AIoT Platforms Market by Offering (Solutions (Device Management, Application Management, Connectivity Management) and Services), Vertical (Manufacturing, Healthcare, Retail) and Region - Global Forecast to 2028

AIoT Platforms Market Overview

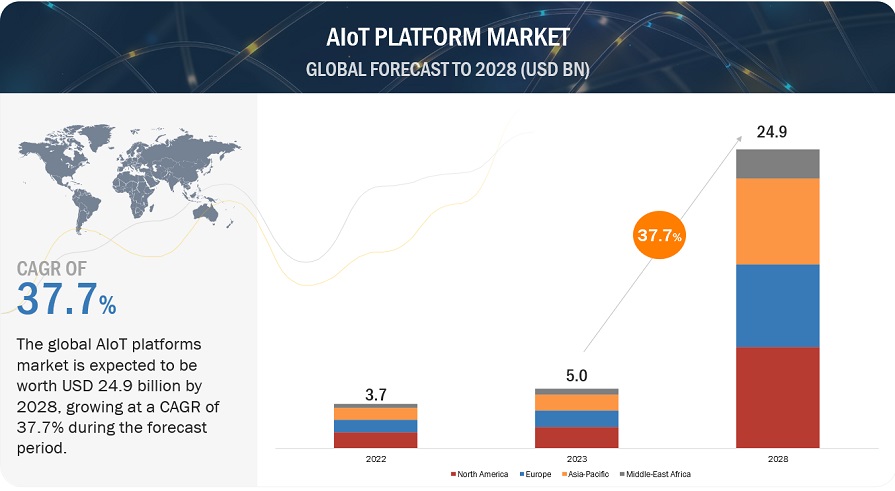

The AIoT Platforms Market size was estimated at USD 5.0 billion in 2023 and is projected to reach USD 24.9 billion by 2028 at a CAGR of 37.7% during the forecast period. The primary factor driving the growth of AIoT platforms is the increasing government spending and initiatives to establish AIoT platforms developments. Also the increasing demand for effective management of data generated from IoT devices to gain valuable insights, streamline the production process, and reduce downtime is to drive the growth of the AIoT platforms market.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

AIoT Platforms Market Dynamics

Driver: Edge-Computing-Powered Artificial Intelligence of Things

The idea of edge computing encourages the development of distributed system architectures with on-device data processing that are extremely effective, scalable, reliable, and well suited for low-latency use cases. Due to the enormous computing resources needed to conduct ML tasks, machine learning and deep learning were first restricted to the cloud platform. Emerging computationally demanding and resource-intensive AIoT applications can be effectively supported at the network edge by utilizing the innovative paradigm of edge intelligence. To achieve quick processing speed and low latency needed for intelligent IoT applications, edge computing is crucial.

Restraint: Security and compatibility issues

Security is a serious problem, since AIoT platforms require integration and exchange of data across numerous devices and networks. Every vulnerability or breach can have serious repercussions, including data loss, identity theft, and monetary losses. AIoT platforms make use of a range of hardware, software, and standards. This may result in compatibility problems that make it challenging to combine various systems. It may be challenging for enterprises to connect various systems together due to the absence of common standards for AI and IoT technology. This may prevent companies reluctant to invest in non-standard technology from adopting AIoT platforms.

Opportunity: Real-time operational decision-making

IoT devices collect significant amounts of data. AIoT technologies use this data for real-time decision-making. A simple example of this is a security camera system integrated with an alarm. A typical IoT camera would stream video data to a center where security personnel would watch the recording. An AIoT camera can detect trespassers and automatically activate a noise alarm to notify the security team. Thus, AIoT technology moves decision-making from human security personnel to the IoT device, enabling labor savings and improved compliance. For example, an automated system is better than security professionals who could fall asleep in front of the screen.

Challenge: Maintenance and update issues

Enterprises are adopting AI-based IoT solutions for predictive maintenance and enhanced customer experience. The vendors in the market must develop AI in IoT systems considering two important factors, namely maintenance and updates. An AI-based IoT system needs to be updated and maintained as per the changing business requirements to implement technological upgrades. As new components are added, the software also needs to be upgraded. The new system must be integrated with the existing as well as additional software. With an increase in the number of systems, the maintenance cost also increases. Maintaining and upgrading AI-based IoT systems is going to be a challenging task for companies offering solutions without any interruption.

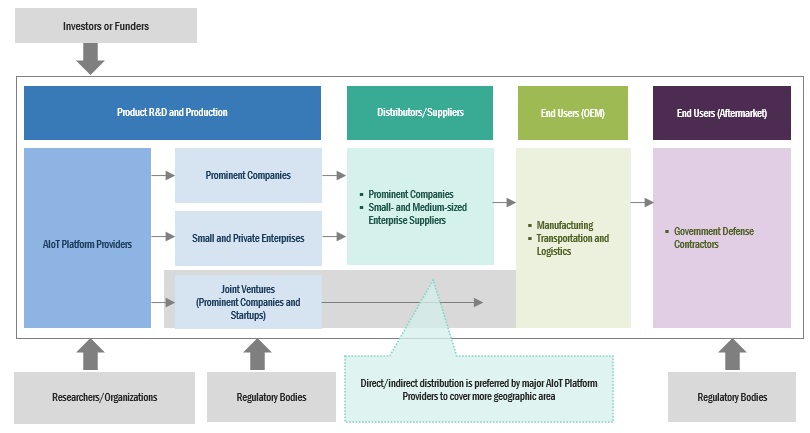

AIoT Platforms Market Ecosystem

Prominent companies in this market include well-established, financially stable provider of AIoT platforms solutions and services. These companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks.

By professional services, Deployment and integration to hold the largest market size during the forecast period

Deployment and integration services are one of the major services as the data generated by AI-enhanced IoT devices needs to be merged with the current systems, necessitating the usage of the appropriate level of connectors and back-end integration abilities. Deployment and integration services begin with collecting customer requirements, and then deploying, integrating, testing, and rolling out the solutions. Many organizations have already deployed various AI-based solutions to manage their workflows and provide ease to their customers and employees. Deployment and integration service providers help these organizations develop a connected environment by integrating IoT devices and AI-based solutions with their existing IT infrastructure. Companies such as OSIsoft and PTC offer deployment and integrations services to organizations in the AIoT market.

By offering, the services segment is expected to register the fastest growth rate during the forecast period.

Factors such as increasing adoption of connected devices across organizations and evolution of high speed networking technologies have encouraged organizations in every industry sector to adopt AIoT solutions. However, the integration of new services and AI-based solutions into a company’s contemporary functioning system or infrastructure forces it to be acquainted with comprehensive detailed insights about services. Additionally, organizations need to have in-depth knowledge about the benefits that the new services would offer to their customers and employees. This knowledge is provided through a specific set of channelized services, offered by AIoT service providers.

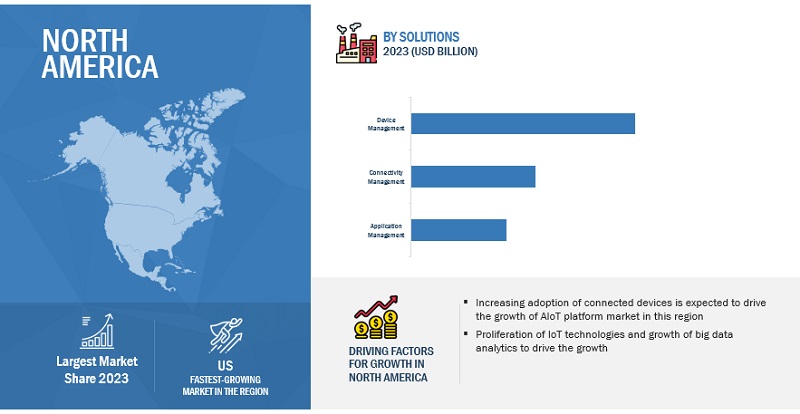

North America is expected to hold the largest market size during the forecast period.

North America being one of the most technologically advanced regions, has frequently set the pace for IoT growth globally. Regarding IoT, the region excels at innovation and developing fresh approaches to common issues. Due to the increasing adoption of AIoT by the manufacturing and automotive industries and the presence of significant solution providers in this region, North America is anticipated to dominate the growth of the global artificial intelligence of things (AIoT) market.

Market Key Players:

The major players in the AIoT platforms market are IBM (US), Sharp Global (Japan), Google (US), AWS (US), Microsoft (US), Oracle (US), HPE (US), Cisco (US), Intel (US), Tencent Cloud (China), NXP (Netherlands), SAS (US), Hitachi (Japan), SAP (Germany), AxiomTek (Taiwan), Autoplant Systems India Pvt. Ltd. (India), Williot (Israel), Cognosos (US), Relayr (US), Terminus Group (China), Semifive (South Korea), Uptake (Chicago), Falkonry (US), and Sightmachine (US). These players have adopted various growth strategies, such as partnerships, agreements and collaborations, new product launches and product enhancements, and acquisitions to expand their footprint in the AIoT platforms market.

Scope of the Report

|

Report Metrics |

Details |

|

Market size available for years |

2017-2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD) Million/Billion |

|

Segments covered |

Offering (Solutions and Services), Verical and Region |

|

Region covered |

North America, Europe, Asia Pacific, Middle East and Africa, and Latin America |

|

Companies covered |

IBM (US), Sharp Global (Japan), Google (US), AWS (US), Microsoft (US), Oracle (US), HPE (US), Cisco (US), Intel (US), Tencent Cloud (China), NXP (Netherlands), SAS (US), Hitachi (Japan), SAP (Germany), AxiomTek (Taiwan), Autoplant Systems India Pvt. Ltd. (India), Williot (Israel), Cognosos (US), Relayr (US), Terminus Group (China), Semifive (South Korea), Uptake (Chicago), Falkonry (US), and Sightmachine (US). |

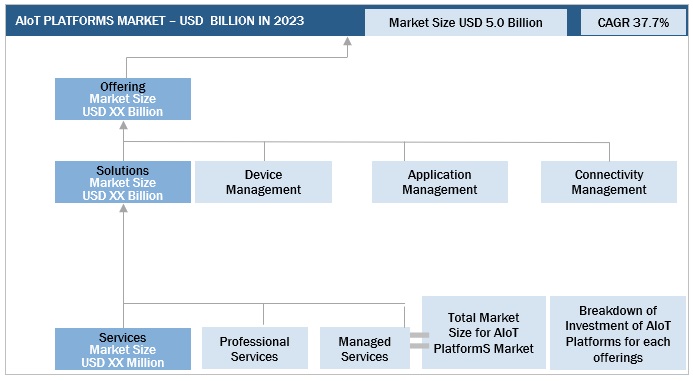

This research report categorizes the AIoT platforms market to forecast revenues and analyze trends in each of the following submarkets:

Based on Offering:

-

Solutions

- Device Management

- Application Managemnet

- Connectivity Management

-

Services

-

Professional Services

- Deployment and Integration

- Support and Maintenance

- Training and Consulting

- Managed Services

-

Professional Services

Based on Vertical:

- BFSI

- Manufacturing

- Healthcare

- Energy & Utilties

- Retail

- Transportation & Logistics

- Other Verticals

By Region:

-

North America

- United States (US)

- Canada

-

Europe

- United Kingdom (UK)

- Germany

- France

- Italy

- Spain

- Nordics

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Australia and New Zealand

- Southeast Asia

- Rest of Asia Pacific

-

Middle East and Africa

-

Middle East

- KSA

- UAE

- Rest of Middle East

-

Africa

- South Africa

- Egypt

- Nigeria

- Rest of Africa

-

Middle East

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments

- In March 2022, Cisco Meraki expanded its IoT portfolio by launching a smart automation button, MT30; a new indoor air quality sensor, MT14; and new MV analytics capabilities. Cisco Meraki addresses smart workspace requirements and the future needs of enterprises to protect places, people, and things.

- In June 2022, Intel collaborated with Vingroup to develop smart city solutions. Intel would explore opportunities for 5G-enabled smart city and smart building solutions, which could be applied to Vinhomes’ smart city projects, and deploy smart factory IoT solutions for VinES batteries manufacturing and VinFast EV manufacturing.

- In July 2021, IBM and Siemens announced a collaboration to integrate Siemens’ MindSphere IoT platform with IBM's Watson AI and Edge computing technologies. The collaboration is aimed at helping businesses improve their industrial operations and make better use of IoT data.

Frequently Asked Questions (FAQ):

What is the definition of AIoT platforms market?

An AIoT platform is a fusion of Artificial Intelligence (AI) technologies and the Internet of Things (IoT) infrastructure. Its purpose is to optimize IoT operations, enhance interactions between humans and machines, and elevate data management and analytics for improved efficiency.

AI is crucial for extracting meaningful insights from the massive amount of data collected by IoT devices. An AIoT platform plays a pivotal role in reducing the data that needs to be transmitted to the cloud and enabling real-time decision-making. By integrating AI and IoT, an AIoT platform enhances the effectiveness and efficiency of both systems, allowing them to work synergistically.

What is the market size of the AIoT platforms market?

The AIoT platforms market is estimated at USD 5.0 billion in 2023 and is projected to reach USD 24.9 billion by 2028, at a CAGR of 37.7% from 2023 to 2028.

What are the major drivers in the AIoT platforms market?

The major drivers in AIoT platforms market are edge-computing-powered artificial intelligence of things, integration of ai-based solutions in iot projects, reduced maintenance cost and downtime

Who are the key players operating in the AIoT platforms market?

The major companies profiled in the AIoT platforms market are A IBM (US), Sharp Global (Japan), Google (US), AWS (US), Microsoft (US), Oracle (US), HPE (US), Cisco (US), Intel (US), Tencent Cloud (China), NXP (Netherlands), SAS (US), Hitachi (Japan), SAP (Germany), AxiomTek (Taiwan), Autoplant Systems India Pvt. Ltd. (India), Williot (Israel), Cognosos (US), Relayr (US), Terminus Group (China), Semifive (South Korea), Uptake (Chicago), Falkonry (US), and Sightmachine (US).

Which are the key technology trends prevailing in AIoT platforms market?

The AIoT platform is heavily reliant on AI. Without AI, the Internet of Things would just be a collection of internet-connected devices that were collecting data. But, artificial intelligence is able to interpret all of this data and transform it into insightful knowledge.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Rising need to develop effective distributed system architectures- High efficiency of AIoT devices- Reduced maintenance costs and downtimeRESTRAINTS- Shortage of skilled workforce in companies requiring expertise in AIoT- Absence of common AI and IoT technology standardsOPPORTUNITIES- Increased adoption of AIoT devices across sectors for real-time decision-making- Growing investments in IoTCHALLENGES- High volume of data generated led to data security and privacy issues- Constant need to update and upgrade AIoT software solutions

-

5.3 INDUSTRY TRENDSCUMULATIVE GROWTH ANALYSISVALUE CHAIN ANALYSISECOSYSTEM ANALYSISPORTER’S FIVE FORCES ANALYSIS- Threat from new entrants- Threat from substitutes- Bargaining power of suppliers- Bargaining power of buyers- Intensity of competitive rivalryKEY STAKEHOLDERS AND BUYING CRITERIA- Key stakeholders in buying process- Buying criteriaTECHNOLOGY ANALYSIS- Introduction- Artificial Intelligence & Internet of Things- Industrial Internet of Things (IIoT)- Autonomous Things (AuT)TRENDS AND DISRUPTIONS IMPACTING BUYERSPATENT ANALYSIS- Methodology- Document type- Innovation and patent applications- Top applicantsPRICING ANALYSISCASE STUDY ANALYSIS- Case study 1: SUEZ improved its production quality control with AI and IoT solutions- Case study 2: US-based global manufacturer of professional factory grade systems used Orion’s AIoT solutions to track system anomalies- Case study 3: Alibaba Cloud’s ET City Brain solution helped city administrators in Hangzhou analyze traffic dataTARIFF AND REGULATORY IMPACT- General Data Protection Regulation- Health Insurance Portability and Accountability Act- Federal Trade Commission- Federal Communications Commission- International Organization for Standardization/International Electrotechnical Commission StandardsEUROPEAN COMMITTEE FOR STANDARDIZATION- CEN/CENELECNATIONAL INSTITUTE OF STANDARDS AND TECHNOLOGYEU EPRIVACY REGULATION

-

6.1 INTRODUCTIONOFFERINGS: AIOT PLATFORMS MARKET DRIVERS

-

6.2 SOLUTIONSDEVICE MANAGEMENT- Growing need for AIoT platforms to manage informationAPPLICATION MANAGEMENT- Increasing adoption of AIoT solutions to design and manage applicationsCONNECTIVITY MANAGEMENT- Growing use of AIoT solutions in managing many IoT devices simultaneously

-

6.3 SERVICESPROFESSIONAL SERVICES- Deployment and integration- Support and maintenance- Training and consultingMANAGED SERVICES- Increased adoption of outsourced managed services in AIoT ecosystem

-

7.1 INTRODUCTIONVERTICALS: AIOT PLATFORMS MARKET DRIVERS

-

7.2 BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI)FRAUD AND RISK MANAGEMENT- Rising adoption of AIoT solutions for handling huge amounts of critical dataINVESTMENT PREDICTION- AI-powered services facilitate effective investment decisionsPAYMENT TRANSACTION SECURITY- Rising use of AIoT to protect sensitive customer dataOTHERS

-

7.3 MANUFACTURINGPREDICTIVE MAINTENANCE- Growing use of AIoT in monitoring machines in manufacturing centersPROCESS OPTIMIZATION- Growing urgency to automate production processes to boost use of AIoTSUPPLY CHAIN MANAGEMENT- Enhanced supply chain management guaranteed through use of AIoT and big data analyticsOTHERS

-

7.4 HEALTHCAREREMOTE PATIENT MONITORING- Growing adoption of AI-infused software for real-time monitoring of patient health conditionsPERSONALIZED TREATMENT- AIoT solutions to help doctors personalize treatmentCLINICAL APPS- Growing need for AIoT services for effective diagnosis and treatmentOTHERS

-

7.5 ENERGY & UTILITIESREAL-TIME ENERGY MONITORING IN RETAIL, RESIDENTIAL, AND COMMERCIAL SPACES- Increasing use of AIoT platforms for real-time energy monitoringSMART GRID MANAGEMENT- Adoption of AIoT solutions to build intelligent utility gridsPOWER USAGE ANALYTICS- AIoT platforms enable organizations in power sector offer personalized customer serviceOTHERS

-

7.6 RETAILSMART STORES- Growing need to enhance customer experience in smart stores to fuel adoption of AI technologyINVENTORY PLANNING- AIoT enables retailers analyze trends and predict salesUPSELLING AND CROSS-CHANNEL MARKETING- Active use of AI technology in promotional activitiesOTHERS

-

7.7 TRANSPORTATION & LOGISTICSCONNECTED VEHICLES- Growing technological advancements in AI and IoT paving way for connected vehiclesFLEET MANAGEMENT- Increasing adoption of AI-infused fleet management systems for personalized driving experienceASSET TRACKING AND PERFORMANCE MANAGEMENT- Growing need for AIoT solutions to reduce operating costs in transportation sectorOTHERS

- 7.8 OTHER VERTICALS

- 8.1 INTRODUCTION

-

8.2 NORTH AMERICANORTH AMERICA: RECESSION IMPACTUS- Rising inclination toward innovation and state-of-the-art infrastructureCANADA- Active funding in research and development by government to drive adoption of AIoT

-

8.3 EUROPERECESSION IMPACT: EUROPEUK- Increasing adoption of AI-powered solutions in healthcare sectorGERMANY- Increased use of AIoT solutions for optimizing industrial systemsFRANCE- Rise in investments by global players to boost country’s technological sectorSPAIN- Growth in initiatives to drive innovations in AIoTITALY- Rising demand for predictive maintenance and need for robust supply chain managementNORDICS- Environmental concerns to drive adoption of AIoT solutionsREST OF EUROPE

-

8.4 ASIA PACIFICRECESSION IMPACT: ASIA PACIFICCHINA- Active involvement of global players in promoting use of AIoTJAPAN- Enterprises to realize opportunities in sensor-to-edge and edge-to-core AIoT platformsINDIA- Extensive deployment of AIoT solutions in farming sectorAUSTRALIA & NEW ZEALAND- Presence of skilled engineers and data scientists with abilities to create cutting-edge AIoT solutionsSOUTHEAST ASIA- Rising need for smart solutions and emphasis on Industry 4.0 projectsREST OF ASIA PACIFIC

-

8.5 MIDDLE EAST & AFRICARECESSION IMPACT: MIDDLE EAST & AFRICAMIDDLE EAST- Increasing investments in data center infrastructures and growth in number of startups- Saudi Arabia- UAE- IsraelAFRICA- Rising collaboration between startups and key players to promote use of AIoT solutions- South AfricaREST OF MIDDLE EAST & AFRICA

-

8.6 LATIN AMERICARECESSION IMPACT: LATIN AMERICABRAZIL- Government initiatives to support growth of AIoTMEXICO- Need for enhanced connectivity in business processesREST OF LATIN AMERICA

- 9.1 OVERVIEW

- 9.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 9.3 MARKET SHARE ANALYSIS

- 9.4 HISTORICAL REVENUE ANALYSIS

- 9.5 MARKET RANKING OF KEY PLAYERS

-

9.6 EVALUATION QUADRANT MATRIX FOR KEY PLAYERS, 2023STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

9.7 EVALUATION QUADRANT MATRIX FOR STARTUPS/SMES, 2023PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 9.8 COMPETITIVE BENCHMARKING

-

9.9 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALS

-

10.1 KEY PLAYERSIBM- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewGOOGLE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewAMAZON WEB SERVICES- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewMICROSOFT- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewORACLE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCISCO- Business overview- Products/Solutions/Services offered- Recent developmentsHITACHI- Business overview- Products/Solutions/Services offered- Recent developmentsINTEL- Business overview- Product/Solutions/Services offered- Recent developmentsHPE- Business overview- Products/Solutions/Services offered- Recent developmentsTENCENT CLOUD- Business overview- Products/Solutions/Services offered

-

10.2 OTHER PLAYERSSHARP GLOBALSAPNXPAXIOMTEKSAS INSTITUTE INC.

-

10.3 STARTUPS/SMESAUTOPLANT SYSTEM INDIA PVT. LTD.WILIOTCOGNOSOSRELAYRTERMINUS GROUPSEMIFIVEUPTAKE TECHNOLOGIES INC.FALKONRYSIGHT MACHINE

-

11.1 INTRODUCTIONLIMITATIONS

-

11.2 INDUSTRIAL IOT MARKETMARKET DEFINITIONMARKET OVERVIEW- Industrial IoT market, by device and technology- Industrial IoT market, by connectivity technology- Industrial IoT market, by software- Industrial IoT market, by vertical- Industrial IoT market, by region

-

11.3 IOT SOLUTIONS AND SERVICES MARKETMARKET DEFINITIONMARKET OVERVIEW- IoT solutions and services market, by component- IoT solutions and services market, by deployment mode- IoT solutions and services market, by organization size- IoT solutions and services market, by focus area- IoT solutions and services market, by region

-

11.4 ARTIFICIAL INTELLIGENCE PLATFORMS MARKETMARKET DEFINITIONMARKET OVERVIEW- Artificial intelligence platforms market, by component- Artificial intelligence platforms market, by deployment mode- Artificial intelligence platforms market, by application- Artificial intelligence platforms market, by end user- Artificial intelligence platforms market, by region

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES, 2020–2022

- TABLE 2 FACTOR ANALYSIS

- TABLE 3 ECOSYSTEM ANALYSIS

- TABLE 4 PORTER’S FIVE FORCES ANALYSIS

- TABLE 5 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS

- TABLE 6 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 7 PATENTS FILED, 2020–2023

- TABLE 8 AVERAGE SELLING PRICING MODEL

- TABLE 9 KEY CONFERENCES & EVENTS, 2022–2023

- TABLE 10 AIOT PLATFORMS MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 11 MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 12 MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 13 MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 14 SOLUTIONS: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 15 SOLUTIONS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 16 DEVICE MANAGEMENT: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 17 DEVICE MANAGEMENT: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 18 APPLICATION MANAGEMENT: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 19 APPLICATION MANAGEMENT: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 20 CONNECTIVITY MANAGEMENT: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 21 CONNECTIVITY MANAGEMENT: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 22 MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 23 AIOT PLATFORMS MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 24 SERVICES: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 25 SERVICES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 26 MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 27 MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 28 PROFESSIONAL SERVICES: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 29 PROFESSIONAL SERVICES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 30 DEPLOYMENT AND INTEGRATION: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 31 DEPLOYMENT AND INTEGRATION: MARKETS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 32 SUPPORT AND MAINTENANCE: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 33 SUPPORT AND MAINTENANCE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 34 TRAINING AND CONSULTING: AIOT PLATFORMS, BY REGION, 2017–2022 (USD MILLION)

- TABLE 35 TRAINING AND CONSULTING: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 36 MANAGED SERVICES: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 37 MANAGED SERVICES: AIOT PLATFORMS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 38 MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 39 MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 40 BFSI: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 41 BFSI: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 42 MANUFACTURING: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 43 MANUFACTURING: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 44 HEALTHCARE: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 45 HEALTHCARE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 46 ENERGY & UTILITIES: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 47 ENERGY & UTILITIES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 48 RETAIL: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 49 RETAIL: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 50 TRANSPORTATION & LOGISTICS: AIOT PLATFORMS MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 51 TRANSPORTATION & LOGISTICS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 52 OTHER VERTICALS: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 53 OTHER VERTICALS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 54 MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 55 MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 56 NORTH AMERICA: AIOT PLATFORMS MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 57 NORTH AMERICA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 58 NORTH AMERICA: MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 59 NORTH AMERICA: MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 60 NORTH AMERICA: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 61 NORTH AMERICA: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 62 NORTH AMERICA: MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 63 NORTH AMERICA: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 64 NORTH AMERICA: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 65 NORTH AMERICA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 66 NORTH AMERICA: MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 67 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 68 US: AIOT PLATFORMS MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 69 US: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 70 US: MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 71 US: MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 72 US: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 73 US: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 74 US: MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 75 US: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 76 US: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 77 US: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 78 EUROPE: AIOT PLATFORMS MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 79 EUROPE: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 80 EUROPE: MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 81 EUROPE: MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 82 EUROPE: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 83 EUROPE: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 84 EUROPE: MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 85 EUROPE: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 86 EUROPE: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 87 EUROPE: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 88 EUROPE: MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 89 EUROPE: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 90 UK: AIOT PLATFORMS MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 91 UK: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 92 UK: MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 93 UK: MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 94 UK: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 95 UK: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 96 UK: MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 97 UK: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 98 UK: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 99 UK: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 100 GERMANY: AIOT PLATFORMS MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 101 GERMANY: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 102 GERMANY: MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 103 GERMANY: MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 104 GERMANY: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 105 GERMANY: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 106 GERMANY: MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 107 GERMANY: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 108 GERMANY: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 109 GERMANY: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 110 ASIA PACIFIC: AIOT PLATFORMS MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 111 ASIA PACIFIC: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 112 ASIA PACIFIC: MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 113 ASIA PACIFIC: MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 114 ASIA PACIFIC: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 115 ASIA PACIFIC: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 116 ASIA PACIFIC: MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 117 ASIA PACIFIC: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 118 ASIA PACIFIC: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 119 ASIA PACIFIC: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 120 ASIA PACIFIC: MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 121 ASIA PACIFIC: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 122 CHINA: AIOT PLATFORMS MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 123 CHINA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 124 CHINA: MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 125 CHINA: MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 126 CHINA: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 127 CHINA: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 128 CHINA: MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 129 CHINA: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 130 CHINA: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 131 CHINA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 132 JAPAN: AIOT PLATFORMS MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 133 JAPAN: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 134 JAPAN: MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 135 JAPAN: MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 136 JAPAN: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 137 JAPAN: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 138 JAPAN: MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 139 JAPAN: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 140 JAPAN: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 141 JAPAN: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 142 INDIA: AIOT PLATFORMS MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 143 INDIA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 144 INDIA: MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 145 INDIA: MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 146 INDIA: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 147 INDIA: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 148 INDIA: MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 149 INDIA: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 150 INDIA: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 151 INDIA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 152 MIDDLE EAST & AFRICA: AIOT PLATFORMS MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 153 MIDDLE EAST & AFRICA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 154 MIDDLE EAST & AFRICA: MARKET, BY SOLUTION, –2022 (USD MILLION)

- TABLE 155 MIDDLE EAST & AFRICA: MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 156 MIDDLE EAST & AFRICA: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 157 MIDDLE EAST & AFRICA: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 158 MIDDLE EAST & AFRICA: MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 159 MIDDLE EAST & AFRICA: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 160 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 161 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 162 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 163 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 164 SAUDI ARABIA: AIOT PLATFORMS MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 165 SAUDI ARABIA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 166 SAUDI ARABIA: MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 167 SAUDI ARABIA: MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 168 SAUDI ARABIA: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 169 SAUDI ARABIA: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 170 SAUDI ARABIA: MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 171 SAUDI ARABIA: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 172 SAUDI ARABIA: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 173 SAUDI ARABIA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 174 SOUTH AFRICA: AIOT PLATFORMS MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 175 SOUTH AFRICA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 176 SOUTH AFRICA: MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 177 SOUTH AFRICA: MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 178 SOUTH AFRICA: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 179 SOUTH AFRICA: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 180 SOUTH AFRICA: MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 181 SOUTH AFRICA: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 182 SOUTH AFRICA: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 183 SOUTH AFRICA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 184 LATIN AMERICA: AIOT PLATFORMS MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 185 LATIN AMERICA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 186 LATIN AMERICA: MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 187 LATIN AMERICA: MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 188 LATIN AMERICA: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 189 LATIN AMERICA: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 190 LATIN AMERICA: MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 191 LATIN AMERICA: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 192 LATIN AMERICA: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 193 LATIN AMERICA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 194 LATIN AMERICA: MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 195 LATIN AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 196 BRAZIL: AIOT PLATFORMS MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 197 BRAZIL: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 198 BRAZIL: MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 199 BRAZIL: MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 200 BRAZIL: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 201 BRAZIL: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 202 BRAZIL: MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 203 BRAZIL: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 204 BRAZIL: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 205 BRAZIL: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 206 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 207 AIOT PLATFORMS MARKET: INTENSITY OF COMPETITIVE RIVALRY

- TABLE 208 PRODUCT FOOTPRINT WEIGHTAGE

- TABLE 209 LIST OF STARTUPS/SMES

- TABLE 210 COMPETITIVE BENCHMARKING FOR STARTUPS/SMES (BY OFFERING, KEY VERTICALS, AND REGION)

- TABLE 211 COMPETITIVE BENCHMARKING FOR KEY PLAYERS (BY OFFERING, KEY VERTICALS, AND REGION)

- TABLE 212 PRODUCT LAUNCHES, 2020–2022

- TABLE 213 DEALS, 2020–2022

- TABLE 214 IBM: BUSINESS OVERVIEW

- TABLE 215 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 216 IBM: PRODUCT LAUNCHES

- TABLE 217 IBM: DEALS

- TABLE 218 GOOGLE: BUSINESS OVERVIEW

- TABLE 219 GOOGLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 220 GOOGLE: PRODUCT LAUNCHES

- TABLE 221 GOOGLE: DEALS

- TABLE 222 AMAZON WEB SERVICES: BUSINESS OVERVIEW

- TABLE 223 AMAZON WEB SERVICES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 224 AMAZON WEB SERVICES: PRODUCT LAUNCHES

- TABLE 225 AMAZON WEB SERVICES: DEALS

- TABLE 226 MICROSOFT: BUSINESS OVERVIEW

- TABLE 227 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 228 MICROSOFT: PRODUCT LAUNCHES

- TABLE 229 MICROSOFT: DEALS

- TABLE 230 ORACLE: BUSINESS OVERVIEW

- TABLE 231 ORACLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 232 ORACLE: DEALS

- TABLE 233 CISCO: BUSINESS OVERVIEW

- TABLE 234 CISCO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 235 CISCO: PRODUCT LAUNCHES

- TABLE 236 CISCO: DEALS

- TABLE 237 HITACHI: BUSINESS OVERVIEW

- TABLE 238 HITACHI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 239 HITACHI: PRODUCT LAUNCHES

- TABLE 240 HITACHI: DEALS

- TABLE 241 HITACHI: OTHERS

- TABLE 242 INTEL: BUSINESS OVERVIEW

- TABLE 243 INTEL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 244 INTEL: PRODUCT LAUNCHES

- TABLE 245 INTEL: DEALS

- TABLE 246 HPE: BUSINESS OVERVIEW

- TABLE 247 HPE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 248 HPE: PRODUCT LAUNCHES

- TABLE 249 HPE: DEALS

- TABLE 250 TENCENT CLOUD: BUSINESS OVERVIEW

- TABLE 251 TENCENT CLOUD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 252 INDUSTRIAL IOT MARKET, BY DEVICE AND TECHNOLOGY, 2017–2020 (USD BILLION)

- TABLE 253 INDUSTRIAL IOT MARKET, BY DEVICE AND TECHNOLOGY, 2021–2026 (USD BILLION)

- TABLE 254 INDUSTRIAL IOT MARKET, BY CONNECTIVITY TECHNOLOGY, 2017–2020 (USD BILLION)

- TABLE 255 INDUSTRIAL IOT MARKET, BY CONNECTIVITY TECHNOLOGY, 2021–2026 (USD BILLION)

- TABLE 256 INDUSTRIAL IOT MARKET, BY SOFTWARE, 2017–2020 (USD BILLION)

- TABLE 257 INDUSTRIAL IOT MARKET, BY SOFTWARE, 2021–2026 (USD BILLION)

- TABLE 258 INDUSTRIAL IOT MARKET, BY VERTICAL, 2017–2020 (USD BILLION)

- TABLE 259 INDUSTRIAL IOT MARKET, BY VERTICAL, 2021–2026 (USD BILLION)

- TABLE 260 INDUSTRIAL IOT MARKET, BY REGION, 2017–2020 (USD BILLION)

- TABLE 261 INDUSTRIAL IOT MARKET, BY REGION, 2021–2026 (USD BILLION)

- TABLE 262 IOT SOLUTIONS AND SERVICES MARKET, BY COMPONENT, 2016–2021 (USD BILLION)

- TABLE 263 IOT SOLUTIONS AND SERVICES MARKET, BY COMPONENT, 2022–2027 (USD BILLION)

- TABLE 264 IOT SOLUTIONS AND SERVICES MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD BILLION)

- TABLE 265 IOT SOLUTIONS AND SERVICES MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD BILLION)

- TABLE 266 IOT SOLUTIONS AND SERVICES MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD BILLION)

- TABLE 267 IOT SOLUTIONS AND SERVICES MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD BILLION)

- TABLE 268 IOT SOLUTIONS AND SERVICES MARKET, BY FOCUS AREA, 2016–2021 (USD BILLION)

- TABLE 269 IOT SOLUTIONS AND SERVICES MARKET, BY FOCUS AREA, 2022–2027 (USD BILLION)

- TABLE 270 IOT SOLUTIONS AND SERVICES MARKET, BY REGION, 2016–2021 (USD BILLION)

- TABLE 271 IOT SOLUTIONS AND SERVICES MARKET, BY REGION, 2022–2027 (USD BILLION)

- TABLE 272 ARTIFICIAL INTELLIGENCE PLATFORMS MARKET, BY COMPONENT, 2015–2022 (USD MILLION)

- TABLE 273 ARTIFICIAL INTELLIGENCE PLATFORMS MARKET, BY TOOL, 2015–2022 (USD MILLION)

- TABLE 274 ARTIFICIAL INTELLIGENCE PLATFORMS MARKET, BY SERVICE, 2015–2022 (USD MILLION)

- TABLE 275 ARTIFICIAL INTELLIGENCE PLATFORMS MARKET, BY DEPLOYMENT MODE, 2015–2022 (USD MILLION)

- TABLE 276 ARTIFICIAL INTELLIGENCE PLATFORMS MARKET, BY APPLICATION, 2015–2022 (USD MILLION)

- TABLE 277 ARTIFICIAL INTELLIGENCE PLATFORMS MARKET, BY END-USER, 2015–2022 (USD MILLION)

- TABLE 278 ARTIFICIAL INTELLIGENCE PLATFORMS MARKET, BY REGION, 2015–2022 (USD MILLION)

- FIGURE 1 RESEARCH DESIGN

- FIGURE 2 RESEARCH METHODOLOGY

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN AND BOTTOM-UP APPROACHES

- FIGURE 4 DATA TRIANGULATION

- FIGURE 5 MARKET, 2023 VS. 2028 (USD MILLION)

- FIGURE 6 AIOT PLATFORMS MARKET, REGIONAL SHARE, 2023

- FIGURE 7 ASIA PACIFIC TO BE LUCRATIVE MARKET FOR INVESTMENTS DURING FORECAST PERIOD

- FIGURE 8 INTEGRATION OF AI-BASED SOLUTIONS IN IOT PROJECTS TO DRIVE MARKET DURING FORECAST PERIOD

- FIGURE 9 SOLUTIONS SEGMENT AND US TO ACCOUNT FOR SIGNIFICANT MARKET SHARE IN 2023

- FIGURE 10 SOLUTIONS SEGMENT AND CHINA TO ACCOUNT FOR SIGNIFICANT MARKET SHARE IN 2023

- FIGURE 11 MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 12 VALUE CHAIN ANALYSIS

- FIGURE 13 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS

- FIGURE 14 KEY BUYING CRITERIA FOR TOP THREE END USERS

- FIGURE 15 REVENUE SHIFT FOR MARKET

- FIGURE 16 NUMBER OF PATENTS GRANTED, 2020–2023

- FIGURE 17 TOP TEN COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS, 2020–2022

- FIGURE 18 SERVICES SEGMENT TO WITNESS HIGHER GROWTH DURING FORECAST PERIOD

- FIGURE 19 APPLICATION MANAGEMENT SEGMENT TO ACHIEVE HIGHEST CAGR BY 2028

- FIGURE 20 MANAGED SERVICES SEGMENT TO ACHIEVE HIGHER GROWTH BY 2028

- FIGURE 21 SUPPORT AND MAINTENANCE SEGMENT TO ACHIEVE HIGHEST CAGR BY 2028

- FIGURE 22 TRANSPORTATION & LOGISTICS SEGMENT TO ACHIEVE HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 23 NORTH AMERICA TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 24 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 25 NORTH AMERICA: AIOT PLATFORMS MARKET SNAPSHOT

- FIGURE 26 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 27 HISTORICAL REVENUE ANALYSIS FOR KEY PLAYERS, 2018–2022 (USD MILLION)

- FIGURE 28 MARKET RANKING OF KEY PLAYERS, 2023

- FIGURE 29 EVALUATION QUADRANT MATRIX FOR KEY PLAYERS: CRITERIA WEIGHTAGE

- FIGURE 30 EVALUATION QUADRANT MATRIX FOR KEY PLAYERS, 2023

- FIGURE 31 EVALUATION QUADRANT MATRIX FOR STARTUPS/SMES: CRITERIA WEIGHTAGE

- FIGURE 32 EVALUATION QUADRANT MATRIX FOR STARTUPS/SMES, 2023

- FIGURE 33 IBM: COMPANY SNAPSHOT

- FIGURE 34 GOOGLE: COMPANY SNAPSHOT

- FIGURE 35 AMAZON WEB SERVICES: COMPANY SNAPSHOT

- FIGURE 36 MICROSOFT: COMPANY SNAPSHOT

- FIGURE 37 ORACLE: COMPANY SNAPSHOT

- FIGURE 38 CISCO: COMPANY SNAPSHOT

- FIGURE 39 HITACHI: COMPANY SNAPSHOT

- FIGURE 40 INTEL: COMPANY SNAPSHOT

- FIGURE 41 HPE: COMPANY SNAPSHOT

This research study involved the use of extensive secondary sources, directories, and databases, such as D&B Hoovers and Bloomberg BusinessWeek, to identify and collect information useful for this technical, market-oriented, and commercial study of the global AIoT platforms market. The primary sources were mainly several industry experts from core and related industries and preferred suppliers, manufacturers, distributors, Service Providers (SPs), technology developers, alliances, and organizations related to all the segments of this industry’s value chain. In-depth interviews were conducted with various primary respondents that included key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants to obtain and verify critical qualitative and quantitative information as well as assess prospects.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information for the study. These included annual reports, press releases, and investor presentations of companies, and white papers, certified publications, and articles from recognized associations and government publishing sources. Several journals and various associations were also referred. Secondary research was mainly used to obtain key information about industry insights, the market’s monetary chain, the overall pool of key players, market classification, and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

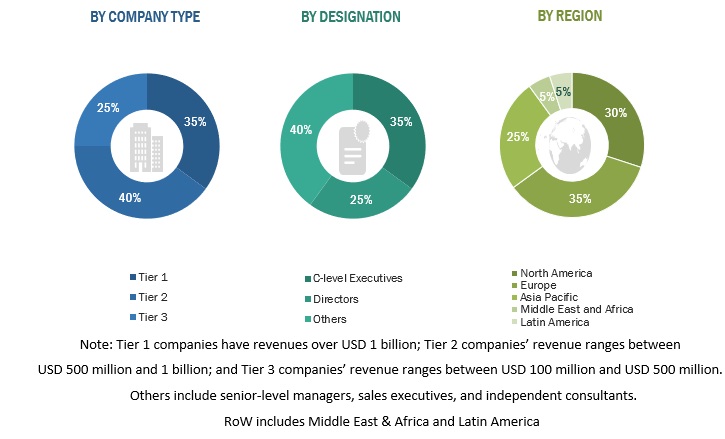

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information for the report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Chief Technology Officers (CTOs), Chief Operating Officers (COOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the AIoT platforms market. The primary sources from the demand side included network administrators/consultants/specialists, Chief Information Officers (CIOs), and subject-matter experts from enterprises and government associations.

The breakup of Primary Research :

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Multiple approaches were adopted for the estimation and forecasting of the AIoT platforms market. The first approach involves estimating the market size by summating companies’ revenue generated through AIoT platforms solutions and services. In this approach for market estimation, we identified the key companies offering AIoT platforms solutions and services by offerings: solutions and services.

Both top-down and bottom-up approaches were used to estimate and validate the total size of the AIoT platforms market. These methods were extensively used to estimate the size of various segments in the market. The research methodology used to estimate the market size includes the following:

- Key players in the market have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

AIoT platforms Market Size: Botton Up Approach

AIoT platforms Market Size: Top Down Approach

Data Triangulation

After arriving at the overall market size, the overall AIoT platforms market was divided into several segments and subsegments. The data triangulation procedures were used to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with data triangulation and market breakdown, the market size was validated by the top-down and bottom-up approaches.

Market Definition

An AIoT platform is a fusion of Artificial Intelligence (AI) technologies and the Internet of Things (IoT) infrastructure. Its purpose is to optimize IoT operations, enhance interactions between humans and machines, and elevate data management and analytics for improved efficiency.

AI is crucial for extracting meaningful insights from the massive amount of data collected by IoT devices. An AIoT platform plays a pivotal role in reducing the data that needs to be transmitted to the cloud and enabling real-time decision-making. By integrating AI and IoT, an AIoT platform enhances the effectiveness and efficiency of both systems, allowing them to work synergistically.

Key Stakeholders

- Senior Management

- Finance/Procurement Department

- R&D Department

- IT Department

Report Objectives

- To determine and forecast the global AIoT platforms market by offering (solutions and services), vertical, and region from 2023 to 2028, and analyze the various macroeconomic and microeconomic factors that affect the market growth.

- To forecast the size of the market segments with respect to five main regions: North America, Europe, Asia Pacific (APAC), Latin America, and the Middle East and Africa (MEA).

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market.

- To analyze each submarket with respect to individual growth trends, prospects, and contributions to the overall market.

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the AIoT platforms market.

- To profile the key market players; provide a comparative analysis on the basis of business overviews, regional presence, product offerings, business strategies, and key financials; and illustrate the competitive landscape of the market.

- To track and analyze competitive developments, such as mergers and acquisitions, product developments, partnerships and collaborations, and Research and Development (R&D) activities, in the market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakup of the Asia Pacific market into countries contributing 75% to the regional market size

- Further breakup of the North American market into countries contributing 75% to the regional market size

- Further breakup of the Latin American market into countries contributing 75% to the regional market size

- Further breakup of the MEA market into countries contributing 75% to the regional market size

- Further breakup of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in AIoT Platforms Market