Aluminum Foil Packaging Market

Aluminum Foil Packaging Market by Product Type (Bags & Pouches, Wraps & Rolls, Blisters), Packaging Type (Semi-rigid, Flexible, Others), Type (Backed Foil, Rolled Foil), Application (Food, Beverages, Pharmaceuticals), & Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

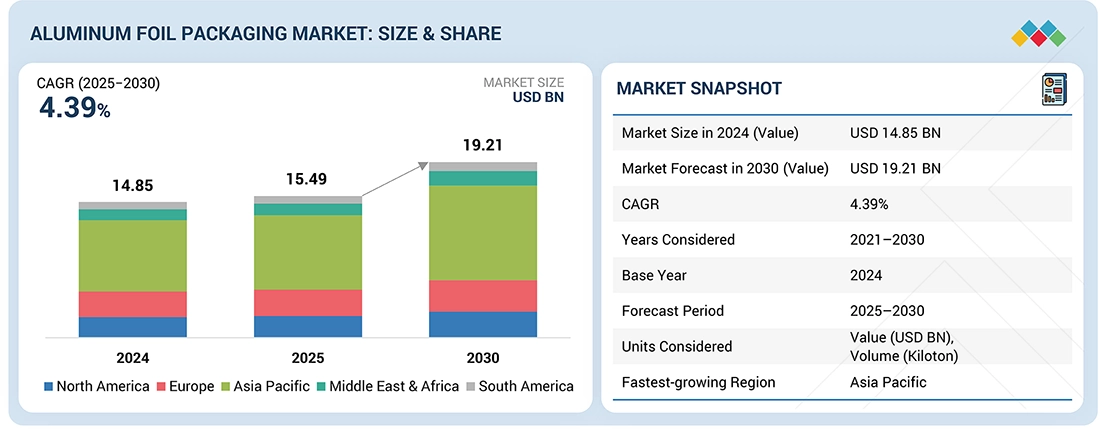

The aluminum foil packaging market is projected to reach USD 19.21 billion by 2030 from USD 15.49 billion in 2025, at a CAGR of 4.39% from 2025 to 2030. The aluminum foil packaging industry is experiencing rapid growth for several reasons. Firstly, aluminum foil offers excellent barrier properties, which help extend the shelf life of food products. Additionally, there is a strong and consistent demand from key industries, such as pharmaceuticals and personal care. The fast growth of the e-commerce market also requires lightweight and protective packaging solutions. Furthermore, there is an increasing emphasis on sustainability, which is driving the demand for aluminum packaging.

KEY TAKEAWAYS

-

BY REGIONThe Asia Pacific is projected to grow at a CAGR of 4.96% in the aluminum foil packaging market during the forecast period.

-

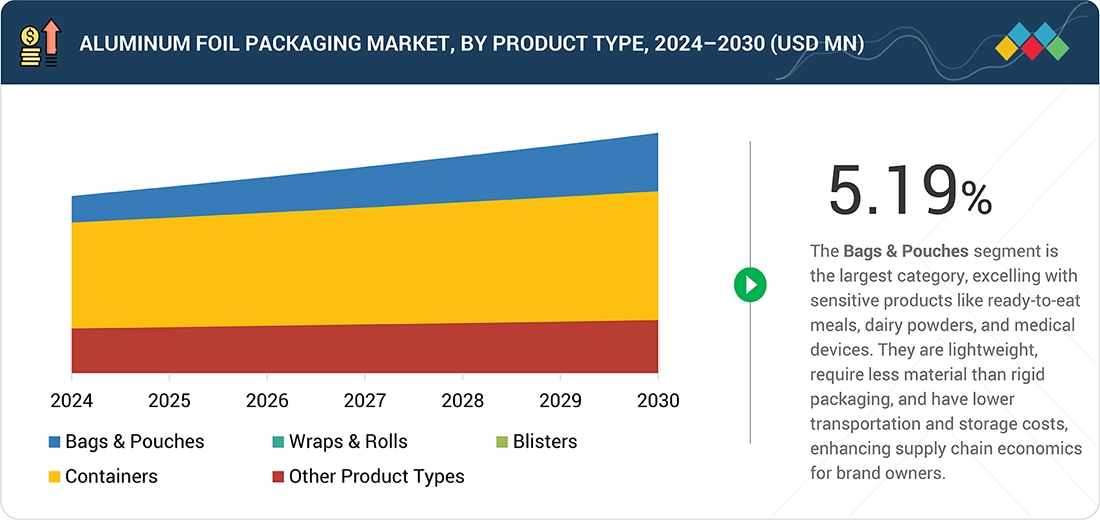

BY PRODUCT TYPEBy product type, the bags & pouches segment is expected to dominate the market during the forecast period.

-

BY TYPEBy type, the rolled foil segment accounted for the largest market share of 50% in 2024.

-

BY PACKAGING TYPEBy packaging type, the flexible segment is expected to grow at the highest CAGR of 5.45% during the forecast period.

-

BY APPLICATIONBy application, the food segment accounted for the largest market share of 43% and is expected to grow at a CAGR of 4.75% between 2025 and 2030.

-

Competitive Landscape- Key PlayersCompanies such as RusAL, Hulamin, Hindalco Industries Ltd., China Hongqiao Group Limited, and Amcor plc were identified as some of the star players in the aluminum foil packaging market (global), given their strong market share and product footprint.

-

Competitive Landscape- StartupsCompanies such as D&W Fine Pack, Wyda South Africa, and LSKB Aluminium Foils Pvt. Ltd., among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

The growth of the aluminum foil packaging market is driven by several factors. There is an increasing demand for food packaging, fueled by the rise in e-commerce sales and the need for sustainable packaging solutions. Various industries are also seeking additional packaging options. New partnerships, company expansions, product launches, investments in recycling technology, and innovations in products are all transforming the industry.

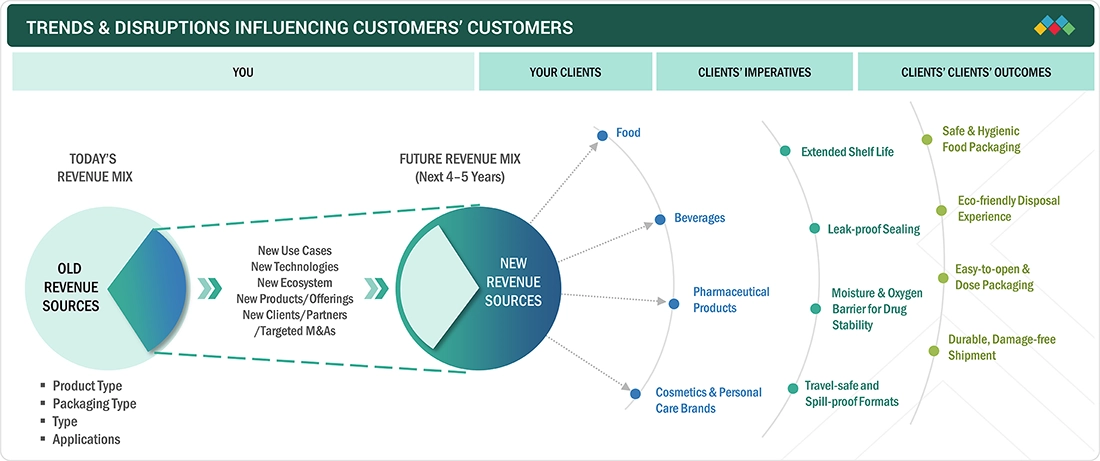

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Aluminum foil packaging trends are turning toward sustainability. The main industry focus is on recycling aluminum foil packaging because aluminum is an easily recyclable product, and this can also help in energy savings. Furthermore, growing demand from large industries like food and pharmaceuticals is driving product innovations.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Long shelf life of food products

-

High demand for aluminum foil from end-use industries

Level

-

Volatile prices of raw materials

-

Easy availability of substitutes

Level

-

Upcoming regulations and government initiatives

-

Demand from food-delivery and retail-ready meals

Level

-

Recyclability of multi-layer aluminum foils

-

Economic imbalance of trade

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: High demand for aluminum foils from end-use industries

The market for aluminum foil packaging is highly driven by the increased demand from the pharmaceutical, food, and cosmetics industries, where the primary concern is the functionality of protecting the product and maintaining its shelf life. Aluminum foil becomes essential in the blister and strip packaging of pharmaceuticals because it has almost total protection against moisture, oxygen, light, and contaminants, which guarantees the drug's effectiveness and regulatory acceptance. Foil usage has also continued to grow as a result of the rapid growth of generic medications, over-the-counter drugs, and unit-dose containers. Aluminum foil packaging is commonly used in the food industry for ready-to-eat meals, dairy products, confectionery, snacks, and beverages to maintain freshness, flavor, and nutritional content, particularly in areas with hot and humid climates. The cosmetics and personal care industry also plays a big role in terms of foil seals, sachets, and tubes that shield sensitive formulas against oxidation and microbial infestations. The conjoining expansion of urban populations, structured retail, e-commerce, and evolving customer lifestyles is consistently driving the demand for aluminum foil packaging in these end-use segments.

Restraint: Volatile prices of raw materials

The aluminum foil packaging market faces a significant challenge due to the volatility in raw material prices, particularly primary aluminum. The cost of aluminum is highly sensitive to various factors, including energy prices, mining production, geopolitical tensions, trade regulations, and supply-demand imbalances. A substantial portion of aluminum production costs is tied to energy expenses, meaning that fluctuations in electricity prices directly impact the costs of aluminum foil, as well as the profit margins of suppliers and converters. This price instability poses financial risks for packaging manufacturers and brand owners, making it challenging to establish long-term pricing contracts and impacting investment planning. Smaller converters are particularly vulnerable, as they often lack the financial flexibility to absorb sudden price increases. In highly competitive markets such as food and cosmetics, cost pressures may lead to a shift toward alternative materials like plastic films or metallized substrates, thereby limiting the use of aluminum foil. As a result, the issue of raw material price volatility remains a persistent challenge to maintaining profitability in the aluminum foil packaging sector.

Opportunity: Upcoming regulations and government initiatives

Future policies and government initiatives hold significant potential for the aluminum foil packaging market, particularly in terms of food safety, pharmaceutical compliance, and sustainability. Globally, governments are tightening regulations related to hygienic packaging, extending shelf life, and preventing contamination, which increasingly favors high-barrier materials like aluminum foil. In the pharmaceutical sector, there is a growing need for drug stability, tamper evidence, and traceability, leading to a reliance on aluminum blister and strip packages. Additionally, sustainability-oriented policies that prioritize recyclability, reduce plastic usage, and adopt the circular economy model present opportunities for aluminum foil, given its high recyclability and material value. Investments in recycling infrastructure and low-carbon aluminum production are also enhancing the environmental outlook for foil packaging. Furthermore, capacity expansion is being supported by incentives for domestic manufacturing, particularly in the Asia Pacific region and emerging economies. These regulatory and policy changes position aluminum foil packaging as a forward-thinking and compliant solution for a wide range of applications.

Challenge: Recyclability of multi-layer aluminum foils

Aluminum is inherently recyclable, but the recyclability of multi-layer aluminum foil structures presents a significant challenge for the packaging industry. Flexible aluminum foil packaging is often combined with plastics, paper, or coatings to achieve the desired strength, sealability, and printability. Unfortunately, these layered materials cannot be easily separated using standard recycling methods, resulting in low recycling rates and increased amounts of waste that end up in landfills or are burned. Growing regulatory and consumer interest in reducing packaging waste has intensified pressure on brand owners and converters to address this issue. The lack of standardized collection and recycling systems for multi-layer foils complicates efforts to achieve a circular economy, especially in developing countries. While research is underway on mono-material foil structures, delamination technologies, and chemical recycling, these solutions have not yet gained widespread commercial adoption. A critical technical and economic challenge facing the aluminum foil packaging market is the need to balance high barrier performance with recyclability, all while keeping costs manageable. Addressing this challenge is essential for ensuring the long-term sustainability of aluminum foil packaging.

ALUMINUM FOIL PACKAGING MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Aluminum foil containers designed for beer packaging, offering an alternative to traditional glass bottles and cans while ensuring product freshness and portability for outdoor and on-the-go consumption. | Excellent barrier protection against light, oxygen, and moisture, preserving the quality and taste of beer. |

|

Pharmaceutical aluminum foil security solutions used in blister and strip packaging to protect medicines from counterfeiting and product tampering. | High barrier protection ensuring drug stability and extended shelf life. |

|

Development of plastic-free aluminum foil packaging for Essentielle, designed to replace conventional plastic-based laminates in consumer goods packaging. | Fully recyclable aluminum-based structure supporting circular economy goals. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The aluminum foil packaging market comprises a number of raw material suppliers, manufacturers, distributors, and companies from end-use applications. It starts with acquiring raw materials, after which aluminum foil packaging manufacturers convert raw materials into finished products, which include bags & pouches, containers, blisters, wraps & rolls, and other products. It is then used by end-use applications to package food, beverage, personal care & cosmetics, pharmaceuticals, and others. Distributors are also involved in the process of supplying the packaging products to the end-use applications.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Aluminum Foil Packaging Market, by Product Type

Blister packaging is the fastest-growing type of aluminum foil packaging, largely due to the rapid expansion of the pharmaceutical and healthcare industries. There is a high demand for unit dose packs and high-barrier packaging. Aluminum foil blister packs offer exceptional protection against moisture, oxygen, light, and contamination, which is crucial for maintaining the stability, safety, and efficacy of tablets, capsules, and sensitive formulations. Increasing regulatory requirements concerning drug safety and shelf-life assurance are driving the popularity of blister packaging compared to bulk and bottle options. The demand for patient-centric packaging is another significant factor in this growth. Blister packs facilitate accurate dosing, enhance patient compliance, and simplify the monitoring of medication adherence, especially important for chronic disease management and among the elderly. Innovations such as child-resistant and senior-friendly blister designs are further contributing to their widespread adoption. Additionally, the emergence of generic medicines, over-the-counter medications, and the contract production of pharmaceuticals has led to a high demand for standardized blister packaging, which predominantly relies on aluminum foil. Beyond pharmaceuticals, blister packaging is also making inroads in nutraceuticals, medical devices, and certain personal care products, where hygiene and evidence of tampering are major concerns. Furthermore, the rise of e-pharmacies and international drug distribution has further fueled the growth of blister packaging, making it the most rapidly expanding segment within aluminum foil packaging.

Aluminum Foil Packaging Market, by Type

Rolled foil is the largest segment of the aluminum foil packaging market, based on type. This is primarily because rolled foil is the most versatile, cost-effective, and widely used option in both domestic and industrial applications. Rolled foil is available in continuous coils or rolls, making it ideal for processes that require speed, such as lamination, printing, slitting, and the production of pouches or blisters. This format is made into various downstream packaging forms, including bags and pouches, lidding foils, wraps, sachets, and blister packs. Its economic advantage comes from economies of scale, reduced handling losses, and more straightforward storage and transportation compared to pre-formed or backed foil. Additionally, rolled foil allows converters and brand owners to customize thickness, tempering, and surface treatment to suit specific application needs. This versatility helps it dominate the food, pharmaceutical, and personal care packaging sectors. The overall consumption of rolled foil is further boosted by rising urban populations in new markets, as it is widely used in cooking and baking, as well as in preserving food items. The growth in flexible packaging, increased demand for longer shelf life, and the expansion of organized retail and food delivery services also contribute to the rising interest in rolled foil.

Aluminum Foil Packaging Market, by Packaging Type

Semi-rigid packaging is the largest category of packaging due to its optimal balance between structural strength and material efficiency. Types such as aluminum trays, containers, blister packs, and lids provide adequate rigidity to protect products during handling, stacking, and transportation while using less material compared to fully rigid packaging. This makes semi-rigid foil packaging particularly valuable for ready-to-eat meals, baked goods, dairy products, pharmaceuticals, and food service applications. In addition, aluminum exhibits high temperature resistance, making it suitable for ovenable and retort packs. Semi-rigid blister packs are especially common in the pharmaceutical industry because they protect medications in unit doses, offer tamper-evidence, and comply with regulatory requirements. Furthermore, semi-rigid aluminum containers are highly recyclable and possess a high barrier capacity, contributing to their dominance in high-volume applications. Their leading market position is further supported by a large installed base of production lines and strong consumer familiarity.

Aluminum Foil Packaging Market, by Application

The primary use of aluminum foil packaging is in the food industry, due to its exceptional barrier properties that help keep various food products fresh, safe, and high-quality. Aluminum foil serves as an effective packaging material for restaurants because it can block moisture, oxygen, light, and microorganisms. This makes it ideal for perishable and sensitive foods such as dairy products, candies, snacks, ready-to-eat meals, and beverages. Its thermal capacity is advantageous for baking, grilling, freezing, and reheating, which is particularly beneficial for convenience foods and food service. The rapid population growth in urban areas, along with changing consumer behaviors and an increasing preference for packaged and processed foods, has further fueled the demand for aluminum foil. Additionally, aluminum foil packaging aids in portion control, extends shelf life, and helps reduce food waste, aligning with both commercial objectives and sustainability goals. Its versatility, cost-effectiveness, and recyclability reinforce its status as the leading application in the aluminum foil packaging market for food products.

REGION

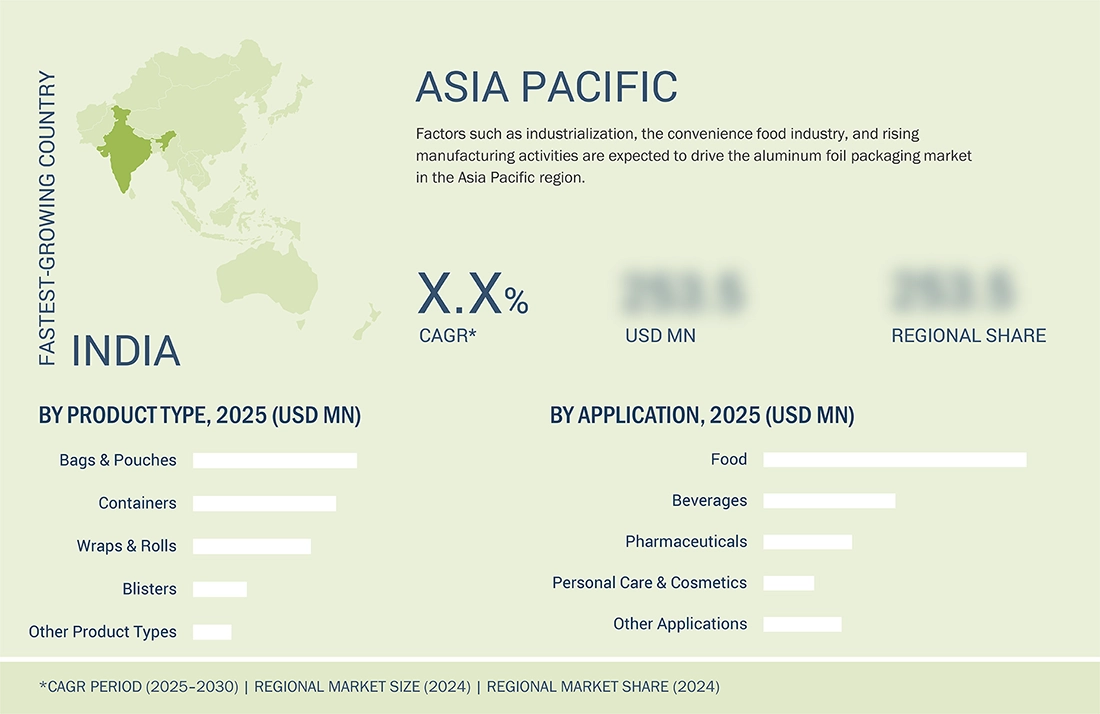

Asia Pacific to be fastest-growing region in global aluminum foil packaging market during forecast period

The Asia Pacific region is the largest and fastest-growing market for aluminum foil packaging due to its significant population base, rapid urbanization, and a focus on high-growth end-use markets, such as food, pharmaceuticals, and personal care. With increasing disposable incomes, shifting lifestyles, and a growing middle class in countries like China, India, Indonesia, and Vietnam, the region is poised to experience the highest rates of packaged food consumption and ready-to-eat meals. One reason for the popularity of aluminum foil packaging in this region is its ability to extend shelf life in hot and humid climates, making it particularly suitable for the local environment. Additionally, the Asia Pacific has a well-established ecosystem for aluminum production and conversion, especially in China, which is the world's largest producer of aluminum and aluminum foil. This concentration provides economies of scale, easy access to raw materials, and bulk production capabilities, all of which stimulate domestic demand and exports. Moreover, the booming pharmaceutical industry, characterized by the production of generics and contract packaging, has significantly increased the demand for aluminum foil in the manufacturing of blister packs and strip packages. The rise of structured retail, online businesses, and food delivery services in the region is also contributing to the growing use of flexible packaging, including aluminum foil. Together with competitive labor costs and rising investments in packaging infrastructure, these factors position the Asia Pacific as the leading market for aluminum foil packaging.

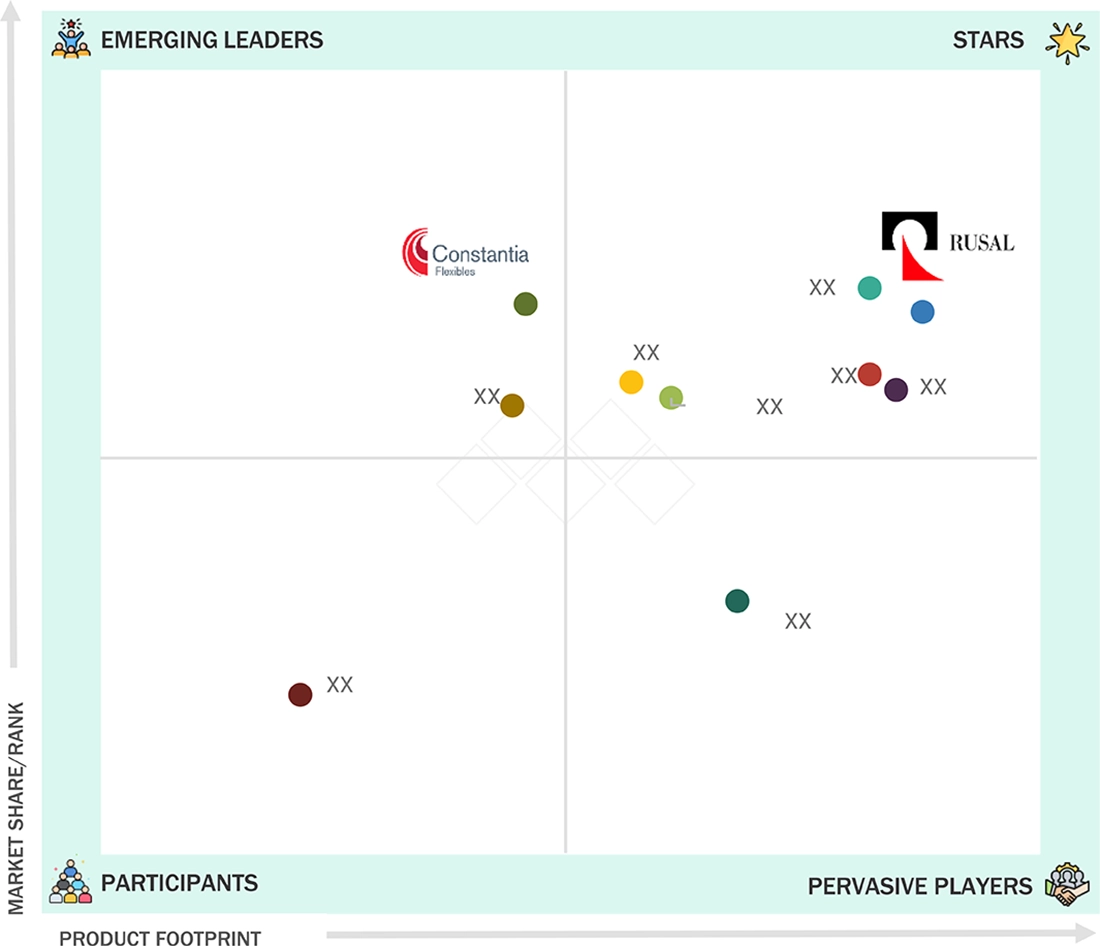

ALUMINUM FOIL PACKAGING MARKET: COMPANY EVALUATION MATRIX

In the aluminum foil packaging market matrix, RusAL (Star) leads with a strong market share and extensive product footprint, driven by its largescale production and huge international market presence. Constantia Flexibles (Emerging Leader) is gaining visibility with its expertise in sustainability and market acquisitions. While RusAL dominates through scale and a diverse portfolio, Constantia Flexibles shows significant potential to move toward the leaders’ quadrant as demand for aluminum foil packaging continues to rise.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- RusAL (Russia)

- Hulamin (South Africa)

- Hindalco Industries Ltd. (India)

- China Hongqiao Group Limited (China )

- Amcor plc (Switzerland)

- Kibar Holding (Turkey)

- Constantia Flexibles (Austria)

- Reynolds Consumer Products (US)

- GARMCO (Bahrain)

- Raviraj Foils Limited (India)

- Eurofoil Luxembourg SA (Luxembourg)

- Penny Plate, LLC (US)

- Coppice (UK)

- Alufoil Products Co. (US)

- AMPCO (Saudi Arabia)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 14.85 Billion |

| Market Forecast in 2030 (Value) | USD 19.21 Billion |

| Growth Rate | CAGR of 4.39% from 2025–2030 |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million/Billion), Volume (Kiloton) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, and the Middle East & Africa |

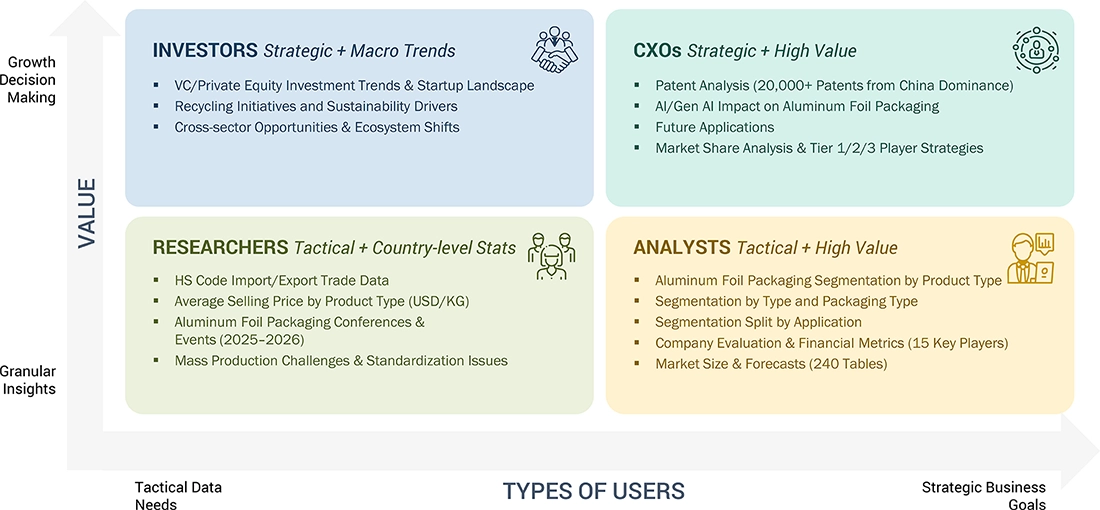

WHAT IS IN IT FOR YOU: ALUMINUM FOIL PACKAGING MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Additional Segments | By thickness and technology segments studied | Identified market opportunities in materials on the basis of thickness and technology of aluminum foil packaging |

RECENT DEVELOPMENTS

- July 2025 : RusAL introduced Russia’s first ultra-low-carbon aluminum beverage can through a strategic partnership with AB InBev Efes, an aluminum packaging manufacturer, and a major retailer. Using ALLOW INERTA technology and over 50% recycled aluminum, the project significantly cuts emissions and advances circular economy goals in sustainable packaging.

- October 2024 : Amcor Capsules launched ESSENTIELLE, a plastic-free aluminum-paper foil, in collaboration with Moët & Chandon. This innovative foil offers a 31% lower carbon footprint compared to standard foils, retains premium bottle aesthetics, ensures full recyclability, and supports high-speed packaging lines, marking a major step in sustainable wine and spirits packaging.

- August 2024 : Hongfa Aluminum is accelerating its digital transformation as part of China Hongqiao Group’s broader expansion into intelligent manufacturing. By integrating advanced AI systems across casting, hot rolling, inspection, and safety management processes, the company is significantly enhancing production efficiency, operational safety, and product quality.

Table of Contents

Methodology

The study involved four major activities to estimate the current size of the global aluminum foil packaging market. Exhaustive secondary research was conducted to gather information on the market, the peer product market, and the parent product group market. The next step was to validate these findings, assumptions, and sizes with industry experts across the aluminum foil packaging value chain through primary research. The top-down and bottom-up approaches were employed to estimate the overall size of the aluminum foil packaging market. Following this, market breakdown and data triangulation procedures were employed to determine the size of various market segments.

Secondary Research

The market for companies offering aluminum foil packaging is determined by secondary data obtained from paid and unpaid sources, analyzing the product portfolios of major companies in the ecosystem, and evaluating companies based on their performance and quality. Various secondary sources, including Business Standard, Bloomberg, the World Bank, and Factiva, were consulted to identify and collect information for this study on the aluminum foil packaging market. During the secondary research process, various secondary sources were consulted to identify and collect information relevant to the study. Secondary sources included annual reports, press releases, investor presentations, forums, certified publications, and white papers from aluminum foil packaging vendors. The secondary research was utilized to gather critical information on the industry’s value chain, the total pool of key players, market classification, and segmentation from both market- and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as chief executive officers (CEOs), vice presidents (VPs), marketing directors, technology and innovation directors, and related key executives from several key companies and organizations operating in the aluminum foil packaging market. After completing the market engineering process (calculations for market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers derived. Primary research was also conducted to identify the segmentation types, industry trends, and competitive landscape of aluminum foil packaging offered by various market players, as well as key market dynamics, including drivers, restraints, opportunities, challenges, and industry trends, and key player strategies. In the complete market engineering process, the top-down and bottom-up approaches and several data triangulation methods were extensively used to perform the market estimation and market forecasting for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list the key information/insights throughout the report.

Notes: Other designations include sales, marketing, and product managers. Tier 1: >USD 1 billion, Tier 2: USD 500 million to USD 1 billion, and Tier 3: USD 500 million

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the size of the global aluminum foil packaging market. These approaches were also used extensively to estimate the size of various dependent market segments. The research methodology used to estimate the market size included the following:

Aluminum Foil Packaging Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size using the market size estimation processes, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Aluminum foil packaging utilizes thin aluminum foil sheets to package various products. Aluminum foil is a versatile material used in various applications. It is lightweight, flexible, and easy to shape and size, making it an excellent option for packaging.

Aluminum foil packaging is used in various industries, including food, beverages, pharmaceuticals, personal care & cosmetics, and others. It is commonly used in the food and beverage industries for snacking, ready-to-eat meals, dairy goods, and beverages. It extends the product’s shelf life by protecting the food from air, moisture, and light. Moreover, it is frequently used in the healthcare sector for packaging medical equipment, medications, and other products that require sterility and tamper-evident packaging. Aluminum foil packaging comes in various shapes and sizes, including containers, pouches, wraps, lids, and tapes. The packaging material can be customized with laminations, coatings, and printing to meet the individual needs of the packaged product. Aluminum foil packaging has a low environmental impact due to its reusability and recyclability.

Key Stakeholders

- Raw Material Suppliers

- Regulatory Bodies

- Government and Consulting Firms

- End Users

- Research and Development Organizations

- Aluminum foil Packaging Manufacturers, Dealers, Traders, and Suppliers

Report Objectives

- To define, describe, and forecast the size of the global aluminum foil packaging market based on product type, type, packaging type, application, and region in terms of value and volume

- To provide detailed information on the significant drivers, restraints, opportunities, and challenges influencing the market

- To strategically analyze micromarkets concerning individual growth trends, prospects, and their contribution to the market

- To assess the growth opportunities in the market for stakeholders and provide details on the competitive landscape for market leaders

- To forecast the market size of segments for North America, Europe, Asia Pacific, South America, and the Middle East & Africa

- To strategically profile the key players and comprehensively analyze their market shares and core competencies

- To analyze competitive developments such as product launches, expansions, partnerships, and acquisitions in the aluminum foil packaging market

- To provide the impact of AI on the market

Available customizations:

With the given market data, MarketsandMarkets offers customizations according to client-specific needs.

The following customization options are available for the aluminum foil packaging report:

Product Analysis

- A product matrix that gives a detailed comparison of the product portfolio of each company

Regional Analysis

- A further breakdown of the aluminum foil packaging market for additional countries

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Aluminum Foil Packaging Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Aluminum Foil Packaging Market