Agricultural biosolutions Market by Type (Biostimulants, Biopesticides, Biofertilizers, Microbial Inoculants), Crop Type (Cereals & Grains, Oilseeds & Pulses, Fruits & Vegetables), Mode of Application, Form and Region - Global Forecast to 2029

The global agricultural biosolutions market is on a trajectory of significant expansion, with an estimated value projected to reach USD XX billion by 2029 from the 2024 valuation of USD XX billion, displaying a promising Compound Annual Growth Rate (CAGR) of 12.9%. Agricultural biosolutions encompass a range of biological products and processes that enhance agricultural productivity while minimizing environmental impact. These solutions include biological pesticides, biofertilizers, and biostimulants that harness natural mechanisms to improve crop health and yield. The growing demand for agricultural biosolutions is primarily driven by the imperative of achieving food security amidst a burgeoning global population. As the world faces the challenge of feeding over 9 billion people by 2050, sustainable agricultural practices are crucial. Biosolutions play a pivotal role by promoting soil health, biodiversity, and ecosystem resilience, thereby ensuring long-term agricultural sustainability.

Moreover, agricultural biosolutions offer significant advantages over conventional chemical inputs. They reduce the dependency on synthetic pesticides and fertilizers, which can have detrimental effects on soil fertility and water quality. By harnessing natural biological processes, these solutions not only enhance crop yields but also contribute to mitigating climate change impacts by sequestering carbon and reducing greenhouse gas emissions associated with traditional agricultural practices. Thus, the adoption of biosolutions represents a paradigm shift towards more ecologically balanced and economically viable farming methods, essential for meeting the dual challenges of food production and environmental stewardship in the 21st century.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Market Dynamics

Drivers: Rising focus on sustainable agricultural practices

As global environmental concerns escalate, there is an increasing demand for farming methods that minimize ecological impact. Sustainable practices, which emphasize reducing chemical inputs, conserving water, and enhancing soil health, align perfectly with the principles of agricultural biosolutions. These solutions, including biofertilizers, biopesticides, and biostimulants, offer natural and effective alternatives to traditional chemical products, promoting healthier ecosystems and biodiversity.

Furthermore, regulatory bodies worldwide are tightening restrictions on synthetic agrochemicals, prompting farmers to seek compliant and eco-friendly options. The push for sustainability is also driven by consumer preferences for organic and sustainably-produced food, which further compels farmers to adopt biosolutions to meet market demands. Additionally, technological advancements in biotechnology and increased research investments are enhancing the efficacy and availability of agricultural biosolutions, making them more accessible and attractive to farmers.

Restraints: High production costs and requirement for significant R&D investments

Developing innovative biosolutions, such as biopesticides, biofertilizers, and biostimulants, requires substantial investment in advanced technologies, extensive field trials, and rigorous regulatory approvals. These processes are time-consuming and costly, often demanding specialized expertise and significant financial resources. For many small and medium-sized enterprises (SMEs), which are pivotal in driving innovation within the sector, the high R&D expenses can be prohibitive, limiting their ability to bring new products to market.

Moreover, the lengthy and complex regulatory landscape for agricultural biosolutions adds to the financial burden. Ensuring that new biosolutions meet safety and efficacy standards involves comprehensive testing and compliance with varying international regulations, further escalating costs. This financial barrier can stifle innovation and slow the pace at which new, environmentally sustainable solutions reach the market.

Opportunities: Government policies favoring bio-based solutions

Government policies favoring bio-based solutions over chemical inputs present a significant opportunity for the growth of the agricultural biosolutions market. These policies often include subsidies, tax incentives, and research grants aimed at promoting sustainable agricultural practices. By reducing the financial burden on farmers and agribusinesses, these incentives make it more feasible for them to adopt bio-based products such as biopesticides, biofertilizers, and biostimulants. For instance, the Government of India encourages biofertilizers over chemical fertilizers through schemes like PKVY, MOVCDNER, NMOOP, and NFSM, as per the Ministry of Agriculture & Farmers Welfare article published in November 2019. Additionally, stringent regulations on chemical inputs and growing environmental concerns drive the demand for safer, eco-friendly alternatives.

Moreover, government support can spur innovation and investment in the biosolutions sector. Enhanced funding for research and development accelerates the creation of advanced bio-based products that can compete with traditional chemicals in terms of efficacy and cost. Policies that promote organic farming and regenerative agriculture also align with the broader trend toward sustainability, increasing consumer demand for bio-based agricultural products.

Challenges: Complex and inconsistent regulatory landscape across regions

Different regulatory frameworks across regions can significantly delay or complicate the approval and market entry of agricultural biosolutions, posing substantial challenges to the market's growth. Each country or region often has its unique set of regulations, safety standards, and compliance requirements that biosolution providers must navigate. These varying regulations can lead to prolonged approval processes, as companies must tailor their products to meet the specific criteria of each regulatory body. This not only increases the time to market but also escalates development and compliance costs.

Moreover, the lack of harmonization between regulatory frameworks can create uncertainties and inefficiencies. Companies may face difficulties in predicting approval timelines and requirements, leading to strategic planning challenges. This fragmentation can also deter investment in biosolutions, as investors may perceive higher risks associated with regulatory hurdles. Additionally, small and medium-sized enterprises (SMEs), which are often at the forefront of innovation in agricultural biosolutions, may find it particularly burdensome to allocate resources to meet diverse regulatory demands, hindering their growth and market participation.

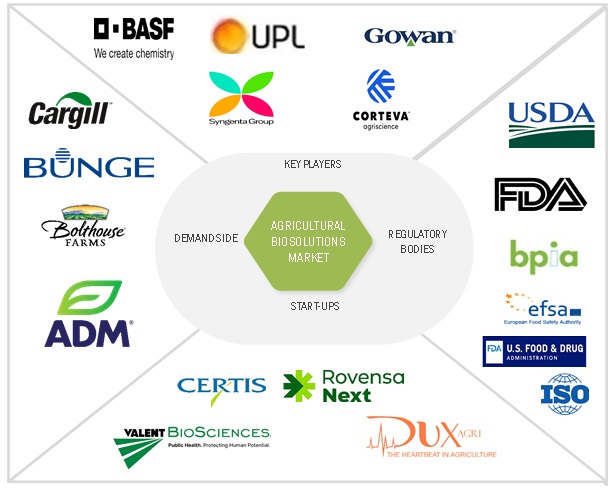

Market Ecosystem

Biopesticides, BY type, accounted for the highest market SHARE and is the fastest growing segment among type SEGMENT during the study period.

Biopesticides are derived from natural materials like plants, bacteria, and fungi, making them attractive for farmers aiming to reduce chemical pesticide use and adhere to stricter environmental regulations. This natural origin not only enhances their appeal but also addresses consumer concerns over chemical residues in food. Moreover, biopesticides offer targeted pest control with minimal impact on non-target organisms and beneficial insects, promoting sustainable farming practices. This precision reduces ecological disruption compared to chemical alternatives, further bolstering their market acceptance.

In contrast, biostimulants, biofertilizers, and microbial inoculants serve different agricultural needs such as enhancing plant growth, improving soil fertility, and promoting beneficial microbial activity. While these biosolutions are essential for sustainable agriculture, biopesticides' direct impact on pest management and regulatory preferences towards safer, environmentally friendly options drive their larger market share and accelerated growth within agricultural biosolutions.

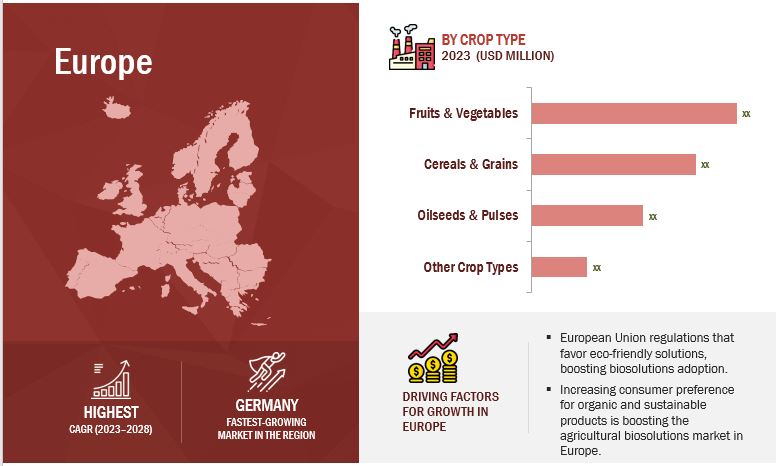

Fruits & Vegetables, BY crop type, accounted for the highest market SHARE and is the fastest growing segment among crop type SEGMENT during the study period.

Fruits and vegetables are highly perishable, requiring effective pest management and disease control, which drives demand for biosolutions such as biopesticides and biostimulants. These crops are also grown intensively and face stringent residue limits, making organic and sustainable solutions more attractive. Additionally, consumer demand for residue-free produce and organic options has surged, incentivizing growers to adopt bio-based solutions that align with these preferences.

Moreover, the shorter growing cycles of many fruits and vegetables necessitate faster-acting solutions, where biopesticides and biostimulants offer advantages over traditional chemicals in terms of safety, residue levels, and sustainability. Furthermore, regulatory pressures and evolving environmental standards push growers towards sustainable practices, with bio-based solutions offering viable alternatives.

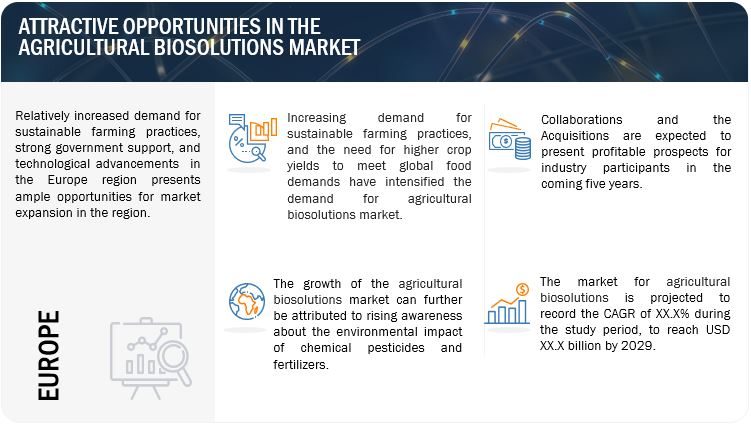

EUROPE IS THE FASTEST-GROWING MARKET FOR AGRICULTURAL BIOSOLUTIONS AMONG THE REGIONS.

Europe has been a pioneer in implementing stringent regulatory frameworks aimed at reducing chemical inputs in agriculture. This proactive approach has fueled the demand for sustainable and eco-friendly agricultural solutions, driving the adoption of biosolutions. Companies such as BASF SE (Germany), Novozymes A/S (Denmark), Syngenta (Swizerland), Bayer AG (Germany), Agrauxine (France), and Lallemand Inc. (France), which are major players in the biosolutions market, have a strong presence in Europe. Their commitment to research and development, coupled with strategic partnerships with local farmers and regulatory bodies, has further accelerated market growth.

Moreover, Europe's agricultural sector faces increasing pressure to enhance productivity while minimizing environmental impact, aligning perfectly with the benefits offered by biosolutions. These products not only improve crop yields but also promote soil health and biodiversity, addressing broader sustainability goals.

Key Market Players

The key players in this market include BASF SE (Germany), UPL (India), Novozymes A/S (Denmark), Syngenta (Swizerland), Bayer AG (Germany), Corteva (US), Gowan Company (US), Coromandel International Limited (India), Agrauxine (France), FMC Corporation (US), T.Stanes and Company Limited (India), Rallis India Limited (India), and Lallemand Inc. (France).

Recent Developments

- In February 2024, HAL Investments (Netherlands) invested USD 151.5 million in Koppert (Netherlands), bolstering its capital for expanding production facilities and global growth initiatives in the agricultural biological solutions sector. This strategic partnership not only enhances Koppert's market position but also accelerates research and development efforts, fostering innovation in sustainable agriculture. The investment enables Koppert to pursue in-licensing and mergers and acquisitions, facilitating its commitment to advancing biological solutions and strengthening its foothold in the global market.

- In January 2024, Novozymes A/S (Denmark) and Chr. Hansen (Denmark) successfully merged to form Novonesis (Denmark), a leading company in biosolutions. With combined expertise spanning over 100 years, Novonesis aims to innovate in biosolutions for agriculture and beyond, leveraging a diverse portfolio to enhance food production, promote healthier living, and support sustainable practices. This merger strengthens Novozymes' position in the agricultural biosolutions market, allowing them to expand their offerings and capabilities, thus better serving the needs of farmers and advancing sustainable agriculture practices worldwide.

- In July 2023, Syngenta (Switzerland) merged its biologicals businesses, including Valagro, to form Syngenta Biologicals, enhancing its global leadership in agricultural biosolutions. This consolidation integrates Syngenta's extensive R&D and commercial capabilities with Valagro's innovative technologies and market expertise. The merger expands Syngenta Biologicals' portfolio, offering farmers a wider range of sustainable solutions. By combining strengths, Syngenta strengthens its position to innovate and deliver effective biologicals that meet evolving agricultural challenges, fostering sustainability and supporting global farming needs.

Frequently Asked Questions (FAQ):

What is the current size of the agricultural biosolutions market?

The agricultural biosolutions market is estimated at USD XX billion in 2024 and is projected to reach USD XX billion by 2029, at a CAGR of 12.9% from 2024 to 2029.

Which are the key players in the market, and how intense is the competition?

The key players in the agricultural biosolutions market include BASF SE (Germany), UPL (India), Novozymes A/S (Denmark), Syngenta (Swizerland), Bayer AG (Germany), Corteva (US), Gowan Company (US), Coromandel International Limited (India), Agrauxine (France), FMC Corporation (US), T.Stanes and Company Limited (India), Rallis India Limited (India), and Lallemand Inc. (France).

The agricultural biosolutions market witnesses increased scope for growth. The market is seeing an increase in the number of new product launches, joint ventures, acquisitions, and new expansions. Moreover, the companies involved in manufacturing agricultural biosolutions products are investing a considerable proportion of their revenues in research and development activities.

Which region is projected to account for the largest share of the agricultural biosolutions market?

The North American market is expected to dominate during the forecast period. North America holds the largest share in the agricultural biosolutions market due to advanced agricultural practices, high investment in research and development, and supportive regulatory frameworks promoting sustainable farming. The region benefits from robust infrastructure, extensive adoption of biotechnological innovations, and a strong emphasis on environmental sustainability, driving significant growth in biopesticides, biofertilizers, and biostimulants sectors.

What kind of information is provided in the company profile section?

The company profiles mentioned above offer valuable information such as a comprehensive business overview, including details on the company's various business segments, financial performance, geographical reach, revenue composition, and the breakdown of their business revenue. Additionally, these profiles offer insights into the company's product offerings, significant milestones, and expert analyst perspectives to further explain the company's potential.

What are the factors driving the agricultural biosolutions market?

The demand for agricultural biosolutions is primarily driven by increasing demand for sustainable agricultural practices, stringent regulations on chemical pesticide usage, and growing consumer preference for organic produce. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Growth opportunities and latent adjacency in Agricultural biosolutions Market