aminophenol market across the globe. The impact can be felt on the economy with lockdowns and discontinuation of operations due to social distancing norms. Decrease in the demand from end use industries impacted the aminophenol market across the globe.

Many companies have introduced short-term plans to keep their operations running amid the COVID-19 pandemic. The companies started selling their products through online platforms with contactless delivery.

Aminophenol Market Dynamics

Driver: Growth in end-use industries

The global market for aminophenol is undergoing strong growth due to the rising demand from end-use industries, especially pharmaceutical and chemical. These end-users are also expected to drive the market over the next few years.

The demand for aminophenol is also high in the cosmetic industry due to the Growing awareness of hair care, grooming, personal care, and innovation in hair dye product formulations and formats.

Restraint: Rising number of uncertainties associated with the products

One of the major challenges associated with HPAPIs is the variability and uncertainty associated with each compound. In most cases, the prominence of occupational exposure limits (OELs) is highly neglected during the discovery research and early developmental phases of cytotoxic drugs. Many companies use a one-size-fits-all approach to handling and managing the containment of bulk drug substances. However, every individual process offers different challenges. The situation is intensified by the lack of universally accepted definitions for highly potent or cytotoxic products, which is likely to generate confusion between client companies and custom-CMOs.

Opportunity: Financially attractive market

With the growing demand for aminophenol and their emerging applications, there are many players active in this market. A growing number of global and local players in every country. This increase in competition and the level of market fragmentation for aminophenol highlights the attractiveness of the market.

Challenge: Constant evolution of industry standards and technologies

One of the major challenges faced by the players in this market is the continual evolution of industry standards, technologies, and regulations. Companies that are willing to enter this market are required to adopt these newer technologies, which generally translates to huge investments. Such a rapidly evolving environment poses a challenge to the players in this market.

Aminophenol Market Ecosystem

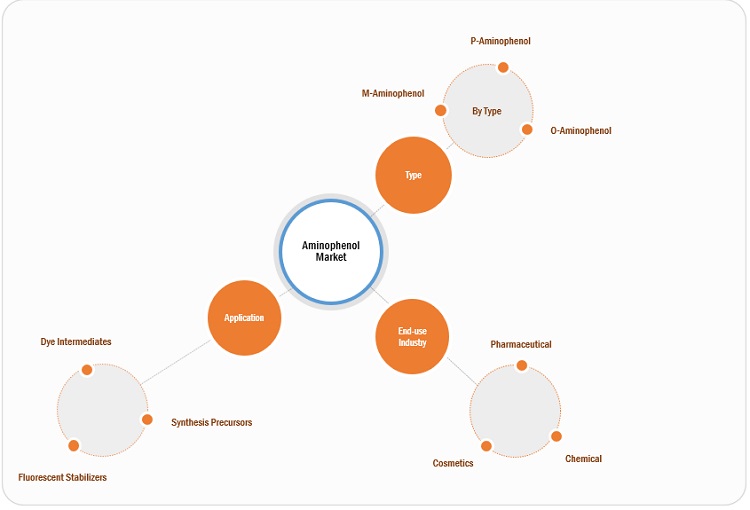

P-aminophenol accounted for the largest share of the aminophenol market during the forecast period

The different types of aminophenol are P-aminophenol, M-aminophenol, and O-aminophenol. P-aminophenol is a major type of aminophenol, which accounts for the largest share. This is primarily due to increased usage in pharmaceutical, chemical, and cosmetics applications.

Pharmaceutical is the fastest-growing end-use industry during the forecast period

Aminophenol are used extensively in end-use industries such as pharmaceutical, chemical, cosmetic, and others. Hence, the rapid development of these industries should contribute to the growth of the aminophenol market. Pharmaceutical is the fastest-growing segment due to the increase in demand for medicines (paracetamol).

APAC accounted for the major share of the Aminophenol market

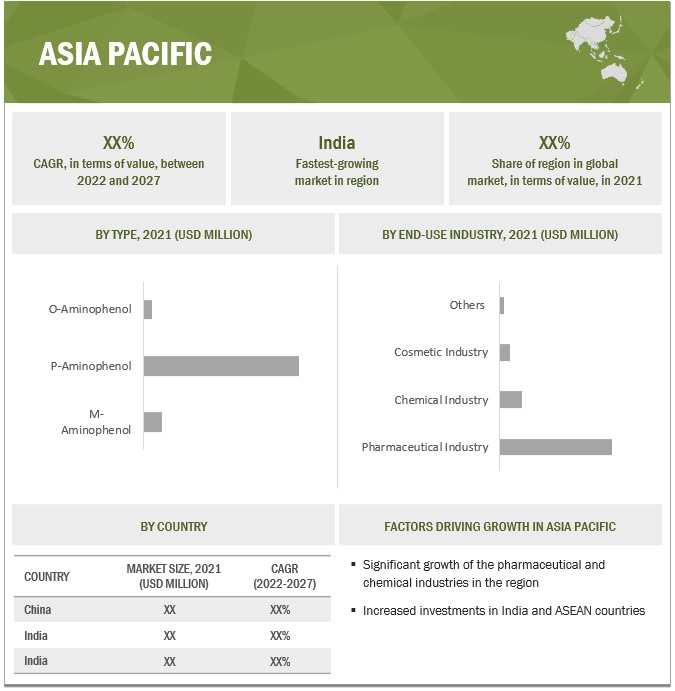

The aminophenol market in APAC is forecast to record its highest CAGR, in terms of value, between 2022 and 2027. Such growth is due to the growing end-use industries of aminophenol in the region. The growth of these major industries further drives demand for the aminophenol market.

To know about the assumptions considered for the study, download the pdf brochure

Aminophenol Market Players

Wego Chemical Group (US), Parchem (US), CDH Fine Chemicals (India), Loba Chemie (India), Glentham Life Sciences Ltd (England), Taixing Yangzi Pharm Chemical CO., LTD. (China), Liaoning Shixing Pharmaceutical & Chemical CO., Ltd. (China), EMCO Dyetuff Pvt Ltd. (India), and Anhui Bayi Chemical Industry Co. Ltd. (China) among others are some of the major players operating in the global market.

Aminophenol Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2022 |

USD 1.4 billion |

|

Revenue Forecast in 2027 |

USD 1.7 billion |

|

CAGR |

4.0% |

|

Years Considered for the study |

2020–2027 |

|

Base year |

2021 |

|

Forecast period |

2022–2027 |

|

Units considered |

Value (USD Million/Billion) and Volume (Kilotons) |

|

Segments |

Type, Applications and End-Use Industry |

|

Regions |

APAC, North America, Europe, the Middle East & Africa, and South America |

|

Companies |

Glentham Life Sciences Ltd (England), Wego Chemical Group (US), Parchem (US), CDH Fine Chemicals (India), EMCO Dyetuff Pvt Ltd. (India), Loba Chemie (India), Liaoning Shixing Pharmaceutical & Chemical CO., Ltd. (China), Anhui Bayi Chemical Industry Co. Ltd. (China), and Taixing Yangzi Pharm Chemical CO., LTD. (China) among others. A total of 24 players are covered. |

This research report categorizes the Aminophenol market based on type, applications, end-use industry, and region.

Based on type, the Aminophenol market has been segmented as follows:

- M-aminophenol

- P-aminophenol

- O-aminophenol

Based on applications, the Aminophenol market has been segmented as follows:

- Synthesis Precursors

- Dye Intermediate

- Fluorescent Stabilizers

- Others

Based on end-use industries, the Aminophenol market has been segmented as follows:

- Pharmaceutical

- Chemical

- Cosmetic

- Other Industries

Based on the region, the Aminophenol market has been segmented as follows:

- North America

- Europe

- APAC

- Middle East & Africa

- South America

Recent Developments

- In 2021 Glentham Life Sciences expanded in Germany as Glentham Life Sciences GmbH. The first bulk shipments within the company are now taking place.

- In 2019, Taixing yangzi pharm chemical co., ltd. added 113 stocks and were newly acquired by brokers; however, company profited from the fresh rise in pharmaceutical firms. The use of drugs and chemicals is preferred.

Frequently Asked Questions (FAQ):

Does this report covers the new applications of aminophenol?

Yes the report covers the new applications of amino phenol.

Does this report cover the volume tables in addition to value tables?

Does this report cover the volume tables in addition to value tables?

What is the current competitive landscape in the aminophenol market in terms of new applications, production, and sales?

The market has various large, medium, and small-scale players operating across the globe. Many players are constantly innovating and developing new products and expanding to developing countries where the demand is constantly growing; thereby boosting sales.

Which all countries are considered in the report?

China, Japan, and India are major countries considered in the report. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 27)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

FIGURE 1 AMINOPHENOL MARKET SEGMENTATION

1.4 YEARS CONSIDERED

1.5 CURRENCY CONSIDERED

1.6 UNITS CONSIDERED

1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 30)

2.1 RESEARCH DATA

FIGURE 2 AMINOPHENOL MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primary interviews

TABLE 1 PARTICIPANT INDUSTRY EXPERTS

2.2 MARKET SIZE ESTIMATION

FIGURE 3 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

FIGURE 4 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

2.3 DATA TRIANGULATION

FIGURE 5 AMINOPHENOL MARKET: DATA TRIANGULATION

2.4 ASSUMPTIONS

2.5 LIMITATIONS AND RISK ASSESSMENT

3 EXECUTIVE SUMMARY (Page No. - 37)

FIGURE 6 P-AMINOPHENOL SEGMENT TO ACCOUNT FOR LARGEST SHARE IN 2021

FIGURE 7 PHARMACEUTICAL SEGMENT TO ACCOUNT FOR LARGEST SHARE IN 2021

FIGURE 8 ASIA PACIFIC TO ACHIEVE HIGHEST GROWTH RATE DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 40)

4.1 SIGNIFICANT OPPORTUNITIES IN AMINOPHENOL MARKET

FIGURE 9 EMERGING ECONOMIES TO OFFER LUCRATIVE GROWTH OPPORTUNITIES TO MARKET PLAYERS BETWEEN 2022 AND 2027

4.2 ASIA PACIFIC: AMINOPHENOL MARKET, BY TYPE AND COUNTRY, 2021 (BY VOLUME)

FIGURE 10 P-AMINOPHENOL SEGMENT AND CHINA ACCOUNTED FOR LARGEST SHARE

4.3 AMINOPHENOL MARKET, BY KEY COUNTRY

FIGURE 11 US TO BE FASTEST-GROWING MARKET FOR AMINOPHENOL

5 MARKET OVERVIEW (Page No. - 42)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 12 AMINOPHENOL MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Increase in demand for paracetamol

5.2.1.2 Rising demand from end-use industries

5.2.1.3 Growing focus on precision medicine

5.2.2 RESTRAINTS

5.2.2.1 Rising uncertainties

5.2.2.2 High risk of cross-contamination

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing demand in emerging economies

5.2.3.2 Financially attractive market

5.2.4 CHALLENGES

5.2.4.1 Constant evolution of industry standards and technologies

5.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 13 AMINOPHENOL MARKET: PORTER’S FIVE FORCES ANALYSIS

5.3.1 THREAT OF NEW ENTRANTS

5.3.2 THREAT OF SUBSTITUTES

5.3.3 BARGAINING POWER OF BUYERS

5.3.4 BARGAINING POWER OF SUPPLIERS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

TABLE 2 AMINOPHENOL MARKET: PORTER’S FIVE FORCES ANALYSIS

5.4 SUPPLY CHAIN ANALYSIS

FIGURE 14 AMINOPHENOL MARKET: SUPPLY CHAIN ANALYSIS

5.5 TRADE ANALYSIS

5.5.1 IMPORT SCENARIO

TABLE 3 IMPORT SCENARIO FOR HS CODE 292229, BY IMPORTER/COUNTRY, 2017–2021 (USD THOUSAND)

5.5.2 EXPORT SCENARIO

TABLE 4 EXPORT SCENARIO FOR HS CODE: 292229, BY EXPORTER/COUNTRY, 2017–2021 (USD THOUSAND)

5.6 PRICING ANALYSIS

TABLE 5 AMINOPHENOL MARKET: PRICING ANALYSIS

TABLE 6 AMINOPHENOL MARKET: PRICING ANALYSIS AVERAGE PRICE RANGE (USD/MT)

5.7 ECOSYSTEM MAP

FIGURE 15 AMINOPHENOL MARKET: ECOSYSTEM MAP

5.8 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

FIGURE 16 AMINOPHENOL MARKET: TRENDS IMPACTING CUSTOMER BUSINESS

5.9 KEY CONFERENCES AND EVENTS, 2022–2023

TABLE 7 AMINOPHENOL MARKET: DETAILED LIST OF CONFERENCES AND EVENTS, 2022–2023

5.10 KEY STAKEHOLDERS AND BUYING CRITERIA

5.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 17 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS

TABLE 8 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP TWO END-USE INDUSTRIES (%)

5.10.2 BUYING CRITERIA

FIGURE 18 KEY BUYING CRITERIA FOR AUTOMOTIVE AND TRANSPORTATION AND CONSUMER APPLIANCE INDUSTRIES

TABLE 9 KEY BUYING CRITERIA FOR AMINOPHENOL IN TOP TWO END-USE INDUSTRIES

5.11 TECHNOLOGY ANALYSIS

5.11.1 SYNTHESIS METHOD

5.11.1.1 P-Nitrophenol method

5.11.2 PHENOL METHOD

5.11.2.1 Phenol nitrosation method

5.11.2.2 Phenol coupling method

5.12 PATENT ANALYSIS

5.12.1 INTRODUCTION

5.12.2 METHODOLOGY

5.12.3 DOCUMENT TYPE

TABLE 10 TOTAL PATENTS GRANTED, 2011–2021

FIGURE 19 NUMBER OF PATENTS PUBLISHED, 2010–2020

FIGURE 20 NUMBER OF PATENTS PUBLISHED, 2011–2021

5.12.4 INSIGHTS

5.12.5 JURISDICTION ANALYSIS

FIGURE 21 PATENT ANALYSIS, BY TOP JURISDICTION, 2011–2021

5.12.6 TOP COMPANIES/APPLICANTS

FIGURE 22 TOP TEN PATENT APPLICANTS, 2011–2021

TABLE 11 TOP 10 US PATENT OWNERS, 2011–2021

6 AMINOPHENOL MARKET, BY TYPE (Page No. - 58)

6.1 INTRODUCTION

FIGURE 23 AMINOPHENOL MARKET, BY TYPE, 2021 (VOLUME)

TABLE 12 AMINOPHENOL MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 13 AMINOPHENOL MARKET, BY TYPE, 2020–2027 (KILOTON)

6.2 P-AMINOPHENOL

6.2.1 INCREASING DEMAND FOR PARACETAMOL

TABLE 14 P-AMINOPHENOL: AMINOPHENOL MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 15 P-AMINOPHENOL: AMINOPHENOL MARKET, BY REGION, 2020–2027 (KILOTON)

6.3 M-AMINOPHENOL

6.3.1 GROWING USE AS DYE INTERMEDIATE

TABLE 16 M-AMINOPHENOL: AMINOPHENOL MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 17 M-AMINOPHENOL: AMINOPHENOL MARKET, BY REGION, 2020–2027 (KILOTON)

6.4 O-AMINOPHENOL

6.4.1 GROWING CONSUMPTION OF COSMETICS

TABLE 18 O-AMINOPHENOL: AMINOPHENOL MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 19 O-AMINOPHENOL: AMINOPHENOL MARKET, BY REGION, 2020–2027 (KILOTON)

7 AMINOPHENOL MARKET, BY APPLICATION (Page No. - 63)

7.1 INTRODUCTION

FIGURE 24 AMINOPHENOL MARKET, BY APPLICATION, 2021, (VOLUME)

TABLE 20 AMINOPHENOL MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 21 AMINOPHENOL MARKET, BY APPLICATION, 2020–2027 (KILOTON)

7.2 SYNTHESIS PRECURSORS

7.2.1 GROWTH IN END-USE INDUSTRIES

TABLE 22 SYNTHESIS PRECURSORS: AMINOPHENOL MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 23 SYNTHESIS PRECURSORS: AMINOPHENOL MARKET, BY REGION, 2020–2027 (KILOTON)

7.3 DYE INTERMEDIATE

7.3.1 INCREASING DEMAND FOR DYES

TABLE 24 DYE INTERMEDIATE: AMINOPHENOL MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 25 DYE INTERMEDIATE: AMINOPHENOL MARKET, BY REGION, 2020–2027 (KILOTON)

7.4 FLUORESCENT STABILIZERS

7.4.1 INCREASED USE IN TEXTILES, LAUNDRY DETERGENTS, AND SOAPS

TABLE 26 FLUORESCENT STABILIZERS: AMINOPHENOL MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 27 FLUORESCENT STABILIZERS: AMINOPHENOL MARKET, BY REGION, 2020–2027 (KILOTON)

7.5 OTHER APPLICATIONS

TABLE 28 OTHER APPLICATIONS: AMINOPHENOL MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 29 OTHER APPLICATIONS: AMINOPHENOL MARKET, BY REGION, 2020–2027 (KILOTON)

8 AMINOPHENOL MARKET, BY END-USE INDUSTRY (Page No. - 69)

8.1 INTRODUCTION

FIGURE 25 AMINOPHENOL MARKET, BY END-USE INDUSTRY, 2021 (VOLUME)

TABLE 30 AMINOPHENOL MARKET, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 31 AMINOPHENOL MARKET, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

8.2 PHARMACEUTICALS

8.2.1 INCREASED PREVALENCE OF CHRONIC DISEASES

TABLE 32 PHARMACEUTICALS: AMINOPHENOL MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 33 PHARMACEUTICALS: AMINOPHENOL MARKET, BY REGION, 2020–2027 (KILOTON)

8.3 CHEMICALS

8.3.1 STEADY GROWTH OF RUBBER AND COATING INDUSTRIES

TABLE 34 CHEMICALS: AMINOPHENOL MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 35 CHEMICALS: AMINOPHENOL MARKET, BY REGION, 2020–2027 (KILOTON)

8.4 COSMETICS

8.4.1 INCREASING INNOVATIONS IN PRODUCT FORMULATION AND FORMATS

TABLE 36 COSMETICS: AMINOPHENOL MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 37 COSMETICS: AMINOPHENOL MARKET, BY REGION, 2020–2027 (KILOTON)

8.5 OTHER INDUSTRIES

TABLE 38 OTHER INDUSTRIES: AMINOPHENOL MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 39 OTHER INDUSTRIES: AMINOPHENOL MARKET, BY REGION, 2020–2027 (KILOTON)

9 AMINOPHENOL MARKET, BY REGION (Page No. - 76)

9.1 INTRODUCTION

FIGURE 26 US TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

TABLE 40 AMINOPHENOL MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 41 AMINOPHENOL MARKET, BY REGION, 2020–2027 (KILOTON)

9.2 ASIA PACIFIC

FIGURE 27 ASIA PACIFIC: AMINOPHENOL MARKET SNAPSHOT

TABLE 42 ASIA PACIFIC: AMINOPHENOL MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 43 ASIA PACIFIC: AMINOPHENOL MARKET, BY COUNTRY, 2020–2027 (KILOTON)

TABLE 44 ASIA PACIFIC: AMINOPHENOL MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 45 ASIA PACIFIC: AMINOPHENOL MARKET, BY TYPE, 2020–2027 (KILOTON)

TABLE 46 ASIA PACIFIC: AMINOPHENOL MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 47 ASIA PACIFIC: AMINOPHENOL MARKET, BY APPLICATION, 2020–2027 (KILOTON)

TABLE 48 ASIA PACIFIC: AMINOPHENOL MARKET, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 49 ASIA PACIFIC: AMINOPHENOL MARKET, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

9.2.1 CHINA

9.2.1.1 Dominance of aminophenol manufacturers

TABLE 50 CHINA: AMINOPHENOL MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 51 CHINA: AMINOPHENOL MARKET, BY TYPE, 2020–2027 (KILOTON)

TABLE 52 CHINA: AMINOPHENOL MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 53 CHINA: AMINOPHENOL MARKET, BY APPLICATION, 2020–2027 (KILOTON)

TABLE 54 CHINA: AMINOPHENOL MARKET, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 55 CHINA: AMINOPHENOL MARKET, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

9.2.2 INDIA

9.2.2.1 Promotion of domestic manufacturing of drug intermediate and APIs under government initiatives

TABLE 56 INDIA: AMINOPHENOL MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 57 INDIA: AMINOPHENOL MARKET, BY TYPE, 2020–2027 (KILOTON)

TABLE 58 INDIA: AMINOPHENOL MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 59 INDIA: AMINOPHENOL MARKET, BY APPLICATION, 2020–2027 (KILOTON)

TABLE 60 INDIA: AMINOPHENOL MARKET, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 61 INDIA: AMINOPHENOL MARKET, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

9.2.3 JAPAN

9.2.3.1 Growing demand from major pharmaceutical manufacturers

TABLE 62 JAPAN: AMINOPHENOL MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 63 JAPAN: AMINOPHENOL MARKET, BY TYPE, 2020–2027 (KILOTON)

TABLE 64 JAPAN: AMINOPHENOL MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 65 JAPAN: AMINOPHENOL MARKET, BY APPLICATION, 2020–2027 (KILOTON)

TABLE 66 JAPAN: AMINOPHENOL MARKET, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 67 JAPAN: AMINOPHENOL MARKET, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

9.2.4 SOUTH KOREA

9.2.4.1 Growth in end-use industries

TABLE 68 SOUTH KOREA: AMINOPHENOL MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 69 SOUTH KOREA: AMINOPHENOL MARKET, BY TYPE, 2020–2027 (KILOTON)

TABLE 70 SOUTH KOREA: AMINOPHENOL MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 71 SOUTH KOREA: AMINOPHENOL MARKET, BY APPLICATION, 2020–2027 (KILOTON)

TABLE 72 SOUTH KOREA: AMINOPHENOL MARKET, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 73 SOUTH KOREA: AMINOPHENOL MARKET, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

9.2.5 REST OF ASIA PACIFIC

TABLE 74 REST OF ASIA PACIFIC: AMINOPHENOL MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 75 REST OF ASIA PACIFIC: AMINOPHENOL MARKET, BY TYPE, 2020–2027 (KILOTON)

TABLE 76 REST OF ASIA PACIFIC: AMINOPHENOL MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 77 REST OF ASIA PACIFIC: AMINOPHENOL MARKET, BY APPLICATION, 2020–2027 (KILOTON)

TABLE 78 REST OF ASIA PACIFIC: AMINOPHENOL MARKET, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 79 REST OF ASIA PACIFIC: AMINOPHENOL MARKET, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

9.3 EUROPE

TABLE 80 EUROPE: AMINOPHENOL MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 81 EUROPE: AMINOPHENOL MARKET, BY COUNTRY, 2020–2027 (KILOTON)

TABLE 82 EUROPE: AMINOPHENOL MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 83 EUROPE: AMINOPHENOL MARKET, BY TYPE, 2020–2027 (KILOTON)

TABLE 84 EUROPE: AMINOPHENOL MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 85 EUROPE: AMINOPHENOL MARKET, BY APPLICATION, 2020–2027 (KILOTON)

TABLE 86 EUROPE: AMINOPHENOL MARKET, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 87 EUROPE: AMINOPHENOL MARKET, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

9.3.1 GERMANY

9.3.1.1 Growth of pharmaceutical, chemical, and cosmetic industries

TABLE 88 GERMANY: AMINOPHENOL MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 89 GERMANY: AMINOPHENOL MARKET, BY TYPE, 2020–2027 (KILOTON)

TABLE 90 GERMANY: AMINOPHENOL MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 91 GERMANY: AMINOPHENOL MARKET, BY APPLICATION, 2020–2027 (KILOTON)

TABLE 92 GERMANY: AMINOPHENOL MARKET, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 93 GERMANY: AMINOPHENOL MARKET, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

9.3.2 FRANCE

9.3.2.1 Increased production of paracetamol

TABLE 94 FRANCE: AMINOPHENOL MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 95 FRANCE: AMINOPHENOL MARKET, BY TYPE, 2020–2027 (KILOTON)

TABLE 96 FRANCE: AMINOPHENOL MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 97 FRANCE: AMINOPHENOL MARKET, BY APPLICATION, 2020–2027 (KILOTON)

TABLE 98 FRANCE: AMINOPHENOL MARKET, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 99 FRANCE: AMINOPHENOL MARKET, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

9.3.3 UK

9.3.3.1 Declining sale of hair colorants

TABLE 100 UK: AMINOPHENOL MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 101 UK: AMINOPHENOL MARKET, BY TYPE, 2020–2027 (KILOTON)

TABLE 102 UK: AMINOPHENOL MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 103 UK: AMINOPHENOL MARKET, BY APPLICATION, 2020–2027 (KILOTON)

TABLE 104 UK: AMINOPHENOL MARKET, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 105 UK: AMINOPHENOL MARKET, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

9.3.4 SPAIN

9.3.4.1 Rising demand in end-use industries

TABLE 106 SPAIN: AMINOPHENOL MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 107 SPAIN: AMINOPHENOL MARKET, BY TYPE, 2020–2027 (KILOTON)

TABLE 108 SPAIN: AMINOPHENOL MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 109 SPAIN: AMINOPHENOL MARKET, BY APPLICATION, 2020–2027 (KILOTON)

TABLE 110 SPAIN: AMINOPHENOL MARKET, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 111 SPAIN: AMINOPHENOL MARKET, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

9.3.5 ITALY

9.3.5.1 Increased funding for national health

TABLE 112 ITALY: AMINOPHENOL MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 113 ITALY: AMINOPHENOL MARKET, BY TYPE, 2020–2027 (KILOTON)

TABLE 114 ITALY: AMINOPHENOL MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 115 ITALY: AMINOPHENOL MARKET, BY APPLICATION, 2020–2027 (KILOTON)

TABLE 116 ITALY: AMINOPHENOL MARKET, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 117 ITALY: AMINOPHENOL MARKET, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

9.3.6 REST OF EUROPE

TABLE 118 REST OF EUROPE: AMINOPHENOL MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 119 REST OF EUROPE: AMINOPHENOL MARKET, BY TYPE, 2020–2027 (KILOTON)

TABLE 120 REST OF EUROPE: AMINOPHENOL MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 121 REST OF EUROPE: AMINOPHENOL MARKET, BY APPLICATION, 2020–2027 (KILOTON)

TABLE 122 REST OF EUROPE: AMINOPHENOL MARKET, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 123 REST OF EUROPE: AMINOPHENOL MARKET, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

9.4 MIDDLE EAST AND AFRICA

TABLE 124 MIDDLE EAST AND AFRICA: AMINOPHENOL MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 125 MIDDLE EAST AND AFRICA: AMINOPHENOL MARKET, BY COUNTRY, 2020–2027 (KILOTON)

TABLE 126 MIDDLE EAST AND AFRICA: AMINOPHENOL MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 127 MIDDLE EAST AND AFRICA: AMINOPHENOL MARKET, BY TYPE, 2020–2027 (KILOTON)

TABLE 128 MIDDLE EAST AND AFRICA: AMINOPHENOL MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 129 MIDDLE EAST AND AFRICA: AMINOPHENOL MARKET, BY APPLICATION, 2020–2027 (KILOTON)

TABLE 130 MIDDLE EAST AND AFRICA: AMINOPHENOL MARKET, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 131 MIDDLE EAST AND AFRICA: AMINOPHENOL MARKET, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

9.4.1 SAUDI ARABIA

9.4.1.1 Growing pharmaceuticals market

TABLE 132 SAUDI ARABIA: AMINOPHENOL MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 133 SAUDI ARABIA: AMINOPHENOL MARKET, BY TYPE, 2020–2027 (KILOTON)

TABLE 134 SAUDI ARABIA: AMINOPHENOL MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 135 SAUDI ARABIA: AMINOPHENOL MARKET, BY APPLICATION, 2020–2027 (KILOTON)

TABLE 136 SAUDI ARABIA: AMINOPHENOL MARKET, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 137 SAUDI ARABIA: AMINOPHENOL MARKET, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

9.4.2 UAE

9.4.2.1 Growth of end-use industries

TABLE 138 UAE: AMINOPHENOL MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 139 UAE: AMINOPHENOL MARKET, BY TYPE, 2020–2027 (KILOTON)

TABLE 140 UAE: AMINOPHENOL MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 141 UAE: AMINOPHENOL MARKET, BY APPLICATION, 2020–2027 (KILOTON)

TABLE 142 UAE: AMINOPHENOL MARKET, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 143 UAE: AMINOPHENOL MARKET, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

9.4.3 REST OF MIDDLE EAST AND AFRICA

TABLE 144 REST OF MIDDLE EAST AND AFRICA: AMINOPHENOL MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 145 REST OF MIDDLE EAST AND AFRICA: AMINOPHENOL MARKET, BY APPLICATION, 2020–2027 (KILOTON)

TABLE 146 REST OF MIDDLE EAST AND AFRICA: AMINOPHENOL MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 147 REST OF MIDDLE EAST AND AFRICA: AMINOPHENOL MARKET, BY TYPE, 2020–2027 (KILOTON)

TABLE 148 REST OF MIDDLE EAST AND AFRICA: AMINOPHENOL MARKET, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 149 REST OF MIDDLE EAST AND AFRICA: AMINOPHENOL MARKET, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

9.5 NORTH AMERICA

TABLE 150 NORTH AMERICA: AMINOPHENOL MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 151 NORTH AMERICA: AMINOPHENOL MARKET, BY COUNTRY, 2020–2027 (KILOTON)

TABLE 152 NORTH AMERICA: AMINOPHENOL MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 153 NORTH AMERICA: AMINOPHENOL MARKET, BY TYPE, 2020–2027 (KILOTON)

TABLE 154 NORTH AMERICA: AMINOPHENOL MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 155 NORTH AMERICA: AMINOPHENOL MARKET, BY APPLICATION, 2020–2027 (KILOTON)

TABLE 156 NORTH AMERICA: AMINOPHENOL MARKET, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 157 NORTH AMERICA: AMINOPHENOL MARKET, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

9.5.1 US

9.5.1.1 Presence of major pharmaceutical manufacturers

TABLE 158 US: AMINOPHENOL MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 159 US: AMINOPHENOL MARKET, BY TYPE, 2020–2027 (KILOTON)

TABLE 160 US: AMINOPHENOL MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 161 US: AMINOPHENOL MARKET, BY APPLICATION, 2020–2027 (KILOTON)

TABLE 162 US: AMINOPHENOL MARKET, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 163 US: AMINOPHENOL MARKET, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

9.5.2 CANADA

9.5.2.1 A leading exporter of pharmaceutical products

TABLE 164 CANADA: AMINOPHENOL MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 165 CANADA: AMINOPHENOL MARKET, BY TYPE, 2020–2027 (KILOTON)

TABLE 166 CANADA: AMINOPHENOL MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 167 CANADA: AMINOPHENOL MARKET, BY APPLICATION, 2020–2027 (KILOTON)

TABLE 168 CANADA: AMINOPHENOL MARKET, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 169 CANADA: AMINOPHENOL MARKET, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

9.5.3 MEXICO

9.5.3.1 Use of aminophenol as dye intermediate, stabilizer, synthetic precursor

TABLE 170 MEXICO: AMINOPHENOL MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 171 MEXICO: AMINOPHENOL MARKET, BY TYPE, 2020–2027 (KILOTON)

TABLE 172 MEXICO: AMINOPHENOL MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 173 MEXICO: AMINOPHENOL MARKET, BY APPLICATION, 2020–2027 (KILOTON)

TABLE 174 MEXICO: AMINOPHENOL MARKET, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 175 MEXICO: AMINOPHENOL MARKET, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

9.6 SOUTH AMERICA

TABLE 176 SOUTH AMERICA: AMINOPHENOL MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 177 SOUTH AMERICA: AMINOPHENOL MARKET, BY COUNTRY, 2020–2027 (KILOTON)

TABLE 178 SOUTH AMERICA: AMINOPHENOL MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 179 SOUTH AMERICA: AMINOPHENOL MARKET, BY TYPE, 2020–2027 (KILOTON)

TABLE 180 SOUTH AMERICA: AMINOPHENOL MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 181 SOUTH AMERICA: AMINOPHENOL MARKET, BY APPLICATION, 2020–2027 (KILOTON)

TABLE 182 SOUTH AMERICA: AMINOPHENOL MARKET, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 183 SOUTH AMERICA: AMINOPHENOL MARKET, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

9.6.1 BRAZIL

9.6.1.1 Government focus on strengthening economic conditions

TABLE 184 BRAZIL: AMINOPHENOL MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 185 BRAZIL: AMINOPHENOL MARKET, BY TYPE, 2020–2027 (KILOTON)

TABLE 186 BRAZIL: AMINOPHENOL MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 187 BRAZIL: AMINOPHENOL MARKET, BY APPLICATION, 2020–2027 (KILOTON)

TABLE 188 BRAZIL: AMINOPHENOL MARKET, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 189 BRAZIL: AMINOPHENOL MARKET, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

9.6.2 ARGENTINA

9.6.2.1 Expected growth in economy to boost market

TABLE 190 ARGENTINA: AMINOPHENOL MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 191 ARGENTINA: AMINOPHENOL MARKET, BY TYPE, 2020–2027 (KILOTON)

TABLE 192 ARGENTINA: AMINOPHENOL MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 193 ARGENTINA: AMINOPHENOL MARKET, BY APPLICATION, 2020–2027 (KILOTON)

TABLE 194 ARGENTINA: AMINOPHENOL MARKET, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 195 ARGENTINA: AMINOPHENOL MARKET, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

9.6.3 REST OF SOUTH AMERICA

TABLE 196 REST OF SOUTH AMERICA: AMINOPHENOL MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 197 REST OF SOUTH AMERICA: AMINOPHENOL MARKET, BY TYPE, 2020–2027 (KILOTON)

TABLE 198 REST OF SOUTH AMERICA: AMINOPHENOL MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 199 REST OF SOUTH AMERICA: AMINOPHENOL MARKET, BY APPLICATION, 2020–2027 (KILOTON)

TABLE 200 REST OF SOUTH AMERICA: AMINOPHENOL MARKET, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

TABLE 201 REST OF SOUTH AMERICA: AMINOPHENOL MARKET, BY END-USE INDUSTRY, 2020–2027 (KILOTON)

10 COMPETITIVE LANDSCAPE (Page No. - 132)

10.1 INTRODUCTION

10.2 STRATEGIES ADOPTED BY KEY PLAYERS

TABLE 202 OVERVIEW OF STRATEGIES ADOPTED BY AMINOPHENOL MANUFACTURERS

10.3 MARKET SHARE ANALYSIS

10.3.1 MARKET SHARE OF KEY PLAYERS, 2021

TABLE 203 AMINOPHENOL MARKET: MARKET SHARE OF KEY PLAYERS

FIGURE 28 AMINOPHENOL MARKET SHARE ANALYSIS

10.4 COMPANY EVALUATION QUADRANT (KEY PLAYERS)

10.4.1 STARS

10.4.2 PERVASIVE PLAYERS

10.4.3 EMERGING LEADERS

10.4.4 PARTICIPANTS

FIGURE 29 AMINOPHENOL MARKET: COMPANY EVALUATION QUADRANT, 2021

10.5 AMINOPHENOL MARKET, EVALUATION QUADRANT (OTHER PLAYERS)

10.5.1 PROGRESSIVE COMPANIES

10.5.2 RESPONSIVE COMPANIES

10.5.3 DYNAMIC COMPANIES

10.5.4 STARTING BLOCKS

FIGURE 30 START-UPS AND SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION MATRIX, 2021

10.6 COMPETITIVE BENCHMARKING

TABLE 204 AMINOPHENOL MARKET: DETAILED LIST OF KEY PLAYERS

TABLE 205 AMINOPHENOL MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS, BY TYPE

TABLE 206 AMINOPHENOL MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS, BY END-USE INDUSTRY

10.7 COMPETITIVE ANALYSIS AND TRENDS

10.7.1 DEALS

TABLE 207 AMINOPHENOL MARKET: DEALS, 2018–2022

11 COMPANY PROFILES (Page No. - 141)

11.1 MAJOR PLAYERS

(Business Overview, Products/Solutions/Services offered, Recent Developments, MnM view, Key strengths/right to win, Strategic choices, Weaknesses and competitive threats) *

11.1.1 WEGO CHEMICAL GROUP

TABLE 208 WEGO CHEMICAL GROUP: COMPANY OVERVIEW

11.1.2 PARCHEM

TABLE 209 PARCHEM: COMPANY OVERVIEW

11.1.3 CDH FINE CHEMICALS

TABLE 210 CDH FINE CHEMICALS: COMPANY OVERVIEW

11.1.4 GLENTHAM LIFE SCIENCES LTD.

TABLE 211 GLENTHAM LIFE SCIENCES LTD.: COMPANY OVERVIEW

11.1.5 EMCO DYESTUFF PVT. LTD.

TABLE 212 EMCO DYESTUFF PVT., LTD.: COMPANY OVERVIEW

11.1.6 LOBA CHEMIE

TABLE 213 LOBA CHEMIE: COMPANY OVERVIEW

11.1.7 TAIXING YANGZI PHARM CHEMICAL CO., LTD.

TABLE 214 TAIXING YANGZI PHARM CHEMICAL CO., LTD.: COMPANY OVERVIEW

11.1.8 LIAONING SHIXING PHARMACEUTICAL & CHEMICAL CO., LTD.

TABLE 215 LIAONING SHIXING PHARMACEUTICAL & CHEMICAL CO., LTD.: COMPANY OVERVIEW

11.1.9 ANHUI BAYI CHEMICAL INDUSTRY CO., LTD.

TABLE 216 ANHUI BAYI CHEMICAL INDUSTRY CO., LTD.: COMPANY OVERVIEW

*Details on Business Overview, Products/Solutions/Services offered, Recent Developments, MnM view, Key strengths/right to win, Strategic choices, Weaknesses and competitive threats might not be captured in case of unlisted companies.

11.2 OTHER PLAYERS

11.2.1 AARTI INDUSTRIES LIMITED (AIL)

TABLE 217 AARTI INDUSTRIES LIMITED (AIL): COMPANY OVERVIEW

11.2.2 J K CHEMICAL

TABLE 218 J K CHEMICAL: COMPANY OVERVIEW

11.2.3 JAY ORGANICS PVT. LTD.

TABLE 219 JAY ORGANICS PVT. LTD.: COMPANY OVERVIEW

11.2.4 VALIANT ORGANICS LIMITED

TABLE 220 VALIANT ORGANICS LIMITED: COMPANY OVERVIEW

11.2.5 KAJAY REMEDIES PVT. LTD.

TABLE 221 KAJAY REMEDIES PVT. LTD.: COMPANY OVERVIEW

11.2.6 JIANDE XINGFENG CHEMICAL CO., LTD.

TABLE 222 JIANDE XINGFENG CHEMICAL CO., LTD.: COMPANY OVERVIEW

11.2.7 HEBEI XINGYU CHEMICAL CO., LTD.

TABLE 223 HEBEI XINGYU CHEMICAL CO., LTD.: COMPANY OVERVIEW

11.2.8 CAMING PHARMACEUTICAL LIMITED

TABLE 224 CAMING PHARMACEUTICAL LIMITED: COMPANY OVERVIEW

11.2.9 HULUDAO TIANQI SHENGYE CHEMICAL CO. LTD.

TABLE 225 HULUDAO TIANQI SHENGYE CHEMICAL CO. LTD.: COMPANY OVERVIEW

11.2.10 JAYVIR DYE CHEM

TABLE 226 JAYVIR DYE CHEM: COMPANY OVERVIEW

11.2.11 SEQENS GROUP

TABLE 227 SEQENS GROUP: COMPANY OVERVIEW

11.2.12 OTTO CHEMIE PVT. LTD.

TABLE 228 OTTO CHEMIE PVT. LTD.: COMPANY OVERVIEW

11.2.13 SHREE HARI ORGANICS

TABLE 229 SHREE HARI ORGANICS: COMPANY OVERVIEW

11.2.14 SYNEX GLOBAL SERVICES LLP

TABLE 230 SYNEX GLOBAL SERVICES LLP: COMPANY OVERVIEW

11.2.15 ACS CHEMICALS

TABLE 231 ACS CHEMICALS: COMPANY OVERVIEW

12 APPENDIX (Page No. - 169)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGESTORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

12.3 CUSTOMIZATION OPTIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

The study involved four major activities in estimating the current market size of aminophenol. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both supply-side and demand-side approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation methods were used to estimate the size of the segments and subsegments of the overall market.

Secondary Research

This research report involves the use of extensive secondary sources, directories, and databases, such as Bloomberg, BusinessWeek, Factiva, ICIS, and OneSource to identify and collect information useful for the technical, market-oriented, and commercial study of the aminophenol market. The secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, and articles from recognized authors, authenticated directories, and databases.

Primary Research

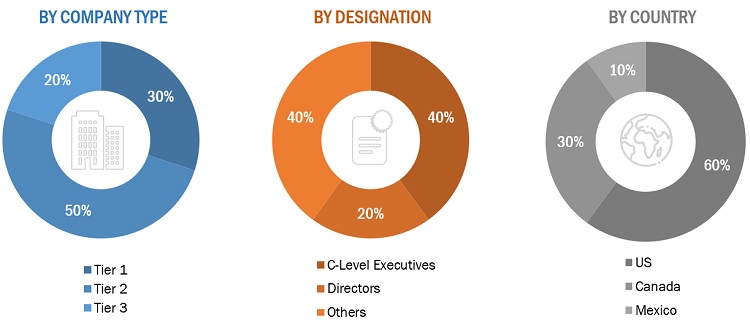

The aminophenol market comprises several stakeholders, such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations. The demand side of this market is characterized by the development of agrochemicals, pharmaceuticals, chemical, cosmetic and other end-use industries. The supply side included industry experts, such as CEOs, vice presidents, marketing directors, technology and innovation directors, and related key executives from various companies and organizations operating in the market. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Following is the breakdown of primary respondents:

Notes: Companies are classified based on their revenue–Tier 1 = >USD 7 billion, Tier 2 = USD 500 million to USD 7 billion, and Tier 3 =

Others include sales, marketing, and product managers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Supply-side and Demand-side approaches have been used to estimate and validate the total size of the aminophenol market. These approaches have also been used extensively to estimate the size of various dependent sub-segments of the market. The research methodology used to estimate the market size includes the following steps:

- The key players have been identified through extensive secondary research.

- The aminophenol industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares split, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

Data Triangulation

After arriving at the overall size of the aminophenol market from the estimation process explained above, the total market has been split into several segments and sub-segments. The data triangulation and market breakdown procedures have been employed, wherever applicable to complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Apart from this, the market size has been validated using both supply-side and demand-side approaches.

Report Objectives

- To define, describe, and forecast the size of the aminophenol market, in terms of value and volume

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the market growth

- To analyze and forecast the market based on type, applications, and end-use industry

- To analyze and forecast the market based on key regions, such as North America, Europe, Asia Pacific (APAC), the Middle East & Africa, and South America

- To strategically analyze the micro-markets with respect to individual growth trends, growth prospects, and their contribution to the overall market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for the market leaders

- To analyze competitive developments in the market, such as new product launches, collaboration, and expansion

- To strategically profile the key players and comprehensively analyze their market shares and core competencies

Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country

Company Information

- Detailed analysis and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Aminophenol Market