Adaptogens Market by Product Type (Ashwagandha, Ginseng, Astragalus, Tulsi, Rhodiola Rosea, Schisandra, Reishi Mushrooms, Turmeric, Licorice Root, Cordyceps, and Maca Root), Application (Food & Beverages, Dietary Supplements, Cosmetics and Personal Care, and Pharmaceuticals), Distribution Channel (Retail Channels, Online Channels, and Direct Sales), and Region - Global Forecast to 2029

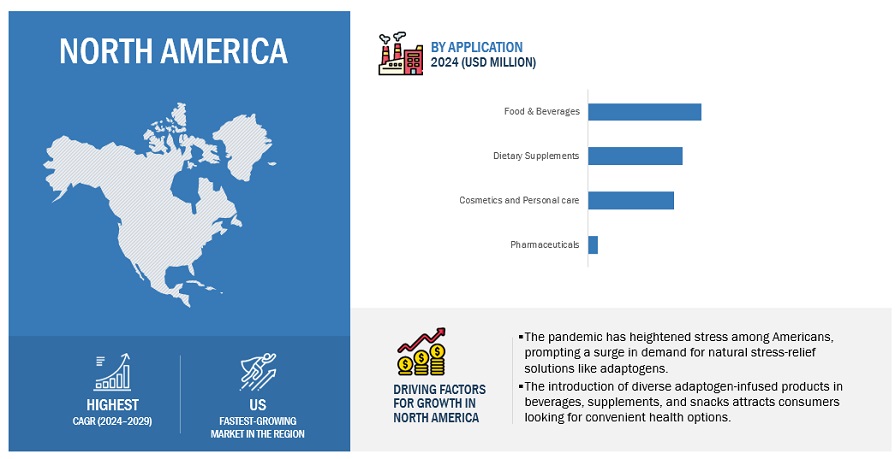

The global adaptogens market growth is on a trajectory of significant expansion, with an estimated value projected to reach USD XX.X billion by 2029 from the 2024 valuation of USD XX.X billion, displaying a promising Compound Annual Growth Rate (CAGR) of X.X%. According to an article by UCLA Health from February 2022, the demand for adaptogens in the market is increasing as more people seek alternative effective solutions to stress. nearly 47% of Americans state that they have experienced higher levels of stress, spurring demand for natural remedies. Adaptogens are herbs and plants that have been seen to help with response to stress as well as recovery. They improve one's mood, boost one's immunity, as well as reduce one's fatigue; thus, there is an increasing trend in the consumption of adaptogens. The growing need for adaptogens is a primary driver of market growth as research continues to increase.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Market Dynamics

Drivers: Consumer stress drives significant growth in adaptogen market

Strongly based on the growing level of consumer stress, the adaptogen market is significantly growing. Some of the reasons for this include pandemic effects, supply chain disruption, and geopolitical tensions; due to which more than 75% of U.S adults are reporting symptoms of stress, American Psychological Association (2022). Consumer perception has heightened so much that they have sought natural remedies, and use of such an adaptogen as ashwagandha is gaining popularity for effective stress management. A desire for natural ingredients has further propelled demand, as consumers increasingly look towards traditional herbal remedies for overall health and wellness. The variety of adaptogen-infused beverages, supplements, and snacks supports this growth trend.

Restraints: Market saturation hindering growth in adaptogens market

Market saturation in the space of adaptogens is a strong entry barrier for new entrants. Increasingly, companies have been launching similar products- Ashwagandha supplements and functional beverages -thereby creating a frenzy among the competitors. Established brands, Sun Potion (US) and Four Sigmatic (US) exercise stronger grip on market visibility and customer loyalty and thus instill greater difficulties for the new entrant to differentiate their offerings. Such saturation culminates into price wars that reduce profit margins because smaller companies will compete on price rather than quality. Additionally, the consumer is presented with choices that are overwhelming in number, they will inevitably fail to identify the effective products, leading to decision fatigue. New products hence risk failing to make traction, and companies must innovate and create unique value propositions that differentiate them in such saturated markets.

Opportunities: Adaptogens offer diverse opportunities for innovative product development

The growth and innovation prospects are high in adaptogens market, especially with synergistic adaptogens. Brands can create multi-functional products by combining adaptogens with other beneficial ingredients to deliver products responding to consumers' needs on every level of immunity, digestive health, and sleep quality. This trend opens up new product development opportunities in the food, beverages, and nutraceutical industries. Skincare is also a potential area for adaptogenic products because it has been proven to decrease the expression of inflammation and boosts the synthesis of collagen. As consumers tend more toward natural remedy seekers and holistic wellness, the opportunity for companies exists through adaptation into this rapidly growing market in the form of innovative and effective products that contain adaptogens.

Challenges: Supply chain issues disrupt adaptogen availability, impacting costs and stability

Fluctuations in raw materials directly impact the adaptogen business, which is sensitive to variable availability of basic products. Most of the adaptogens such as ashwagandha and reishi are produced in specific geographic locations. In this respect, the industry is mainly susceptible to changes in climate, contamination of soil, and natural disasters impacting crop production. This also tends to raise sourcing issues in the event of small-scale farmers and local suppliers relying on lack of resources and infrastructure leading to inconsistent quality and supply. Such interruption will add higher costs and reduce availability and, therefore, influence pricing in the product and market stability since companies fail to stay with consistent supply accompanied with growing consumer demand.

Market Ecosystem

ASHWAGANDHA segment accounted for A HIGHER market SHARE among PRODUCT TYPE SEGMENT in 2023.

Among all adaptogens, ashwagandha enjoys the largest market share since it offers such benefits as a reduction of stress levels, improvement in cognitive functions, and acquiring more stamina. Its popularity is most pronounced in North America and Asia Pacific, where consumers are increasingly looking for natural solutions to satisfy their mental wellness and stress management needs. Such a rising awareness of the health benefit of ashwagandha has led it to be included in different products, such as supplements, beverages, and functional food. Ashwagandha has also become a product of Himalaya Herbal Healthcare (India), Kapiva (India), Nutrafol (US), and many others. Recently, a brand, REBBL Inc (US), came out with a line of Protein Shakes with ashwagandha, continuing the pattern of functional beverages that hails the flexibility of the ingredient in modern solutions for wellness and hence positions it even better in the market.

THE food and beverages SEGMENT IS PROJECTED TO BE THE dominant DURING THE FORECAST PERIOD IN BY APPLICATION SEGMENT.

Food and beverages hold the highest market share among all these types of adaptogens, as this is being used by the most people. The demand for functional products that enhance health and wellness is on the rise, making consumers look for natural remedies against the element of stress, weak immunity, and other general health issues, thus the profitable introduction of adaptogens. According to WholeFoods Magazine article, January 2023, 35% of all available adaptogens in the market are available as beverages, including tea, coffee, and energy drinks. Companies such as REBBL Inc (US), a plant-powered drink company, and Four Sigmatic (US), a mushroom-based coffee company, are examples of businesses that took advantage of the trend. MUD\WTR (US) introduced its Rise Blend, an alternative coffee accompanied by masala chai, cacao, and adaptogenic mushrooms, which boasts such strong ingredients as Lion's mane for focus, immune-supporting chaga and reishi mushrooms, and cordyceps for natural energy, in a 100% organic formula with no added sweeteners, giving you all the benefits of coffee without jitters and crashing.

ASIA PACIFIC REGION IS EXPECTED TO DOMINATE FOR ADAPTOGENS MARKET AMONG THE REGIONS.

Asia Pacific will remain the largest market for adaptogens during the forecast period. Rapid urbanization and changing lifestyle in India and China elevated stress levels, which brings interest in adaptogens for managing stress in the consumer's self. Increased focus on holistic and alternative medicine has led to more interest in herbal supplements. In India, some key players in the industry, Organic India (India), Emami Limited (India), and Dabur India Limited (India), are capitalizing on the growing demand for innovative adaptogen-based products, while similar companies in China, such as Xian Yuensun Biological Technology Co. Ltd. (China), Xi'an Greena Biotech Co. Ltd. (China), continue to capture more market shares.

Key Market Players

The key players in this market include NutraScience Labs (US), Organic India (India), Emami Limited (India), Dabur India Limited (India), PLT Health Solutions, Inc. (US), Xi’an Yuensun Biological Technology Co. Ltd. (China), REBBL Inc. (US), Nootropics (US) and Gaia Herbs (US).

Recent Developments

- In August 2024, Emami Limited (India) agreed to acquire 100% ownership by purchasing the 49.60% remained stake in The Man Company, owned by Helios Lifestyle Pvt Ltd. This acquisition will make Emami strong in the digital-first premium male grooming market. "The Man Company" portfolio dominated natural ingredient-based products like licorice products that extensively cater to the rising demand for adaptogens in personal care. Such products inclusions will allow Emami to capitalize on the adaptogen market while in search of health-conscious consumers that look for grooming solutions with natural, functional benefits.

- In March 2024, REBBL Inc. (US) released its Protein Shakes with the boost of adaptogens ashwagandha, reishi, and maca extract, adding strength to the brand in the market for adaptogens. That inspired line was built for a healthy consumer who needs functional benefits-providing 26 grams of protein and only 4 grams of sugar. In combining these adaptogens, REBBL's Protein Shakes filled the gap in plant-based beverages with a brand that associated the market leadership with such sustainable, functionally nourishing nutrition, thus aligning with the demand for holistic wellness from conscious and environmentally responsible consumers.

- In August 2020, Dabur India Limited (India) has brought eight new Ayurveda-based baby care products like Dabur Baby Massage Oil, Dabur Baby Skin Cream, and Dabur Baby Hair Oil, which can increase the portfolio of the company with natural adaptogens like licorice and turmeric by providing overall wellbeing and resilience to babies. Dabur is poised itself in the adaptogen market by producing adaptogenic components meant to be utilized in the company's baby care, in relation to health-conscious parents who want safe and effective products for their children.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Growth opportunities and latent adjacency in Adaptogens Market