Aircraft Arresting System Market by Type (Net Barrier, Cable, Maas, EMAS, Aircraft Carrier Arresting System), End User (Commercial Airport, Military Airbase, Aircraft Carrier), System (Fixed, Portable), Platform, and Region - Global Forecast to 2022

[165 Pages Report] The aircraft arresting system market was USD 749.5 Million in 2016 and is projected to reach USD 1,104.5 Million by 2022, at a CAGR of 6.38% during the forecast period. Factors such as an increase in spending on runway safety and the acquisition of aircraft are expected to drive the market. This report forecasts the aircraft arresting system market and its dynamics over the next five years, also recognizing market application gaps, recent developments in the market, and high potential countries. The objectives of the report are to study the factors influencing the market, map major industry players, and provide vendor analysis and competitor landscapes. The base year considered is 2016 and the forecast period is from 2017 to 2022.

The aircraft arresting system market is projected to reach USD 1,104.5 Million by 2022, at a CAGR of 6.38% from 2017 to 2022. The growth of the market can be attributed to various technological developments taking place across the globe, which include the development of advanced arresting gears for Ford-class carriers, and mobile aircraft arresting systems, among others.

The aircraft arresting system market has been segmented on the basis of type, end use, system, platform, and region. Among types, the Engineered Material Arresting System (EMAS) segment is projected to grow at the highest CAGR during the forecast period; the cable segment is projected to lead the market during the forecast period. Factors such as mandatory installation of EMAS at airports having runway safety length less than 1,000 feet and increasing spending on runway safety measures are expected to drive the market.

On the basis of end use, the aircraft arresting system market has been segmented into commercial airport, aircraft carrier, and military airbase. The military airbase segment is projected to lead the market during the forecast period owing to the increase in procurement of jet aircraft and the construction of temporary runways.

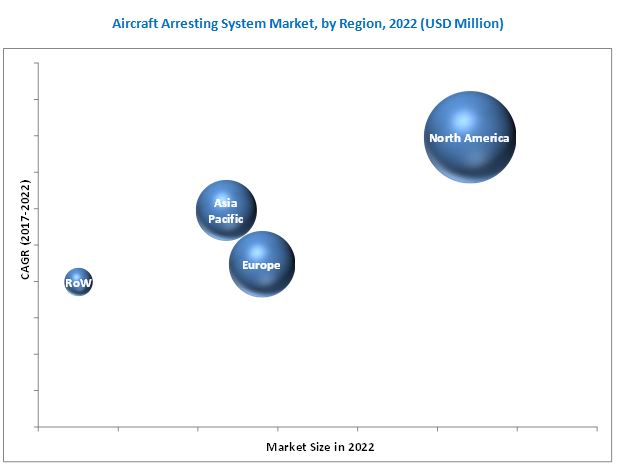

Based on system, the fixed system segment is estimated to account for a share of 87.4% of the aircraft arresting system market in 2017. Based on platform, the naval-based segment of the market is projected to grow at the highest CAGR during the forecast period. The growth of this segment of the market can be attributed to an increase in the number of aircraft carriers across the globe and replacement of conventional systems with naval-based aircraft arresting systems. North America accounted for the largest share of the market in 2016, followed by Europe and the Asia Pacific, respectively.

The major challenge for aircraft arresting system manufacturers is the high cost. The cost of installing one EMAS bed in 300 foot *150 foot usually cost between USD 5 Million and USD 8 Million.

The major players in the aircraft arresting system market are Zodiac Aerospace (France), Runway Safe (Sweden), and General Atomics (US). Manufacturers mostly adopt new product launches as their key growth strategy. Zodiac Aerospace (France) is the leading company in the market, and caters to both, military and commercial segments. In the commercial segment, it commands over 90% of the total market share.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 17)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Regional Scope

1.3.3 Years Considered for the Study

1.4 Currency

1.5 Study Limitations

1.6 Market Stakeholders

2 Research Methodology (Page No. - 21)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

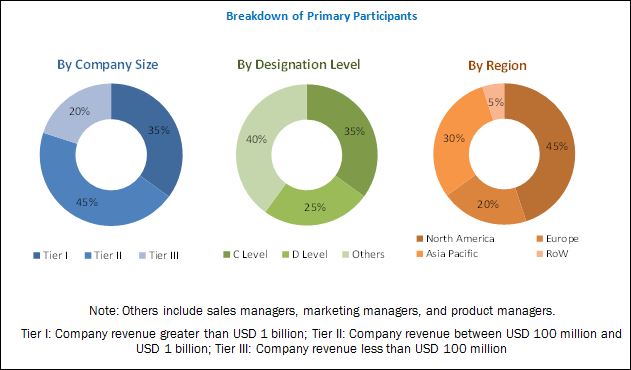

2.1.2.1 Breakdown of Primaries

2.2 Demand- and Supply-Side Analysis

2.2.1 Introduction

2.2.2 Demand-Side Indicators

2.2.2.1 Increasing Demand for Naval Carriers Across the Globe

2.2.2.2 Capitalization of Airport Investments

2.2.3 Supply-Side Indicators

2.2.3.1 Advancements in Arresting Gear Technologies

2.2.3.2 Accidents Taking Place During Landing of Aircraft and Runway Overruns

2.2.4 Bottom-Up Approach

2.2.5 Top-Down Approach

2.3 Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 31)

4 Premium Insights (Page No. - 35)

4.1 Attractive Opportunities in the Aircraft Arresting System Market

4.2 Market, By End User

4.3 Asia Pacific Market, 2017

4.4 Market, By Platform

4.5 Market, By System

4.6 Market, By Region

5 Market Overview (Page No. - 39)

5.1 Introduction

5.2 Market Segmentation

5.2.1 Market, By System

5.2.2 Market, By Platform

5.2.3 Market, By End User

5.2.4 Aircraft Arresting System Market, By Type

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increasing Installations of EMAS at Airports to Avoid Aircraft Overruns

5.3.1.2 Increasing Use of Arresting Systems for Naval Carriers to Prevent Aircraft Overruns

5.3.1.3 Increasing Territorial Disputes Across the Globe to Lead Towards Development of Tactical Infrastructures

5.3.2 Restraints

5.3.2.1 High Costs Involved in the Development of Arresting Systems Used in Aircraft Carriers

5.3.2.2 Operational Concerns of Commercial Airlines Regarding Use of Aircraft Arresting Systems

5.3.3 Opportunities

5.3.3.1 Increasing Demand for Aircraft Arresting Systems on Naval Carriers

5.3.3.2 Requirement for Low Manpower and Limited Land Utilization

5.3.3.3 Increasing Use of Arresting Gears in Unmanned Aerial Vehicles (UAVs)

5.3.4 Challenges

5.3.4.1 Limited Capabilities of Advanced Arresting Gears

5.3.4.2 Funding Challenges Involved in the Installation and Repairing of EMAS

5.3.4.3 Low Operational Life of Cross Deck Pendants

6 Industry Trends (Page No. - 51)

6.1 Introduction

6.2 Roadmap of Technologies Used in Aircraft Arresting Systems

6.3 Technology Trends

6.3.1 Arresting System Bak-14

6.3.2 Mk-7 Mod3 and Mod4 Hydraulic Arresting Systems

6.3.3 Mobile Aircraft Arresting System (MAAS)

6.3.4 EMAS Arresting Gears for Commercial Airports

6.3.5 Advanced Arresting Gears for Ford-Class Carriers

6.4 Porter’s Five Force Analysis

6.4.1 Threat of New Entrants

6.4.2 Threat of Substitutes

6.4.3 Bargaining Power of Suppliers

6.4.4 Bargaining Power of Buyers

6.4.5 Intensity of Competitive Rivalry

7 Aircraft Arresting System Market, By Type (Page No. - 62)

7.1 Introduction

7.2 Aircraft Arresting System Type Market, By Type

7.3 Aircraft Arresting System Type Market, By Region

7.4 Net Barrier

7.5 Cable

7.6 Mobile Aircraft Arresting System (MAAS)

7.7 Engineered Materials Arresting System (EMAS)

7.8 Aircraft Carrier Arresting System

8 Aircraft Arresting System Market, By End User (Page No. - 67)

8.1 Introduction

8.2 Aircraft Arresting System Market Size, By End User

8.3 Market Size, By Region

8.4 Commercial Airport

8.5 Aircraft Carrier

8.6 Military Airbase

9 Aircraft Arresting System Market, By System (Page No. - 71)

9.1 Introduction

9.2 Fixed

9.3 Portable

10 Aircraft Arresting System Market, By Platform (Page No. - 74)

10.1 Introduction

10.2 Ground-Based

10.3 Ship-Based

11 Aircraft Arresting System Market, By Region (Page No. - 78)

11.2 Introduction

11.3 North America

11.3.1 By Type

11.3.2 By End User

11.3.3 By System

11.3.4 By Platform

11.3.4.1 US

11.3.4.1.1 By Type

11.3.4.1.2 By End User

11.3.4.1.3 By System

11.3.4.1.4 By Platform

11.3.4.2 Canada

11.3.4.2.1 By Type

11.3.4.2.2 By End User

11.3.4.2.3 By System

11.3.4.2.4 By Platform

11.4 Europe

11.4.1 By Type

11.4.2 By End User

11.4.3 By System

11.4.4 By Platform

11.4.5 By Country

11.4.5.1 Russia

11.4.5.1.1 By Type

11.4.5.1.2 By End User

11.4.5.1.3 By System

11.4.5.1.4 By Platform

11.4.5.2 Germany

11.4.5.2.1 By Type

11.4.5.2.2 By End User

11.4.5.2.3 By System

11.4.5.2.4 By Platform

11.4.5.3 Spain

11.4.5.3.1 By Type

11.4.5.3.2 By End User

11.4.5.3.3 By System

11.4.5.3.4 By Platform

11.4.5.4 France

11.4.5.4.1 By Type

11.4.5.4.2 By End User

11.4.5.4.3 By System

11.4.5.4.4 By Platform

11.4.5.5 UK

11.4.5.5.1 By Type

11.4.5.5.2 By End User

11.4.5.5.3 By System

11.4.5.5.4 By Platform

11.4.5.6 Rest of Europe

11.4.5.6.1 By Type

11.4.5.6.2 By End User

11.4.5.6.3 By System

11.4.5.6.4 By Platform

11.5 Asia Pacific

11.5.1 By Type

11.5.2 By End User

11.5.3 By System

11.5.4 By Platform

11.5.5 By Country

11.5.5.1 China

11.5.5.1.1 By Type

11.5.5.1.2 By End User

11.5.5.1.3 By System

11.5.5.1.4 By Platform

11.5.5.2 India

11.5.5.2.1 By Type

11.5.5.2.2 By End User

11.5.5.2.3 By System

11.5.5.2.4 By Platform

11.5.5.3 Japan

11.5.5.3.1 By Type

11.5.5.3.2 By End User

11.5.5.3.3 By System

11.5.5.3.4 By Platform

11.5.5.4 Australia

11.5.5.4.1 By Type

11.5.5.4.2 By End User

11.5.5.4.3 By System

11.5.5.4.4 By Platform

11.5.5.5 South Korea

11.5.5.5.1 By Type

11.5.5.5.2 By End User

11.5.5.5.3 By System

11.5.5.5.4 By Platform

11.5.5.6 Rest of Asia Pacific

11.5.5.6.1 By End User

11.5.5.6.2 By System

11.5.5.6.3 By Platform

11.6 Rest of the World (RoW)

11.6.1 By Type

11.6.2 By End User

11.6.3 By System

11.6.4 By Platform

11.6.5 By Country

11.6.5.1 UAE

11.6.5.1.1 By Type

11.6.5.1.2 By End User

11.6.5.1.3 By System

11.6.5.2 South Africa

11.6.5.2.1 By Type

11.6.5.2.2 By End User

11.6.5.2.3 By System

11.6.5.2.4 By Platform

12 Competitive Landscape (Page No. - 127)

12.1 Introduction

12.1.1 Visionary Leaders

12.1.2 Innovators

12.1.3 Dynamic Differentiators

12.1.4 Emerging Companies

12.2 Competitive Benchmarking

12.2.1 Strength of Product Portfolio (13 Companies)

12.2.2 Business Strategy Excellence (13 Companies)

13 Company Profiles (Page No. - 131)

(Overview, Products and Services, Financials, Strategy & Development)*

13.1 General Atomics

13.2 Zodiac Aerospace

13.3 Scama Ab

13.4 Aries Test Systems and Instrumentation

13.5 Atech Inc.

13.6 A-Laskuvarjo

13.7 Escribano Mechanical & Engineering

13.8 Victor Balata Belting Company

13.9 Foster-Miller, Inc.

13.10 Curtiss-Wright Corp.

13.11 Wire Rope Industries

13.12 Wireco Worldgroup

13.13 Runway Safe

*Details on Overview, Products and Services, Financials, Strategy & Development Might Not Be Captured in Case of Unlisted Companies

14 Appendix (Page No. - 158)

14.1 Discussion Guide

14.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.3 Introducing RT: Real-Time Market Intelligence

14.4 Available Customizations

14.5 Related Reports

14.6 Author Details

List of Tables (108 Tables)

Table 1 Distribution of Aircraft Accidents, By Region, 2009-2012 (Million)

Table 2 Number of Accidents Related to Runway Safety, 1995-2008

Table 3 Ongoing EMAS Installation Projects in the US

Table 4 US Defense Funding for Advanced Arresting Gear Systems for Various Years

Table 5 Aircraft Arresting System Market Size, By Type, 2015–2022 (USD Million)

Table 6 Aircraft Arresting System Type Market Size, By Region, 2015-2022 (USD Million)

Table 7 Net Barrier Segment, By Region, 2015-2022 (USD Million)

Table 8 Cable Segment, By Region, 2015-2022 (USD Million)

Table 9 MAAS Segment, By Region, 2015-2022 (USD Million)

Table 10 EMAS Segment, By Region, 2015-2022 (USD Million)

Table 11 Aircraft Carrier Arresting System Segment, By Region, 2015-2022 (USD Million)

Table 12 Market Size, By End User, 2015-2022 (USD Million)

Table 13 Aircraft Arresting System End User Market, By Region, 2015-2022 (USD Million)

Table 14 Commercial Airport Segment, By Region, 2015-2022 (USD Million)

Table 15 Aircraft Carrier Segment, By Region, 2015-2022 (USD Million)

Table 16 Military Airbase Segment, By Region, 2015-2022 (USD Million)

Table 17 Market Size, By System, 2015-2022 (USD Million)

Table 18 Fixed Segment, By Region, 2015-2022 (USD Million)

Table 19 Portable Segment, By Region, 2015-2022 (USD Million)

Table 20 Market Size, By Platform, 2015-2022 (USD Million)

Table 21 Ground-Based Segment, By Region, 2015-2022 (USD Million)

Table 22 Ship-Based Segment, By Region, 2015-2022 (USD Million)

Table 23 Market Size, By Region, 2015-2022 (USD Million)

Table 24 North America Market: Driver Impact Analysis

Table 25 North America Market Size, By Type, 2015-2022 (USD Million)

Table 26 North America Market Size, By End User, 2015-2022 (USD Million)

Table 27 North America Market Size, By System, 2015-2022 (USD Million)

Table 28 North America Market Size, By Platform, 2015-2022 (USD Million)

Table 29 North America Market Size, By Country, 2015-2022 (USD Million)

Table 30 US Market Size, By Type, 2015-2022 (USD Million)

Table 31 US Market Size, By End User, 2015-2022 (USD Million)

Table 32 US Market Size, By System, 2015-2022 (USD Million)

Table 33 US Market Size, By Platform, 2015-2022 (USD Million)

Table 34 Canada Aircraft Arresting System Market Size, By Type, 2015-2022 (USD Million)

Table 35 Canada Market Size, By End User, 2015-2022 (USD Million)

Table 36 Canada Market Size, By System, 2015-2022 (USD Million)

Table 37 Canada Market Size, By Platform, 2015-2022 (USD Million)

Table 38 Europe Market: Driver Impact Analysis

Table 39 Europe Market, By Type, 2015-2022 (USD Million)

Table 40 Europe Market Size, By End User, 2015-2022 (USD Million)

Table 41 Europe Market Size, By System, 2015-2022 (USD Million)

Table 42 Europe Market Size, By Platform, 2015-2022 (USD Million)

Table 43 Europe Market Size, By Country, 2015-2022 (USD Million)

Table 44 Russia Market Size, By Type, 2015-2022 (USD Million)

Table 45 Russia Market Size, By End User, 2015-2022 (USD Million)

Table 46 Russia Market Size, By System, 2015-2022 (USD Million)

Table 47 Russia Market Size, By Platform, 2015-2022 (USD Million)

Table 48 Germany Market Size, By Type, 2015-2022 (USD Million)

Table 49 Germany Market Size, By End User, 2015-2022 (USD Million)

Table 50 Germany Market Size, By System, 2015-2022 (USD Million)

Table 51 Germany Market Size, By Platform, 2015-2022 (USD Million)

Table 52 Spain Aircraft Arresting System Market Size, By Type, 2015-2022 (USD Million)

Table 53 Spain Market Size, By End User, 2015-2022 (USD Million)

Table 54 Spain Market Size, By System, 2015-2022 (USD Million)

Table 55 Spain Market Size, By Platform, 2015-2022 (USD Million)

Table 56 France Market Size, By Type, 2015-2022 (USD Million)

Table 57 France Market Size, By End User, 2015-2022 (USD Million)

Table 58 France Market Size, By System, 2015-2022 (USD Million)

Table 59 France Market Size, By Platform, 2015-2022 (USD Million)

Table 60 UK Market Size, By Type, 2015-2022 (USD Million)

Table 61 UK Market Size, By End User, 2015-2022 (USD Million)

Table 62 UK Market Size, By System, 2015-2022 (USD Million)

Table 63 UK Market Size, By Platform, 2015-2022 (USD Million)

Table 64 Rest of Europe Market Size, By Type, 2015-2022 (USD Million)

Table 65 Rest of Europe Market Size, By End User, 2015-2022 (USD Million)

Table 66 Rest of Europe Market Size, By System, 2015-2022 (USD Million)

Table 67 Rest of Europe Market Size, By Platform, 2015-2022 (USD Million)

Table 68 Asia Pacific Market Size, By Type, 2015-2022 (USD Million)

Table 69 Asia Pacific Market Size, By End User, 2015-2022 (USD Million)

Table 70 Asia Pacific Market Size, By System, 2015-2022 (USD Million)

Table 71 Asia Pacific Market Size, By Platform, 2015-2022 (USD Million)

Table 72 Asia Pacific Market Size, By Country, 2015-2022 (USD Million)

Table 73 China Market Size, By Type, 2015-2022 (USD Million)

Table 74 China Market Size, By End User, 2015-2022 (USD Million)

Table 75 China Aircraft Arresting System Market Size, By System, 2015-2022 (USD Million)

Table 76 China Market Size, By Platform, 2015-2022 (USD Million)

Table 77 India Market Size, By Type, 2015-2022 (USD Million)

Table 78 India Market Size, By End User, 2015-2022 (USD Million)

Table 79 India Market Size, By System, 2015-2022 (USD Million)

Table 80 India Market Size, By Platform, 2015-2022 (USD Million)

Table 81 Japan Market Size, By Type, 2015-2022 (USD Million)

Table 82 Japan Market Size, By End User, 2015-2022 (USD Million)

Table 83 Japan Market Size, By System, 2015-2022 (USD Million)

Table 84 Japan Market Size, By Platform, 2015-2022 (USD Million)

Table 85 Australia Market Size, By Type, 2015-2022 (USD Million)

Table 86 Australia Market Size, By End User, 2015-2022 (USD Million)

Table 87 Australia Market Size, By System, 2015-2022 (USD Million)

Table 88 Australia Market Size, By Platform, 2015-2022 (USD Million)

Table 89 South Korea Market Size, By Type, 2015-2022 (USD Million)

Table 90 South Korea Market Size, By End User, 2015-2022 (USD Million)

Table 91 South Korea Market Size, By System, 2015-2022 (USD Million)

Table 92 South Korea Market Size, By Platform, 2015-2022 (USD Million)

Table 93 Rest of Asia Pacific Market Size, By Type, 2015-2022 (USD Million)

Table 94 Asia Pacific Aircraft Arresting System Market Size, By End User, 2015-2022 (USD Million)

Table 95 Asia Pacific Market Size, By System, 2015-2022 (USD Million)

Table 96 Asia Pacific Market Size, By Platform, 2015-2022 (USD Million)

Table 97 Rest of the World Aircraft Arresting System Market Size, By Type, 2015-2022 (USD Million)

Table 98 Rest of the World Market Size, By End User, 2015-2022 (USD Million)

Table 99 Rest of the World Market Size, By System, 2015-2022 (USD Million)

Table 100 Rest of the World Market Size, By Platform, 2015-2022 (USD Million)

Table 101 Rest of the World Market Size, By Country, 2015-2022 (USD Million)

Table 102 UAE Market Size, By Type, 2015-2022 (USD Million)

Table 103 UAE Market Size, By End User, 2015-2022 (USD Million)

Table 104 UAE Market Size, By System, 2015-2022 (USD Million)

Table 105 South Africa Market Size, By Type, 2015-2022 (USD Million)

Table 106 South Africa Market Size, By End User, 2015-2022 (USD Million)

Table 107 South Africa Market Size, By System, 2015-2022 (USD Million)

Table 108 South Africa Market Size, By Platform, 2015-2022 (USD Million)

List of Figures (42 Figures)

Figure 1 Aircraft Arresting System Market Segmentation

Figure 2 Research Flow

Figure 3 Research Design

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Data Triangulation

Figure 7 Assumptions of the Research Study

Figure 8 Market, By Platform, 2017 & 2022 (USD Million)

Figure 9 Aircraft Arresting System Market, By System, 2017 & 2022 (USD Million)

Figure 10 The North American Region is Expected to Be the Largest Market for Aircraft Arresting Systems in 2017

Figure 11 Increased Investments in Runway Safety Measures and Maritime Security to Drive the Growth of the Aircraft Arresting System Market

Figure 12 The Military Airbase End User Segment is Projected to Lead the Aircraft Arresting System Market From 2017 to 2022

Figure 13 The Military Airbase End User Segment is Estimated to Account for the Largest Share of the Asia Pacific Arresting System Market in 2017

Figure 14 The Ship-Based Platform Segment of the Market is Projected to Grow at the Highest CAGR From 2017 to 2022

Figure 15 The Fixed System Segment is Projected to Lead the Market From 2017 to 2022

Figure 16 The North American Region is Estimated to Account for the Largest Share of the Aircraft Arresting System Market in 2017

Figure 17 The Asia Pacific Market to Witness Significant Growth From 2017 to 2022

Figure 18 Market, By System

Figure 19 Market, By Platform

Figure 20 Aircraft Arresting System Market, By End User

Figure 21 Market, By Type

Figure 22 Aircraft Arresting System Market: Drivers, Restraints, Opportunities, and Challenges

Figure 23 Operational Concerns of Airlines Regarding Use of Aircraft Arresting Systems

Figure 24 Comparison Between Various Recovery Systems

Figure 25 Compounded Average Results for Recovery Systems

Figure 26 Evolution of Technologies Used in Aircraft Arresting Systems

Figure 27 Advanced Technologies Used in Aircraft Arresting Systems

Figure 28 Porter’s Five Forces

Figure 29 Porter’s Five Forces Analysis

Figure 30 Threat of New Entrants

Figure 31 Threat of Substitutes

Figure 32 Bargaining Power of Suppliers

Figure 33 Bargaining Power of Buyers

Figure 34 Intensity of Competitive Rivalry

Figure 35 North America is Estimated to Account for the Largest Share of the Market in 2017

Figure 36 North America Market Snapshot

Figure 37 Europe Market Snapshot

Figure 38 Asia Pacific Aircraft Arresting System Market

Figure 39 Competitive Leadership Mapping, 2017

Figure 40 Zodiac Aerospace: Company Snapshot

Figure 41 Curtiss-Wright Corp.: Company Snapshot

Figure 42 Runway Safe: Company Snapshot

Market size estimations for various segments and subsegments of the aircraft arresting system market were arrived at through extensive secondary research and government sources (FAA fact sheet, ICAO) such as company websites, corporate filings such as annual reports, investor presentations and financial statements, and trade, business, and professional associations, among others. Corroboration with primaries and further market triangulation with the help of statistical techniques using econometric tools were carried out. All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data is consolidated and added with detailed inputs and analysis from MarketsandMarkets, and presented in this report.

To know about the assumptions considered for the study, download the pdf brochure

The ecosystem of the aircraft arresting system market comprises manufacturers, raw material suppliers, distributors, and end users. The key end users of the market are commercial airports, military airbases, and aircraft carriers. Key manufacturers in the market are Zodiac Aerospace (France), General Atomics (US), Runway Safe (Sweden), SCAMA AB (Sweden), and Boeing (US).

“This study answers several questions for stakeholders, primarily, which segments they need to focus upon over the next six years to prioritize their efforts and investments.”

Target Audience

- Original Equipment Manufacturers (OEMs)

- Regulatory Bodies

- Component Suppliers

- Military

- Technology Providers

- Distributors

Scope of the report

This research report categorizes the aircraft arresting system market into the following segments and subsegments:

-

Aircraft Arresting System Market, By Type

- Net Barrier

- Cable

- Mobile Aircraft Arresting System (MAAS)

- Engineered Material Arresting System (EMAS)

- Aircraft Carrier Arresting System

-

Aircraft Arresting System Market, By End Use

- Commercial Airport

- Military Airbase

- Aircraft Carrier

-

Aircraft Arresting System Market, By System

- Fixed System

- Portable System

-

Aircraft Arresting System Market, By Platform

- Ground-based

- Ship-based

-

Aircraft Arresting System Market, By Region

- North America

- Europe

- Asia Pacific

- Rest of the World (RoW)

Customizations available for the report

With the given market data, MarketsandMarkets offers customizations as per the specific needs of a company. The following customization options are available for the report:

-

Country-level Analysis

- Comprehensive market projections for countries categorized under the Rest of Europe, the Rest of Asia-Pacific, and the Rest of the World

-

Company Information

- Detailed analysis and profiles of additional market players (Up to 5)

Growth opportunities and latent adjacency in Aircraft Arresting System Market

I want to know if the purchase of aircraft arresting barrier net suitable for G+W Make 61 QS II Stanchion System and 500 S-8 Rotor Break friction type. Detailed technical specification.

Aircraft arresting system. Require details of net barriers manufactured by Zodiac Aerospace and its features, leading particulars and specifications and types of net.