AI in Clinical Care Market - Global Forecast 2024 to 2030

AI in clinical care market comprises of the integration of artificial intelligence (AI) technology in clinical care applications such as patient data & risk analysis, inpatient care & hospital management, medical imaging & diagnostics, among others. AI in clinical care helps to analyse the complex data of patient. It also helps to encompass the treatment, management and prevention of injury or illness, as well as maintaining physical, mental, and psychological wellbeing. With the use of AI technology, the medical treatment and diagnosis of a patient can be done easily and in lesser time, with less human intervention and higher precision.

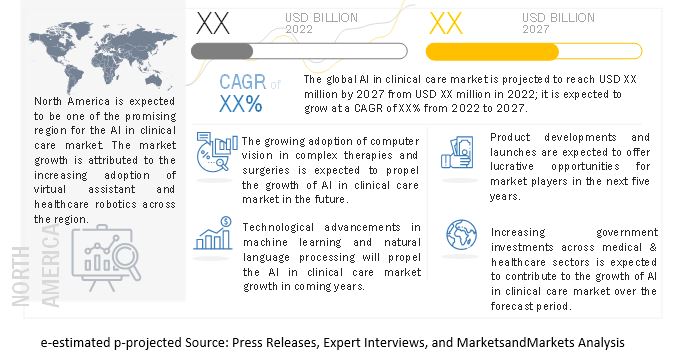

The global AI in clinical care market size is expected to grow from USD XX million in 2024 to USD XX million by 2030, at a CAGR of XX%. The growing use of computer vision in complex therapies and surgeries, and the increasing adoption of AI-based elderly care robots are some of the major factors fueling the growth of AI in clinical care market.

To know about the assumptions considered for the study, Request for Free Sample Report

Drivers: Increase in use of computer vision in complex therapies and surgeries

Computer vision is one of the major AI technologies used by clinical care industry for data analysis and drawing inferences. This technology interprets picture obtained through high-resolution cameras. This technology has significant application across clinical care sector majorly for therapies and surgeries. Robotic surgery applications leverage computer vision to identify distances or specific body parts. The computer vision systems helps to achieve high precision in patient diagnosis, further reducing the false positive rates in the treatment. The adoption of this technology in long run can potentially minimize the requirement for expensive therapies and redundant surgical procedures. Adding to this, the technological advancements in machine learning and natural language processing is expected to drive the AI in clinical care market growth.

Growing adoption of AI-based elderly care robots across the globe

With the growth in the geriatric population, the incidence of several age-related diseases are expected to increase across the world. According to the World Health Organization (WHO) statistics the population aged 60 years and above will increase from 1 billion in 2020 to 1.4 billion in 2030. This growing population is expected to increase the adoption of AI-based elderly care robots and virtual assistants. Adding to this, various healthcare enterprises and government agencies are investing in the adoption of noval technologies such as AI and robotics to target clinical care and elderly care markets. For instance, in September 2022, UBTECH ROBOTICS CORP LTD (US) announced that the company is leveraging AI technology for the development of elderly care robots that will provide clinical and nursing care services to the senior citizens living in the community centers. Such AI-based development initiatives will fuel the AI in clinical care market growth over the forecast period.

Challenges: Reluctance among medical practitioners to adopt AI based technologies across clinical care sectors

Currently several healthcare professionals have doubts about the capabilities of AI solutions in terms of acurately diagnosing patient conditions. Considering this, it is challenging to convince providers that AI-based solutions are cost effective, efficient, and safe solutions that offer convenience to doctors as well as better care for patients. However, reluctance among medical practitioners to adopt AI based technologies across clinical care sectors pose a major challenge in the market. Adding to this, there is a misconception among medical practitioners that AI may replace doctors in coming years. This is further hindering the growth opportunities for AI in clinical care solution providers in the market.

Key players in the market

Intel Corporation (US), Siemens Healthcare GmbH (Germany), NVIDIA Corporation (US), Medtronic (Ireland), Amazon Web Services, Inc. (US), GE Healthcare (US), Metadvice Ltd. (UK), PathAI (US), Babylon Health (UK), AiCure (US), and Arterys (US) are few key players in the AI in clinical care market globally.

Recent Developments

- In March 2022, PathAI (US) announced a five-year strategic collaboration with Cleveland Clinic (US). This strategic collaboration focuses on building digital pathology infrastructure and use AI-based algorithms for research and clinical care applications.

- In November 2021, GE Healthcare (US) launched over 60 innovative solutions spanning healthcare spectrum including therapy planning, diagnostics, patient screening, and monitoring that are leveraging artificial intelligence (AI) and digital technologies. The company accelerated innovations using artificial intelligence (AI) and digital technologies making it more efficient for clinicians, and more personalized and precise for patients.

- In May 2021, Arterys (US) announced strategic partnership with Ambra Health (US), a provider of cloud-based medical image management solutions. The strategic partnership focuses on accelerating clinical-grade AI-imaging capabilities.

TABLE OF CONTENTS

1 Introduction

1.1. Study Objective

1.2. Definition

1.3. Study Scope

1.4. Stakeholder

1.5. Summary of changes

2 Research Methodology

3 Executive Summary

4 Premium Insights

5 Market Overview

5.1. Introduction

5.2. Market Dynamics

5.2.1. Driver

5.2.2. Restraints

5.2.3. Opportunities

5.2.4. Challenges

5.3. Technology Analysis

5.4. Value Chain Analysis

5.5. Ecosystem

5.6. Trends/Disruptions Impacting Customer’s Business

5.7. Porter’s Five Forces Analysis

5.8. ASP Analysis

5.9. Case Study Analysis

5.10. Trade Analysis

5.11. Patent Analysis

5.12. Key Conferences & Events In 2022-23

5.13. Standards & Regulatory Landscape

5.13.1. Regulatory Bodies, Government Agencies, and Other Organizations

5.13.2. Regulatory Standards

5.13.3. Government Regulations

5.14. Key Stakeholders & Buying Criteria

6 AI in Clinical Care Market, by Offerings

6.1. Introduction

6.2. Hardware

6.3. Software

6.4. Services

7 AI in Clinical Care Market, by Technology

7.1. Introduction

7.2. Machine Learning

7.3. Natural Language Processing

7.4. Context-aware Computing

7.5. Computer Vision

8 AI in Clinical Care Market, by Application

8.1. Introduction

8.2. Patient Data & Risk Analysis

8.3. Inpatient Care & Hospital Management

8.4. Medical Imaging & Diagnostics

8.5. Lifestyle Management & Monitoring

8.6. Virtual Assistants

8.7. Healthcare Assistant Robots

8.8. Precision Medicine

8.9. Emergency Room & Surgery

8.10. Wearables

8.11. Mental Health

9 AI in Clinical Care Market, By Region

9.1. Introduction

9.2. North America

9.2.1. US

9.2.2. Canada

9.2.3. Mexico

9.3. Europe

9.3.1. Germany

9.3.2. UK

9.3.3. France

9.3.4. Italy

9.3.5. Rest of Europe

9.4. APAC

9.4.1. China

9.4.2. India

9.4.3. Japan

9.4.4. South Korea

9.4.5. Rest of the APAC

9.5. RoW

9.5.1. South America

9.5.2. Middle East & Africa

10 Competitive Landscape

10.1. Overview

10.2. Revenue Analysis

10.3. Market Share Analysis (2021)

10.4. Company Evaluation Matrix

10.4.1. Star

10.4.2. Emerging Leader

10.4.3. Pervasive

10.4.4. Participant

10.5. Competitive Benchmarking

10.6. Startup Evaluation Matrix

10.6.1. Progressive Companies

10.6.2. Responsive Companies

10.6.3. Dynamic Companies

10.6.4. Starting Blocks

10.7. Company Footprint

10.8. Competitive Scenario & Trends

10.8.1. Deal – Joint Venture, Partnership, and MEA

10.8.2. Product Launch and Development

10.8.3. Others

11 Company Profiles

13.1. Key Players

11.1.1. Intel Corporation

11.1.2. Koninklijke Philips N.V.

11.1.3. IBM

11.1.4. Siemens Healthcare Private Limited

11.1.5. NVIDIA Corporation

11.1.6. Google

11.1.7. General Electric Company

11.1.8. Medtronic

11.1.9. Micron Technology, Inc.

11.1.10. Amazon Web Services, Inc.

11.1.11. Metadvice Ltd.

11.2. Other Players

11.2.1. Babylon Health

11.2.2. AiCure

11.2.3. Apixio

11.2.4. Butterfly Network, Inc.

11.2.5. Enlitic, Inc

11.2.6. Sensely, Inc.

11.2.7. Arterys Inc.

11.2.8. Caption Health

11.2.9. Ginger

11.2.10. Biobeat

12 Appendix

Growth opportunities and latent adjacency in AI in Clinical Care Market