Adventure Touring Motorcycle Market by Engine Capacity (500-1100cc, >1100cc), Application (Off-Road and Street and Others), Propulsion (ICE and Electric) and Region - Global Forecast to 2027

The term "adventure motorbikes," also referred to as "ADV bikes" or "larger-displacement multi-cylinder motorcycles," refers to street-legal vehicles having the capacity to tour on both paved and dirt roads, covering great distances and offering the rider some level of comfort. The off-road vehicle-based adventure motorcycles typically have added rear-view mirrors, instruments, lights, and signals and can be used for cross-country and public road permits. They are also outfitted with suspension and tough tires for better operational performance.

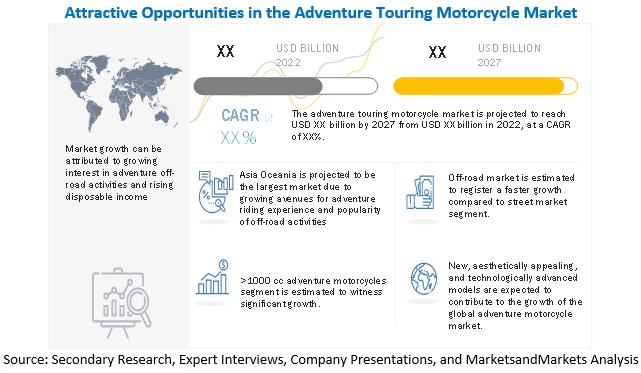

The adventure touring motorcycle market globally is estimated to grow from USD 0.3 billion in 2021 to USD 0.5 billion by 2027, at a CAGR of 9.4%. The market for adventure motorcycles is expanding primarily due to the rising demand for outdoor and sporting activities. Additionally, with an improved standard of living and disposable income, the inclination to engage in adventure activities is driving the market's expansion globally.

Market Dynamics

DRIVER: Rising interest in adventure long touring activities and increase in disposable income to drive the demand for adventure touring motorcycles

Adventure motorcycles have higher ground clearance, enabling the rider to conquer even the most challenging terrain. These motorcycles are just as good as any other street motorcycles on smooth roads, but their value becomes more apparent when traveling through off-road terrain. The ride is comfortable due to the high-quality chassis and suspension system. These bikes have high-raked suspension, big fuel tanks, and aerodynamic fairing, and thus, due to this particular design, can deal with a decent amount of harsh terrain riding. Adventure-seeking individuals prefer these types of bikes rather than other modes of transportation. This justifies the enormous growth potential of the market for adventure touring motorcycles.

RESTRAINTS: Affordability, Flexibility, and reliability of commuter bikes are constraints to the sales of adventure bikes.

The developments and pricing competitiveness of commuter motorcycles, accompanied by the flexibility to use them for long-distance travel, are some of the major restraints for the growth of adventure touring motorcycles. Due to the higher costs of adventure touring motorcycles and lower usage for commuter purposes, the market considers it a restraint for growth.

Also, compared to adventure bikes, commuter bikes have higher availability of spare parts at much cheaper costs than adventure bikes. Also, these spare parts have high availability and can be purchased from local small-scale dealerships that are not registered with OEMs. Thus, spare parts can be reasonably priced and easily found in remote areas. These advantages are not found in the case of adventure bikes where spares are hard to find but also expensive. Not all countries have robust infrastructure suitable for touring and adventure activities. In many countries, tourists/adventure lovers use modified commuter bikes for adventure activities. Thus, these are the factors that are restraining the growth.

OPPORTUNITIES: More options for customization and the addition of newer digital technologies for better navigation

Adventure touring majorly prefers customization and personalization of motorcycles for the uniqueness and practicality of its usage in varied terrain. The availability of additional accessories for carriage and safety gear in motorcycles adds a major opportunity for the growth of the market for adventure touring motorcycles. Advancement of battery technology also opens the space for electric-driven adventure motorcycles without any need for refueling.

Ducati said the Multistrada V4 has also adopted radar technology that can support and make riding more comfortable due to the ability to reconstruct the reality surrounding the motorcycle. Vodafone Automotive has been working with some major two-wheel manufacturers so that they can add connected features to their newest products. Due to these inbuilt telematics systems, motorcycles will automatically call emergency services if they are involved in a crash. The BMW K 1600 GT is the first motorbike with that capability, with connectivity provided by Vodafone. Vodafone provides end-to-end technology, including hardware, connectivity and services to help riders of the Yamaha TMAX SX or DX to keep their scooters safe. My TMAX Connect enables riders to: track the location of the vehicle at all times; remotely sound their vehicle’s horn or flash its lights to scare off anyone trying to tamper with it; and, if the TMAX is stolen, owners can recover it using Vodafone’s stolen vehicle tracking and recovery service.

CHALLENGES: Higher regulatory norms for safety and rising accidents cases

Adventure touring brings safety concerns when navigating rugged terrain for thrill and experience. The cases of accidents with adventure motorcycles and the rise in standards for safety across the world are some of the major challenges to the growth of adventure touring motorcycles. The niche nature of adventure touring motorcycles also restricts them to not many applications, due to which the market for the same is negatively impacted.

Adventure Bikes are considerably heavier than other bikes making off-road using and challenging. During off-road driving, body positioning is restrained due to windscreens, seat designs and luggage systems. Their weight and sticking-out parts (e.g. Panniers and windscreens) could make them harder to drive during aggressive off-road using. The complexity of the engines and advanced electronics can make Adventure Bikes hard to repair in a far flung area if required. Motorcycles also are more expensive to purchase, preserve and restore than Dual Sport bikes.

According to Insurance Institute for Highway Safety (IIHS) and Highway Loss Data Institute (HLDI) a total of 5,579 motorcyclists died in crashes in 2020. That is the highest number recorded and an 11 percent increase from 2019. The engine sizes of motorcycles whose drivers were killed in crashes have increased dramatically. Among motorcycle drivers killed in 2020, 34 percent drove motorcycles with engine sizes larger than 1,400 cc, compared with 9 percent in 2000 and less than 1 percent in 1990. Thus, increasing fatality rates is expected to be a major challenge in the adventure touring motorcycle market.

|

Report Metrics |

Details |

| Base year for estimation | 2021 |

| Forecast period | 2022-2027 |

| Market Growth and Revenue forecast | 9.4% |

| Top Players | BMW Group (Germany), Kawasaki Motors Corp. (Japan), KTM AG (Austria), Benelli Q.J. (Italy), YAMAHA Motor Pvt. Ltd. (Japan), Honda Motor Company (Japan), Triumph Motorcycles (UK), Ducati Motor Holding S.p.A (Italy), and Suzuki Motor Corporation (Japan), |

| Fastest Growing Market | Asia-Pacific |

| Largest Market | Asia Pacific |

| Segments covered | Application (Off-road, street, others), by engine capacity (500 CC, 1000 cc), by propulsion (ICE, Electric), by Region (sia-Pacific, Europe, North America, ROW) |

| Application | Off-road, street, others |

| Engine Capacity | 500 CC, 1000 cc |

| Propulsion | ICE, Electric |

| By Region | Asia-Pacific, Europe, North America, ROW |

Key Market Players

The adventure touring motorcycle market is dominated by major players such as BMW Group (Germany), Kawasaki Motors Corp. (Japan), KTM AG (Austria), Benelli Q.J. (Italy), YAMAHA Motor Pvt. Ltd. (Japan), Honda Motor Company (Japan), Triumph Motorcycles (UK), Ducati Motor Holding S.p.A (Italy), and Suzuki Motor Corporation (Japan), among others. These companies have strong distribution networks at a global level and offer an extensive product range. These companies adopt strategies such as new product developments, collaborations, and contracts & agreements to sustain their market position.

Recent Developments

- In April 2022, BMW unveiled three new motorcycles for the 2022 model year. They are all 2-cylinder, 900cc engines. The new F 850 GS and F 850 GS Adventure are better equipped and have more features than previous models. The F 850 GS will be offered in 'Pro' trim with the Style Rallye Package. On the other hand, the F 850 GS Adventure is intended for long journeys and difficult terrain. This dual-sport motorcycle is even better prepared for long tours thanks to improved standard equipment such as the TFT display and BMW Connected, the USB charge port, and ABS Pro and DTC.

- In January 2022, Aprilia unveiled the Tuareg adventure motorcycle. The Italian motorcycle is now likely to expand into other countries. The Aprilia Tuareg 660 comes with an enduro racing motorcycle inspired by the Paris-Dakar rally. The Tuareg 660 has an athletic body, an upright front fairing, and a futuristic headlamp. The headlamp features a double tick-mark LED DRL as well as Aprilia's signature triple light beams. The bike also includes a clear windshield that is tall enough to shield the rider from wind and weather. The Tuareg 660 features a large, shrouded fuel tank, a sleek tail section, and a flat bench seat.

- In December 2021, Ducati launched DessertX adventure touring motorcycle. The new DesertX has distinctive twin headlights that are reminiscent of vintage Dakar bikes. The DesertX includes the latest electronics and some tasty extras such as the standard Termignoni exhaust found on all Ducati’s, a rear-mounted 8-liter fuel tank (which increases overall fuel capacity to 29 liters), up to 117 liters of storage, additional lights, and center stand.

- In October 2021, Husqvarna launched Norden 901, an adventure touring motorcycle. It's the first multi-cylinder bike to bear the Husqvarna brand name since the short-lived Nuda 900 of 2012-13, which featured a reworked, big-bore, 898cc version of BMW's F800 parallel twin and the chassis from the same model, wrapped in distinctive Husqvarna bodywork.

- In August 2021, Triumph launched its all-new Tiger 1200 adventure motorcycle in four variants, including new long-range Explorers. The all-new Tiger 1200 family includes Pro variants (GT Pro and Rally Pro) as well as long-distance variants (GT Explorer and Rally Explorer). To accommodate every adventure motorcyclist, Tiger now offers the Sport 660, 850 Sport, 900 GT, 900 Rally, 900 Rally Pro, 1200 GT Pro, 1200 Rally Pro, 1200 GT Explorer, and 1200 Rally Explorer.

TABLE OF CONTENT

1 INTRODUCTION

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 RESEARCH DATA

1.4 SECONDARY DATA

1.5 PRIMARY DATA

1.6 MARKET SIZE ESTIMATION

1.6.1 BOTTOM UP APPROACH

1.6.2 TOP DOWN APPROACH

1.7 ASSUMPTIONS

1.9 LIMITATIONS

2 RESEARCH METHODOLOGY

2.1 RESEARCH DATA

2.2 SECONDARY DATA

2.2.1 KEY SECONDARY SOURCES

2.2.2 KEY DATA FROM SECONDARY SOURCES

2.3 PRIMARY DATA

2.3.1 SAMPLING TECHNIQUES & DATA COLLECTION METHODS

2.3.2 PRIMARY PARTICIPANTS

2.4 MARKET ESTIMATION

2.4.1 BOTTOM-UP APPROACH

2.4.2 TOP-DOWN APPROACH

2.5 MARKET BREAKDOWN AND DATA TRIANGULATION

2.6 FACTOR ANALYSIS

2.7 ASSUMPTIONS

2.9 LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.2 RESTRAINTS

5.2.3 OPPORTUNITIES

5.2.4 CHALLENGES

5.3 TRENDS/DISRUPTIONS IMPACTING ADVENTURE TOURING MOTORCYCLE MARKET

5.4 SCENARIO ANALYSIS: ADVENTURE TOURING MOTORCYCLE MARKET

5.4.1 REALISTIC SCENARIO

5.4.2 HIGH IMPACT SCENARIO

5.4.3 LOW IMPACT SCENARIO

5.5 PATENT ANALYSIS

5.6 SUPPLY CHAIN ANALYSIS

5.7 TRADE ANALYSIS

5.8 AVERAGE SELLING PRICE ANALYSIS

5.9 CASE STUDY ANALYSIS

5.10 TECHNOLOGICAL ANALYSIS

5.11 MARKET ECOSYSTEM

5.12 PORTER’S FIVE FORCES ANALYSIS

5.12.1 INTENSITY OF COMPETITIVE RIVALRY

5.12.2 THREAT OF NEW ENTRANTS

5.12.3 THREAT OF SUBSTITUTES

5.12.4 BARGAINING POWER OF SUPPLIERS

5.12.5 BARGAINING POWER OF BUYERS

5.13 REGULATORY LANDSCAPE

5.14 KEY STAKEHOLDERS & CUSTOMER BUYING BEHAVIOUR

5.15 KEY CONFERENCES & EVENTS IN 2022-2023

6 ADVENTURE TOURING MOTORCYCLE MARKET, BY APPLICATION

6.1 INTRODUCTION

6.1.1 RESEARCH METHODOLOGY

6.1.2 ASSUMPTIONS/LIMITATIONS

6.1.3 INDUSTRY INSIGHTS

6.2 OFF-ROAD

6.3 STREET

6.4 OTHERS

The Chapter would further be segmented at Regional Level in terms of volume & value, and considered Regions are Asia Pacific, Europe, and Americas

8 ADVENTURE TOURING MOTORCYCLE MARKET, BY ENGINE CAPACITY

8.1 INTRODUCTION

8.1.1 RESEARCH METHODOLOGY

8.1.2 ASSUMPTIONS/LIMITATIONS

8.1.3 INDUSTRY INSIGHTS

8.2 500-1100 CC

8.3 >1100 CC

The Chapter would further be segmented at Regional Level in terms of volume & value, and considered Regions are Asia Pacific, Europe, and Americas

9 ADVENTURE TOURING MOTORCYCLE MARKET, BY PROPULSION

9.1 INTRODUCTION

7.1.1 RESEARCH METHODOLOGY

7.1.2 ASSUMPTIONS/LIMITATIONS

7.1.3 INDUSTRY INSIGHTS

7.2 ICE

7.3 ELECTRIC

The Chapter would further be segmented at Regional Level in terms of volume & value, and considered Regions are Asia Pacific, Europe, and Americas

9 ADVENTURE TOURING MOTORCYCLE MARKET, BY REGION

Note: The Chapter is Further Segmented by End-User and country level. The Chapter will be provided in units and USD million

9.1 INTRODUCTION

9.1.1 RESEARCH METHODOLOGY

9.1.2 ASSUMPTIONS/LIMITATIONS

9.1.3 INDUSTRY INSIGHTS

9.2 ASIA PACIFIC

9.2.1 CHINA

9.2.2 INDIA

9.2.3 JAPAN

9.2.4 SOUTH KOREA

9.3 EUROPE

9.3.1 GERMANY

9.3.2 FRANCE

9.3.3 SPAIN

9.3.4 ITALY

9.3.5 UK

9.3.6 RUSSIA

9.3.7 TURKEY

9.4 NORTH AMERICA

9.4.1 US

9.4.2 CANADA

9.4.3 MEXICO

9.4.4 BRAZIL

9.4 ROW

9.4.1 BRAZIL

9.4.2 SOUTH AFRICA

10 COMPETITIVE LANDSCAPE

10.1 OVERVIEW

10.2 ADVENTURE TOURING MOTORCYCLE MARKET SHARE ANALYSIS, 2021

10.3 REVENUE ANALYSIS OF TOP 5 PLAYERS

10.4 COMPETITIVE EVALUATION QUADRANT: ADVENTURE TOURING MOTORCYCLE MATERIAL MANUFACTURERS

10.4.1 STARS

10.4.2 EMERGING LEADERS

10.4.3 PERVASIVE PLAYERS

10.4.4 PARTICIPANTS

10.5 ADVENTURE TOURING MOTORCYCLE MARKET: COMPANY PRODUCT FOOTPRINT

10.6 ADVENTURE TOURING MOTORCYCLE MARKET: COMPANY APPLICATION FOOTPRINT

10.7 ADVENTURE TOURING MOTORCYCLE MARKET: COMPETITIVE BENCHMARKING

10.9 COMPETITIVE SCENARIO

10.9.1 NEW PRODUCT LAUNCHES

10.9.2 DEALS

10.9.3 EXPANSIONS

11 COMPANY PROFILES

11.1 HONDA MOTOR COMPANY

11.2 BMW GROUP

11.3 KTM SPORTMOTORCYCLE GMBH

11.4 KAWASAKI MOTORS CORP.

11.5 YAMAHA

11.6 APRILLIA

11.7 SUZUKI MOTORS

11.9 DUCATI MOTOR HOLDING S.P.A

11.9 TRIUMPH MOTORCYCLES

11.10 BENELLI Q.J.

11.11 ADDITIONAL COMPANIES

Note: Indicative list of companies and may get updated during course of the study.

Note – Each company profile will include Business Overview, Products Offered, Financial information, and Recent Developments for listed companies only

Profiles of ‘Additional players’ cover Business Overview, Products Offered, and Company’s Regional Presence

12 RECOMMENDATIONS BY MARKETSANDMARKETS

13 APPENDIX

13.1 CURRENCY & PRICING

13.2 KEY INSIGHTS OF INDUSTRY EXPERTS

13.3 DISCUSSION GUIDE

13.4 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.5 AVAILABLE CUSTOMIZATIONS

13.6 RELATED REPORTS

13.7 AUTHOR DETAILS

13.9 ADDITIONAL CUSTOMIZATIONS

Growth opportunities and latent adjacency in Adventure Touring Motorcycle Market