Aircraft Generators Market by Current Type (AC, DC), Type (VSCF, IDG, APU, Starter Generator), Power Rating, Aircraft Technology, Platform (Fixed-wing, Rotary-wing), End Use (OEM, Aftermarket) and Region - Global Forecast to 2027

Updated on : Oct 22, 2024

The Aircraft Generators Market is projected to grow from USD 5.2 billion in 2022 to USD 7.3 billion by 2027, growing at a CAGR of 7.1% during the forecast period.

The growth of the aircraft generators market can be attributed to several factors, such as the growing trend towards more electric aircraft (MEA) and the increasing demand for automation in flight control. The aviation industry is undertaking continuous efforts to make flight operations cleaner and greener. Electrification of aircraft will contribute to this goal as it helps replace traditional systems like hydraulic and pneumatic systems, thus reducing the harmful effects of leakage and the need for maintenance

To know about the assumptions considered for the study, Request for Free Sample Report

Aircraft Generator Market Dynamics:

Driver: Growing Trend of More Electric Technology

As the trend toward more electric aircraft (MEA) accelerates, aircraft OEMs have started collaborating with suppliers to design new systems and set up new electrically intensive architectures. The concept of MEA acts as a critical enabler in the aircraft industry and unlocks significant potential for aircraft weight reduction, fuel-efficient engines, reduction in operational costs by reducing maintenance costs, and increased aircraft reliability. All non-propulsive systems are currently driven by hydraulic, pneumatic, and mechanical power sources. The concept of MEA provides an incentive for the utilization of electric power in such traditional systems. In MEA, wattage is employed in the non-propulsion systems of an aircraft like flight-control, wing-ice protection, environmental protection, fuel pumping systems, among others. For instance, the Boeing 787 uses electric motors for its environmental protection system, electrical braking system, and ice protection, while the Airbus A380 and F-35 use electric motors in their control systems. With the usage of electrical motors in aircraft gaining popularity through step-by-step adoption of electrically powered equipment in additional aircraft systems, the expansion of the aircraft generators market is imminent.

Restraint: High Voltage and Thermal Issues

Transmitting large quantities of electricity around an aircraft (e.g., from batteries or generators to electric motors) is ideally done at high voltages. Also, with the use of high-power density batteries and motors aircraft systems, the operating voltage is significantly higher during flight. This may generate hundreds of kilowatts of dissipated heat from multiple sources such as electric motors, batteries, power electronics or cabling. The over-heating can be mitigated with the use of an efficient cooling system in place; the absence of this can have a detrimental effect. In 2018, Magnus eFusion, a prototype electric aircraft developed by Siemens (Germany) and EcoFly (Austria) caught fire due to battery thermal issues when it was cruising at a low altitude. Such instances can be avoided by integrating a heat generation mitigation system in place. Also, to cope with such large output power of batteries and motors, improvements in thermal and electrical insulation materials are required.

Opportunity: Development of advanced power electronics

The increasing use of programmable solid-state devices and switching power devices in place of traditional electromechanical circuit breaker technology is expected to benefit aircraft in terms of load management, fault isolation, diagnostic health monitoring, and improved flexibility to accommodate modifications and system upgrades. Traditionally, electrical power for aerospace applications has been generated using a variable ratio gearbox-mounted wound-field synchronous machine to obtain a three-phase 115 V AC system at a constant frequency of 400 Hz. This machine, known as an integrated drive generator (IDG), is still commonly used today. However, operating experiences under the new requirements of lower cost, increased reliability, easier maintenance, and higher operating temperatures have shown that a replacement for the gearbox using power electronics has obvious advantages. A high-quality three-phase AC-DC conversion plus subsequent DC-AC conversion is one of the steps in achieving these objectives. The resulting system is known as a variable speed constant frequency (VSCF) system, which is a promising technology that meets the above requirements.

Challenge: Stringent Regulatory Framework

The aviation industry is highly regulated mainly due to the inherent risks associated with aircraft operations. A multitude of bilateral, national, and international regulations and standards bind the actions of airports and aircraft operators. The International Civil Aviation Organization (ICAO) lays down globally consistent regulations due to the universal nature of the industry. All aeronautical parts and activities of a civil airport must meet the ICAO standards to ensure the safe operation of aircraft and control the risks associated with it to an acceptable level.

The globalization and liberalization of aviation businesses have put immense commercial pressure on airlines and airports due to the increasing international competition. Components and systems for aircraft undergo stringent quality checks and rigorous testing to increase safety levels. With the complexity of modern aircraft increasing due to the growing use of electronic components, airplane manufacturers struggle to keep up with their delivery commitments. With rapid technological advancements and new technologies and products replacing the old ones every five to seven years, it becomes a challenge for component and system manufacturers to adhere to the regulatory environment.

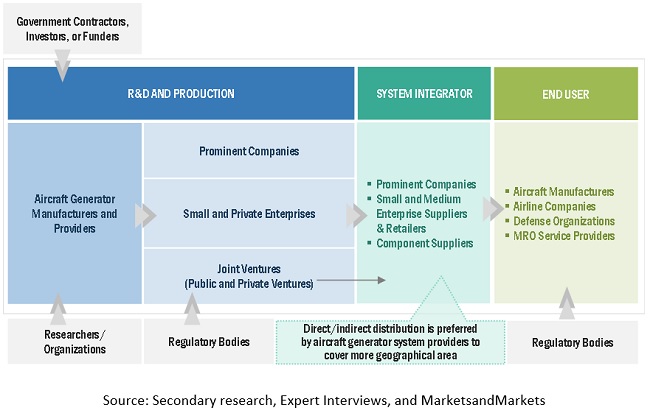

Aircraft Generator Market Ecosystem

Prominent companies who manufacture and provide aircraft generators, private & small enterprises, distributors/suppliers/retailers, and end customers are key stakeholders in the aircraft generators market ecosystem. Investors, funders, academic researchers, integrators, service providers, and licensing authorities serve as major influencers in the market.

The OEM segment is estimated to lead the aircraft generator market in 2022

Based on End Use, the OEM segment of the aircraft generator market is accounted for the largest growth during the forecast period. The increasing demand for different aircraft across all regions, due to the increasing air traffic is expected to drive the demand for the aircraft generators across these regions.

The AC current type is expected to grow at the highest CAGR during the forecast period

Based on current type, AC current type is expected to grow the largest during the forecast period. The AC power system results in better design and allows for more efficient use of electrical and electronic devices. The main advantage is that they can transmit electricity over a long range easily and efficiently. These factors contribute to the high growth of the AC current type.

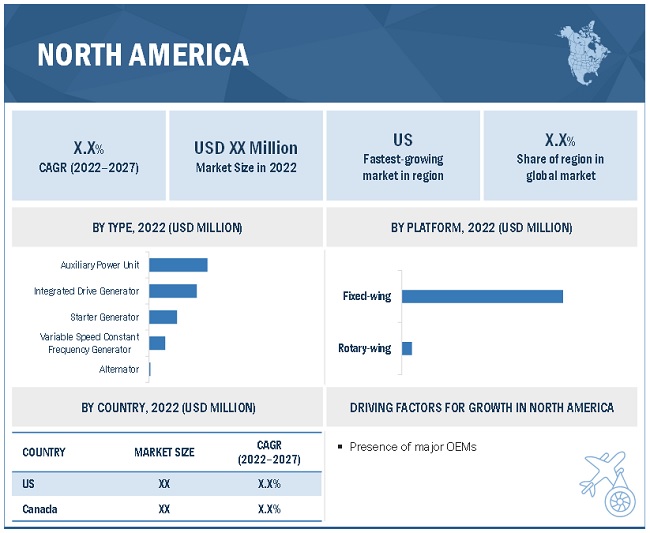

North American region is expected to have the highest market share during the forecast period

North American region constitutes that largest aircraft generator manufacturers among all the regions. Key companies like Honeywell, General Electric and Collins Aerospace all have their headquarters situated in the US. The North American region also designs and manufactures high number of different aircraft platforms. These factors contribute to the largest growth in the region.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

Major players operating in the aircraft generator market include Honeywell (US), General Electric (US), Collins Aerospace (US), Safran (France), Thales Group (France) among others. These key players offer aircraft generators and services to different key stakeholders.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2018-2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022-2027 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Current Type, Type, Platform, Power Rating, Aircraft Technology, End Use and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, the Middle East, Latin America and Africa. |

|

Companies covered |

Honeywell (US) , General Electric (US), Collins Aerospace (US), Safran (France) , Thales Group (France) among others |

This research report categorizes the aircraft generator market into Current Type, Type, Platform, Power Rating, Aircraft Technology, End Use and Region

By End Use

- OEM

- Aftermarket

By Current Type

- AC

- DC

By Platform

- Fixed-wing

- Rotary-wing

By Type

- Variable Speed Constant Frequency

- Auxiliary Power Unit

- Starter Generator

- Integrated Drive Generator

- Alternator

By Aircraft Technology

- Conventional Aircraft

- Hybrid Electric Aircraft

By Power Rating

- Less than 100 kW

- 100- 500 kW

- More than 500 kW

By Region

- North America

- Europe

- Asia Pacific

- Middle East

- Latin America

- Africa

Recent Developments

- In April 2022, A variety of Honeywell (NASDAQ: HON) engine and power systems technology has been selected by Lockheed Martin Sikorsky-Boeing for its DEFIANT X helicopter, which is currently a contender to win the US Army's Future Long-Range Assault Aircraft (FLRAA) competition. Team DEFIANT selected Honeywell's GTCP 36-150 auxiliary power units (APUs) series, as well as Honeywell's main engine generator and APU generator.

- In January 2022, As part of the US Air Force's ongoing modernization efforts to keep the B-52 bomber flying into the 2050s, Boeing has selected Collins Aerospace to upgrade the aircraft with a new electric power generation system (EPGS). Collins will supply a modern EPGS derived from industry-leading commercial technology. The new EPGS will be an upgrade to the B-52's current 70-year-old system, with more efficient technology that requires less power from the engine to operate. This will contribute to the Air Force's goal of a 30% improvement in fuel efficiency for the B-52, along with a decrease in carbon dioxide emissions.

Frequently Asked Questions (FAQ):

What is the current size of the aircraft generator market?

The Aircraft Generator Market is projected to grow from USD 5.2 billion in 2022 to USD 7.3 billion by 2027, at a CAGR of 7.1% during the forecast period.

Who are the winners and small enterprises in the aircraft generator market?

Major players operating in the aircraft generator market include Honeywell (US), General Electric (US), Collins Aerospace (US), Safran (France), Thales Group (France) among others. These key players offer aircraft generators and services to different key stakeholders.

What are some of the technological advancements in the market?

Helbio, a high-tech company based out of Greece that specializes in the development and manufacturing of hydrogen and energy systems, is developing a hydrogen-based electricity generator. Helbio’s technology is an alternative solution to conventional power systems designed for dual operation, either as an auxiliary power unit (APU) or as a combined heat and power system with almost no atmospheric pollutants. It is compact, silent, and has an electrical efficiency of more than 35%. Compared to conventional generators, it has much lower maintenance needs and emits 170 times less NOx and hydrocarbons, 27 times less CO, and no Sox, while consuming 54% less fuel. In addition, the system is multi-fuel fed and can be operated with biofuels.

What are the factors driving the growth of the market?

As the trend toward more electric aircraft (MEA) accelerates, aircraft OEMs have started collaborating with suppliers to design new systems and set up new electrically intensive architectures. The concept of MEA acts as a critical enabler in the aircraft industry and unlocks significant potential for aircraft weight reduction, fuel-efficient engines, reduction in operational costs by reducing maintenance costs, and increased aircraft reliability. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 35)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 AIRCRAFT GENERATORS MARKET SEGMENTATION

1.3.2 REGIONAL SCOPE

FIGURE 2 REGIONAL SCOPE

1.3.3 YEARS CONSIDERED

1.4 INCLUSIONS AND EXCLUSIONS

TABLE 1 INCLUSIONS AND EXCLUSIONS IN AIRCRAFT GENERATORS MARKET

1.5 CURRENCY & PRICING

TABLE 2 AVERAGE ANNUAL CURRENCY CONVERSION RATES

1.6 LIMITATIONS

1.7 MARKET STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 39)

2.1 RESEARCH DATA

FIGURE 3 RESEARCH PROCESS FLOW

FIGURE 4 AIRCRAFT GENERATORS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key primary sources

2.2 DEMAND- & SUPPLY-SIDE ANALYSIS

2.2.1 INTRODUCTION

2.2.2 DEMAND-SIDE INDICATORS

2.2.2.1 Growing trend of more electric technology

2.2.2.2 Increasing demand for new commercial aircraft

2.2.3 SUPPLY-SIDE INDICATORS

2.2.3.1 Advancements in power generation technologies

2.3 MARKET SIZE ESTIMATION

2.3.1 SEGMENTS AND SUBSEGMENTS

2.4 RESEARCH APPROACH & METHODOLOGY

2.4.1 BOTTOM-UP APPROACH

TABLE 3 AIRCRAFT GENERATORS MARKET: BOTTOM-UP APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.4.2 TOP-DOWN APPROACH

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.5 MARKET BREAKDOWN & DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.6 GROWTH RATE ASSUMPTIONS

2.7 ASSUMPTIONS FOR THE RESEARCH STUDY

2.8 RISKS

3 EXECUTIVE SUMMARY (Page No. - 49)

FIGURE 8 AUXILIARY POWER UNIT TO HOLD LARGEST MARKET SHARE IN 2022

FIGURE 9 AC SEGMENT TO DOMINATE AIRCRAFT GENERATORS MARKET IN 2022

FIGURE 10 CONVENTIONAL AIRCRAFT SEGMENT TO COMMAND LARGER SHARE IN 2022

FIGURE 11 NORTH AMERICA TO BE LARGEST AIRCRAFT GENERATORS MARKET IN 2022

4 PREMIUM INSIGHTS (Page No. - 51)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN AIRCRAFT GENERATORS MARKET

FIGURE 12 INCREASING NEED FOR ELECTRICAL SYSTEMS IN AIRCRAFT EXPECTED TO DRIVE MARKET FROM 2022 TO 2027

4.2 AIRCRAFT GENERATORS MARKET, BY END USE

FIGURE 13 OEM SEGMENT PROJECTED TO LEAD MARKET FROM 2022 TO 2027

4.3 AIRCRAFT GENERATOR MARKET, BY PLATFORM

FIGURE 14 FIXED-WING SEGMENT PROJECTED TO DOMINATE DURING FORECAST PERIOD

4.4 AIRCRAFT GENERATORS MARKET, BY COUNTRY

FIGURE 15 AIRCRAFT GENERATORS MARKET IN ISRAEL PROJECTED TO REGISTER HIGHEST CAGR FROM 2022 TO 2027

5 MARKET OVERVIEW (Page No. - 53)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 16 AIRCRAFT GENERATORS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Growing trend of more electric technology

TABLE 4 MORE ELECTRIC AIRCRAFT PROGRAMS, BY CATEGORY

5.2.1.2 Advancement in power generation technology of hybrid electric platforms and light aircraft

TABLE 5 HYBRID ELECTRIC AIRCRAFT PROGRAMS, BY CATEGORY

5.2.1.3 Increasing demand for new commercial aircraft

5.2.2 RESTRAINTS

5.2.2.1 High voltage and thermal issues

5.2.2.2 Existing backlog of aircraft deliveries

TABLE 6 ORDER BACKLOGS OF TOP AIRCRAFT MANUFACTURERS

5.2.3 OPPORTUNITIES

5.2.3.1 Development of advanced power electronics

5.2.4 CHALLENGES

5.2.4.1 Stringent regulatory framework

5.2.4.2 Reduced global demand for maintenance, repair, and overhaul (MRO) services due to COVID-19

5.3 PRICING ANALYSIS

TABLE 7 AVERAGE SELLING PRICE RANGE: AIRCRAFT GENERATORS MARKET, BY GENERATOR TYPE (USD)

FIGURE 17 PRICING ANALYSIS OF AIRCRAFT GENERATORS, BY TYPE (USD)

5.4 VALUE CHAIN ANALYSIS

FIGURE 18 VALUE CHAIN ANALYSIS

5.5 AIRCRAFT GENERATORS MARKET ECOSYSTEM

5.5.1 PROMINENT COMPANIES

5.5.2 PRIVATE AND SMALL ENTERPRISES

5.5.3 END USERS

FIGURE 19 AIRCRAFT GENERATORS MARKET ECOSYSTEM MAP

TABLE 8 AIRCRAFT GENERATOR MARKET ECOSYSTEM

5.6 TRADE DATA STATISTICS

TABLE 9 TRADE DATA FOR AIRCRAFT GENERATORS

5.7 TECHNOLOGY TRENDS IN AIRCRAFT GENERATORS MARKET

5.7.1 TURBOGENERATORS FOR ELECTRIC MOTORS AND BATTERIES

5.7.2 VARIABLE SPEED CONSTANT FREQUENCY GENERATORS

5.8 CASE STUDY ANALYSIS

5.8.1 HONEYWELL APU INTRODUCES TWO-STAGE AXIAL TURBINE SYSTEM

5.9 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

5.9.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR AIRCRAFT GENERATOR MANUFACTURERS

FIGURE 20 REVENUE SHIFT IN AIRCRAFT GENERATORS MARKET

5.10 PORTER'S FIVE FORCES ANALYSIS

TABLE 10 AIRCRAFT GENERATORS MARKET: PORTER'S FIVE FORCES ANALYSIS

FIGURE 21 AIRCRAFT GENERATORS MARKET: PORTER'S FIVE FORCES ANALYSIS

5.10.1 THREAT OF NEW ENTRANTS

5.10.2 THREAT OF SUBSTITUTES

5.10.3 BARGAINING POWER OF SUPPLIERS

5.10.4 BARGAINING POWER OF BUYERS

5.10.5 INTENSITY OF COMPETITIVE RIVALRY

5.11 KEY STAKEHOLDERS & BUYING CRITERIA

5.11.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 22 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS OF AIRCRAFT GENERATORS

TABLE 11 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS OF AIRCRAFT GENERATORS (%)

5.11.2 BUYING CRITERIA

FIGURE 23 KEY BUYING CRITERIA FOR AIRCRAFT GENERATORS

TABLE 12 KEY BUYING CRITERIA FOR AIRCRAFT GENERATORS

5.12 KEY CONFERENCES & EVENTS IN 2022-2023

TABLE 13 AIRCRAFT GENERATORS MARKET: CONFERENCES & EVENTS

5.13 TARIFF AND REGULATORY LANDSCAPE

TABLE 14 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 15 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 16 ASIA-PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 17 REST OF WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

6 INDUSTRY TRENDS (Page No. - 74)

6.1 INTRODUCTION

FIGURE 24 AIRCRAFT ELECTRICAL POWER DEMAND, 2010-2050

6.2 TECHNOLOGY TRENDS

6.2.1 HYDROGEN-BASED ELECTRICITY GENERATOR

6.2.2 HYBRID ELECTRIC PROPULSION SYSTEM

6.3 IMPACT OF MEGATRENDS

6.3.1 3D PRINTING

6.3.2 SUSTAINABLE AVIATION FUEL

6.4 SUPPLY CHAIN ANALYSIS

FIGURE 25 SUPPLY CHAIN ANALYSIS

6.5 INNOVATION & PATENT REGISTRATIONS

TABLE 18 INNOVATION & PATENT REGISTRATIONS

7 AIRCRAFT GENERATORS MARKET, BY CURRENT TYPE (Page No. - 79)

7.1 INTRODUCTION

FIGURE 26 AC SEGMENT PROJECTED TO DOMINATE MARKET DURING FORECAST PERIOD

TABLE 19 AIRCRAFT GENERATORS MARKET, BY CURRENT TYPE, 2018–2021 (USD MILLION)

TABLE 20 AIRCRAFT GENERATOR MARKET, BY CURRENT TYPE, 2022–2027 (USD MILLION)

7.2 AC

7.2.1 CAN EFFICIENTLY TRANSMIT ELECTRICITY OVER A LONG RANGE

7.3 DC

7.3.1 INCREASING USAGE IN LIGHT AIRCRAFT

8 AIRCRAFT GENERATORS MARKET, BY AIRCRAFT TECHNOLOGY (Page No. - 82)

8.1 INTRODUCTION

FIGURE 27 CONVENTIONAL AIRCRAFT TO HOLD LARGEST MARKET SHARE (2022-2027)

TABLE 21 AIRCRAFT GENERATORS MARKET, BY AIRCRAFT TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 22 AIRCRAFT GENERATORS MARKET, BY AIRCRAFT TECHNOLOGY, 2022–2027(USD MILLION)

8.2 CONVENTIONAL AIRCRAFT

8.2.1 NEED TO REPLACE CONVENTIONAL POWER SYSTEMS WITH ELECTRICAL SYSTEMS BOOSTS SEGMENT

8.3 HYBRID ELECTRIC AIRCRAFT

8.3.1 NEED FOR ENVIRONMENTALLY FRIENDLY AIRCRAFT DRIVES GROWTH

9 AIRCRAFT GENERATORS MARKET, BY TYPE (Page No. - 85)

9.1 INTRODUCTION

FIGURE 28 VSCF GENERATOR SEGMENT PROJECTED TO GROW FASTEST DURING FORECAST PERIOD

TABLE 23 AIRCRAFT GENERATORS MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 24 AIRCRAFT GENERATORS MARKET, BY TYPE, 2022–2027 (USD MILLION)

9.2 VARIABLE SPEED CONSTANT FREQUENCY GENERATOR

9.2.1 PROVIDES MORE FLEXIBLE ELECTRICAL SYSTEM ARCHITECTURE

9.3 INTEGRATED DRIVE GENERATOR

9.3.1 INCREASING USAGE IN COMMERCIAL AND MILITARY AIRCRAFT FOR ELECTRICAL SYSTEMS

9.4 AUXILIARY POWER UNIT

9.4.1 ESSENTIAL AS BACK-UP ELECTRICAL SUPPLY FOR AIRCRAFT

9.5 STARTER GENERATOR

9.5.1 ACTS AS PARALLEL ELECTRICAL POWER SUPPLY UNIT

9.6 ALTERNATOR

9.6.1 PROVIDES SMOOTHER OUTPUT AND CAN REACH HIGH SPEED FASTER THAN GENERATORS

10 AIRCRAFT GENERATORS MARKET, BY POWER RATING (Page No. - 89)

10.1 INTRODUCTION

FIGURE 29 MORE THAN 500 KW SEGMENT PROJECTED TO HAVE HIGHEST CAGR

TABLE 25 AIRCRAFT GENERATORS MARKET, BY POWER RATING, 2018–2021 (USD MILLION)

TABLE 26 AIRCRAFT GENERATORS MARKET, BY POWER RATING, 2022–2027 (USD MILLION)

10.2 LESS THAN 100 KW

10.2.1 INCREASING USAGE IN LIGHT AIRCRAFT

10.3 100-500 KW

10.3.1 WIDE-SCALE USAGE IN COMMERCIAL AND MILITARY AIRCRAFT FOR ELECTRICAL SYSTEMS

10.4 MORE THAN 500 KW

10.4.1 APPLICATION IN HYBRID ELECTRIC AIRCRAFT ON THE RISE

11 AIRCRAFT GENERATORS MARKET, BY PLATFORM (Page No. - 92)

11.1 INTRODUCTION

FIGURE 30 FIXED-WING SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

TABLE 27 AIRCRAFT GENERATORS MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 28 AIRCRAFT GENERATOR MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

11.2 FIXED-WING AIRCRAFT

11.2.1 COMMERCIAL AVIATION

TABLE 29 COMMERCIAL AVIATION: FIXED-WING AIRCRAFT GENERATORS MARKET, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

TABLE 30 COMMERCIAL AVIATION: FIXED-WING AIRCRAFT GENERATOR MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

11.2.1.1 Narrow-body aircraft

11.2.1.1.1 Growth in air passenger traffic to drive demand

11.2.1.2 Wide-body aircraft

11.2.1.2.1 Demand booster-increase in long-haul travel

11.2.1.3 Regional transport aircraft

11.2.1.3.1 Increasing use in US and Japan–key growth contributor

11.2.2 BUSINESS & GENERAL AVIATION

TABLE 31 BUSINESS & GENERAL AVIATION: FIXED-WING AIRCRAFT GENERATORS MARKET, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

TABLE 32 BUSINESS & GENERAL AVIATION: FIXED-WING AIRCRAFT GENERATORS MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

11.2.2.1 Business jets

11.2.2.1.1 Increase in private aviation companies globally drives demand

11.2.2.2 Light aircraft

11.2.2.2.1 Segment driven by technology advancements and modernization of general aviation

11.2.3 MILITARY AVIATION

TABLE 33 MILITARY AVIATION: FIXED-WING AIRCRAFT GENERATORS MARKET, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

TABLE 34 MILITARY AVIATION: FIXED-WING AIRCRAFT GENERATORS MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

11.2.3.1 Fighter aircraft

11.2.3.1.1 Growing concerns over border tensions fuel segment

11.2.3.2 Transport aircraft

11.2.3.2.1 Increasing demand for transport aircraft in military operations

11.2.3.3 Special mission aircraft

11.2.3.3.1 Growing defense spending and territorial disputes drive demand

11.3 ROTARY-WING AIRCRAFT

TABLE 35 ROTARY-WING: AIRCRAFT GENERATORS MARKET, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

TABLE 36 ROTARY-WING: AIRCRAFT GENERATORS MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

11.3.1 COMMERCIAL HELICOPTERS

11.3.1.1 Increasing usage for passenger transport and medical services

11.3.2 MILITARY HELICOPTERS

11.3.2.1 Technologically advanced military helicopters with next-generation electro-optic systems drive demand

12 AIRCRAFT GENERATORS MARKET, BY END USE (Page No. - 101)

12.1 INTRODUCTION

FIGURE 31 OEM SEGMENT PROJECTED TO LEAD MARKET DURING FORECAST PERIOD

TABLE 37 AIRCRAFT GENERATORS MARKET, BY END USE, 2018–2021 (USD MILLION)

TABLE 38 AIRCRAFT GENERATORS MARKET, BY END USE, 2022–2027 (USD MILLION)

12.2 ORIGINAL EQUIPMENT MANUFACTURERS (OEM)

12.2.1 INCREASING NEED FOR NEW AIRCRAFT DRIVES SEGMENT GROWTH

12.3 AFTERMARKET

12.3.1 FOCUS ON REDUCED REPAIR TIME AND IMPROVED READINESS INCREASES NEED FOR AFTERMARKET REFURBISHMENT

13 REGIONAL ANALYSIS (Page No. - 104)

13.1 INTRODUCTION

FIGURE 32 AIRCRAFT GENERATORS MARKET: REGIONAL SNAPSHOT

TABLE 39 AIRCRAFT GENERATOR MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 40 AIRCRAFT GENERATORS MARKET, BY REGION, 2022–2027 (USD MILLION)

13.2 NORTH AMERICA

FIGURE 33 NORTH AMERICA: AIRCRAFT GENERATORS MARKET SNAPSHOT

13.2.1 PESTLE ANALYSIS: NORTH AMERICA

TABLE 41 NORTH AMERICA: AIRCRAFT GENERATORS MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 42 NORTH AMERICA: AIRCRAFT GENERATOR MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 43 NORTH AMERICA: MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 44 NORTH AMERICA: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 45 NORTH AMERICA: AIRCRAFT GENERATOR MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 46 NORTH AMERICA: AIRCRAFT GENERATORS MARKET, BY TYPE, 2022–2027 (USD MILLION)

13.2.2 US

13.2.2.1 Presence of leading OEMs drives market

TABLE 47 US: AIRCRAFT GENERATORS MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 48 US: AIRCRAFT GENERATOR MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 49 US: AIRCRAFT GENERATOR MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 50 US: AIRCRAFT GENERATORS MARKET, BY TYPE, 2022–2027 (USD MILLION)

13.2.3 CANADA

13.2.3.1 Aircraft modernization programs fuel market

TABLE 51 CANADA: AIRCRAFT GENERATOR MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 52 CANADA: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 53 CANADA: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 54 CANADA: AIRCRAFT GENERATOR MARKET, BY TYPE, 2022–2027 (USD MILLION)

13.3 EUROPE

FIGURE 34 EUROPE: AIRCRAFT GENERATORS MARKET SNAPSHOT

13.3.1 PESTLE ANALYSIS: EUROPE

TABLE 55 EUROPE: AIRCRAFT GENERATOR MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 56 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 57 EUROPE: AIRCRAFT GENERATOR MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 58 EUROPE: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 59 EUROPE: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 60 EUROPE: AIRCRAFT GENERATOR MARKET, BY TYPE, 2022–2027 (USD MILLION)

13.3.2 UK

13.3.2.1 Growing air traffic to drive demand

TABLE 61 UK: AIRCRAFT GENERATORS MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 62 UK: AIRCRAFT GENERATOR MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 63 UK: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 64 UK: AIRCRAFT GENERATOR MARKET, BY TYPE, 2022–2027 (USD MILLION)

13.3.3 FRANCE

13.3.3.1 High investments in aerospace fuel market

TABLE 65 FRANCE: AIRCRAFT GENERATORS MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 66 FRANCE: AIRCRAFT GENERATOR MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 67 FRANCE: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 68 FRANCE: AIRCRAFT GENERATOR MARKET, BY TYPE, 2022–2027 (USD MILLION)

13.3.4 GERMANY

13.3.4.1 Growing investments in air travel and connectivity drive market

TABLE 69 GERMANY: AIRCRAFT GENERATOR MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 70 GERMANY: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 71 GERMANY: AIRCRAFT GENERATOR MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 72 GERMANY: AIRCRAFT GENERATORS MARKET, BY TYPE, 2022–2027 (USD MILLION)

13.3.5 ITALY

13.3.5.1 Demand for electric components from aircraft manufacturers supports market growth

TABLE 73 ITALY: AIRCRAFT GENERATOR MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 74 ITALY: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 75 ITALY: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 76 ITALY: AIRCRAFT GENERATOR MARKET, BY TYPE, 2022–2027 (USD MILLION)

13.3.6 RUSSIA

13.3.6.1 Market driven by increase in military budget to manufacture advanced aircraft

TABLE 77 RUSSIA: AIRCRAFT GENERATORS MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 78 RUSSIA: AIRCRAFT GENERATOR MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 79 RUSSIA: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 80 RUSSIA: AIRCRAFT GENERATOR MARKET, BY TYPE, 2022–2027 (USD MILLION)

13.3.7 REST OF EUROPE

13.3.7.1 Market boosted by aviation development initiatives undertaken

TABLE 81 REST OF EUROPE: AIRCRAFT GENERATOR MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 82 REST OF EUROPE: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 83 REST OF EUROPE: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 84 REST OF EUROPE: AIRCRAFT GENERATOR MARKET, BY TYPE, 2022–2027 (USD MILLION)

13.4 ASIA PACIFIC

FIGURE 35 ASIA PACIFIC: AIRCRAFT GENERATORS MARKET SNAPSHOT

13.4.1 PESTLE ANALYSIS: ASIA PACIFIC

TABLE 85 ASIA PACIFIC: AIRCRAFT GENERATORS MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 86 ASIA PACIFIC: AIRCRAFT GENERATOR MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 87 ASIA PACIFIC: MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 88 ASIA PACIFIC: AIRCRAFT GENERATOR MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 89 ASIA PACIFIC: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 90 ASIA PACIFIC: AIRCRAFT GENERATORS MARKET, BY TYPE, 2022–2027 (USD MILLION)

13.4.2 CHINA

13.4.2.1 Growing demand for aerospace products fuels market

TABLE 91 CHINA: AIRCRAFT GENERATOR MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 92 CHINA: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 93 CHINA: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 94 CHINA: AIRCRAFT GENERATOR MARKET, BY TYPE, 2022–2027 (USD MILLION)

13.4.3 INDIA

13.4.3.1 Improving domestic capabilities of aerospace industry drive market

TABLE 95 INDIA: AIRCRAFT GENERATORS MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 96 INDIA: AIRCRAFT GENERATOR MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 97 INDIA: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 98 INDIA: AIRCRAFT GENERATORS MARKET, BY TYPE, 2022–2027 (USD MILLION)

13.4.4 JAPAN

13.4.4.1 Increasing in-house development of aircraft to drive market

TABLE 99 JAPAN: AIRCRAFT GENERATORS MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 100 JAPAN: AIRCRAFT GENERATOR MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 101 JAPAN: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 102 JAPAN: AIRCRAFT GENERATOR MARKET, BY TYPE, 2022–2027 (USD MILLION)

13.4.5 AUSTRALIA

13.4.5.1 Increase in air traffic and new aircraft deliveries fuel growth

TABLE 103 AUSTRALIA: AIRCRAFT GENERATORS MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 104 AUSTRALIA: AIRCRAFT GENERATOR MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 105 AUSTRALIA: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 106 AUSTRALIA: AIRCRAFT GENERATOR MARKET, BY TYPE, 2022–2027 (USD MILLION)

13.4.6 SOUTH KOREA

13.4.6.1 Market driver - modernization programs in aviation industry

TABLE 107 SOUTH KOREA: AIRCRAFT GENERATOR MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 108 SOUTH KOREA: AIRCRAFT GENERATORS MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 109 SOUTH KOREA: AIRCRAFT GENERATOR MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 110 SOUTH KOREA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

13.4.7 REST OF ASIA PACIFIC

13.4.7.1 Replacement of aging aircraft boosts market growth

TABLE 111 REST OF ASIA PACIFIC: AIRCRAFT GENERATOR MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 112 REST OF ASIA PACIFIC: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 113 REST OF ASIA PACIFIC: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 114 REST OF ASIA PACIFIC: AIRCRAFT GENERATOR MARKET, BY TYPE, 2022–2027 (USD MILLION)

13.5 MIDDLE EAST

13.5.1 PESTLE ANALYSIS: MIDDLE EAST

TABLE 115 MIDDLE EAST: AIRCRAFT GENERATORS MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 116 MIDDLE EAST: AIRCRAFT GENERATOR MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 117 MIDDLE EAST: MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 118 MIDDLE EAST: AIRCRAFT GENERATOR MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 119 MIDDLE EAST: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 120 MIDDLE EAST: AIRCRAFT GENERATOR MARKET, BY TYPE, 2022–2027 (USD MILLION)

13.5.2 ISRAEL

13.5.2.1 Increasing air transport to contribute to market growth

TABLE 121 ISRAEL: AIRCRAFT GENERATORS MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 122 ISRAEL: AIRCRAFT GENERATOR MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 123 ISRAEL: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 124 ISRAEL: AIRCRAFT GENERATOR MARKET, BY TYPE, 2022–2027 (USD MILLION)

13.5.3 UAE

13.5.3.1 Increasing upgrades of commercial airlines drive market

TABLE 125 UAE: AIRCRAFT GENERATOR MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 126 UAE: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 127 UAE: AIRCRAFT GENERATOR MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 128 UAE: MARKET, BY TYPE, 2022–2027 (USD MILLION)

13.5.4 SAUDI ARABIA

13.5.4.1 High military expenditure fuels market

TABLE 129 SAUDI ARABIA: AIRCRAFT GENERATOR MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 130 SAUDI ARABIA: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 131 SAUDI ARABIA: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 132 SAUDI ARABIA: AIRCRAFT GENERATOR MARKET, BY TYPE, 2022–2027 (USD MILLION)

13.5.5 TURKEY

13.5.5.1 Market growth result of substantial rise in military spending and development of UAVs

TABLE 133 TURKEY: AIRCRAFT GENERATORS MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 134 TURKEY: AIRCRAFT GENERATOR MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 135 TURKEY: AIRCRAFT GENERATOR MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 136 TURKEY: AIRCRAFT GENERATORS MARKET, BY TYPE, 2022–2027 (USD MILLION)

13.5.6 REST OF MIDDLE EAST

13.5.6.1 Growing demand for aircraft electric components drives market

TABLE 137 REST OF MIDDLE EAST: AIRCRAFT GENERATORS MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 138 REST OF MIDDLE EAST: AIRCRAFT GENERATOR MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 139 REST OF MIDDLE EAST: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 140 REST OF MIDDLE EAST: AIRCRAFT GENERATOR MARKET, BY TYPE, 2022–2027 (USD MILLION)

13.6 LATIN AMERICA

13.6.1 PESTLE ANALYSIS: LATIN AMERICA

TABLE 141 LATIN AMERICA: AIRCRAFT GENERATOR MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 142 LATIN AMERICA: AIRCRAFT GENERATORS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 143 LATIN AMERICA: AIRCRAFT GENERATOR MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 144 LATIN AMERICA: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 145 LATIN AMERICA: AIRCRAFT GENERATOR MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 146 LATIN AMERICA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

13.6.2 BRAZIL

13.6.2.1 Presence of OEMs and growth opportunities for airlines to boost market

TABLE 147 BRAZIL: AIRCRAFT GENERATOR MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 148 BRAZIL: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 149 BRAZIL: AIRCRAFT GENERATOR MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 150 BRAZIL: AIRCRAFT GENERATORS MARKET, BY TYPE, 2022–2027 (USD MILLION)

13.6.3 MEXICO

13.6.3.1 Use of UAVs by government to fight organized crimes drives market

TABLE 151 MEXICO: AIRCRAFT GENERATOR MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 152 MEXICO: AIRCRAFT GENERATORS MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 153 MEXICO: AIRCRAFT GENERATOR MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 154 MEXICO: AIRCRAFT GENERATOR MARKET, BY TYPE, 2022–2027 (USD MILLION)

13.6.4 REST OF LATIN AMERICA

13.6.4.1 Increasing aircraft fleet size fuels market growth

TABLE 155 REST OF LATIN AMERICA: AIRCRAFT GENERATOR MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 156 REST OF LATIN AMERICA: AIRCRAFT GENERATORS MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 157 REST OF LATIN AMERICA: AIRCRAFT GENERATOR MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 158 REST OF LATIN AMERICA: AIRCRAFT GENERATORS MARKET, BY TYPE, 2022–2027 (USD MILLION)

13.7 AFRICA

13.7.1 PESTLE ANALYSIS: AFRICA

TABLE 159 AFRICA: AIRCRAFT GENERATOR MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 160 AFRICA: AIRCRAFT GENERATORS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 161 AFRICA: AIRCRAFT GENERATOR MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 162 AFRICA: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 163 AFRICA: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 164 AFRICA: AIRCRAFT GENERATOR MARKET, BY TYPE, 2022–2027 (USD MILLION)

13.7.2 SOUTH AFRICA

13.7.2.1 Market driven by aircraft and airport modernization projects

TABLE 165 SOUTH AFRICA: AIRCRAFT GENERATOR MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 166 SOUTH AFRICA: AIRCRAFT GENERATORS MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 167 SOUTH AFRICA: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 168 SOUTH AFRICA: AIRCRAFT GENERATOR MARKET, BY TYPE, 2022–2027 (USD MILLION)

13.7.3 NIGERIA

13.7.3.1 Expansion of aviation sector fuels market

TABLE 169 NIGERIA: AIRCRAFT GENERATORS MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 170 NIGERIA: AIRCRAFT GENERATOR MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 171 NIGERIA: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 172 NIGERIA: AIRCRAFT GENERATOR MARKET, BY TYPE, 2022–2027 (USD MILLION)

13.7.4 REST OF AFRICA

13.7.4.1 Presence of MRO service providers in aviation sector drives market

TABLE 173 REST OF AFRICA: AIRCRAFT GENERATOR MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 174 REST OF AFRICA: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 175 REST OF AFRICA: AIRCRAFT GENERATOR MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 176 REST OF AFRICA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

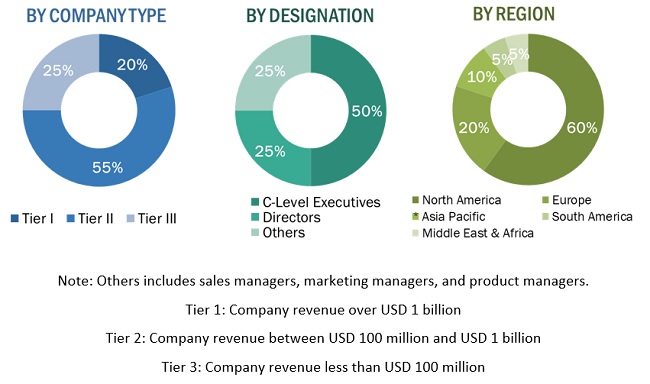

The research study conducted on the aircraft generator market involved extensive use of secondary sources, directories, and databases such as Hoovers, Bloomberg Businessweek, and Factiva to identify and collect information relevant to the aircraft generator market. The primary sources considered included industry experts from the aircraft generator market as well as raw material providers, aircraft generator manufacturers, solution providers, technology developers, alliances, government agencies, and aftermarket service providers related to all segments of the value chain of this industry. In-depth interviews with various primary respondents, including key industry participants, Subject Matter Experts (SMEs), industry consultants, and C-level executives have been conducted to obtain and verify critical qualitative and quantitative information pertaining to the aircraft generator market as well as to assess the growth prospects of the market.

Secondary Research

The ranking of companies operating in the aircraft generator market was arrived at based on secondary data made available through paid and unpaid sources, the analysis of product portfolios of the major companies in the market and rating them on the basis of their performance and quality. These data points were further validated by primary sources.

Secondary sources referred for this research study on the aircraft generator market included government sources, such as corporate filings that included annual reports, investor presentations, and financial statements, and trade, business, and professional associations. Secondary data was collected and analyzed to arrive at the overall market size, which was further validated by various primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

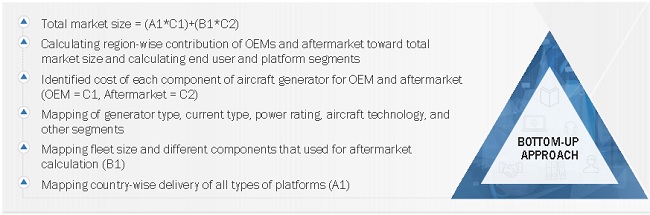

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the aircraft generator market. The following figure offers a representation of the overall market size estimation process employed for the purpose of this study on the aircraft generator market.

The research methodology used to estimate the market size includes the following details:

- Key players in this market were identified through secondary research, and their market share was determined through primary and secondary research. This included a study of the annual and financial reports of top market players and extensive interviews of leaders such as Chief Executive Officers (CEOs), directors, and marketing executives of leading companies operating in the aircraft generator market.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

Market size estimation methodology: Bottom-up approach

To know about the assumptions considered for the study, Request for Free Sample Report

Market size estimation methodology: Top-Down approach

Data triangulation

After arriving at the overall market size through the market size estimation process explained above, the total market was split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegments, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand- and supply-sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Report Objectives

- To define, describe, segment, and forecast the aircraft generator market based on current type, type, platform, power rating, aircraft technology, end use and region

- To analyze demand- and supply-side indicators influencing the growth of the market

- To understand the market structure by identifying high-growth segments and subsegments of the market

- To provide in-depth market intelligence regarding key market dynamics, such as drivers, restraints, opportunities, and challenges, influencing the growth of the market

- To forecast the revenues of market segments with respect to 6 main regions: North America, Europe, Asia Pacific, the Middle East, Africa, and Latin America

- To analyze technological advancements and new product launches in the market from 2018 to 2022

- To provide a detailed competitive landscape of the market, in addition to market share analysis of leading players

- To identify the financial position, product portfolio, and key developments of leading players operating in the market

- To analyze micromarkets with respect to their individual growth trends, prospects, and contribution to the overall market

- To provide a comprehensive analysis of business and corporate strategies adopted by key market players

- To profile key market players and comprehensively analyze their core competencies

Available customizations

Along with the market data, MarketsandMarkets offers customizations as per the specific needs of companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the market segments at country-level

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Aircraft Generators Market

Looking for information on market trends for DC aircraft generators