Agriculture Analytics Market by Offering (Solution and Services), Agriculture Type (Precision Farming, Livestock Farming, Vertical Farming), Technology (Remote Sensing, GIS, Robotics, Automation), Farm Size, End Users and Region - Global Forecast to 2028

Updated on : Nov 17, 2025

Agriculture Analytics Market Overview

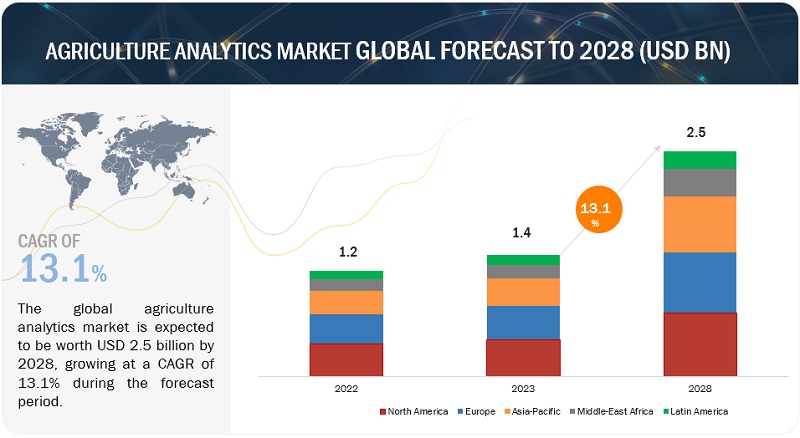

The global agriculture analytics market was valued at US$1.4 billion in 2023 and is projected to reach US$2.5 billion by 2028, growing at a steady CAGR of 13.1% during the forecast period.

The growing trend of digitization and the rising need for optimal resource utilization is also expected to drive market growth. However, high cost associated with data collection and analysis is one of the factors hindering the industry growth.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Agriculture Analytics Market Dynamics

Driver: Rising need for optimal resource utilization

Efficient resource utilization is crucial for sustainable agriculture, and agriculture analytics solutions play a vital role in optimizing resource allocation on farms. With the integration of data from various sources, including field sensors, machinery, and weather stations, farmers can gather information on resource availability and requirements. This data, combined with advanced analytics tools, allows farmers to make data-driven decisions to allocate resources effectively. For example, by analysing soil moisture data from field sensors and weather data, farmers can determine the optimal irrigation schedule for their crops. This helps avoid over- or under-watering, reducing water waste and ensuring that crops receive the right amount of moisture for their growth. Similarly, by monitoring nutrient levels in the soil and analysing crop health data, farmers can apply fertilizers more precisely, avoiding excessive use and minimizing environmental impact. This targeted approach to resource allocation not only reduces waste but also improves crop health and productivity.

Agriculture analytics solutions also enable farmers to optimize the use of machinery and equipment. By analysing data on equipment performance, fuel consumption, and operational efficiency, farmers can identify opportunities to improve machinery utilization and reduce downtime. This helps farmers make informed decisions regarding equipment maintenance, replacement, or upgrades, ultimately saving costs and improving overall farm productivity. Overall, the use of agriculture analytics solutions facilitates optimal resource utilization, reducing waste, minimizing environmental impact, and improving the sustainability of farming practices.

Restraint: Data privacy and security concern

Technology advancements like sensors, drones, and data analysis tools are used in precision agriculture to increase resource production and decision-making on farms. Farmers are concerned about the privacy of their data because these technologies collect a lot of information about farms. Farmers are worried about agricultural technology providers unauthorized access to, collection of, and sharing of their data with outside parties. Data privacy and security in agriculture analytics can be challenging due to data volume, data variety, data integration, human error, and lack of awareness. Moreover, the absence of best practices and regulations for the protection of farm data exacerbates the situation. Strong data privacy and security policies, the use of cutting-edge security technology like encryption and access controls and ensuring that all staff are trained in data privacy and security best practices are necessary to handle these difficulties.

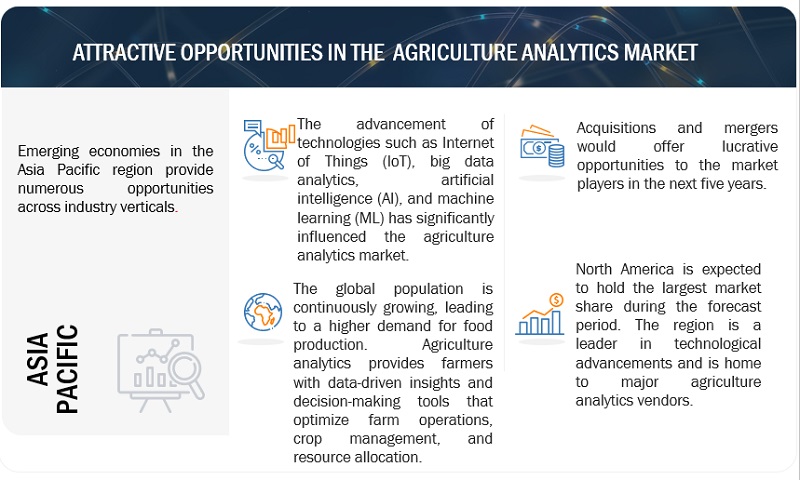

Opportunity: Technological advancements such as IoT, AI, ML

Technological advancements have played a significant role in driving the adoption of agriculture analytics by revolutionizing data collection, analysis, and decision-making processes in the agricultural sector. Firstly, the development and widespread availability of IoT devices, sensors, and drones have enabled farmers to collect real-time data on various aspects of their operations. This data includes information on soil conditions, weather patterns, crop health, and equipment performance. The ability to gather such detailed and up-to-date data has provided a foundation for more accurate and insightful analytics in agriculture. AI technologies, including machine learning and predictive analytics, enable farmers to make accurate predictions and recommendations based on historical and real-time data. AI algorithms can analyze complex datasets, recognize patterns, and provide insights for optimizing crop management, disease detection, yield prediction, and resource allocation. Machine learning algorithms can analyze historical data to identify patterns and make predictions. In agriculture, machine learning models can help predict crop diseases, optimize irrigation schedules, detect anomalies in livestock behavior, and automate various tasks. These models can continuously learn and improve as more data becomes available.

Challenge: Technological literacy and the skills gap

Technological literacy and the skills gap present significant challenges to the growth of the agriculture analytics market. One key challenge is the lack of awareness and understanding among farmers and agricultural stakeholders about the potential benefits of analytics in agriculture. Many may be unfamiliar with the concepts of data analysis and how it can improve decision-making and productivity. This lack of awareness can hinder the adoption of agriculture analytics solutions, as potential users may not perceive them as valuable or relevant to their operations. Another challenge is the limited availability of training and educational resources tailored to the specific needs of the agriculture sector. Farmers and agricultural stakeholders require practical and accessible training programs that teach them how to effectively use analytics tools and interpret the results. However, the availability of such resources is often limited, especially in rural areas where access to training institutions and programs may be scarce. This gap in educational resources and training opportunities contributes to the skills gap and inhibits the growth of the agriculture analytics market.

Furthermore, the rapid pace of technological advancements can pose challenges for individuals with limited technological literacy. New analytics tools and platforms constantly emerge, and staying up to date with the latest developments can be overwhelming for farmers and agricultural stakeholders who already have busy schedules and limited resources. The lack of ongoing support and training to keep up with evolving technologies can make it difficult for users to effectively utilize agriculture analytics solutions, further hindering market growth.

To address these challenges, it is crucial to invest in comprehensive awareness campaigns and education programs targeted specifically at the agricultural community. These initiatives should emphasize the tangible benefits of agriculture analytics and provide practical examples of how analytics can enhance farming operations and improve yields. Additionally, the development of user-friendly analytics tools with intuitive interfaces can help bridge the technological literacy gap and make the adoption process easier for farmers and stakeholders. Ongoing support, including training, workshops, and technical assistance, is also vital to ensure users can fully leverage the potential of agriculture analytics and contribute to the market's growth.

Agriculture Analytics Market Ecosystem

By Agriculture type,precision farming segment to grow at the highest CAGR during the forecast period

Livestock farming using agriculture analytics solutions and services helps gather real-time information about animal health, feeding behavior, hygiene, and location tracking, among others, to enhance the livestock management process and improve productivity and production quality. Livestock farming uses devices such as RFID, GPS, feeding systems, farm management systems, robotic milking machines, and other software technology solutions to improve farm production.

By Technology, visualization and reporting segment to grow at the highest CAGR during the forecast period

Visualization and reporting play a crucial role in the agriculture analytics market by providing valuable insights and facilitating data-driven decision-making. In this context, visualization refers to the graphical representation of agricultural data, while reporting involves the presentation of these visualizations along with relevant analysis and findings. The need for farmers, agronomists, and other stakeholders to quickly grasp complex information and identify patterns or trends that may not be immediately apparent in raw data will drive the market

By end users, the agronomists segment to grow at the highest CAGR during the forecast period

Agronomists are professionals who specialize in the science and practice of crop production and soil management. They play a crucial role in agriculture analytics, utilizing data to improve farming practices, optimize yields, and ensure sustainable agricultural systems. Agronomists work closely with farmers, providing expert advice and guidance on various aspects of crop production. They leverage agriculture analytics to analyze data collected from fields, such as soil samples, weather patterns, and crop performance data. By interpreting this data, agronomists can assess soil fertility, nutrient deficiencies, and disease or pest risks, enabling them to make tailored recommendations to farmers.

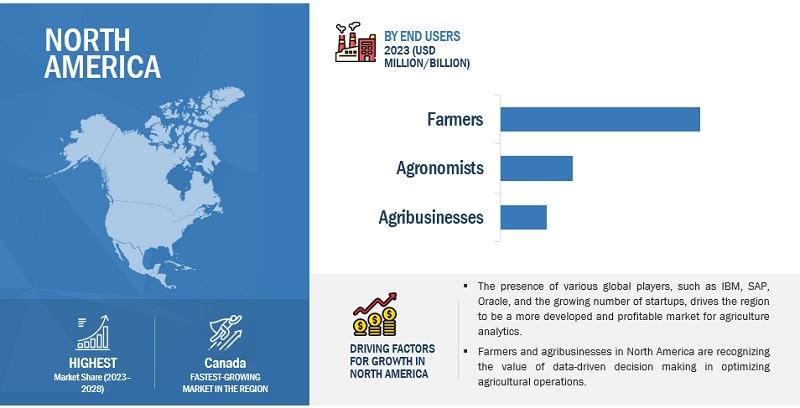

North America is expected to account for the largest market size during the forecast period

In North America, agriculture analytics has gained significant importance as farmers and agribusinesses leverage data-driven approaches to optimize their operations. With the increasing adoption of advanced technologies and the availability of vast amounts of data, farmers and agribusinesses are leveraging analytics to gain valuable insights into their operations and make informed decisions. The rapid developments in infrastructure, high adoption of digital technologies, and demand for data-driven solutions contribute to the agriculture analytics market growth in the region.

Top Agriculture Analytics Market Companies:

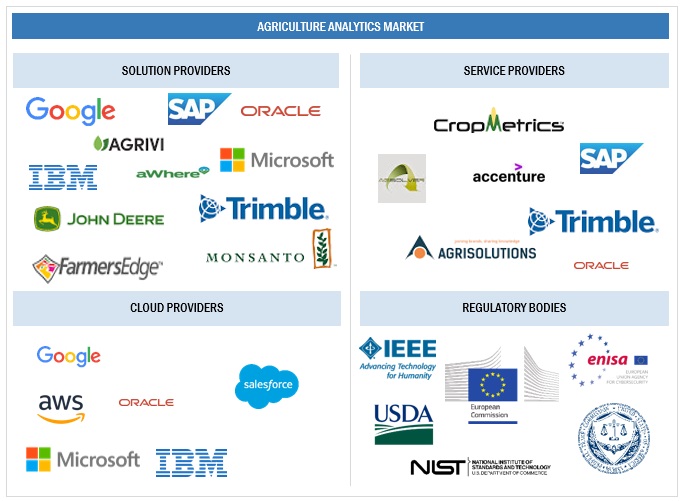

The agriculture analytics platform vendors have implemented various types of organic as well as inorganic growth strategies, such as new product launches, product upgradations, partnerships and agreements, business expansions, and mergers and acquisitions, to strengthen their offerings in the market. The major vendors offering Agriculture analytics solutions are Deere & Company(US), IBM(US), Bayer Ag (Germany), SAP(Germany), Trimble(US), Accenture(Ireland), ABACO(Italy), DeLaval(Sweden), Oracle(US), DTN(US), Farmers Edge(Canada), SAS Institute(US), Iteris(US), PrecisionHawk(US), Conservis(US), Stesalit Systems(India), Agribotix(US), Agrivi(UK), Granular(US), FBN(US), Gro Intelligence(US), Resson(Canada), AgVue Technologies(US), Taranis(US), CropX(Israel), Trace Genomics(US), Fasal(India), AgEye Technologies(US), HelioPas AI(Germany), OneSoil (Switzerland), Root AI (US)and AgShift(US).

Scope of the Report

|

Report Metric |

Details |

|

Market Size Available for years |

2017-2028 |

|

Base year considered |

2022 |

|

Forecast Period |

2023-2028 |

|

Forecast units |

Value (USD Billion) |

|

Segments covered |

By Offering, Agriculture Type, Farm Size, Technology, End Users, and Region |

|

Geographies covered |

North America, APAC, Europe, MEA and Latin America |

|

Companies covered |

The major market players include Deere & Company(US),IBM(US), Bayer Ag, (Grmany),SAP(Germany), Trimble(US), Accenture(Ireland), ABACO(Italy), DeLaval(Sweden),Oracle(US),DTN(US), Farmers Edge(Canada),SAS Institute(US), Iteris(US), PrecisionHawk(US), Conservis(US), Stesalit Systems(India), Agribotix(US), Agrivi(UK), Granular(US),FBN(US), Gro Intelligence(US), Resson(Canada), AgVue Technologies(US), Taranis(US), CropX(Israel), Trace Genomics(US), Fasal(India), AgEye Technologies(US), HelioPas AI(Germany),OneSoil(Switzerland),Root AIand AgShift(US). |

The study categorizes the agriculture analytics market based on component, deployment mode, farm size, application areas at the regional and global level.

On the basis of offering, the agriculture analytics market has been segmented as follows:

- Solutions

- Services

On the basis of agriculture type, the agriculture analytics market has been segmented as follows:

- Precision Farming

- Livestock Farming

- Aquaculture Farming

- Vertical Farming

- Others (Organic and Conventional farming)

On the basis of farm size, the agriculture analytics market has been segmented as follows:

- Large Farms

- Small and Medium-Sized Farms

On the basis of technology, the agriculture analytics market has been segmented as follows:

- Remote Sensing and Satellite Imagery

- Geographic Information System

- Robotics and Automation

- Big Data and Cloud Computing

- Visualization and Reporting

- Blockchain Technology

- Others (Mobile Applications, Internet of Things (IoT) and Machine Learning and AI)

On the basis of end users, the agriculture analytics market has been segmented as follows:

- Farmers

- Agronomists

- Agribusinesses

- Agricultural Researchers

- Government Agencies

- Others (Insurance Assessors,Drone Services, Consumers and Consumers' Organizations)

On the basis of regions, the agriculture analytics market has been segmented as follows:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Italy

- The Netherlands

- Rest of Europe

-

APAC

- China

- India

- Japan

- ANZ

- South Korea

- Rest of Asia Pacific

-

MEA

- UAE

- Saudi Arabia

- South Africa

- Israel

- Rest of Middle East & Africa

-

Latin America

- Brazil

- Mexico

- Agrentina

- Rest of Latin America

Agriculture Analytics Market News:

- In March 2023, IBM announced a partnership with The Climate Corporation, a subsidiary of Monsanto, to develop and market a new agriculture analytics solution. The solution will use IBM's Watson IoT platform to collect and analyze data from a variety of sources, including weather data, soil data, and crop data. The data will be used to help farmers make better decisions about how to manage their crops.

- In January 2023, John Deere and Nutrien Ag Solutions partner on digital connectivity. This connectivity enables both companies to better serve growers by optimizing logistics and enabling variable rate agronomic recommendations to be seamlessly transferred to their equipment for execution.

- In January 2023, SAP partnered with DeHaat, a technology-driven platform, offering end-to-end agricultural services to farmers in India. DeHaat, will use SAP’s cloud enterprise resource planning (ERP) solution S/4HANA Cloud.

- In October 2022, Bayer’s launches innovative solutions to the challenges facing farmers, consumers and planet, the company announced of the LifeHub Monheim, a future partnership-focused facility located on the campus of Bayer’s global crop science division headquarters in Monheim, Germany.

- In February 2022, Trimble Agriculture has launched its Virtual Farm. The software explores topics such as labor skill levels, water management, and input management, and then connects the user with opportunities to address those concerns through Trimble’s services

Frequently Asked Questions (FAQ):

How big is the Agriculture Analytics Market?

What is growth rate of the Agriculture Analytics Market?

What are the key trends affecting the global Agriculture Analytics Market?

Who are the key players in Agriculture Analytics Market?

Who will be the leading hub for Agriculture Analytics Market?

What is Agriculture Analytics?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing size and complexity of farms- Rising need for optimal resource utilization- Enhancing sustainability and reducing environmental impact- Applying Big Data in farmingRESTRAINTS- High costs associated with data collection and analysis- Data privacy and security concernsOPPORTUNITIES- Technological advancements such as IoT, AI, and ML- Prospect of public-private collaborations to advance use of agriculture analyticsCHALLENGES- Lack of technological literacy and skills gap- Data transfer and storage

-

5.3 CASE STUDY ANALYSISCASE STUDY 1: BETTER WINE PRODUCTION AT E. & J. GALLO WINERY WITH IBM SOLUTIONCASE STUDY 2: BUNGE RUNS SOPHISTICATED ANALYSIS TO IMPROVE ACTIVITIES USING IBM GIS MAPPING SOFTWARECASE STUDY 3: DELAVAL HELPS ABIS DAIRY FARM TO IMPROVE ANIMAL WELFARE AND WORK EFFICIENCYCASE STUDY 4: NESTLÉ USES AGRIVI 360 AGRICULTURE SUPPLY CHAIN PLATFORM FOR COMPLETE TRACEABILITY THROUGHOUT CHAINCASE STUDY 5: VEGGITECH AND AGRIVI BRINGS AGRONOMY INTO MODERN WORLDCASE STUDY 6: WYMAN INCREASES PRODUCTIVITY WITH CONSERVISCASE STUDY 7: SPROULE FARMS INCREASES EFFICIENCY AND PROFITABILITY WITH CONSERVISCASE STUDY 8: AGROPECUÁRIA CANOA MIRIM S/A IMPROVES PROFITABILITY AND PRODUCTIVITY BY OPTIMIZING FERTILIZER USECASE STUDY 9: MFA STREAMLINES STANDARDIZATION ACROSS ORGANIZATION BY IMPLEMENTING PROAGRICA’S SOLUTIONSCASE STUDY 10: ONESOIL YIELD ASSISTS SMART FARMING IN IMPROVING PERFORMANCECASE STUDY 11: WOODHALL GROWERS ACHIEVES ACCURACY AND FLEXIBILITY WITH AG LEADER’S SOLUTIONCASE STUDY 12: DE BORTOLI WINES SAVES 15–20% ON INPUT COSTS WITH AGWORLD’S SOLUTIONS

- 5.4 BRIEF HISTORY OF AGRICULTURE ANALYTICS

-

5.5 AGRICULTURE ANALYTICS MARKET: ECOSYSTEM

- 5.6 SUPPLY CHAIN ANALYSIS

- 5.7 PRICING MODEL ANALYSIS

-

5.8 PATENT ANALYSISMETHODOLOGYDOCUMENT TYPEINNOVATION AND PATENT APPLICATIONS- Top applicants

-

5.9 TECHNOLOGY ANALYSISRELATED TECHNOLOGY- GIS-based agriculture- Sensor technologyALLIED TECHNOLOGY- Blockchain- Sky-drones- Robotics and automation technology

-

5.10 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

- 5.11 KEY CONFERENCES & EVENTS

-

5.12 REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSREGULATIONS, BY REGION- North America- Europe- Asia Pacific- Middle East & Africa- Latin AmericaREGULATORY IMPLICATIONS AND INDUSTRY STANDARDS- General Data Protection Regulation- Securities and Exchange Commission Rule 17a-4- International Organization for Standardization/International Electrotechnical Commission 27001- System and Organization Controls 2 Type II Compliance- Financial Industry Regulatory Authority- Freedom of Information Act- Health Insurance Portability and Accountability Act

-

5.13 KEY COMPONENTS OF AGRICULTURE ANALYTICS ARCHITECTUREDATA COLLECTIONDATA MANAGEMENTDATA ANALYSISPREDICTIVE MODELINGDECISION SUPPORT SYSTEMS

-

5.14 TYPE OF AGRICULTURE ANALYTICSFARMING ANALYTICSLIVESTOCK ANALYTICSAQUACULTURE ANALYTICS

-

5.15 KEY STAKEHOLDERS & BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 5.16 DISRUPTIONS IMPACTING BUYERS/CLIENTS IN AGRICULTURE ANALYTICS MARKET

- 5.17 TECHNOLOGY ROADMAP OF MARKET

- 5.18 BUSINESS MODELS OF AGRICULTURE ANALYTICS

-

5.19 PRACTICES IN MARKETAGRI-EDUCATION AND TRAININGAGRI-MARKET FORECASTING AND PRICE ANALYSISSAFETY AND HEALTHCROP SELECTION AND DIVERSITYWATER CONSERVATION

-

6.1 INTRODUCTIONOFFERING: MARKET DRIVERS

- 6.2 SOLUTIONS

-

6.3 SERVICESPROFESSIONAL SERVICES- Training and Consulting- System Integration and Implementation- Support and MaintenanceMANAGED SERVICES- Farm operation services- Data services- Analytics Services

-

7.1 INTRODUCTIONAGRICULTURE TYPE: MARKET DRIVERS

-

7.2 PRECISION FARMINGINCREASED EFFICIENCY AND REDUCED LABOR COSTSYIELD MONITORING AND PREDICTIONVARIABLE RATE TECHNOLOGYFARM LABOR MANAGEMENTDECISION SUPPORT SYSTEMSSOIL HEALTH ANALYSISIRRIGATION AND WATER MANAGEMENTWEATHER TRACKING & FORECASTINGFINANCIAL AND RISK MANAGEMENTSUPPLY CHAIN MANAGEMENT- Order Delivery and Invoice Management- Shipping Management- Inventory ManagementOTHER PRECISION FARMING

-

7.3 LIVESTOCK FARMINGOPTIMIZES PRODUCTION PROCESSES AND ENHANCES PRODUCTIVITYFEEDING MANAGEMENTHEAT STRESS MANAGEMENTMILK HARVESTINGBREEDING MANAGEMENTBEHAVIOR MONITORING AND MANAGEMENTREAL-TIME MONITORINGCALF MANAGEMENTSUPPLY CHAIN MANAGEMENT- Order Delivery and Invoice Management- Shipping Management- Inventory ManagementOTHER LIVESTOCK FARMING

-

7.4 AQUACULTURE FARMINGADOPTION OF DATA-DRIVEN DECISION-MAKING PROCESSES BOOSTS SEGMENTAL GROWTHFISH TRACKING AND FLEET NAVIGATIONFEEDING MANAGEMENTWATER QUALITY MANAGEMENTQUALITY CONTROL AND TRACEABILITYPEST AND DISEASE MANAGEMENTFOOD PRODUCTIONAERATION SYSTEMSSUPPLY CHAIN MANAGEMENT- Order Delivery and Invoice Management- Shipping Management- Inventory ManagementOTHER AQUACULTURE FARMING

-

7.5 VERTICAL FARMINGOFFERS SOLUTION BY MAXIMIZING CROP YIELD IN LIMITED SPACESSUSTAINABILITY AND ENVIRONMENTAL MONITORINGENERGY OPTIMIZATIONNUTRIENT MANAGEMENTRESOURCE PLANNING AND OPTIMIZATIONGRADING AND MARKETINGPLANTING AND SEEDINGSUPPLY CHAIN MANAGEMENT- Order Delivery and Invoice Management- Shipping Management- Inventory ManagementOTHER VERTICAL FARMING

- 7.6 OTHER AGRICULTURE TYPE

-

8.1 INTRODUCTIONFARM SIZE: MARKET DRIVERS

-

8.2 SMALL AND MEDIUM-SIZED FARMSMEDIUM-SIZED FARMS TO DOMINATE MARKET

-

8.3 LARGE FARMSOWNERS ADOPT ADVANCED TECHNOLOGIES TO ATTAIN GRANULAR DATA POINTS ON SOIL CONDITIONS AND OTHER VITAL DETAILS

-

9.1 INTRODUCTIONTECHNOLOGY: MARKET DRIVERS

-

9.2 REMOTE SENSING AND SATELLITE IMAGERYINCREASING PRODUCTIVITY AND PROMOTING ENVIRONMENTAL STEWARDSHIP

-

9.3 GEOGRAPHIC INFORMATION SYSTEMIMPROVED CROP MANAGEMENT AND ENVIRONMENTALLY SUSTAINABLE FARMING PRACTICES

-

9.4 ROBOTICS AND AUTOMATIONANALYZES AGRICULTURAL DATA TO OPTIMIZE FARMING PRACTICES

-

9.5 BIG DATA AND CLOUD COMPUTINGEXTRACTS VALUABLE INSIGHTS FROM COMPLEX AGRICULTURAL DATA

-

9.6 VISUALIZATION AND REPORTINGTRANSFORMING COMPLEX INFORMATION INTO VISUALLY INTUITIVE REPRESENTATIONS

-

9.7 BLOCKCHAIN TECHNOLOGYPROVIDES SECURE DATA MANAGEMENT, TRACEABILITY, AND INTEGRATION OF DIVERSE DATA SOURCES

- 9.8 OTHER TECHNOLOGY

-

10.1 INTRODUCTIONEND USERS: MARKET DRIVERS

-

10.2 FARMERSADOPTION OF INNOVATIVE SOLUTIONS TO ENHANCE PRODUCTIVITY AND SUSTAINABILITY

-

10.3 AGRONOMISTSIMPROVED CROP MANAGEMENT AND ENVIRONMENTALLY SUSTAINABLE FARMING PRACTICES

-

10.4 AGRIBUSINESSESDRIVES PROFITABILITY, SUSTAINABILITY, AND INNOVATION IN EVER-EVOLVING AGRICULTURE INDUSTRY

-

10.5 AGRICULTURAL RESEARCHERSENSURES SECURE AND RESILIENT FOOD SUPPLY

-

10.6 GOVERNMENT AGENCIESGATHER, ANALYZE, AND DISTRIBUTE DATA FOR POLICY FORMULATION

- 10.7 OTHER END USERS

- 11.1 INTRODUCTION

-

11.2 NORTH AMERICANORTH AMERICA: MARKET DRIVERSNORTH AMERICA: IMPACT OF RECESSIONUS- Increasing application of artificial intelligence in agricultureCANADA- Growing research on predictive analysis and machine learning

-

11.3 EUROPEEUROPE: AGRICULTURE ANALYTICS MARKET DRIVERSEUROPE: IMPACT OF RECESSIONUK- Several government initiatives and laws in favor of agriculture analytics to boost market growthGERMANY- Farming 4.0 and increased funding from established players to expand market sizeFRANCE- Growing application of GIS in agriculture analyticsITALY- Shift to AI-based farming to promote market growthNETHERLANDS- Increased usage of advanced agricultural practices to favor market expansionREST OF EUROPE

-

11.4 ASIA PACIFICASIA PACIFIC: AGRICULTURE ANALYTICS MARKET DRIVERSASIA PACIFIC: IMPACT OF RECESSIONCHINA- Implementation of “Digital Village” to enhance market growthJAPAN- Rise of innovative technologies and government initiatives to drive use of analytics technologiesINDIA- Digital transformation of Indian agriculture sector to provide opportunities to AI technology providersSOUTH KOREA- Increasing investments in aquaculture industry to create lucrative opportunitiesANZ- Growing adoption of agriculture robots in farming to strengthen marketREST OF ASIA PACIFIC

-

11.5 MIDDLE EAST AND AFRICAMIDDLE EAST AND AFRICA: AGRICULTURE ANALYTICS MARKET DRIVERSMIDDLE EAST AND AFRICA: IMPACT OF RECESSIONSAUDI ARABIA- Disburses subsidies and grants interest-free loans to farmersUAE- Advancement and adoption of AI and ML technologies to boost marketISRAEL- Employment of advanced analytics tools to favor market growthSOUTH AFRICA- Government initiatives to boost marketREST OF MIDDLE EAST & AFRICA

-

11.6 LATIN AMERICALATIN AMERICA: AGRICULTURE ANALYTICS MARKET DRIVERSLATIN AMERICA: IMPACT OF RECESSIONBRAZIL- Growing initiatives to digitize agriculture sector to strengthen market expansionMEXICO- Increasing initiatives to develop smart farming technologies to support market growthARGENTINA- Application of satellite imagery, remote sensing, and data analytics to augment market sizeREST OF LATIN AMERICA

- 12.1 OVERVIEW

- 12.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 12.3 REVENUE ANALYSIS

- 12.4 MARKET SHARE ANALYSIS

-

12.5 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE COMPANIESPARTICIPANTSCOMPETITIVE BENCHMARKING

-

12.6 STARTUP/SME EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSSTARTUPS/SMES COMPETITIVE BENCHMARKING

-

12.7 COMPETITIVE SCENARIOS AND TRENDSPRODUCT LAUNCHESDEALS

- 13.1 INTRODUCTION

-

13.2 KEY PLAYERSIBM- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewDEERE & COMPANY- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewBAYER AG- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSAP- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewTRIMBLE INC- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewACCENTURE- Business overview- Products/Services/Solutions offered- Recent developmentsABACO GROUP- Business overview- Products/Solutions/Services offered- Recent developmentsDELAVAL- Business overview- Products/Solutions/Services offered- Recent developmentsORACLE- Business overview- Products/Solutions/Services offered- Recent developmentsDTN- Business overview- Products/Solutions/Services offered- Recent developmentsFARMERS EDGE- Business overview- Products/Solutions/Services offered- Recent developmentsSAS INSTITUTE- Business overview- Products/Solutions/Services offered- Recent developments

-

13.3 OTHER KEY PLAYERSITERISPRECISIONHAWKCONSERVISSTESALIT SYSTEMSAGRIBOTIXAGRIVIGRANULARFBNGRO INTELLIGENCERESSON

-

13.4 STARTUPSAGVUE TECHNOLOGIESTARANISCROPXTRACE GENOMICSFASALAGEYE TECHNOLOGIESHELIOPAS AIONESOILROOT AIAGSHIFT

- 14.1 INTRODUCTION

-

14.2 PRECISION FARMING MARKET – GLOBAL FORECAST TO 2030MARKET DEFINITIONMARKET SEGMENT- By Offering- By Technology- By Application- By Region

-

14.3 AI IN AGRICULTURE MARKET – GLOBAL FORECAST TO 2028MARKET DEFINITIONMARKET OVERVIEW- By Technology- By Offering- By Application- By Region

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

- TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2020–2022

- TABLE 2 PRIMARY INTERVIEWS

- TABLE 3 FACTOR ANALYSIS

- TABLE 4 AGRICULTURE ANALYTICS MARKET SIZE AND GROWTH RATE, 2017–2022 (USD MILLION, Y-O-Y %)

- TABLE 5 MARKET SIZE AND GROWTH RATE, 2023–2028 (USD MILLION, Y-O-Y %)

- TABLE 6 AVERAGE SELLING PRICE ANALYSIS, 2023

- TABLE 7 PATENTS FILED, 2013–2023

- TABLE 8 TOP 10 PATENT OWNERS IN MARKET, 2013–2023

- TABLE 9 LIST OF PATENTS IN MARKET, 2021–2023

- TABLE 10 PORTER’S FIVE FORCES ANALYSIS

- TABLE 11 MARKET: DETAILED LIST OF CONFERENCES AND EVENTS, 2023–2024

- TABLE 12 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 MIDDLE EAST AND AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 LATIN AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE AGRICULTURE TYPE

- TABLE 18 KEY BUYING CRITERIA FOR TOP THREE AGRICULTURE TYPE

- TABLE 19 SHORT-TERM ROADMAP, 2023–2025

- TABLE 20 MID-TERM ROADMAP, 2026–2028

- TABLE 21 LONG-TERM ROADMAP, 2029–2030

- TABLE 22 AGRICULTURE ANALYTICS MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 23 MARKET SIZE, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 24 SOLUTIONS: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 25 SOLUTIONS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 26 MARKET, BY SERVICES, 2017–2022 (USD MILLION)

- TABLE 27 MARKET, BY SERVICES, 2023–2028 (USD MILLION)

- TABLE 28 SERVICES: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 29 SERVICES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 30 PROFESSIONAL SERVICES: MARKET, BY SERVICES, 2017–2022 (USD MILLION)

- TABLE 31 PROFESSIONAL SERVICES: MARKET, BY SERVICES, 2023–2028 (USD MILLION)

- TABLE 32 PROFESSIONAL SERVICES: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 33 PROFESSIONAL SERVICES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 34 TRAINING AND CONSULTING: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 35 TRAINING AND CONSULTING: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 36 SYSTEM INTEGRATION AND IMPLEMENTATION: AGRICULTURE ANALYTICS MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 37 SYSTEM INTEGRATION AND IMPLEMENTATION: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 38 SUPPORT AND MAINTENANCE: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 39 SUPPORT AND MAINTENANCE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 40 MANAGED SERVICES: MARKET, BY SERVICES, 2017–2022 (USD MILLION)

- TABLE 41 MANAGED SERVICES: MARKET, BY SERVICES, 2023–2028 (USD MILLION)

- TABLE 42 MANAGED SERVICES: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 43 MANAGED SERVICES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 44 FARM OPERATION SERVICES: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 45 FARM OPERATION SERVICES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 46 DATA SERVICES: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 47 DATA SERVICES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 48 ANALYTICS SERVICES: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 49 ANALYTICS SERVICES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 50 MARKET, BY AGRICULTURE TYPE, 2017–2022 (USD MILLION)

- TABLE 51 MARKET, BY AGRICULTURE TYPE, 2023–2028 (USD MILLION)

- TABLE 52 PRECISION FARMING: AGRICULTURE ANALYTICS MARKET, BY TECHNOLOGY, 2017–2022 (USD MILLION)

- TABLE 53 PRECISION FARMING: MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 54 PRECISION FARMING: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 55 PRECISION FARMING: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 56 LIVESTOCK FARMING: MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 57 LIVESTOCK FARMING: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 58 LIVESTOCK FARMING: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 59 LIVESTOCK FARMING: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 60 AQUACULTURE FARMING: MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 61 AQUACULTURE FARMING: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 62 AQUACULTURE FARMING: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 63 AQUACULTURE FARMING: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 64 MARKET, BY VERTICAL FARMING TYPE, 2017–2022 (USD MILLION)

- TABLE 65 MARKET, BY VERTICAL FARMING TYPE, 2023–2028 (USD MILLION)

- TABLE 66 VERTICAL FARMING: AGRICULTURE ANALYTICS MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 67 VERTICAL FARMING: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 68 MARKET, BY FARM SIZE, 2017–2022 (USD MILLION)

- TABLE 69 MARKET, BY FARM SIZE, 2023–2028 (USD MILLION)

- TABLE 70 SMALL AND MEDIUM-SIZED FARMS: MARKET SIZE, BY REGION, 2017–2022 (USD MILLION)

- TABLE 71 SMALL AND MEDIUM-SIZED FARMS: MARKET SIZE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 72 LARGE FARMS: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 73 LARGE FARMS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 74 TECHNOLOGY: MARKET, 2017–2022, (USD MILLION)

- TABLE 75 TECHNOLOGY: MARKET, 2023–2028 (USD MILLION)

- TABLE 76 REMOTE SENSING AND SATELLITE IMAGERY: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 77 REMOTE SENSING AND SATELLITE IMAGERY: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 78 GEOGRAPHIC INFORMATION SYSTEM: AGRICULTURE ANALYTICS MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 79 GEOGRAPHIC INFORMATION SYSTEM: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 80 ROBOTICS AND AUTOMATION: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 81 ROBOTICS AND AUTOMATION: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 82 BIG DATA AND CLOUD COMPUTING: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 83 BIG DATA AND CLOUD COMPUTING: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 84 VISUALIZATION AND REPORTING: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 85 VISUALIZATION AND REPORTING: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 86 BLOCKCHAIN TECHNOLOGY: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 87 BLOCKCHAIN TECHNOLOGY: AGRICULTURE ANALYTICS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 88 MARKET, BY END USERS, 2017–2022 (USD MILLION)

- TABLE 89 MARKET, BY END USERS, 2023–2028 (USD MILLION)

- TABLE 90 FARMERS: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 91 FARMERS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 92 AGRONOMISTS: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 93 AGRONOMISTS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 94 AGRIBUSINESSES: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 95 AGRIBUSINESSES: AGRICULTURE ANALYTICS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 96 AGRICULTURAL RESEARCHERS: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 97 AGRICULTURAL RESEARCHERS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 98 GOVERNMENT AGENCIES: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 99 GOVERNMENT AGENCIES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 100 MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 101 MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 102 NORTH AMERICA: AGRICULTURE ANALYTICS MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 103 NORTH AMERICA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 104 NORTH AMERICA: MARKET, BY SERVICES, 2017–2022 (USD MILLION)

- TABLE 105 NORTH AMERICA: MARKET, BY SERVICES, 2023–2028 (USD MILLION)

- TABLE 106 NORTH AMERICA: MARKET, BY PROFESSIONAL SERVICES, 2017–2022 (USD MILLION)

- TABLE 107 NORTH AMERICA: MARKET, BY PROFESSIONAL SERVICES, 2023–2028 (USD MILLION)

- TABLE 108 NORTH AMERICA: MARKET, BY MANAGED SERVICES, 2017–2022 (USD MILLION)

- TABLE 109 NORTH AMERICA: MARKET, BY MANAGED SERVICES, 2023–2028 (USD MILLION)

- TABLE 110 NORTH AMERICA: MARKET, BY AGRICULTURE TYPE, 2017–2022 (USD MILLION)

- TABLE 111 NORTH AMERICA: MARKET, BY AGRICULTURE TYPE, 2023–2028 (USD MILLION)

- TABLE 112 NORTH AMERICA: MARKET, BY FARM SIZE, 2017–2022 (USD MILLION)

- TABLE 113 NORTH AMERICA: AGRICULTURE ANALYTICS MARKET, BY FARM SIZE, 2023–2028 (USD MILLION)

- TABLE 114 NORTH AMERICA: MARKET, BY TECHNOLOGY, 2017–2022 (USD MILLION)

- TABLE 115 NORTH AMERICA: MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 116 NORTH AMERICA: MARKET, BY END USERS, 2017–2022 (USD MILLION)

- TABLE 117 NORTH AMERICA: MARKET, BY END USERS, 2023–2028 (USD MILLION)

- TABLE 118 NORTH AMERICA: MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 119 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 120 US: MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 121 US: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 122 US: MARKET, BY FARM SIZE, 2017–2022 (USD MILLION)

- TABLE 123 US: MARKET, BY FARM SIZE, 2023–2028 (USD MILLION)

- TABLE 124 CANADA: AGRICULTURE ANALYTICS MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 125 CANADA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 126 CANADA: MARKET, BY FARM SIZE, 2017–2022 (USD MILLION)

- TABLE 127 CANADA: MARKET, BY FARM SIZE, 2023–2028 (USD MILLION)

- TABLE 128 EUROPE: MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 129 EUROPE: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 130 EUROPE: MARKET, BY SERVICES, 2017–2022 (USD MILLION)

- TABLE 131 EUROPE: MARKET, BY SERVICES, 2023–2028 (USD MILLION)

- TABLE 132 EUROPE: MARKET, BY PROFESSIONAL SERVICES: 2017–2022 (USD MILLION)

- TABLE 133 EUROPE: AGRICULTURE ANALYTICS MARKET, BY PROFESSIONAL SERVICES, 2023–2028 (USD MILLION)

- TABLE 134 EUROPE: MARKET, BY MANAGED SERVICES, 2017–2022 (USD MILLION)

- TABLE 135 EUROPE: MARKET, BY MANAGED SERVICES, 2023–2028 (USD MILLION)

- TABLE 136 EUROPE: MARKET, BY AGRICULTURE TYPE, 2017–2022 (USD MILLION)

- TABLE 137 EUROPE: MARKET, BY AGRICULTURE TYPE, 2023–2028 (USD MILLION)

- TABLE 138 EUROPE: MARKET, BY FARM SIZE, 2017–2022 (USD MILLION)

- TABLE 139 EUROPE: MARKET, BY FARM SIZE, 2023–2028 (USD MILLION)

- TABLE 140 EUROPE: MARKET, BY TECHNOLOGY, 2017–2022 (USD MILLION)

- TABLE 141 EUROPE: MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 142 EUROPE: MARKET, BY END USERS, 2017–2022 (USD MILLION)

- TABLE 143 EUROPE: MARKET, BY END USERS, 2023–2028 (USD MILLION)

- TABLE 144 EUROPE: MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 145 EUROPE: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 146 UK: AGRICULTURE ANALYTICS MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 147 UK: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 148 UK: MARKET, BY FARM SIZE, 2017–2022 (USD MILLION)

- TABLE 149 UK: MARKET, BY FARM SIZE, 2023–2028 (USD MILLION)

- TABLE 150 GERMANY: MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 151 GERMANY: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 152 GERMANY: MARKET, BY FARM SIZE, 2017–2022 (USD MILLION)

- TABLE 153 GERMANY: MARKET, BY FARM SIZE, 2023–2028 (USD MILLION)

- TABLE 154 FRANCE: AGRICULTURE ANALYTICS MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 155 FRANCE: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 156 FRANCE: MARKET, BY FARM SIZE, 2017–2022 (USD MILLION)

- TABLE 157 FRANCE: MARKET, BY FARM SIZE, 2023–2028 (USD MILLION)

- TABLE 158 ITALY: MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 159 ITALY: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 160 ITALY: MARKET, BY FARM SIZE, 2017–2022 (USD MILLION)

- TABLE 161 ITALY: MARKET, BY FARM SIZE, 2023–2028 (USD MILLION)

- TABLE 162 NETHERLANDS: AGRICULTURE ANALYTICS MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 163 NETHERLANDS: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 164 NETHERLANDS: MARKET, BY FARM SIZE, 2017–2022 (USD MILLION)

- TABLE 165 NETHERLANDS: MARKET, BY FARM SIZE, 2023–2028 (USD MILLION)

- TABLE 166 ASIA PACIFIC: MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 167 ASIA PACIFIC: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 168 ASIA PACIFIC: MARKET, BY SERVICES, 2017–2022 (USD MILLION)

- TABLE 169 ASIA PACIFIC: MARKET, BY SERVICES, 2023–2028 (USD MILLION)

- TABLE 170 ASIA PACIFIC: MARKET, BY PROFESSIONAL SERVICES: 2017–2022 (USD MILLION)

- TABLE 171 ASIA PACIFIC: MARKET, BY PROFESSIONAL SERVICES, 2023–2028 (USD MILLION)

- TABLE 172 ASIA PACIFIC: MARKET, BY MANAGED SERVICES, 2017–2022 (USD MILLION)

- TABLE 173 ASIA PACIFIC: AGRICULTURE ANALYTICS MARKET, BY MANAGED SERVICES, 2023–2028 (USD MILLION)

- TABLE 174 ASIA PACIFIC: MARKET, BY AGRICULTURE TYPE, 2017–2022 (USD MILLION)

- TABLE 175 ASIA PACIFIC: MARKET, BY AGRICULTURE TYPE, 2023–2028 (USD MILLION)

- TABLE 176 ASIA PACIFIC: MARKET, BY FARM SIZE, 2017–2022 (USD MILLION)

- TABLE 177 ASIA PACIFIC: MARKET, BY FARM SIZE, 2023–2028 (USD MILLION)

- TABLE 178 ASIA PACIFIC: MARKET, BY TECHNOLOGY, 2017–2022 (USD MILLION)

- TABLE 179 ASIA PACIFIC: MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 180 ASIA PACIFIC: MARKET, BY END USERS, 2017–2022 (USD MILLION)

- TABLE 181 ASIA PACIFIC: MARKET, BY END USERS, 2023–2028 (USD MILLION)

- TABLE 182 ASIA PACIFIC: MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 183 ASIA PACIFIC: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 184 CHINA: AGRICULTURE ANALYTICS MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 185 CHINA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 186 CHINA: MARKET, BY FARM SIZE, 2017–2022 (USD MILLION)

- TABLE 187 CHINA: MARKET, BY FARM SIZE, 2023–2028 (USD MILLION)

- TABLE 188 JAPAN: MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 189 JAPAN: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 190 JAPAN: MARKET, BY FARM SIZE, 2017–2022 (USD MILLION)

- TABLE 191 JAPAN: MARKET, BY FARM SIZE, 2023–2028 (USD MILLION)

- TABLE 192 INDIA: MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 193 INDIA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 194 INDIA: MARKET, BY FARM SIZE, 2017–2022 (USD MILLION)

- TABLE 195 INDIA: MARKET, BY FARM SIZE, 2023–2028 (USD MILLION)

- TABLE 196 SOUTH KOREA: AGRICULTURE ANALYTICS MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 197 SOUTH KOREA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 198 SOUTH KOREA: MARKET, BY FARM SIZE, 2017–2022 (USD MILLION)

- TABLE 199 SOUTH KOREA: MARKET, BY FARM SIZE, 2023–2028 (USD MILLION)

- TABLE 200 ANZ: MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 201 ANZ: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 202 ANZ: MARKET, BY FARM SIZE, 2017–2022 (USD MILLION)

- TABLE 203 ANZ: MARKET, BY FARM SIZE, 2023–2028 (USD MILLION)

- TABLE 204 MIDDLE EAST AND AFRICA: AGRICULTURE ANALYTICS MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 205 MIDDLE EAST AND AFRICA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 206 MIDDLE EAST AND AFRICA: MARKET, BY SERVICES, 2017–2022 (USD MILLION)

- TABLE 207 MIDDLE EAST AND AFRICA: MARKET, BY SERVICES, 2023–2028 (USD MILLION)

- TABLE 208 MIDDLE EAST AND AFRICA: MARKET, BY PROFESSIONAL SERVICES: 2017–2022 (USD MILLION)

- TABLE 209 MIDDLE EAST AND AFRICA: MARKET, BY PROFESSIONAL SERVICES, 2023–2028 (USD MILLION)

- TABLE 210 MIDDLE EAST AND AFRICA: MARKET, BY MANAGED SERVICES, 2017–2022 (USD MILLION)

- TABLE 211 MIDDLE EAST AND AFRICA: MARKET, BY MANAGED SERVICES, 2023–2028 (USD MILLION)

- TABLE 212 MIDDLE EAST AND AFRICA: MARKET, BY AGRICULTURE TYPE, 2017–2022 (USD MILLION)

- TABLE 213 MIDDLE EAST AND AFRICA: MARKET, BY AGRICULTURE TYPE, 2023–2028 (USD MILLION)

- TABLE 214 MIDDLE EAST AND AFRICA: MARKET, BY FARM SIZE, 2017–2022 (USD MILLION)

- TABLE 215 MIDDLE EAST AND AFRICA: AGRICULTURE ANALYTICS MARKET, BY FARM SIZE, 2023–2028 (USD MILLION)

- TABLE 216 MIDDLE EAST AND AFRICA: MARKET, BY TECHNOLOGY, 2017–2022 (USD MILLION)

- TABLE 217 MIDDLE EAST AND AFRICA: MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 218 MIDDLE EAST AND AFRICA: MARKET, BY END USERS, 2017–2022 (USD MILLION)

- TABLE 219 MIDDLE EAST AND AFRICA: MARKET, BY END USERS, 2023–2028 (USD MILLION)

- TABLE 220 MIDDLE EAST AND AFRICA: MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 221 MIDDLE EAST AND AFRICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 222 SAUDI ARABIA: MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 223 SAUDI ARABIA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 224 SAUDI ARABIA: MARKET, BY FARM SIZE, 2017–2022 (USD MILLION)

- TABLE 225 SAUDI ARABIA: MARKET, BY FARM SIZE, 2023–2028 (USD MILLION)

- TABLE 226 UAE: AGRICULTURE ANALYTICS MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 227 UAE: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 228 UAE: MARKET, BY FARM SIZE, 2017–2022 (USD MILLION)

- TABLE 229 UAE: MARKET, BY FARM SIZE, 2023–2028 (USD MILLION)

- TABLE 230 ISRAEL: MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 231 ISRAEL: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 232 ISRAEL: MARKET, BY FARM SIZE, 2017–2022 (USD MILLION)

- TABLE 233 ISRAEL: MARKET, BY FARM SIZE, 2023–2028 (USD MILLION)

- TABLE 234 SOUTH AFRICA: AGRICULTURE ANALYTICS MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 235 SOUTH AFRICA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 236 SOUTH AFRICA: MARKET, BY FARM SIZE, 2017–2022 (USD MILLION)

- TABLE 237 SOUTH AFRICA: MARKET, BY FARM SIZE, 2023–2028 (USD MILLION)

- TABLE 238 LATIN AMERICA: MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 239 LATIN AMERICA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 240 LATIN AMERICA: MARKET, BY SERVICES, 2017–2022 (USD MILLION)

- TABLE 241 LATIN AMERICA: MARKET, BY SERVICES, 2023–2028 (USD MILLION)

- TABLE 242 LATIN AMERICA: MARKET, BY PROFESSIONAL SERVICES: 2017–2022 (USD MILLION)

- TABLE 243 LATIN AMERICA: MARKET, BY PROFESSIONAL SERVICES, 2023–2028 (USD MILLION)

- TABLE 244 LATIN AMERICA: MARKET, BY MANAGED SERVICES, 2017–2022 (USD MILLION)

- TABLE 245 LATIN AMERICA: MARKET, BY MANAGED SERVICES, 2023–2028 (USD MILLION)

- TABLE 246 LATIN AMERICA: MARKET, BY AGRICULTURE TYPE, 2017–2022 (USD MILLION)

- TABLE 247 LATIN AMERICA: AGRICULTURE ANALYTICS MARKET, BY AGRICULTURE TYPE, 2023–2028 (USD MILLION)

- TABLE 248 LATIN AMERICA: MARKET, BY FARM SIZE, 2017–2022 (USD MILLION)

- TABLE 249 LATIN AMERICA: MARKET, BY FARM SIZE, 2023–2028 (USD MILLION)

- TABLE 250 LATIN AMERICA: MARKET, BY TECHNOLOGY, 2017–2022 (USD MILLION)

- TABLE 251 LATIN AMERICA: MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 252 LATIN AMERICA: MARKET, BY END USERS, 2017–2022 (USD MILLION)

- TABLE 253 LATIN AMERICA: MARKET, BY END USERS, 2023–2028 (USD MILLION)

- TABLE 254 LATIN AMERICA: MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 255 LATIN AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 256 BRAZIL: AGRICULTURE ANALYTICS MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 257 BRAZIL: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 258 BRAZIL: MARKET, BY FARM SIZE, 2017–2022 (USD MILLION)

- TABLE 259 BRAZIL: MARKET, BY FARM SIZE, 2023–2028 (USD MILLION)

- TABLE 260 MEXICO: MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 261 MEXICO: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 262 MEXICO: MARKET, BY FARM SIZE, 2017–2022 (USD MILLION)

- TABLE 263 MEXICO: MARKET, BY FARM SIZE, 2023–2028 (USD MILLION)

- TABLE 264 ARGENTINA: MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 265 ARGENTINA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 266 ARGENTINA: MARKET, BY FARM SIZE, 2017–2022 (USD MILLION)

- TABLE 267 ARGENTINA: MARKET, BY FARM SIZE, 2023–2028 (USD MILLION)

- TABLE 268 OVERVIEW OF STRATEGIES ADOPTED BY KEY AGRICULTURE ANALYTICS VENDORS

- TABLE 269 MARKET: DEGREE OF COMPETITION

- TABLE 270 AGRICULTURE ANALYTICS MARKET: PRODUCT FOOTPRINT ANALYSIS OF KEY PLAYERS, 2022

- TABLE 271 MARKET: PRODUCT FOOTPRINT ANALYSIS OF OTHER PLAYERS, 2022

- TABLE 272 MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 273 PRODUCT LAUNCHES, 2020–2023

- TABLE 274 DEALS, 2020–2023

- TABLE 275 IBM: BUSINESS OVERVIEW

- TABLE 276 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 277 IBM: PRODUCT LAUNCHES

- TABLE 278 IBM: DEALS

- TABLE 279 DEERE & COMPANY: BUSINESS OVERVIEW

- TABLE 280 DEERE & COMPANY: PRODUCTS/SOLUTIONS SERVICES OFFERED

- TABLE 281 DEERE & COMPANY: DEALS

- TABLE 282 BAYER AG: BUSINESS OVERVIEW

- TABLE 283 BAYER AG: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 284 BAYER AG: PRODUCT LAUNCHES

- TABLE 285 BAYER AG: DEALS

- TABLE 286 SAP: BUSINESS OVERVIEW

- TABLE 287 SAP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 288 SAP: PRODUCT LAUNCHES

- TABLE 289 SAP: DEALS

- TABLE 290 TRIMBLE INC: BUSINESS OVERVIEW

- TABLE 291 TRIMBLE INC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 292 TRIMBLE INC: PRODUCT LAUNCHES

- TABLE 293 TRIMBLE INC: DEALS

- TABLE 294 ACCENTURE: BUSINESS OVERVIEW

- TABLE 295 ACCENTURE: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 296 ACCENTURE: DEALS

- TABLE 297 ABACO GROUP: BUSINESS OVERVIEW

- TABLE 298 ABACO GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 299 ABACO GROUP: DEALS

- TABLE 300 DELAVAL: BUSINESS OVERVIEW

- TABLE 301 DELAVAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 302 DELAVAL: PRODUCT LAUNCHES AND DEVELOPMENTS

- TABLE 303 DELAVAL: DEALS

- TABLE 304 ORACLE: BUSINESS OVERVIEW

- TABLE 305 ORACLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 306 ORACLE: DEALS

- TABLE 307 DTN: BUSINESS OVERVIEW

- TABLE 308 DTN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 309 DTN: DEALS

- TABLE 310 FARMERS EDGE: BUSINESS OVERVIEW

- TABLE 311 FARMERS EDGE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 312 FARMERS EDGE: DEALS

- TABLE 313 SAS INSTITUTE: BUSINESS OVERVIEW

- TABLE 314 SAS INSTITUTE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 315 SAS INSTITUTE: DEALS

- TABLE 316 PRECISION FARMING MARKET, BY OFFERING, 2018–2021 (USD MILLION)

- TABLE 317 PRECISION FARMING MARKET, BY OFFERING, 2022–2030 (USD MILLION)

- TABLE 318 PRECISION FARMING MARKET, BY HARDWARE, 2018–2021 (USD MILLION)

- TABLE 319 PRECISION FARMING MARKET, BY HARDWARE, 2022–2030 (USD MILLION)

- TABLE 320 SOFTWARE: PRECISION FARMING MARKET, BY DEPLOYMENT TYPE, 2018–2021 (USD MILLION)

- TABLE 321 SOFTWARE: PRECISION FARMING MARKET, BY DEPLOYMENT TYPE, 2022–2030 (USD MILLION)

- TABLE 322 PRECISION FARMING MARKET FOR SERVICES, BY SERVICE TYPE, 2018–2021 (USD MILLION)

- TABLE 323 PRECISION FARMING MARKET FOR SERVICES, BY SERVICE TYPE, 2022–2030 (USD MILLION)

- TABLE 324 PRECISION FARMING MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

- TABLE 325 PRECISION FARMING MARKET, BY TECHNOLOGY, 2022–2030 (USD MILLION)

- TABLE 326 PRECISION FARMING MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 327 PRECISION FARMING MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 328 PRECISION FARMING MARKET, BY REGION, 2022–2030 (USD MILLION)

- TABLE 329 AI IN AGRICULTURE MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 330 AI IN AGRICULTURE MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 331 AI IN AGRICULTURE MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 332 AI IN AGRICULTURE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 333 HARDWARE: AI IN AGRICULTURE MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 334 HARDWARE: AI IN AGRICULTURE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 335 SOFTWARE: AI IN AGRICULTURE MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 336 SOFTWARE: AI IN AGRICULTURE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 337 SERVICE: AI IN AGRICULTURE MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 338 SERVICE: AI IN AGRICULTURE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 339 AI IN AGRICULTURE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 340 AI IN AGRICULTURE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 341 AI IN AGRICULTURE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 342 AI IN AGRICULTURE MARKET, BY REGION, 2023–2028 (USD MILLION)

- FIGURE 1 MARKET: RESEARCH DESIGN

- FIGURE 2 DATA TRIANGULATION

- FIGURE 3 MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 1 (SUPPLY SIDE): REVENUE OF SOLUTIONS/SERVICES OF MARKET

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 2 - BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE OF ALL SOLUTIONS/SERVICES OF MARKET

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 3, BOTTOM-UP (DEMAND-SIDE): SHARE OF AGRICULTURE ANALYTICS THROUGH OVERALL AGRICULTURE ANALYTICS SPENDING

- FIGURE 7 SOLUTIONS SEGMENT TO SECURE HIGHER MARKET SHARE IN 2023

- FIGURE 8 PROFESSIONAL SEGMENT TO DOMINATE MARKET IN 2023

- FIGURE 9 TRAINING AND CONSULTING SERVICES TO CLAIM LARGER MARKET SHARE IN 2023

- FIGURE 10 LARGE FARMS SEGMENT TO LEAD MARKET IN 2023

- FIGURE 11 REMOTE SENSING AND SATELLITE IMAGERY SEGMENT TO CLAIM LARGER MARKET SHARE IN 2023

- FIGURE 12 PRECISION FARMING SEGMENT TO DOMINATE MARKET IN 2023

- FIGURE 13 FARMERS SEGMENT TO SECURE LARGER MARKET SHARE IN 2023

- FIGURE 14 MARKET, BY REGION

- FIGURE 15 RISING NEED FOR RISK ASSESSMENT IN FARMING TO DRIVE ADOPTION OF AGRICULTURE ANALYTICS

- FIGURE 16 MARKET TO WITNESS MINOR DECLINE IN Y-O-Y GROWTH IN 2023

- FIGURE 17 PRECISION FARMING SEGMENT TO HOLD HIGHEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 18 NORTH AMERICA TO ACCOUNT FOR HIGHEST MARKET SHARE IN 2023

- FIGURE 19 PRECISION FARMING AND FARMERS SEGMENTS ESTIMATED TO SECURE MAXIMUM MARKET SHARE IN 2023

- FIGURE 20 MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 21 BRIEF HISTORY OF AGRICULTURE ANALYTICS

- FIGURE 22 MARKET: ECOSYSTEM

- FIGURE 23 SUPPLY CHAIN ANALYSIS: MARKET

- FIGURE 24 TOTAL NUMBER OF PATENTS GRANTED, JANUARY 2013– APRIL 2023

- FIGURE 25 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN LAST 10 YEARS, 2013–2023

- FIGURE 26 REGIONAL ANALYSIS OF PATENTS GRANTED, 2013–2023

- FIGURE 27 PORTER’S FIVE FORCES ANALYSIS

- FIGURE 28 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE AGRICULTURE TYPE

- FIGURE 29 KEY BUYING CRITERIA FOR TOP THREE AGRICULTURE TYPE

- FIGURE 30 MARKET: DISRUPTIONS IMPACTING BUYERS/CLIENTS

- FIGURE 31 SERVICES SEGMENT TO RECORD HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 32 MANAGED SERVICES SEGMENT TO EXHIBIT HIGHER CAGR IN AGRICULTURE ANALYTICS MARKET DURING FORECAST PERIOD

- FIGURE 33 SYSTEM INTEGRATION AND IMPLEMENTATION TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 34 DATA SERVICES SUB-SEGMENT TO DISPLAY HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 35 LIVESTOCK FARMING TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 36 SMALL AND MEDIUM FARMS SEGMENT TO RECORD HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 37 VISUALIZATION AND REPORTING SEGMENT TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 38 AGRONOMISTS SEGMENT TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 39 ASIA PACIFIC TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 40 INDIA TO ATTAIN FASTEST GROWTH DURING FORECAST PERIOD

- FIGURE 41 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 42 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 43 REVENUE ANALYSIS OF KEY MARKET PLAYERS, 2020–2022

- FIGURE 44 MARKET SHARE ANALYSIS FOR KEY COMPANIES, 2022

- FIGURE 45 KEY COMPANY EVALUATION MATRIX, 2022

- FIGURE 46 STARTUPS/SME EVALUATION MATRIX, 2022

- FIGURE 47 IBM: COMPANY SNAPSHOT

- FIGURE 48 DEERE & COMPANY: COMPANY SNAPSHOT

- FIGURE 49 BAYER AG: COMPANY SNAPSHOT

- FIGURE 50 SAP: COMPANY SNAPSHOT

- FIGURE 51 TRIMBLE INC: COMPANY SNAPSHOT

- FIGURE 52 ACCENTURE: COMPANY SNAPSHOT

- FIGURE 53 DELAVAL: COMPANY SNAPSHOT

- FIGURE 54 ORACLE: COMPANY SNAPSHOT

The study involved four major activities in estimating the current market size of the agriculture analytics market. Extensive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were used to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the agriculture analytics market.

Secondary Research

In the secondary research process, various secondary sources, such as D&B Hoovers and Bloomberg BusinessWeek, Dun Bradstreet, and Factiva, have been referred to for identifying and collecting information for this study. Secondary sources included annual reports; press releases and investor presentations of companies; whitepapers, certified publications and articles by recognized authors; gold standard and silver standard websites; Research and Development (R&D) organizations; regulatory bodies; and databases.

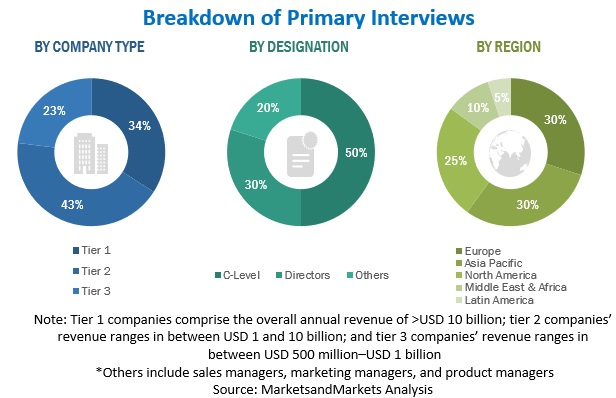

Primary Research

Various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief X Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and product development/innovation teams; related key executives from agriculture analytics solution vendors, system integrators, service providers, industry associations, and consultants; and key opinion leaders. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, various departments within organizations, such as sales, operations, and administration, were covered to provide a holistic viewpoint in our report.

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the agriculture analytics market.

- In this approach, the overall agriculture analytics market size for each organization size have been considered at a country and regional level.

- Extensive secondary and primary research has been carried out to understand the global market scenario for various agriculture analytics platform type used in the key verticals.

- Several primary interviews have been conducted with key opinion leaders related to agriculture analytics providers, including key OEMs and Tier I suppliers

- Qualitative aspects such as market drivers, restraints, opportunities, and challenges have been taken into consideration while calculating and forecasting the market size.

Definition

The agriculture analytics market pertains to the industry that utilizes advanced data analytics, technology, and software solutions to gather, process, analyze, and derive valuable insights from agricultural data. It involves the application of diverse analytical techniques and tools to enhance decision-making, optimize farm operations, and improve agricultural productivity and sustainability.

Stakeholders

- Agriculture analytics vendors

- Precision farming providers

- Managed service providers

- Smart farming vendors

- Farming equipment manufacturers

- System integrators

- Consulting service providers

- Resellers and distributors

- Research organizations

- Government agencies

- Enterprise users

- Technology providers

- Venture capitalists, private equity firms, and startup companies

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakup procedures were employed, wherever applicable. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Report Objectives

- To define, describe, and forecast the agriculture analytics market by offering, agriculture type, farm size, technology, end users, and region

- To provide detailed information about the major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the market growth

- To analyze the opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders

- To forecast the market size of the segments with respect to five main regions: North America, Europe, Asia Pacific, Middle East and Africa, and Latin America

- To profile the key players and comprehensively analyze their market rankings and core competencies

- To analyze competitive developments, such as mergers and acquisitions, new product developments, and R&D activities in the market

- To analyze the impact of recession across all the regions across the agriculture analytics market.

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of agriculture analytics market

- Profiling of additional market players (total up to 15)

- Country-level analysis of main segments such as component, solutions, applications, organization size, deployment mode, industry vertical

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Agriculture Analytics Market

Who are the top players in APAC region for Agriculture Analytics Market