Artificial Intelligence in Agriculture Market Size, Share & Industry Growth Analysis Report by Technology (Machine Learning, Computer Vision, and Predictive Analytics), Offering (Software, AI-as-a-Service), Application (Drone Analytics, Precision Farming) and Region - Global Forecast to 2028

Updated on : October 22, 2024

Artificial Intelligence in Agriculture Market Size & Growth

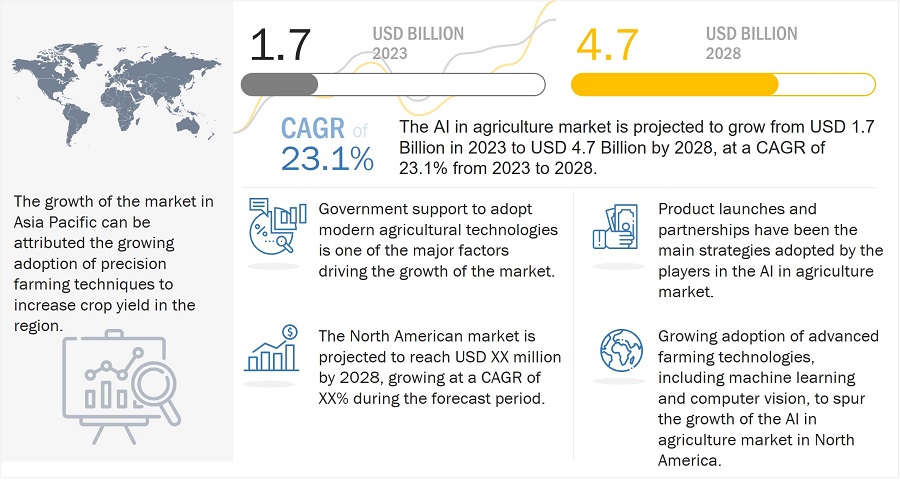

The Artificial Intelligence in Agriculture Market size is projected to grow from USD 1.7 billion in 2023 to USD 4.7 billion by 2028; growing at a Compound Annual Growth Rate (CAGR) of 23.1% from 2023 to 2028.

AI in agriculture offers several advantages to the farmers such as real-time insights from their fields, monitor soil quality, plant health, temperature, automate irrigation, pesticide process- all of which are helping to improve the overall harvest quality and accuracy. AI in agriculture has various applications aimed at optimizing the efficiency of crop production such as precision farming, livestock monitoring, drone analytics, agriculture robots, labor management. Increasing crop productivity through deep learning technology driving the growth of the AI in agriculture market.

The objective of the report is to define, describe, and forecast the artificial intelligence in agriculture market share based on technology, offering, application and region.

Artificial Intelligence in Agriculture Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Artificial Intelligence in Agriculture Market Trends:

Rising need for real-time data by growers and farmers to take preventive measures

Increasing agricultural activities and the growing need for real-time data largely drive the market for AI in agriculture. Real-time data from agricultural farms help make prompt decisions regarding preventive measures. Farmers from North America, South America, and Europe use sensors, drones, guidance technologies, and soil sampling techniques to gather data on soil moisture and nutrient levels across their fields. Farmers and growers from the US, Canada, Brazil, and most Western European countries are turning to high-tech tools for data collection and data analysis. Drone-enabled scouting is one of the most convenient ways of collecting farm data.

Government schemes encouraging adoption of AI solutions to manage small farms

There are over 570 million farms worldwide, and 95% of all these farms are less than 5 hectares in size. AI solutions are predominantly implemented in farms with over 100 hectares of land. This can be attributed to the high initial investment required for implementing AI solutions. Farmers owning lands over 100 hectares generally have the capability to invest in AI-based solutions for farm management and other applications. However, with governments around the world supporting the use of AI for agricultural applications and providing aid to farmers with small farms, there is an opportunity for solution providers to focus on farms with less than 5 hectares of land. For instance, in the US, the Department of Agriculture provides small and mid-size producers with programs that avail farmers with easy loans and improve their technological know-how to use the best technology for farming.

High cost of AI-driven precision farming equipment

The major restraining factor for the AI in agricultural market is the high cost of AI-enabled farming products and solutions, including sensors, software, and robots. Many factors are responsible for the high cost of gathering precise field data. For instance, companies develop AI-powered solutions or platforms according to customer requirements. They offer AI-powered prebuilt and custom-built solutions such as analytics systems, virtual assistants, and chatbots. Similarly, AI features and AI management are also important factors that incur additional costs.

Availability of limited workforce with technological expertise

Artificial intelligence (AI) is a complex system, and for developing, managing, and successfully implementing AI systems, farmers require certain skill sets. For instance, people dealing with AI systems should know about technologies such as cognitive computing, machine learning, deep learning, and image recognition. In addition, the integration of AI solutions in existing systems is a difficult task that requires extensive data processing to replicate the behavior of a human brain. Even a minor error can result in system failure or adversely affect the desired result.

Artificial Intelligence in Agriculture Market Segmentation

Machine learning enabled AI in agriculture contributes largest market share through the forecast period.”

Machine learning-enabled solutions are being significantly adopted by agricultural organizations and farmers worldwide to enhance farm productivity and to gain a competitive edge in business operations. Technological advancement and proliferation in farm data generation are some of the major driving factors for the AI in agriculture market. With the use of machine learning farmers able to capture the factor of soil, seeds quality fertilizer application, environmental variables and irrigation.

AI in agriculture market for software segment is to hold the largest market share through the forecast period.

artificial intelligence in agriculture market share has been segmented based on offerings into hardware, software, AI-as-a-service, and service. Software segment is to hold the largest market share through the forecast period. The software integrated into a computer system is responsible for carrying out complex operations. It synthesizes the data received from the hardware and processes it in the AI system to generate an intelligent response. Furthermore software segment is segmented into AI platform and AI solution. Where in AI platform data is combined with a decision-making algorithm to enable developers to create a business solution.

Precision farming application of AI in agriculture to hold significant share during the forecast period”

The market for precision farming applications was valued at USD 542 million in 2022 and is projected to reach USD 1,432 million by 2028; it is expected to grow at a CAGR of 20.5% during the forecast period. This segment is likely to continue to hold the second-largest market share in the coming years due to the high adoption rate of AI technologies for precision farming applications. Precision farming and automatization in food production are priorities for food growers in the current situation, and AI fuels the gains.

Market for computer vision technology based AI products is expected to grow at highest CAGR during forecasted period.

The AI in agriculture market has been segmented based on technology into machine learning, computer vision, and predictive analytics. Artificial intelligence in agriculture market for computer vision technology based AI products is expected to grow at highest CAGR during forecasted period. This high growth rate is attributed to the rising need for continuous monitoring and analysis of crop health and increasing use of computer vision technology in agricultural applications such as sorting the produce according to weight, color, size, and ripeness and identifying defects in agricultural produce.

Artificial Intelligence in Agriculture Industry Regional Analysis

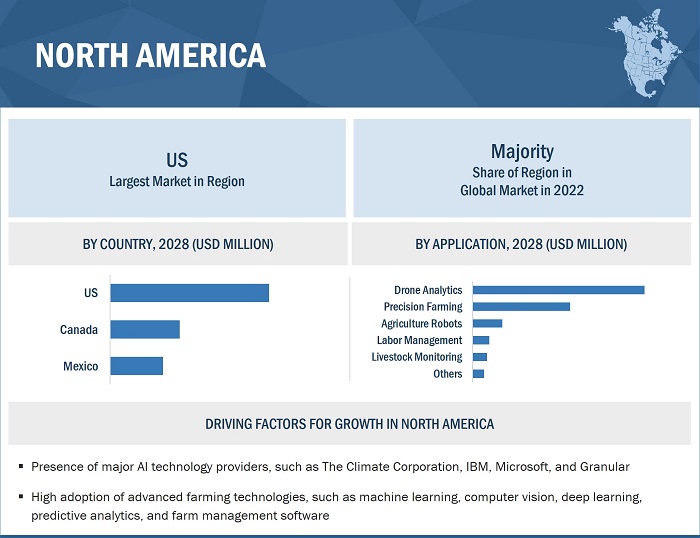

North America is to contribute the largest in the market during the forecast period

The North America held the largest artificial intelligence in agriculture market share during the forecast period. The AI in agriculture industry in this region has been segmented into US, Canada and Mexico. North America has large scale agriculture players in the region are already using AI technology to significantly improve the speed and accuracy of their planting and crop management techniques. The demand for advanced agricultural solutions is expected to drive the growth of the AI in agriculture market in this region.

Artificial Intelligence in Agriculture Market by Region

To know about the assumptions considered for the study, download the pdf brochure

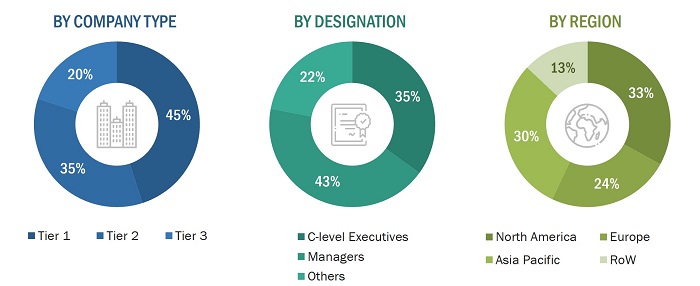

In the process of determining and verifying the market size for several segments and subsegments gathered through secondary research, extensive primary interviews have been conducted with key industry experts in the AI in agriculture market space. The break-up of primary participants for the report has been shown below:

- By Company Type: Tier 1 – 45%, Tier 2 – 35%, and Tier 3 – 20%

- By Designation: C-level Executives – 35%, Directors – 43%, and Others – 22%

- By Region: North America –33%, Asia Pacific– 30%, Europe – 24%, and RoW – 13%

Top Artificial Intelligence in Agriculture Companies - Key Market Players

- Deere & Company (US),

- IBM (US),

- Microsoft (US),

- The Climate Corporation (US),

- Farmers Edge Inc. (Canada),

- Granular Inc. (Canada),

- AgEagle Aerial Syatems Inc. (US),

- Descartes Labs, Inc. (US).

Artificial Intelligence in Agriculture Market Report Scope

|

Report Metric |

Details |

|

Estimated Market Size |

USD 1.7 billion in 2023 |

|

Expected Market Size |

USD 4.7 billion by 2028 |

|

Growth Rate |

CAGR of 23.1% |

|

Market size available for years |

2019—2028 |

|

Base year |

2022 |

|

Forecast period |

2023—2028 |

|

Units |

Value (USD Billion) |

|

Segments covered |

Technology, offering, application, and geography. |

|

Geographic regions covered |

North America, Europe, Asia Pacific, and RoW |

|

Companies covered |

Deere & Company (US), IBM (US), Microsoft (US), The Climate Corporation (US), Farmers Edge Inc. (Canada), Granular Inc. (Canada), AgEagle Aerial Systems Inc. (US), Descartes Labs, Inc. (US) are the major players in the market. |

Artificial Intelligence in Agriculture Market Highlights

This report categorizes the AI in agriculture market share based on technology, offering, application, geography.

|

Segment |

Subsegment |

|

AI in Agriculture Market, by Technology: |

|

|

AI in Agriculture, by Offering: |

|

|

AI in Agriculture Market, by Application: |

|

|

AI in Agriculture Market, by Region: |

|

Recent Developments in Artificial Intelligence in Agriculture Industry

- In May 2022, Alliance for a Green Revolution in Africa (AGRA) and Microsoft announced the expansion of their partnership to advance digital agriculture transformation in Africa to improve food security. The partnership of AGRA with Microsoft will support governments, farmers, and small and medium-sized enterprises (SMEs) to build food systems in the region by using digital tools provided by Microsoft.

- In February 2022, Farmers Edge and Deere & Company (US), a manufacturer of agriculture machinery and heavy equipment, entered into an agreement allowing users of FarmCommand to integrate their data with the John Deer Operations Center account. This will give users the insights to make decisions that drive yields and profits.

- In October 2021, IBM launched the IBM Environment Intelligence Suite, an AI-driven software for environment intelligence that helps companies anticipate the climate risks, such as floods and wildfires, and understand agricultural production and market intelligence by providing weather data, climate risk analytics, and carbon accounting.

- In March 2021, Climate LLC, a Bayer Crop Science Digital arm subsidiary, launched the industry-leading digital farming platform, climate FieldView, in South Africa. Launching the product in the African region helps the farmers manage risk and increase productivity while simplifying their operations actively.

- In January 2020, Descartes Labs launched a cloud-based geospatial data refinery and modeling platform called the Descartes Labs Platform. This platform has improved forecasting abilities in agriculture.

Frequently Asked Questions (FAQ):

Which are the major companies in the artificial intelligence in agriculture market? What are their major strategies to strengthen their market presence?

Deere & Company (US), IBM (US), Microsoft (US), The Climate Corporation (US), Farmers Edge Inc. (Canada), Granular Inc. (Canada), AgEagle Aerial Syatems Inc. (US), Descartes Labs, Inc. (US). These companies have adopted organic as well as inorganic growth strategies such as product launch, innovation in product, and partnerships to gain competitive advantage in the market.

Which is the potential market for AI in agriculture in terms of the region?

Asia Pacific is the region with high growth opportunities owing to the presence of countries such as China, Japan, South Korea, India and Australia. Rising adoption innovative technologies in industries in China, South Korea, Japan and India also facilitate growth to the market.

What are the opportunities for new artificial intelligence in agriculture market entrants?

Development of AI solutions to manage small farms, use of drones to improve farming are creating opportunities for the players in the market.

Which applications are expected to drive the growth of the artificial intelligence in agriculture market in the next six years?

Drone analytics is expected to remain the major application driving significant demand for AI in agriculture market. Ability of drones to capture high-resolution aerial images in a single flight irrespective of farm areas, thereby enabling cost-effective and highly accurate data collection even in overcast conditions has driven the adoption of drones in the agricultural applications.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Adoption of newer technologies in arable land to balance food supply and population increase- Rising need for real-time data by growers and farmers to take preventive measures- Increasing crop productivity through deep learning technology- Government support to adopt modern agricultural techniques- Increasing use of AI-enabled robots and automation in agriculture due to labor shortageRESTRAINTS- High cost of AI-driven precision farming equipmentOPPORTUNITIES- Potential growth opportunities in developing countries- Government schemes encouraging adoption of AI solutions to manage small farms- Rising use of drones to increase farm productivity and profitabilityCHALLENGES- Interoperability issues due to lack of standardization of communication protocols- Availability of limited workforce with technological expertise- Insufficient historical data to build predictive models

- 5.3 VALUE CHAIN ANALYSIS

-

5.4 ECOSYSTEM ANALYSIS

-

5.5 PRICING ANALYSISAVERAGE SELLING PRICE ANALYSIS OF PROCESSOR COMPONENTS OFFERED BY TOP 3 PLAYERS

-

5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

-

5.7 TECHNOLOGY ANALYSISINTERNET OF THINGS (IOT)ROBOTICSBLOCKCHAIN TECHNOLOGYAI-DRIVEN DRONES

-

5.8 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.9 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESS

-

5.10 CASE STUDIES

- 5.11 TRADE ANALYSIS

-

5.12 PATENT ANALYSIS

- 5.13 KEY CONFERENCES AND EVENTS, 2023–2024

-

5.14 REGULATIONS AND STANDARDSSTANDARDSREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

ARTIFICIAL INTELLIGENCE IN AGRICULTURE MARKET, BY TECHNOLOGY

67

- 6.1 INTRODUCTION

-

6.2 MACHINE LEARNINGNEED TO MINIMIZE RISKS AND COSTS ASSOCIATED WITH AGRICULTURAL OPERATIONS TO DRIVE DEMAND FOR MACHINE LEARNING TECHNOLOGY

-

6.3 COMPUTER VISIONUSE OF COMPUTER VISION TECHNOLOGY TO MONITOR CROP HEALTH AND PREDICT NUTRIENT DEFICIENCY TO PROVIDE OPPORTUNITIES FOR MARKET PLAYERS

-

6.4 PREDICTIVE ANALYTICSADOPTION OF PREDICTIVE ANALYTICS TECHNOLOGY TO MAKE AGRONOMIC DECISIONS TO DRIVE MARKET

- 7.1 INTRODUCTION

-

7.2 HARDWAREAVAILABILITY OF HIGH-TECH TOOLKITS FOR AGRICULTURAL APPLICATIONS TO BOOST MARKETPROCESSOR- Need for highly advanced processors to run complex algorithms and translate them into useful informationSTORAGE DEVICE- Requirement for high-capacity storage devices to store critical data generated through sensors and dronesNETWORK- Network systems include RAMs, memory boards, Ethernet adaptors, and interconnects

-

7.3 SOFTWAREINSTALLATION OF SOFTWARE TO SYNTHESIZE DATA HELPFUL IN MAKING PROMPT DECISIONS TO DRIVE DEMANDAI PLATFORM- Adoption of AI platforms to fetch and store data from different sources to create consolidated data environmentAI SOLUTION- Commercialization of robust AI solutions by Alphabet, Siemens, Data RPM, and other players to contribute to segmental growth

-

7.4 AI-AS-A-SERVICEINCLINATION TOWARD IMPLEMENTING EFFICIENT FARMING METHODS TO REDUCE WASTAGE AND INCREASE CROP YIELD TO DRIVE DEMAND FOR AIAAS

-

7.5 SERVICESINCREASING REQUIREMENT FOR ONLINE AND OFFLINE SUPPORT SERVICES TO BOOST SEGMENTAL GROWTHDEPLOYMENT & INTEGRATION- Rising adoption of software-integrated on-premises and cloud-based platforms by modern farmers to accelerate demand for deployment & integration servicesSUPPORT & MAINTENANCE- Post-installation requirement to address operations-related issues to drive demand for support & maintenance services

- 8.1 INTRODUCTION

-

8.2 PRECISION FARMINGFARMERS’ FOCUS ON INCREASING CROP YIELDS USING LIMITED RESOURCES TO INCREASE DEMAND FOR AI IN PRECISION FARMINGYIELD MONITORING- Integration of advanced sensors into yield monitoring solutions to track moisture and nutrient levels in soilFIELD MAPPING- Adoption of AI-powered field mapping tools to record field boundaries and calculate surface areaCROP SCOUTING- Implementation of AI-enabled crop scouting tools to examine crop conditions and gain information on pests and crop injuriesWEATHER TRACKING & FORECASTING- Use of weather tracking and forecasting tools to gather information and predict weather conditionsIRRIGATION MANAGEMENT- Implementation of AI-based irrigation systems to achieve optimal yield and water conservation

-

8.3 LIVESTOCK MONITORINGINCORPORATION OF AI IN FEEDING AND HEAT STRESS MANAGEMENT SOLUTIONS AND MILKING ROBOTS TO FUEL MARKET GROWTH

-

8.4 DRONE ANALYTICSUSE OF AI-POWERED DRONES TO IDENTIFY INSECTS AND DISEASES AFFLICTING CROPS TO ACCELERATE MARKET GROWTH

-

8.5 AGRICULTURE ROBOTSINCREASED DEEP LEARNING CAPABILITIES OF AGRICULTURE ROBOTS TO CONTRIBUTE TO MARKET GROWTH

-

8.6 LABOR MANAGEMENTREDUCTION IN PRODUCTION COSTS THROUGH LABOR MANAGEMENT SOFTWARE TO STIMULATE MARKET GROWTH

-

8.7 OTHERSSMART GREENHOUSE MANAGEMENTSOIL MANAGEMENT- Moisture monitoring- Nutrient monitoringFISH FARMING MANAGEMENT

- 9.1 INTRODUCTION

-

9.2 NORTH AMERICAUS- Presence of giant companies offering AI-powered solutions and services to boost market growthCANADA- Federal investments and favorable regulatory environment framework to propel marketMEXICO- Limited water resources to accelerate demand for AI in agriculture sector

-

9.3 EUROPEUK- Investments by government in high-tech farming projects to stimulate market growthGERMANY- High adoption of agricultural drones to monitor crops to propel market growthFRANCE- Focus of startup companies on development of advanced technologies for agriculture sector to support market growthITALY- Limited water resources to encourage use of AI in agriculture sectorSPAIN- Government-run pilot projects encouraging adoption of AI in agriculture to boost market growthREST OF EUROPE

-

9.4 ASIA PACIFICAUSTRALIA- Government support in agricultural development to promote market growthCHINA- Inclination toward precision farming techniques to create opportunities for AI technology providersJAPAN- Rise in urban farming practices to fuel growth of AI in agriculture marketSOUTH KOREA- Government funding and initiatives to develop smart farming technologies to support market growthINDIA- Digital transformation of Indian agriculture sector to provide opportunities for AI technology providersREST OF ASIA PACIFIC

-

9.5 REST OF THE WORLDMIDDLE EAST & AFRICA- Increasing adoption of remote sensing and precision farming technologies to boost marketSOUTH AMERICA- Growing adoption of modern farming practices to drive market

- 10.1 OVERVIEW

- 10.2 COMPANY REVENUE ANALYSIS, 2017–2021

- 10.3 MARKET SHARE ANALYSIS, 2022

-

10.4 COMPANY EVALUATION QUADRANTSTARSPERVASIVE PLAYERSEMERGING LEADERSPARTICIPANTS

- 10.5 COMPANY FOOTPRINT

-

10.6 SMES EVALUATION QUADRANTPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 10.7 SMES EVALUATION MATRIX

-

10.8 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALS

-

11.1 KEY PLAYERSIBM- Business overview- Products offered- Recent developments- MnM viewDEERE & COMPANY- Business overview- Products offered- Recent developments- MnM viewMICROSOFT- Business overview- Products offered- Recent developments- MnM viewTHE CLIMATE CORPORATION- Business overview- Products offered- Recent developments- MnM viewFARMERS EDGE INC.- Business overview- Products offered- Recent developments- MnM viewGRANULAR INC.- Business overview- Products offeredAGEAGLE AERIAL SYSTEMS INC.- Business overview- Products offered- Recent developmentsDESCARTES LABS, INC.- Business overview- Products offered- Recent developmentsPROSPERA TECHNOLOGIES, INC.- Business overview- Products offered- Recent developmentsTARANIS- Business overview- Products offered- Recent developmentsCROPIN TECHNOLOGY SOLUTIONS PRIVATE LIMITED- Business overview- Products offered- Recent developments

-

11.2 OTHER KEY COMPANIESGAMAYAEC2CEPRECISION HAWKVINEVIEWEVER.AGTULE TECHNOLOGIESRESSON AEROSPACE INC.CONNECTERRA B.V.VISION ROBOTICS CORPORATIONFARMBOTHARVEST CROO ROBOTICS LLCPROGRESSIVE ENVIRONMENTAL & AGRICULTURAL TECHNOLOGIES (PEAT)TRACE GENOMICSCROPX INC.

- 12.1 INTRODUCTION

- 12.2 STUDY LIMITATIONS

-

12.3 PRECISION FARMING MARKET, BY TECHNOLOGYGUIDANCE TECHNOLOGY- GPS/GNSS-based guidance technology- GIS-based guidance technologyREMOTE SENSING TECHNOLOGY- Handheld or ground-based sensing- Satellite or aerial sensingVARIABLE RATE TECHNOLOGY (VRT)- MAP-based VRT- Sensor-based VRT

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 PARAMETERS CONSIDERED TO ANALYZE IMPACT OF RECESSION ON AI IN AGRICULTURE MARKET

- TABLE 2 ECOSYSTEM MAPPING

- TABLE 3 INDICATIVE PRICING ANALYSIS OF AI PRODUCTS OFFERED BY KEY COMPANIES

- TABLE 4 ASP RANGE OF PROCESSOR COMPONENTS, 2019–2028

- TABLE 5 ASP RANGE OF PROCESSOR, BY REGION, 2019–2028 (USD)

- TABLE 6 AI IN AGRICULTURE MARKET: PORTER’S FIVE FORCES ANALYSIS, 2022

- TABLE 7 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS (%)

- TABLE 8 E&J GALLO (US) ADOPTED IBM CLOUD TO INCREASE YIELDS AND REDUCE WATER USAGE

- TABLE 9 BUNGE (US) IMPLEMENTED IBM PAIRS TO GAIN DATA AND COMPUTING POWER TO BUILD ADVANCED STATISTICAL MODELS

- TABLE 10 AGROPECUÁRIA CANOA MIRIM S/A (BRAZIL) DEPLOYED VARIABLE RATE TECHNOLOGY OFFERED BY FARMERS EDGE TO ENSURE ACCURATE QUANTITY OF FERTILIZERS

- TABLE 11 TOP 12 PATENT OWNERS IN LAST 10 YEARS

- TABLE 12 IMPORTANT PATENTS RELATED TO AI IN AGRICULTURE MARKET

- TABLE 13 MARKET: CONFERENCES AND EVENTS, 2023–2024

- TABLE 14 STANDARDS FOR ARTIFICIAL INTELLIGENCE IN AGRICULTURE MARKET

- TABLE 15 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 AI IN AGRICULTURE MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 19 ARTIFICIAL INTELLIGENCE IN AGRICULTURE MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 20 MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 21 MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 22 HARDWARE: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 23 HARDWARE: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 24 SOFTWARE: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 25 SOFTWARE: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 26 SERVICES: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 27 SERVICES: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 28 AI IN AGRICULTURE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 29 ARTIFICIAL INTELLIGENCE IN AGRICULTURE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 30 PRECISION FARMING: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 31 PRECISION FARMING: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 32 PRECISION FARMING: MARKET, BY REGION 2019–2022 (USD MILLION)

- TABLE 33 PRECISION FARMING: MARKET, BY REGION 2023–2028 (USD MILLION)

- TABLE 34 PRECISION FARMING: MARKET IN NORTH AMERICA, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 35 PRECISION FARMING: MARKET IN NORTH AMERICA, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 36 PRECISION FARMING: MARKET IN EUROPE, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 37 PRECISION FARMING: MARKET IN EUROPE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 38 PRECISION FARMING: MARKET IN ASIA PACIFIC, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 39 PRECISION FARMING: MARKET IN ASIA PACIFIC, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 40 PRECISION FARMING: MARKET IN ROW, BY REGION, 2019–2022 (USD MILLION)

- TABLE 41 PRECISION FARMING: MARKET IN ROW, BY REGION, 2023–2028 (USD MILLION)

- TABLE 42 LIVESTOCK MONITORING: AI IN AGRICULTURE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 43 LIVESTOCK MONITORING: ARTIFICIAL INTELLIGENCE IN AGRICULTURE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 44 LIVESTOCK MONITORING: MARKET IN NORTH AMERICA, BY COUNTRY, 2019–2022, (USD MILLION)

- TABLE 45 LIVESTOCK MONITORING: MARKET IN NORTH AMERICA, BY COUNTRY, 2023–2028, (USD MILLION)

- TABLE 46 LIVESTOCK MONITORING: MARKET IN EUROPE, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 47 LIVESTOCK MONITORING: MARKET IN EUROPE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 48 LIVESTOCK MONITORING: MARKET IN ASIA PACIFIC, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 49 LIVESTOCK MONITORING: MARKET IN ASIA PACIFIC, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 50 LIVESTOCK MONITORING: MARKET IN ROW, BY REGION, 2019–2022 (USD MILLION)

- TABLE 51 LIVESTOCK MONITORING: MARKET IN ROW, BY REGION, 2023–2028 (USD MILLION)

- TABLE 52 DRONE ANALYTICS: AI IN AGRICULTURE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 53 DRONE ANALYTICS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 54 DRONE ANALYTICS: MARKET IN NORTH AMERICA, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 55 DRONE ANALYTICS: MARKET IN NORTH AMERICA, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 56 DRONE ANALYTICS: MARKET IN EUROPE, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 57 DRONE ANALYTICS: MARKET IN EUROPE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 58 DRONE ANALYTICS: MARKET IN ASIA PACIFIC, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 59 DRONE ANALYTICS: MARKET IN ASIA PACIFIC, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 60 DRONE ANALYTICS: MARKET IN ROW, BY REGION, 2019–2022 (USD MILLION)

- TABLE 61 DRONE ANALYTICS: MARKET IN ROW, BY REGION, 2023–2028 (USD MILLION)

- TABLE 62 AGRICULTURE ROBOTS: AI IN AGRICULTURE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 63 AGRICULTURE ROBOTS: ARTIFICIAL INTELLIGENCE IN AGRICULTURE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 64 AGRICULTURE ROBOTS: MARKET IN NORTH AMERICA, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 65 AGRICULTURE ROBOTS: MARKET IN NORTH AMERICA, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 66 AGRICULTURE ROBOTS: MARKET IN EUROPE, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 67 AGRICULTURE ROBOTS: MARKET IN EUROPE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 68 AGRICULTURE ROBOTS: MARKET IN ASIA PACIFIC, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 69 AGRICULTURE ROBOTS: MARKET IN ASIA PACIFIC, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 70 AGRICULTURE ROBOTS: MARKET IN ROW, BY REGION, 2019–2022 (USD MILLION)

- TABLE 71 AGRICULTURE ROBOTS: MARKET IN ROW, BY REGION, 2023–2028 (USD MILLION)

- TABLE 72 LABOR MANAGEMENT: AI IN AGRICULTURE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 73 LABOR MANAGEMENT: ARTIFICIAL INTELLIGENCE IN AGRICULTURE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 74 LABOR MANAGEMENT: MARKET IN NORTH AMERICA, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 75 LABOR MANAGEMENT: MARKET IN NORTH AMERICA, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 76 LABOR MANAGEMENT: MARKET IN EUROPE, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 77 LABOR MANAGEMENT: MARKET IN EUROPE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 78 LABOR MANAGEMENT: MARKET IN ASIA PACIFIC, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 79 LABOR MANAGEMENT: MARKET IN ASIA PACIFIC, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 80 LABOR MANAGEMENT: MARKET IN ROW, BY REGION, 2019–2022 (USD MILLION)

- TABLE 81 LABOR MANAGEMENT: MARKET IN ROW, BY REGION, 2023–2028 (USD MILLION)

- TABLE 82 OTHERS: AI IN AGRICULTURE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 83 OTHERS: ARTIFICIAL INTELLIGENCE IN AGRICULTURE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 84 OTHERS: MARKET IN NORTH AMERICA, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 85 OTHERS: MARKET IN NORTH AMERICA, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 86 OTHERS: MARKET IN EUROPE, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 87 OTHERS: MARKET IN EUROPE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 88 OTHERS: MARKET IN ASIA PACIFIC, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 89 OTHERS: MARKET IN ASIA PACIFIC, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 90 OTHERS: MARKET IN ROW, BY REGION, 2019–2022 (USD MILLION)

- TABLE 91 OTHERS: MARKET IN ROW, BY REGION, 2023–2028 (USD MILLION)

- TABLE 92 AI IN AGRICULTURE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 93 MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 94 NORTH AMERICA: ARTIFICIAL INTELLIGENCE IN AGRICULTURE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 95 NORTH AMERICA: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 96 NORTH AMERICA: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 97 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 98 EUROPE: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 99 EUROPE: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 100 EUROPE: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 101 EUROPE: AI IN AGRICULTURE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 102 ASIA PACIFIC: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 103 ASIA PACIFIC: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 104 ASIA PACIFIC: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 105 ASIA PACIFIC: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 106 ROW: ARTIFICIAL INTELLIGENCE IN AGRICULTURE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 107 ROW: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 108 ROW: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 109 ROW: AI IN AGRICULTURE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 110 DEGREE OF COMPETITION

- TABLE 111 FOOTPRINTS OF COMPANIES

- TABLE 112 APPLICATION FOOTPRINT OF COMPANIES

- TABLE 113 REGION FOOTPRINT OF COMPANIES

- TABLE 114 DETAILED LIST OF KEY SMES

- TABLE 115 COMPETITIVE BENCHMARKING OF KEY SMES

- TABLE 116 PRODUCT LAUNCHES, 2020–2022

- TABLE 117 DEALS, 2020–2022

- TABLE 118 IBM: COMPANY OVERVIEW

- TABLE 119 IBM: PRODUCTS OFFERED

- TABLE 120 IBM: PRODUCT LAUNCHES

- TABLE 121 IBM: DEALS

- TABLE 122 DEERE & COMPANY: COMPANY OVERVIEW

- TABLE 123 DEERE & COMPANY: PRODUCTS OFFERED

- TABLE 124 DEERE & COMPANY: DEALS

- TABLE 125 MICROSOFT: COMPANY OVERVIEW

- TABLE 126 MICROSOFT: PRODUCTS OFFERED

- TABLE 127 MICROSOFT: DEALS

- TABLE 128 THE CLIMATE CORPORATION: COMPANY OVERVIEW

- TABLE 129 THE CLIMATE CORPORATION: PRODUCTS OFFERED

- TABLE 130 THE CLIMATE CORPORATION: PRODUCT LAUNCHES

- TABLE 131 THE CLIMATE CORPORATION: DEALS

- TABLE 132 FARMERS EDGE INC.: COMPANY OVERVIEW

- TABLE 133 FARMERS EDGE INC.: PRODUCTS OFFERED

- TABLE 134 FARMERS EDGE INC.: DEALS

- TABLE 135 FARMERS EDGE INC.: OTHERS

- TABLE 136 GRANULAR INC.: COMPANY OVERVIEW

- TABLE 137 GRANULAR INC.: PRODUCTS OFFERED

- TABLE 138 AGEAGLE AERIAL SYSTEMS INC.: COMPANY OVERVIEW

- TABLE 139 AGEAGLE AERIAL SYSTEMS INC.: PRODUCTS OFFERED

- TABLE 140 AGEAGLE AERIAL SYSTEMS INC.: OTHERS

- TABLE 141 DESCARTES LABS, INC.: COMPANY OVERVIEW

- TABLE 142 DESCARTES LABS, INC.: PRODUCTS OFFERED

- TABLE 143 DESCARTES LABS, INC.: PRODUCT LAUNCHES

- TABLE 144 PROSPERA TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 145 PROSPERA TECHNOLOGIES, INC.: PRODUCTS OFFERED

- TABLE 146 PROSPERA TECHNOLOGIES, INC.: OTHERS

- TABLE 147 TARANIS: COMPANY OVERVIEW

- TABLE 148 TARANIS: PRODUCTS OFFERED

- TABLE 149 TARANIS: DEALS

- TABLE 150 TARANIS: OTHERS

- TABLE 151 CROPIN TECHNOLOGY SOLUTIONS PRIVATE LIMITED: COMPANY OVERVIEW

- TABLE 152 CROPIN TECHNOLOGY SOLUTIONS PRIVATE LIMITED: PRODUCTS OFFERED

- TABLE 153 CROPIN TECHNOLOGY SOLUTIONS PRIVATE LIMITED: PRODUCT LAUNCHES

- TABLE 154 CROPIN TECHNOLOGY SOLUTIONS PRIVATE LIMITED: DEALS

- TABLE 155 CROPIN TECHNOLOGY SOLUTIONS PRIVATE LIMITED: OTHERS

- TABLE 156 PRECISION FARMING MARKET, BY TECHNOLOGY TYPE, 2018–2021 (USD MILLION)

- TABLE 157 PRECISION FARMING MARKET, BY TECHNOLOGY TYPE, 2022–2030 (USD MILLION)

- FIGURE 1 SEGMENTATION OF AI IN AGRICULTURE MARKET

- FIGURE 2 ARTIFICIAL INTELLIGENCE IN AGRICULTURE MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 6 DATA TRIANGULATION

- FIGURE 7 RESEARCH STUDY ASSUMPTIONS

- FIGURE 8 MACHINE LEARNING TECHNOLOGY TO ACCOUNT FOR LARGEST SHARE OF AI IN AGRICULTURE MARKET IN 2028

- FIGURE 9 SOFTWARE OFFERINGS TO HOLD LARGEST MARKET SHARE THROUGHOUT FORECAST PERIOD

- FIGURE 10 DRONE ANALYTICS APPLICATION TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 11 NORTH AMERICA ACCOUNTED FOR LARGEST SHARE OF ARTIFICIAL INTELLIGENCE IN AGRICULTURE MARKET IN 2022

- FIGURE 12 GDP GROWTH PROJECTION TILL 2023 FOR MAJOR ECONOMIES (PERCENTAGE CHANGE)

- FIGURE 13 AI IN AGRICULTURE MARKET: PRE- AND POST-RECESSION SCENARIOS

- FIGURE 14 RISING USE OF DRONES TO INCREASE FARM PRODUCTIVITY AND PROFITABILITY TO PROVIDE OPPORTUNITIES FOR PLAYERS OFFERING AI-POWERED SOLUTIONS

- FIGURE 15 COMPUTER VISION TECHNOLOGY TO REGISTER HIGHEST CAGR IN MARKET BETWEEN 2023 AND 2028

- FIGURE 16 US AND DRONE ANALYTICS TO ACCOUNT FOR LARGEST SHARE OF MARKET IN NORTH AMERICA IN 2028

- FIGURE 17 ASIA PACIFIC TO RECORD HIGHEST CAGR IN MARKET DURING FORECAST PERIOD

- FIGURE 18 ARTIFICIAL INTELLIGENCE IN AGRICULTURE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 19 VOLUME OF DATA GENERATED PER DAY BY IOT-CONNECTED FARMS GLOBALLY

- FIGURE 20 VALUE CHAIN ANALYSIS FOR MARKET

- FIGURE 21 AI IN AGRICULTURE MARKET: ECOSYSTEM ANALYSIS

- FIGURE 22 AVERAGE SELLING PRICE OF PROCESSOR COMPONENTS

- FIGURE 23 AVERAGE SELLING PRICE OF PROCESSORS OFFERED BY TOP 3 COMPANIES

- FIGURE 24 REVENUE SHIFT AND NEW REVENUE POCKETS FOR PLAYERS IN MARKET

- FIGURE 25 PORTER’S FIVE FORCES ANALYSIS: AI IN AGRICULTURE MARKET

- FIGURE 26 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS

- FIGURE 27 EXPORT DATA FOR PRODUCTS COVERED UNDER HS CODE 8432, 2017–2021 (USD MILLION)

- FIGURE 28 IMPORT DATA FOR PRODUCTS COVERED UNDER HS CODE 8432, 2017–2021 (USD MILLION)

- FIGURE 29 NUMBER OF PATENTS GRANTED FROM 2013 TO 2022

- FIGURE 30 TOP 10 PATENT APPLICANT COMPANIES IN LAST 10 YEARS

- FIGURE 31 COMPUTER VISION TECHNOLOGY TO REGISTER HIGHEST CAGR IN AI IN AGRICULTURE MARKET BETWEEN 2023 AND 2028

- FIGURE 32 AI-AS-A-SERVICE SEGMENT TO EXHIBIT HIGHEST CAGR BETWEEN 2023 AND 2028

- FIGURE 33 DRONE ANALYTICS SEGMENT TO RECORD HIGHEST CAGR IN ARTIFICIAL INTELLIGENCE IN AGRICULTURE MARKET, BY APPLICATION, DURING FORECAST PERIOD

- FIGURE 34 ASIA PACIFIC COUNTRIES TO BE PROSPECTIVE MARKETS FOR AI IN AGRICULTURE DURING FORECAST PERIOD

- FIGURE 35 NORTH AMERICA: AI IN AGRICULTURE MARKET SNAPSHOT

- FIGURE 36 EUROPE: MARKET SNAPSHOT

- FIGURE 37 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 38 FIVE-YEAR REVENUE ANALYSIS OF KEY PLAYERS, 2017–2021

- FIGURE 39 SHARE OF MAJOR PLAYERS IN ARTIFICIAL INTELLIGENCE IN AGRICULTURE MARKET, 2022

- FIGURE 40 COMPANY EVALUATION QUADRANT, 2022

- FIGURE 41 SMES EVALUATION QUADRANT, 2022

- FIGURE 42 IBM: COMPANY SNAPSHOT

- FIGURE 43 DEERE & COMPANY: COMPANY SNAPSHOT

- FIGURE 44 MICROSOFT: COMPANY SNAPSHOT

- FIGURE 45 FARMERS EDGE INC.: COMPANY SNAPSHOT

- FIGURE 46 AGEAGLE AERIAL SYSTEMS INC.: COMPANY SNAPSHOT

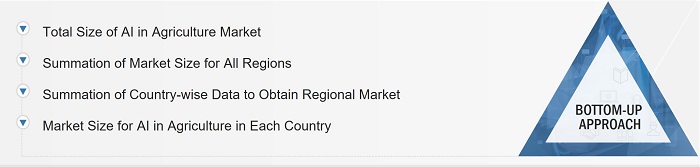

The study involved four major activities in estimating the size for AI in agriculture market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across value chains through primary research. The bottom-up approach was employed to estimate the overall market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various sources were referred to for identifying and collecting information important for this study. Secondary sources include corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers, AI in agriculture-related journals, and certified publications; articles by recognized authors; gold and silver standard websites; and directories.

Secondary research was mainly conducted to obtain key information about the market value chain, the industry supply chain, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, and key developments from both market- and technology-oriented perspectives. Data from secondary research was collected and analyzed to arrive at the overall market size, which was further validated by primary research.

Primary Research

Extensive primary research has been conducted after understanding and analyzing the AI in agriculture market through secondary research. Several primary telephonic interviews have been conducted with key opinion leaders from the demand- and supply-side vendors across four major regions—North America, Europe, Asia Pacific, and the Rest of the World (RoW). Moreover, questionnaires and emails were also used to collect the data.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In this report for the complete market engineering process, both top-down and bottom-up approaches were used, along with several data triangulation methods, to estimate, forecast and validate the size of the market and its segments and subsegments listed in the report. Extensive qualitative and quantitative analyses were carried out to list the key information/insights pertaining to AI in agriculture market.

Major players in the AI in agriculture market have been identified through secondary research, and their market shares in the respective regions have been determined through primary and secondary research. The entire research methodology included the study of annual and financial reports of top players and interviews with experts (such as CEOs, VPs, directors, and marketing executives) for key insights (quantitative and qualitative). All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources. This data was consolidated and enhanced with detailed inputs and analysis from MarketsandMarkets and presented in this report.

AI in Agriculture Market: Bottom-Up Approach

AI in Agriculture Market: Top-Down Approach

Data Triangulation

After arriving at the overall size of the AI in agriculture market from the estimation process explained above, the total market was split into several segments and subsegments. The market breakdown and data triangulation procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Report Objectives

- To define, analyze, and forecast the artificial intelligence (AI) in agriculture market, in terms of value, by technology, offering, application, and region

- To forecast the market size for various segments with respect to four main regions: North America, Europe, Asia Pacific, and Rest of the World (RoW)

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing market growth

- To strategically analyze the micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To provide a detailed overview of the value chain in the artificial intelligence in agriculture market and analyze the market trends

- To analyze opportunities in the market for various stakeholders by identifying the high-growth segments of artificial intelligence in agriculture market

- To strategically profile the key players and comprehensively analyze their market position in terms of ranking and core competencies2, along with detailing the competitive landscape for the market leaders

- To benchmark players within the market using competitive leadership mapping, which analyzes market players on various parameters within the broad categories of business and product strategies

- To map the competitive intelligence based on company profiles, key player strategies, and game-changing developments, such as product launches, partnerships, and acquisitions

- To analyze the probable impact of the recession on the market in the near future

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Product Analysis

- Detailed analysis and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Artificial Intelligence in Agriculture Market