AI in Telecommunication Market by Technology, Application (Network Optimization, Network Security, Self-diagnostics, Customer Analytics, and Virtual Assistance), Component (Solutions and Services), Deployment Mode, and Region - Global Forecast to 2022

[134 Pages Report] The AI in telecommunication market expected to grow from $235.7 Million in 2016 to reach $2,497.8 Million by 2022, at a Compound Annual Growth Rate (CAGR) of 46.8% during the forecast period. The base year considered for the study is 2016 and the forecast period is 20172022.The increasing adoption of Artificial Intelligence (AI) for various applications in the telecommunication industry and utilization of AI-enabled smartphones are expected to be driving the growth of the market.

The objective of the report is to define, describe, and forecast the size of the AI in telecommunication market on the basis of technologies, applications, components (solutions and services), deployment modes, and regions. The report also aims at providing detailed information about the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges).

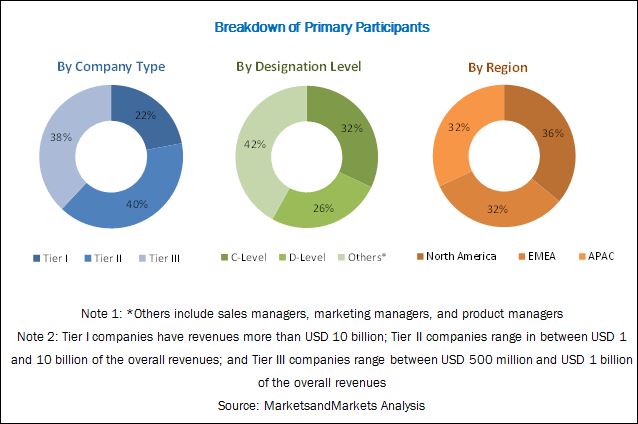

The research methodology used to estimate and forecast the global AI in telecommunication market size began with capturing the data from the key vendor revenues through secondary research, annual reports, government publishing sources, IEEE, Factiva, Bloomberg, and press releases. The vendor offerings were also taken into consideration to determine the market segmentation. The bottom-up procedure was employed to arrive at the overall global AI in telecommunication market size from the revenues of the key market players. After arriving at the overall market size, the total market was split into several segments and subsegments, which were then verified through primary research by conducting extensive interviews with key individuals, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and executives. The data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments. The breakdown of the profiles of the primary participants has been depicted in the figure given below:

To know about the assumptions considered for the study, download the pdf brochure

The AI in telecommunication market includes various AI in telecommunication vendors, such as IBM (US), Microsoft (US), Intel (US), Google (US), AT&T (US), Cisco Systems (US), Nuance Communications (US), Sentient Technologies (US), H2O.ai (US), Infosys (India), Salesforce (US), and NVIDIA (US).

Key Target Audience

- Government agencies

- AI in telecommunication solution/service vendors

- Application developers

- System integrators

- Application end-users

The study answers several questions for the stakeholders, primarily, which market segments to focus on in the next 2 to 5 years for prioritizing efforts and investments.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

20172022 |

|

Base year considered |

2016 |

|

Forecast period |

20172022 |

|

Forecast units |

Billion (USD) |

|

Segments covered |

Technologies, Applications, Components (solutions and services), Deployment Modes, and Regions |

|

Geographies covered |

North America, Europe, APAC, Latin America, and MEA |

|

Companies covered |

IBM (US), Microsoft (US), Intel (US), Google (US), AT&T (US), Cisco Systems (US), Nuance Communications (US), Sentient Technologies (US), H2O.ai (US), Infosys (India), Salesforce (US), and NVIDIA (US) |

The AI in telecommunication market is segmented on the basis of technologies, applications, components (solutions and services), deployment modes, and regions:

AI in Telecommunication Market By Technology

- Machine learning and deep learning

- Natural Language Processing (NLP)

Market By Application

- Customer analytics

- Network security

- Network optimization

- Self-diagnostics

- Virtual assistance

- Others (contact center analytics and marketing campaign analytics)

AI in Telecommunication Market By Component

- Solutions

- Software tools

- Platforms

- Services

- Professional services

- Managed services

Market By Deployment Mode

- Cloud

- On-premises

AI in Telecommunication Market By Region

- North America

- Europe

- Asia Pacific (APAC)

- Middle East and Africa (MEA)

- Latin America

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the companys specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the North American AI in telecommunication market

- Further breakdown of the European market

- Further breakdown of the APAC market

- Further breakdown of the MEA market

- Further breakdown of the Latin American market

Company Information

- Detailed analysis and profiling of additional market players

MarketsandMarkets expects the global Artificial Intelligence (AI) in telecommunication market to grow from USD 365.8 Million in 2017 to USD 2,497.8 Million by 2022, at a Compound Annual Growth Rate (CAGR) of 46.8% during the forecast period. The increasing adoption of AI for various applications in the telecommunication industry and the utilization of AI-enabled smartphones are expected to be driving the growth of the AI in telecommunication market.

Among technologies, the Natural Language Processing (NLP) segment is expected to grow at a higher CAGR during the forecast period. In the telecommunication industry, utilization of the NLP technology is increasing to read the information stored in the digital format and understand the human languages from various data sets.

The component segment has been further segmented into solutions and services. The services segment is expected to grow at a higher CAGR during the forecast period. Growing awareness among telecommunication enterprises regarding the features and benefits of the AI technology in the telecommunication industry, increasing adoption of AI for various applications in the telecommunication industry, and utilization of AI-enabled smartphones are driving the global AI in telecommunication market.

The AI in telecommunication market is segmented on the basis of applications too. The customer analytics application is expected to have the largest market size during the forecast period. In the telecommunication industry, there is an increase in the use of customer analytics applications to analyze the customer data, generated through telecommunication systems, which helps in planning strategies such as sales and marketing campaigns.

The component segment has been segmented into solutions and services. Among services, the professional services segment is expected to grow at a higher CAGR during the forecast period, as these services offer end-to-end effective implementation, starting from requirement gathering to user training.

On the basis of deployment modes, the cloud deployment mode is expected to grow at a higher CAGR during the forecast period. This deployment mode is simple and cost-effective for use in applications, such as customer analytics, virtual assistance, and self-diagnostics.

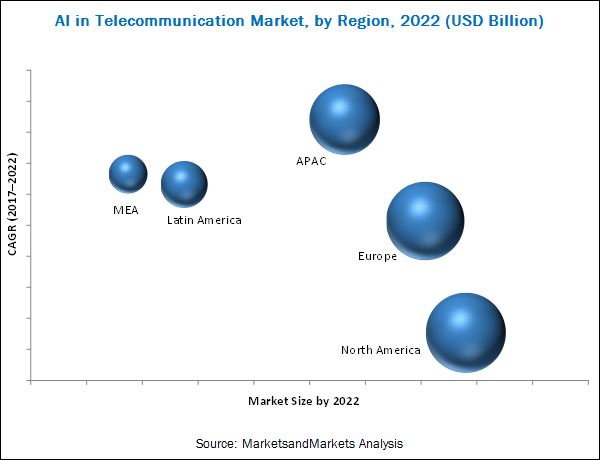

North America is expected to have the largest market size in the AI in telecommunication market, while Asia Pacific (APAC) is projected to grow at the highest CAGR during the forecast period. The North American region has shown increased investments in the market, and several vendors have evolved to cater to the rapidly growing market. A considerable growth is expected in the region during the forecast period. In North America, the AI in telecommunication technology is effectively used for various applications, such as network optimization, network security, customer diagnostics, and virtual assistance.

The AI in telecommunication market faces many challenges; for instance, incompatibility concerns between the AI technology and telecommunication systems, which may generate integration complexities in AI in telecommunication solutions, are expected to act as restraints for the growth of the market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.4 Years Considered for the Study

1.5 Currency

1.6 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakdown of Primaries

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.3 Research Assumptions

2.4 Limitations

3 Executive Summary (Page No. - 22)

4 Premium Insights (Page No. - 27)

4.1 Attractive Opportunities in the AI in Telecommunication Market

4.2 Market Top 3 Applications

4.3 Market Top 3 Applications and Regions

4.4 Market Potential, By Region

4.5 Life Cycle Analysis, By Region

5 AI in Telecommunication Market Overview and Industry Trends (Page No. - 30)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Adoption of AI for Various Applications in the Telecommunication Industry

5.2.1.2 AI Can Be the Key to Self-Driving Telecommunication Networks

5.2.1.3 Increased Need for Monitoring the Content Spread on Telecommunication Networks

5.2.2 Restraints

5.2.2.1 Incompatibility Concerns

5.2.3 Opportunities

5.2.3.1 Cloud-Based AI Offerings in the Telecommunication Industry

5.2.3.2 Utilization of AI-Enabled Smartphones

5.2.4 Challenges

5.2.4.1 Concerns Over the Privacy and Identity of Individuals

5.2.4.2 Insufficient Skills

5.3 Industry Trends

5.3.1 Introduction

5.3.2 AI in Telecommunication Market: Use Cases

5.3.2.1 Use Case: Scenario 1

5.3.2.2 Use Case: Scenario 2

5.3.2.3 Use Case: Scenario 3

5.4 Regulatory Implications

5.4.1 Introduction

5.4.2 General Data Protection Regulation (GDPR)

5.4.3 European Telecommunications Standards Institute (ETSI)

5.4.4 Russian Ministry of Telecommunication

5.4.5 Telecom Regulatory Authority of India (TRAI)

5.4.6 Wireless Application Service Providers Association (WASPA)

5.4.7 Youth Media Protection Treaty

5.4.8 Office of the Telecommunications Authority (OFTA)

6 AI in Telecommunication Market, By Technology (Page No. - 36)

6.1 Introduction

6.2 Machine Learning and Deep Learning

6.3 Natural Language Processing

7 AI in Telecommunication Market By Application (Page No. - 40)

7.1 Introduction

7.2 Customer Analytics

7.3 Network Security

7.4 Network Optimization

7.5 Self-Diagnostics

7.6 Virtual Assistance

7.7 Others

8 AI in Telecommunication Market, By Component (Page No. - 48)

8.1 Introduction

8.2 Solutions

8.2.1 Software Tools

8.2.2 Platforms

8.3 Services

8.3.1 Professional Services

8.3.2 Managed Services

9 AI in Telecommunication Market By Deployment Mode (Page No. - 55)

9.1 Introduction

9.2 Cloud

9.3 On-Premises

10 AI in Telecommunication Market, By Region (Page No. - 59)

10.1 Introduction

10.2 North America

10.2.1 United States

10.2.2 Canada

10.3 Europe

10.3.1 United Kingdom

10.3.2 Germany

10.3.3 Switzerland

10.3.4 Rest of Europe

10.4 Asia Pacific

10.4.1 China

10.4.2 Japan

10.4.3 Rest of APAC

10.5 Latin America

10.5.1 Brazil

10.5.2 Rest of Latin America

10.6 Middle East and Africa

10.6.1 Middle East

10.6.2 Africa

11 Competitive Landscape (Page No. - 86)

11.1 Overview

11.2 Top Players Operating in the AI in Telecommunication Market

11.3 Competitive Situation and Trends

11.3.1 New Product Launches

11.3.2 Agreements, Partnerships, and Collaborations

11.3.3 Acquisitions

11.3.4 Business Expansions

12 Company Profiles (Page No. - 93)

12.1 Introduction

12.2 IBM

(Business Overview, Services Offered, Recent Developments, SWOT Analysis, and MnM View)*

12.3 Microsoft

12.4 Intel

12.5 Google

12.6 AT&T

12.7 Cisco Systems

12.8 Nuance Communications

12.9 Sentient Technologies

12.10 H2O.ai

12.11 Infosys

12.12 Salesforce

12.13 Nvidia

*Details on Business Overview, Services Offered, Recent Developments, SWOT Analysis, and MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 125)

13.1 Industry Excerpts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets Subscription Portal

13.4 Available Customizations

13.5 Related Reports

13.6 Author Details

List of Tables (77 Tables)

Table 1 United States Dollar Exchange Rate, 20142017

Table 2 Global AI in Telecommunication Market Size and Growth Rate, 20152022 (USD Million and Y-O-Y %)

Table 3 Market Size By Technology, 20152022 (USD Million)

Table 4 Machine Learning and Deep Learning: Market Size By Region, 20152022 (USD Million)

Table 5 Natural Language Processing: Market Size By Region, 20152022 (USD Million)

Table 6 AI in Telecommunication Market Size, By Application, 20152022 (USD Million)

Table 7 Customer Analytics: Market Size By Region, 20152022 (USD Million)

Table 8 Network Security: Market Size By Region, 20152022 (USD Million)

Table 9 Network Optimization: Market Size By Region, 20152022 (USD Million)

Table 10 Self-Diagnostics: Market Size, By Region, 20152022 (USD Million)

Table 11 Virtual Assistance: Market Size, By Region, 20152022 (USD Million)

Table 12 Others: Market Size By Region, 20152022 (USD Million)

Table 13 AI in Telecommunication Market Size, By Component, 20152022 (USD Million)

Table 14 Solutions: Market Size By Type, 20152022 (USD Million)

Table 15 Software Tools Market Size, By Region, 20152022 (USD Million)

Table 16 Platforms Market Size, By Region, 20152022 (USD Million)

Table 17 Services: Market Size By Type, 20152022 (USD Million)

Table 18 Professional Services Market Size, By Region, 20152022 (USD Million)

Table 19 Managed Services Market Size, By Region, 20152022 (USD Million)

Table 20 Market Size, By Deployment Mode, 20152022 (USD Million)

Table 21 Cloud: Market Size By Region, 20152022 (USD Million)

Table 22 On-Premises: Market Size By Region, 20152022 (USD Million)

Table 23 AI in Telecommunication Market Size, By Region, 20152022 (USD Million)

Table 24 Internet Users in North America, 20172022 (Million)

Table 25 Mobile Connections in North America, 20172022 (Million)

Table 26 Smartphone Users in North America, 20172022 (Million)

Table 27 North America: Market Size, By Country, 20152022 (USD Million)

Table 28 North America: Market Size By Technology, 20152022 (USD Million)

Table 29 North America: Market Size By Application, 20152022 (USD Million)

Table 30 North America: Market Size By Component, 20152022 (USD Million)

Table 31 North America: Market Size By Solution, 20152022 (USD Million)

Table 32 North America: Market Size By Service, 20152022 (USD Million)

Table 33 North America: Market Size By Deployment Mode, 20152022 (USD Million)

Table 34 Internet Users in Europe, 20172022 (Million)

Table 35 Mobile Connections in Europe, 20172022 (Million)

Table 36 Smartphone Users in Europe, 20172022 (Million)

Table 37 Europe: AI in Telecommunication Market Size, By Country, 20152022 (USD Million)

Table 38 Europe: Market Size By Technology, 20152022 (USD Million)

Table 39 Europe: Market Size By Application, 20152022 (USD Million)

Table 40 Europe: Market Size By Component, 20152022 (USD Million)

Table 41 Europe: Market Size By Solution, 20152022 (USD Million)

Table 42 Europe: Market Size By Service, 20152022 (USD Million)

Table 43 Europe: Market Size By Deployment Mode, 20152022 (USD Million)

Table 44 Internet Users in Asia Pacific, 20172022 (Million)

Table 45 Mobile Connections in Asia Pacific, 20172022 (Million)

Table 46 Smartphone Users in Asia Pacific, 20172022 (Million)

Table 47 Asia Pacific: AI in Telecommunication Market Size, By Country, 20152022 (USD Million)

Table 48 Asia Pacific: Market Size By Technology, 20152022 (USD Million)

Table 49 Asia Pacific: Market Size By Application, 20152022 (USD Million)

Table 50 Asia Pacific: Market Size By Component, 20152022 (USD Million)

Table 51 Asia Pacific: Market Size By Solution, 20152022 (USD Million)

Table 52 Asia Pacific: Market Size By Service, 20152022 (USD Million)

Table 53 Asia Pacific: Market Size By Deployment Mode, 20152022 (USD Million)

Table 54 Internet Users in Latin America, 20172022 (Million)

Table 55 Mobile Connections in Latin America, 20172022 (Million)

Table 56 Smartphone Users in Latin America, 20172022 (Million)

Table 57 Latin America: AI in Telecommunication Market Size, By Country, 20152022 (USD Million)

Table 58 Latin America: Market Size By Technology, 20152022 (USD Million)

Table 59 Latin America: Market Size By Application, 20152022 (USD Million)

Table 60 Latin America: Market Size By Component, 20152022 (USD Million)

Table 61 Latin America: Market Size By Solution, 20152022 (USD Million)

Table 62 Latin America: Market Size By Service, 20152022 (USD Million)

Table 63 Latin America: Market Size By Deployment Mode, 20152022 (USD Million)

Table 64 Internet Users in Middle East and Africa, 20172022 (Million)

Table 65 Smartphone Users in Middle East and Africa, 20172022 (Million)

Table 66 Middle East and Africa: AI in Telecommunication Market Size, By Subregion, 20152022 (USD Million)

Table 67 Middle East and Africa: Market Size By Technology, 20152022 (USD Million)

Table 68 Middle East and Africa: Market Size By Application, 20152022 (USD Million)

Table 69 Middle East and Africa: Market Size By Component, 20152022 (USD Million)

Table 70 Middle East and Africa: Market Size By Solution, 20152022 (USD Million)

Table 71 Middle East and Africa: Market Size By Service, 20152022 (USD Million)

Table 72 Middle East and Africa: Market Size By Deployment Mode, 20152022 (USD Million)

Table 73 Market Ranking for the Market 2017

Table 74 New Product Launches, 20152017

Table 75 Agreements, Partnerships, and Collaborations, 20152017

Table 76 Acquisitions, 20152017

Table 77 Business Expansions, 2015

List of Figures (54 Figures)

Figure 1 AI in Telecommunication Market Segmentation

Figure 2 Regional Scope

Figure 3 Market Research Design

Figure 4 Data Triangulation

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 North America is Estimated to Have the Largest Market Share in 2017

Figure 8 Market Snapshot By Technology, 2017

Figure 9 Market Snapshot By Application, 2017

Figure 10 Market Snapshot By Component, 2017

Figure 11 Market Snapshot By Solution, 2017

Figure 12 Market Snapshot By Service, 2017

Figure 13 Market Snapshot By Deployment Mode, 2017

Figure 14 The Global AI in Telecommunication Market is Expected to Witness Significant Growth During the Forecast Period

Figure 15 Virtual Assistance Application is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 16 Customer Analytics Application and North America are Estimated to Have the Largest Market Shares in the Market in 2017

Figure 17 Asia Pacific is Expected to Register the Highest CAGR During the Forecast Period

Figure 18 Asia Pacific is Expected to Have the Fastest Growth Rate During the Forecast Period

Figure 19 AI in Telecommunication Market: Drivers, Restraints, Opportunities, and Challenges

Figure 20 Global Number of Smartphone Users

Figure 21 Natural Language Processing Technology is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 22 Virtual Assistance Application is Expected to Witness the Highest CAGR During the Forecast Period

Figure 23 Services Component is Expected to Exhibit A Higher CAGR During the Forecast Period

Figure 24 Platforms Segment is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 25 Professional Services Segment is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 26 Cloud Deployment Mode is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 27 North America is Estimated to Have the Largest Market Size in 2017

Figure 28 Asia Pacific is Expected to Register the Highest CAGR During the Forecast Period

Figure 29 North America: Market Snapshot

Figure 30 North America: Market By Application

Figure 31 Europe: Market By Application

Figure 32 Asia Pacific: Market Snapshot

Figure 33 Asia Pacific: Market By Application

Figure 34 Latin America: Market By Application

Figure 35 Middle East and Africa: Market By Application

Figure 36 Key Developments By the Leading Players in the AI in Telecommunication Market During 20142017

Figure 37 Market Evaluation Framework

Figure 38 Geographic Revenue Mix of the Top 5 Market Players

Figure 39 IBM: Company Snapshot

Figure 40 IBM: SWOT Analysis

Figure 41 Microsoft: Company Snapshot

Figure 42 Microsoft: SWOT Analysis

Figure 43 Intel: Company Snapshot

Figure 44 Intel: SWOT Analysis

Figure 45 Google: Company Snapshot

Figure 46 Google: SWOT Analysis

Figure 47 AT&T: Company Snapshot

Figure 48 AT&T: SWOT Analysis

Figure 49 Cisco Systems: Company Snapshot

Figure 50 Cisco Systems: SWOT Analysis

Figure 51 Nuance Communications: Company Snapshot

Figure 52 Infosys: Company Snapshot

Figure 53 Salesforce: Company Snapshot

Figure 54 Nvidia: Company Snapshot

Growth opportunities and latent adjacency in AI in Telecommunication Market

Need insights into Telecom Usage of AI for targeted marketing, customer analytics, price optimization, and personalized product development.

Indepth understanding of the larger deep learning (AI) market share in the telecommunications industry, specifically as it applies to improving the network functionality and spectrum sharing.

Understand the AI application in Telecommunications, and proliferation of the said market in coming years.

Chatbots in telecommunication is the perfect way to provide low cost and robust customer support. Increased customer retention. Connect with Engati here http://s.engati.com/1cg

Indeed. We have been closely tracking various innovations in the telecom sector and chatbots is surely one of them. Our research suggests that that there's lot of disruptions happening specially with AI, Voice-enabled tech coming together in support of customer service, customer retention, and customer experience resulting in higher customer satisfaction levels. Happy to discuss more if'd like. Please feel free reach out to sales@marketsandmarkets.com. Have a great day!

Gather insights into AI in Telecommunication Market by Technology, Application (Network Optimization, Network Security, Self-diagnostics, Customer Analytics, and Virtual Assistance), Component (Solutions and Services), Deployment Mode, and Region and also its Global Forecast to 2022.

Deep understanding of the Artificial intelligence and telecommunication market.