Airborne Radars Market by Application (Defense and Security, Commercial and Civil), Waveform (FMCW, Doppler, Ultra-Wideband), Technology (Software Defined Radios, Quantum Radars, Conventional Radars), Dimension (2D, 3D, 4D), Range, Installation Type, Component, Platform and Region - Global Forecast to 2028

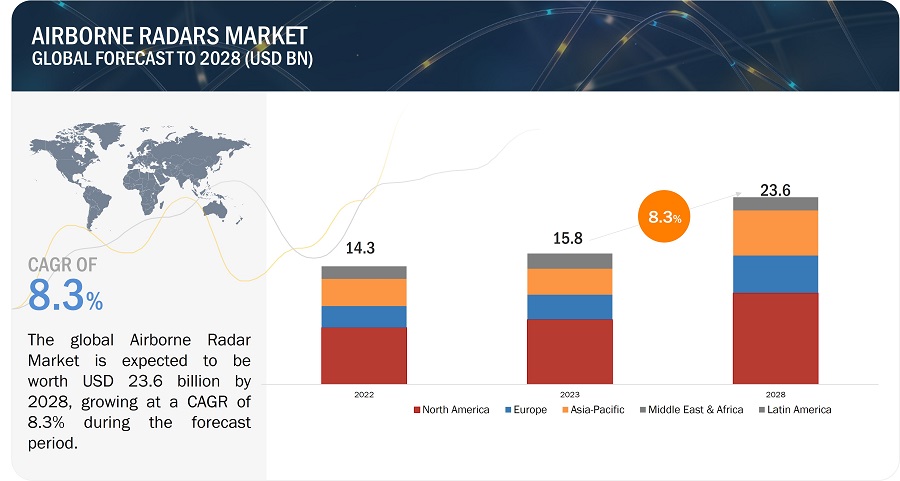

[311 Pages Report] The Airborne Radars Market is estimated to grow from USD 15.8 billion in 2023 to USD 23.6 billion by 2028, at a CAGR of 8.3% from 2023 to 2028. The market is driven by factors such as increasing demand for advanced weather monitoring radars, technological advancements in airborne radar systems and increasing Adoption of airborne radar in geological surveying and research.

Airborne Radars Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Airborne Radars Market Dynamics:

Driver: Increased Demand for advanced airborne weather monitoring radars

Weather-related disruptions are a significant challenge for the aviation industry. Advanced weather monitoring radars enable better real-time weather data collection, helping pilots make informed decisions, avoid turbulence, and navigate safely, ultimately improving flight efficiency and passenger safety. Governments and disaster management agencies rely on airborne radars data to monitor and predict weather-related disasters such as floods and storms. Advanced weather monitoring radars play a critical role in issuing early warnings and facilitating evacuation procedures. Agriculture increasingly relies on accurate weather data to optimize crop management. Advanced airborne radars provide valuable insights into rainfall patterns, soil moisture, and weather forecasts, helping farmers make data-driven decisions. This increasing demand of advanced weather monitoring radars will to drive the market of airborne radars.

Restraint: High development and maintenance costs

Modern-day commercial and military aircraft, including passenger planes, fighters, bombers, and unmanned aerial vehicles, rely heavily on airborne radar systems. These systems combine various technologies and hardware, such as synthetic aperture radar and software-defined radio, to create a multi-domain platform. However, the development and integration of these systems into a nation’s defense capabilities is costly and time-consuming. Additionally, maintenance of these systems is expensive. As a result, the high cost and time required for development and deployment are significant factors that limit the growth of this market.

Opportunity: Research and development in advanced airborne surveillance technologies

When considering an airborne radar, countries prioritize system reliability. Advanced hardware units help gather and distribute imagery across defense platforms, including combat vehicles and command headquarters. Both commercial and military surveillance systems have improved over time with advancements like software-defined radio and synthetic aperture radars. These radars are strategically located to increase detection rates and have low false alarms. Countries facing border disputes, drug trafficking, and illegal immigration rely on them for border protection. As a result, increased research and development in advanced airborne surveillance technologies are creating numerous opportunities in the defense sector. Recently, in August 2020, JSC Radar MMS developed a robotic helicopter-based search and rescue radar for military and commercial applications.

Challenges: Vulnerability of airborne radars to new jamming techniques

In recent times, the use of modern defense technologies has led to significant advancements in radar jamming techniques. Radar jamming involves intentionally emitting radio frequency signals that disrupt the enemy’s radar operations by creating noise in the receiver. Two primary techniques utilized in radar jamming are the noise technique and the repeater technique. Airborne radars are more vulnerable to these jamming techniques due to their limited range, small size, and mobile nature. New electronic radar jamming techniques utilize interfering signals that block the receiver with highly concentrated energy signals, effectively obstructing the signal from reaching the airborne radar and impeding its effectiveness. In 2019, the US Army awarded BAE Systems (UK) a contract to develop and supply advanced radar jamming technology to enhance air survivability and mission effectiveness for the Army’s rotary-wing aircraft and unmanned aerial systems. Under this contract, the company would undertake research and development to integrate adaptive radio frequency jamming and sensing capabilities. Such innovative radar frequency jamming technologies will prompt airborne radar providers to improve their products to maintain operational efficiency.

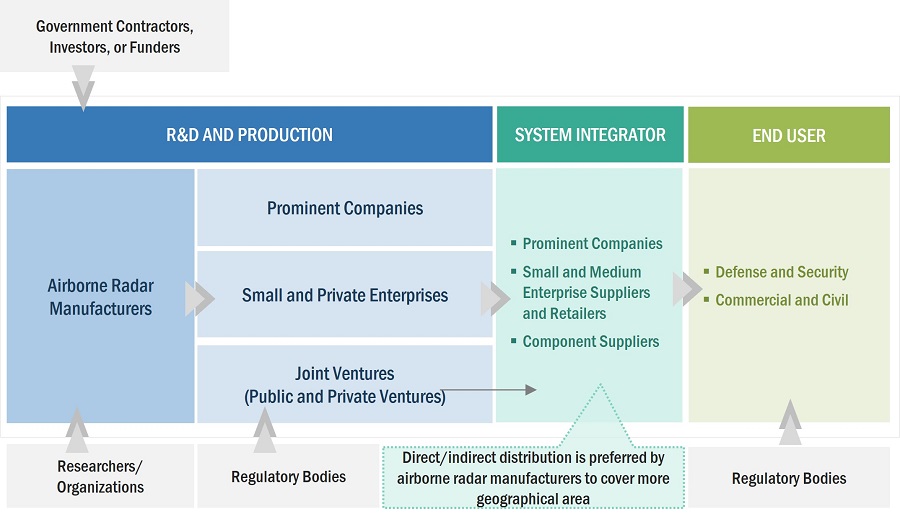

Airborne Radar Market Ecosystem:

Based on Waveform, the doppler segment is projected to have the second highest share in 2023

Based on Waveform, the airborne radars market has been segmented into frequency modulated continuous wave (FMCW), Doppler, and ultra-wideband impulse. A Doppler radar determines the range of a target using pulse-timing techniques and uses the Doppler effect of the returned signal to determine the velocity of the target. Doppler radar is further classified into conventional Doppler radar and pulse-Doppler radar. Doppler radars are capable of measuring wind speed, in contrast to conventional radar, making them suitable for use in airborne weather monitoring. They are lightweight and can be easily incorporated within platforms with limited space, such as small aircraft and helicopters. Doppler radar provides stability and navigation by emitting sinusoidal waves toward the earth’s surface in order to determine the velocity of the aircraft, resulting in accurate navigation.

Based on Installation Type, the New Installation segment of the market is projected to grow at the highest CAGR from 2023 to 2028.

Based on Installation Type, airborne radars have been segmented into new installation and upgradation. The new installation segment introduces cutting-edge technology or innovative features that significantly outperform existing airborne radar systems, it could attract more customers and gain a competitive edge. The new installation segment offers cost-effective solutions compared to retrofitting existing systems or purchasing traditional airborne radar systems, which becomes more appealing to customers, leading to market leadership.

Based on Component, the Duplexrs segment of the market is projected to grow at the second highest CAGR from 2023 to 2028.

Based on components, the airborne radar market has been segmented into antennas, transmitters, power amplifiers, duplexers, digital signal processors, graphical user interfaces, stabilization system, and other components such as modulators and filters. A duplexer in a radar system allows bi-directional (duplex) communication over a single path between the signal source and the receiver end. In radar and radio communications systems, a duplexer primarily isolates the receiver from the transmitter while permitting them to share a common antenna. Radio repeater systems deploy duplexers on a large scale. Duplexers are designed for seamless integration with various types of radar systems hence leading to gain second highest CAGR. Compatibility with both existing radar systems and newer installations give duplexers a competitive advantage. Duplexers are developed to be cost-effective without compromising performance, radar manufacturers prefer them, leading to their growth in the airborne radar market.

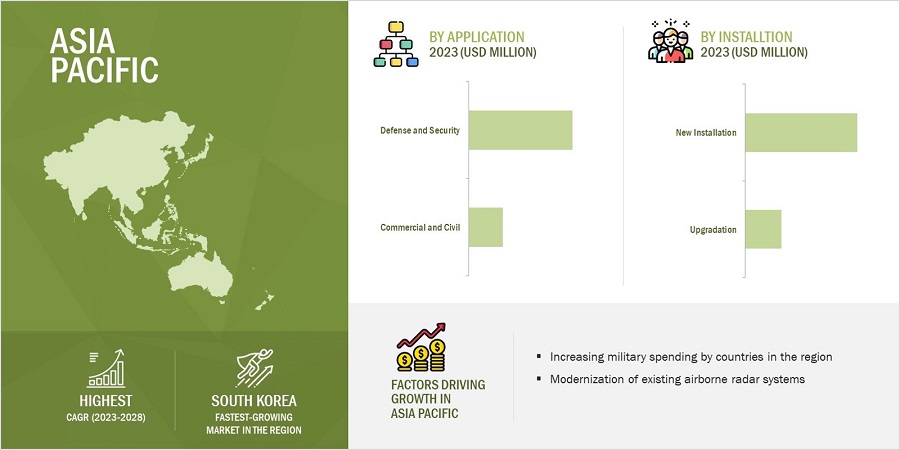

Asia-Pacific is expected to account for the highest CAGR in the forecasted period.

Asia-Pacific is estimated to account for the highest CAGR in the forecasted period. The market growth in this region is expected to be fueled by the growing demand for airborne surveillance, scientific research, weather monitoring for commercial aircraft and business jets, perimeter surveillance, and battlefield surveillance. The Australian government is focusing on modernizing its airborne surveillance radar for the Royal Australian Navy and Air Force. The South Korean government is increasing its defense budget allocation which will grow the airborne radars market.

Airborne Radars Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

Players such as Raytheon Technologies Corporation (US), Lockheed Martin Corporation (US), Thales Group (France), Northrop Grumman Corporation (US), Saab Group (Sweden), Leonardo S.p.A. (Italy) among others covers various industry trends and new technological innovations in the airborne radars companies for the period 2020-2023.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2091-2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023-2030 |

|

Forecast units |

Value (USD) |

|

Segments Covered |

By component, by waveform, by platform, by application, by dimension, by range, by frequency band, by installation type, by technology |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

|

Companies covered |

Raytheon Technologies Corporation (US), Lockheed Martin Corporation (US), Thales Group (France), Northrop Grumman Corporation (US), Saab Group (Sweden), Leonardo S.p.A. (Italy), and Israel Aerospace Industries (Israel) are some of the major players of airborne radars market. (25 Companies) |

Airborne Radars Market Highlights

This research report categorizes the airborne radars market based on component, waveform, platform, application, dimension, range, frequency band, installation type, technology, and region.

|

Segment |

Subsegment |

|

By Component |

|

|

By Waveform |

|

|

By Platform |

|

|

By Application |

|

|

By Dimension |

|

|

By Range |

|

|

By Frequency Band |

|

|

By Installation Type |

|

|

By Technology |

|

|

By Region |

|

Recent Developments

- In January 2021, Northrop Grumman Corporation was awarded a contract by the US Air Force to support the Joint Surveillance Target Attack Radar System (Joint STARS).

- In January 2021, Northrop Grumman Corporation received a contract from the French government to supply E-2D Advanced Hawkeye airborne radar equipped command and control aircraft.

- In October 2020, The Boeing Company awarded a commercial contract to Raytheon Technologies Corporation to provide active electronically scanned array radar systems for installation on future F-15EX aircraft of the US Air Force.

- In June 2020, Raytheon Technologies Corporation secured a contract worth USD 203 million from the US Air Force to provide maintenance services for the F-15E aircraft’s active electronically scanned array radar systems.

- In February 2020, LONGBOW LLC, (US) a joint venture between Lockheed Martin Corporation and Northrop Grumman Corporation, was awarded a contract to provide post-production support services for the AH-64 Apache helicopter AN/APG-78 LONGBOW Fire Control Radar (FCR) to international customers.

Frequently Asked Questions:

What is the current size of the airborne radar Market?

The global airborne radar market size is estimated to grow from USD 15.85 billion in 2023 to USD 23.66 billion by 2028, at a CAGR of 8.3% during the forecasted period.

Who are the winners in the airborne radar market?

Raytheon Technologies Corporation (US), Lockheed Martin Corporation (US), Thales Group (France), Northrop Grumman Corporation (US), Saab Group (Sweden), Leonardo S.p.A. (Italy).

What are some of the opportunities of the airborne radar market?

Rapid development for lightweight radar for unmanned aerial vehicles and development in advanced airborne surveillance technologies market expansion are a few opportunities for the airborne radar market.

What are some of the technological advancements in the market?

Software defined radar, 3D 4D radar and quantum radar are some of the technological advancements in the airborne radar market.

What are the factors driving the growth of the market?

The increasing demand for advanced weather monitoring radars with technological advancements and growing governmental investments to upgrade existing fighter aircraft with advanced radar systems are few growth prospects of the airborne radars market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increased demand for advanced airborne weather monitoring radars- Technological advancements in airborne radar systems- Government investments to upgrade existing fighter aircraft radars- Adoption of airborne radars in geological surveying and research- Growing preference for phased array radarsRESTRAINTS- High development and maintenance costsOPPORTUNITIES- Research & development in advanced airborne surveillance technologies- Rapid development of lightweight radars for unmanned aerial vehiclesCHALLENGES- Implications of extreme weather conditions- Vulnerability of airborne radars to new jamming techniques- Stringent policies on cross-border trading

- 5.3 RECESSION IMPACT ANALYSIS: OPTIMISTIC, PESSIMISTIC, AND NEUTRAL SCENARIOS

-

5.4 VALUE CHAIN ANALYSISRAW MATERIALSR&DCOMPONENT MANUFACTURINGOEMSEND USERS

-

5.5 ECOSYSTEM MAPPINGPROMINENT COMPANIESPRIVATE AND SMALL ENTERPRISESEND USERS

- 5.6 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

-

5.7 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

- 5.8 PRICING ANALYSIS

- 5.9 VOLUME DATA

- 5.10 TRADE DATA

- 5.11 REGULATORY LANDSCAPE

- 5.12 KEY CONFERENCES AND EVENTS, 2023–2024

-

5.13 USE CASE ANALYSISACTIVE ELECTRONICALLY SCANNED ARRAYINTEGRATION OF SURVEILLANCE RADAR IN UAVS

-

5.14 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 6.1 INTRODUCTION

-

6.2 TECHNOLOGY TRENDSSOFTWARE-DEFINED RADARMULTIPLE-INPUTS/MULTIPLE-OUTPUTS (MIMO)3D AND 4D RADARINVERSE SYNTHETIC APERTURE RADAR (ISAR)QUANTUM RADARLIDAR TECHNOLOGY

- 6.3 TECHNOLOGY ANALYSIS

- 6.4 IMPACT OF MEGATRENDS

- 6.5 SUPPLY CHAIN ANALYSIS

- 6.6 INNOVATIONS AND PATENT REGISTRATIONS

- 6.7 ROADMAP FOR AIRBORNE RADARS MARKET COMMERCIALIZATION

- 7.1 INTRODUCTION

-

7.2 ANTENNASPARABOLIC REFLECTOR ANTENNAS- High signal gain and directivity at narrow bandwidths to drive marketSLOTTED WAVEGUIDE ANTENNAS- Increasing demand for lightweight and portable airborne surveillance radars to drive marketPLANAR PHASED ARRAY ANTENNAS- Growing adoption of tactical defense radar systems to drive marketACTIVE SCANNED ARRAY ANTENNAS- Increasing demand for reliable and efficient airborne surveillance radars to drive marketPASSIVE SCANNED ARRAY ANTENNAS- Ability to track multiple targets to drive market

-

7.3 TRANSMITTERSMICROWAVE TUBE-BASED TRANSMITTERS- Ability to transmit high-power microwaves to drive marketSOLID-STATE ELECTRONICS- Preference for reliable signal transmission in critical weather conditions to drive market

-

7.4 DUPLEXERSGROWING DEMAND FOR COMPACT RADAR SYSTEMS TO DRIVE MARKET

-

7.5 RECEIVERSANALOG RECEIVERS- Cost-effectiveness with low latency to drive marketDIGITAL RECEIVERS- Higher reliability than analog receivers to drive market

-

7.6 POWER AMPLIFIERSTRAVELING WAVE TUBE AMPLIFIERS- Demand for large bandwidth radars to drive marketSOLID-STATE POWER AMPLIFIERS- Narrow bandwidth and low voltage to drive market- Gallium arsenide- Gallium nitride (GAN)

-

7.7 DIGITAL SIGNAL PROCESSORSINCREASING USE OF FIELD PROGRAMMABLE GATED ARRAY AND GRAPHICS PROCESSING UNIT TO DRIVE MARKET

-

7.8 GRAPHICAL USER INTERFACESCONTROL PANELS- Demand for multiple control features to drive marketGRAPHIC PANELS- Need for simplistic view of various functions and structures to drive marketDISPLAYS- Assistance in target locking and firing missiles to drive market

-

7.9 STABILIZATION SYSTEMSGROWING DEMAND FOR 360-DEGREE FULL ROTATIONAL RADAR SYSTEMS TO DRIVE MARKET

- 7.10 OTHER COMPONENTS

- 8.1 INTRODUCTION

-

8.2 MILITARY AIRCRAFTFIGHTER AIRCRAFT- Wide adoption of airborne surveillance radars for defense and national security to drive marketTRANSPORT AIRCRAFT- High demand for airborne radars for navigation to drive marketTRAINER AIRCRAFT- Increase in demand for advanced aircraft to train pilots and aircrew to drive marketRECONNAISSANCE AIRCRAFT- Adoption of modern intelligence, surveillance, and reconnaissance technologies to drive marketSPECIAL MISSION AIRCRAFT- Increasing need to detect cross-border infiltration to drive market

-

8.3 COMMERCIAL AIRCRAFTNARROW-BODY AIRCRAFT- Cost-effective operations to drive marketNEW MID-SIZE AIRCRAFT- Demand for large-capacity commercial aircraft to drive marketWIDE-BODY AIRCRAFT- Rising demand for intercontinental air travel to drive marketBUSINESS JETS- Increasing demand for surveillance and reconnaissance applications by military and government agencies to drive market

-

8.4 HELICOPTERSCOMMERCIAL HELICOPTERS- Utilization in tourism and emergency rescue services to drive marketMILITARY HELICOPTERS- Ability to carry out one-time tasks efficiently to drive market

-

8.5 UNMANNED AIR VEHICLES (UAVS)COMMERCIAL UAVS- Ability to locate targets in rough terrain and critical weather conditions to drive marketMILITARY UAVS- Government investment in modern surveillance technologies to drive market- Tactical UAVs- Strategic UAVs- Medium-altitude long endurance (MALE) UAVs- High-altitude long endurance (HALE) UAVs- Special-purpose UAVsAEROSTATS- Need for surveillance to monitor border disputes and drug trafficking to drive marketURBAN AIR MOBILITY (UAM)- Need to transport cargo and passengers at lower altitudes to drive market

- 9.1 INTRODUCTION

-

9.2 COMMERCIAL AND CIVILSCIENTIFIC RESEARCH- Low-cost remote target field remote sensing to drive marketAIRPORT PERIMETER SECURITY- Increased emphasis on airport security to drive marketCRITICAL INFRASTRUCTURE- Need for intruder detection systems at ports and harbors to drive marketWEATHER MONITORING- Demand for precise weather monitoring to drive marketNAVIGATION- Need for precise navigation for commercial aircraft and helicopters to drive marketCOLLISION AVOIDANCE- Wide-scale use of radars to avoid incoming objects to drive marketOTHER APPLICATIONS

-

9.3 DEFENSE AND SECURITYPERIMETER SECURITY- Use in air traffic control and bomb scoring to drive marketISR- Need for actionable intelligence to ensure safety against unauthorized targets to drive marketAIR DEFENSE- Increased use of intercontinental ballistic missiles to drive marketBATTLEFIELD SURVEILLANCE- Use of surveillance drones to gather battlefield to drive marketSEARCH AND RESCUE- Integration of radar with EO/IR systems to drive marketWEATHER MONITORING- Demand for accurate and precise weather forecasting to drive marketNAVIGATION- Long-distance and intercontinental missions to drive market

- 10.1 INTRODUCTION

-

10.2 FREQUENCY MODULATED CONTINUOUS WAVE (FMCW)INCREASED DEPENDENCY ON LOW-POWER TRANSMISSION DEVICES TO DRIVE MARKET

-

10.3 DOPPLERCONVENTIONAL DOPPLER- Wide adoption for monitoring weather conditions to drive marketPULSE-DOPPLER- Meteorological applications to drive market

-

10.4 ULTRA-WIDEBAND IMPULSEAPPLICATIONS IN RADAR IMAGING AND DETECTION OF HUMAN VITAL SIGNALS TO DRIVE MARKET

- 11.1 INTRODUCTION

-

11.2 SOFTWARE-DEFINED RADARSPHASED ARRAY RADARS- Active electronically scanned array (AESA)- Passive electronically scanned array (PESA)MIMO

-

11.3 QUANTUM RADARSR&D IN PRODUCTION STAGES TO DRIVE MARKET

-

11.4 CONVENTIONAL RADARSUSE IN COVERT MILITARY OPERATIONS TO DRIVE MARKET

- 12.1 INTRODUCTION

-

12.2 C-BANDAPPLICATION IN LONG-RANGE MILITARY SURVEILLANCE TO DRIVE MARKET

-

12.3 L-BANDUSE IN ASSET TRACKING TO DRIVE MARKET

-

12.4 X-BANDSITUATIONAL AWARENESS IN MILITARY APPLICATIONS TO DRIVE MARKET

-

12.5 KA-BANDHIGH FOCUSED AND POWERFUL SIGNALS TO DRIVE MARKET

-

12.6 S-BANDWIDE-SCALE USE IN AIRBORNE MARITIME SURVEILLANCE TO DRIVE MARKET

-

12.7 KU-BANDWIDE BEAM COVERAGE AND HIGHER THROUGHPUT TO DRIVE MARKET

-

12.8 HF/UHF/VHF BANDSHIGH ADOPTION IN EARLY WARNING SYSTEMS TO DRIVE MARKET

-

12.9 MULTI-BANDCOHERENT DETECTION AND TRACKING OF MOVING TARGETS TO DRIVE MARKET

- 13.1 INTRODUCTION

-

13.2 LONG-RANGE (200 KM TO 500 KM)USE FOR LONG-DISTANCE TRACKING OF BALLISTIC MISSILES TO DRIVE MARKET

-

13.3 VERY LONG-RANGE (ABOVE 500 KM)ASSISTANCE IN TRACKING AIR-BREATHING TARGETS TO DRIVE MARKET

-

13.4 MEDIUM-RANGE (50 KM TO 200 KM)HIGH DEMAND ACROSS DEFENSE AND SECURITY APPLICATIONS TO DRIVE MARKET

-

13.5 SHORT-RANGE (10 KM TO 50 KM)ABILITY TO PROFILE WEATHER CELLS AND PROVIDE THREAT ANALYSIS TO DRIVE MARKET

-

13.6 VERY SHORT-RANGE (< 10 KM)USE IN MONITORING OF CRITICAL INFRASTRUCTURE TO DRIVE MARKET

- 14.1 INTRODUCTION

-

14.2 2DEXTENSIVE USE IN EARLY WARNING AND CONTROL SYSTEMS TO DRIVE MARKET

-

14.3 3DTARGET LOCATION ACCURACY TO DRIVE MARKET

-

14.4 4DWIDE-SCALE USE IN AUTONOMOUS TACTICAL SURVEILLANCE VEHICLES TO DRIVE MARKET

- 15.1 INTRODUCTION

-

15.2 NEW INSTALLATIONGROWING DEFENSE BUDGETS WORLDWIDE TO DRIVE MARKET

-

15.3 UPGRADEINTEGRATION OF AIRBORNE SURVEILLANCE RADARS TO DRIVE MARKET

- 16.1 INTRODUCTION

- 16.2 RECESSION IMPACT ANALYSIS

-

16.3 NORTH AMERICARECESSION IMPACT ANALYSISPESTLE ANALYSISUS- Aircraft fleet modernization programs to drive marketCANADA- Increasing R&D investments by government and defense equipment manufacturers to drive market

-

16.4 EUROPERECESSION IMPACT ANALYSISPESTLE ANALYSISRUSSIA- Ongoing military reform programs and digitization of radar systems to drive marketGERMANY- Need to detect and restrict illegal immigrants through UAV-based surveillance to drive marketUK- Focus on replacing existing radar systems with advanced early warning and control systems to drive marketITALY- Production of drones for target acquisition and ISR missions to drive marketFRANCE- Focus on enhancing airborne defense platform capabilities to drive marketREST OF EUROPE

-

16.5 ASIA PACIFICRECESSION IMPACT ANALYSISASIA PACIFIC: PESTLE ANALYSISCHINA- Increasing investment in advanced early warning systems to drive marketINDIA- Efforts to strengthen air surveillance and early warning capabilities to drive marketJAPAN- Uplifting of self-imposed defense equipment export ban to drive marketSOUTH KOREA- Investments in modernizing military against evolving security challenges to drive marketAUSTRALIA- Rise in demand to replace existing aircraft to drive marketREST OF ASIA PACIFIC

-

16.6 LATIN AMERICARECESSION IMPACT ANALYSISPESTLE ANALYSISBRAZIL- Ongoing military modernization programs to drive marketMEXICO- Demand for advanced fighter aircraft with airborne warning and control system capabilities to drive market

-

16.7 MIDDLE EAST & AFRICARECESSION IMPACT ANALYSISPESTLE ANALYSISTURKEY- Increasing focus on procuring low-altitude airborne surveillance radar to drive marketSAUDI ARABIA- Ongoing border security operations to drive marketISRAEL- Presence of major manufacturers of airborne radars to drive marketSOUTH AFRICA- Increasing geopolitical instability to drive market

- 17.1 INTRODUCTION

- 17.2 RANKING ANALYSIS, 2022

- 17.3 REVENUE ANALYSIS, 2022

- 17.4 MARKET SHARE ANALYSIS, 2022

-

17.5 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

- 17.6 COMPANY FOOTPRINT

-

17.7 STARTUP/SME EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS- COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

-

17.8 COMPETITIVE SCENARIOS AND TRENDSDEALSEXPANSIONS

-

18.1 KEY PLAYERSRAYTHEON TECHNOLOGIES CORPORATION- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewLOCKHEED MARTIN CORPORATION- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewLEONARDO SPA- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewNORTHROP GRUMMAN CORPORATION- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewTHALES GROUP- Business overview- Products/Services/Solutions offered- MnM viewSAAB AB- Business overview- Products/Services/Solutions offered- Recent developmentsBAE SYSTEMS PLC- Business overview- Products/Services/Solutions offered- Recent developmentsTHE BOEING COMPANY- Business overview- Products/Services/Solutions offered- Recent developmentsISRAEL AEROSPACE INDUSTRIES LTD.- Business overview- Products/Services/Solutions offered- Recent developmentsASELSAN AS- Business overview- Products/Services/Solutions offered- Recent developmentsSRC, INC.- Business overview- Products/Services/Solutions offered- Recent developmentsHENSOLDT AG- Business overview- Products/Services/Solutions offered- Recent developmentsELBIT SYSTEMS LTD.- Business Overview- Products/Services/Solutions offered- Recent developmentsINDRA SISTEMAS, SA- Business overview- Products/Services/Solutions offered- Recent developmentsHONEYWELL INTERNATIONAL INC.- Business overview- Products/Services/Solutions offered- Recent developmentsL3HARRIS TECHNOLOGIES, INC.- Business overview- Products/Services/Solutions offered- Recent developmentsTELEPHONICS CORPORATION- Business overview- Products/Services/Solutions offeredMITSUBISHI ELECTRIC CORPORATION- Business overview- Products/Services/Solutions offered- Recent developmentsAIRBUS SE- Business overview- Products/Services/Solutions offered- Recent developmentsAINSTEIN RADAR SYSTEMS- Business overview- Products/Services/Solutions offeredOPTIMARE SYSTEMS GMBH- Business overview- Products/Services/Solutions offered- Recent developmentsJSC RADAR MMS- Business overview- Products/Services/Solutions offeredGARMIN LIMITED- Business overview- Products/Services/Solutions offered

-

18.2 OTHER PLAYERSMETASENSINGBHARAT ELECTRONICS LTD.

- 19.1 DISCUSSION GUIDE

- 19.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 19.3 CUSTOMIZATION OPTIONS

- 19.4 RELATED REPORT

- 19.5 AUTHOR DETAILS

- TABLE 1 INCLUSIONS AND EXCLUSIONS

- TABLE 2 USD EXCHANGE RATES

- TABLE 3 ROLE OF KEY PLAYERS IN ECOSYSTEM

- TABLE 4 IMPACT OF PORTER’S FIVE FORCES

- TABLE 5 AVERAGE SELLING PRICE OF RADAR SYSTEMS PER AIRCRAFT, BY SEGMENT, 2022 (USD)

- TABLE 6 AVERAGE SELLING PRICE OF RADAR SYSTEMS PER AIRCRAFT, BY REGION, 2022 (USD)

- TABLE 7 VOLUME DATA OF RADARS FOR NEW AIRCRAFT INSTALLATIONS, BY TYPE (UNITS)

- TABLE 8 COUNTRY-WISE IMPORTS, 2020–2022 (USD THOUSAND)

- TABLE 9 COUNTRY-WISE EXPORTS, 2020–2022 (USD THOUSAND)

- TABLE 10 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER AGENCIES

- TABLE 11 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER AGENCIES

- TABLE 12 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER AGENCIES

- TABLE 13 KEY CONFERENCES AND EVENTS, 2023–2024

- TABLE 14 INFLUENCE OF STAKEHOLDERS ON BUYING AIRBORNE RADARS, BY APPLICATION (%)

- TABLE 15 KEY BUYING CRITERIA FOR AIRBORNE RADARS, BY APPLICATION

- TABLE 16 INNOVATIONS AND PATENT REGISTRATIONS, 2020–2023

- TABLE 17 AIRBORNE RADARS MARKET, BY COMPONENT, 2019–2022 (USD MILLION)

- TABLE 18 AIRBORNE RADARS MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 19 ANTENNAS: AIRBORNE RADARS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 20 ANTENNAS: AIRBORNE RADARS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 21 TRANSMITTERS: AIRBORNE RADARS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 22 TRANSMITTERS: AIRBORNE RADARS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 23 RECEIVERS: AIRBORNE RADARS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 24 RECEIVERS: AIRBORNE RADARS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 25 POWER AMPLIFIERS: AIRBORNE RADARS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 26 POWER AMPLIFIERS: AIRBORNE RADARS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 27 SOLID-STATE POWER AMPLIFIERS: AIRBORNE RADARS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 28 SOLID-STATE POWER AMPLIFIERS: AIRBORNE RADARS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 29 AIRBORNE RADARS MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 30 AIRBORNE RADARS MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 31 AIRBORNE RADARS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 32 AIRBORNE RADARS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 33 COMMERCIAL AND CIVIL: AIRBORNE RADARS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 34 COMMERCIAL AND CIVIL: AIRBORNE RADARS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 35 DEFENSE AND SECURITY: AIRBORNE RADARS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 36 DEFENSE AND SECURITY: AIRBORNE RADARS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 37 AIRBORNE RADARS MARKET, BY WAVEFORM, 2019–2022 (USD MILLION)

- TABLE 38 AIRBORNE RADARS MARKET, BY WAVEFORM, 2023–2028 (USD MILLION)

- TABLE 39 DOPPLER: AIRBORNE RADARS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 40 DOPPLER: AIRBORNE RADARS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 41 AIRBORNE RADARS MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 42 AIRBORNE RADARS MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 43 AIRBORNE RADARS MARKET, BY FREQUENCY BAND, 2019–2022 (USD MILLION)

- TABLE 44 AIRBORNE RADARS MARKET, BY FREQUENCY BAND, 2023–2028 (USD MILLION)

- TABLE 45 AIRBORNE RADARS MARKET, BY RANGE, 2019–2022 (USD MILLION)

- TABLE 46 AIRBORNE RADARS MARKET, BY RANGE, 2023–2028 (USD MILLION)

- TABLE 47 AIRBORNE RADARS MARKET, BY DIMENSION, 2019–2022 (USD MILLION)

- TABLE 48 AIRBORNE RADARS MARKET, BY DIMENSION, 2023–2028 (USD MILLION)

- TABLE 49 AIRBORNE RADARS MARKET, BY INSTALLATION TYPE, 2019–2022 (USD MILLION)

- TABLE 50 AIRBORNE RADARS MARKET, BY INSTALLATION TYPE, 2023–2028 (USD MILLION)

- TABLE 51 AIRBORNE RADARS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 52 AIRBORNE RADARS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 53 RECESSION IMPACT ANALYSIS

- TABLE 54 NORTH AMERICA: AIRBORNE RADARS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 55 NORTH AMERICA: AIRBORNE RADARS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 56 NORTH AMERICA: AIRBORNE RADARS MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 57 NORTH AMERICA: AIRBORNE RADARS MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 58 NORTH AMERICA: AIRBORNE RADARS MARKET, BY FREQUENCY BAND, 2019–2022 (USD MILLION)

- TABLE 59 NORTH AMERICA: AIRBORNE RADARS MARKET, BY FREQUENCY BAND, 2023–2028 (USD MILLION)

- TABLE 60 NORTH AMERICA: AIRBORNE RADARS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 61 NORTH AMERICA: AIRBORNE RADARS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 62 NORTH AMERICA: AIRBORNE RADARS MARKET, BY COMMERCIAL AND CIVIL APPLICATION, 2019–2022 (USD MILLION)

- TABLE 63 NORTH AMERICA: AIRBORNE RADARS MARKET, BY COMMERCIAL AND CIVIL APPLICATION, 2023–2028 (USD MILLION)

- TABLE 64 NORTH AMERICA: AIRBORNE RADARS MARKET, BY DEFENSE AND SECURITY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 65 NORTH AMERICA: AIRBORNE RADARS MARKET, BY DEFENSE AND SECURITY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 66 NORTH AMERICA: AIRBORNE RADARS MARKET, BY INSTALLATION TYPE, 2019–2022 (USD MILLION)

- TABLE 67 NORTH AMERICA: AIRBORNE RADARS MARKET, BY INSTALLATION TYPE, 2023–2028 (USD MILLION)

- TABLE 68 NORTH AMERICA: AIRBORNE RADARS MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 69 NORTH AMERICA: AIRBORNE RADARS MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 70 US: AIRBORNE RADARS MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 71 US: AIRBORNE RADARS MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 72 US: AIRBORNE RADARS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 73 US: AIRBORNE RADARS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 74 US: AIRBORNE RADARS MARKET, BY INSTALLATION TYPE, 2019–2022 (USD MILLION)

- TABLE 75 US: AIRBORNE RADARS MARKET, BY INSTALLATION TYPE, 2023–2028 (USD MILLION)

- TABLE 76 US: AIRBORNE RADARS MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 77 US: AIRBORNE RADARS MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 78 CANADA: AIRBORNE RADARS MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 79 CANADA: AIRBORNE RADARS MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 80 CANADA: AIRBORNE RADARS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 81 CANADA: AIRBORNE RADARS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 82 CANADA: AIRBORNE RADARS MARKET, BY INSTALLATION TYPE, 2019–2022 (USD MILLION)

- TABLE 83 CANADA: AIRBORNE RADARS MARKET, BY INSTALLATION TYPE, 2023–2028 (USD MILLION)

- TABLE 84 CANADA: AIRBORNE RADARS MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 85 CANADA: AIRBORNE RADARS MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 86 EUROPE: AIRBORNE RADARS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 87 EUROPE: AIRBORNE RADARS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 88 EUROPE: AIRBORNE RADARS MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 89 EUROPE: AIRBORNE RADARS MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 90 EUROPE: AIRBORNE RADARS MARKET, BY FREQUENCY BAND, 2019–2022 (USD MILLION)

- TABLE 91 EUROPE: AIRBORNE RADARS MARKET, BY FREQUENCY BAND, 2023–2028 (USD MILLION)

- TABLE 92 EUROPE: AIRBORNE RADARS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 93 EUROPE: AIRBORNE RADARS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 94 EUROPE: AIRBORNE RADARS MARKET, BY COMMERCIAL AND CIVIL APPLICATION, 2019–2022 (USD MILLION)

- TABLE 95 EUROPE: AIRBORNE RADARS MARKET, BY COMMERCIAL AND CIVIL APPLICATION, 2023–2028 (USD MILLION)

- TABLE 96 EUROPE: AIRBORNE RADARS MARKET, BY DEFENSE AND SECURITY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 97 EUROPE: AIRBORNE RADARS MARKET, BY DEFENSE AND SECURITY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 98 EUROPE: AIRBORNE RADARS MARKET, BY INSTALLATION TYPE, 2019–2022 (USD MILLION)

- TABLE 99 EUROPE: AIRBORNE RADARS MARKET, BY INSTALLATION TYPE, 2023–2028 (USD MILLION)

- TABLE 100 EUROPE: AIRBORNE RADARS MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 101 EUROPE: AIRBORNE RADARS MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 102 RUSSIA: AIRBORNE RADARS MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 103 RUSSIA: AIRBORNE RADARS MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 104 RUSSIA: AIRBORNE RADARS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 105 RUSSIA: AIRBORNE RADARS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 106 RUSSIA: AIRBORNE RADARS MARKET, BY INSTALLATION TYPE, 2019–2022 (USD MILLION)

- TABLE 107 RUSSIA: AIRBORNE RADARS MARKET, BY INSTALLATION TYPE, 2023–2028 (USD MILLION)

- TABLE 108 RUSSIA: AIRBORNE RADARS MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 109 RUSSIA: AIRBORNE RADAR MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 110 GERMANY: AIRBORNE RADARS MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 111 GERMANY: AIRBORNE RADARS MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 112 GERMANY: AIRBORNE RADARS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 113 GERMANY: AIRBORNE RADARS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 114 GERMANY: AIRBORNE RADARS MARKET, BY INSTALLATION TYPE, 2019–2022 (USD MILLION)

- TABLE 115 GERMANY: AIRBORNE RADAR MARKET, BY INSTALLATION TYPE, 2023–2028 (USD MILLION)

- TABLE 116 GERMANY: AIRBORNE RADARS MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 117 GERMANY: AIRBORNE RADARS MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 118 UK: AIRBORNE RADARS MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 119 UK: AIRBORNE RADARS MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 120 UK: AIRBORNE RADARS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 121 UK: AIRBORNE RADARS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 122 UK: AIRBORNE RADARS MARKET, BY INSTALLATION TYPE, 2019–2022 (USD MILLION)

- TABLE 123 UK: AIRBORNE RADARS MARKET, BY INSTALLATION TYPE, 2023–2028 (USD MILLION)

- TABLE 124 UK: AIRBORNE RADARS MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 125 UK: AIRBORNE RADARS MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 126 ITALY: AIRBORNE RADARS MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 127 ITALY: AIRBORNE RADARS MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 128 ITALY: AIRBORNE RADARS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 129 ITALY: AIRBORNE RADARS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 130 ITALY: AIRBORNE RADARS MARKET, BY INSTALLATION TYPE, 2019–2022 (USD MILLION)

- TABLE 131 ITALY: AIRBORNE RADARS MARKET, BY INSTALLATION TYPE, 2023–2028 (USD MILLION)

- TABLE 132 ITALY: AIRBORNE RADARS MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 133 ITALY: AIRBORNE RADAR MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 134 FRANCE: AIRBORNE RADARS MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 135 FRANCE: AIRBORNE RADARS MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 136 FRANCE: AIRBORNE RADARS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 137 FRANCE: AIRBORNE RADARS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 138 FRANCE: AIRBORNE RADARS MARKET, BY INSTALLATION TYPE, 2019–2022 (USD MILLION)

- TABLE 139 FRANCE: AIRBORNE RADARS MARKET, BY INSTALLATION TYPE, 2023–2028 (USD MILLION)

- TABLE 140 FRANCE: AIRBORNE RADARS MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 141 FRANCE: AIRBORNE RADARS MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 142 REST OF EUROPE: AIRBORNE RADARS MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 143 REST OF EUROPE: AIRBORNE RADARS MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 144 REST OF EUROPE: AIRBORNE RADARS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 145 REST OF EUROPE: AIRBORNE RADARS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 146 REST OF EUROPE: AIRBORNE RADARS MARKET, BY INSTALLATION TYPE, 2019–2022 (USD MILLION)

- TABLE 147 REST OF EUROPE: AIRBORNE RADARS MARKET, BY INSTALLATION TYPE, 2023–2028 (USD MILLION)

- TABLE 148 REST OF EUROPE: AIRBORNE RADARS MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 149 REST OF EUROPE: AIRBORNE RADARS MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 150 ASIA PACIFIC: AIRBORNE RADARS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 151 ASIA PACIFIC: AIRBORNE RADARS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 152 ASIA PACIFIC: AIRBORNE RADARS MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 153 ASIA PACIFIC: AIRBORNE RADARS MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 154 ASIA PACIFIC: AIRBORNE RADARS MARKET, BY FREQUENCY BAND, 2019–2022 (USD MILLION)

- TABLE 155 ASIA PACIFIC: AIRBORNE RADARS MARKET, BY FREQUENCY BAND, 2023–2028 (USD MILLION)

- TABLE 156 ASIA PACIFIC: AIRBORNE RADARS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 157 ASIA PACIFIC: AIRBORNE RADARS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 158 ASIA PACIFIC: AIRBORNE RADARS MARKET, BY COMMERCIAL AND CIVIL APPLICATION, 2019–2022 (USD MILLION)

- TABLE 159 ASIA PACIFIC: AIRBORNE RADARS MARKET, BY COMMERCIAL AND CIVIL APPLICATION, 2023–2028 (USD MILLION)

- TABLE 160 ASIA PACIFIC: AIRBORNE RADARS MARKET, BY DEFENSE AND SECURITY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 161 ASIA PACIFIC: AIRBORNE RADARS MARKET, BY DEFENSE AND SECURITY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 162 ASIA PACIFIC: AIRBORNE RADARS MARKET, BY INSTALLATION TYPE, 2019–2022 (USD MILLION)

- TABLE 163 ASIA PACIFIC: AIRBORNE RADARS MARKET, BY INSTALLATION TYPE, 2023–2028 (USD MILLION)

- TABLE 164 ASIA PACIFIC: AIRBORNE RADARS MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 165 ASIA PACIFIC: AIRBORNE RADARS MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 166 CHINA: AIRBORNE RADARS MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 167 CHINA: AIRBORNE RADARS MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 168 CHINA: AIRBORNE RADARS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 169 CHINA: AIRBORNE RADARS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 170 CHINA: AIRBORNE RADARS MARKET, BY INSTALLATION TYPE, 2019–2022 (USD MILLION)

- TABLE 171 CHINA: AIRBORNE RADARS MARKET, BY INSTALLATION TYPE, 2023–2028 (USD MILLION)

- TABLE 172 CHINA: AIRBORNE RADARS MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 173 CHINA: AIRBORNE RADARS MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 174 INDIA: AIRBORNE RADARS MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 175 INDIA: AIRBORNE RADARS MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 176 INDIA: AIRBORNE RADARS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 177 INDIA: AIRBORNE RADARS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 178 INDIA: AIRBORNE RADARS MARKET, BY INSTALLATION TYPE, 2019–2022 (USD MILLION)

- TABLE 179 INDIA: AIRBORNE RADARS MARKET, BY INSTALLATION TYPE, 2023–2028 (USD MILLION)

- TABLE 180 INDIA: AIRBORNE RADARS MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 181 INDIA: AIRBORNE RADARS MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 182 JAPAN: AIRBORNE RADARS MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 183 JAPAN: AIRBORNE RADARS MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 184 JAPAN: AIRBORNE RADARS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 185 JAPAN: AIRBORNE RADARS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 186 JAPAN: AIRBORNE RADARS MARKET, BY INSTALLATION TYPE, 2019–2022 (USD MILLION)

- TABLE 187 JAPAN: AIRBORNE RADARS MARKET, BY INSTALLATION TYPE, 2023–2028 (USD MILLION)

- TABLE 188 JAPAN: AIRBORNE RADARS MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 189 JAPAN: AIRBORNE RADAR MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 190 SOUTH KOREA: AIRBORNE RADARS MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 191 SOUTH KOREA: AIRBORNE RADARS MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 192 SOUTH KOREA: AIRBORNE RADARS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 193 SOUTH KOREA: AIRBORNE RADARS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 194 SOUTH KOREA: AIRBORNE RADARS MARKET, BY INSTALLATION TYPE, 2019–2022 (USD MILLION)

- TABLE 195 SOUTH KOREA: AIRBORNE RADARS MARKET, BY INSTALLATION TYPE, 2023–2028 (USD MILLION)

- TABLE 196 SOUTH KOREA: AIRBORNE RADARS MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 197 SOUTH KOREA: AIRBORNE RADARS MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 198 AUSTRALIA: AIRBORNE RADARS MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 199 AUSTRALIA: AIRBORNE RADARS MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 200 AUSTRALIA: AIRBORNE RADARS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 201 AUSTRALIA: AIRBORNE RADARS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 202 AUSTRALIA: AIRBORNE RADARS MARKET, BY INSTALLATION TYPE, 2019–2022 (USD MILLION)

- TABLE 203 AUSTRALIA: AIRBORNE RADARS MARKET, BY INSTALLATION TYPE, 2023–2028 (USD MILLION)

- TABLE 204 AUSTRALIA: AIRBORNE RADARS MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 205 AUSTRALIA: AIRBORNE RADARS MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 206 REST OF ASIA PACIFIC: AIRBORNE RADARS MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 207 REST OF ASIA PACIFIC: AIRBORNE RADARS MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 208 REST OF ASIA PACIFIC: AIRBORNE RADARS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 209 REST OF ASIA PACIFIC: AIRBORNE RADARS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 210 REST OF ASIA PACIFIC: AIRBORNE RADARS MARKET, BY INSTALLATION TYPE, 2019–2022 (USD MILLION)

- TABLE 211 REST OF ASIA PACIFIC: AIRBORNE RADARS MARKET, BY INSTALLATION TYPE, 2023–2028 (USD MILLION)

- TABLE 212 REST OF ASIA PACIFIC: AIRBORNE RADARS MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 213 REST OF ASIA PACIFIC: AIRBORNE RADARS MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 214 LATIN AMERICA: AIRBORNE RADARS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 215 LATIN AMERICA: AIRBORNE RADARS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 216 LATIN AMERICA: AIRBORNE RADARS MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 217 LATIN AMERICA: AIRBORNE RADARS MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 218 LATIN AMERICA: AIRBORNE RADARS MARKET, BY FREQUENCY BAND, 2019–2022 (USD MILLION)

- TABLE 219 LATIN AMERICA: AIRBORNE RADARS MARKET, BY FREQUENCY BAND, 2023–2028 (USD MILLION)

- TABLE 220 LATIN AMERICA: AIRBORNE RADARS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 221 LATIN AMERICA: AIRBORNE RADARS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 222 LATIN AMERICA: AIRBORNE RADARS MARKET, BY COMMERCIAL AND CIVIL APPLICATION, 2019–2022 (USD MILLION)

- TABLE 223 LATIN AMERICA: AIRBORNE RADARS MARKET, BY COMMERCIAL AND CIVIL APPLICATION, 2023–2028 (USD MILLION)

- TABLE 224 LATIN AMERICA: AIRBORNE RADARS MARKET, BY DEFENSE AND SECURITY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 225 LATIN AMERICA: AIRBORNE RADARS MARKET, BY DEFENSE AND SECURITY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 226 LATIN AMERICA: AIRBORNE RADARS MARKET, BY INSTALLATION TYPE, 2019–2022 (USD MILLION)

- TABLE 227 LATIN AMERICA: AIRBORNE RADARS MARKET, BY INSTALLATION TYPE, 2023–2028 (USD MILLION)

- TABLE 228 LATIN AMERICA: AIRBORNE RADARS MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 229 LATIN AMERICA: AIRBORNE RADARS MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 230 BRAZIL: AIRBORNE RADARS MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 231 BRAZIL: AIRBORNE RADARS MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 232 BRAZIL: AIRBORNE RADARS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 233 BRAZIL: AIRBORNE RADARS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 234 BRAZIL: AIRBORNE RADARS MARKET, BY INSTALLATION TYPE, 2019–2022 (USD MILLION)

- TABLE 235 BRAZIL: AIRBORNE RADARS MARKET, BY INSTALLATION TYPE, 2023–2028 (USD MILLION)

- TABLE 236 BRAZIL: AIRBORNE RADARS MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 237 BRAZIL: AIRBORNE RADARS MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 238 MEXICO: AIRBORNE RADARS MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 239 MEXICO: AIRBORNE RADARS MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 240 MEXICO: AIRBORNE RADARS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 241 MEXICO: AIRBORNE RADARS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 242 MEXICO: AIRBORNE RADARS MARKET, BY INSTALLATION TYPE, 2019–2022 (USD MILLION)

- TABLE 243 MEXICO: AIRBORNE RADARS MARKET, BY INSTALLATION TYPE, 2023–2028 (USD MILLION)

- TABLE 244 MEXICO: AIRBORNE RADARS MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 245 MEXICO: AIRBORNE RADARS MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 246 MIDDLE EAST & AFRICA: AIRBORNE RADARS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 247 MIDDLE EAST & AFRICA: AIRBORNE RADARS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 248 MIDDLE EAST & AFRICA: AIRBORNE RADARS MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 249 MIDDLE EAST & AFRICA: AIRBORNE RADARS MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 250 MIDDLE EAST & AFRICA: AIRBORNE RADARS MARKET, BY FREQUENCY BAND, 2019–2022 (USD MILLION)

- TABLE 251 MIDDLE EAST & AFRICA: AIRBORNE RADARS MARKET, BY FREQUENCY BAND, 2023–2028 (USD MILLION)

- TABLE 252 MIDDLE EAST & AFRICA: AIRBORNE RADARS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 253 MIDDLE EAST & AFRICA: AIRBORNE RADARS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 254 MIDDLE EAST & AFRICA: AIRBORNE RADARS MARKET, BY COMMERCIAL AND CIVIL APPLICATIONS, 2019–2022 (USD MILLION)

- TABLE 255 MIDDLE EAST & AFRICA: AIRBORNE RADARS MARKET, BY COMMERCIAL AND CIVIL APPLICATIONS, 2023–2028 (USD MILLION)

- TABLE 256 MIDDLE EAST & AFRICA: AIRBORNE RADARS MARKET, BY DEFENSE AND SECURITY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 257 MIDDLE EAST & AFRICA: AIRBORNE RADARS MARKET, BY DEFENSE AND SECURITY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 258 MIDDLE EAST & AFRICA: AIRBORNE RADARS MARKET, BY INSTALLATION TYPE, 2019–2022 (USD MILLION)

- TABLE 259 MIDDLE EAST & AFRICA: AIRBORNE RADARS MARKET, BY INSTALLATION TYPE, 2023–2028 (USD MILLION)

- TABLE 260 MIDDLE EAST & AFRICA: AIRBORNE RADARS MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 261 MIDDLE EAST & AFRICA: AIRBORNE RADARS MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 262 TURKEY: AIRBORNE RADARS MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 263 TURKEY: AIRBORNE RADARS MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 264 TURKEY: AIRBORNE RADARS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 265 TURKEY: AIRBORNE RADARS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 266 TURKEY: AIRBORNE RADARS MARKET, BY INSTALLATION TYPE, 2019–2022 (USD MILLION)

- TABLE 267 TURKEY: AIRBORNE RADARS MARKET, BY INSTALLATION TYPE, 2023–2028 (USD MILLION)

- TABLE 268 TURKEY: AIRBORNE RADARS MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 269 TURKEY: AIRBORNE RADARS MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 270 SAUDI ARABIA: AIRBORNE RADARS MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 271 SAUDI ARABIA: AIRBORNE RADARS MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 272 SAUDI ARABIA: AIRBORNE RADARS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 273 SAUDI ARABIA: AIRBORNE RADARS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 274 SAUDI ARABIA: AIRBORNE RADARS MARKET, BY INSTALLATION TYPE, 2019–2022 (USD MILLION)

- TABLE 275 SAUDI ARABIA: AIRBORNE RADARS MARKET, BY INSTALLATION TYPE, 2023–2028 (USD MILLION)

- TABLE 276 SAUDI ARABIA: AIRBORNE RADARS MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 277 SAUDI ARABIA: AIRBORNE RADARS MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 278 ISRAEL: AIRBORNE RADARS MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 279 ISRAEL: AIRBORNE RADARS MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 280 ISRAEL: AIRBORNE RADARS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 281 ISRAEL: AIRBORNE RADARS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 282 ISRAEL: AIRBORNE RADARS MARKET, BY INSTALLATION TYPE, 2019–2022 (USD MILLION)

- TABLE 283 ISRAEL: AIRBORNE RADARS MARKET, BY INSTALLATION TYPE, 2023–2028 (USD MILLION)

- TABLE 284 ISRAEL: AIRBORNE RADARS MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 285 ISRAEL: AIRBORNE RADARS MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 286 SOUTH AFRICA: AIRBORNE RADARS MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 287 SOUTH AFRICA: AIRBORNE RADARS MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 288 SOUTH AFRICA: AIRBORNE RADARS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 289 SOUTH AFRICA: AIRBORNE RADARS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 290 SOUTH AFRICA: AIRBORNE RADARS MARKET, BY INSTALLATION TYPE, 2019–2022 (USD MILLION)

- TABLE 291 SOUTH AFRICA: AIRBORNE RADARS MARKET, BY INSTALLATION TYPE, 2023–2028 (USD MILLION)

- TABLE 292 SOUTH AFRICA: AIRBORNE RADARS MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 293 SOUTH AFRICA: AIRBORNE RADARS MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 294 STRATEGIES ADOPTED BY KEY PLAYERS IN AIRBORNE RADARS MARKET, 2022–2023

- TABLE 295 AIRBORNE RADARS MARKET: DEGREE OF COMPETITION

- TABLE 296 COMPANY FOOTPRINT

- TABLE 297 SEGMENT FOOTPRINT

- TABLE 298 AIRBORNE RADARS MARKET: KEY STARTUPS/SMES

- TABLE 299 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 300 AIRBORNE RADARS MARKET: DEALS, 2020–2023

- TABLE 301 AIRBORNE RADARS MARKET: EXPANSIONS, 2020–2023

- TABLE 302 RAYTHEON TECHNOLOGIES CORPORATION: COMPANY OVERVIEW

- TABLE 303 RAYTHEON TECHNOLOGIES CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 304 RAYTHEON TECHNOLOGIES CORPORATION: DEALS

- TABLE 305 LOCKHEED MARTIN CORPORATION: COMPANY OVERVIEW

- TABLE 306 LOCKHEED MARTIN CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 307 LOCKHEED MARTIN CORPORATION: DEALS

- TABLE 308 LEONARDO SPA: COMPANY OVERVIEW

- TABLE 309 LEONARDO SPA: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 310 LEONARDO SPA: DEALS

- TABLE 311 NORTHROP GRUMMAN CORPORATION: COMPANY OVERVIEW

- TABLE 312 NORTHROP GRUMMAN CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 313 NORTHROP GRUMMAN CORPORATION: DEALS

- TABLE 314 THALES GROUP: COMPANY OVERVIEW

- TABLE 315 THALES GROUP: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 316 SAAB AB: COMPANY OVERVIEW

- TABLE 317 SAAB AB: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 318 SAAB AB: DEALS

- TABLE 319 BAE SYSTEMS PLC: COMPANY OVERVIEW

- TABLE 320 BAE SYSTEMS PLC: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 321 BAE SYSTEMS PLC: DEALS

- TABLE 322 THE BOEING COMPANY: COMPANY OVERVIEW

- TABLE 323 THE BOEING COMPANY: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 324 THE BOEING COMPANY: DEALS

- TABLE 325 ISRAEL AEROSPACE INDUSTRIES LTD.: COMPANY OVERVIEW

- TABLE 326 ISRAEL AEROSPACE INDUSTRIES LTD.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 327 ISRAEL AEROSPACE INDUSTRIES LTD.: DEALS

- TABLE 328 ASELSAN AS: COMPANY OVERVIEW

- TABLE 329 ASELSAN AS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 330 ASELSAN AS: DEALS

- TABLE 331 SRC, INC.: COMPANY OVERVIEW

- TABLE 332 SRC, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 333 SRC, INC.: OTHERS

- TABLE 334 HENSOLDT AG: COMPANY OVERVIEW

- TABLE 335 HENSOLDT AG: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 336 HENSOLDT AG: DEALS

- TABLE 337 ELBIT SYSTEMS LTD.: COMPANY OVERVIEW

- TABLE 338 ELBIT SYSTEMS LTD.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 339 ELBIT SYSTEMS LTD.: DEALS

- TABLE 340 INDRA SISTEMAS, SA: COMPANY OVERVIEW

- TABLE 341 INDRA SISTEMAS, SA: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 342 INDRA SISTEMAS, SA: DEALS

- TABLE 343 HONEYWELL INTERNATIONAL INC.: COMPANY OVERVIEW

- TABLE 344 HONEYWELL INTERNATIONAL INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 345 HONEYWELL INTERNATIONAL INC.: DEALS

- TABLE 346 L3HARRIS TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 347 L3HARRIS TECHNOLOGIES, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 348 L3HARRIS TECHNOLOGIES, INC: DEALS

- TABLE 349 TELEPHONICS CORPORATION: COMPANY OVERVIEW

- TABLE 350 TELEPHONICS CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 351 MITSUBISHI ELECTRIC CORPORATION: COMPANY OVERVIEW

- TABLE 352 MITSUBISHI ELECTRIC CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 353 MITSUBISHI ELECTRIC CORPORATION: DEALS

- TABLE 354 AIRBUS SE: COMPANY OVERVIEW

- TABLE 355 AIRBUS SE: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 356 AIRBUS SE: DEALS

- TABLE 357 AINSTEIN RADAR SYSTEMS: COMPANY OVERVIEW

- TABLE 358 AINSTEIN RADAR SYSTEMS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 359 OPTIMARE SYSTEMS GMBH: COMPANY OVERVIEW

- TABLE 360 OPTIMARE SYSTEMS GMBH: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 361 OPTIMARE SYSTEMS GMBH: DEALS

- TABLE 362 JSC RADAR MMS: COMPANY OVERVIEW

- TABLE 363 JSC RADAR MMS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 364 GARMIN LIMITED: COMPANY OVERVIEW

- TABLE 365 GARMIN LIMITED: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- FIGURE 1 AIRBORNE RADARS MARKET SEGMENTATION

- FIGURE 2 REPORT PROCESS FLOW

- FIGURE 3 AIRBORNE RADARS MARKET: RESEARCH DESIGN

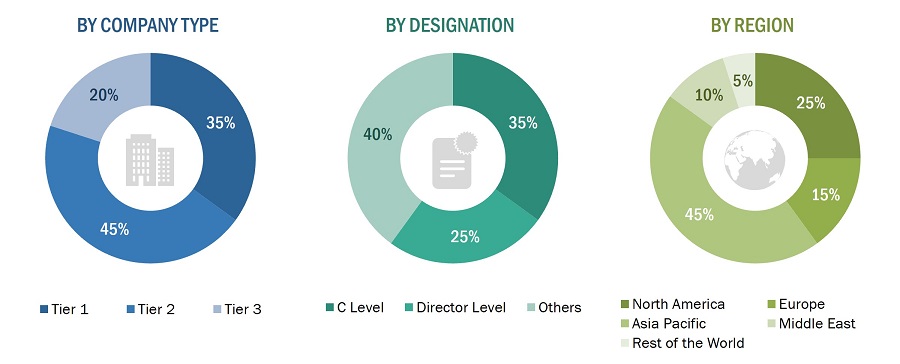

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 7 AIRBORNE RADARS MARKET: DATA TRIANGULATION

- FIGURE 8 DIGITAL SIGNAL PROCESSORS SEGMENT TO LEAD MARKET FROM 2023 TO 2028

- FIGURE 9 DEFENSE AND SECURITY SEGMENT TO DOMINATE AIRBORNE RADARS MARKET DURING FORECAST PERIOD

- FIGURE 10 3D SEGMENT TO GROW AT FASTEST RATE DURING FORECAST PERIOD

- FIGURE 11 KU-BAND TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 12 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 13 DEMAND FOR PHASED ARRAY RADARS FOR ENHANCED OPERATIONAL EFFICIENCY TO DRIVE MARKET

- FIGURE 14 NEW INSTALLATION TO HOLD LARGEST SHARE DURING FORECAST PERIOD

- FIGURE 15 VERY LONG-RANGE SEGMENT TO HAVE HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 16 FREQUENCY MODULATED CONTINUOUS WAVE (FMCW) SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 17 SOUTH KOREAN MARKET TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 18 AIRBORNE RADARS MARKET DYNAMICS

- FIGURE 19 VALUE CHAIN ANALYSIS

- FIGURE 20 ECOSYSTEM MAPPING

- FIGURE 21 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 22 PORTER’S FIVE FORCES ANALYSIS

- FIGURE 23 INFLUENCE OF STAKEHOLDERS ON BUYING AIRBORNE RADARS, BY APPLICATION

- FIGURE 24 KEY BUYING CRITERIA FOR AIRBORNE RADARS, BY APPLICATION

- FIGURE 25 SUPPLY CHAIN ANALYSIS

- FIGURE 26 TOP 10 PATENT APPLICANTS

- FIGURE 27 DEVELOPMENT POTENTIAL OF AIRBORNE RADARS MARKET FROM 2000 TO 2030

- FIGURE 28 DIGITAL SIGNAL PROCESSORS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 29 UAM SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 30 DEFENSE AND SECURITY SEGMENT TO DOMINATE DURING FORECAST PERIOD

- FIGURE 31 FREQUENCY MODULATED CONTINUOUS WAVE (FMCW) SEGMENT TO GROW FASTEST DURING FORECAST PERIOD

- FIGURE 32 SOFTWARE-DEFINED RADARS TO LEAD MARKET FROM 2023 TO 2028

- FIGURE 33 KA-BAND SEGMENT TO PROGRESS AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 34 VERY LONG-RANGE SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 35 3D SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 36 NEW INSTALLATION OF AIRBORNE RADARS TO COMMAND LARGEST SHARE DURING FORECAST PERIOD

- FIGURE 37 ASIA PACIFIC MARKET TO ACCOUNT FOR HIGHEST GROWTH FROM 2023 TO 2028

- FIGURE 38 NORTH AMERICA: AIRBORNE RADARS MARKET SNAPSHOT

- FIGURE 39 EUROPE: AIRBORNE RADARS MARKET SNAPSHOT

- FIGURE 40 ASIA PACIFIC: AIRBORNE RADARS MARKET SNAPSHOT

- FIGURE 41 LATIN AMERICA: AIRBORNE RADARS MARKET SNAPSHOT

- FIGURE 42 MIDDLE EAST & AFRICA: AIRBORNE RADARS MARKET SNAPSHOT

- FIGURE 43 MARKET RANKING OF KEY PLAYERS, 2022

- FIGURE 44 REVENUE ANALYSIS OF KEY PLAYERS, 2022

- FIGURE 45 MARKET SHARE OF KEY PLAYERS, 2022

- FIGURE 46 COMPANY EVALUATION MATRIX, 2022

- FIGURE 47 STARTUP/SME EVALUATION MATRIX, 2022

- FIGURE 48 RAYTHEON TECHNOLOGIES CORPORATION: COMPANY SNAPSHOT

- FIGURE 49 LOCKHEED MARTIN CORPORATION: COMPANY SNAPSHOT

- FIGURE 50 LEONARDO SPA: COMPANY SNAPSHOT

- FIGURE 51 NORTHROP GRUMMAN CORPORATION: COMPANY SNAPSHOT

- FIGURE 52 THALES GROUP: COMPANY SNAPSHOT

- FIGURE 53 SAAB AB: COMPANY SNAPSHOT

- FIGURE 54 BAE SYSTEMS PLC: COMPANY SNAPSHOT

- FIGURE 55 THE BOEING COMPANY: COMPANY SNAPSHOT

- FIGURE 56 ISRAEL AEROSPACE INDUSTRIES LTD.: COMPANY SNAPSHOT

- FIGURE 57 ELBIT SYSTEMS LTD.: COMPANY SNAPSHOT

- FIGURE 58 INDRA SISTEMAS, SA: COMPANY SNAPSHOT

- FIGURE 59 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

- FIGURE 60 L3HARRIS TECHNOLOGIES, INC.: COMPANY SNAPSHOT

- FIGURE 61 MITSUBISHI ELECTRIC CORPORATION: COMPANY SNAPSHOT

- FIGURE 62 AIRBUS SE: COMPANY SNAPSHOT

- FIGURE 63 GARMIN LIMITED: COMPANY SNAPSHOT

This research study used secondary sources, directories, and databases like D&B Hoovers, Bloomberg Businessweek, and Factiva to identify and collect information relevant to the airborne radars market. Primary sources included industry experts from the core and related industries, preferred suppliers, manufacturers, solution providers, technology developers, alliances, and organizations related to all the segments of this industry’s value chain. All primary sources were interviewed to obtain and verify critical qualitative and quantitative information and assess prospects for the market's growth during the forecast period.

Secondary Research:

The market share of companies was determined based on secondary data made available through paid and unpaid sources, as well as the analysis of product portfolios of major companies, which were rated based on performance and quality. Primary sources further validated these data points.

Secondary sources referred to for this research study included the financial statements of companies offering airborne radar and information from various trade, business, and professional associations, among others. This secondary data was collected and analyzed to arrive at the overall size of the airborne radars market, which was validated by primary respondents.

Primary Research:

Extensive primary research was conducted after obtaining information regarding the airborne radars market scenario through secondary research. Several primary interviews were conducted with market experts from the demand and supply sides across major countries of North America, Europe, Asia Pacific, Middle East, and Latin America. This primary data was collected through questionnaires, e-mails, and telephonic interviews.

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, such as vice presidents, directors, regional managers, technology providers, product development teams, distributors, and end users.

Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products & services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the trends related to component, by waveform, by platform, by application, by dimension, by range, by frequency band, by installation type, by technology, and region. Stakeholders from the demand side, such as CXOs, production managers, engineers, and installation teams of end users of airborne radars, were interviewed to understand the buyer’s perspective on the suppliers, products, service providers, and their current usage and future outlook of their business, which could affect the airborne radars market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The sizing of the market was carried out from the demand side. The market was upsized based on the procurement and modernization of commercial as well as defense airborne platforms. These included commercial aircraft, military aircraft, business jets, helicopters, UAVs, UAM, and aerostats at a regional level. Procurements provide information about the demand for airborne radar in each platform. All possible application areas where airborne radars are integrated or installed were mapped for each platform. The average selling price of airborne radar in each platform was calculated, with the combination of volume and average selling price leading to the global market size.

The key players in the airborne radar market were identified through secondary research, and their market shares were determined through primary and secondary research. This included a study of the annual and financial reports of the top market players and extensive interviews with leaders such as directors, engineers, marketing executives, and other stakeholders of leading companies operating in the airborne radar market.

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data on the airborne radars market. This data was consolidated, enhanced with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

Market size estimation methodology: Bottom-up Approach

Market size estimation methodology: Top-Down Approach

Market Definition

Airborne radar can be installed upon any airborne platform: business jets, fighter aircraft, unmanned aerial vehicles (UAVs), or helicopters, and can be used for commercial as well as military applications. According to the National Defense Industrial Association (US), airborne radar can be classified into three major categories: air-target surveillance and cueing radars mounted in rotodomes, nose-mounted fighter radars, and side-looking radars for ground reconnaissance and surveillance. Side-looking radars constitute the smallest sector of the airborne radar industry, which is primarily dominated by synthetic aperture radar (SAR) and ground-moving target indicator (GMTI) sensors.

Key Stakeholders

- Armed Forces

- Airborne Radar Manufacturers

- Component Manufacturers

- Distributors and Suppliers

- Research Organizations, Forums, Alliances, and Associations

- Ministries of Defense

- Original Equipment Manufacturers (OEMs)

- Regulatory Bodies

- R&D Companies

- Aerospace and Defense Industries

- Airborne Radar System Integrators

- Airborne Radar Support Providers

- Software/Hardware/Service and Solution Providers

Objectives of the Study

- To define, describe, segment, and forecast the size of the airborne radars market based on component, waveform, platform, application, dimension, range, frequency band, installation type, technology, and region.

- To analyze the degree of competition in the market by mapping the recent developments, products, and services of key market players

- To understand the structure of the airborne radars market by identifying its various segments and subsegments

- To identify and analyze key drivers, restraints, opportunities, and challenges that influence the growth of the market.

- To provide an overview of the tariff and regulatory landscape for the adoption of airborne radars across regions

- To forecast the size of market segments across North America, Europe, Asia Pacific, Middle East & Africa, and Latin America, and Rest of the World along with major countries in each region

- To identify transportation industry trends, market trends, and technology trends currently prevailing in the market

- To analyze micromarkets with respect to individual technological trends and their contribution to the total market

- To analyze opportunities in the market for stakeholders by identifying key market trends

- To profile key market players and comprehensively analyze their market share and core competencies.

- To provide a detailed competitive landscape of the market, along with an analysis of business and strategies such as mergers & acquisitions, partnerships, agreements, and product developments in the airborne radars market

- To identify detailed financial positions, key products, and unique selling points of leading companies in the market

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of the airborne radars market

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the airborne radars aircraft market.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Airborne Radars Market