Air-to-Air Refueling Market Size, Share, Trends & Growth Analysis by System (Probe & Drogue, Boom Refueling, Autonomous), Component (Pumps, Valves, Hoses, Boom, Probes, Fuel Tanks, Pods), Aircraft Type (Fixed, Rotary), Type (Manned, Unmanned), End User and Region - Global Forecast to 2027

Updated on : Jul 16, 2025

Air-to-Air Refueling Market Size & Share

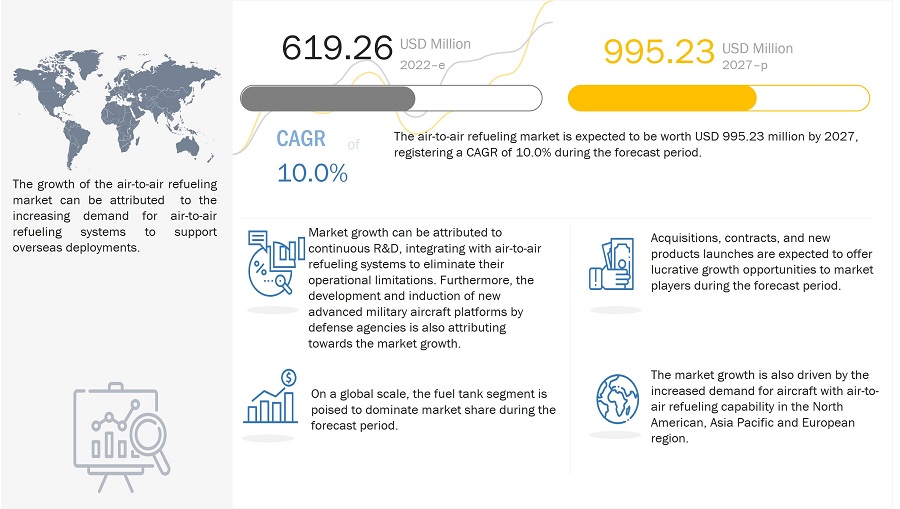

The air-to-air refueling market is projected to grow from USD 619.26 Million in 2022 to USD 995.23 Million by 2027 registering a CAGR of 10.0% during the forecast period. The aviation refueling market complements this growth trend by addressing the need for versatile, multi-role refueling systems that can support longer flight durations and strategic missions. Air-to-air refueling is primarily use by the defense forces to transfer fuel from one aircraft to the other, most generally from a tanker to any other recipient aircraft, while both the aircraft are in flight. Air-to-air air refueling is vital in to enhance the endurance of the receiver aircraft and is critical to the success of long-range missions as the aircraft are not required to land for refueling, saving essential time and effort. The increasing instances of overseas deployment of military aircraft has been one of the main reasons for the rising demand for air-to-air refueling technologies and has encouraged the adoption of aircraft equipped with such capability, both from the donor and recipient point of view. Both the air-to-air and aviation refueling markets are expected to continue their upward trajectory, driven by technological innovation and rising demands for refueling infrastructure across global defense and aviation sectors.

Air-to-Air Refueling Market Forecast to 2027

To know about the assumptions considered for the study, Request for Free Sample Report

Air-to-Air Refueling Market Trends:

Driver: Increasing demand for air-to-air refueling systems to support overseas deployments

There has been an increase of air sorties flown for long distances away from carriers or ground bases, making refueling a necessary mission element. For instance, Asia Pacific is witnessing an increase in military bases being developed by foreign countries in the region. The US Department of Defense (DoD) anticipates China to establish additional military bases around the world because of its investments in the One Belt, One Road initiative, that was initiated in 2013. Currently, Beijing has one overseas military base in Djibouti but is expected to add more military bases in the coming years. India has also established itself as a strong military power, with its armed forces articulating the need to operate beyond the country’s immediate borders. In 2018, the country secured access to naval facilities in the Middle East, near the Strait of Hormuz. In the same year, India and Seychelles signed an agreement, valid for 20 years, to build an airstrip and a naval jetty on Assumption Island. Russia also plans to establish a long-term military presence in Latin America and the Middle East. In 2017, the country signed a long-term agreement to increase its military presence in Syria as well as secure rights to its airbase. This agreement enables Russia to deploy forces in Syria for the next 50 years. Thus, the demand for air-to-air refueling is expected to grow during the forecast period, as there is a need for air-to-air refueling to support the overseas deployment of military aircraft.

Restraint: Vulnerability against ground-based attacks

Large tanker aircraft, which serve as the source of fuel for air-to-air refueling operations, lack maneuverability and hence can be easily targeted by ground-based air defense systems. Though these aircraft are equipped with certain countermeasures such as flares, the large size of such aircraft render them susceptible to enemy fire, especially to ballistic missiles which can change its orientation and course according to its target. Furthermore, tanker aircraft are very heavy and slow moving as compared to the recipient aircraft, hence they may be vulnerable to enemy fire during an air-to-air refueling procedure, as both the donor and the recipient aircraft are required to maintain a certain speed and heading for the system to attach and transfer fuel. Such vulnerabilities restrict the use of such resources in highly contested spaces.

Opportunity: Development of autonomous refueling systems

The goal of autonomous refueling is to integrate manned and unmanned operations seamlessly. Hence, Automated Air-to-Air Refueling (A3R) will be designed to utilize the existing standardized voice command and control (C2) messages and procedures that are translated into data link messages that the UAV’s computer can process. According to the US Joint Air Power Competence Centre (JAPCC), A3R procedures will be developed to accommodate current manned AAR standards and procedures. In the case of UAVs, they can safely maintain flight and execute a maneuver by selecting a pre-defined action without supervision. In manned aircraft, capabilities to perform automated refueling are included, wherein the engagement process is expected to be an automated task, and the pilot would only monitor (safety observer). Currently, A3R is at its conceptual stage and various developments are carried out to introduce it in the market. However, for A3R to become a reality, more sophisticated control systems must be developed, including relative positioning systems, data link systems, and remote aerial vehicle operators.

Challenge: High installation and maintenance cost

Though air-to-air refueling is a technology aspired by several countries, the associated high cost oof installation and maintenance of a Multipoint Refueling System (MPRS) restricts its widespread adoption. Currently, a MPRS costs around USD 5 to 7 million per aircraft and accounts for around 5,000 to 7,000 labor hours. The average life of an air-to-air refueling tanker is 40-60 years, along with periodic maintenance and sizeable investment to maintain the tanker throughout its life. Further, when this tanker starts aging, the possibility of corrosion and material degradation sets in, thus increasing its maintenance costs. For instance, the US DoD decided to retire a part of its fleet of KC-135 aircraft due to increasing material degradation and maintenance costs. Technical expertise is also required to use and maintain the proper functioning of aerial refueling systems and ensure effective integration of system components. Highly skilled personnel are required to perform aerial refueling operations. An air-to-air refueling aircraft also requires extensive training to operate and comes with one of the most difficult flight maneuvers for a pilot. For instance, the tanker and receiver aircraft should be 35 feet apart during boom refueling and about 80 feet apart in hose and drogue refueling. The airflow around the tanker and the receiver aircraft is complex and makes maneuvering of the aircraft a challenge.

Air-to-Air Refueling Market Segmentation

Based on component, the fuel tank segment dominated market share throughout the forecast period

Based on component, the air-to-air refueling market is segmented into pumps, valves, nozzles, hoses, boom, probes, pods, fuel tanks, and others. The growth of the fuel-tank segment of the market can be attributed to the enhanced investment towards the procurement of tanker aircraft that are designed to supply fuel to receiver aircraft platforms by several nations across the globe, including the US, UK, France, etc.

Based on system, the boom refueling segment is projected to witness fastest growth by 2027

Based on system, the air-to-air refueling market is segmented into probe & drogue, boom refueling, and autonomous. The boom refueling segment is projected to lead market share as most current generation tanker aircraft use boom refueling systems for transferring fuel to receiver aircraft. Since the boom is rigid, it is capable of a higher transfer rate as compared to probe and drogue, thereby favoring its integration in most leading tanker aircraft models.

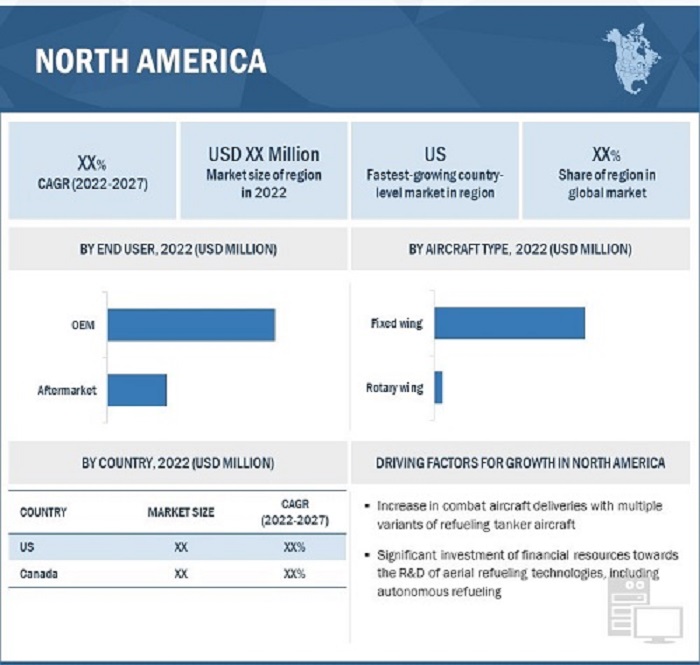

Based on aircraft type, the fixed wing segment held the leading market share in 2022

Based on aircraft type, the air-to-air refueling market is segmented into fixed wing and rotary wing. The higher induction of fixed wing aircraft, including combat and specal mission aircraft, is anticipated to drive the fixed wing segment of the market. The development of new extended range variant of such aircraft with air-to-air refueling capability greatly enhances the strike capabilities of nations, therby driving their procurement.

Based on type, the manned segment held the leading market share in 2022

Based on type, the air-to-air refueling market is segmented into manned and unmanned aircraft. Though there is rapid induction of UAVs for a plethora of missions, they do not possess the necessary capability for air-to-air refueling due to size, weight, and power (SWaP) constraints which hampers their payload capacity. Thus, the manned aircraft segment is expected to dominate market share during the forecast period.

Based on end user, the linefit segment accounts for the largest market size during the forecast period

Based on end user, the air-to-air refueling market is segmented into OEM and aftermarket. The OEM segment is forecasted to dominate market share as new models of most military aircraft are being made available with air-to-air refueling capability as a standard fitment. However, there is also scope for modernizing older aircraft with such capabilities using aftermarket kits, however the feasibility of such an upgrade is limited.

Air-to-Air Refueling Market Regional Analysis

The North America region is projected to dominate market share during the forecast period

North America is one of the leading markets for air-to-air refueling systems in terms of R&D, deployment, and the presence of key market players. The military aviation sector in North America is growing steadily, consequently created a significant demand for air-to-air refueling systems. The presence of major players, OEMs, and component manufacturers are one of the key factors expected to boost the air-to-air refueling industry in North America. An increasing number of military aircraft upgrade programs, ongoing R&D of advanced military aircraft platforms, and the presence of major systems and components manufacturers are expected to lead to a surge in demand for air-to-air refueling systems in the region during the forecast period.

Air-to-Air Refueling Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Top Air-to-Air Refueling Companies - Key Market Players

Some of the major players in the air-to-air refueling market are Cobham Limited (UK), Eaton Corporation (US), Airbus SE (Netherlands), The Boeing Company (US), and GE Aviation (US) among others. These players have adopted various growth strategies such as contracts, joint ventures, partnerships & agreements, acquisitions, and new product launches to further expand their presence in the air-to-air refueling market.

Cobham Limited is the leading player in the air-to-air refueling market. The company focuses on the expansion of its existing activities through acquisitions and contracts. For instance, it acquired the Cropmead facility of the British aerospace and defense company Tods Aerospace in May 2020 to strengthen its core aerospace and defense business. Cobham is also focused on the development of air-to-air refueling systems. In December 2020, Cobham confirmed its underwing mounted refueling buddy store was carried for the first time during a successful test flight of Boeing’s MQ-25 test asset, known as T1.

Eaton Corporation is ranked second in the aviation refueling market. The company has extended its capabilities by gaining various long-term contracts from its customers. The company aims at entering new contracts and other collaborations, agreements, and acquisitions with leading market players worldwide. For instance, in February 2021, it announced the signing of an agreement to acquire Cobham Mission Systems, a leading manufacturer of air-to-air refueling systems, environmental systems, and actuation primarily for defense markets.

Airbus SE is another major player in the air-to-air refueling market. It focuses on new product developments to enhance its customer base across the globe. In April 2020, Airbus achieved the first-ever fully A3R operation with a boom system. The flight test campaign, conducted earlier in the year over the Atlantic Ocean, involved an Airbus tanker test aircraft equipped with the Airbus A3R solution, with an F-16 fighter aircraft of the Portuguese Air Force acting as a receiver. The company has a significant presence in the aviation refueling market, especially in the North American and European regions.

The Boeing Company provides aerial refueling tankers through its Defence, Space & Security segment. Boeing managed to be one of the leaders in the air-to-air refueling market by focusing on new product developments and receiving various contracts. In December 2020, Boeing and the US Navy flew the MQ-25 T1 test asset with an aerial refueling store (ARS), which marked a significant milestone in the development of the unmanned aerial refueling tanker. In April 2019, Boeing received a new USD 5.7 billion contract from the US DoD for post-production work on K-46 Pegasus tanker aircraft to prepare the US Air Force’s aircraft refueling fleet for combat. The contract will remain operational till April 2029.

GE Aviation is focused on enhancing its competitive position by driving infrastructure leadership and investing in research & developmental activities to further improve the operational and functional efficiency of its air-to-air refueling systems. The company is a leader in the design, development, and manufacturing of advanced refueling probes for fighter and transport aircraft. The company’s success in the commercial aviation industry depends on its ability to develop and market innovative products and services.

Air-to-Air Refueling Market Report Scope

|

Report Metric |

Details |

|

Estimated Market Size in 2022 |

USD 619.26 Million |

|

Projected Market Size by 2027 |

USD 995.23 Million |

|

Growth Rate (CAGR) |

11.2% |

|

Forecast period |

2022-2027 |

|

Market size available for years |

2016-2027 |

|

Base year considered |

2019 |

|

Forecast units |

Value (USD) |

|

Segments covered |

By component, system,aircraft type,type and end user. |

|

Geographies covered |

North America, Asia Pacific, Europe, and the Rest of the World (the Middle East, Latin America, and Africa). |

|

Companies covered |

Cobham plc (UK), Eaton Corporation (US), Airbus (Netherlands), Boeing (US), and GE Aviation (US), among others. |

This research report categorizes the Air-to-Air Refueling Market based on industry, forecasting type, purpose, organization size, and region.

Air-to-Air Refueling Market, By Component

- Pumps

- Valves

- Nozzles

- Hoses

- Boom

- Probes

- Fuel tanks

- Pods

- Others

Air-to-Air Refueling Market, By Systm

- Probe & Drogue

- Boom Refueling

- Autonomous

Air-to-Air Refueling Market, By Aircraft type

- Fixed Wing

- Rotary Wing

Air-to-Air Refueling Market, By Type

- Manned

- Unmanned

Air-to-Air Refueling Market, By End User

- OEM

- Aftermarket

Air-to-Air Refueling Market, By Region

- North America

- Europe

- Asia Pacific

- Middle East

- Latin America

- Africa

Air-To-Air Refueling Market Highlights:

What is new?

- Major developments that can change the business landscape as well as market forecasts.

The aerospace and defense (A&D) industry has witnessed numerous technological advancements over the years in terms of platform diversification and enhanced operational capabilities. Substantial investments have been made in the R&D and upgrades of several aircraft platforms. Continuous R&D in the field of air-to-air refueling have enhanced the design of aerial platforms over the years while also leading to significant changes in their size, endurance, power, and propulsion systems.

-

Emerging Technology Trends

- Virtual air refueling

- Autonomous refueling

- Remote Vision System

- Buddy Refueling Pods

- Coverage of new market players and change in the market share of existing players of the air-to-air refueling market.

Company profiles: Company profiles give a glimpse of the key players in the market with respect to their business overviews, financials, product offerings, recent developments undertaken by them, and MnM view. In the new edition of the report, we have total 25 players (15 major, 10 Startups/SME). Moreover, the share of companies operating in the air-to-air refueling market and start-up matrix have also been provided in the report.

- Updated financial information and product portfolios of players operating in the air-to-air refueling market.

Newer and improved representation of financial information: The new edition of the report provides updated financial information in the context of the air-to-air refueling market till 2021/2022 for each listed company in the graphical representation in a single diagram (instead of multiple tables). This would help to easily analyze the present status of profiled companies in terms of their financial strength, profitability, key revenue-generating region/country, business segment focus in terms of the highest revenue-generating segment and investment on research and development activities.

- Updated market developments of the profiled players.

Recent Developments: Updated market developments such as contracts, joint ventures, partnerships & agreements, acquisitions, new service launches, new product launches, investments, funding, and certification have been mapped for the years 2019 to 2022.

- Any new data points/analysis (frameworks) which was not present in the previous version of the report

- Competitive benchmarking of start-ups /SME which covers details about employees, financial status, latest funding round and total funding.

- Inclusion of impact of megatrends on the air-to-air refueling market that includes a shift in global climate change, rapid urbanization, greater customization, and disruptive technologies

- Technology analysis and case studies are added in this edition of the report to give the technological perspective and the significance of the advancements in the air-to-air refueling market

- Inclusion of patent registrations to have an overview of R&D activities in the air-to-air refueling market.

- The start-up evaluation matrix is added in this edition of the report, covering air-to-air refueling start-ups focused on serving the commercial and defense naval sectors.

The new edition of the report consists of trends/disruptions on customer’s business, tariff & regulatory landscape, pricing analysis, and a market ecosystem map to enable a better understanding of the market dynamics for air-to-air refueling market.

Recent Developments

- In February 2021, Eaton Corporation announced the signing of an agreement to acquire Cobham Mission Systems, a subsidiary of Cobham plc. Under the terms of the agreement, Eaton will pay USD 2.83 billion for CMS, inclusive of USD 130 million in tax benefits.

- In December 2020, The Boeing Company and the US Navy flew the MQ-25 T1 test asset with an aerial refueling store (ARS) for the first time achieving a significant milestone in the development of the unmanned aerial refueling tanker.

- In April 2020, Airbus SE achieved the first-ever fully A3R operation with a boom system. The flight test campaign, conducted earlier in the year over the Atlantic Ocean, involved an Airbus tanker test aircraft equipped with the Airbus A3R solution, with an F-16 fighter aircraft of the Portuguese Air Force acting as a receiver.

Key Benefits of the Report/Reason to Buy:

Target Audience:

Frequently Asked Questions (FAQs):

What is the current size of the air-to-air refueling market?

The air-to-air refueling market is projected to grow from USD 619.26 Million in 2022 to USD 995.23 Million by 2027 registering a CAGR of 10.0% during the forecast period.

Who are the winners in the air-to-air refueling market?

Cobham Limited (UK), Eaton Corporation (US), Airbus SE (Netherlands), The Boeing Company (US), and GE Aviation (US).

What are some of the technological advancements in the market?

Currently, military organizations and various companies engaged in the air-to-air refueling platform focus on developing autonomous aerial refueling capability. Various developments have been carried out to gain autonomous aerial refueling capability. In 2015, Northrop Grumman and the US Navy demonstrated fully autonomous aerial refueling (AAR) with the X-47B Unmanned Combat Air System Demonstration (UCAS-D) aircraft. In 2018, Airbus Defence and Space and the Royal Australian Air Force (RAAF) conducted the first automatic air-to-air refueling between an Airbus 310 development tanker and a RAAF KC-30A multi-role tanker transport.

Virtual air refueling (VAR) offers the cost-effective and training capability to air forces. Companies like Northrop Grumman provide realistic training capability to maintain aircrew readiness and increase training opportunities. In March 2021, the 916th Air Refueling Wing Security Forces (ARWSF) Squadron of the US Air Force was able to purchase a new MILO Firearms training simulator using Squadron Innovation Funds allowing the ARWSF Squadron to train in near real-world scenarios. The simulator provides 916 SFS Defenders a unique virtual training environment to build on the skills needed to face on-the-job challenges involving the protection of life and Air Force assets. In October 2020, the US Navy’s unmanned air vehicle operators from the service’s developmental test squadron and operational test squadron started training to fly the Boeing MQ-25A Stingray unmanned in-flight refueling tanker on a desktop-based simulator.

What are the factors driving the growth of the market?

The increasing instances of overseas deployment of military aircraft has been one of the main reasons for the rising demand for air-to-air refueling technologies and has encouraged the adoption of aircraft equipped with such capability.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 33)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

1.3.1 AIR-TO-AIR REFUELING MARKET SEGMENTATION

1.3.2 REGIONAL SCOPE

1.3.3 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 37)

2.1 RESEARCH DATA

FIGURE 1 RESEARCH PROCESS FLOW

FIGURE 2 AIR-TO-AIR REFUELING MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primaries

2.1.3 MARKET DEFINITION & SCOPE

2.1.4 SEGMENTS & SUBSEGMENTS

2.1.5 SEGMENT DEFINITIONS

2.1.5.1 Air-to-air refueling market, by system

2.1.5.2 Market, by component

2.1.5.3 Market, by aircraft type

2.1.5.4 Market, by type

2.2 RESEARCH APPROACH & METHODOLOGY

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Regional air-to-air refueling market

2.2.1.2 Air-to-air refueling market, by system

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH - 1

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH - 2

2.2.2 TOP-DOWN APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.2.3 PRICING ANALYSIS

2.3 TRIANGULATION & VALIDATION

2.3.1 TRIANGULATION THROUGH SECONDARY RESEARCH

2.3.2 TRIANGULATION THROUGH PRIMARIES

FIGURE 6 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

2.4.1 MARKET SIZING

2.4.2 MARKET FORECASTING

FIGURE 7 ASSUMPTIONS OF THE RESEARCH STUDY

2.5 RISKS

3 EXECUTIVE SUMMARY (Page No. - 48)

FIGURE 8 BY SYSTEM, BOOM REFUELING SEGMENT EXPECTED TO LEAD AIR-TO-AIR REFUELING MARKET FROM 2020 TO 2025

FIGURE 9 BY AIRCRAFT TYPE, FIXED WING SEGMENT PROJECTED TO LEAD AIR-TO-AIR REFUELING MARKET DURING FORECAST PERIOD

FIGURE 10 NORTH AMERICA ESTIMATED TO ACCOUNT FOR LARGEST MARKET SHARE IN 2020

4 PREMIUM INSIGHTS (Page No. - 50)

4.1 ATTRACTIVE OPPORTUNITIES IN AIR-TO-AIR REFUELING MARKET

FIGURE 11 DEVELOPMENT OF NEXT-GENERATION AERIAL TANKERS EXPECTED TO DRIVE AIR-TO-AIR REFUELING MARKET GROWTH

4.2 AIR-TO-AIR REFUELING MARKET, BY SYSTEM

FIGURE 12 BY SYSTEM, BOOM REFUELING SEGMENT EXPECTED TO LEAD AIR-TO-AIR REFUELING MARKET DURING FORECAST PERIOD

4.3 AIR-TO-AIR REFUELING MARKET, BY AIRCRAFT TYPE

FIGURE 13 BY AIRCRAFT TYPE, FIXED WING SEGMENT PROJECTED TO LEAD MARKET DURING FORECAST PERIOD

4.4 AIR-TO-AIR REFUELING MARKET FOR AIRCRAFT TYPE, BY FIXED WING

FIGURE 14 FIGHTER AIRCRAFT SEGMENT PROJECTED TO LEAD AIR-TO-AIR REFUELING MARKET DURING FORECAST PERIOD

4.5 AIR-TO-AIR REFUELING MARKET, BY COUNTRY

FIGURE 15 US AIR-TO-AIR REFUELING MARKET TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 53)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 16 AIR-TO-AIR REFUELING MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Increasing demand for air-to-air refueling systems to support overseas deployments

5.2.1.2 Increased defense expenditure of countries

FIGURE 17 DEFENSE SPENDING OF REGIONS, 2015–2019 (USD BILLION)

5.2.1.3 Development of advanced aerial tankers

5.2.1.4 Increase in combat aircraft procurement

FIGURE 18 COMBAT AIRCRAFT FLEET, 2017–2020 (UNITS)

5.2.2 OPPORTUNITIES

5.2.2.1 Autonomous refueling

5.2.3 CHALLENGES

5.2.3.1 High installation and maintenance cost

5.3 RANGE/SCENARIOS

FIGURE 19 COVID-19 IMPACT ON AIR-TO-AIR REFUELING MARKET: GLOBAL SCENARIOS

5.4 COVID-19 IMPACT ON AVIATION REFUELING MARKET

5.4.1 REALISTIC SCENARIO (POST-COVID-19)

TABLE 1 REALISTIC SCENARIO (POST-COVID-19): AIR-TO-AIR REFUELING MARKET

5.4.2 OPTIMISTIC SCENARIO (POST-COVID-19)

TABLE 2 OPTIMISTIC SCENARIO (POST-COVID-19): AIR-TO-AIR REFUELING MARKET

5.4.3 PESSIMISTIC SCENARIO (POST-COVID-19)

TABLE 3 PESSIMISTIC SCENARIO (POST-COVID-19): AIR-TO-AIR REFUELING MARKET

5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESS

5.5.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR AIR-TO-AIR REFUELING MARKET

FIGURE 20 REVENUE SHIFT IN AIR-TO-AIR REFUELING MARKET

5.6 MARKET ECOSYSTEM

5.6.1 PROMINENT COMPANIES

5.6.2 PRIVATE AND SMALL ENTERPRISES

5.6.3 END-USERS

FIGURE 21 MARKET ECOSYSTEM MAP: AIR-TO-AIR REFUELING MARKET

5.7 PRICING ANALYSIS

FIGURE 22 PRICING ANALYSIS, BY TANKER AIRCRAFT

5.8 VALUE CHAIN ANALYSIS

FIGURE 23 VALUE CHAIN ANALYSIS: AIR-TO-AIR REFUELING MARKET

5.9 REGULATORY NORMS FOR AIR-TO-AIR REFUELING

5.10 TRADE DATA

5.10.1 AIRCRAFT, SPACECRAFT, & SUBASSEMBLY EXPORT AND IMPORT DATA, 2018–2019

TABLE 4 AIRCRAFT, SPACECRAFT, & SUBASSEMBLY EXPORT DATA, 2018–2019

TABLE 5 AIRCRAFT, SPACECRAFT, & SUBASSEMBLY IMPORT DATA, 2018–2019

5.11 PORTER’S FIVE FORCES MODEL

5.12 TECHNOLOGY ANALYSIS

5.12.1 UNMANNED AERIAL REFUELING VEHICLES

5.12.2 AIRCRAFT REFUELING CONTROLS

5.13 USE CASES

5.13.1 COMMERCIALIZATION OF REFUELING SERVICES

5.13.2 FOCUS OF US NAVY TOWARDS DEVELOPMENT OF MQ-25A STINGRAY AERIAL REFUELING AIRCRAFT

5.13.3 BUDDY REFUELING PODS

5.14 OPERATIONAL DATA

TABLE 6 TOP 10 ACTIVE COMBAT AIRCRAFT FLEET SIZE WORLDWIDE

TABLE 7 TOP 10 ACTIVE TANKER AIRCRAFT FLEET SIZE WORLDWIDE

TABLE 8 ACTIVE TANKER FLEET SIZE, BY COUNTRY

TABLE 9 ACTIVE COMBAT AIRCRAFT FLEET SIZE, BY COUNTRY

6 INDUSTRY TRENDS (Page No. - 69)

6.1 INTRODUCTION

6.2 TANKER INVENTORY

TABLE 10 TANKER INVENTORY, 2020–2025

6.3 TECHNOLOGICAL TRENDS

6.3.1 AUTONOMOUS REFUELING

6.3.2 VIRTUAL REFUELING

6.3.3 REMOTE VISION SYSTEM

6.3.4 BUDDY REFUELING PODS

6.4 INNOVATIONS AND PATENT REGISTRATIONS, 2013–2020

TABLE 11 INNOVATIONS AND PATENT REGISTRATIONS, 2013–2020

7 AIR-TO-AIR REFUELING MARKET, BY COMPONENT (Page No. - 73)

7.1 INTRODUCTION

FIGURE 24 FUEL TANKS SEGMENT PROJECTED TO LEAD AIR-TO-AIR REFUELING MARKET DURING FORECAST PERIOD

TABLE 12 MARKET SIZE, BY COMPONENT, 2017–2019 (USD MILLION)

TABLE 13 MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

7.2 PUMPS

7.2.1 PUMPS ARE MAJORLY USED IN FUEL SYSTEMS, ENGINES, AND HYDRAULIC SYSTEMS

7.3 VALVES

7.3.1 IMPROVING OPERATIONAL EFFICIENCY OF VALVES LEADS TO HIGHER RELIABILITY AND SAFETY OF OPERATIONS

7.4 NOZZLES

7.4.1 NOZZLES ARE MAJORLY USED TO CONTROL AIRCRAFT ENGINE

7.5 HOSES

7.5.1 HOSES ARE USED FOR PROBE & DROGUE REFUELING

7.6 BOOM

7.6.1 BOOM SYSTEM IS PRIMARILY USED FOR RAPID FUEL TRANSFER

7.7 PROBES

7.7.1 PROBE SYSTEMS ARE MAJORLY USED FOR FIGHTER AND MILITARY HELICOPTERS

7.8 FUEL TANKS

7.8.1 FUEL TANKS INCREASINGLY USED IN ENVIRONMENTAL CONTROL SYSTEMS AND ENGINE BLEED AIR SUPPLY SYSTEMS

7.9 PODS

7.9.1 WING PODS ENABLE MULTI-POINT AIR-TO-AIR REFUELING

8 AIR-TO-AIR REFUELING MARKET, BY SYSTEM (Page No. - 78)

8.1 INTRODUCTION

FIGURE 25 BY SYSTEM, BOOM REFUELING SEGMENT PROJECTED TO LEAD AIR-TO-AIR REFUELING MARKET DURING FORECAST PERIOD

TABLE 14 AVIATION REFUELING MARKET SIZE, BY SYSTEM, 2017–2019 (USD MILLION)

TABLE 15 MARKET SIZE, BY SYSTEM, 2020–2025 (USD MILLION)

8.2 PROBE & DROGUE

8.2.1 PROBE & DROGUE SYSTEM DOES NOT REQUIRE BOOM OPERATOR

8.2.1.1 Multi-Point

8.2.1.2 Buddy

TABLE 16 PROBE & DROGUE MARKET SIZE, BY TYPE, 2017–2019 (USD MILLION)

TABLE 17 PROBE & DROGUE MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

8.3 BOOM REFUELING

8.3.1 BOOM REFUELING SYSTEM REDUCES TIME REQUIRED TO TRANSFER FUEL FROM ONE AIRCRAFT TO ANOTHER

TABLE 18 BOOM REFUELING MARKET SIZE, BY TYPE, 2017–2019 (USD MILLION)

TABLE 19 BOOM REFUELING MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

8.4 AUTONOMOUS

8.4.1 INCREASING USE OF AUTONOMOUS REFUELING SYSTEMS FOR MID-AIR REFUELING

TABLE 20 AUTONOMOUS MARKET SIZE, BY TYPE, 2017–2019 (USD MILLION)

TABLE 21 AUTONOMOUS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

9 AIR-TO-AIR REFUELING MARKET, BY AIRCRAFT TYPE (Page No. - 83)

9.1 INTRODUCTION

FIGURE 26 BY AIRCRAFT TYPE, FIXED-WING SEGMENT ESTIMATED TO LEAD AIR-TO-AIR REFUELING MARKET DURING FORECAST PERIOD

TABLE 22 AVIATION MARKET SIZE, BY AIRCRAFT TYPE, 2017–2019 (USD MILLION)

TABLE 23 MARKET SIZE, BY AIRCRAFT TYPE, 2020–2025 (USD MILLION)

9.2 FIXED WING

9.2.1 FIGHTER AIRCRAFT

9.2.1.1 Increasing procurement of fighter aircraft due to increasing military budgets

9.2.2 TANKER AIRCRAFT

9.2.2.1 Tankers majorly used to transfer aviation fuel from one military aircraft to another

9.2.3 MILITARY TRANSPORT AIRCRAFT

9.2.3.1 Increasing use of transport aircraft in military operations

9.2.4 UAVS

9.2.4.1 Increasing production of long-range UAVs expected to drive UAV market

TABLE 24 FIXED WING AIRCRAFT: AIR-TO-AIR REFUELING MARKET SIZE, BY TYPE, 2017–2019 (USD MILLION)

TABLE 25 FIXED WING AIRCRAFT: MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 26 MARKET SIZE FOR FIXED WING AIRCRAFT, BY END USER, 2017–2019 (USD MILLION)

TABLE 27 MARKET SIZE FOR FIXED WING AIRCRAFT, BY END USER, 2020–2025 (USD MILLION)

9.3 ROTARY WING

9.3.1 ATTACK HELICOPTERS

9.3.1.1 Attack helicopters are majorly used for reconnaissance and security operations

9.3.2 TRANSPORT HELICOPTERS

9.3.2.1 Military transport helicopters are majorly used for airlifting troops & weapons

TABLE 28 ROTARY WING AIRCRAFT: AIR-TO-AIR REFUELING MARKET SIZE, BY TYPE, 2017–2019 (USD MILLION)

TABLE 29 ROTARY WING AIRCRAFT: MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 30 MARKET SIZE FOR ROTARY WING AIRCRAFT, BY END USER, 2017–2019 (USD MILLION)

TABLE 31 AIR-TO-AIR REFUELING MARKET SIZE FOR ROTARY WING AIRCRAFT, BY END USER, 2020–2025 (USD MILLION)

10 AIR-TO-AIR REFUELING MARKET, BY TYPE (Page No. - 90)

10.1 INTRODUCTION

FIGURE 27 MANNED SEGMENT PROJECTED TO LEAD AIR-TO-AIR REFUELING MARKET DURING FORECAST PERIOD

TABLE 32 MARKET SIZE, BY TYPE, 2017–2019 (USD MILLION)

TABLE 33 AVIATION MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

10.2 MANNED

10.2.1 PILOT-CONTROLLED AIRCRAFT

10.3 UNMANNED

10.3.1 ARTIFICIALLY INTELLIGENT AIRCRAFT

11 AIR-TO-AIR REFUELING MARKET, BY END USER (Page No. - 93)

11.1 INTRODUCTION

11.2 IMPACT OF COVID-19 ON END USER

11.2.1 MOST IMPACTED END USER

11.2.2 LEAST IMPACTED END USER

FIGURE 28 AIR-TO-AIR REFUELING MARKET, BY END USER, 2020 & 2025

TABLE 34 MARKET SIZE, BY END USER, 2017–2019 (USD MILLION)

TABLE 35 MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

11.3 OEM

TABLE 36 AIR-TO-AIR REFUELING OEM MARKET SIZE, BY REGION, 2017–2019 (USD MILLION)

TABLE 37 AIR-TO-AIR REFUELING OEM MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

11.4 AFTERMARKET

TABLE 38 AIR-TO-AIR REFUELING AFTERMARKET SIZE, BY REGION, 2017–2019 (USD MILLION)

TABLE 39 AIR-TO-AIR REFUELING AFTERMARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

12 REGIONAL ANALYSIS (Page No. - 98)

12.1 INTRODUCTION

12.2 GLOBAL SCENARIOS OF AIR-TO-AIR REFUELING MARKET

FIGURE 29 GLOBAL SCENARIOS OF AVIATION REFUELING MARKET

FIGURE 30 NORTH AMERICA ESTIMATED ACCOUNT FOR LARGEST SHARE OF AIR-TO-AIR REFUELING MARKET IN 2020

TABLE 40 MARKET SIZE, BY REGION, 2017–2019 (USD MILLION)

TABLE 41 MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

12.3 NORTH AMERICA

12.3.1 PESTLE ANALYSIS: NORTH AMERICA

FIGURE 31 NORTH AMERICA: AIR-TO-AIR REFUELING MARKET SNAPSHOT

TABLE 42 NORTH AMERICA: MARKET SIZE, BY SYSTEM, 2017–2019 (USD MILLION)

TABLE 43 NORTH AMERICA: MARKET SIZE, BY SYSTEM, 2020–2025 (USD MILLION)

TABLE 44 NORTH AMERICA: MARKET SIZE, BY AIRCRAFT TYPE, 2017–2019 (USD MILLION)

TABLE 45 NORTH AMERICA: MARKET SIZE, BY AIRCRAFT TYPE, 2020–2025 (USD MILLION)

TABLE 46 NORTH AMERICA: MARKET SIZE FOR FIXED WING AIRCRAFT, BY TYPE, 2017–2019 (USD MILLION)

TABLE 47 NORTH AMERICA: MARKET SIZE FOR FIXED WING AIRCRAFT, BY TYPE, 2020–2025 (USD MILLION)

TABLE 48 NORTH AMERICA: MARKET SIZE FOR ROTARY WING AIRCRAFT, BY TYPE, 2017–2019 (USD MILLION)

TABLE 49 NORTH AMERICA: MARKET SIZE FOR ROTARY WING AIRCRAFT, BY TYPE, 2020–2025 (USD MILLION)

TABLE 50 NORTH AMERICA: MARKET SIZE, BY TYPE, 2017–2019 (USD MILLION)

TABLE 51 NORTH AMERICA: MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 52 NORTH AMERICA: MARKET SIZE, BY END USER, 2017–2019 (USD MILLION)

TABLE 53 NORTH AMERICA: MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

TABLE 54 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 55 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

12.3.2 US

12.3.2.1 Increase in tanker aircraft deliveries from Boeing drives market growth in US

TABLE 56 US: MARKET SIZE, BY SYSTEM, 2017–2019 (USD MILLION)

TABLE 57 US: MARKET SIZE, BY SYSTEM, 2020–2025 (USD MILLION)

TABLE 58 US: MARKET SIZE, BY AIRCRAFT TYPE, 2017–2019 (USD MILLION)

TABLE 59 US: MARKET SIZE, BY AIRCRAFT TYPE, 2020–2025 (USD MILLION)

12.3.3 CANADA

12.3.3.1 Increase in demand for UAVs for military applications driving market growth in Canada

TABLE 60 CANADA: AIR-TO-AIR REFUELING MARKET SIZE, BY SYSTEM, 2017–2019 (USD MILLION)

TABLE 61 CANADA: MARKET SIZE, BY SYSTEM, 2020–2025 (USD MILLION)

TABLE 62 CANADA: MARKET SIZE, BY AIRCRAFT TYPE, 2017–2019 (USD MILLION)

TABLE 63 CANADA: MARKET SIZE, BY AIRCRAFT TYPE, 2020–2025 (USD MILLION)

12.4 EUROPE

12.4.1 PESTLE ANALYSIS: EUROPE

FIGURE 32 EUROPE: AIR-TO-AIR REFUELING MARKET SNAPSHOT

TABLE 64 EUROPE: MARKET SIZE, BY SYSTEM, 2017–2019 (USD MILLION)

TABLE 65 EUROPE: MARKET SIZE, BY SYSTEM, 2020–2025 (USD MILLION)

TABLE 66 EUROPE: MARKET SIZE, BY AIRCRAFT TYPE, 2017–2019 (USD MILLION)

TABLE 67 EUROPE: MARKET SIZE, BY AIRCRAFT TYPE, 2020–2025 (USD MILLION)

TABLE 68 EUROPE: MARKET SIZE FOR FIXED WING AIRCRAFT, BY TYPE, 2017–2019 (USD MILLION)

TABLE 69 EUROPE: MARKET SIZE FOR FIXED WING AIRCRAFT, BY TYPE, 2020–2025 (USD MILLION)

TABLE 70 EUROPE: MARKET SIZE FOR ROTARY WING AIRCRAFT, BY TYPE, 2017–2019 (USD MILLION)

TABLE 71 EUROPE: MARKET SIZE FOR ROTARY WING AIRCRAFT, BY TYPE, 2020–2025 (USD MILLION)

TABLE 72 EUROPE: MARKET SIZE, BY TYPE, 2017–2019 (USD MILLION)

TABLE 73 EUROPE: MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 74 EUROPE: MARKET SIZE, BY END USER, 2017–2019 (USD MILLION)

TABLE 75 EUROPE: MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

TABLE 76 EUROPE: MARKET SIZE, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 77 EUROPE: MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

12.4.2 FRANCE

12.4.2.1 Modernization of aerial refueling fleet driving market growth in France

FIGURE 33 FRANCE: MILITARY SPENDING, 2010–2019 (USD BILLION)

TABLE 78 FRANCE: AIR-TO-AIR REFUELING MARKET SIZE, BY SYSTEM, 2017–2019 (USD MILLION)

TABLE 79 FRANCE: MARKET SIZE, BY SYSTEM, 2020–2025 (USD MILLION

TABLE 80 FRANCE: MARKET SIZE, BY AIRCRAFT TYPE, 2017–2019 (USD MILLION)

TABLE 81 FRANCE: MARKET SIZE, BY AIRCRAFT TYPE, 2020–2025 (USD MILLION)

12.4.3 GERMANY

12.4.3.1 Increase in defense spending driving market growth in Germany

TABLE 82 GERMANY: MARKET SIZE, BY SYSTEM, 2017–2019 (USD MILLION)

TABLE 83 GERMANY: MARKET SIZE, BY SYSTEM, 2020–2025 (USD MILLION)

TABLE 84 GERMANY: MARKET SIZE, BY AIRCRAFT TYPE, 2017–2019 (USD MILLION)

TABLE 85 GERMANY: MARKET SIZE, BY AIRCRAFT TYPE, 2020–2025 (USD MILLION)

12.4.4 UK

12.4.4.1 Presence of major component manufacturers, such as Cobham and BAE Systems, driving market growth in UK

FIGURE 34 UK: MILITARY SPENDING, 2010–2019 (USD BILLION)

TABLE 86 UK: AIR-TO-AIR REFUELING MARKET SIZE, BY SYSTEM, 2017–2019 (USD MILLION)

TABLE 87 UK: MARKET SIZE, BY SYSTEM, 2020–2025 (USD MILLION)

TABLE 88 UK: MARKET SIZE, BY AIRCRAFT TYPE, 2017–2019 (USD MILLION)

TABLE 89 UK: MARKET SIZE, BY AIRCRAFT TYPE, 2020–2025 (USD MILLION)

12.4.5 REST OF EUROPE

TABLE 90 REST OF EUROPE: MARKET SIZE, BY SYSTEM, 2017–2019 (USD MILLION)

TABLE 91 REST OF EUROPE: MARKET SIZE, BY SYSTEM, 2020–2025 (USD MILLION)

TABLE 92 REST OF EUROPE: MARKET SIZE, BY AIRCRAFT TYPE, 2017–2019 (USD MILLION)

TABLE 93 REST OF EUROPE: MARKET SIZE, BY AIRCRAFT TYPE, 2020–2025 (USD MILLION)

12.5 ASIA PACIFIC

12.5.1 PESTLE ANALYSIS: ASIA PACIFIC

FIGURE 35 ASIA PACIFIC: AIR-TO-AIR REFUELING MARKET SNAPSHOT

TABLE 94 ASIA PACIFIC: MARKET SIZE, BY SYSTEM, 2017–2019 (USD MILLION)

TABLE 95 ASIA PACIFIC: MARKET SIZE, BY SYSTEM, 2020–2025 (USD MILLION)

TABLE 96 ASIA PACIFIC: MARKET SIZE, BY AIRCRAFT TYPE, 2017–2019 (USD MILLION)

TABLE 97 ASIA PACIFIC: MARKET SIZE, BY AIRCRAFT TYPE, 2020–2025 (USD MILLION)

TABLE 98 ASIA PACIFIC: MARKET SIZE FOR FIXED WING AIRCRAFT, BY TYPE, 2017–2019 (USD MILLION)

TABLE 99 ASIA PACIFIC: MARKET SIZE FOR FIXED WING AIRCRAFT, BY TYPE, 2020–2025 (USD MILLION)

TABLE 100 ASIA PACIFIC: MARKET SIZE FOR ROTARY WING AIRCRAFT, BY TYPE, 2017–2019 (USD MILLION)

TABLE 101 ASIA PACIFIC: MARKET SIZE FOR ROTARY WING AIRCRAFT, BY TYPE, 2020–2025 (USD MILLION)

TABLE 102 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2017–2019 (USD MILLION)

TABLE 103 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 104 ASIA PACIFIC: MARKET SIZE, BY END USER, 2017–2019 (USD MILLION)

TABLE 105 ASIA PACIFIC: MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

TABLE 106 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 107 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

12.5.2 RUSSIA

FIGURE 36 RUSSIA: MILITARY SPENDING, 2010–2019 (USD BILLION)

TABLE 108 RUSSIA: AIR-TO-AIR REFUELING MARKET SIZE, BY SYSTEM, 2017–2019 (USD MILLION)

TABLE 109 RUSSIA: MARKET SIZE, BY SYSTEM, 2020–2025 (USD MILLION)

TABLE 110 RUSSIA: MARKET SIZE, BY AIRCRAFT TYPE, 2017–2019 (USD MILLION)

TABLE 111 RUSSIA: MARKET SIZE, BY AIRCRAFT TYPE, 2020–2025 (USD MILLION)

12.5.3 JAPAN

12.5.3.1 Increasing demand for military transport aircraft to drive market growth in Japan

TABLE 112 JAPAN: MARKET SIZE, BY SYSTEM, 2017–2019 (USD MILLION)

TABLE 113 JAPAN: MARKET SIZE, BY SYSTEM, 2020–2025 (USD MILLION)

TABLE 114 JAPAN: MARKET SIZE, BY AIRCRAFT TYPE, 2017–2019 (USD MILLION)

TABLE 115 JAPAN: MARKET SIZE, BY AIRCRAFT TYPE, 2020–2025 (USD MILLION)

12.5.4 CHINA

12.5.4.1 Presence of major aircraft manufacturers, such as Comac, to drive market growth in China

TABLE 116 CHINA: MARKET SIZE, BY SYSTEM, 2017–2019 (USD MILLION)

TABLE 117 CHINA: MARKET SIZE, BY SYSTEM, 2020–2025 (USD MILLION)

TABLE 118 CHINA: MARKET SIZE, BY AIRCRAFT TYPE, 2017–2019 (USD MILLION)

TABLE 119 CHINA: MARKET SIZE, BY AIRCRAFT TYPE, 2020–2025 (USD MILLION)

12.5.5 INDIA

12.5.5.1 Development of light combat aircraft to drive market growth in India

TABLE 120 INDIA: AIR-TO-AIR REFUELING MARKET SIZE, BY SYSTEM, 2017–2019 (USD MILLION)

TABLE 121 INDIA: MARKET SIZE, BY SYSTEM, 2020–2025 (USD MILLION)

TABLE 122 INDIA: MARKET SIZE, BY AIRCRAFT TYPE, 2017–2019 (USD MILLION)

TABLE 123 INDIA: MARKET SIZE, BY AIRCRAFT TYPE, 2020–2025 (USD MILLION)

12.5.6 REST OF ASIA PACIFIC

12.5.6.1 Focus of countries to enhance defense and security drive market growth in this region

TABLE 124 REST OF ASIA PACIFIC: MARKET SIZE, BY SYSTEM, 2017–2019 (USD MILLION)

TABLE 125 REST OF ASIA PACIFIC: MARKET SIZE, BY SYSTEM, 2020–2025 (USD MILLION)

TABLE 126 REST OF ASIA PACIFIC: MARKET SIZE, BY AIRCRAFT TYPE, 2017–2019 (USD MILLION)

TABLE 127 REST OF ASIA PACIFIC: MARKET SIZE, BY AIRCRAFT TYPE, 2020–2025 (USD MILLION)

12.6 REST OF THE WORLD

12.6.1 PESTLE ANALYSIS: REST OF THE WORLD

TABLE 128 REST OF THE WORLD: AIR-TO-AIR REFUELING MARKET SIZE, BY SYSTEM, 2017–2019 (USD MILLION)

TABLE 129 REST OF THE WORLD: MARKET SIZE, BY SYSTEM, 2020–2025 (USD MILLION)

TABLE 130 REST OF THE WORLD: MARKET SIZE, BY AIRCRAFT TYPE, 2017–2019 (USD MILLION)

TABLE 131 REST OF THE WORLD: MARKET SIZE, BY AIRCRAFT TYPE, 2020–2025 (USD MILLION)

TABLE 132 REST OF THE WORLD: MARKET SIZE FOR FIXED WING AIRCRAFT, BY TYPE, 2017–2019 (USD MILLION)

TABLE 133 REST OF THE WORLD: MARKET SIZE FOR FIXED WING AIRCRAFT, BY TYPE, 2020–2025 (USD MILLION)

TABLE 134 REST OF THE WORLD: MARKET SIZE FOR ROTARY WING AIRCRAFT, BY TYPE, 2017–2019 (USD MILLION)

TABLE 135 REST OF THE WORLD: MARKET SIZE FOR ROTARY WING AIRCRAFT, BY TYPE, 2020–2025 (USD MILLION)

TABLE 136 REST OF THE WORLD: MARKET SIZE, BY TYPE, 2017–2019 (USD MILLION)

TABLE 137 REST OF THE WORLD: MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 138 REST OF THE WORLD: MARKET SIZE, BY END USER, 2017–2019 (USD MILLION)

TABLE 139 REST OF THE WORLD: MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

12.6.2 MIDDLE EAST

TABLE 140 MIDDLE EAST: AIR-TO-AIR REFUELING MARKET SIZE, BY SYSTEM, 2017–2019 (USD MILLION)

TABLE 141 MIDDLE EAST: MARKET SIZE, BY SYSTEM, 2020–2025 (USD MILLION)

TABLE 142 MIDDLE EAST: MARKET SIZE, BY AIRCRAFT TYPE, 2017–2019 (USD MILLION)

TABLE 143 MIDDLE EAST: MARKET SIZE, BY AIRCRAFT TYPE, 2020–2025 (USD MILLION)

TABLE 144 MIDDLE EAST: MARKET SIZE FOR FIXED WING AIRCRAFT, BY TYPE, 2017–2019 (USD MILLION)

TABLE 145 MIDDLE EAST: MARKET SIZE FOR FIXED WING AIRCRAFT, BY TYPE, 2020–2025 (USD MILLION)

TABLE 146 MIDDLE EAST: MARKET SIZE FOR ROTARY WING AIRCRAFT, BY TYPE, 2017–2019 (USD MILLION)

TABLE 147 MIDDLE EAST: MARKET SIZE FOR ROTARY WING AIRCRAFT, BY TYPE, 2020–2025 (USD MILLION)

TABLE 148 MIDDLE EAST: MARKET SIZE, BY TYPE, 2017–2019 (USD MILLION)

TABLE 149 MIDDLE EAST: MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 150 MIDDLE EAST: MARKET SIZE, BY END USER, 2017–2019 (USD MILLION)

TABLE 151 MIDDLE EAST: MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

12.6.2.1 Saudi Arabia

TABLE 152 SAUDI ARABIA: AIR-TO-AIR REFUELING MARKET SIZE, BY SYSTEM, 2017–2019 (USD MILLION)

TABLE 153 SAUDI ARABIA: MARKET SIZE, BY SYSTEM, 2020–2025 (USD MILLION)

TABLE 154 SAUDI ARABIA: MARKET SIZE, BY AIRCRAFT TYPE, 2017–2019 (USD MILLION)

TABLE 155 SAUDI ARABIA: MARKET SIZE, BY AIRCRAFT TYPE, 2020–2025 (USD MILLION)

12.6.2.2 Rest of Middle East

TABLE 156 REST OF MIDDLE EAST: MARKET SIZE, BY SYSTEM, 2017–2019 (USD MILLION)

TABLE 157 REST OF MIDDLE EAST: MARKET SIZE, BY SYSTEM, 2020–2025 (USD MILLION)

TABLE 158 REST OF MIDDLE EAST: MARKET SIZE, BY AIRCRAFT TYPE, 2017–2019 (USD MILLION)

TABLE 159 REST OF MIDDLE EAST: MARKET SIZE, BY AIRCRAFT TYPE, 2020–2025 (USD MILLION)

12.6.3 LATIN AMERICA

TABLE 160 LATIN AMERICA: AIR-TO-AIR REFUELING MARKET SIZE, BY SYSTEM, 2017–2019 (USD MILLION)

TABLE 161 LATIN AMERICA: MARKET SIZE, BY SYSTEM, 2020–2025 (USD MILLION)

TABLE 162 LATIN AMERICA: MARKET SIZE, BY AIRCRAFT TYPE, 2017–2019 (USD MILLION)

TABLE 163 LATIN AMERICA: MARKET SIZE, BY AIRCRAFT TYPE, 2020–2025 (USD MILLION)

TABLE 164 LATIN AMERICA: MARKET SIZE FOR FIXED WING AIRCRAFT, BY TYPE, 2017–2019 (USD MILLION)

TABLE 165 LATIN AMERICA: MARKET SIZE FOR FIXED WING AIRCRAFT, BY TYPE, 2020–2025 (USD MILLION)

TABLE 166 LATIN AMERICA: MARKET SIZE FOR ROTARY WING AIRCRAFT, BY TYPE, 2017–2019 (USD MILLION)

TABLE 167 LATIN AMERICA: MARKET SIZE FOR ROTARY WING AIRCRAFT, BY TYPE, 2020–2025 (USD MILLION)

TABLE 168 LATIN AMERICA: MARKET SIZE, BY TYPE, 2017–2019 (USD MILLION)

TABLE 169 LATIN AMERICA: MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 170 LATIN AMERICA: MARKET SIZE, BY END USER, 2017–2019 (USD MILLION)

TABLE 171 LATIN AMERICA: MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

12.6.3.1 Brazil

12.6.3.1.1 Modernization of armed forces boosts market growth in Brazil

TABLE 172 BRAZIL: AIR-TO-AIR REFUELING MARKET SIZE, BY SYSTEM, 2017–2019 (USD MILLION)

TABLE 173 BRAZIL: MARKET SIZE, BY SYSTEM, 2020–2025 (USD MILLION)

TABLE 174 BRAZIL: MARKET SIZE, BY AIRCRAFT TYPE, 2017–2019 (USD MILLION)

TABLE 175 BRAZIL: MARKET SIZE, BY AIRCRAFT TYPE, 2020–2025 (USD MILLION)

12.6.3.2 Rest of Latin America

TABLE 176 REST OF LATIN AMERICA: MARKET SIZE, BY SYSTEM, 2017–2019 (USD MILLION)

TABLE 177 REST OF LATIN AMERICA: MARKET SIZE, BY SYSTEM, 2020–2025 (USD MILLION)

TABLE 178 REST OF LATIN AMERICA: MARKET SIZE, BY AIRCRAFT TYPE, 2017–2019 (USD MILLION)

TABLE 179 REST OF LATIN AMERICA: MARKET SIZE, BY AIRCRAFT TYPE, 2020–2025 (USD MILLION)

12.6.4 AFRICA

TABLE 180 AFRICA: AIR-TO-AIR REFUELING MARKET SIZE, BY SYSTEM, 2017–2019 (USD MILLION)

TABLE 181 AFRICA: MARKET SIZE, BY SYSTEM, 2020–2025 (USD MILLION)

TABLE 182 AFRICA: MARKET SIZE, BY AIRCRAFT TYPE, 2017–2019 (USD MILLION)

TABLE 183 AFRICA: MARKET SIZE, BY AIRCRAFT TYPE, 2020–2025 (USD MILLION)

TABLE 184 AFRICA: MARKET SIZE FOR FIXED WING AIRCRAFT, BY TYPE, 2017–2019 (USD MILLION)

TABLE 185 AFRICA: MARKET SIZE FOR FIXED WING AIRCRAFT, BY TYPE, 2020–2025 (USD MILLION)

TABLE 186 AFRICA: MARKET SIZE FOR ROTARY WING AIRCRAFT, BY TYPE, 2017–2019 (USD MILLION)

TABLE 187 AFRICA: MARKET SIZE FOR ROTARY WING AIRCRAFT, BY TYPE, 2020–2025 (USD MILLION)

TABLE 188 AFRICA: MARKET SIZE, BY TYPE, 2017–2019 (USD MILLION)

TABLE 189 AFRICA: MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 190 AFRICA: MARKET SIZE, BY END USER, 2017–2019 (USD MILLION)

TABLE 191 AFRICA: MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

13 COMPETITIVE LANDSCAPE (Page No. - 151)

13.1 INTRODUCTION

13.2 RANKING OF LEADING PLAYERS, 2020

FIGURE 37 MARKET RANKING OF LEADING PLAYERS IN AIR-TO-AIR REFUELING MARKET, 2020

13.3 MARKET SHARE ANALYSIS OF LEADING PLAYERS, 2020

FIGURE 38 MARKET SHARE ANALYSIS OF LEADING PLAYERS IN AVIATION REFUELING MARKET, 2020

13.4 REVENUE ANALYSIS OF LEADING MARKET PLAYERS, 2019

FIGURE 39 REVENUE ANALYSIS OF LEADING PLAYERS IN AIR-TO-AIR REFUELING MARKET, 2019

13.5 COMPETITIVE OVERVIEW

TABLE 192 KEY DEVELOPMENTS BY LEADING PLAYERS IN AIR-TO-AIR REFUELING MARKET BETWEEN 2019 AND 2021

13.6 COMPANY PRODUCT FOOTPRINT ANALYSIS

TABLE 193 COMPANY PRODUCT FOOTPRINT

TABLE 194 COMPANY APPLICATION FOOTPRINT

TABLE 195 COMPANY INDUSTRY FOOTPRINT

TABLE 196 COMPANY REGION FOOTPRINT

13.7 COMPANY EVALUATION QUADRANT

13.7.1 STAR

13.7.2 EMERGING LEADER

13.7.3 PERVASIVE

13.7.4 PARTICIPANT

FIGURE 40 AIR-TO-AIR REFUELING MARKET COMPETITIVE LEADERSHIP MAPPING, 2019

13.8 COMPETITIVE SCENARIO

13.8.1 MERGERS & ACQUISITIONS

TABLE 197 MERGERS & ACQUISITIONS, 2018–2021

13.8.2 NEW PRODUCT DEVELOPMENTS

TABLE 198 NEW PRODUCT LAUNCHES, 2017–2020

13.8.3 CONTRACTS, PARTNERSHIPS, & AGREEMENTS

TABLE 199 CONTRACTS, PARTNERSHIPS, & AGREEMENTS, 2018–2020

14 COMPANY PROFILES (Page No. - 164)

(Business Overview, Products & solutions Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

14.1 INTRODUCTION

14.2 KEY PLAYERS

14.2.1 COBHAM PLC

TABLE 200 COBHAM PLC: BUSINESS OVERVIEW

FIGURE 41 COBHAM PLC: COMPANY SNAPSHOT

14.2.2 EATON CORPORATION

TABLE 201 EATON CORPORATION: BUSINESS OVERVIEW

FIGURE 42 EATON CORPORATION: COMPANY SNAPSHOT

14.2.3 AIRBUS

TABLE 202 AIRBUS: BUSINESS OVERVIEW

FIGURE 43 AIRBUS: COMPANY SNAPSHOT

14.2.4 BOEING

TABLE 203 BOEING: BUSINESS OVERVIEW

FIGURE 44 BOEING: COMPANY SNAPSHOT

14.2.5 GE AVIATION

TABLE 204 GE AVIATION: BUSINESS OVERVIEW

14.3 OTHER PLAYERS

14.3.1 PARKER HANNIFIN CORPORATION

TABLE 205 PARKER HANNIFIN CORPORATION: BUSINESS OVERVIEW

FIGURE 45 PARKER HANNIFIN CORPORATION: COMPANY SNAPSHOT

14.3.2 SAFRAN

TABLE 206 SAFRAN: BUSINESS OVERVIEW

FIGURE 46 SAFRAN: COMPANY SNAPSHOT

14.3.3 MARSHALL AEROSPACE AND DEFENCE GROUP

TABLE 207 MARSHALL AEROSPACE AND DEFENCE GROUP: BUSINESS OVERVIEW

14.3.4 ISRAEL AEROSPACE INDUSTRIES

TABLE 208 ISRAEL AEROSPACE INDUSTRIES: BUSINESS OVERVIEW

FIGURE 47 ISRAEL AEROSPACE INDUSTRIES: COMPANY SNAPSHOT

14.3.5 BAE SYSTEMS

TABLE 209 BAE SYSTEMS: BUSINESS OVERVIEW

FIGURE 48 BAE SYSTEMS: COMPANY SNAPSHOT

14.3.6 DRAKEN INTERNATIONAL

TABLE 210 DRAKEN INTERNATIONAL: BUSINESS OVERVIEW

14.3.7 LOCKHEED MARTIN CORPORATION

TABLE 211 LOCKHEED MARTIN CORPORATION: BUSINESS OVERVIEW

FIGURE 49 LOCKHEED MARTIN CORPORATION: COMPANY SNAPSHOT

14.3.8 RAYTHEON TECHNOLOGIES CORPORATION

TABLE 212 RAYTHEON TECHNOLOGIES CORPORATION: BUSINESS OVERVIEW

FIGURE 50 RAYTHEON TECHNOLOGIES CORPORATION: COMPANY SNAPSHOT

14.3.9 RAFAUT GROUP

TABLE 213 RAFAUT GROUP: BUSINESS OVERVIEW

14.3.10 ELBIT SYSTEMS LTD.

TABLE 214 ELBIT SYSTEMS: BUSINESS OVERVIEW

FIGURE 51 ELBIT SYSTEMS LTD.: COMPANY SNAPSHOT

14.3.11 MOOG

TABLE 215 MOOG: BUSINESS OVERVIEW

FIGURE 52 MOOG: COMPANY SNAPSHOT

14.3.12 PROTANKGRUP

TABLE 216 PROTANKGRUP: BUSINESS OVERVIEW

14.3.13 ESCO TECHNOLOGIES

TABLE 217 ESCO TECHNOLOGIES: BUSINESS OVERVIEW

FIGURE 53 ESCO TECHNOLOGIES COMPANY SNAPSHOT

14.3.14 NORTHSTAR

TABLE 218 NORTHSTAR: BUSINESS OVERVIEW

14.3.15 WITTENSTEIN SE

TABLE 219 WITTENSTEIN SE: COMPANY OVERVIEW

*Details on Business Overview, Products & solutions Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

15 APPENDIX (Page No. - 207)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 RELATED REPORTS

15.4 AUTHOR DETAILS

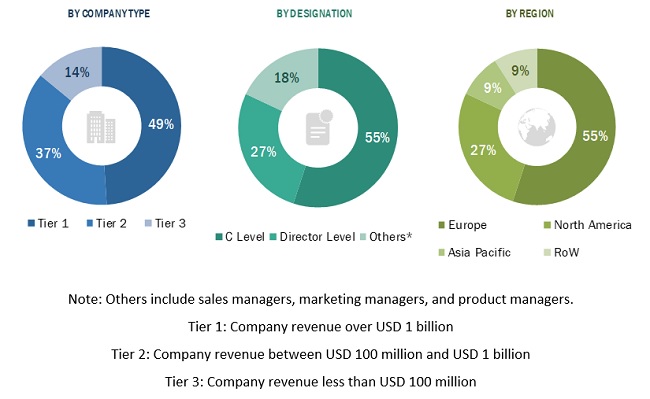

The research study conducted on the air-to-air refueling market involved extensive use of secondary sources, directories, and databases such as Hoovers, Bloomberg Businessweek, and Factiva to identify and collect information relevant to the air-to-air refueling market. The primary sources considered included industry experts from the air-to-air refueling market as well as sub-component manufacturers, air-to-air refueling system service providers, government agencies, technology vendors, system integrators, research organizations, and original equipment manufacturers related to all segments of the value chain of this industry. In-depth interviews with various primary respondents, including key industry participants, Subject Matter Experts (SMEs), industry consultants, and C-level executives, have been conducted to obtain and verify critical qualitative and quantitative information pertaining to the air-to-air refueling market as well as to assess te growth prospects of the market.

Secondary Research

Secondary sources referred for this research study included Boeing and Airbus Market Outlook 2019, General Aviation Manufacturers Association (GAMA); International Air Transport Association (IATA) publications; FlightGlobal World Airforce Fleet; Stockholm International Peace Research Institute, corporate filings (such as annual reports, investor presentations, and financial statements); Federal Aviation Administration (FAA) and trade, business, and professional associations. Secondary data was collected and analyzed to arrive at the overall market size, which was further validated by primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

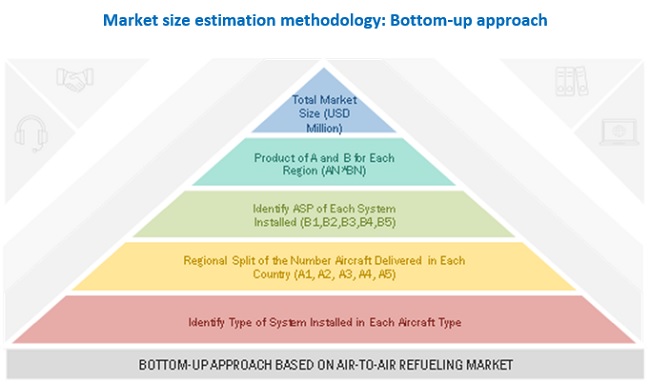

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the air-to-air refueling market. The research methodology used to estimate the market size also included the following details:

- Key players in the market were identified through secondary research, and their market ranking was determined through primary and secondary research. This included a study of annual and financial reports of top market players and extensive interviews with industry experts with knowledge on air-to-air refueling.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated, enhanced with detailed inputs, and analyzed by MarketsandMarkets and presented in this report.

To know about the assumptions considered for the study, Request for Free Sample Report

Data triangulation

After arriving at the overall market size from the market size estimation process, the total market was split into several segments and subsegments. Data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the estimated market numbers for the segments and subsegments of the air-to-air refueling market. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size was validated using both top-down and bottom-up approaches.

Report Objectives

- To define, describe, and forecast the size of the air-to-air refueling market based on component, system, type, aircraft type, end user, and region

- To identify and analyze key drivers, opportunities, and challenges influencing the growth of the market

- To identify industry trends, market trends, and technology trends currently prevailing in the market

- To forecast the size of different segments of the market with respect to North America, Europe, Asia Pacific, and the Rest of the World (the Middle East, Latin America, and Africa)

- To profile leading market players based on their product portfolios, financial positions, and key growth strategies

- To analyze the degree of competition in the market by identifying key growth strategies, such as mergers & acquisitions, contracts, agreements, collaborations, new product launches, and expansions, adopted by leading market players

- To provide a detailed competitive landscape of the market, along with rank analysis, revenue share analysis, and market share analysis of key players

- To provide a comprehensive analysis of business and corporate strategies adopted by key market players

Available customizations

Along with the market data, MarketsandMarkets offers customizations as per the specific needs of companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the market segments at country-level

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Air-to-Air Refueling Market