Aircraft Engine Outlook 2035: Market Overview (Ecosystem, Macroeconomics, Regulatory, Programs, Expenditure, Alliances, Dynamics), Industry Trends (Technologies, Use Cases, Maturity Curve), Market Segments (Civil and Military Engines), Customer Insights (Operators, OEMs, Shifts, initiatives, Business Models, Market Position), Competitive Landscape (Competitors, Partners, Evaluation Matrix, Key Profiles) and Future Opportunities (Future Landscape, Technology Roadmap, Major Projects, Top Opportunities)

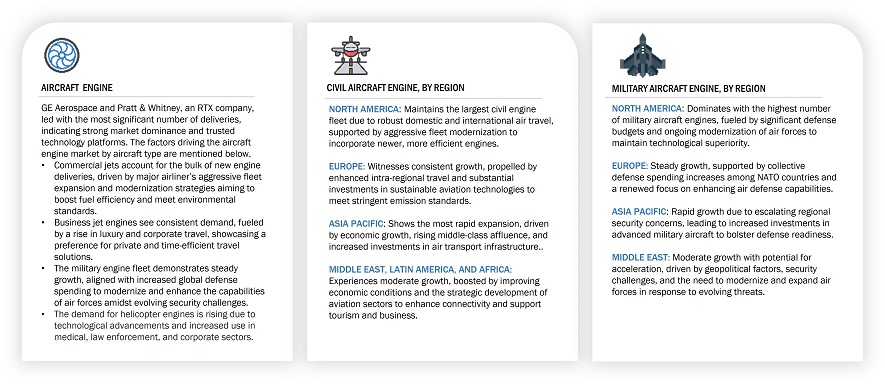

The global aircraft engine market is poised for significant transformation by 2035, driven by technological advancements, environmental regulations, and evolving airline demands. The industry is expected to grow at a steady CAGR, with key players focusing on innovation, sustainability, and cost efficiency. Factors such as increasing air travel demand, the need for fuel-efficient engines, and stringent emission regulations are shaping the market dynamics.

With the global commercial aircraft fleet projected to double by 2035, the demand for new and replacement engines is set to rise. Emerging markets, particularly in Asia-Pacific and the Middle East, will play a crucial role in driving growth. The increasing demand for narrow-body aircraft for short- to medium-haul routes will further fuel engine manufacturing and development.

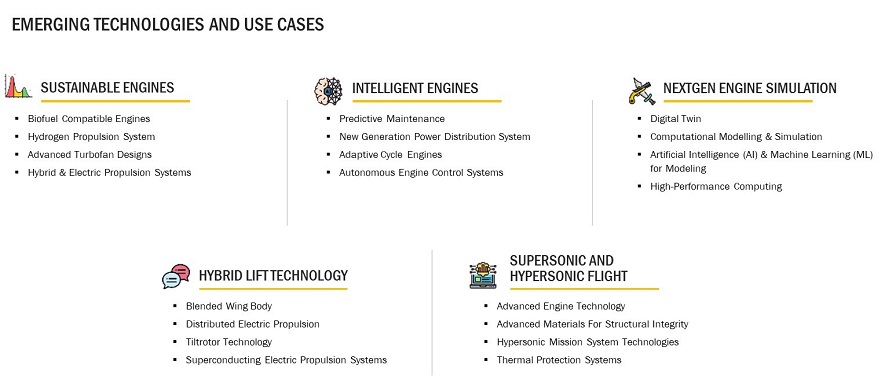

Industry Trends

1. Sustainable Aviation Technologies

The aviation industry is under immense pressure to reduce carbon emissions. The shift toward sustainable aviation fuels (SAFs), hybrid-electric propulsion, and hydrogen-powered engines is gaining momentum. Major engine manufacturers, including Rolls-Royce, General Electric (GE), and Pratt & Whitney, are investing heavily in research and development (R&D) to develop more sustainable engine solutions.

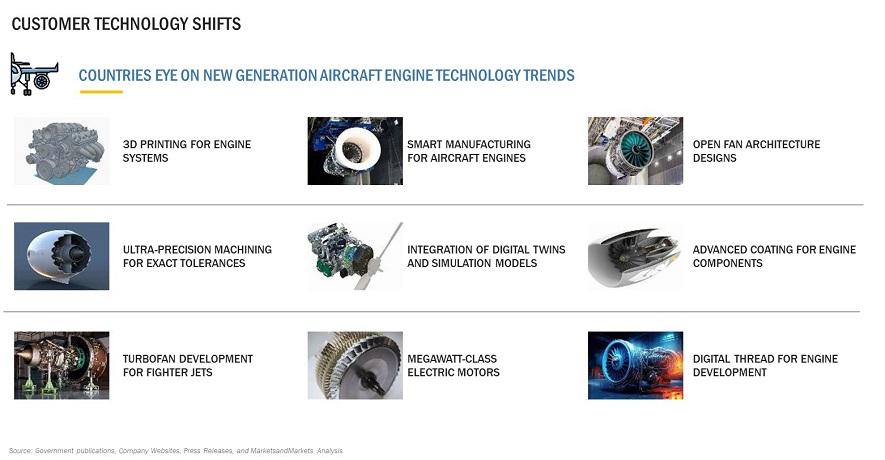

2. Digitalization and Predictive Maintenance

The integration of artificial intelligence (AI) and big data analytics in aircraft engines is enhancing predictive maintenance and operational efficiency. Predictive analytics help airlines reduce downtime, lower maintenance costs, and improve engine performance by identifying potential failures before they occur.

3. Lightweight Materials and Advanced Manufacturing

Advancements in composite materials, such as ceramic matrix composites (CMCs) and additive manufacturing (3D printing), are improving engine efficiency and durability. These materials help reduce engine weight, improve fuel efficiency, and extend engine life cycles, making them highly attractive for the next generation of aircraft engines.

4. Supersonic and Urban Air Mobility (UAM)

The resurgence of supersonic travel and the development of urban air mobility (UAM) vehicles are influencing aircraft engine designs. Companies like Boom Supersonic and NASA are exploring new propulsion technologies to enable faster and more efficient air travel. Additionally, electric vertical take-off and landing (eVTOL) aircraft are driving demand for innovative propulsion systems.

Customer Insights

Customer preferences in the aircraft engine market are shifting toward cost-effective, fuel-efficient, and environmentally friendly solutions. Airlines are prioritizing engines with lower maintenance costs and higher fuel efficiency to optimize operational profitability. Key customer segments include:

- Commercial Airlines: Seeking fuel-efficient engines to reduce operational expenses.

- Military and Defense: Investing in next-generation engines with enhanced performance and stealth capabilities.

- Cargo Operators: Looking for engines with high durability and reliability for freight transportation.

- Private and Business Aviation: Requiring quieter, high-performance engines with lower emissions.

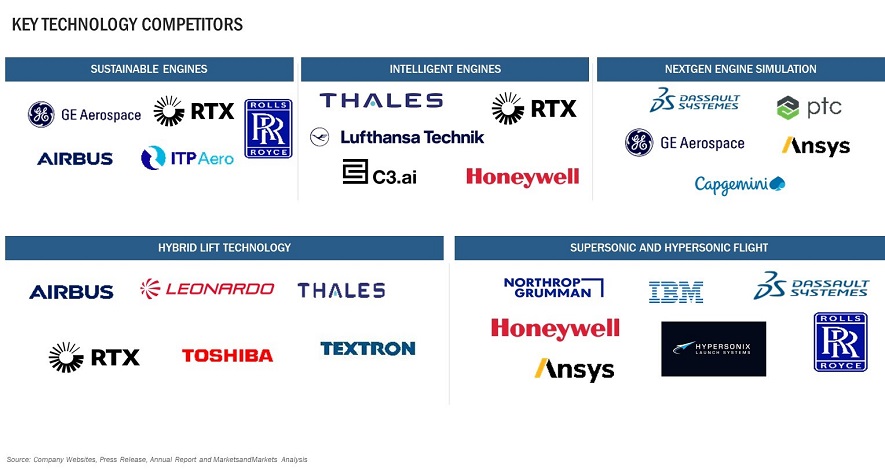

Competitive Landscape

The aircraft engine market is dominated by a few key players, each investing significantly in R&D to maintain their competitive edge. The leading players include:

- General Electric Aviation (GE Aviation): A market leader focusing on fuel-efficient and hybrid-electric propulsion systems.

- Rolls-Royce: Investing in ultra-efficient and sustainable aviation engine technologies, including hydrogen and electric propulsion.

- Pratt & Whitney: Known for its Geared Turbofan (GTF) engines, which offer reduced noise and fuel consumption.

- Safran: A major player in the narrow-body aircraft engine segment, collaborating with other manufacturers to enhance engine efficiency.

Collaborations, joint ventures, and mergers and acquisitions (M&A) are key strategies among these companies to stay ahead in the competitive landscape. For instance, the CFM International joint venture between GE and Safran is focused on developing the next generation of fuel-efficient engines.

Future Opportunities

The future of aircraft engines presents several opportunities for manufacturers, airlines, and investors. Key areas of growth include:

1. Hydrogen-Powered and Electric Propulsion

Hydrogen fuel cell technology and electric propulsion are gaining traction as viable alternatives to conventional jet engines. Airbus and other major players are actively developing hydrogen-powered aircraft that could revolutionize the industry by 2035.

2. Hybrid-Electric and Sustainable Aviation Fuel (SAF) Integration

The hybrid-electric propulsion market is expected to expand, with airlines and manufacturers exploring ways to integrate SAF into existing and new engine designs. SAF is expected to account for a significant share of aviation fuel consumption by 2035.

3. Advanced Materials and Manufacturing Techniques

Continued advancements in additive manufacturing and lightweight composite materials will drive further efficiency improvements in aircraft engines. This will lead to reduced costs, lower fuel consumption, and enhanced performance.

4. Expansion of Aftermarket Services

Engine maintenance, repair, and overhaul (MRO) services will experience increased demand as airlines look to extend the life of their existing fleets. Digital twin technology and AI-driven diagnostics will play a critical role in optimizing engine maintenance strategies.

The aircraft engine market is on a trajectory of significant transformation, driven by sustainability goals, technological advancements, and evolving customer needs. Industry players must invest in research, digitalization, and next-generation propulsion systems to stay competitive. As airlines, manufacturers, and regulatory bodies collaborate to shape the future of aviation, the landscape of aircraft engines in 2035 will be markedly different, with a stronger emphasis on efficiency, sustainability, and innovation.

Growth opportunities and latent adjacency in Aircraft Engine Outlook 2035: Market