Aerospace Riveting Equipment Market by Rivet Type (Solid, Blind, Semi-tubular), End Use (OEM, MRO), Equipment Type (Pneumatic, Hydraulic, Electric), Mobility (Fixed, Portable), Technology (Automated, Manual), and Region - Global Forecast to 2028

Update: 07/14/2025

Aerospace Riveting Equipment Market Summary

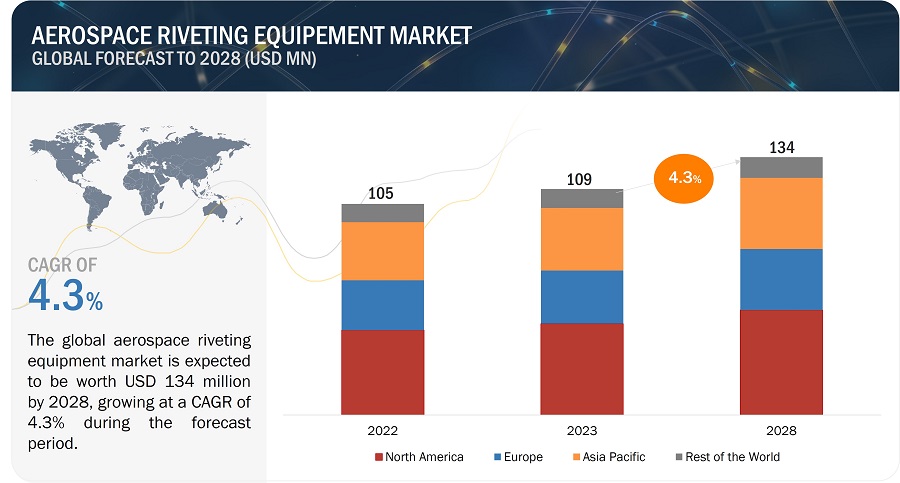

The Aerospace Riveting Equipment Market size was estimated at USD 105 Million in 2022 and is predicted to increase from USD 109 Million in 2023 to approximately USD 134 Million by 2028, expanding at a CAGR of 4.3 % from 2023 to 2028.

Aerospace Riveting Equipment Market Key Takeaways

-

By Market Size & Growth, Aerospace Riveting Equipment Industry is projected to reach USD 134 Million by 2028, growing from USD 109 Million in 2023 at a CAGR of 4.3 % during the forecast period from 2023 to 2028.

-

By facing increasingly complex aircraft designs, manufacturers are relying on high-precision riveting tools such as pneumatic, hydraulic, and manual systems to meet strict quality and structural integrity requirements.

-

By expanding beyond traditional hubs, countries like India are emerging as new centers for aerospace manufacturing, increasing demand for riveting equipment in both aircraft assembly and maintenance operations.

-

By aligning with national manufacturing goals, regions like the Middle East, especially Saudi Arabia, are investing in local aerospace production, fueling growth in portable and automated riveting technologies.

-

By leveraging high-tech aerospace ecosystems, nations such as Germany are pushing for advanced robotic and automated riveting solutions to support their growing aerospace exports and Tier-1 supplier networks.

-

By adapting to new material trends, the rising use of composite and lightweight materials in aircraft structures is driving the need for specialized riveting equipment that ensures strength without added weight.

-

By being driven by key industry players, companies are actively innovating in product design and functionality, offering solutions tailored to different rivet sizes, cycle times, and material types.

-

By supporting diverse riveting applications, equipment options now range from ultra-fast impact riveters to highly controlled orbital systems, offering flexibility for varied aircraft production requirements.

Market Size & Forecast Report

-

2023 Market Size: USD 109 Million

-

2028 Projected Market Size:USD 134 Million

-

CAGR (2023-2028): 4.3 %

-

North America : Largest Share

Aerospace Riveting Equipment Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Aerospace Riveting Equipment Market Dynamics

Driver: Technological Advancements in Aerospace Manufacturing

Continuous advancements in aerospace manufacturing technologies are driving the demand for innovative riveting equipment. As aircraft designs evolve to incorporate lightweight materials and intricate structures, the need for precision in joining components becomes paramount. Technologies like laser riveting and friction stir welding offer solutions that enhance the strength, durability, and efficiency of aircraft structures. This driver stimulates a culture of innovation among riveting equipment manufacturers, fostering the development of cutting-edge solutions to meet the stringent requirements of modern aerospace applications. The increasing emphasis on fuel efficiency and the demand for sophisticated aircraft further fuel the adoption of advanced riveting technologies, positioning the market for sustained growth.

Technological advancements in aerospace manufacturing, characterized by innovations like laser riveting and friction stir welding, represent a paradigm shift in the way aircraft structures are constructed. Laser riveting, utilizing high-powered lasers for precise joining, and friction stir welding, a solid-state welding process ensuring high-strength joints without material melting, are at the forefront of these advancements. These technologies offer solutions that go beyond traditional riveting methods, providing enhanced strength, weight reduction, and improved fatigue resistance in aircraft components.

In the realm of lightweight materials, these technological strides enable manufacturers to explore and incorporate advanced alloys and composites into their designs. The intricate structures made possible by these materials demand precision in the joining process, precisely where innovative riveting equipment plays a pivotal role. The marriage of cutting-edge materials and sophisticated riveting techniques aligns with the aerospace industry's pursuit of fuel efficiency, environmental sustainability, and superior performance.

As the aerospace sector embraces these transformative technologies, riveting equipment manufacturers are compelled to stay at the forefront of research and development. This drive for innovation not only meets the immediate demands of the industry but also positions manufacturers as key contributors to the evolution of aerospace manufacturing. The continuous push for precision, efficiency, and adaptability in riveting equipment underscores its indispensable role in shaping the future of aerospace engineering.

Restraints: Stringent Regulatory Compliance and Certification Standards

Navigating complex regulatory compliance and certification standards is a persistent challenge in the aerospace riveting equipment market. Meeting and maintaining compliance with evolving safety and quality standards requires continuous investment in research, testing, and documentation. Additionally, the time-consuming nature of certification processes can impact the speed at which new riveting technologies can be brought to market. Successfully overcoming these challenges necessitates a deep understanding of regulatory nuances, sustained investment in compliance efforts, and strategic collaboration with aviation authorities.

The aerospace industry operates within a framework of stringent regulatory standards, and compliance with these standards is a continuous and non-negotiable facet of manufacturing processes, especially in the context of riveting equipment. Regulatory bodies, such as the Federal Aviation Administration (FAA) in the United States and the European Union Aviation Safety Agency (EASA) in Europe, set forth guidelines and requirements to ensure the safety, reliability, and quality of aerospace products.

Navigating this intricate landscape of regulatory compliance and certification standards poses multifaceted challenges for manufacturers of riveting equipment. Each innovation or modification in riveting technology necessitates meticulous scrutiny and validation to ensure adherence to the latest regulatory protocols. This involves extensive research and development efforts to not only meet current standards but also anticipate and align with evolving industry expectations.

The demand for continuous investment in research, testing, and documentation stems from the dynamic nature of the aerospace sector, where safety is paramount. Rigorous testing procedures, including simulated stress tests and material analysis, are essential to validate the structural integrity of riveted joints under various operating conditions. Documentation processes must be comprehensive, detailing every aspect of the design, manufacturing, and performance of riveting equipment to satisfy the meticulous requirements of regulatory authorities.

As a result, the speed of introducing new riveting technologies may be impacted. The thoroughness required in the certification process inherently extends the timeline from conceptualizing innovative solutions to their market entry. This challenge emphasizes the delicate balance that aerospace riveting equipment manufacturers must strike between innovation and compliance, recognizing that the introduction of new technologies must align with the industry's overarching commitment to safety and adherence to regulatory frameworks.

The ongoing dialogue between manufacturers and regulatory bodies becomes pivotal in fostering an environment where advancements in riveting technologies can be seamlessly integrated into the aerospace landscape without compromising safety and quality. It underscores the collaborative nature of the aerospace industry, where innovation and compliance converge to shape the future of aviation technology.

Opportunities: Emerging Markets and Regional Expansion

Opportunities arise from the exploration of emerging aerospace markets in regions such as Asia-Pacific. Regional expansion strategies allow riveting equipment manufacturers to tap into new growth areas with increasing demand for aircraft. The globalization of air travel creates opportunities for manufacturers to establish a presence in emerging markets, foster partnerships with local aviation stakeholders, and cater to the evolving needs of regional aerospace industries. The strategic pursuit of emerging markets and regional expansion stands as a catalyst for riveting equipment manufacturers aiming to capitalize on the dynamic growth in aerospace demand, particularly in regions like Asia-Pacific. This geographical diversification aligns with the evolving landscape of global aerospace manufacturing, where burgeoning economies drive a surge in air travel and demand for new aircraft. By strategically entering and expanding within these emerging markets, manufacturers position themselves to meet the escalating demand for efficient riveting solutions. This approach not only unlocks new avenues for business but also fosters collaborations with local industry players, strengthening the global footprint of riveting equipment manufacturers and ensuring they remain agile in responding to regional variations in aerospace manufacturing needs.

Challenges: Dependence on Aircraft Production Cycles

The aerospace riveting equipment market's dependence on aircraft production cycles introduces cyclicality in demand. Economic downturns or fluctuations in the aviation industry can impact new aircraft orders, affecting the market for riveting equipment. The long lead times associated with aircraft manufacturing mean that changes in market conditions may not be immediately reflected in equipment demand. Manufacturers must manage their production capacity and adapt to the cyclical nature of the aerospace industry by diversifying their product offerings and exploring aftermarket services to mitigate the impact of production cycle fluctuations. While supply chain shortages have seen improvement across various industries, the aerospace sector continues to grapple with challenges. Airbus and Boeing, major players in aircraft production, have witnessed a substantial decline since 2019, exacerbated by Boeing's production cuts in 2018 due to the B737 Max grounding. Persistent software and safety concerns led to a 1.5-year production lag until 2022, and full recovery remains elusive. As of 2023, delivery targets stand at approximately 75% of pre-pandemic levels, necessitating additional time for supply chains and aircraft manufacturers to regain full operational capacity, impacting the availability of aerospace riveting equipment in the market.

Market Ecosystem Map

Based on the Equipment, the Pneumatic Riveting Equipment Segment is Estimated to Lead the Aerospace Riveting Equipment Market in 2023

Based on the equipment, the aerospace riveting equipment market has been segmented broadly into Hydraulic, pneumatic, and electric. Here pneumatic riveting equipment is leading this segment in 2023. The pneumatic riveting equipment in the riveting equipment market is propelled by its efficiency and versatility in various industries. The demand for lightweight, durable, and secure joints in aerospace sector fuels the adoption of pneumatic riveting tools. Their ability to deliver consistent force, speed, and precision in fastening materials like metals and plastics drives their widespread use. Additionally, the ease of operation and reduced maintenance costs associated with pneumatic riveting equipment contribute to its growing preference among manufacturers seeking reliable and high-performance riveting solutions for assembly and fabrication processes.

Based on the End Use, OEM Segment is Estimated to Lead the Aerospace Riveting Equipment Market in 2023

Based on the end use, the aerospace riveting equipment market has been segmented into OEM and aftermarket. OEM segment is expected to lead the market in 2023. OEMs are responsible for designing and manufacturing specific components or systems based on type, mobility, riveting, and automation solutions. OEMs produce original products or components that are typically sold to other companies, often integrators or aircraft manufacturers. The OEMs strive to maintain high-quality standards for their products through rigorous testing, quality control measures, and adherence to industry standards, resulting in the growth of the market.

Based on the Mobility, the Fixed Equipment Segment Dominates the Market and is Projected to Witness the Largest Share in 2023

Based on mobility, the aerospace riveting equipment market has been segmented into fixed and portable. The fixed equipment segment to dominate the market in 2023. The fixed equipment segment in the aerospace riveting equipment market is driven by the need for precision and stability in aircraft assembly. Aerospace manufacturers require reliable and stationary riveting solutions for critical assembly processes. Fixed riveting equipment offers enhanced accuracy, consistent performance, and structural integrity, crucial for constructing aircraft components. Its stability ensures high-quality, standardized joints, meeting stringent aviation safety and quality standards. As aerospace companies aim for efficiency and error-free assembly, fixed riveting equipment remains integral, enabling the seamless production of aircraft parts with precision and reliability in the dynamic aviation industry.

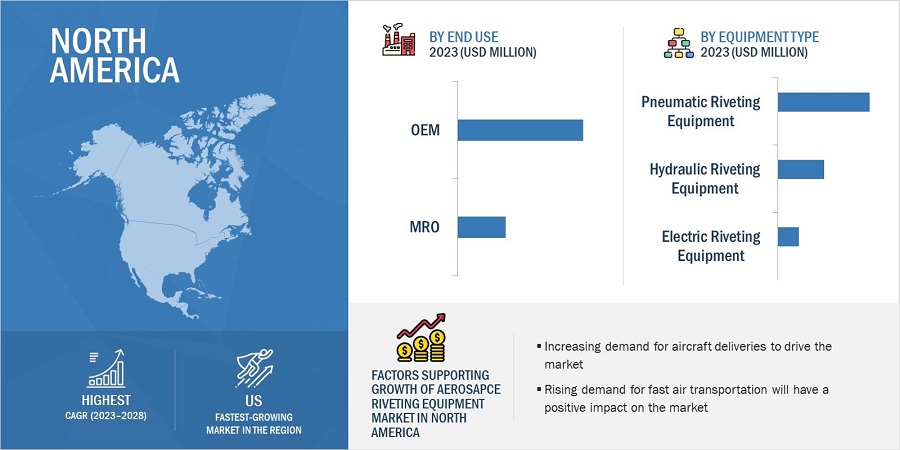

The North America Market is Projected to Have the Largest Share in 2023 in the Aerospace Riveting Equipment Market

Based on region, the aerospace riveting equipment market has been segmented into North America, Europe, Asia Pacific and Rest of the World (RoW). North America region seems to dominate the market in 2023. The region hosts major aircraft manufacturers and suppliers, fostering high demand for precision assembly tools. Stringent safety standards and the pursuit of innovative, efficient manufacturing techniques fuel the need for advanced riveting equipment. North America's substantial investment in aerospace R&D and infrastructure further bolsters market growth. The region's emphasis on quality, compliance, and technological innovation positions it as a key market influencer, catering to the evolving demands of the aerospace industry and driving continuous advancements in riveting equipment technologies.

Aerospace Riveting Equipment Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Aerospace Riveting Equipment Industry Companies - Top Key Market Players

The Aerospace Riveting Equipment Companies is dominated by a few globally established players such as Ingersoll Rand (US), Cherry Aerospace (US), Brown Aviation Tool Company (US), Stanley Engineered Fastening (SEF) (US), LAS Aerospace Ltd. (UK) among others, are the key players that secured aerospace riveting equipment contracts in the last few years. The primary focus was given to the contracts and new product development due to the upcoming government regulations about space sustainability across the world.

Scope of the Report

|

Report Metric |

Details |

|

Estimated Market Size |

USD 109 Million in 2023 |

|

Projected Market Size |

USD 134 Million by 2028 |

|

Growth Rate |

4.3 % |

|

Market Size Available for Years |

2018–2028 |

|

Base Year Considered |

2022 |

|

Forecast Period |

2023-2028 |

|

Forecast Units |

Value (USD Million/Billion) |

|

Segments Covered |

By Rivet Type, by End Use, by Equipment Type, By Mobility, By Technology, and By Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and Rest of the World. |

|

Companies Covered |

Ingersoll Rand (US), Cherry Aerospace (US), Brown Aviation Tool Company (US), Stanley Engineered Fastening (SEF) (US), LAS Aerospace Ltd. (UK) |

High-speed Data Converter Market Highlights

The study categorizes the Aerospace Riveting Equipment market based on type, platform, end user, and region.

|

Segment |

Subsegment |

|

By Rivet Type |

|

|

By End Use |

|

|

By Equipment Type |

|

|

By Mobility |

|

|

By Technology |

|

|

By Region |

|

Recent Developments

- In July 2023, Cherry Aerospace (US) Unveiled a new type of lightweight rivet with improved joint strength and fatigue resistance for aircraft structures. This aligns with the industry’s focus on fuel-efficient materials and designs.

- In September 2023, Stanley Engineered Fastening (SEF) (US) Announced plans to invest in additive manufacturing technologies for producing customized fasteners and tooling for aerospace applications. This allows for greater design flexibility and potentially lighter components.

- In January 2020, Stanley Black & Decker announced it acquired Consolidated Aerospace Manufacturing (CAM) for USD 1.5 Billion, boosting the company presence in the aerospace riveting market.

Frequently Asked Questions (FAQs) Addressed by the Report:

Which are the major companies in the aerospace riveting equipment market? What are their major strategies to strengthen their market presence?

Some of the key players in the aerospace riveting equipment market are Ingersoll Rand (US), Cherry Aerospace (US), Brown Aviation Tool Company (US), Stanley Engineered Fastening (SEF) (US), LAS Aerospace Ltd. (UK) among others are the key players that secured aerospace riveting equipment contracts in the last few years. Contracts were the key strategies these companies adopted to strengthen their aerospace riveting market presence.

What are the drivers and opportunities for the aerospace riveting equipment market?

Increased aircraft production, demand for efficient and high strength joining methods for lightweight materials are the drivers of the market. Growing demand for fuel-efficient aircraft and advanced materials paves the way for innovative, lightweight riveting solutions and niche market expansion could be seen as an opportunity to the market.

Which region is expected to grow most in the next five years?

The market in North America is projected to grow at the highest CAGR from 2023 to 2028, showcasing strong demand for aircraft deliveries in the region. One key factor driving the North America market is the rising demand for OEM Equipment manufacturers which play a significant role in growing the market.

Which technique of aerospace riveting equipment will significantly lead in the coming years?

The pneumatic riveting equipment segment of the aerospace riveting equipment market is projected to witness the highest CAGR due to the increasing demand for aircraft deliveries across the globe.

Which are the key technology trends prevailing in the aerospace riveting equipment market?

Automation and Robotics, Advanced Riveting Techniques such as hybrid riveting and advancement in materials used for riveting are the prevailing trends in the aerospace riveting equipment.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Growing emphasis on lightweight materials- Increasing complexities in aircraft designs- Rising focus on precision and quality in manufacturing aerospace componentsRESTRAINTS- Stringent regulatory compliance and certification standards- Limited adoption of advanced technologiesOPPORTUNITIES- Innovations in materials and joining techniques- Integration of smart riveting technologies- Aftermarket services and maintenance contractsCHALLENGES- High initial investment and certification challenges- Cyclical demand dependent on aircraft production cycles- Limited availability of skilled workforce

- 5.3 MARKET SCENARIO ANALYSIS

-

5.4 VALUE CHAIN ANALYSISRAW MATERIALSRESEARCH & DEVELOPMENTCOMPONENT MANUFACTURINGOEMSEND USERSAFTERSALES SERVICES

-

5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

-

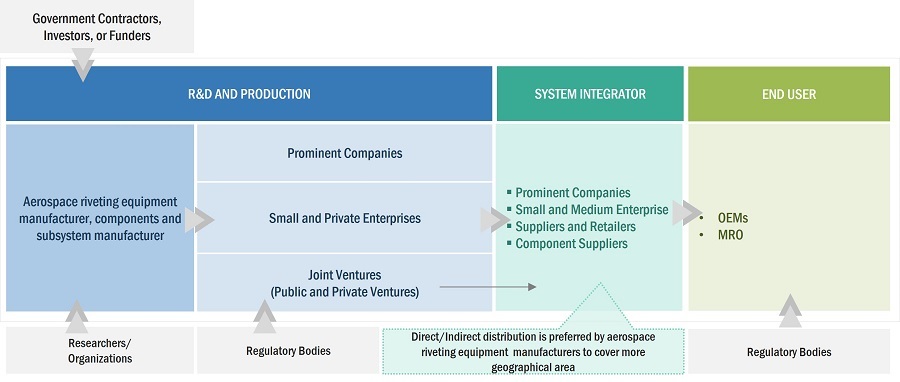

5.6 ECOSYSTEM ANALYSISPROMINENT COMPANIESPRIVATE AND SMALL ENTERPRISESEND USERS

-

5.7 TECHNOLOGY ANALYSISAUTO-FEED RIVETING TOOLSBATTERY-POWERED RIVET GUNS

-

5.8 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.9 AVERAGE SELLING PRICE ANALYSISINDICATIVE PRICING ANALYSIS

- 5.10 TARIFF AND REGULATORY LANDSCAPE

- 5.11 TRADE DATA ANALYSIS

-

5.12 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 5.13 KEY CONFERENCES AND EVENTS, 2024

-

5.14 USE CASE ANALYSISINSTALLATION OF ROBOTIC TECHNOLOGY IN AIRCRAFT ASSEMBLY LINE

- 6.1 INTRODUCTION

-

6.2 TECHNOLOGY TRENDSADVANCED AUTOMATION AND HUMAN-ROBOT COLLABORATIONADVANCED MATERIALS SOLUTIONADDITIVE MANUFACTURINGENERGY-EFFICIENT RIVETING PROCESS

-

6.3 IMPACT OF MEGATRENDSINDUSTRY 4.03D PRINTINGARTIFICIAL INTELLIGENCE AND MACHINE LEARNINGPREDICTIVE MAINTENANCE

- 6.4 SUPPLY CHAIN ANALYSIS

-

6.5 INNOVATIONS AND PATENT ANALYSIS

- 6.6 TECHNOLOGICAL ROADMAP

- 7.1 INTRODUCTION

-

7.2 ORIGINAL EQUIPMENT MANUFACTURER (OEM)INCREASING AIR TRAVEL AND DEMAND FOR NEW AIRCRAFT TO DRIVE MARKET

-

7.3 MAINTENANCE, REPAIR, AND OVERHAUL (MRO)GLOBAL FLEET OF AGEING AIRCRAFT AND STRINGENT REGULATORY REQUIREMENTS FOR MAINTENANCE TO DRIVE MARKET

- 8.1 INTRODUCTION

-

8.2 HYDRAULIC RIVETING EQUIPMENTHIGH FORCE OUTPUT TO DRIVE MARKET

-

8.3 PNEUMATIC RIVETING EQUIPMENTLIGHTWEIGHT DESIGN, COST-EFFECTIVENESS, AND VERSATILITY TO DRIVE MARKET

-

8.4 ELECTRIC RIVETING EQUIPMENTPRECISION, ECO-FRIENDLINESS, AND ADAPTABILITY TO MODERN MANUFACTURING TO DRIVE MARKET

- 9.1 INTRODUCTION

-

9.2 FIXED EQUIPMENTCONTINUOUS ADVANCEMENTS IN AUTOMATION TECHNOLOGY TO DRIVE MARKET

-

9.3 PORTABLE EQUIPMENTLOWER INITIAL COSTS AND FLEXIBLE OPERATIONS TO DRIVE MARKET

- 10.1 INTRODUCTION

-

10.2 AUTOMATED RIVETING EQUIPMENTEFFICIENT EXECUTION OF PROGRAMMED PATTERNS AND UNIFORM PRODUCT QUALITY TO DRIVE MARKET

-

10.3 MANUAL RIVETING EQUIPMENTSUITABILITY FOR SPECIALIZED AEROSPACE SCENARIOS TO DRIVE MARKET

- 11.1 INTRODUCTION

-

11.2 BLIND RIVETSECURED FASTENING AND EFFICIENT ASSEMBLY TO DRIVE MARKET

-

11.3 SEMI-TUBULAR RIVETINCREASING FOCUS ON LIGHTWEIGHTING AND STRUCTURAL OPTIMIZATION TO DRIVE MARKET

-

11.4 SOLID RIVETLOAD-BEARING CAPABILITIES AND RESISTANCE TO VIBRATION TO DRIVE MARKET

- 11.5 OTHER RIVET TYPES

- 12.1 INTRODUCTION

- 12.2 REGIONAL RECESSION IMPACT ANALYSIS

-

12.3 NORTH AMERICANORTH AMERICA: PESTLE ANALYSISUS- Presence of major aircraft manufacturers and defense contractors to drive marketCANADA- Government initiatives supporting R&D in aerospace technologies and skilled workforce to drive market

-

12.4 EUROPEEUROPE: PESTLE ANALYSISUK- Presence of MRO companies and stringent safety standards to drive marketFRANCE- Carbon-neutrality efforts to drive marketGERMANY- Robust regulatory framework to test airworthiness of aircraft components to drive marketRUSSIA- Increased military budget to manufacture advanced military aircraft to drive marketREST OF EUROPE

-

12.5 ASIA PACIFICASIA PACIFIC: PESTLE ANALYSISCHINA- Strategic focus on aerospace innovations and domestic maintenance of aircraft components to drive marketINDIA- Increasing foreign direct investments and focus on regional connectivity to drive marketJAPAN- Replacement of existing aircraft with technologically advanced models to drive marketSOUTH KOREA- Growing adoption of low-cost carriers to drive marketAUSTRALIA- Increasing air traffic and new aircraft deliveries to drive marketREST OF ASIA PACIFIC

-

12.6 REST OF THE WORLDREST OF THE WORLD: PESTLE ANALYSISUAE- Commercial airplane upgrades and establishment of domestic facilities to drive marketSAUDI ARABIA- Modernization of defense aircraft fleet to drive marketBRAZIL- Development and expansion of aircraft infrastructure to drive marketOTHER COUNTRIES

- 13.1 INTRODUCTION

- 13.2 MARKET RANKING ANALYSIS

- 13.3 MARKET SHARE ANALYSIS

-

13.4 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT

-

13.5 STARTUP/SME EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING

-

14.1 KEY PLAYERSSTANLEY ENGINEERED FASTENING- Business overview- Products/Solutions/Services offered- MnM viewCHERRY AEROSPACE- Business overview- Products/Solutions/Services offered- MnM viewBROWN TOOL- Business overview- Products/Solutions/Services offered- MnM viewLAS AEROSPACE LTD.- Business overview- Products/Solutions/Services offered- MnM viewINGERSOLL RAND- Business overview- Products/Solutions/Services offered- MnM viewFASTENING SYSTEMS INTERNATIONAL- Business overview- Products/Solutions/Services offeredBROETJE-AUTOMATION- Business overview- Products/Solutions/Services offeredATLAS COPCO AB- Business overview- Products/Solutions/Services offeredAIRCRAFT SPRUCE- Business overview- Products/Solutions/Services offeredGEMCORE ASCENT- Business overview- Products/Solutions/Services offeredKUKA SYSTEMS- Business overview- Products/Solutions/Services offeredAVDEL- Business overview- Products/Solutions/Services offeredCLECO TOOLS- Business overview- Products/Solutions/Services offeredSIOUX TOOLS- Business overview- Products/Solutions/Services offered

-

14.2 OTHER PLAYERSBAY SUPPLYAIRCRAFT TOOL SUPPLY COMPANYSKYSHOP AUSTRALIAMONROE AEROSPACE

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

- TABLE 1 INCLUSIONS AND EXCLUSIONS

- TABLE 2 USD EXCHANGE RATES

- TABLE 3 ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 4 IMPACT OF PORTER’S FIVE FORCES

- TABLE 5 AVERAGE SELLING PRICE, BY MOBILITY AND EQUIPMENT TYPE, 2023 (USD)

- TABLE 6 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 COUNTRY-WISE IMPORTS, 2018–2022 (USD THOUSAND)

- TABLE 11 COUNTRY-WISE EXPORTS, 2018–2022 (USD THOUSAND)

- TABLE 12 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY EQUIPMENT TYPE (%)

- TABLE 13 KEY BUYING CRITERIA, BY TECHNOLOGY

- TABLE 14 KEY CONFERENCES AND EVENTS, 2024

- TABLE 15 INNOVATIONS AND PATENT REGISTRATIONS, 2019–2023

- TABLE 16 MARKET, BY END USE, 2018–2022 (USD MILLION)

- TABLE 17 MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 18 MARKET, BY EQUIPMENT TYPE, 2018–2022 (USD MILLION)

- TABLE 19 MARKET, BY EQUIPMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 20 MARKET, BY MOBILITY, 2018–2022 (USD MILLION)

- TABLE 21 MARKET, BY MOBILITY, 2023–2028 (USD MILLION)

- TABLE 22 MARKET, BY TECHNOLOGY, 2018–2022 (USD MILLION)

- TABLE 23 MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 24 MARKET, BY RIVET TYPE, 2018–2022 (USD MILLION)

- TABLE 25 MARKET, BY RIVET TYPE, 2023–2028 (USD MILLION)

- TABLE 26 MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 27 MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 28 REGIONAL RECESSION IMPACT ANALYSIS

- TABLE 29 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 30 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 31 NORTH AMERICA: MARKET, BY RIVET TYPE, 2018–2022 (USD MILLION)

- TABLE 32 NORTH AMERICA: MARKET, BY RIVET TYPE, 2023–2028 (USD MILLION)

- TABLE 33 NORTH AMERICA: MARKET, BY END USE, 2018–2022 (USD MILLION)

- TABLE 34 NORTH AMERICA: MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 35 NORTH AMERICA: MARKET, BY EQUIPMENT TYPE, 2018–2022 (USD MILLION)

- TABLE 36 NORTH AMERICA: MARKET, BY EQUIPMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 37 NORTH AMERICA: MARKET, BY MOBILITY, 2018–2022 (USD MILLION)

- TABLE 38 NORTH AMERICA: MARKET, BY MOBILITY, 2023–2028 (USD MILLION)

- TABLE 39 NORTH AMERICA: MARKET, BY TECHNOLOGY, 2018–2022 (USD MILLION)

- TABLE 40 NORTH AMERICA: MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 41 US: MARKET, BY END USE, 2018–2022 (USD MILLION)

- TABLE 42 US: MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 43 US: MARKET, BY EQUIPMENT TYPE, 2018–2022 (USD MILLION)

- TABLE 44 US: MARKET, BY EQUIPMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 45 US: MARKET, BY TECHNOLOGY, 2018–2022 (USD MILLION)

- TABLE 46 US: MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 47 CANADA: MARKET, BY END USE, 2018–2022 (USD MILLION)

- TABLE 48 CANADA: MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 49 CANADA: MARKET, BY EQUIPMENT TYPE, 2018–2022 (USD MILLION)

- TABLE 50 CANADA: MARKET, BY EQUIPMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 51 CANADA: MARKET, BY TECHNOLOGY, 2018–2022 (USD MILLION)

- TABLE 52 CANADA: MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 53 EUROPE: MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 54 EUROPE: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 55 EUROPE: MARKET, BY RIVET TYPE, 2018–2022 (USD MILLION)

- TABLE 56 EUROPE: MARKET, BY RIVET TYPE, 2023–2028 (USD MILLION)

- TABLE 57 EUROPE: MARKET, BY END USE, 2018–2022 (USD MILLION)

- TABLE 58 EUROPE: MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 59 EUROPE: MARKET, BY EQUIPMENT TYPE, 2018–2022 (USD MILLION)

- TABLE 60 EUROPE: MARKET, BY EQUIPMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 61 EUROPE: MARKET, BY MOBILITY, 2018–2022 (USD MILLION)

- TABLE 62 EUROPE: MARKET, BY MOBILITY, 2023–2028 (USD MILLION)

- TABLE 63 EUROPE: MARKET, BY TECHNOLOGY, 2018–2022 (USD MILLION)

- TABLE 64 EUROPE: MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 65 UK: MARKET, BY END USE, 2018–2022 (USD MILLION)

- TABLE 66 UK: MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 67 UK: MARKET, BY EQUIPMENT TYPE, 2018–2022 (USD MILLION)

- TABLE 68 UK: MARKET, BY EQUIPMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 69 UK: MARKET, BY TECHNOLOGY, 2018–2022 (USD MILLION)

- TABLE 70 UK: MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 71 FRANCE: MARKET, BY END USE, 2018–2022 (USD MILLION)

- TABLE 72 FRANCE: MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 73 FRANCE: MARKET, BY EQUIPMENT TYPE, 2018–2022 (USD MILLION)

- TABLE 74 FRANCE: MARKET, BY EQUIPMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 75 FRANCE: MARKET, BY TECHNOLOGY, 2018–2022 (USD MILLION)

- TABLE 76 FRANCE: MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 77 GERMANY: MARKET, BY END USE, 2018–2022 (USD MILLION)

- TABLE 78 GERMANY: MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 79 GERMANY: MARKET, BY EQUIPMENT TYPE, 2018–2022 (USD MILLION)

- TABLE 80 GERMANY: MARKET, BY EQUIPMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 81 GERMANY: MARKET, BY TECHNOLOGY, 2018–2022 (USD MILLION)

- TABLE 82 GERMANY: MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 83 RUSSIA: MARKET, BY END USE, 2018–2022 (USD MILLION)

- TABLE 84 RUSSIA: MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 85 RUSSIA: MARKET, BY EQUIPMENT TYPE, 2018–2022 (USD MILLION)

- TABLE 86 RUSSIA: MARKET, BY EQUIPMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 87 RUSSIA: MARKET, BY TECHNOLOGY, 2018–2022 (USD MILLION)

- TABLE 88 RUSSIA: MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 89 REST OF EUROPE: MARKET, BY END USE, 2018–2022 (USD MILLION)

- TABLE 90 REST OF EUROPE: MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 91 REST OF EUROPE: MARKET, BY EQUIPMENT TYPE, 2018–2022 (USD MILLION)

- TABLE 92 REST OF EUROPE: MARKET, BY EQUIPMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 93 REST OF EUROPE: MARKET, BY TECHNOLOGY, 2018–2022 (USD MILLION)

- TABLE 94 REST OF EUROPE: MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 95 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 96 ASIA PACIFIC: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 97 ASIA PACIFIC: MARKET, BY RIVET TYPE, 2018–2022 (USD MILLION)

- TABLE 98 ASIA PACIFIC: MARKET, BY RIVET TYPE, 2023–2028 (USD MILLION)

- TABLE 99 ASIA PACIFIC: MARKET, BY END USE, 2018–2022 (USD MILLION)

- TABLE 100 ASIA PACIFIC: MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 101 ASIA PACIFIC: MARKET, BY EQUIPMENT TYPE, 2018–2022 (USD MILLION)

- TABLE 102 ASIA PACIFIC: MARKET, BY EQUIPMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 103 ASIA PACIFIC: MARKET, BY MOBILITY, 2018–2022 (USD MILLION)

- TABLE 104 ASIA PACIFIC: MARKET, BY MOBILITY, 2023–2028 (USD MILLION)

- TABLE 105 ASIA PACIFIC: MARKET, BY TECHNOLOGY, 2018–2022 (USD MILLION)

- TABLE 106 ASIA PACIFIC: MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 107 CHINA: MARKET, BY END USE, 2018–2022 (USD MILLION)

- TABLE 108 CHINA: MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 109 CHINA: MARKET, BY EQUIPMENT TYPE, 2018–2022 (USD MILLION)

- TABLE 110 CHINA: MARKET, BY EQUIPMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 111 CHINA: MARKET, BY TECHNOLOGY, 2018–2022 (USD MILLION)

- TABLE 112 CHINA: MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 113 INDIA: MARKET, BY END USE, 2018–2022 (USD MILLION)

- TABLE 114 INDIA: MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 115 INDIA: MARKET, BY EQUIPMENT TYPE, 2018–2022 (USD MILLION)

- TABLE 116 INDIA: MARKET, BY EQUIPMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 117 INDIA: MARKET, BY TECHNOLOGY, 2018–2022 (USD MILLION)

- TABLE 118 INDIA: MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 119 JAPAN: MARKET, BY END USE, 2018–2022 (USD MILLION)

- TABLE 120 JAPAN: MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 121 JAPAN: MARKET, BY EQUIPMENT TYPE, 2018–2022 (USD MILLION)

- TABLE 122 JAPAN: MARKET, BY EQUIPMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 123 JAPAN: MARKET, BY TECHNOLOGY, 2018–2022 (USD MILLION)

- TABLE 124 JAPAN: MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 125 SOUTH KOREA: MARKET, BY END USE, 2018–2022 (USD MILLION)

- TABLE 126 SOUTH KOREA: MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 127 SOUTH KOREA: MARKET, BY EQUIPMENT TYPE, 2018–2022 (USD MILLION)

- TABLE 128 SOUTH KOREA: MARKET, BY EQUIPMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 129 SOUTH KOREA: MARKET, BY TECHNOLOGY, 2018–2022 (USD MILLION)

- TABLE 130 SOUTH KOREA: MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 131 AUSTRALIA: MARKET, BY END USE, 2018–2022 (USD MILLION)

- TABLE 132 AUSTRALIA: MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 133 AUSTRALIA: MARKET, BY EQUIPMENT TYPE, 2018–2022 (USD MILLION)

- TABLE 134 AUSTRALIA: MARKET, BY EQUIPMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 135 AUSTRALIA: MARKET, BY TECHNOLOGY, 2018–2022 (USD MILLION)

- TABLE 136 AUSTRALIA: MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 137 REST OF ASIA PACIFIC: AEROSPACE RIVETING EQUIPMENT MARKET, BY END USE, 2018–2022 (USD MILLION)

- TABLE 138 REST OF ASIA PACIFIC: AEROSPACE RIVETING EQUIPMENT MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 139 REST OF ASIA PACIFIC: AEROSPACE RIVETING EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2018–2022 (USD MILLION)

- TABLE 140 REST OF ASIA PACIFIC: AEROSPACE RIVETING EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 141 REST OF ASIA PACIFIC: AEROSPACE RIVETING EQUIPMENT MARKET, BY TECHNOLOGY, 2018–2022 (USD MILLION)

- TABLE 142 REST OF ASIA PACIFIC: AEROSPACE RIVETING EQUIPMENT MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 143 REST OF THE WORLD: AEROSPACE RIVETING EQUIPMENT MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 144 REST OF THE WORLD: AEROSPACE RIVETING EQUIPMENT MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 145 REST OF THE WORLD: AEROSPACE RIVETING EQUIPMENT MARKET, BY RIVET TYPE, 2018–2022 (USD MILLION)

- TABLE 146 REST OF THE WORLD: AEROSPACE RIVETING EQUIPMENT MARKET, BY RIVET TYPE, 2023–2028 (USD MILLION)

- TABLE 147 REST OF THE WORLD: AEROSPACE RIVETING EQUIPMENT MARKET, BY END USE, 2018–2022 (USD MILLION)

- TABLE 148 REST OF THE WORLD: AEROSPACE RIVETING EQUIPMENT MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 149 REST OF THE WORLD: AEROSPACE RIVETING EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2018–2022 (USD MILLION)

- TABLE 150 REST OF THE WORLD: AEROSPACE RIVETING EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 151 REST OF THE WORLD: AEROSPACE RIVETING EQUIPMENT MARKET, BY MOBILITY, 2018–2022 (USD MILLION)

- TABLE 152 REST OF THE WORLD: AEROSPACE RIVETING EQUIPMENT MARKET, BY MOBILITY, 2023–2028 (USD MILLION)

- TABLE 153 REST OF THE WORLD: AEROSPACE RIVETING EQUIPMENT MARKET, BY TECHNOLOGY, 2018–2022 (USD MILLION)

- TABLE 154 REST OF THE WORLD: AEROSPACE RIVETING EQUIPMENT MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 155 UAE: AEROSPACE RIVETING EQUIPMENT MARKET, BY END USE, 2018–2022 (USD MILLION)

- TABLE 156 UAE: AEROSPACE RIVETING EQUIPMENT MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 157 UAE: AEROSPACE RIVETING EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2018–2022 (USD MILLION)

- TABLE 158 UAE: AEROSPACE RIVETING EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 159 UAE: AEROSPACE RIVETING EQUIPMENT MARKET, BY TECHNOLOGY, 2018–2022 (USD MILLION)

- TABLE 160 UAE: AEROSPACE RIVETING EQUIPMENT MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 161 SAUDI ARABIA: AEROSPACE RIVETING EQUIPMENT MARKET, BY END USE, 2018–2022 (USD MILLION)

- TABLE 162 SAUDI ARABIA: AEROSPACE RIVETING EQUIPMENT MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 163 SAUDI ARABIA: AEROSPACE RIVETING EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2018–2022 (USD MILLION)

- TABLE 164 SAUDI ARABIA: AEROSPACE RIVETING EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 165 SAUDI ARABIA: AEROSPACE RIVETING EQUIPMENT MARKET, BY TECHNOLOGY, 2018–2022 (USD MILLION)

- TABLE 166 SAUDI ARABIA: AEROSPACE RIVETING EQUIPMENT MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 167 BRAZIL: AEROSPACE RIVETING EQUIPMENT MARKET, BY END USE, 2018–2022 (USD MILLION)

- TABLE 168 BRAZIL: AEROSPACE RIVETING EQUIPMENT MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 169 BRAZIL: AEROSPACE RIVETING EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2018–2022 (USD MILLION)

- TABLE 170 BRAZIL: AEROSPACE RIVETING EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 171 BRAZIL: AEROSPACE RIVETING EQUIPMENT MARKET, BY TECHNOLOGY, 2018–2022 (USD MILLION)

- TABLE 172 BRAZIL: AEROSPACE RIVETING EQUIPMENT MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 173 OTHER COUNTRIES: AEROSPACE RIVETING EQUIPMENT MARKET, BY END USE, 2018–2022 (USD MILLION)

- TABLE 174 OTHER COUNTRIES: AEROSPACE RIVETING EQUIPMENT MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 175 OTHER COUNTRIES: AEROSPACE RIVETING EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2018–2022 (USD MILLION)

- TABLE 176 OTHER COUNTRIES: AEROSPACE RIVETING EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 177 OTHER COUNTRIES: AEROSPACE RIVETING EQUIPMENT MARKET, BY TECHNOLOGY, 2018–2022 (USD MILLION)

- TABLE 178 OTHER COUNTRIES: AEROSPACE RIVETING EQUIPMENT MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 179 DEGREE OF COMPETITION

- TABLE 180 COMPANY FOOTPRINT

- TABLE 181 COMPANY FOOTPRINT, BY EQUIPMENT TYPE

- TABLE 182 COMPANY FOOTPRINT, BY REGION

- TABLE 183 KEY STARTUPS/SMES

- TABLE 184 COMPETITIVE BENCHMARKING

- TABLE 185 STANLEY ENGINEERED FASTENING: COMPANY OVERVIEW

- TABLE 186 STANLEY ENGINEERED FASTENING: PRODUCTS/SOLUTIONS/SERVICES OFFERED?

- TABLE 187 CHERRY AEROSPACE: COMPANY OVERVIEW

- TABLE 188 CHERRY AEROSPACE: PRODUCTS/SOLUTIONS/SERVICES OFFERED?

- TABLE 189 BROWN TOOL: COMPANY OVERVIEW

- TABLE 190 BROWN TOOL: PRODUCTS/SOLUTIONS/SERVICES OFFERED?

- TABLE 191 LAS AEROSPACE LTD.: COMPANY OVERVIEW

- TABLE 192 LAS AEROSPACE LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED?

- TABLE 193 INGERSOLL RAND: COMPANY OVERVIEW

- TABLE 194 INGERSOLL RAND: PRODUCTS/SOLUTIONS/SERVICES OFFERED?

- TABLE 195 FASTENING SYSTEMS INTERNATIONAL: COMPANY OVERVIEW

- TABLE 196 FASTENING SYSTEMS INTERNATIONAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED?

- TABLE 197 BROETJE-AUTOMATION: COMPANY OVERVIEW

- TABLE 198 BROETJE-AUTOMATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED?

- TABLE 199 ATLAS COPCO AB: COMPANY OVERVIEW

- TABLE 200 ATLAS COPCO AB: PRODUCTS/SOLUTIONS/SERVICES OFFERED?

- TABLE 201 AIRCRAFT SPRUCE: COMPANY OVERVIEW

- TABLE 202 AIRCRAFT SPRUCE: PRODUCTS/SOLUTIONS/SERVICES OFFERED?

- TABLE 203 GEMCORE ASCENT: COMPANY OVERVIEW

- TABLE 204 GEMCORE ASCENT: PRODUCTS/SOLUTIONS/SERVICES OFFERED?

- TABLE 205 KUKA SYSTEMS: COMPANY OVERVIEW

- TABLE 206 KUKA SYSTEMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED?

- TABLE 207 AVDEL: COMPANY OVERVIEW

- TABLE 208 AVDEL: PRODUCTS/SOLUTIONS/SERVICES OFFERED?

- TABLE 209 CLECO TOOLS: COMPANY OVERVIEW

- TABLE 210 CLECO TOOLS: PRODUCTS/SOLUTIONS/SERVICES OFFERED?

- TABLE 211 SIOUX TOOLS: COMPANY OVERVIEW

- TABLE 212 SIOUX TOOLS: PRODUCTS/SOLUTIONS/SERVICES OFFERED?

- TABLE 213 BAY SUPPLY: COMPANY OVERVIEW

- TABLE 214 AIRCRAFT TOOL SUPPLY COMPANY: COMPANY OVERVIEW

- TABLE 215 SKYSHOP AUSTRALIA: COMPANY OVERVIEW

- TABLE 216 MONROE AEROSPACE: COMPANY OVERVIEW

- FIGURE 1 AEROSPACE RIVETING EQUIPMENT MARKET SEGMENTATION

- FIGURE 2 REPORT PROCESS FLOW

- FIGURE 3 RESEARCH DESIGN

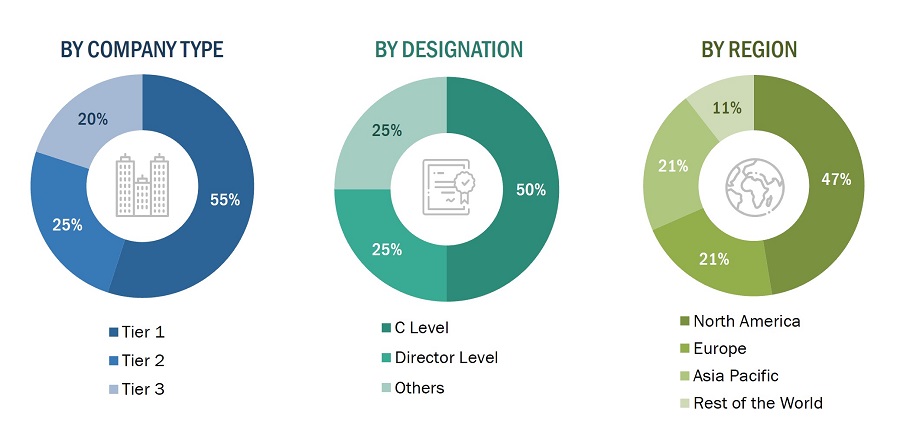

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

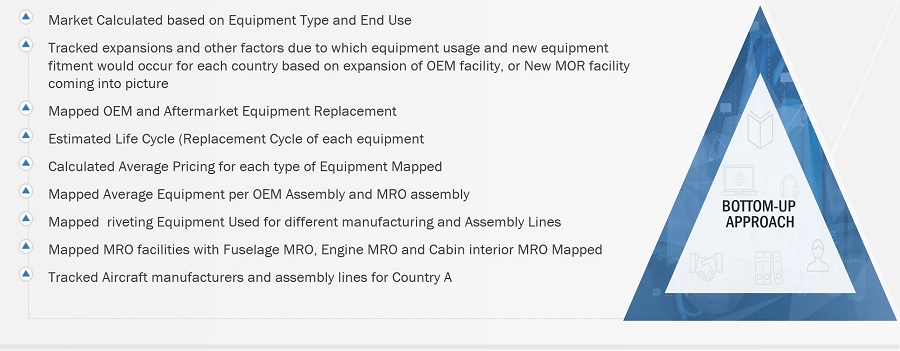

- FIGURE 5 BOTTOM-UP APPROACH

- FIGURE 6 TOP-DOWN APPROACH

- FIGURE 7 DATA TRIANGULATION

- FIGURE 8 ORIGINAL EQUIPMENT MANUFACTURER TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 9 PNEUMATIC RIVETING EQUIPMENT SEGMENT TO ACQUIRE LARGEST MARKET SHARE IN 2023

- FIGURE 10 PORTABLE EQUIPMENT SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 11 NORTH AMERICAN MARKET TO ACCOUNT FOR LARGEST SHARE IN 2023

- FIGURE 12 INCREASING DEMAND FOR AIRCRAFT DELIVERIES AND DEVELOPMENT OF INNOVATIVE RIVETING TECHNOLOGIES TO DRIVE MARKET

- FIGURE 13 MANUAL RIVETING EQUIPMENT SEGMENT TO HAVE LARGEST MARKET SHARE IN 2023

- FIGURE 14 SOLID RIVET TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 15 SAUDI ARABIA TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 16 AEROSPACE RIVETING EQUIPMENT MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 17 VALUE CHAIN ANALYSIS

- FIGURE 18 REVENUE SHIFT AND NEW REVENUE POCKETS FOR PLAYERS IN AEROSPACE RIVETING EQUIPMENT MARKET

- FIGURE 19 ECOSYSTEM MAPPING

- FIGURE 20 AVERAGE SELLING PRICE, BY MOBILITY

- FIGURE 21 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- FIGURE 22 KEY BUYING CRITERIA FOR AEROSPACE RIVETING EQUIPMENT MARKET, BY TECHNOLOGY

- FIGURE 23 SUPPLY CHAIN ANALYSIS

- FIGURE 24 LIST OF MAJOR PATENTS RELATED TO AEROSPACE RIVETING EQUIPMENT MARKET, 2013–2023

- FIGURE 25 EVOLUTION OF AEROSPACE RIVETING EQUIPMENT MARKET

- FIGURE 26 OEM END USE SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 27 PNEUMATIC RIVETING EQUIPMENT SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 28 PORTABLE EQUIPMENT SEGMENT TO HAVE LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 29 MANUAL RIVETING EQUIPMENT SEGMENT TO COMMAND LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 30 SOLID RIVET SEGMENT TO HAVE HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 31 NORTH AMERICA TO RECORD HIGHEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 32 NORTH AMERICA: AEROSPACE RIVETING EQUIPMENT MARKET SNAPSHOT

- FIGURE 33 EUROPE: AEROSPACE RIVETING EQUIPMENT MARKET SNAPSHOT

- FIGURE 34 ASIA PACIFIC: AEROSPACE RIVETING EQUIPMENT MARKET SNAPSHOT

- FIGURE 35 REST OF THE WORLD: AEROSPACE RIVETING EQUIPMENT MARKET SNAPSHOT

- FIGURE 36 MARKET RANKING OF TOP 5 PLAYERS, 2022

- FIGURE 37 MARKET SHARE ANALYSIS OF TOP 5 PLAYERS, 2022

- FIGURE 38 COMPANY EVALUATION MATRIX, 2022

- FIGURE 39 STARTUP/SME EVALUATION MATRIX, 2022

- FIGURE 40 INGERSOLL RAND: COMPANY SNAPSHOT

- FIGURE 41 ATLAS COPCO AB: COMPANY SNAPSHOT

The study involved four major activities in estimating the current size of the Aerospace Riveting Equipment Market. Exhaustive secondary research was done to collect information on the Aerospace Riveting Equipment market, its adjacent markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Demand-side analyses were carried out to estimate the overall size of the market. After that, market breakdown and data triangulation procedures were used to estimate the sizes of different segments and subsegments of the Aerospace Riveting Equipment market.

Secondary Research

The market ranking of companies was determined using secondary data made available through paid and unpaid sources and by analyzing the product portfolios of major companies. These companies perform on the basis of the performance and quality of their products. These data points were further validated by primary sources.

Secondary sources referred to for this research study included financial statements of companies offering Aerospace Riveting Equipment products and services and information from various trade, business, and professional associations. The secondary data was collected and analyzed to arrive at the overall size of the Aerospace Riveting Equipment market, which was validated by primary respondents.

Primary Research

Extensive primary research was conducted after acquiring information regarding the Aerospace Riveting Equipment market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, the Middle East, and the Rest of the World, which includes Africa and Latin America. Primary data was collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The market sizing of the market was undertaken from the demand side. The market was upsized at a regional level based on procurements and missions planned by the country. Such procurements provide information on each application demand aspects of Aerospace Riveting Equipment.

Note: An analysis of technological, funding, year-on-year investments, and operational costs was carried out to arrive at the CAGR and understand the market dynamics of all regions in the report. The market share for all types, platforms, and end users was based on the recent and upcoming planned missions of Aerospace Riveting Equipment in every region from 2023 to 2028.

Aerospace Riveting Equipment Market Size: Bottom-up Approach

Aerospace Riveting Equipment Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

The Aerospace Riveting Equipment Market encompasses machinery designed for joining and fastening components in aircraft using rivets. Rivets are permanent fasteners that are used to join two pieces of metal together. They are critical components of aircraft, as they are made to withstand a lot of pressure and vibration in the aerospace environment.

Key Stakeholders

- Aerospace Riveting Equipment Manufacturers

- Subcomponent Manufacturers

- Technology Support Providers

- Research Bodies

- System Integrators

- Commercial Vessel Operators

- Defense Organizations

Report Objectives

- To define, describe, segment, and forecast the size of the aerospace riveting equipment market based on rivet type, end use, equipment type, mobility, technology, and region.

- To analyze the degree of competition in the market by mapping the recent developments, products, and services of key market players

- To understand the structure of the aerospace riveting equipment market by identifying its various segments and subsegments

- To identify and analyze key drivers, restraints, opportunities, and challenges that influence the market growth.

- To provide an overview of the tariff and regulatory landscape for the adoption of aerospace riveting equipments across regions

- To forecast the size of market segments across North America, Europe, Asia Pacific, and Rest of the World along with major countries in each region

- To identify transportation industry trends, market trends, and technology trends currently prevailing in the market

- To analyze micromarkets1 with respect to individual technological trends and their contribution to the total market

- To analyze opportunities in the market for stakeholders by identifying key market trends

- To profile key market players and comprehensively analyze their market share and core competencies

- To provide a detailed competitive landscape of the market, along with an analysis of business and strategies such as mergers and acquisitions, partnerships, and agreements in the aerospace riveting equipment market

- To identify detailed financial positions, key products, and unique selling points of leading companies in the market

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of the Aerospace Riveting Equipment Market

- Profiling of other market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the Aerospace Riveting Equipment Market.

Growth opportunities and latent adjacency in Aerospace Riveting Equipment Market