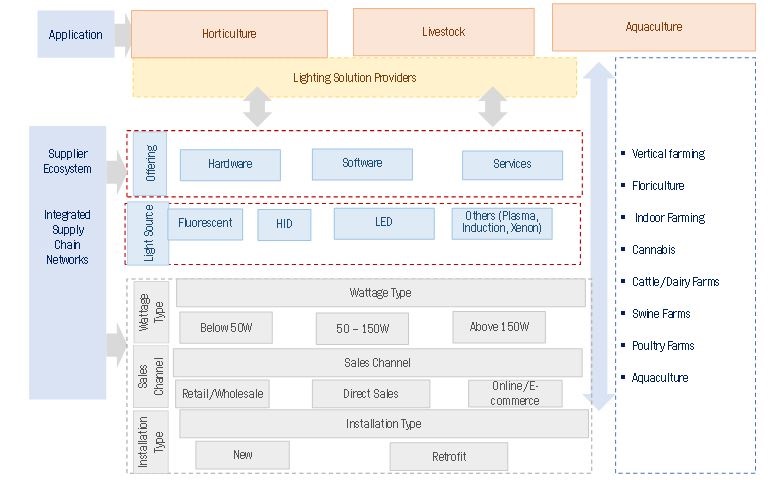

Agricultural Lighting Market by Light Source (Fluorescent, HID, LED), Application (Horticulture, Livestock, Aquaculture), Offering (Hardware, Software, Services), Installation Type, Wattage Type, Sales Channel and Region - Global Forecast to 2028

Updated on : October 22, 2024

Agricultural Lighting Market Size & Growth

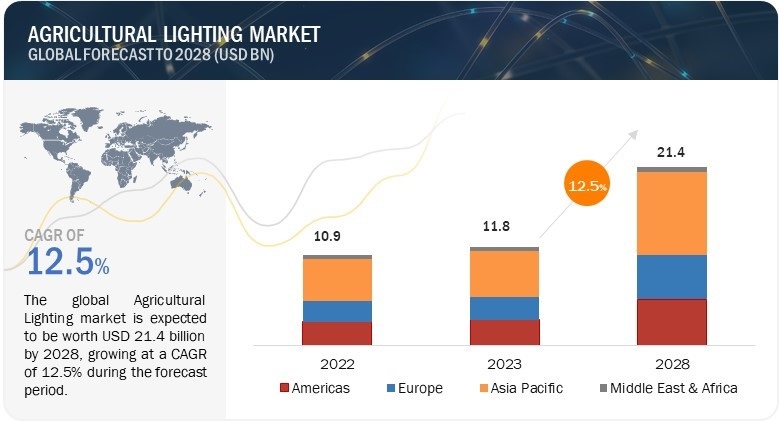

The global agricultural lighting market size is projected to grow from USD 11.8 billion in 2023 to USD 21.4 billion by 2028; growing at a CAGR of 12.5% from 2023 to 2028.

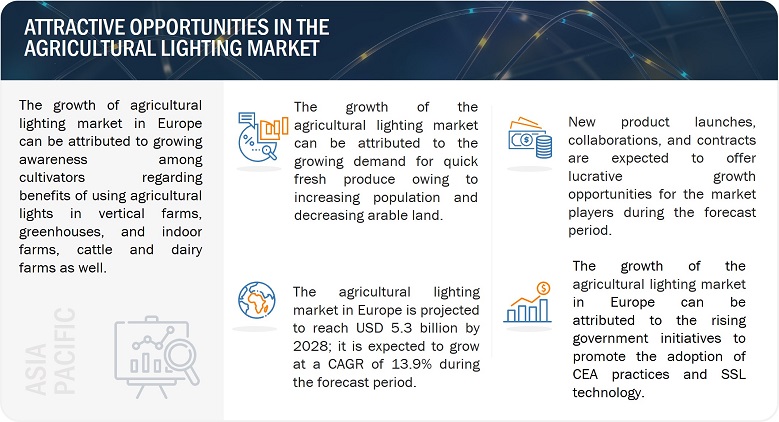

The key factors fueling the growth of the agriculture lighting market include rising number of government initiatives to promote the adoption of CEA practices and SSL technology, surging demand for food owing to the continuously increasing population, extensive deployment of LED fixtures in controlled agricultural environment increased funding to develop vertical farms and greenhouses, gradual emergence of agriculture lighting software and widespread use of automated and energy-efficient lighting fixtures to minimize energy costs and regulate plant growth.

Agricultural Lighting Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Agricultural Lighting Market Trends and Dynamice:

Driver: Extensive deployment of LED fixtures in controlled agricultural environment

Sufficient light with the correct spectral range stimulates photosynthesis and is necessary for plant growth. Different wavelengths are important for the plant's growth, shape, development, and blossoming. The time period during which the plants are exposed to light is also significant for plant growth. The “natural daytime” can, thus, be extended with the aid of artificial light, resulting in stronger growth and increased bud development. With LED technologies, it is possible to maximize plant exposure to the precise wavelength that promotes photosynthesis and optimum growth. In controlled indoor environments, such as hydroponics, greenhouses, and indoor farms, LEDs have always been effective as they consume less power than other lights. Additionally, LEDs are reliable, compact, and have fast-switching operations. LED technology offers several long-term benefits in agricultural lighting, such as compact size, low power consumption, and high durability; it can potentially reduce the carbon footprint in agriculture farms. In Europe, the greenhouse industry is one of the largest energy consumers, using artificial lighting. To reduce energy consumption, European governments are studying the benefits of LED technology for greenhouse plants. This study aims at replacing HPS lamps with LED grow lights to improve energy efficiency in greenhouses. All these factors contribute to the growing demand for LED grow lights in the agricultural lighting market.

Restraint: Complex requirement for varied light spectra for different crops

Different characteristics of light, such as wavelength, intensity, duration, and direction, can influence plant growth and development. Plants generally utilize the light spectrum between 400 and 750 nm, which includes red, orange, yellow, green, blue, indigo, and violet light. Some spectra stimulate vegetative growth and others increase the yield in flowers and fruits. Blue light helps in the photosynthesis and development of roots and vegetative growth, while red light promotes flower and fruit production. In some cases, blue light is not useful during the flowering and budding phases, which may yield fewer plant buds. Compared to HID lights, compact fluorescent lamps (CFLs) and LEDs are more useful as they efficiently provide full-spectrum light. LED lights help growers scale plant production due to their full-light spectrum capabilities, low heat waste and maintenance, and extended lifespan. The selection of the wrong type of LEDs affects plant growth. HPS lights promote better plant growth but offer a poor color rendering index (CRI). Plants grow elongated due to the lack of blue/ultraviolet radiation from HPS lights.

The advent of patented spectra is expected to diminish the impact of this factor in the coming years. For example, Valoya has developed spectra for all plant requirements, from seed to sale. The company’s patented spectra are designed to optimize the growth of a variety of plants in different applications. In addition to photosynthesis, the company’s spectra give valuable information about plants, their environment, allowing control of plant morphology and physiological traits.

Opportunity: Year-round crop production, irrespective of weather conditions

CEA's benefit and ability to help produce crops throughout the year, without depending on the weather conditions, have increased its adoption in regions where the climate does not support traditional farming. For instance, European countries import a substantial share of their fresh produce requirements due to the unavailability of farming land and unfavorable weather conditions. Rain patterns and temperature changes could diminish agricultural output in several countries worldwide. With global weather patterns becoming more unpredictable and global warming being a major challenge, CEA is expected to emerge as an ideal option and effective solution for cities or countries that depend highly on imports of various essential greens. With the help of agriculture lighting, year-round crop production can be achieved in any region of the world. As the production process is not dependent on the weather, controlled environment farming eliminates the concept of seasonal crops. It also reduces the harvest time and increases the production volume without compromising flavor or quality.

Challenge: Effective integration of different components and technologies used in CEA facilities

CEA facilities, such as vertical farms and greenhouses, combine technologies such as HVAC systems, sensors, and LED grow lights. The effective integration of all these elements is challenging as different companies provide systems with additional attributes to control the environment of these facilities. Thus, these companies need to work together to develop compatible systems to control environments of such facilities for maximum yields. Some companies such as Certhon (Netherlands) and Nexus Corporation (US) provide commercial greenhouses. Other companies such as Logiqs B.V. (Netherlands) provide greenhouse material handling logistics. Companies such as LumiGrow Inc. (US) and Heliospectra A.B. (Sweden) offer LED grow lights. Thus, it becomes challenging for agriculturists and growers to receive different components from different companies and integrate them effectively.

Agricultural Lighting Market Ecosystem

The prominent players in the agricultural lighting market share are Signify Holding (Netherlands), ams-OSRAM GmbH (Germany), Gavita International B.V. (Netherlands), Valoya (Finland), California LightWorks (US), DeLaval (Sweden), CBM Lighting (Canada), Heliospectra AB (Sweden), Hortilux Schréder (Netherlands). These companies not only boast a comprehensive product portfolio but also have a strong geographic footprint.

Agricultural Lighting Market Segmentation

Retrofit installations segment is expected to register a higher CAGR during the forecast period

Retrofit installations segment is expected to register a higher CAGR during the forecast period by installation type. The retrofitting of light fixtures in commercial greenhouses, vertical farms, livestock facilities helps in energy consumption, reduction in maintenance costs. This, in turn, results in low operating costs as grow lights require to operate for nearly 14 to 18 hours daily, depending on the types of plants that are being cultivated. The retrofitting of HID lamps with LED grow lights results in their high efficiency, lightweight, and long life. These factors are expected to drive the growth of the retrofit installations market globally.

Software offering segment to grow at the highest CAGR during the forecast period

Light-controlling software and technical services are relatively new in the agriculture lighting market. The software segment of the agricultural lighting market is projected to grow at a higher CAGR than the hardware segment during the forecast period owing to the increasing adoption of automation solutions in the agriculture sector to minimize labor costs and enhance production efficiency. With the increasing demand and awareness to conserve energy and save energy costs, the concept of automated lighting solutions is bound to boom in the upcoming years. This is possible with the integration of lighting fixtures with dedicated software, leading to the growth of software segment in the forecast period.

LED light source is expected to hold the largest market share throughout the forecast period

The agricultural lighting market is experiencing a rapid transition from conventional lighting technologies to LED lighting technology. Energy efficiency continues to be a key factor for adopting LED technology in agriculture, along with additional benefits in low heat, long lifespan, light weight, and enhanced controllability. Vertical farms are gaining traction across urban localities in Americas, Europe, Asia Pacific, and the Middle East & Africa as farmers strive to meet the demand for fresh fruits and vegetables throughout the year. LED grow lights are suitable for vertical farming applications owing to their compact and highly directional design and adjustable light spectrum. In addition to this, the LED lights are suitable for livestock facilities as they require 12-16 hours of lighting per day, in such cases LED lights are essential owing to their energy efficiency characteristics. As a result, the LED segment is projected to account for the largest size of the agriculture lighting market from 2023 to 2028.

Retail/Wholesale sales channel to hold the largest market share in 2022

The retail/wholesale segment is projected to account for the largest size of the agricultural lighting market from 2023 to 2028, owing to the increased convenience of conventional buying or sales channel. The after-sales-support and guidance is more as compared to other sales channels. Most of the buyers have traditional buying methods which tend them to prefer retail or wholesale methods of sales over the others, leading too this segment holding the largest market share.

Below 50W lamps are expected to hold the largest market share throughout the forecast period

Below 50W lamps and lighting have the largest market share in the agricultural lighting for wattage type segment, owing to lesser electricity consumption by these lamps. Additionally, with the rising adoption of LED lighting in agricultural applications, brighter and more sufficient lighting is available in lesser-wattage LED lamps. This results in significant cost savings and energy efficiency, leading to increased profitability for farmers.

Livestock segment to hold the largest market share in 2022

The livestock segment holds the largest market share for the agricultural lighting market, owing to the increased requirement for milk, meat, eggs, and poultry, especially in European and American countries. Since the amount of meat and eggs consumed is much more in American and European countries, clubbed with the fact that the global population is increasing by the day, the livestock segment held the largest agricultural lighting market share in 2022.

Agricultural Lighting Industry Regional Analysis

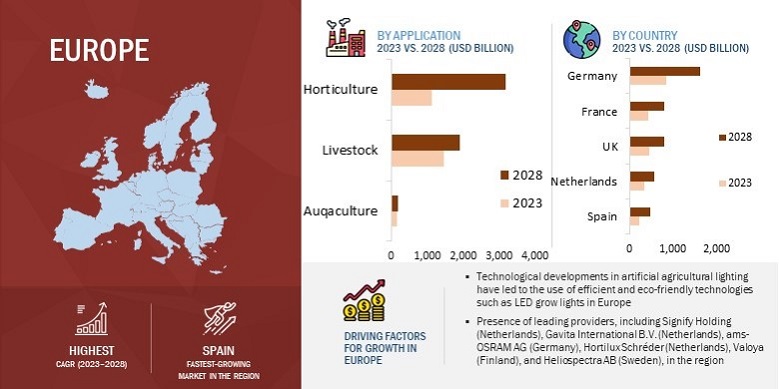

Europe is projected to register the highest CAGR between 2023 and 2028

Europe is expected to grow at the highest CAGR during 2023 and 2028 since the region has the strongest economies in the world, along with flourishing industries that lead to increased capital investment capabilities. Countries such as the Netherlands, Spain, France, and Italy have large areas under greenhouse cultivation and have significantly higher amount of livestock facilities for milking, poultry etc. The use of LED grow lights in this region is gradually increasing from being a supplemental lighting source to becoming a primary light source for indoor farming. The population of Europe has expanded rapidly in recent years, and countries of the region are importing fruits and vegetables in frozen form from Africa and Asia.

Agricultural Lighting Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Top Agricultural Lighting Companies - Key Market Players

The agricultural lighting companies is dominated by a few globally established players such as

- Signify Holding (Netherlands),

- ams-OSRAM GmbH (Germany),

- Gavita International B.V. (Netherlands),

- Valoya (Finland),

- California Lightworks (US),

- DeLaval (Sweden),

- CBM Lighting (Canada),

- Heliospectra AB (Sweden),

- Hortilux Schreder (Netherlands).

These companies have adopted both organic and inorganic growth strategies such as product launches and developments, partnerships, contracts, expansions, and acquisitions to strengthen their position in the agricultural lighting market.

Agricultural Lighting Market Report Scope

|

Report Metric |

Details |

|

Estimated Value |

USD 11.8 billion |

|

Expected Value |

USD 21.4 billion |

|

Growth Rate |

CAGR of 12.5% |

|

Market Size Available for Years |

2019–2028 |

|

Base Year |

2022 |

|

Forecast Period |

2023–2028 |

|

Forecast Unit |

Value (USD Million/Billion) |

|

Segments Covered |

By Offering, By Light Source, By Wattage Type, By Installation Type, By Sales Channel, By Application, and Region |

|

Geographic Regions Covered |

Americas, Europe, Asia Pacific, and RoW (includes Middle East, Africa, and South America) |

|

Companies Covered |

The major players include Signify Holding (Netherlands), ams-OSRAM GmbH (Germany), Gavita International B.V. (Netherlands), Valoya (Finland), California LightWorks (US), DeLaval (Sweden), CBM Lighting (Canada), Heliospectra AB (Sweden), Hortilux Schréder (Netherlands). |

Agricultural Lighting Market Highlights

This report categorizes the agriculture lighting market share based on offering, light source, wattage type, installation type, sales channel, application, and region, available at the regional and global levels.

|

Segment |

Subsegment |

|

By Offering |

|

|

By Light Source |

|

|

By Wattage Type |

|

|

By Installation Type |

|

|

By Sales Channel |

|

|

By Application |

|

|

By Region |

|

Recent Developments in Agricultural Lighting Industry

- In February 2023, ams-OSRAM AG, global leader in optical solutions, announced a collaboration using the OSLON Square platform and OSLON SSL LEDs with Revolution Microelectronics (US), a controlled agriculture environment designer, to provide lighting for GreenCare Collective’s new futuristic facility. A perpetual harvest methodology developed by GreenCare Collective's cutting-edge facility uses seasonal programmed spectrum controls and cutting-edge crop steering techniques to produce an extra harvest of plants every year.

- In January 2023, Energous Corporation (US), a leading developer of RF-based charging for wireless power networks, and ams-OSRAM AG, a leader in optical solutions, announced a collaboration on a wirelessly powered multi-spectral light sensor for Controlled-Environment Agriculture and vertical farming. These sensors allow farmers to manage their lighting in the most efficient way possible.

- In December 2021, Hortilux collaborated with LLC DTK, a Russia’s leading rose company to provide them Hortilux’s HPS NXT2 fixtures which is perfect match for the company requirement: they have good light distribution, are easy to maintain, and they’re extremely reliable. By now the NXT2 1000W fixtures have been installed over a three-hectare area.

- In January 2023, California LightWorks, partnered with Virex Technologies (Spain) to expand European distribution. This partnership is made to implement crop illumination, lower installation costs, and save energy by producing less heat.

- In September 2022, Signify Saudi Arabia signed an MoU with MEWA to meet the growing demands of agriculture in the kingdom of Saudi Arabia. It mainly focuses on Smart animal farms with Dynamic lighting system, Horticulture smart farms with high tech GrowWise control system for Sustainable, predictable quality and locally produced crops; and Aquaculture smart farms with lighting control system using tailored lighting conditions to optimize aquatic environment.

- In May 2022, ams-OSRAM AG expanded its lighting solutions and products by adding OSLON LED horticulture lighting products to its portfolio. OSLON Optimal LEDs balance performance and cost with robustness, high reliability, and excellent lifetime. The new products are based on the same advanced InGaAlP Thin film chip technology. It has a larger spherical lens which produces a wide 120° viewing angle, providing an even distribution of light over crops without ‘hot spots’ of concentrated light.

- In February 2022, California LightWorks launched its new MegaDrive Vertical series for indoor cannabis cultivators. This patented new LED system offers indoor cultivators the same technology that greenhouses across the nation have adopted from California Lightworks to achieve dramatically lower total installed cost while boosting return on investment by reducing heat, energy consumption, and carbon footprint.

- In December 2021, Hortilux collaborated with LLC DTK, Russia’s leading rose company, to provide them Hortilux’s HPS NXT2 fixtures, which match the company’s requirement perfectly. By now, the NXT2 1000W fixtures have been installed over a 3-hectare area.

- In September 2021, HORTILED Multi Fusion is an LED grow light system that is perfectly suited to indoor farming. wide beam angle, ensuring uniform light distribution. This in turn results in a more uniform crop. It also means that fewer light sources are required. It also ensures a high light output combined with significant energy savings.

Frequently Asked Questions (FAQ):

What is the current size of the global agricultural lighting market?

The global agricultural lighting market is projected to grow from USD 10.9 billion in 2022 to USD 21.4 billion by 2028; it is expected to grow at a CAGR of 12.5% from 2023 to 2028.

Who are the key players in the global agricultural lighting market share?

Companies such as Signify Holding (Netherlands), ams-OSRAM AG (Germany), Gavita International B.V. (Netherlands), Valoya (Finland), California Lightworks (US), and Helliospectra AB (Sweden) are key players in agriculture lighting market . These companies cater to the requirements of their customers by providing advanced agricultural lighting with a presence in multiple countries.

What are the opportunities for the existing players and those planning to enter various agricultural lighting value chain stages?

There are various opportunities for the existing players to enter the value chain of agricultural lighting industry. Some of these include the retrofit installations, and shift toward LED technology and increasing demand for right growth recipe for different crops, proper growth of cattle, poultry, swine.

What are the major strategies adopted by market players?

The key players have adopted product launches, acquisitions, and partnerships to strengthen their position in the agricultural lighting market.

What are factors expected to drive the growth of the agricultural lighting market in the next five years?

The key factors fueling the growth of this market include rising number of government initiatives to promote the adoption of CEA practices and SSL technology, surging demand for food owing to the continuously increasing population, extensive deployment of LED fixtures in controlled agricultural environment increased funding to develop vertical farms and greenhouses, gradual emergence of agriculture lighting software and widespread use of automated and energy-efficient lighting fixtures to minimize energy costs and regulate plant growth.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Strong governmental support for controlled environment agriculture and adoption of SSL technology- Heightened demand for fresh food and loss of arable land- Increased investments in vertical farms and greenhouses, along with legalization of cannabis cultivation- Extensive deployment of LED fixtures in controlled agricultural environment- Widespread use of automated and energy-efficient lighting fixtures to minimize energy costs and regulate plant growthRESTRAINTS- High setup and installation costs of LED agriculture lights- Complex requirements for varied light spectra for different cropsOPPORTUNITIES- Consolidating trend of farm-to-table concept- Promising growth opportunities for vertical farming in Asia and Middle East- Year-round crop production, irrespective of weather conditions- Gradual emergence of agricultural lighting software and toolsCHALLENGES- Deployment of controlled environment agriculture technology in large fields and need for technical knowledge- Lack of standard testing practices for assessing product quality of agriculture lights and their fixtures- Effective integration of different components and technologies used in controlled environment agriculture facilities

-

5.3 VALUE CHAIN ANALYSISRESEARCH AND DEVELOPMENT CENTERSCOMPONENT PROVIDERS/INPUT SUPPLIERSORIGINAL EQUIPMENT MANUFACTURERSSYSTEM INTEGRATORS, TECHNOLOGY, AND SERVICE PROVIDERSDISTRIBUTORS AND SALES PARTNERSEND USERS

-

5.4 ECOSYSTEM MAPPING: AGRICULTURAL LIGHTING MARKET

-

5.5 PRICING ANALYSIS: AVERAGE SELLING PRICE TRENDSPRICING ANALYSIS FOR KEY PLAYERS AND APPLICATION

-

5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.7 TECHNOLOGY ANALYSIS

-

5.8 PORTER’S FIVE FORCES ANALYSISINTENSITY OF COMPETITIVE RIVALRYBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF SUBSTITUTESTHREAT OF NEW ENTRANTS

-

5.9 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.10 CASE STUDY ANALYSISKERNOCK PARK PLANTSGLENWOOD VALLEY FARMSGREEN SIMPLICITYNS BRANDS

- 5.11 TRADE ANALYSIS

-

5.12 PATENT ANALYSIS

-

5.13 TARIFF AND REGULATORY LANDSCAPEREGULATIONS: AGRICULTURAL LIGHTINGREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSSTANDARDSTARIFFS: AGRICULTURAL LIGHTING

- 6.1 INTRODUCTION

-

6.2 HARDWAREINCREASED DEMAND FOR LIGHTING TO DRIVE SEGMENTLIGHTING FIXTURES- Lamps- LuminairesLIGHTING CONTROLS

-

6.3 SOFTWAREINCREASING ADOPTION OF AGRICULTURAL LIGHTING SOFTWARE TO ENSURE SEAMLESS OPERATIONS OF FARMING ACTIVITIES

-

6.4 SERVICESINSTALLATION, MAINTENANCE, AND MONITORING TO BOOST SEGMENTPROFESSIONAL SERVICESMANAGED SERVICES

- 7.1 INTRODUCTION

-

7.2 FLUORESCENTINCREASED INDOOR FARMING TO BOOST MARKETT5 FLUORESCENT LIGHTSCOMPACT FLUORESCENT LAMP (CFL)

-

7.3 HIGH-INTENSITY DISCHARGE (HID)HIGH LIGHT OUTPUT IN AQUACULTURE TO INCREASE DEMANDHIGH-PRESSURE SODIUM (HPS) LAMPSMETAL-HALIDE (MH) LAMPS

-

7.4 LIGHT-EMITTING DIODE (LED)LED LIGHTS ADOPTED IN INDOOR FARMING FOR LONG LIFESPAN, SPECTRUM ADJUSTABILITY, AND ENERGY EFFICIENCY

- 7.5 OTHERS

- 8.1 INTRODUCTION

-

8.2 BELOW 50WEXTENSIVE USE OF LED LIGHTS OF BELOW 50W TO HOLD LARGEST MARKET SHARE

-

8.3 50–150WREPLACEMENT OF EXPENSIVE METAL HALIDES TO RESULT IN SIGNIFICANT GROWTH OF SEGMENT

-

8.4 ABOVE 150WINCREASED SAFETY AND REQUIREMENT FOR BRIGHTER ILLUMINATION TO DRIVE MARKET

- 9.1 INTRODUCTION

-

9.2 NEW INSTALLATIONINCREASING POPULATION AND DEMAND TO DRIVE MARKET

-

9.3 RETROFIT INSTALLATIONUPCOMING LED TECHNOLOGY TO INCREASE DEMAND

- 10.1 INTRODUCTION

-

10.2 RETAIL/WHOLESALEMAJOR MARKET SHARE OF RETAIL/WHOLESALE DISTRIBUTION CHANNELS TO DRIVE MARKET

-

10.3 DIRECT SALES/CONTRACT-BASEDLESS INTERFERENCE FROM THIRD PARTIES TO RESULT IN REDUCTION OF PROCUREMENT COSTS

-

10.4 ONLINE/E-COMMERCEE-COMMERCE-BASED FARM LIGHTING SALES TO INCREASE SIGNIFICANTLY

- 11.1 INTRODUCTION

-

11.2 HORTICULTURERISING DEMAND FOR FRESH FARM FOOD TO DRIVE MARKETGREENHOUSESVERTICAL FARMSOTHERS- Indoor farms- Cannabis and research applications

-

11.3 LIVESTOCKRISING DEMAND FOR MILK, MEAT, AND EGGS TO INCREASE MARKET SHARECATTLE/DAIRY FARMSSWINE FARMSPOULTRY FARMS

-

11.4 AQUACULTUREINCREASED DEMAND FOR FARMED FISH TO CREATE SIGNIFICANT DEMAND

- 12.1 INTRODUCTION

-

12.2 AMERICASNORTH AMERICA- US- Canada- MexicoSOUTH AMERICA- Brazil- Argentina- Rest of South AmericaIMPACT OF RECESSION ON AMERICAS

-

12.3 EUROPEUK- Increasing vertical farms and greenhouses to fuel demand for agricultural lightingGERMANY- Presence of prominent agricultural lighting players to fuel market demandFRANCE- High potential growth in aquaculture to boost marketNETHERLANDS- Presence of established greenhouses to support market growthSPAIN- Increased greenhouse production to boost demandREST OF EUROPEIMPACT OF RECESSION ON EUROPE

-

12.4 ASIA PACIFICCHINA- Affordability and availability of LED lighting systems to fuel demandJAPAN- Rising adoption of urban farming practices to encourage use of agricultural lightsINDIA- High adoption rate for greenhouses and vertical farms to drive marketSOUTH KOREA- Adoption of advanced aquaculture technologies to drive marketAUSTRALIA- Legalization of cannabis cultivation, along with less rainfall, to drive marketREST OF ASIA PACIFICIMPACT OF RECESSION ON ASIA PACIFIC

-

12.5 REST OF THE WORLD (ROW)MIDDLE EAST- Increasing investments for local food production to boost marketAFRICA- Unfavorable climatic conditions to increase adoption of agricultural lightingIMPACT OF RECESSION ON REST OF THE WORLD

- 13.1 INTRODUCTION

-

13.2 KEY PLAYER STRATEGIES/RIGHT TO WINPRODUCT PORTFOLIOREGIONAL FOCUSMANUFACTURING FOOTPRINTORGANIC/INORGANIC GROWTH STRATEGIES

- 13.3 MARKET SHARE ANALYSIS

- 13.4 REVENUE ANALYSIS OF TOP PLAYERS

-

13.5 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

13.6 COMPETITIVE BENCHMARKINGSTARTUP EVALUATION MATRIX: AGRICULTURAL LIGHTING MARKET

-

13.7 SME EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

-

13.8 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALSOTHERS

-

14.1 KEY PLAYERSSIGNIFY HOLDING- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewDELAVAL- Business overview- Products/Solutions/Services offered- MnM viewLELY- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSUNBIRD- Business overview- Products/Solutions/Services offered- MnM viewCBM LIGHTING- Business overview- Products/Solutions/Services offered- MnM viewONCE- Business overview- Products/Solutions/Services offeredHATO AGRICULTURAL LIGHTING- Business overview- Products/Solutions/Services offered- Recent developmentsAKVA GROUP- Business overview- Products/Solutions/Services offeredGAVITA INTERNATIONAL B.V.- Business overview- Products/Solutions/Services offered- Recent developmentsAMS-OSRAM AG (PART OF AMS AG)- Business overview- Products/Solutions/Services offered- Recent developmentsHELIOSPECTRA AB- Business overview- Products/Solutions/Services offered- Recent developmentsCALIFORNIA LIGHTWORKS- Business overview- Products/Solutions/Services offered- Recent developmentsHORTILUX SCHRÉDER (DOOL INDUSTRIES)- Business overview- Products/Solutions/Services offered- Recent developmentsVALOYA- Business overview- Products/Solutions/Services offered- Recent developments

-

14.2 OTHER PLAYERSHUBBELLSAMSUNGFIENHAGE POULTRY SOLUTIONSUNI-LIGHTLED LEDHELIO LED LIGHTINGADOLF SCHUCH GMBHPLANET LIGHTINGARUNA LIGHTINGBIG DUTCHMANSHENZHEN HONTECH-WINS ELECTRONICS CO., LTDLUMINUS, INC.NICHIA CORPORATIONEVERLIGHT ELECTRONICS CO., LTD.ILLUMINAR LIGHTINGCREE LIGHTINGGE LIGHTING, A SAVANT COMPANYILLUMITEXSENMATICOREONFLUENCEAPACHE TECH, INC.BIOLOGICAL INNOVATION AND OPTIMIZATION SYSTEMS, LLC. (BIOS LIGHTING)EYE HORTILUX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

- TABLE 1 ASSUMPTIONS FOR RESEARCH STUDY

- TABLE 2 LIST OF NOTICEABLE INVESTMENTS IN VERTICAL AND GREENHOUSE FARMING

- TABLE 3 REDUCTION IN HARVEST CYCLE USING LED AGRICULTURAL LIGHTING ON CANNABIS STRAINS

- TABLE 4 COMPARISON OF TYPICAL SPECIFICATIONS OF LED AND HID

- TABLE 5 STANDARD SPECTRA

- TABLE 6 AGRICULTURAL LIGHTING MARKET ECOSYSTEM MAPPING

- TABLE 7 INDICATIVE PRICES OF AGRICULTURAL LIGHTING FIXTURES

- TABLE 8 AVERAGE SELLING PRICES OF DIFFERENT LIGHT SOURCES, BY KEY PLAYER (USD)

- TABLE 9 LEADING TRENDS IN AGRICULTURE LIGHTING MARKET

- TABLE 10 PORTER’S FIVE FORCES ANALYSIS WITH THEIR IMPACT

- TABLE 11 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE APPLICATIONS (%)

- TABLE 12 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 13 KERNOCK PARK PLANTS INSTALLED PHILIPS GREENPOWER LED TOPLIGHTING AND PRODUCTION MODULE FROM SIGNIFY HOLDING (NETHERLANDS)

- TABLE 14 GLENWOOD VALLEY FARMS (CANADA) USED PHILIPS GREENPOWER LED INTERLIGHTING MODULE TO IMPROVE YIELD

- TABLE 15 GREEN SIMPLICITY DEVELOPED SPECIAL RESEARCH GROWING SYSTEMS WITH HELP OF HORTILUX HORTILED MULTI

- TABLE 16 HELIOSPECTRA AB (SWEDEN) HELPED NS BRANDS (US) WITH GREENHOUSE TOMATO TRIALS

- TABLE 17 IMPORT DATA FOR LAMPS AND LIGHTING FITTINGS, HS CODE: 9405, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 18 EXPORT DATA FOR LAMPS AND LIGHTING FITTINGS, HS CODE: 9405, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 19 LIST OF FEW PATENTS IN AGRICULTURAL LIGHTING, 2019–2022

- TABLE 20 AGRICULTURAL LIGHTING: DETAILED LIST OF CONFERENCES AND EVENTS

- TABLE 21 REGULATIONS: AGRICULTURAL LIGHTING

- TABLE 22 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 23 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 24 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 25 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 26 AGRICULTURAL LIGHTING MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 27 AGRICULTURE LIGHTING MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 28 HARDWARE: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 29 HARDWARE: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 30 HARDWARE: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 31 HARDWARE: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 32 SOFTWARE: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 33 SOFTWARE: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 34 SERVICES: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 35 SERVICES: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 36 SERVICES: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 37 SERVICES: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 38 AGRICULTURAL LIGHTING MARKET, BY LIGHT SOURCE, 2019–2022 (USD MILLION)

- TABLE 39 AGRICULTURE LIGHTING MARKET, BY LIGHT SOURCE, 2023–2028 (USD MILLION)

- TABLE 40 FLUORESCENT LIGHT SOURCE: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 41 FLUORESCENT LIGHT SOURCE: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 42 HID LIGHT SOURCE: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 43 HID LIGHT SOURCE: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 44 LED LIGHT SOURCE: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 45 LED LIGHT SOURCE: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 46 OTHER LIGHT SOURCES: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 47 OTHER LIGHT SOURCES: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 48 AGRICULTURAL LIGHTING MARKET, BY WATTAGE TYPE, 2019–2022 (USD MILLION)

- TABLE 49 AGRICULTURE LIGHTING MARKET, BY WATTAGE TYPE, 2023–2028 (USD MILLION)

- TABLE 50 BELOW 50W: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 51 BELOW 50W: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 52 50-150W: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 53 50-150W: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 54 ABOVE 150W: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 55 ABOVE 150W: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 56 AGRICULTURAL LIGHTING MARKET, BY INSTALLATION TYPE, 2019–2022 (USD MILLION)

- TABLE 57 AGRICULTURE LIGHTING MARKET, BY INSTALLATION TYPE, 2023–2028 (USD MILLION)

- TABLE 58 NEW INSTALLATION: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 59 NEW INSTALLATION: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 60 RETROFIT INSTALLATION: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 61 RETROFIT INSTALLATION: MARKET, BY APPLICATION, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 62 AGRICULTURE LIGHTING MARKET, BY SALES CHANNEL, 2019–2022 (USD MILLION)

- TABLE 63 AGRICULTURE LIGHTING MARKET, BY SALES CHANNEL, 2023–2028 (USD MILLION)

- TABLE 64 RETAIL/WHOLESALE: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 65 RETAIL/WHOLESALE: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 66 DIRECT SALES: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 67 DIRECT SALES: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 68 ONLINE/E-COMMERCE: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 69 ONLINE/E-COMMERCE: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 70 AGRICULTURAL LIGHTING MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 71 AGRICULTURE LIGHTING MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 72 HORTICULTURE: MARKET: BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 73 HORTICULTURE: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 74 HORTICULTURE: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 75 HORTICULTURE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 76 HORTICULTURE: MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 77 HORTICULTURE: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 78 HORTICULTURE: MARKET, BY LIGHT SOURCE, 2019–2022 (USD MILLION)

- TABLE 79 HORTICULTURE: AGRICULTURAL LIGHTING MARKET, BY LIGHT SOURCE, 2023–2028 (USD MILLION)

- TABLE 80 HORTICULTURE: MARKET, BY WATTAGE TYPE, 2019–2022 (USD MILLION)

- TABLE 81 HORTICULTURE: MARKET, BY WATTAGE TYPE, 2023–2028 (USD MILLION)

- TABLE 82 HORTICULTURE: MARKET, BY INSTALLATION TYPE, 2019–2022 (USD MILLION)

- TABLE 83 HORTICULTURE: MARKET, BY INSTALLATION TYPE, 2023–2028 (USD MILLION)

- TABLE 84 HORTICULTURE: MARKET, BY SALES CHANNEL, 2019–2022 (USD MILLION)

- TABLE 85 HORTICULTURE: MARKET, BY SALES CHANNEL, 2023–2028 (USD MILLION)

- TABLE 86 GREENHOUSES: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 87 GREENHOUSES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 88 VERTICAL FARMS: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 89 VERTICAL FARMS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 90 OTHER HORTICULTURE APPLICATIONS: AGRICULTURAL LIGHTING MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 91 OTHER HORTICULTURE APPLICATIONS: AGRICULTURE LIGHTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 92 LIVESTOCK: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 93 LIVESTOCK: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 94 LIVESTOCK: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 95 LIVESTOCK: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 96 LIVESTOCK: MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 97 LIVESTOCK: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 98 LIVESTOCK: MARKET, BY LIGHT SOURCE, 2019–2022 (USD MILLION)

- TABLE 99 LIVESTOCK: MARKET, BY LIGHT SOURCE, 2023–2028 (USD MILLION)

- TABLE 100 LIVESTOCK: AGRICULTURAL LIGHTING MARKET, BY WATTAGE TYPE, 2019–2022 (USD MILLION)

- TABLE 101 LIVESTOCK: AGRICULTURE LIGHTING MARKET, BY WATTAGE TYPE, 2023–2028 (USD MILLION)

- TABLE 102 LIVESTOCK: MARKET, BY INSTALLATION TYPE, 2019–2022 (USD MILLION)

- TABLE 103 LIVESTOCK: MARKET, BY INSTALLATION TYPE, 2023–2028 (USD MILLION)

- TABLE 104 LIVESTOCK: MARKET, BY SALES CHANNEL, 2019–2022 (USD MILLION)

- TABLE 105 LIVESTOCK: MARKET, BY SALES CHANNEL, 2023–2028 (USD MILLION)

- TABLE 106 RECOMMENDED LIGHT LEVELS FOR DAIRY

- TABLE 107 CATTLE/DAIRY FARMS: AGRICULTURE LIGHTING MARKET: BY REGION, 2019–2022 (USD MILLION)

- TABLE 108 CATTLE/DAIRY FARMS: AGRICULTURE LIGHTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 109 RECOMMENDED LIGHT INTENSITY AND PHOTOPERIOD FOR SWINE

- TABLE 110 SWINE FARMS: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 111 SWINE FARMS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 112 POULTRY FARMS: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 113 POULTRY FARMS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 114 AQUACULTURE: AGRICULTURAL LIGHTING MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 115 AQUACULTURE: AGRICULTURE LIGHTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 116 AQUACULTURE: MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 117 AQUACULTURE: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 118 AQUACULTURE: MARKET, BY LIGHT SOURCE, 2019–2022 (USD MILLION)

- TABLE 119 AQUACULTURE: MARKET, BY LIGHT SOURCE, 2023–2028 (USD MILLION)

- TABLE 120 AQUACULTURE: MARKET, BY WATTAGE TYPE, 2019–2022 (USD MILLION)

- TABLE 121 AQUACULTURE: MARKET, BY WATTAGE TYPE, 2023–2028 (USD MILLION)

- TABLE 122 AQUACULTURE: MARKET, BY INSTALLATION TYPE, 2019–2022 (USD MILLION)

- TABLE 123 AQUACULTURE: MARKET, BY INSTALLATION TYPE, 2023–2028 (USD MILLION)

- TABLE 124 AQUACULTURE: MARKET, BY SALES CHANNEL, 2019–2022 (USD MILLION)

- TABLE 125 AQUACULTURE: MARKET, BY SALES CHANNEL, 2023–2028 (USD MILLION)

- TABLE 126 AGRICULTURAL LIGHTING MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 127 AGRICULTURE LIGHTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 128 AMERICAS: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 129 AMERICAS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 130 AMERICAS: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 131 AMERICAS: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 132 NORTH AMERICA: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 133 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 134 SOUTH AMERICA: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 135 SOUTH AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 136 EUROPE: AGRICULTURE LIGHTING MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 137 EUROPE: AGRICULTURE LIGHTING MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 138 EUROPE: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 139 EUROPE: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 140 ASIA PACIFIC: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 141 ASIA PACIFIC: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 142 ASIA PACIFIC: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 143 ASIA PACIFIC: AGRICULTURE LIGHTING MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 144 REST OF THE WORLD: AGRICULTURAL LIGHTING MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 145 REST OF THE WORLD: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 146 REST OF THE WORLD: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 147 REST OF THE WORLD: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 148 OVERVIEW OF STRATEGIES DEPLOYED BY AGRICULTURE LIGHTING MARKET PLAYERS

- TABLE 149 AGRICULTURAL LIGHTING MARKET: INTENSITY OF COMPETITIVE RIVALRY, 2022

- TABLE 150 COMPANY FOOTPRINT

- TABLE 151 APPLICATION FOOTPRINT

- TABLE 152 COMPANY OFFERING FOOTPRINT

- TABLE 153 COMPANY REGION FOOTPRINT

- TABLE 154 MARKET: DETAILED LIST OF KEY SMALL AND MEDIUM-SIZED ENTERPRISES (SMES)

- TABLE 155 MARKET: COMPETITIVE BENCHMARKING OF KEY SMES

- TABLE 156 MARKET: PRODUCT LAUNCHES AND DEVELOPMENTS, JANUARY 2020 –MAY 2023

- TABLE 157 MARKET: DEALS, JANUARY 2020–MAY 2023

- TABLE 158 AGRICULTURE LIGHTING MARKET: OTHERS, JANUARY 2020–MAY 2023

- TABLE 159 SIGNIFY HOLDING: COMPANY OVERVIEW

- TABLE 160 DELAVAL: COMPANY OVERVIEW

- TABLE 161 LELY: COMPANY OVERVIEW

- TABLE 162 SUNBIRD: COMPANY OVERVIEW

- TABLE 163 CBM LIGHTING: COMPANY OVERVIEW

- TABLE 164 ONCE: COMPANY OVERVIEW

- TABLE 165 HATO AGRICULTURAL LIGHTING: COMPANY OVERVIEW

- TABLE 166 AKVA GROUP: COMPANY OVERVIEW

- TABLE 167 GAVITA INTERNATIONAL B.V.: COMPANY OVERVIEW

- TABLE 168 AMS-OSRAM AG: COMPANY OVERVIEW

- TABLE 169 HELIOSPECTRA AB: COMPANY OVERVIEW

- TABLE 170 CALIFORNIA LIGHTWORKS: COMPANY OVERVIEW

- TABLE 171 HORTILUX SCHRÉDER: COMPANY OVERVIEW

- TABLE 172 VALOYA: COMPANY OVERVIEW

- FIGURE 1 MARKET SEGMENTATION

- FIGURE 2 AGRICULTURAL LIGHTING MARKET: PROCESS FLOW OF MARKET SIZE ESTIMATION

- FIGURE 3 AGRICULTURE LIGHTING MARKET: RESEARCH DESIGN

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: DEMAND-SIDE ANALYSIS

- FIGURE 8 DATA TRIANGULATION

- FIGURE 9 HARDWARE OFFERING SEGMENT TO ACCOUNT FOR LARGER SHARE OF AGRICULTURAL LIGHTING MARKET

- FIGURE 10 LED LIGHT SOURCE SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE

- FIGURE 11 NEW INSTALLATIONS SEGMENT TO HOLD LARGER MARKET SHARE

- FIGURE 12 RETAIL/WHOLESALE SALES CHANNEL TO ACCOUNT FOR LARGEST MARKET SIZE

- FIGURE 13 BELOW 50W SEGMENT TO HAVE LARGEST MARKET SHARE, BY WATTAGE TYPE

- FIGURE 14 LIVESTOCK APPLICATION TO HOLD LARGEST MARKET SHARE

- FIGURE 15 EUROPEAN MARKET TO GROW AT HIGHEST CAGR

- FIGURE 16 INCREASING ADOPTION OF VERTICAL FARMING AND GREENHOUSES TO CREATE GROWTH OPPORTUNITIES IN EUROPEAN MARKET

- FIGURE 17 SERVICES OFFERING SEGMENT TO ACCOUNT FOR SECOND-LARGEST MARKET SHARE

- FIGURE 18 HID LIGHT SOURCE TO ACCOUNT FOR SECOND-LARGEST LARGEST MARKET SHARE

- FIGURE 19 LIVESTOCK APPLICATION AND CHINA TO ACCOUNT FOR LARGEST SHARES OF AGRICULTURE LIGHTING MARKET IN ASIA PACIFIC

- FIGURE 20 RETROFIT INSTALLATIONS TO ACCOUNT FOR INCREASED MARKET SHARE

- FIGURE 21 ONLINE/E-COMMERCE SALES CHANNEL TO ACCOUNT FOR INCREASED MARKET SHARE

- FIGURE 22 50-150W SEGMENT TO ACCOUNT FOR SECOND-LARGEST MARKET SHARE, BY WATTAGE TYPE

- FIGURE 23 HORTICULTURE APPLICATION SEGMENT TO ACCOUNT FOR HIGHEST CAGR

- FIGURE 24 AGRICULTURAL LIGHTING MARKET IN ASIA PACIFIC TO HOLD LARGEST MARKET SHARE

- FIGURE 25 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN AGRICULTURE LIGHTING MARKET

- FIGURE 26 POPULATION VS. ARABLE LAND STATISTICS, 1950–2050

- FIGURE 27 DRIVERS AND THEIR IMPACT ON AGRICULTURAL LIGHTING

- FIGURE 28 RESTRAINTS AND THEIR IMPACT ON AGRICULTURAL LIGHTING

- FIGURE 29 OPPORTUNITIES AND THEIR IMPACT ON AGRICULTURAL LIGHTING

- FIGURE 30 CHALLENGES AND THEIR IMPACT ON AGRICULTURAL LIGHTING

- FIGURE 31 MARKET: VALUE CHAIN ANALYSIS

- FIGURE 32 MARKET: ECOSYSTEM MAPPING

- FIGURE 33 INDICATIVE AVERAGE PRICES OF AGRICULTURAL LIGHTING, 2019–2026

- FIGURE 34 AVERAGE SELLING PRICES, BY KEY PLAYER, BY APPLICATION

- FIGURE 35 REVENUE SHIFT FOR AGRICULTURAL LIGHTING

- FIGURE 36 AGRICULTURE LIGHTING MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 37 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE APPLICATIONS

- FIGURE 38 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- FIGURE 39 LAMPS AND LIGHTING FITTINGS, IMPORT VALUES FOR MAJOR COUNTRIES, 2017–2021

- FIGURE 40 LAMPS AND LIGHTING FITTINGS, EXPORT VALUES FOR MAJOR COUNTRIES, 2017–2021

- FIGURE 41 NUMBER OF PATENTS GRANTED FOR AGRICULTURAL LIGHTING MARKET, 2013–2022

- FIGURE 42 REGIONAL ANALYSIS OF PATENTS GRANTED FOR MARKET, 2013–2022

- FIGURE 43 MARKET, BY OFFERING

- FIGURE 44 HARDWARE SEGMENT TO HOLD LARGER MARKET SIZE

- FIGURE 45 LIGHTING FIXTURES TO HAVE LARGER MARKET SHARE IN HARDWARE SEGMENT

- FIGURE 46 MARKET, BY LIGHT SOURCE

- FIGURE 47 LED SEGMENT TO GROW AT HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 48 MARKET, BY WATTAGE TYPE

- FIGURE 49 BELOW 50W WATTAGE TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 50 MARKET, BY INSTALLATION TYPE

- FIGURE 51 NEW INSTALLATION TYPE TO HOLD A LARGER MARKET FOR AGRICULTURAL LIGHTING BETWEEN 2023 AND 2028

- FIGURE 52 MARKET, BY SALES CHANNEL

- FIGURE 53 ONLINE/E-COMMERCE SALES CHANNEL TO RECORD HIGHEST CAGR IN AGRICULTURE LIGHTING MARKET

- FIGURE 54 AGRICULTURAL LIGHTING MARKET, BY APPLICATION

- FIGURE 55 HORTICULTURE TO GROW AT HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 56 MARKET, BY HORTICULTURE

- FIGURE 57 GREENHOUSES SEGMENT TO GROW AT A SIGNIFICANT RATE DURING FORECAST PERIOD

- FIGURE 58 MARKET, BY LIVESTOCK

- FIGURE 59 CATTLE/DAIRY FARMS TO BE LARGEST LIVESTOCK APPLICATION FOR IN 2023

- FIGURE 60 MARKET, BY REGION

- FIGURE 61 MARKET, BY COUNTRY/REGION

- FIGURE 62 AMERICAS: AGRICULTURE LIGHTING MARKET SNAPSHOT

- FIGURE 63 MEXICO TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

- FIGURE 64 MARKET: SOUTH AMERICA, BY COUNTRY

- FIGURE 65 EUROPE: MARKET SNAPSHOT

- FIGURE 66 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 67 REST OF THE WORLD: AGRICULTURAL LIGHTING MARKET, BY REGION

- FIGURE 68 FIVE-YEAR REVENUE ANALYSIS OF LEADING MARKET PLAYERS (2018–2022)

- FIGURE 69 AGRICULTURE LIGHTING MARKET (GLOBAL): COMPANY EVALUATION MATRIX, 2022

- FIGURE 70 AGRICULTURAL LIGHTING MARKET (GLOBAL): SME EVALUATION MATRIX, 2022

- FIGURE 71 SIGNIFY HOLDING: COMPANY SNAPSHOT

- FIGURE 72 DELAVAL: COMPANY SNAPSHOT

- FIGURE 73 AKVA GROUP: COMPANY SNAPSHOT

- FIGURE 74 AMS-OSRAM AG: COMPANY SNAPSHOT

- FIGURE 75 HELIOSPECTRA AB: COMPANY SNAPSHOT

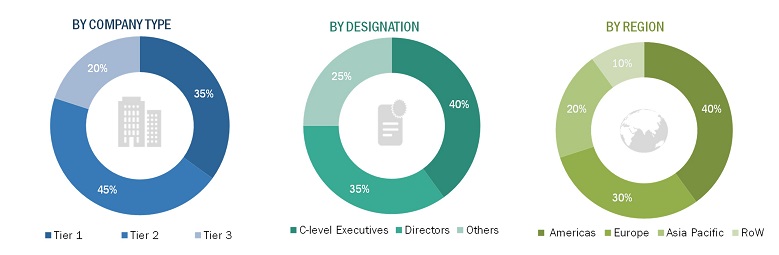

The study involved four major activities for estimating the size of the agricultural lighting market. Exhaustive secondary research has been carried out to collect information relevant to the market, its peer markets, and its parent market. Primary research has been undertaken to validate key findings, assumptions, and sizing with the industry experts across the value chain of the agricultural lighting market. Both top-down and bottom-up approaches have been employed to estimate the complete market size. It has been followed by the market breakdown and data triangulation methods to estimate the size of different segments and subsegments of the market.

Secondary Research

Various secondary sources have been referred to in the secondary research process for identifying and collecting information for this study. Secondary sources include annual reports, press releases, and investor presentations of companies; white papers, journals, certified publications, and articles by recognized authors; websites; directories; and databases. Secondary research has mainly been used to obtain key information about the supply chain of the agricultural lighting industry, value chain of the market, key players, market classification, and segmentation according to the industry trends to the bottom-most level, geographic markets, and key developments from both market- and technology-oriented perspectives. Secondary data has been collected and analyzed to determine the overall market size, further validated through primary research.

Primary Research

In the primary research, various primary sources from both the supply and demand sides have been interviewed to obtain the qualitative and quantitative information relevant to this report. Primary sources from the supply side include the key industry participants, subject-matter experts (SMEs), and C-level executives and consultants from various key companies and organizations in the agricultural lighting ecosystem. After the complete market engineering (including calculations for the market statistics, the market breakdown, the market size estimations, the market forecasting, and the data triangulation), extensive primary research has been conducted to verify and validate the critical market numbers obtained. Extensive qualitative and quantitative analyses have been performed during the market engineering process to list key information/insights throughout the report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

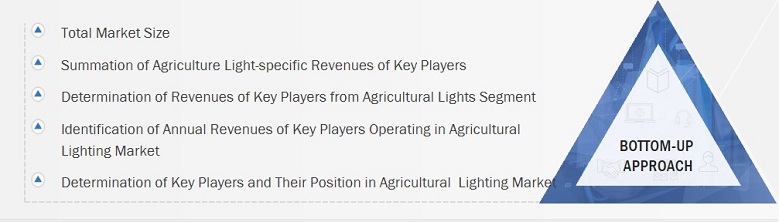

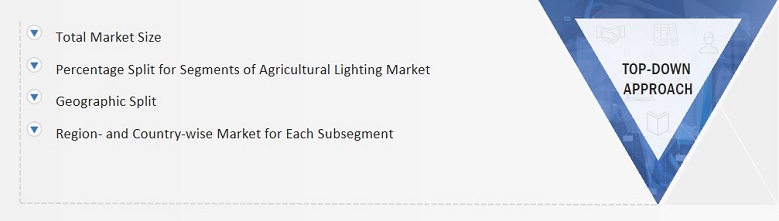

Both top-down and bottom-up approaches have been used to estimate and validate the size of the agricultural lighting market and its segments. The research methodology used to estimate the market size includes the following:

- Key players in the market have been identified through extensive secondary research

- The supply chain and the size of the agricultural lighting market, in terms of value, have been determined through primary and secondary research processes

- Several primary interviews have been conducted with key opinion leaders related to the agricultural lighting market, including key OEMs, IDMs, and Tier I suppliers

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- Qualitative aspects such as market drivers, restraints, opportunities, and challenges have been taken into consideration while calculating and forecasting the market size

Global Agricultural Lighting Market Size: Bottom-up Approach

Global Agricultural Lighting Market Size: Top-down Approach

Data Triangulation

After arriving at the overall market size using the market size estimation process explained above, the total market has been split into several segments and subsegments. The data triangulation and the market breakdown procedures have been employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, wherever applicable. The data has been triangulated after studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated using both top-down and bottom-up approaches.

Market Definition

Agricultural lighting refers to applying artificial lighting in agricultural practices to improve plant growth, optimize crop production, and extend the duration of the growing season. It strategically uses different artificial lighting sources, such as LEDs, HPS lamps, and fluorescent lamps, to provide specific light spectra and intensities tailored to plants' needs. The utilization of agricultural lighting is common in controlled environment agriculture (CEA) systems, including greenhouses, vertical farms, and indoor farms, where natural sunlight may be limited or insufficient. Farmers can establish an ideal environment for their crops by incorporating artificial lighting, granting them control over critical factors such as light spectrum, intensity, duration, and photoperiod.

Key Stakeholders:

- Manufacturers of agricultural lighting solutions

- Original equipment manufacturers

- Technology solution providers

- Horticulture lighting distributors and retailers

- Research organizations

- Technology standard organizations, forums, alliances, and associations

- Technology investors

Report Objectives

- To describe and forecast the agricultural lighting market size in terms of value based on offering, light source, wattage type, installation type, sales channel, application, and region

- To describe and forecast the agricultural lighting market size, in terms of value, for various segments with respect to 4 key regions, namely, North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW)

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market

- To provide a detailed overview of the agricultural lighting value chain

- To strategically profile the key players and comprehensively analyze their market ranking in terms of revenue and core competencies2

- To provide detailed information regarding drivers, restraints, opportunities, and challenges pertaining to the agricultural lighting market

- To map competitive intelligence based on company profiles, strategies of key players, and game-changing developments such as product launches, partnerships, collaborations, and agreements undertaken in the agricultural lighting market

Available Customizations

Along with the market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

- Additional country-level analysis of the agricultural lighting market

- Estimation of the market size of the segments of the agricultural lighting market based on different subsegments

Growth opportunities and latent adjacency in Agricultural Lighting Market