Acrylonitrile Butadiene Styrene Market by Type (Opaque, Transparent, Colored), Grade (High Impact, Heat Resistant, Electroplatable, Flame Retardant, Blended), Manufacturing Process, Technology, Applications, and Region - Global Forecast to 2028

Updated on : September 24, 2025

Acrylonitrile Butadiene Styrene Market

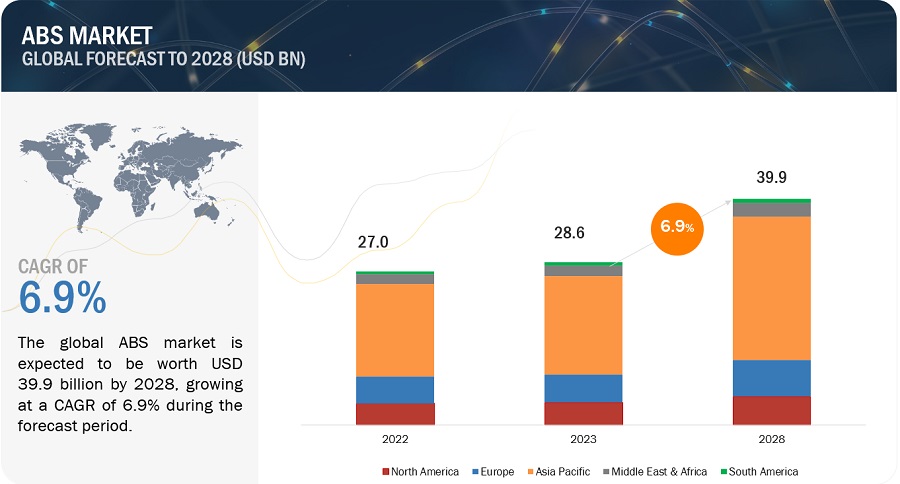

The acrylonitrile butadiene styrene market was valued at USD 28.6 billion in 2023 and is projected to reach USD 39.9 billion by 2028, growing at 6.9% cagr from 2023 to 2028. The demand for acrylonitrile butadiene styrene (ABS) is being driven by growing demand from end-use industries, surging consumer awareness & preferences for high performance plastics, and advancements in manufacturing technologies.

Acrylonitrile Butadiene Styrene Market Forecast & Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Acrylonitrile Butadiene Styrene Market Dynamics

Driver: Growing demand from end-use industries

The growing demand from end-use industries, such as automotive and electrical and electronics, is a significant driver for the ABS market. In the automotive sector, ABS is extensively used in components like bumpers, interior trim, dashboards, and lighting due to its lightweight, impact resistance, and dimensional stability. In the electrical and electronics industry, ABS is favored for producing casings, covers, and structural components, providing essential properties like electrical insulation, impact resistance, and ease of customization, driving its market growth.

Restraint: Competition from alternative materials

Competition from alternative materials poses a restraint for the ABS market. Other plastics such as polycarbonate, polypropylene, and polyethylene offer similar properties to ABS, making them potential substitutes in certain applications. These alternatives can sometimes be more cost-effective or offer specific advantages, leading to a shift in consumer preferences. To remain competitive, ABS manufacturers must continuously innovate, enhance product performance, and offer unique value propositions to retain their market share amidst the presence of alternative materials.

Opportunity:

Advancements in 3D printing present a significant opportunity for the ABS market. 3D printing technology allows for the additive manufacturing of ABS parts, enabling rapid prototyping and customized production. The ability to create complex geometries and intricate designs using ABS opens new possibilities in various industries. As 3D printing becomes more accessible and cost-effective, the demand for ABS as a 3D printing material is expected to grow, creating new avenues for market expansion and diversification of applications.

Challenges: The availability and efficiency of recycling infrastructure for ABS waste

The availability and efficiency of recycling infrastructure for ABS waste poses a challenge for the ABS market. While ABS is a recyclable material, the lack of well-established and efficient recycling facilities can hinder the proper disposal and recycling of ABS waste. Inadequate recycling infrastructure may lead to the improper disposal of ABS products, increasing environmental pollution and waste accumulation. Addressing this challenge requires investment in recycling technologies and infrastructure to promote sustainable practices and circular economy principles within the ABS market.

Acrylonitrile Butadiene Styrene Market Ecosystem

By type, Opaque is the third fastest-growing segment due to its wide-ranging applications in various industries. Opaque ABS formulations offer solid color appearances, providing color consistency and opacity, making them popular in automotive parts, consumer goods, electronics, and household appliances. The demand for opaque ABS is driven by its versatility, durability, and ease of molding, allowing manufacturers to create products with consistent color and appearance, contributing to its rapid growth and market significance.

By grade, high-impact ABS is projected to grow at the fastest CAGR, during the forecast period, due to its exceptional toughness and impact resistance properties. It finds extensive usage in automotive components, safety equipment, and durable consumer goods. The rising demand for lightweight, durable, and visually appealing materials in various industries drives the adoption of high impact ABS. Its ability to withstand harsh environments, mechanical stresses, and rough handling makes it a preferred choice, propelling its rapid growth and market dominance in the ABS market.

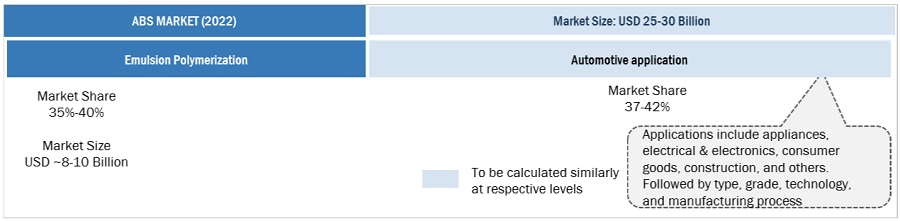

By manufacturing process, Emulsion polymerization accounted for the largest share of the ABS market due to its ability to produce ABS with excellent dispersion and fine particle size. This method offers controlled polymerization, resulting in ABS formulations with desirable properties like high impact strength and good processability. Emulsion polymerization's cost-effectiveness, energy efficiency, and capability to cater to a wide range of applications have contributed to its increasing adoption, driving its rapid growth and significance in the ABS market.

By technology, injection molding is estimated to be the fastest-growing segment during the forecast period in the ABS market due to its high efficiency and cost-effectiveness in mass production. This technology allows for the high-speed injection of molten ABS into molds, enabling the manufacturing of intricate and complex three-dimensional parts with precise accuracy. The widespread adoption of injection molding in various industries, including automotive, electronics, and consumer goods, drives the demand for ABS materials. Its versatility, ease of customization, and ability to produce high-quality components contribute to its rapid growth and prominence in the ABS market.

By applications, appliances segment is projected to grow at the highest rate in the ABS market due to the increasing demand for durable, lightweight, and visually appealing materials in various end-use applications. ABS offers a wide range of properties that meet the requirements of the appliances industry, including high impact resistance, dimensional stability, electrical insulation, and ease of molding. Its use in manufacturing components for appliances such as refrigerators, washing machines, vacuum cleaners, and small domestic appliances has propelled its rapid growth and significance in the ABS market.

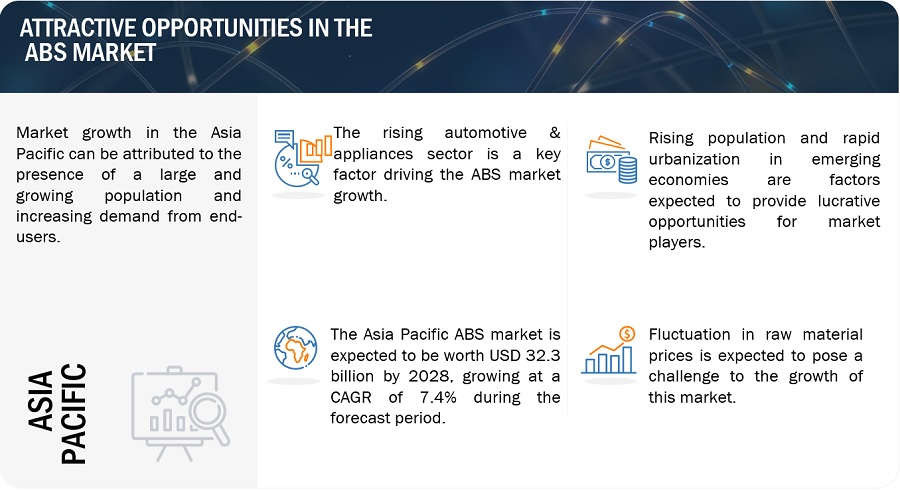

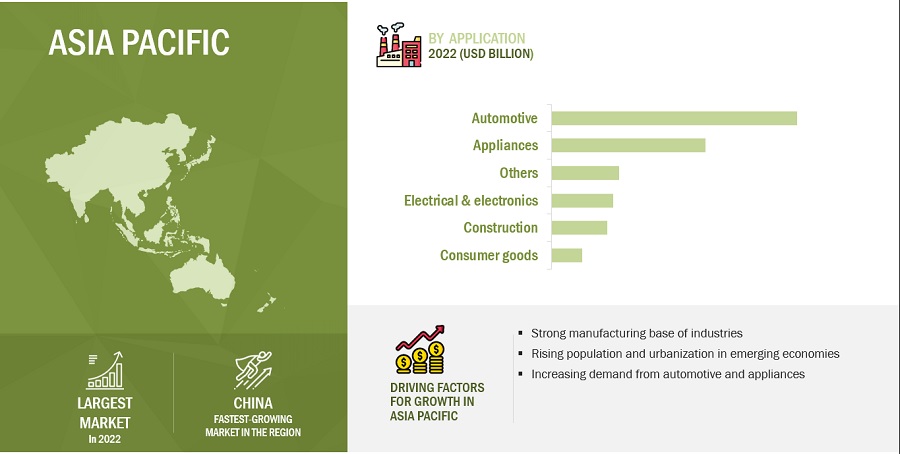

Asia Pacific is the fastest-growing region in the ABS market due to several factors. The region's booming automotive, electronics, and appliances industries drive the demand for ABS in manufacturing various components and products. Additionally, the increasing construction activities and infrastructure development in countries like China and India lead to higher consumption of ABS in pipes, fittings, and other construction applications. Moreover, the rising population, urbanization, and economic growth contribute to the region's expanding consumer goods sector, further boosting the demand for ABS in diverse end-use industries.

Source: Secondary Research, Primary Interviews, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

Acrylonitrile Butadiene Styrene Market Players

The key players in the ABS market are LG Chem Ltd. (South Korea), ChiMei Corporation (Taiwan), INEOS Styrolution (Germany), Petrochina Co Ltd. (China), Formosa Chemicals & Fibre Corporation (Taiwan), Sabic (Saudi Arabia), Toray Industries Inc. (Japan), Lotte Chemical (South Korea), Versalis (Italy), Kumho Petrochemical (South Korea), BASF SE (Germany), and Covestro AG (Germany), Trinseo(US), Techno UMG Ltd(Japan), Tianjin Dagu Chemical (China) , The Iran Petrochemical Commercial Company (Iran) , Shanghai Gaoqiao Petrochemical Company (China), IRPC (Thailand), RTP Company (USA) and Ravago Manufacturing (USA), among others. The ABS market report analyzes the key growth strategies, such as new product launch, expansions, investments, and acquisitions adopted by the leading market players between 2018 and 2023.

Acrylonitrile Butadiene Styrene Market Report Scope

|

Report Metric |

Details |

|

Years considered for the study |

2020-2028 |

|

Base Year |

2022 |

|

Forecast period |

2023–2028 |

|

Units considered |

Value (USD Million), Volume (KT) |

|

Segments |

Type, Grade, Manufacturing Process, Technology, Applications, and Region |

|

Regions |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies |

LG Chem Ltd. (South Korea), ChiMei Corporation (Taiwan), INEOS Styrolution (Germany), Petrochina Co Ltd. (China), Formosa Chemicals & Fibre Corporation (Taiwan), Sabic (Saudi Arabia), Toray Industries Inc. (Japan), Lotte Chemical (South Korea), Versalis (Italy), Kumho Petrochemical (South Korea), BASF SE (Germany), and Covestro AG (Germany), Trinseo(US), Techno UMG Ltd(Japan), Tianjin Dagu Chemical (China) , The Iran Petrochemical Commercial Company (Iran) , Shanghai Gaoqiao Petrochemical Company (China), IRPC (Thailand), RTP Company (USA) and Ravago Manufacturing (USA), are the key players in the market. |

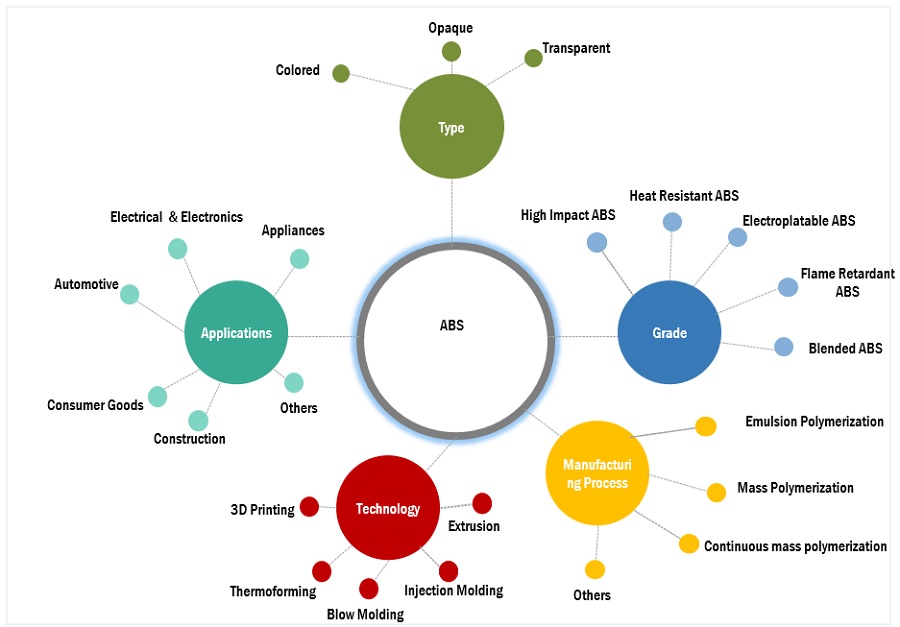

This report categorizes the global acrylonitrile butadiene styrene market based on type, grade, manufacturing process, technology, applications, and region.

On the basis of type, the ABS market has been segmented as follows:

- Opaque

- Transparent

- Colored

On the basis of grade, the ABS market has been segmented as follows:

- High Impact

- Heat Resistant

- Flame Retardant

- Electroplatable

- Blended ABS

On the basis of the manufacturing process, the ABS market has been segmented as follows:

- Emulsion Polymerization

- Mass Polymerization

- Continuous Mass Polymerization

- Others

On the basis of technology, the ABS market has been segmented as follows:

- Extrusion

- Injection Molding

- Blow Molding

- Thermoforming

- 3D printing

On the basis of application, the ABS market has been segmented as follows:

-

Appliances

- washing machine

- refrigeration

- others

-

Electrical and Electronics

- Electronic enclosures

- Computer and printer housing

- Others

-

Automotive

- Instrument panel

- Dashboard console

- Others

-

Consumer Goods

- small domestic appliances

- protective cases

- others

- Construction

- Pipes and fitting

- Roofing and membrane

- Others

- Others

On the basis of region, the ABS market has been segmented as follows:

- Asia Pacific

- Europe

- North America

- Middle East & Africa

- South America

Recent Developments

- In May 2023, After the launch of a 450,000 tons/year ABS manufacturing line in September 2021. Chi Mei Corporation is planning to expand its ABS production capacity at the Zhangzhou plant to 600,000 tons/year by 2025.

- In April 2023, Formosa Chemicals & Fibre Corporation has planned a significant expansion of producing ABS with a projected capacity of 7.43 million tonnes per annum by 2030.

- In January 2022, INEOS Styrolution expanded its ABS capacity in Wingles, France to produce 50 KT ABS with the aim to meet the increased demand for ABS in Europe from the construction, household, and automotive industries.

Frequently Asked Questions (FAQ):

What is the current size of the global ABS market?

The global ABS market is projected to reach USD 39.9 billion by 2028, at a CAGR of 6.9% from USD 28.6 billion in 2023.

Who are the winners in the global ABS market?

Companies such as LG Chem Ltd. (South Korea), ChiMei Corporation (Taiwan), INEOS Styrolution (Germany), PetroChina Co Ltd. (China), Formosa Chemicals & Fibre Corporation (Taiwan), Sabic (Saudi Arabia), Toray Industries Inc. (Japan), Lotte Chemical (South Korea), Versalis (Italy), Kumho Petrochemical (South Korea), BASF SE (Germany), and Covestro AG (Germany), Trinseo(US), Techno UMG Ltd(Japan), Tianjin Dagu Chemical (China) , The Iran Petrochemical Commercial Company (Iran) , Shanghai Gaoqiao Petrochemical Company (China), IRPC (Thailand), RTP Company (USA) and Ravago Manufacturing (USA). They have the potential to broaden their product portfolio and compete with other key market players.

What are some of the drivers in the market?

Advancements in manufacturing technologies.

Which segment on the basis of application is expected to garner the highest traction within the ABS market?

Based on application, the automotive segment held the largest share of the ABS market in 2022.

What are some of the strategies adopted by the top market players to penetrate emerging regions?

The major players in the market use new product launches, expansions, and acquisitions as important growth tactics. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Growing demand from end-use industries- Advancements in manufacturing technologies- Surging consumer awareness and preference for high-performance plasticsRESTRAINTS- Competition from alternative materials- Lack of skilled workforce and testing facilities in emerging economiesOPPORTUNITIES- Advancements in 3D printing- Increasing demand for sustainable packaging solutionsCHALLENGES- Availability and efficiency of recycling infrastructure for ABS waste

-

5.3 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSBARGAINING POWER OF BUYERSBARGAINING POWER OF SUPPLIERSTHREAT OF SUBSTITUTESINTENSITY OF COMPETITIVE RIVALRY

- 5.4 SUPPLY CHAIN ANALYSIS

-

5.5 RAW MATERIAL ANALYSISACRYLONITRILEBUTADIENESTYRENE

-

5.6 CASE STUDY ANALYSISCOST-EFFECTIVE MATERIAL SOLUTION FOR PREMIUM CAR SPEAKER GRILLSDEVELOPING CUSTOMIZED MATERIAL SOLUTION FOR HOME OXYGEN CONCENTRATORSPOWER OF ANTIMICROBIAL ABS FOR DAILY LIFE PRODUCTS

-

5.7 MACROECONOMIC INDICATORSGDP TRENDS AND FORECAST

-

5.8 REGULATORY LANDSCAPEREGULATIONS- Europe- US- OthersSTANDARDS- Occupational Safety and Health Act of 1970 (OSHA Standards)- European Committee for Standardization (CEN)REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.9 TRADE ANALYSIS

-

5.10 TECHNOLOGY ANALYSISADDITIVE MANUFACTURING/3D PRINTINGBIO-BASED ABSSURFACE MODIFICATION TECHNIQUESDIGITALIZATION AND DATA-DRIVEN MANUFACTURINGHYBRID ABS COMPOSITES

- 5.11 AVERAGE SELLING PRICE TREND

-

5.12 ECOSYSTEM MAPPING

- 5.13 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

-

5.14 PATENT ANALYSISINTRODUCTIONMETHODOLOGYDOCUMENT TYPEPUBLICATION TRENDS, LAST 10 YEARSINSIGHTSLEGAL STATUS OF PATENTSJURISDICTION ANALYSISTOP COMPANIES/APPLICANTS- Patents by Seagate Plastics Company- Patents by LG Chemical LTD- Patents by LG Electronics INCTOP 10 PATENT OWNERS (US) IN LAST 10 YEARS

- 5.15 KEY CONFERENCES & EVENTS IN 2023–2024

- 5.16 BUYING CRITERIA

- 6.1 INTRODUCTION

-

6.2 OPAQUE ABSINCREASED DEMAND FROM VARIOUS END-USE INDUSTRIES TO DRIVE MARKET

-

6.3 COLORED ABSEXCELLENT MECHANICAL PROPERTIES TO DRIVE MARKET

-

6.4 TRANSPARENT ABSVISUAL APPEAL AND STRENGTH TO DRIVE MARKET

- 7.1 INTRODUCTION

-

7.2 HIGH-IMPACT ABSOUTSTANDING TOUGHNESS TO DRIVE MARKET

-

7.3 HEAT-RESISTANT ABSHIGH DEMAND FROM VARIOUS END-USE INDUSTRIES TO DRIVE MARKET

-

7.4 ELECTROPLATABLE ABSINCREASING DEMAND FROM AUTOMOTIVE AND ELECTRONICS TO DRIVE MARKET

-

7.5 FLAME-RETARDANT ABSENHANCED FIRE SAFETY PROPERTIES TO DRIVE MARKET

-

7.6 BLENDED ABSENHANCED PERFORMANCE CAPABILITIES TO DRIVE MARKET

- 8.1 INTRODUCTION

-

8.2 EMULSION POLYMERIZATIONENHANCED ABS PROPERTIES TO DRIVE MARKET

-

8.3 MASS POLYMERIZATIONENHANCED IMPACT RESISTANCE AND TENSILE STRENGTH TO DRIVE MARKET

-

8.4 CONTINUOUS MASS POLYMERIZATIONCONSISTENT PRODUCT QUALITY THROUGHOUT PRODUCTION PROCESS TO DRIVE MARKET

- 8.5 OTHERS

- 9.1 INTRODUCTION

-

9.2 EXTRUSIONWIDE PRODUCTION OF ABS SHEETS TO DRIVE MARKET

-

9.3 INJECTION MOLDINGHIGH PRODUCTION RATES TO DRIVE MARKET

-

9.4 BLOW MOLDINGLARGE-SCALE PRODUCTION OF HOLLOW PLASTIC PRODUCTS TO DRIVE MARKET

-

9.5 THERMOFORMINGCOST-EFFECTIVE PRODUCTION PROCESS TO DRIVE MARKET

-

9.6 3D PRINTINGQUICK AND COST-EFFECTIVE PRINTING TO DRIVE MARKET

- 10.1 INTRODUCTION

-

10.2 APPLIANCESEXTENSIVE USE IN APPLIANCES INDUSTRY TO DRIVE MARKET- Washing machine- Refrigeration- Others

-

10.3 ELECTRICAL AND ELECTRONICSENHANCED PRODUCT PERFORMANCE TO DRIVE MARKET- Electronic enclosures- Computer printer housing- Others

-

10.4 AUTOMOTIVEHIGH DEMAND FOR ABS IN AUTOMOTIVE INDUSTRY TO DRIVE MARKET- Instrument panel- Dashboard console- Others

-

10.5 CONSUMER GOODSUNLEASHING VERSATILITY AND DURABILITY TO DRIVE MARKET- Small domestic appliances- Protective cases- Others

-

10.6 CONSTRUCTIONEMBRACING ABS FOR CONSTRUCTION EXCELLENCE TO DRIVE MARKET- Pipes and fittings- Roofing and membranes- Others

- 10.7 OTHERS

- 11.1 INTRODUCTION

-

11.2 ASIA PACIFICCHINA- Increasing demand for passenger cars to drive marketINDIA- Strategic government initiatives to drive marketJAPAN- Stringent government regulations concerning greenhouse gas emissions to drive marketSOUTH KOREA- Growth in automotive sector to drive marketREST OF ASIA PACIFIC

-

11.3 EUROPEGERMANY- Technological advancements in electronics sector to drive marketITALY- Government initiatives to promote sales of electric vehicles to drive marketPOLAND- Robust manufacturing sector to drive marketSPAIN- Accelerating automotive sector to drive marketUK- Increasing demand for passenger vehicles to drive marketREST OF EUROPE

-

11.4 NORTH AMERICAUS- Increasing demand for electric vehicles to drive marketCANADA- Government initiatives for zero-emission electric vehicles to drive marketMEXICO- Exports and domestic manufacturing to drive market

-

11.5 MIDDLE EAST & AFRICAUAE- Increasing demand from construction sector to drive demandSAUDI ARABIA- Growing construction and manufacturing activities to drive marketSOUTH AFRICA- Increasing demand from construction sector to drive marketREST OF MIDDLE EAST & AFRICA

-

11.6 SOUTH AMERICABRAZIL- Economic growth to drive marketARGENTINA- Electronics and automotive sectors to drive marketREST OF SOUTH AMERICA

- 12.1 OVERVIEW

- 12.2 RANKING ANALYSIS OF KEY MARKET PLAYERS

- 12.3 MARKET SHARE ANALYSIS

- 12.4 REVENUE ANALYSIS OF TOP PLAYERS

- 12.5 MARKET EVALUATION MATRIX

-

12.6 COMPANY EVALUATION MATRIX, 2022STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

12.7 START-UPS AND SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION MATRIXRESPONSIVE COMPANIESSTARTING BLOCKSPROGRESSIVE COMPANIESDYNAMIC COMPANIES

- 12.8 COMPANY END-USE INDUSTRY FOOTPRINT

- 12.9 COMPANY REGION FOOTPRINT

- 12.10 STRENGTH OF PRODUCT PORTFOLIO

- 12.11 BUSINESS STRATEGY EXCELLENCE

-

12.12 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALSOTHER DEVELOPMENTS

-

13.1 KEY PLAYERSLG CHEM LTD- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCHIMEI CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewINEOS STYROLUTION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewPETROCHINA CO LTD- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewFORMOSA CHEMICALS & FIBRE CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSABIC- Business overview- Products/Solutions/Services offered- MnM viewTORAY INDUSTRIES, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewLOTTE CHEMICAL- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewVERSALIS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewKUMHO PETROCHEMICAL- Business overview- Products/Solutions/Services offered- MnM viewBASF SE- Business overview- Products/Solutions/Services offered- MnM viewCOVESTRO AG- Business overview- Products/Solutions/Services offered- MnM view

-

13.2 OTHER PLAYERSTRINSEOTECHNO UMG CO LTD.TIANJIN DAGU CHEMICAL CO., LTD.THE IRAN PETROCHEMICAL COMMERCIAL COMPANYSHANGHAI GAOQIAO PETROCHEMICAL COMPANYIRPCRTP COMPANYRAVAGO MANUFACTURING AMERICAS LLC

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- TABLE 1 ABS MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 ABS MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 3 GDP TRENDS AND FORECAST, BY MAJOR ECONOMY, 2021–2028 (USD BILLION)

- TABLE 4 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 5 MAJOR EXPORTING COUNTRIES – ABS (USD MILLION)

- TABLE 6 MAJOR IMPORTING COUNTRIES– ABS (USD MILLION)

- TABLE 7 AVERAGE SELLING PRICE, BY REGION (USD/KG)

- TABLE 8 AVERAGE SELLING PRICE, BY KEY PLAYER (USD/KG)

- TABLE 9 AVERAGE SELLING PRICE, BY KEY APPLICATION (USD/KG)

- TABLE 10 ABS MARKET: ECOSYSTEM

- TABLE 11 PATENTS BY SEAGATE PLASTICS COMPANY

- TABLE 12 PATENTS BY LG CHEMICAL LTD

- TABLE 13 PATENTS BY LG ELECTRONICS INC

- TABLE 14 TOP 10 PATENT OWNERS

- TABLE 15 ABS MARKET: CONFERENCES & EVENTS

- TABLE 16 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

- TABLE 17 ABS MARKET, BY TYPE, 2021–2028 (KILOTON)

- TABLE 18 ABS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 19 ABS MARKET, BY GRADE, 2021–2028 (KILOTON)

- TABLE 20 ABS MARKET, BY GRADE, 2021–2028 (USD MILLION)

- TABLE 21 ABS MARKET, BY MANUFACTURING PROCESS, 2021–2028 (KILOTON)

- TABLE 22 ABS MARKET, BY MANUFACTURING PROCESS, 2021–2028 (USD MILLION)

- TABLE 23 ABS MARKET, BY TECHNOLOGY, 2021–2028 (KILOTON)

- TABLE 24 ABS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 25 ABS MARKET, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 26 ABS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 27 ABS MARKET, BY REGION, 2021–2028 (KILOTON)

- TABLE 28 ABS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 29 ASIA PACIFIC: ABS MARKET, BY COUNTRY, 2021–2028 (KILOTON)

- TABLE 30 ASIA PACIFIC: ABS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 31 ASIA PACIFIC: ABS MARKET, BY TYPE, 2021–2028 (KILOTON)

- TABLE 32 ASIA PACIFIC: ABS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 33 ASIA PACIFIC: ABS MARKET, BY GRADE, 2021–2028 (KILOTON)

- TABLE 34 ASIA PACIFIC: ABS MARKET, BY GRADE, 2021–2028 (USD MILLION)

- TABLE 35 ASIA PACIFIC: ABS MARKET, BY MANUFACTURING PROCESS, 2021–2028 (KILOTON)

- TABLE 36 ASIA PACIFIC: ABS MARKET, BY MANUFACTURING PROCESS, 2021–2028 (USD MILLION)

- TABLE 37 ASIA PACIFIC: ABS MARKET, BY TECHNOLOGY, 2021–2028 (KILOTON)

- TABLE 38 ASIA PACIFIC: ABS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 39 ASIA PACIFIC: ABS MARKET, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 40 ASIA PACIFIC: ABS MARKET SIZE, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 41 CHINA: ABS MARKET, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 42 CHINA: ABS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 43 INDIA: ABS MARKET, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 44 INDIA: ABS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 45 JAPAN: ABS MARKET, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 46 JAPAN: ABS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 47 SOUTH KOREA: ABS MARKET, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 48 SOUTH KOREA: ABS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 49 REST OF ASIA PACIFIC: ABS MARKET, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 50 REST OF ASIA PACIFIC: ABS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 51 EUROPE: ABS MARKET, BY COUNTRY, 2021–2028 (KILOTON)

- TABLE 52 EUROPE: ABS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 53 EUROPE: ABS MARKET, BY TYPE, 2021–2028 (KILOTON)

- TABLE 54 EUROPE: ABS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 55 EUROPE: ABS MARKET, BY GRADE, 2021–2028 (KILOTON)

- TABLE 56 EUROPE: ABS MARKET, BY GRADE, 2021–2028 (USD MILLION)

- TABLE 57 EUROPE: ABS MARKET, BY MANUFACTURING PROCESS, 2021–2028 (KILOTON)

- TABLE 58 EUROPE: ABS MARKET, BY MANUFACTURING PROCESS, 2021–2028 (USD MILLION)

- TABLE 59 EUROPE: ABS MARKET, BY TECHNOLOGY, 2021–2028 (KILOTON)

- TABLE 60 EUROPE: ABS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 61 EUROPE: ABS MARKET, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 62 EUROPE: ABS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 63 GERMANY: ABS MARKET, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 64 GERMANY: ABS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 65 ITALY: ABS MARKET, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 66 ITALY: ABS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 67 POLAND: ABS MARKET, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 68 POLAND: ABS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 69 SPAIN: ABS MARKET, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 70 SPAIN: ABS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 71 UK: ABS MARKET, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 72 UK: ABS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 73 REST OF EUROPE: ABS MARKET, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 74 REST OF EUROPE: ABS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 75 NORTH AMERICA: ABS MARKET, BY COUNTRY, 2021–2028 (KILOTON)

- TABLE 76 NORTH AMERICA: ABS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 77 NORTH AMERICA: ABS MARKET, BY TYPE, 2021–2028 (KILOTON)

- TABLE 78 NORTH AMERICA: ABS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 79 NORTH AMERICA: ABS MARKET, BY GRADE, 2021–2028 (KILOTON)

- TABLE 80 NORTH AMERICA: ABS MARKET, BY GRADE, 2021–2028 (USD MILLION)

- TABLE 81 NORTH AMERICA: ABS MARKET, BY MANUFACTURING PROCESS, 2021–2028 (KILOTON)

- TABLE 82 NORTH AMERICA: ABS MARKET, BY MANUFACTURING PROCESS, 2021–2028 (USD MILLION)

- TABLE 83 NORTH AMERICA: ABS MARKET, BY TECHNOLOGY, 2021–2028 (KILOTON)

- TABLE 84 NORTH AMERICA: ABS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 85 NORTH AMERICA: ABS MARKET, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 86 NORTH AMERICA: ABS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 87 US: ABS MARKET, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 88 US: ABS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 89 CANADA: ABS MARKET, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 90 CANADA: ABS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 91 MEXICO: ABS MARKET, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 92 MEXICO: ABS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 93 MIDDLE EAST & AFRICA: ABS MARKET, BY COUNTRY, 2021–2028 (KILOTON)

- TABLE 94 MIDDLE EAST & AFRICA: ABS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 95 MIDDLE EAST & AFRICA: ABS MARKET, BY TYPE, 2021–2028 (KILOTON)

- TABLE 96 MIDDLE EAST & AFRICA: ABS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 97 MIDDLE EAST & AFRICA: ABS MARKET, BY GRADE, 2021–2028 (KILOTON)

- TABLE 98 MIDDLE EAST & AFRICA: ABS MARKET, BY GRADE, 2021–2028 (USD MILLION)

- TABLE 99 MIDDLE EAST & AFRICA: ABS MARKET, BY MANUFACTURING PROCESS, 2021–2028 (KILOTON)

- TABLE 100 MIDDLE EAST & AFRICA: ABS MARKET, BY MANUFACTURING PROCESS, 2021–2028 (USD MILLION)

- TABLE 101 MIDDLE EAST & AFRICA: ABS MARKET, BY TECHNOLOGY, 2021–2028 (KILOTON)

- TABLE 102 MIDDLE EAST & AFRICA: ABS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 103 MIDDLE EAST & AFRICA: ABS MARKET, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 104 MIDDLE EAST & AFRICA: ABS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 105 UAE: ABS MARKET, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 106 UAE: ABS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 107 SAUDI ARABIA: ABS MARKET, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 108 SAUDI ARABIA: ABS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 109 SOUTH AFRICA: ABS MARKET, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 110 SOUTH AFRICA: ABS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 111 REST OF MIDDLE EAST & AFRICA: ABS MARKET, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 112 REST OF MIDDLE EAST & AFRICA: ABS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 113 SOUTH AMERICA: ABS MARKET, BY COUNTRY, 2021–2028 (KILOTON)

- TABLE 114 SOUTH AMERICA: ABS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 115 SOUTH AMERICA: ABS MARKET, BY TYPE, 2021–2028 (KILOTON)

- TABLE 116 SOUTH AMERICA: ABS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 117 SOUTH AMERICA: ABS MARKET, BY GRADE, 2021–2028 (KILOTON)

- TABLE 118 SOUTH AMERICA: ABS MARKET, BY GRADE, 2021–2028 (USD MILLION)

- TABLE 119 SOUTH AMERICA: ABS MARKET, BY MANUFACTURING PROCESS, 2021–2028 (KILOTON)

- TABLE 120 SOUTH AMERICA: ABS MARKET, BY MANUFACTURING PROCESS, 2021–2028 (USD MILLION)

- TABLE 121 SOUTH AMERICA: ABS MARKET, BY TECHNOLOGY, 2021–2028 (KILOTON)

- TABLE 122 SOUTH AMERICA: ABS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 123 SOUTH AMERICA: ABS MARKET, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 124 SOUTH AMERICA: ABS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 125 BRAZIL: ABS MARKET, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 126 BRAZIL: ABS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 127 ARGENTINA: ABS MARKET, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 128 ARGENTINA: ABS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 129 REST OF SOUTH AMERICA: ABS MARKET, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 130 REST OF SOUTH AMERICA: ABS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 131 ABS MARKET: DEGREE OF COMPETITION

- TABLE 132 ABS MARKET: REVENUE ANALYSIS (USD BILLION)

- TABLE 133 MARKET EVALUATION MATRIX

- TABLE 134 PRODUCT LAUNCHES, 2019–2023

- TABLE 135 DEALS, 2017—2023

- TABLE 136 OTHER DEVELOPMENTS, 2019–2023

- TABLE 137 LG CHEM LTD: COMPANY OVERVIEW

- TABLE 138 LG CHEM LTD: PRODUCT OFFERED

- TABLE 139 LG CHEM LTD: OTHER DEVELOPMENTS

- TABLE 140 CHIMEI CORPORATION: COMPANY OVERVIEW

- TABLE 141 CHIMEI CORPORATION: PRODUCT OFFERINGS

- TABLE 142 CHIMEI CORPORATION: PRODUCT LAUNCHES

- TABLE 143 CHIMEI CORPORATION: OTHER DEVELOPMENTS

- TABLE 144 INEOS STYROLUTION: COMPANY OVERVIEW

- TABLE 145 INEOS STYROLUTION: PRODUCTS OFFERED

- TABLE 146 INEOS STYROLUTION: DEALS

- TABLE 147 INEOS STYROLUTION: NEW PRODUCT LAUNCHES

- TABLE 148 INEOS STYROLUTION: OTHER DEVELOPMENTS

- TABLE 149 PETROCHINA CO LTD: COMPANY OVERVIEW

- TABLE 150 PETROCHINA CO LTD: PRODUCTS OFFERED

- TABLE 151 PETROCHINA CO LTD: OTHER DEVELOPMENTS

- TABLE 152 FORMOSA CHEMICALS & FIBRE CORPORATION: COMPANY OVERVIEW

- TABLE 153 FORMOSA CHEMICALS & FIBRE CORPORATION: PRODUCTS OFFERED

- TABLE 154 FORMOSA CHEMICALS & FIBRE CORPORATION: OTHER DEVELOPMENTS

- TABLE 155 SABIC: COMPANY OVERVIEW

- TABLE 156 SABIC: PRODUCTS OFFERED

- TABLE 157 TORAY INDUSTRIES, INC.: COMPANY OVERVIEW

- TABLE 158 TORAY INDUSTRIES, INC.: PRODUCTS OFFERED

- TABLE 159 TORAY INDUSTRIES, INC.: OTHER DEVELOPMENTS

- TABLE 160 LOTTE CHEMICAL COMPANY OVERVIEW

- TABLE 161 LOTTE CHEMICAL: PRODUCTS OFFERED

- TABLE 162 LOTTE CHEMICALS: DEALS

- TABLE 163 LOTTE CHEMICALS: OTHER DEVELOPMENTS

- TABLE 164 VERSALILS: COMPANY OVERVIEW

- TABLE 165 VERSALILS: PRODUCTS OFFERED

- TABLE 166 VERSALIS: OTHER DEVELOPMENTS

- TABLE 167 KUMHO PETROCHEMICAL: COMPANY OVERVIEW

- TABLE 168 KUMHO PETROCHEMICAL: PRODUCTS OFFERED

- TABLE 169 BASF SE: COMPANY OVERVIEW

- TABLE 170 COVESTRO AG: COMPANY OVERVIEWS

- FIGURE 1 ABS MARKET SEGMENTATION

- FIGURE 2 ABS MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION APPROACH

- FIGURE 4 MARKET SIZE REGIONAL ESTIMATION

- FIGURE 5 TOP-DOWN APPROACH

- FIGURE 6 BOTTOM-UP APPROACH

- FIGURE 7 ABS MARKET: DATA TRIANGULATION

- FIGURE 8 OPAQUE SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 9 HIGH IMPACT GRADE TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 10 INJECTION MOLDING TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 11 EMULSION POLYMERIZATION ACCOUNTED FOR LARGEST SHARE OF ABS MARKET

- FIGURE 12 AUTOMOTIVE APPLICATIONS ACCOUNTED FOR LARGEST SHARE OF ABS MARKET

- FIGURE 13 ASIA PACIFIC ACCOUNTED FOR LARGEST SHARE OF ABS MARKET

- FIGURE 14 ASIA PACIFIC TO OFFER ATTRACTIVE OPPORTUNITIES IN ABS MARKET DURING FORECAST PERIOD

- FIGURE 15 OPAQUE SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 16 INJECTION MOLDING TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 17 HIGH IMPACT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 18 EMULSION POLYMERIZATION TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 19 AUTOMOTIVE SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 20 AUTOMOTIVE SEGMENT AND CHINA ACCOUNTED FOR LARGEST SHARES

- FIGURE 21 CHINA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 23 ABS MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 24 ABS MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 25 ABS ECOSYSTEM MAPPING

- FIGURE 26 AUTOMOTIVE, CONSUMER GOODS, AND CONSTRUCTION APPLICATIONS TO DRIVE MARKET

- FIGURE 27 TOTAL NUMBER OF PATENTS REGISTERED IN 10 YEARS (2012–2022)

- FIGURE 28 NUMBER OF PATENTS YEAR-WISE FROM 2012 TO 2022

- FIGURE 29 PATENT ANALYSIS, BY LEGAL STATUS

- FIGURE 30 TOP JURISDICTION – BY DOCUMENT

- FIGURE 31 TOP 10 PATENT APPLICANTS

- FIGURE 32 INFLUENCE OF KEY STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 APPLICATIONS

- FIGURE 33 ABS MARKET, BY TYPE (2023–2028)

- FIGURE 34 ABS MARKET, BY GRADE (2023–2028)

- FIGURE 35 ABS MARKET, BY MANUFACTURING PROCESS (2023–2028)

- FIGURE 36 ABS MARKET, BY TECHNOLOGY (2023–2028)

- FIGURE 37 ABS MARKET, BY APPLICATION (2023–2028)

- FIGURE 38 CHINA TO BE FASTEST GROWING MARKET DURING FORECAST PERIOD

- FIGURE 39 ASIA PACIFIC: ABS MARKET SNAPSHOT

- FIGURE 40 EUROPE: ABS MARKET SNAPSHOT

- FIGURE 41 NORTH AMERICA: ABS MARKET SNAPSHOT

- FIGURE 42 MIDDLE EAST & AFRICA: ABS MARKET SNAPSHOT

- FIGURE 43 SOUTH AMERICA: ABS MARKET SNAPSHOT

- FIGURE 44 COMPANIES ADOPTED ACQUISITION AND EXPANSION AS KEY GROWTH STRATEGIES BETWEEN 2019 AND 2023

- FIGURE 45 RANKING OF TOP FIVE PLAYERS IN ABS MARKET, 2022

- FIGURE 46 ABS MARKET SHARE, BY COMPANY (2022)

- FIGURE 47 ABS MARKET: COMPANY EVALUATION MATRIX, 2022

- FIGURE 48 ABS MARKET: START-UPS AND SMES MATRIX, 2022

- FIGURE 49 LG CHEM LTD: COMPANY SNAPSHOT

- FIGURE 50 CHIMEI CORP: COMPANY SNAPSHOT

- FIGURE 51 INEOS STYROLUTION: COMPANY SNAPSHOT

- FIGURE 52 PETROCHEM CO LTD: COMPANY SNAPSHOT

- FIGURE 53 FORMOSA CHEMICALS & FIBRE CORPORATION: COMPANY SNAPSHOT

- FIGURE 54 SABIC: COMPANY SNAPSHOT

- FIGURE 55 TORAY INDUSTRIES, INC.: COMPANY SNAPSHOT

- FIGURE 56 LOTTE CHEMICAL: COMPANY SNAPSHOT

- FIGURE 57 VERSALIS: COMPANY SNAPSHOT

- FIGURE 58 KUMHO PETROCHEMICALS: COMPANY SNAPSHOT

- FIGURE 59 BASF SE: COMPANY SNAPSHOT

- FIGURE 60 COVESTRO AG: COMPANY SNAPSHOT

The study involved four major activities in estimating the market size of the ABS market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information for this study. These secondary sources include annual reports, press releases, investor presentations of companies, white papers, trade directories, certified publications, articles from recognized authors, construction data websites, automotive journals, and databases.

Secondary research has been used to obtain key information about the value chain of the industry, the monetary chain of the market, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, and regional markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The ABS market comprises several stakeholders in the value chain, which include raw material suppliers, ABS manufacturers, distributors, and end users. Various primary sources from the supply and demand sides of the ABS market have been interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include key opinion leaders in end-use sectors. The primary sources from the supply side include manufacturers, associations, and institutions involved in the ABS industry.

Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to type, grades, manufacturing process, technology, applications, and regions. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of ABS and the future outlook of their business which will affect the overall market.

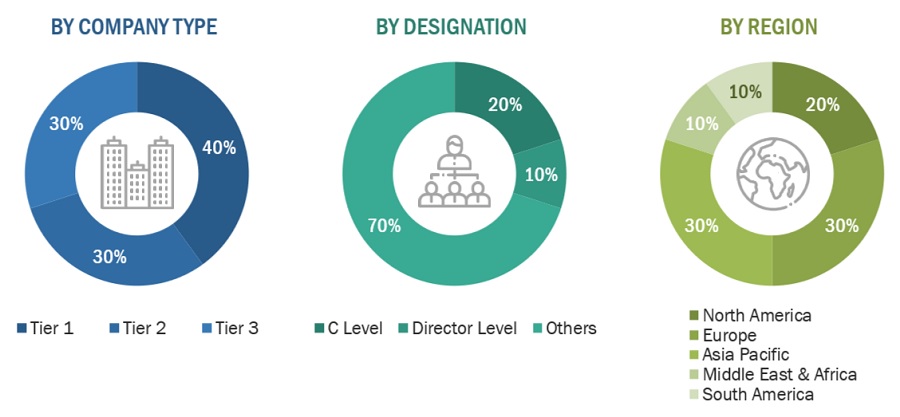

The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2022 available in the public domain, product portfolios, and geographical presence.

Other designations include consultants and sales, marketing, and procurement managers.

To know about the assumptions considered for the study, download the pdf brochure

|

Company Name |

Designation |

|

LG Chem |

Sales Director |

|

INEOS |

Sales Manager |

|

Formosa Chemicals |

Director |

|

BASF |

Marketing Manager |

|

SABIC |

R&D Manager |

|

|

|

Market Size Estimation

The top-down and bottom-up approaches have been used to estimate and validate the size of the ABS market.

- The key players in the industry have been identified through extensive secondary research.

- The type, grades, technology, manufacturing process, and applications in the industry have been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of the key market players, along with extensive interviews for opinions with leaders such as directors and marketing executives.

Abs Market: Bottum-Up Approach

Note: All the numbers are based on the global market size and are provided for representation purposes only.

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, Request for Free Sample Report

Abs Market: Top-Down Approach

Data Triangulation

After arriving at the total market size from the estimation process explained above, the overall market has been split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments, data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated by using both the top-down and bottom-up approaches and primary interviews. Hence, for every data segment, there have been three sources—top-down approach, bottom-up approach, and expert interviews. The data was assumed correct when the values arrived from the three sources matched.

Market Definition

The ABS market refers to the global industry involving the production, distribution, and utilization of Acrylonitrile Butadiene Styrene resin. ABS is a thermoplastic polymer known for its impact resistance, mechanical strength, and versatility. It finds applications in various industries, such as automotive, electronics, appliances, consumer goods, construction, and others where its properties are utilized for manufacturing a wide range of products.

Key Stakeholders

- Senior Management

- End User

- Finance/Procurement Department

- R&D Department

Report Objectives

- To define, describe, and forecast the size of the ABS market, in terms of value and volume.

- To provide detailed information regarding the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the market

- To estimate and forecast the market size based on type, grade, manufacturing process, technology, applications, and region.

- To forecast the size of the market with respect to major regions, namely, Europe, North America, Asia Pacific, Middle East & Africa, and South America, along with their key countries

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of market leaders.

- To track and analyze recent developments such as new product launches, partnerships, expansions, and acquisitions in the market.

- To strategically profile key market players and comprehensively analyze their core competencies.

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country or additional application

Company Information

- Detailed analysis and profiles of additional market players

Growth opportunities and latent adjacency in Acrylonitrile Butadiene Styrene Market