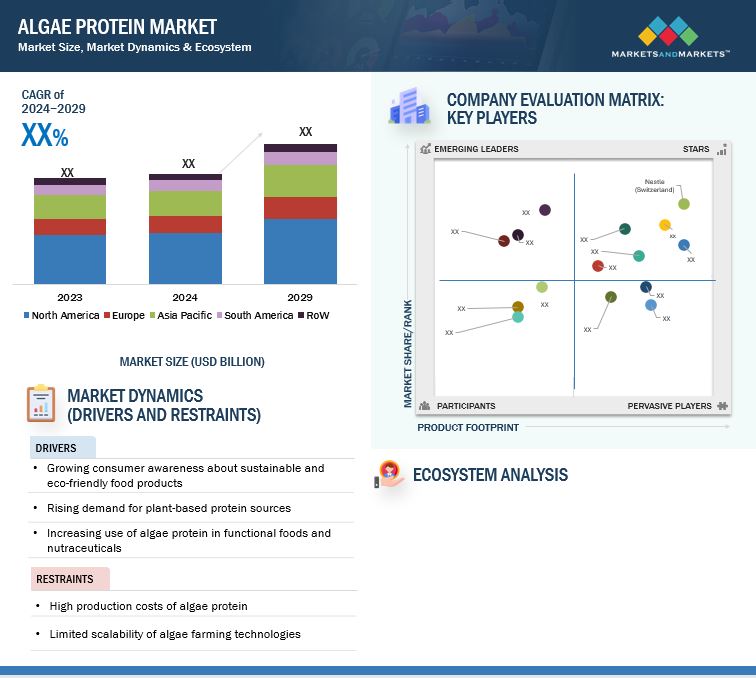

Algae Protein Market

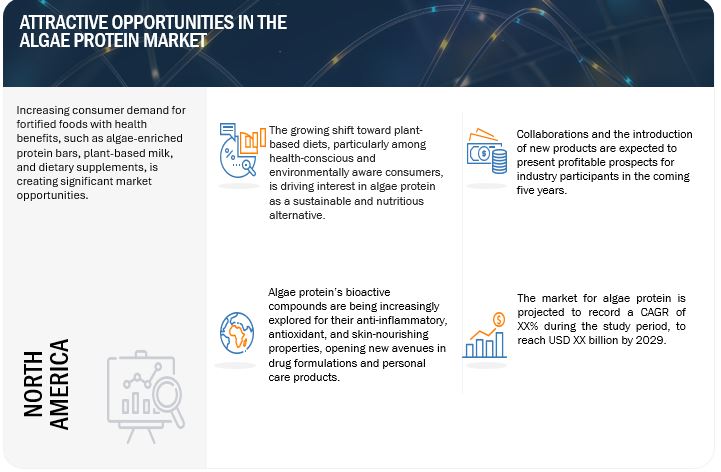

The market for algae protein is estimated at USD XX billion in 2024; it is projected to grow at a CAGR of XX% to reach USD XX billion by 2029. The algae protein market is experiencing significant growth due to the increasing demand for sustainable and environmentally friendly protein sources. As more consumers seek alternatives to animal-based proteins, algae have emerged as a promising solution, offering high-quality, plant-based protein that is rich in essential amino acids. Studies, such as those from the University of Exeter as mentioned in the American Society for Nutrition Journal 2023, highlight algae as a highly effective source of protein for supporting muscle health, which further boosts its appeal, particularly in the growing fitness and health-conscious markets.

The 2024 MDPI (Multidisciplinary Digital Publishing Institute) journal on Microalgae states that Microalgae, in particular, have gained attention for their exceptional nutritional value, containing up to 70% protein with all 20 essential amino acids required by the human body. Unlike traditional protein sources, algae require minimal land and water resources for cultivation, making them a more sustainable option. This eco-friendly nature of algae cultivation resonates well with consumers concerned about environmental sustainability and ethical food production, fueling its adoption in various food and beverage products.

Global Algae Protein Market Trends

Market Drivers

Drivers:

Growing consumer awareness about sustainable and eco-friendly food products

In recent years, there has been a significant shift in consumer behavior, driven by a growing awareness of environmental issues and the impact of food production on the planet. As concerns about climate change, resource depletion, and animal welfare continue to rise, more consumers are seeking food products that align with their values, particularly when it comes to sustainability and eco-friendliness. This trend is becoming increasingly evident in the food industry, with a marked shift toward plant-based, organic, and responsibly sourced products.

Restraints:

High production costs of algae protein

Algae require specific environmental conditions to grow effectively, and these conditions can be difficult and expensive to replicate on a large scale. While algae can be cultivated in both freshwater and marine environments, large-scale cultivation often requires carefully controlled environments to optimize growth and yield. Algae cultivation typically takes place in open ponds or photobioreactors (closed systems), both of which come with their own set of challenges.

In open ponds, the risk of contamination from unwanted species can hinder the growth of the targeted algae, requiring frequent monitoring and maintenance. Closed systems, such as photobioreactors, offer better control over the growing conditions but are costly to build and maintain due to the sophisticated equipment and infrastructure required. These systems also demand significant energy inputs for lighting, temperature control, and nutrient management, all of which increase the overall cost of production.

Opportunities:

Increasing adoption in animal feed and aquaculture sectors

The animal feed industry, particularly in poultry and livestock farming, traditionally relies on protein sources such as soybeans, fishmeal, and corn. However, the environmental impacts of these ingredients such as deforestation from soy farming, overfishing for fishmeal, and the large amounts of land and water required for conventional crop production have sparked interest in alternative, more sustainable protein sources. Algae protein is particularly attractive due to its low environmental footprint. Algae require far less land and water than traditional crops and do not contribute to deforestation or soil degradation.

Several companies have begun integrating algae protein into livestock and poultry feeds to reduce reliance on conventional protein sources. For instance, DSM, a global leader in animal nutrition, has been developing algae-based feed products to supplement traditional feed formulations. They have introduced life’s OMEGA, a sustainable, algae-derived omega-3 solution that offers a plant-based alternative to traditional fish-based omega-3 sources. This innovation addresses the growing consumer demand for both healthier food options and eco-friendly, sustainable solutions. By harnessing algae's natural ability to produce omega-3s, DSM provides a solution that avoids the environmental impact of overfishing while supporting the nutritional needs of a rapidly growing global population.

Algae's high protein content, along with its rich nutrient profile containing essential amino acids, omega-3 fatty acids, and antioxidants makes it a suitable addition to animal diets. Additionally, algae protein has been shown to improve feed efficiency and promote overall animal health, making it an increasingly popular choice for livestock farmers seeking to optimize production while minimizing their environmental impact.

Challenges:

Competition from alternative plant-based protein sources

Plant-based protein sources like chickpeas, mung beans, and fava beans are becoming increasingly popular due to their perceived naturalness, clean-label status, and compatibility with emerging consumer trends like allergen-free and gluten-free diets. Companies in the alternative protein space are also heavily investing in research and development to improve the functionality, taste, and cost-effectiveness of these proteins. For example, innovations in textured pea protein have made it a staple in plant-based meat production, while rice protein is gaining attention in the sports nutrition segment due to its digestibility. In contrast, algae protein production is still associated with high costs and lower consumer awareness, making it challenging to compete directly with these well-entrenched alternatives. Overcoming these competitive pressures will require ongoing advancements in algae protein production technologies, cost reduction efforts, and targeted marketing to emphasize algae's unique sustainability and nutritional benefits.

Algae Protein Market Ecosystem

Prominent companies in this market include well-established, financially stable manufacturers of algae protein. These companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Prominent companies in this market include Corbion (Netherlands), Fermentalg (France), Vinpai (France), Cyanotech (US), and Tianjin Norland Biotech Co., Ltd. (China) among others.

Based on type, the spirulina protein segment is projected to be the dominant segment in the market.

Spirulina, a blue-green microalga, is rich in protein (containing up to 70% of its dry weight), essential amino acids, vitamins, and minerals, making it a preferred choice in food, nutraceuticals, and dietary supplements. Its recognition as a superfood has bolstered consumer interest, particularly in the health and wellness sectors. For instance, a study published by the Journal of Medicinal Food highlighted spirulina’s role in reducing oxidative stress and improving immunity, further solidifying its popularity among fitness enthusiasts and individuals seeking functional foods.

Moreover, spirulina’s versatility in product formulations from protein powders and snack bars to vegan protein shakes has led to widespread adoption. Companies like Cyanotech Corporation (US) have focused on scaling the production of high-quality spirulina to meet global demand. Additionally, spirulina’s use in combating malnutrition has gained support from organizations such as the United Nations World Food Programme, which considers it a cost-effective solution for addressing protein deficiencies in developing regions. These factors, combined with increased investments in spirulina cultivation technologies, ensure that this segment will remain a key driver of growth in the algae protein market.

The pharmaceuticals & nutraceuticals segment among applications in the algae protein market is projected to have a significant share.

Algae protein, particularly from spirulina and chlorella, is rich in antioxidants, anti-inflammatory compounds, and essential amino acids, making it highly sought after in the development of health supplements, immunity boosters, and functional foods. A recent 2023 study conducted by the National Institute of Health (NIH) highlighted the effectiveness of algae protein in reducing cholesterol levels and managing blood sugar, increasing its appeal among individuals with chronic conditions. Thus, the growing emphasis on preventative healthcare and the demand for natural, bioactive ingredients helps to boost the market growth.

Asia Pacific is the fastest growing region in the algae protein market.

Countries such as China, India, and Japan are witnessing a surge in demand for algae protein due to its health benefits and sustainability. For instance, an article by BioMed Central Ltd highlights that China has heavily invested in large-scale algae cultivation projects, while Japan has integrated algae protein into traditional and functional foods, such as algae-based noodles and soups. In India, the demand for spirulina is rapidly increasing, supported by government programs promoting its use in combating malnutrition. Additionally, research institutions in Asia are pioneering studies on the cultivation and processing of algae for food and feed, helping to lower production costs and improve efficiency. For example, the Indian Institute of Technology (IIT) has developed cost-effective technologies for spirulina production, increasing its accessibility to local markets.

Key Market Players

- Corbion (Netherlands)

- Fermentalg (France)

- Vinpai (France)

- Cyanotech (US)

- Tianjin Norland Biotech Co., Ltd. (China)

Other players in the market include Back of the Yards algae sciences Inc. (US), NB Laboratories (India), Fuqing King Dnarmsa Spirulina Co., Ltd. (China), SUN CHLORELLA (Japan), Earthrise Nutritional (US).

These market players are focusing on increasing their presence through agreements and collaborations. These companies have a strong presence in North America, Asia Pacific, Europe, South America, and the Rest of the World. They also have manufacturing facilities along with strong distribution networks across these regions.

Recent Developments

- In July 2022, DIC Corporation (Japan) and Back of the Yards Algae Sciences (BYAS) partnered together to advance the algae protein business. This collaboration is centered around research and development (R&D) efforts that combine DIC’s expertise in algae mass-culture technology and functional component extraction with BYAS’s innovative capabilities.

- In March 2022, Corbion (Netherlands), and Nestlé (Switzerland) partnered to create microalgae-based ingredients that will enhance the taste, nutrition, and sustainability of Nestlé's growing plant-based portfolio. This partnership aims to develop algae-derived ingredients, potentially including algae-based flour, to boost the nutritional profile of vegan beverages, plant-based fish, and meat alternatives. By leveraging microalgae as a sustainable alternative protein and micronutrient source, the collaboration will not only strengthen Nestlé’s product offerings but also provide a commercial opportunity for these innovative, eco-friendly ingredients. This R&D initiative aligns with both company's goals of advancing sustainable food solutions and expanding plant-based options for consumers.

Frequently Asked Questions (FAQ):

What is the current size of the algae protein market?

The algae protein market is estimated at USD XX billion in 2024 and is projected to reach USD XX billion by 2029, at a CAGR of XX% during the same period.

Which are the key players in the market, and how intense is the competition?

Corbion (Netherlands), Fermentalg (France), Vinpai (France), Cyanotech (US), Tianjin Norland Biotech Co., Ltd. (China). The market for algae protein is expanding rapidly, with more mergers, acquisitions, and product launches. Companies in this sector are also heavily investing in research and development.

Which region is projected to account for the largest share of the algae protein market?

The North American market is expected to dominate during the forecast period due to the high demand for plant-based foods and dietary supplements, coupled with significant advancements in algae cultivation technologies. The region's strong focus on sustainability and health-conscious consumer trends further drives growth.

What kind of information is provided in the company profiles section?

The provided company profiles deliver crucial details, including a thorough business summary that covers different segments, financial results, geographic presence, revenue distribution, and business revenue breakdown. They also offer insights into product lines, key achievements, and expert analyst opinions to better illustrate the company's potential.

What are the factors driving the algae protein market?

The algae protein market is driven by the rising demand for sustainable, plant-based protein alternatives and increasing consumer awareness about the health and environmental benefits of algae-based products.

TABLE OF CONTENTS

1. INTRODUCTION

Growth opportunities and latent adjacency in Algae Protein Market