Acrylic Polymer Market for Cleaning Application by Type(Water-borne & Solvent-borne), Application(Laundry & Detergent, Dish Washing, Industrial & Institutional, Hard Surface Cleaning) & Region(APAC, North America, Europe, RoW) - Global Forecast to 2026

Updated on : September 02, 2025

Acrylic Polymer Market

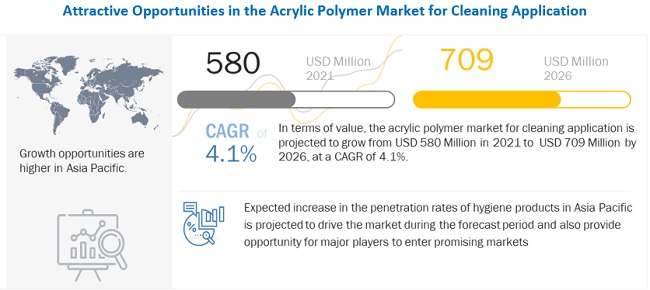

The global acrylic polymer market was valued at USD 580 million in 2021 and is projected to reach USD 709 million by 2026, growing at 4.1% cagr from 2021 to 2026. The market for cleaning application is expected to register a 4.1% CAGR between 2021 and 2026. The water-borne accounted for the largest market share of 93.8% in 2020, in terms of value. Laundry & Detergent is estimated to be the largest application of acrylic polymer market for cleaning application during the forecast period, followed by dish washing in terms of volume. With the increasing population, increasing per-capita income, changing lifestyle, and increasing usage of washing machines across the globe, the demand for laundry detergent is growing, which is subsequently driving the acrylic polymer market for cleaning application. Moreover, increasing demand for liquid dish washing products in hotels, restaurants and food retails, and household applications further supports the growth of the acrylic polymer market.

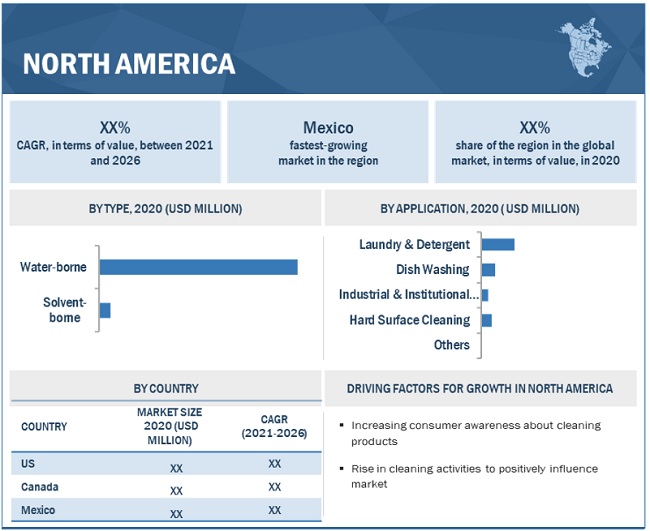

North America accounted for the largest share of the acrylic polymer market for cleaning application in 2020, followed by Europe. The market in North America and Europe is driven by the increasing need for cleaning products such as laundry detergent, dish washing products, and other cleaning products. The need to maintain clean and hygienic surroundings are also expected to drive the demand.

The acrylic polymer market for cleaning application has been witnessing consistent growth due to increasing hygienic awareness and cleaning initiatives by governments in various countries. The markets in developing countries, such as China, India, Brazil, South Africa, and the UAE, are projected to grow at an above-average rate from 2021 to 2026 due to a significant increase in the demand for cleaning products.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the global acrylic polymer market for cleaning application

Due to the COVID-19 pandemic, there is growing awareness about hygiene and cleanliness in public places, and governments have issued guidelines to take the utmost precaution to avoid the spread of the virus. Thus, the demand for cleaning products in industrial and institutional places has increased significantly across the globe, which in turn supports the growth of the acrylic polymer market for cleaning application. However, due to fluctuating crude oil prices and increasing raw material prices across the globe, the market growth may be restricted in the upcoming years.

Acrylic Polymer Market Dynamics

Driver: Increasing demand from institutional & industrial cleaning application

Acrylic polymers are used in laundry & detergents, institutional & industrial cleaning, hard surface cleaning, and other cleaning applications. Cleaning plays a very important role in the growth of industries such as healthcare, manufacturing, hospitality, and retail. In these sectors, there is direct client interaction; thus, these industries focus on ensuring cleanliness. Due to the COVID-19 pandemic, the utmost precaution has been taken to avoid the spread of the virus through commonly touched surfaces. Also, the growing awareness about cleaning and hygiene across has supported the demand for cleaning products in industrial and institutional facilities. In manufacturing, hospitality, and food processing industries, better hygiene not only results in quality products but is also safe for workers' health. All these industries are projected to grow at a positive rate in the upcoming years, which is expected to drive the demand for acrylic polymer in cleaning applications.

In Europe, industrial production increased by 2.3% in 2021 compared to 2020. According to the International Association for Soaps, Detergents and Maintenance Products (A.I.S.E.), the demand for professional cleaning and hygiene products in Europe was USD 9.8 billion in 2020. The increasing demand for cleaning chemicals in industrial and institutional facilities fuels the acrylic polymer market.

Restraints: Potential health and environmental issues of solvent-based acrylic polymers

The harmful effects of solvent-based acrylic polymers on human and environmental health are restraining the market growth. The acute health hazards of solvent-based acrylic polymers include headache, dizziness, and light-headedness, progressing to unconsciousness and seizures. Irritation of the nose, eye, and throat are some other effects of working with these systems. VOCs present in paint systems are harmful to the environment as well as humans. Paints release VOCs during the drying or curing phase. Exposure to VOCs has a degrading effect on the body, with effects ranging from headaches to allergies and asthmatic reactions. It can also cause stress on vital body organs such as the heart and lungs. Due to these harmful effects, the use of solvent-based systems is being heavily regulated by authorities, thereby lowering the demand, especially in the building & construction sector.

Opportunity: Growing requirement for environmentally sustainable formulations

Across the globe, environmental sustainability is a major goal of the industrial sector as well as governments. Owing to this, the manufacturing industry is moving toward the usage of bio-based, green, or less toxic products. With a ban on phosphate-based detergents in developed countries, the demand for an alternative has increased significantly. Acrylic polymer appears to be a better alternative to phosphate binders. As per an analysis carried out by the American Cleaning Institute, the potential ecological risk associated with the use of acrylic homo- and co-polymers in detergent, laundry detergents, dishwashing products, and other products is found to be low. Thus, increasing demand for sustainable & eco-friendly cleaning products across the globe will drive the market for acrylic polymer during the forecast period.

Challenges: Stringent regulations and restrictions

Acrylic polymers used in certain industrial cleaning sectors are subject to various regulations by environmental and government authorities due to their VOC content (mostly in solvent-based cleaning acrylic polymers). Solvent cleaners contain mineral spirits, a solvent commonly used for hard surface cleaning because of their ability to quickly dissolve oil, grease, dirt, grime, burnt-on carbon, and heavy lubricants.

Various regulations, such as DIN EN 16516, EU Construction Products Regulation (CPR), Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH), US EPA, and similar others, regulate the production and sale in European countries and the US. These regulations act as a major challenge for the market players.

Water-borne is the largest segment by type in the acrylic polymer market for cleaning application.

Based on type, the water-borne acrylic polymer segment is estimated to account for the larger share of the overall market. The major factor driving this segment is the high solubility, dispersion in cleaning products, and increasing demand for sustainable products. It also helps to improve the cleaning product's performance and efficacy rate, owing to which it is prevalently used in Europe and North America. However, the cost of water-borne is high compared to solvent-borne.

Laundry & Detergent is the largest segment by application in the acrylic polymer market for cleaning application.

The laundry & detergent segment is estimated to account for the largest share of the overall acrylic polymer market for cleaning application in 2020, closely followed by the dish washing segment. With the increasing population, increasing per-capita income, changing lifestyle, and increasing usage of washing machines across the globe, the demand for laundry detergent is growing, which is subsequently driving the acrylic polymer market for cleaning application. Moreover, increasing demand for liquid dish washing products in hotels, restaurants and food retails, and household applications further supports the growth of the acrylic polymer market.

North America is estimated to be the largest market for acrylic polymer market for cleaning application.

North America accounted for the largest share of the acrylic polymer market for cleaning application in 2020, followed by Europe. In Europe and North America, stringent regulations and increasing demand for sustainable laundry & detergents and other cleaning products have supported the growth of the acrylic polymer market for cleaning application in the regions.

To know about the assumptions considered for the study, download the pdf brochure

Acrylic Polymer Market Players

These companies have adopted various organic as well as inorganic growth strategies between 2018 and 2020 to strengthen their position in the market. New product development, merger & acquisition, and expansion were among the key growth strategies adopted by these leading players to enhance their product offering and regional presence and meet the growing demand for the acrylic polymer market for cleaning application in the emerging economies.

Acrylic Polymer Market Report Scope

|

Report Metric |

Details |

|

Years Considered |

2019–2026 |

|

Base year |

2020 |

|

Forecast period |

2021–2026 |

|

Unit considered |

Value (USD Million), Volume (tons) |

|

Segments |

Type, Application and Region |

|

Regions |

APAC, North America, Europe, and Rest of the World |

|

Companies |

The major players are Dow Inc. (US), BASF SE (Germany), Toagosei Co., Ltd. (Japan), Sumitomo Seika Chemicals Co., Ltd. (Japan), Arkema (France), Nippon Shokubai Co. Ltd. (Japan), Ashland Global Holdings, Inc. (US), and others are covered in the acrylic polymer market for cleaning application. |

This research report categorizes the global acrylic polymer market for cleaning application market on the basis of Type, End-use industry, and Region.

Acrylic Polymer Market on the basis of Type

- Water-borne

- Solvent-borne

Acrylic Polymer Market on the basis of Application

- Laundry & Detergent

- Dish Washing

- Industrial & Institutional

- Hard Surface Cleaning

- Others

Acrylic Polymer Market on the basis of Region

- North America

- Europe

- Asia Pacific (APAC)

- Rest of the World

The market has been further analyzed for the key countries in each of these regions.

Recent Developments

- In August 2021, BASF and SINOPEC will further expand their Verbund site in Nanjing, China. It includes the capacity expansion of several downstream chemical plants, including a new tert-butyl acrylate plant by using acrylic acid and isobutene of the existing Verbund as feedstock.

- In December 2020, Ashland Chemical Holdings Inc. increased production capacity for Aquaflow (Acrylic polymer) synthetic thickeners.

- In November 2019, Nippon Shokubai Indonesia, an Indonesian subsidiary of Nippon Shokubai Co., Ltd., obtained Halal certification in Indonesia from Lppom Mui, a Halal certification authority affiliated with Majelis Ulama Indonesia, about acrylic acid (AA) and acrylates. This will boost the sale of acrylic polymers in the region.

Frequently Asked Questions (FAQ):

What is the major driver influencing the growth of the acrylic polymer market for cleaning application?

Stringent regulations and restrictions is a major challenge in the acrylic polymer market for cleaning application.

How is the acrylic polymer market for cleaning application segmented by type?

The acrylic polymer market for cleaning application is segmented on the basis of type as Water-borne, and Solvent-Borne.

What is the major challenge in the acrylic polymer market for cleaning application?

Stringent regulations and restrictions is a major challenge in the acrylic polymer market for cleaning application.

How is the acrylic polymer market for cleaning application segmented by the Application?

The acrylic polymer market for cleaning application market is segmented on the basis of application as Laundry & Detergent, Dish Washing, Industrial & Institutional, Hard Surface Cleaning, and Others.

What are the major opportunities in the acrylic polymer market for cleaning application?

Growing requirement for environmentally sustainable formulations is an opportunity for the Thermoplastic polyolefin (TPO) market.

Which region has the largest market for acrylic polymer market for cleaning application?

North America has the largest market for acrylic polymer market for cleaning application owing to the increase in demand from cleaning applications in US.

How market segments for acrylic polymer market for cleaning application by region?

On the basis of region the market is segmented into APAC, North America, Europe, and Rest of the World.

What is acrylic polymer?

Acrylic polymer is formed by the free radical polymerization of acrylic acid. Generally, photopolymers of acrylic polymer are formed by polymerization of acrylic acid, whereas co-polymer is formed by polymerization between acrylic acid and maleic acid.

Who are the major manufacturers of acrylic polymer market for cleaning application?

The major manufacturers of acrylic polymer market for cleaning application are Dow Inc. (US), BASF SE (Germany), Toagosei Co., Ltd. (Japan), Sumitomo Seika Chemicals Co., Ltd. (Japan), Arkema (France), Nippon Shokubai Co. Ltd. (Japan), Ashland Global Holdings, Inc. (US), and others.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 23)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

TABLE 1 PROPERTY COMPARISON OF HOMO- AND CO-POLYMER OF ACRYLIC ACID

1.2.1 SCOPE OF REPORT

1.3 MARKET SCOPE

FIGURE 1 ACRYLIC POLYMER MARKET FOR CLEANING APPLICATION: MARKET SEGMENTATION

1.3.1 REGIONS COVERED

1.3.2 YEARS CONSIDERED FOR THE REPORT

1.4 CURRENCY

1.5 UNITS CONSIDERED

1.6 STAKEHOLDERS

1.7 LIMITATIONS

2 RESEARCH METHODOLOGY (Page No. - 28)

2.1 RESEARCH DATA

FIGURE 2 ACRYLIC POLYMER MARKET FOR CLEANING APPLICATION: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Critical secondary inputs

2.1.1.2 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Critical primary inputs

2.1.2.2 Key data from primary sources

2.1.2.3 Key industry insights

2.1.2.4 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION APPROACH

2.2.1 BOTTOM-UP MARKET SIZE ESTIMATION: MARKET SIZE OF SEVERAL COUNTRIES AND ASCERTAINING THEIR SHARE TO ESTIMATE OVERALL DEMAND

FIGURE 3 MARKET SIZE ESTIMATION: DEMAND-SIDE ANALYSIS

2.3 DATA TRIANGULATION

FIGURE 4 ACRYLIC POLYMER MARKET FOR CLEANING APPLICATION: DATA TRIANGULATION

2.4 ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 35)

FIGURE 5 WATER-BORNE SEGMENT ACCOUNTED FOR LARGER MARKET SHARE IN 2020

FIGURE 6 LAUNDRY & DETERGENT HELD MAJOR SHARE IN OVERALL MARKET IN 2020

FIGURE 7 NORTH AMERICA WAS LARGEST ACRYLIC POLYMER MARKET IN 2020

4 PREMIUM INSIGHTS (Page No. - 38)

4.1 SIGNIFICANT OPPORTUNITIES IN ACRYLIC POLYMER MARKET FOR CLEANING APPLICATION

FIGURE 8 HIGH DEMAND FROM LAUNDRY & DETERGENT TO DRIVE MARKET BETWEEN 2021 AND 2026

4.2 NORTH AMERICA ACRYLIC POLYMER MARKET, BY TYPE AND COUNTRY, 2020

FIGURE 9 US ACCOUNTED FOR LARGEST SHARE OF MARKET IN NORTH AMERICA

4.3 ACRYLIC POLYMER MARKET FOR CLEANING APPLICATION, BY KEY COUNTRIES

FIGURE 10 CHINA AND INDIA TO REGISTER HIGHEST CAGR

5 MARKET OVERVIEW (Page No. - 40)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 11 DRIVERS, RESTRAINTS, CHALLENGES, AND OPPORTUNITIES IN ACRYLIC POLYMER MARKET FOR CLEANING APPLICATION

5.2.1 DRIVERS

5.2.1.1 Growing demand from laundry detergent market

FIGURE 12 GLOBAL LAUNDRY DETERGENTS MARKET SIZE (USD BILLION) AND Y-O-Y GROWTH, 2017-2020

5.2.1.2 Increasing demand from industrial and institutional cleaning applications

TABLE 2 EUROPE CLEANING AND HYGIENE PRODUCTS DEMAND IN PROFESSIONAL SECTOR AND Y-O-Y GROWTH, 2020

5.2.1.3 Workplace hygiene initiatives driving demand for cleaning chemicals

5.2.2 RESTRAINTS

5.2.2.1 Fluctuating raw material prices due to volatility in crude oil prices

FIGURE 13 CRUDE OIL PRICES (USD/BARREL), JANUARY 2021 TO FEBRUARY 2022

5.2.2.2 Potential health and environmental issues of solvent-based acrylic polymers

5.2.3 OPPORTUNITIES

5.2.3.1 Growing requirement for environmentally sustainable formulations

5.2.4 CHALLENGES

5.2.4.1 Stringent regulations and restrictions

5.3 PORTER'S FIVE FORCES ANALYSIS

FIGURE 14 ACRYLIC POLYMER MARKET FOR CLEANING APPLICATION: PORTER'S FIVE FORCES ANALYSIS

5.3.1 BARGAINING POWER OF SUPPLIERS

5.3.2 BARGAINING POWER OF BUYERS

5.3.3 INTENSITY OF COMPETITIVE RIVALRY

5.3.4 THREAT OF NEW ENTRANTS

5.3.5 THREAT OF SUBSTITUTES

TABLE 3 ACRYLIC POLYMER MARKET: PORTER'S FIVE FORCES ANALYSIS

5.4 SUPPLY CHAIN ANALYSIS

FIGURE 15 SUPPLY CHAIN OF ACRYLIC POLYMER MARKET FOR CLEANING APPLICATION

5.5 PRICING ANALYSIS

FIGURE 16 PRICING ANALYSIS (USD/TON) OF ACRYLIC POLYMER MARKET FOR CLEANING APPLICATION, BY REGION (2020)

FIGURE 17 FORECASTING FACTOR AND IMPACT ANALYSIS

5.6 MICROPLASTIC

5.6.1 SOURCES OF MICROPLASTICS

5.6.1.1 Textiles

5.6.1.2 Road transport

5.6.1.3 Marine coatings and fishing industry

5.6.1.4 Personal care products

5.6.2 IMPACT OF MICROPLASTICS ON MARINE, LAND, AND CLIMATE

5.6.2.1 Impact on marine

5.6.2.2 Impact on land

5.6.2.3 Impact on climate

5.6.2.4 Impacts on human health

5.7 PATENT ANALYSIS

5.7.1 METHODOLOGY

5.7.2 DOCUMENT TYPE

TABLE 4 ACRYLIC POLYMER MARKET FOR CLEANING APPLICATION: GRANTED, APPLIED, AND LIMITED PATENTS

FIGURE 18 PATENT PUBLICATION TRENDS - LAST 10 YEARS

5.7.3 INSIGHT

5.7.4 LEGAL STATUS OF PATENTS

FIGURE 19 ACRYLIC POLYMER PATENTS: LEGAL STATUS (2011-2021)

5.7.5 JURISDICTION ANALYSIS

FIGURE 20 TOP JURISDICTION, BY COUNTRY

5.7.6 TOP COMPANIES/APPLICANTS

FIGURE 21 TOP 10 COMPANIES/APPLICANTS WITH HIGHEST NUMBER OF PATENTS

TABLE 5 LIST OF PATENTS FOR ACRYLIC POLYMER IN CLEANING APPLICATION

6 ACRYLIC POLYMER MARKET FOR CLEANING APPLICATION, BY TYPE (Page No. - 56)

6.1 INTRODUCTION

FIGURE 22 WATER-BORNE ACRYLIC POLYMER TO BE FASTER-GROWING SEGMENT DURING FORECAST PERIOD

TABLE 6 ACRYLIC POLYMER MARKET FOR CLEANING APPLICATION BY TYPE, 2019–2026 (TON)

TABLE 7 ACRYLIC POLYMER MARKET FOR CLEANING APPLICATION, BY TYPE, 2019–2026 (USD MILLION)

6.2 WATER-BORNE

6.2.1 DEMAND FROM HOUSEHOLD CLEANING PRODUCTS TO DRIVE WATER-BORNE ACRYLIC POLYMERS MARKET

TABLE 8 WATER-BORNE: ACRYLIC POLYMER MARKET FOR CLEANING APPLICATION, BY REGION, 2019–2026 (TON)

TABLE 9 WATER-BORNE: ACRYLIC POLYMER MARKET FOR CLEANING APPLICATION, BY REGION, 2019–2026 (USD MILLION)

6.3 SOLVENT-BORNE

6.3.1 GROWING DEMAND FOR SUSTAINABLE PRODUCTS TO RESTRICT GROWTH OF MARKET

TABLE 10 SOLVENT-BORNE: ACRYLIC POLYMER MARKET FOR CLEANING APPLICATION, BY REGION, 2019–2026 (TON)

TABLE 11 SOLVENT-BORNE: ACRYLIC POLYMER MARKET FOR CLEANING APPLICATION, BY REGION, 2019–2026 (USD MILLION)

7 ACRYLIC POLYMER MARKET FOR CLEANING APPLICATION, BY APPLICATION (Page No. - 60)

7.1 INTRODUCTION

FIGURE 23 LAUNDRY & DETERGENT TO DOMINATE OVERALL MARKET DURING FORECAST PERIOD

TABLE 12 ACRYLIC POLYMER MARKET FOR CLEANING APPLICATION, BY APPLICATION, 2019–2026 (TON)

TABLE 13 ACRYLIC POLYMER MARKET FOR CLEANING APPLICATION, BY APPLICATION, 2019–2026 (USD MILLION)

7.2 LAUNDRY & DETERGENT

7.2.1 RISE IN DEMAND FOR HIGH-PERFORMANCE LAUNDRY & DETERGENT TO DRIVE MARKET

TABLE 14 LAUNDRY & DETERGENT: ACRYLIC POLYMER MARKET FOR CLEANING APPLICATION, BY REGION, 2019–2026 (TON)

TABLE 15 LAUNDRY & DETERGENT: ACRYLIC POLYMER MARKET FOR CLEANING APPLICATION, BY REGION, 2019–2026 (USD MILLION)

7.3 DISH WASHING

7.3.1 INCREASING USAGES OF DISHWASHING PRODUCTS IN HOMECARE, FOOD SERVICE CENTERS, AND HOTEL INDUSTRY TO DRIVE MARKET

TABLE 16 DISH WASHING: ACRYLIC POLYMER MARKET FOR CLEANING APPLICATION, BY REGION, 2019–2026 (TON)

TABLE 17 DISH WASHING: ACRYLIC POLYMER MARKET FOR CLEANING APPLICATION, BY REGION, 2019–2026 (USD MILLION)

7.4 INDUSTRIAL & INSTITUTIONAL

7.4.1 STRONG EMPHASIS ON HYGIENE IN INDUSTRIAL AND INSTITUTIONAL PLACES TO SUPPORT MARKET GROWTH

TABLE 18 USES OF CLEANING APPLICATIONS IN SEVERAL INDUSTRIES

TABLE 19 INDUSTRIAL & INSTITUTIONAL: ACRYLIC POLYMER MARKET FOR CLEANING APPLICATION, BY REGION, 2019–2026 (TON)

TABLE 20 INDUSTRIAL & INSTITUTIONAL: ACRYLIC POLYMER MARKET FOR CLEANING APPLICATION, BY REGION, 2019–2026 (USD MILLION)

7.5 HARD SURFACE CLEANING

7.5.1 HIGH PREVALENCE OF INFECTIONS TO DRIVE USE OF HARD SURFACE CLEANING PRODUCTS IN SEVERAL SECTORS

TABLE 21 HARD SURFACE CLEANING: ACRYLIC POLYMER MARKET FOR CLEANING APPLICATION, BY REGION, 2019–2026 (TON)

TABLE 22 HARD SURFACE CLEANING: ACRYLIC POLYMER MARKET FOR CLEANING APPLICATION, BY REGION, 2019–2026 (USD MILLION)

7.6 OTHERS

TABLE 23 OTHERS: ACRYLIC POLYMER MARKET FOR CLEANING APPLICATION, BY REGION, 2019–2026 (TON)

TABLE 24 OTHERS: ACRYLIC POLYMER MARKET FOR CLEANING APPLICATION, BY REGION, 2019–2026 (USD MILLION)

8 ACRYLIC POLYMER MARKET FOR CLEANING APPLICATION, BY REGION (Page No. - 68)

8.1 INTRODUCTION

FIGURE 24 REGIONAL SNAPSHOT: ASIA PACIFIC EMERGING AS NEW HOTSPOT

TABLE 25 ACRYLIC POLYMER MARKET FOR CLEANING APPLICATION, BY REGION, 2019–2026 (TON)

TABLE 26 ACRYLIC POLYMER MARKET FOR CLEANING APPLICATION, BY REGION, 2019–2026 (USD MILLION)

8.2 NORTH AMERICA

FIGURE 25 NORTH AMERICA: ACRYLIC POLYMER MARKET FOR CLEANING APPLICATION SNAPSHOT

TABLE 27 NORTH AMERICA: ACRYLIC POLYMERS MARKET FOR CLEANING APPLICATION, BY COUNTRY, 2019–2026 (TON)

TABLE 28 NORTH AMERICA: ACRYLIC POLYMERS MARKET FOR CLEANING APPLICATION, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 29 NORTH AMERICA: ACRYLIC POLYMERS MARKET FOR CLEANING APPLICATION, BY TYPE, 2019–2026 (TON)

TABLE 30 NORTH AMERICA: ACRYLIC POLYMERS MARKET FOR CLEANING APPLICATION, BY TYPE, 2019–2026 (USD MILLION)

TABLE 31 NORTH AMERICA: ACRYLIC POLYMERS MARKET FOR CLEANING APPLICATION, BY APPLICATION, 2019–2026 (TON)

TABLE 32 NORTH AMERICA: ACRYLIC POLYMERS MARKET FOR CLEANING APPLICATION, BY APPLICATION, 2019–2026 (USD MILLION)

8.2.1 US

8.2.1.1 Increasing consumer awareness for cleaning products to drive market

TABLE 33 US: ACRYLIC POLYMER MARKET FOR CLEANING APPLICATION, BY APPLICATION, 2019–2026 (TON)

TABLE 34 US: ACRYLIC POLYMERS MARKET FOR CLEANING APPLICATION, BY APPLICATION, 2019–2026 (USD MILLION)

8.2.2 CANADA

8.2.2.1 Rise in cleaning activities to positively influence market

TABLE 35 CANADA: ACRYLIC POLYMER MARKET FOR CLEANING APPLICATION, BY APPLICATION, 2019–2026 (TON)

TABLE 36 CANADA: ACRYLIC POLYMERS MARKET FOR CLEANING APPLICATION, BY APPLICATION, 2019–2026 (USD MILLION)

8.2.3 MEXICO

8.2.3.1 Increasing health & hygiene concerns to boost demand for cleaning products

TABLE 37 MEXICO: ACRYLIC POLYMER MARKET FOR CLEANING APPLICATION, BY APPLICATION, 2019–2026 (TON)

TABLE 38 MEXICO: ACRYLIC POLYMERS MARKET FOR CLEANING APPLICATION, BY APPLICATION, 2019–2026 (USD MILLION)

8.3 EUROPE

FIGURE 26 EUROPE: ACRYLIC POLYMER MARKET SNAPSHOT

TABLE 39 EUROPE: ACRYLIC POLYMER MARKET FOR CLEANING APPLICATION, BY COUNTRY, 2019–2026 (TON)

TABLE 40 EUROPE: ACRYLIC POLYMERS MARKET FOR CLEANING APPLICATION, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 41 EUROPE: ACRYLIC POLYMERS MARKET FOR CLEANING APPLICATION, BY TYPE, 2019–2026 (TON)

TABLE 42 EUROPE: ACRYLIC POLYMERS MARKET FOR CLEANING APPLICATION, BY TYPE, 2019–2026 (USD MILLION)

TABLE 43 EUROPE: ACRYLIC POLYMERS MARKET FOR CLEANING APPLICATION, BY APPLICATION, 2019–2026 (TON)

TABLE 44 EUROPE: ACRYLIC POLYMERS MARKET FOR CLEANING APPLICATION, BY APPLICATION, 2019–2026 (USD MILLION)

8.3.1 GERMANY

8.3.1.1 Expansion of healthcare & hygiene sector creates favorable conditions for market growth

TABLE 45 GERMANY: ACRYLIC POLYMER MARKET FOR CLEANING APPLICATION, BY APPLICATION, 2019–2026 (TON)

TABLE 46 GERMANY: ACRYLIC POLYMERS MARKET FOR CLEANING APPLICATION, BY APPLICATION, 2019–2026 (USD MILLION)

8.3.2 FRANCE

8.3.2.1 Rising demand for cleaning and washing products to increase demand for acrylic polymer

TABLE 47 FRANCE: ACRYLIC POLYMER MARKET FOR CLEANING APPLICATION, BY APPLICATION, 2019–2026 (TON)

TABLE 48 FRANCE: ACRYLIC POLYMERS MARKET FOR CLEANING APPLICATION, BY APPLICATION, 2019–2026 (USD MILLION)

8.3.3 UK

8.3.3.1 Rise in spending on health and hygiene to drive UK acrylic polymer market

TABLE 49 UK: ACRYLIC POLYMER MARKET FOR CLEANING APPLICATION, BY APPLICATION, 2019–2026 (TON)

TABLE 50 UK: ACRYLIC POLYMERS MARKET FOR CLEANING APPLICATION, BY APPLICATION, 2019–2026 (USD MILLION)

8.3.4 ITALY

8.3.4.1 Increasing industrial and institutional cleaning to drive market

TABLE 51 ITALY: ACRYLIC POLYMER MARKET FOR CLEANING APPLICATION, BY APPLICATION, 2019–2026 (TON)

TABLE 52 ITALY: ACRYLIC POLYMERS MARKET FOR CLEANING APPLICATION, BY APPLICATION, 2019–2026 (USD MILLION)

8.3.5 SPAIN

8.3.5.1 Growth in laundry & detergent application to drive market

TABLE 53 SPAIN: ACRYLIC POLYMER MARKET FOR CLEANING APPLICATION, BY APPLICATION, 2019–2026 (TON)

TABLE 54 SPAIN: ACRYLIC POLYMERS MARKET FOR CLEANING APPLICATION, BY APPLICATION, 2019–2026 (USD MILLION)

8.3.6 RUSSIA

8.3.6.1 Increasing investment in cleaning products to drive market

TABLE 55 RUSSIA: ACRYLIC POLYMER MARKET FOR CLEANING APPLICATION, BY APPLICATION, 2019–2026 (TON)

TABLE 56 RUSSIA: ACRYLIC POLYMERS MARKET FOR CLEANING APPLICATION, BY APPLICATION, 2019–2026 (USD MILLION)

8.3.7 BENELUX

8.3.7.1 Increasing exports and imports of acrylic polymer to drive market

TABLE 57 BENELUX: ACRYLIC POLYMER MARKET FOR CLEANING APPLICATION, BY APPLICATION, 2019–2026 (TON)

TABLE 58 BENELUX: ACRYLIC POLYMERS MARKET FOR CLEANING APPLICATION, BY APPLICATION, 2019–2026 (USD MILLION)

8.3.8 NORDIC COUNTRIES

8.3.8.1 Steady growth in demand for cleaning products to drive the market

TABLE 59 NORDIC COUNTRIES: ACRYLIC POLYMER MARKET FOR CLEANING APPLICATION, BY APPLICATION, 2019–2026 (TON)

TABLE 60 NORDIC COUNTRIES: ACRYLIC POLYMERS MARKET FOR CLEANING APPLICATION, BY APPLICATION, 2019–2026 (USD MILLION)

8.3.9 REST OF EUROPE

TABLE 61 REST OF EUROPE: ACRYLIC POLYMER MARKET FOR CLEANING APPLICATION, BY APPLICATION, 2019–2026 (TON)

TABLE 62 REST OF EUROPE: ACRYLIC POLYMERS MARKET FOR CLEANING APPLICATION, BY APPLICATION, 2019–2026 (USD MILLION)

8.4 ASIA PACIFIC

FIGURE 27 ASIA PACIFIC: ACRYLIC POLYMER MARKET FOR CLEANING APPLICATION SNAPSHOT

TABLE 63 ASIA PACIFIC: ACRYLIC POLYMER MARKET FOR CLEANING APPLICATION, BY COUNTRY, 2019–2026 (TON)

TABLE 64 ASIA PACIFIC: ACRYLIC POLYMERS MARKET FOR CLEANING APPLICATION, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 65 ASIA PACIFIC: ACRYLIC POLYMERS MARKET FOR CLEANING APPLICATION, BY TYPE, 2019–2026 (TON)

TABLE 66 ASIA PACIFIC: ACRYLIC POLYMERS MARKET FOR CLEANING APPLICATION, BY TYPE, 2019–2026 (USD MILLION)

TABLE 67 ASIA PACIFIC: ACRYLIC POLYMERS MARKET FOR CLEANING APPLICATION, BY APPLICATION, 2019–2026 (TON)

TABLE 68 ASIA PACIFIC: ACRYLIC POLYMERS MARKET FOR CLEANING APPLICATION, BY APPLICATION, 2019–2026 (USD MILLION)

8.4.1 CHINA

8.4.1.1 Healthy growth of cleaning industry is major driver of acrylic polymer market

TABLE 69 CHINA: ACRYLIC POLYMER MARKET FOR CLEANING APPLICATION, BY APPLICATION, 2019–2026 (TON)

TABLE 70 CHINA: ACRYLIC POLYMERS MARKET FOR CLEANING APPLICATION, BY APPLICATION, 2019–2026 (USD MILLION)

8.4.2 JAPAN

8.4.2.1 Strong cleaning standards and regulations in country to drive market

TABLE 71 JAPAN SOAP, SYNTHETIC DETERGENTS, AND SURFACEACTIVE AGENTS PRODUCTION, 2020 (TON)

TABLE 72 JAPAN: ACRYLIC POLYMER MARKET FOR CLEANING APPLICATION, BY APPLICATION, 2019–2026 (TON)

TABLE 73 JAPAN: ACRYLIC POLYMERS MARKET FOR CLEANING APPLICATION, BY APPLICATION, 2019–2026 (USD MILLION)

8.4.3 INDIA

8.4.3.1 Growing awareness pertaining to hygiene and cleaning coupled with changing lifestyle supporting market growth

TABLE 74 INDIA: ACRYLIC POLYMER MARKET FOR CLEANING APPLICATION, BY APPLICATION, 2019–2026 (TON)

TABLE 75 INDIA: ACRYLIC POLYMERS MARKET FOR CLEANING APPLICATION, BY APPLICATION, 2019–2026 (USD MILLION)

8.4.4 SOUTH KOREA

8.4.4.1 Personal and household care products will support growth of acrylic polymer market

TABLE 76 SOUTH KOREA: ACRYLIC POLYMER MARKET FOR CLEANING APPLICATION, BY APPLICATION, 2019–2026 (TON)

TABLE 77 SOUTH KOREA: ACRYLIC POLYMERS MARKET FOR CLEANING APPLICATION, BY APPLICATION, 2019–2026 (USD MILLION)

8.4.5 ASEAN COUNTRIES

8.4.5.1 Rising health & hygiene concerns to boost market

TABLE 78 ASEAN COUNTRIES: ACRYLIC POLYMER MARKET FOR CLEANING APPLICATION, BY APPLICATION, 2019–2026 (TON)

TABLE 79 ASEAN COUNTRIES: ACRYLIC POLYMERS MARKET FOR CLEANING APPLICATION, BY APPLICATION, 2019–2026 (USD MILLION)

8.4.6 REST OF ASIA PACIFIC

TABLE 80 REST OF ASIA PACIFIC: ACRYLIC POLYMER MARKET FOR CLEANING APPLICATION, BY APPLICATION, 2019–2026 (TON)

TABLE 81 REST OF ASIA PACIFIC: ACRYLIC POLYMERS MARKET FOR CLEANING APPLICATION, BY APPLICATION, 2019–2026 (USD MILLION)

8.5 REST OF WORLD

TABLE 82 REST OF WORLD: ACRYLIC POLYMER MARKET FOR CLEANING APPLICATION, BY COUNTRY, 2019–2026 (TON)

TABLE 83 REST OF WORLD: ACRYLIC POLYMERS MARKET FOR CLEANING APPLICATION, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 84 REST OF WORLD: ACRYLIC POLYMERS MARKET FOR CLEANING APPLICATION, BY TYPE, 2019–2026 (TON)

TABLE 85 REST OF WORLD: ACRYLIC POLYMERS MARKET FOR CLEANING APPLICATION, BY TYPE, 2019–2026 (USD MILLION)

TABLE 86 REST OF WORLD: ACRYLIC POLYMERS MARKET FOR CLEANING APPLICATION, BY APPLICATION, 2019–2026 (TON)

TABLE 87 REST OF WORLD: ACRYLIC POLYMERS MARKET FOR CLEANING APPLICATION, BY APPLICATION, 2019–2026 (USD MILLION)

8.5.1 SAUDI ARABIA

8.5.1.1 Increasing demand for detergents & industrial cleaning products to drive growth of acrylic polymer market

TABLE 88 SAUDI ARABIA: ACRYLIC POLYMER MARKET FOR CLEANING APPLICATION, BY APPLICATION, 2019–2026 (TON)

TABLE 89 SAUDI ARABIA: ACRYLIC POLYMERS MARKET FOR CLEANING APPLICATION, BY APPLICATION, 2019–2026 (USD MILLION)

8.5.2 UAE

8.5.2.1 Rapid urbanization expected to propel growth of UAE market

TABLE 90 UAE: ACRYLIC POLYMER MARKET FOR CLEANING APPLICATION, BY APPLICATION, 2019–2026 (TON)

TABLE 91 UAE: ACRYLIC POLYMERS MARKET FOR CLEANING APPLICATION, BY APPLICATION, 2019–2026 (USD MILLION)

8.5.3 BRAZIL

8.5.3.1 Brazil is one of largest markets for acrylic polymer in cleaning application in Rest of World

TABLE 92 BRAZIL: ACRYLIC POLYMER MARKET FOR CLEANING APPLICATION, BY APPLICATION, 2019–2026 (TON)

TABLE 93 BRAZIL: ACRYLIC POLYMERS MARKET FOR CLEANING APPLICATION, BY APPLICATION, 2019–2026 (USD MILLION)

8.5.4 SOUTH AFRICA

8.5.4.1 Growth in consumer awareness regarding cleaning & personal hygiene products

TABLE 94 SOUTH AFRICA: ACRYLIC POLYMER MARKET FOR CLEANING APPLICATION, BY APPLICATION, 2019–2026 (TON)

TABLE 95 SOUTH AFRICA: ACRYLIC POLYMERS MARKET FOR CLEANING APPLICATION, BY APPLICATION, 2019–2026 (USD MILLION)

8.5.5 OTHERS

TABLE 96 OTHERS: ACRYLIC POLYMER MARKET FOR CLEANING APPLICATION, BY APPLICATION, 2019–2026 (TON)

TABLE 97 OTHERS: ACRYLIC POLYMERS MARKET FOR CLEANING APPLICATION, BY APPLICATION, 2019–2026 (USD MILLION)

9 COMPETITIVE LANDSCAPE (Page No. - 104)

9.1 INTRODUCTION

FIGURE 28 COMPANIES MAINLY ADOPTED INORGANIC GROWTH STRATEGIES BETWEEN 2018 AND 2021

9.2 MARKET SHARE ANALYSIS

FIGURE 29 MARKET SHARE OF KEY PLAYERS, 2020

TABLE 98 ACRYLIC POLYMER MARKET FOR CLEANING APPLICATION: DEGREE OF COMPETITION

TABLE 99 STRATEGIC POSITIONING OF KEY PLAYERS

9.3 COMPETITIVE SITUATION & TRENDS

9.3.1 EXPANSIONS

TABLE 100 EXPANSIONS, 2018-2021

9.3.2 DEALS

TABLE 101 DEALS, 2018–2021

10 COMPANY PROFILE (Page No. - 109)

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

10.1 KEY PLAYERS

10.1.1 DOW INC.

TABLE 102 DOW INC.: COMPANY OVERVIEW

FIGURE 30 DOW INC.: COMPANY SNAPSHOT

FIGURE 31 DOW'S CAPABILITY IN ACRYLIC POLYMER MARKET FOR CLEANING APPLICATION

10.1.2 BASF SE

TABLE 103 BASF SE: BUSINESS OVERVIEW

FIGURE 32 BASF SE: COMPANY SNAPSHOT

TABLE 104 BASF SE.: DEALS

FIGURE 33 BASF'S CAPABILITY IN ACRYLIC POLYMER MARKET FOR CLEANING APPLICATION

10.1.3 TOAGOSEI CO., LTD.

TABLE 105 TOAGOSEI CO., LTD.: COMPANY OVERVIEW

FIGURE 34 TOAGOSEI CO., LTD: COMPANY SNAPSHOT

FIGURE 35 TOAGOSEI'S CAPABILITIES IN ACRYLIC POLYMER MARKET FOR CLEANING APPLICATION

10.1.4 SUMITOMO SEIKA CHEMICALS CO., LTD.

TABLE 106 SUMITOMO SEIKA CHEMICALS CO., LTD.: BUSINESS OVERVIEW

FIGURE 36 SUMITOMO SEIKA CHEMICALS CO., LTD.: COMPANY SNAPSHOT

TABLE 107 SUMITOMO SEIKA CHEMICALS CO. LTD.: PRODUCT/SOLUTION/SERVICE OFFERED

10.1.5 ARKEMA

TABLE 108 ARKEMA: BUSINESS OVERVIEW

FIGURE 37 ARKEMA: COMPANY SNAPSHOT

FIGURE 38 ARKEMA'S CAPABILITY IN ACRYLIC POLYMER MARKET FOR CLEANING APPLICATION

10.1.6 NIPPON SHOKUBAI CO. LTD.

TABLE 109 NIPPON SHOKUBAI CO.LTD.: BUSINESS OVERVIEW

FIGURE 39 NIPPON SHOKUBAI: COMPANY SNAPSHOT

TABLE 110 NIPPON SHOKUBAI CO. LTD.: DEALS

FIGURE 40 NIPPON SHOKUBAI'S CAPABILITIES IN ACRYLIC POLYMER MARKET FOR CLEANING APPLICATION

10.1.7 ASHLAND GLOBAL HOLDINGS, INC.

TABLE 111 ASHLAND GLOBAL HOLDINGS, INC.: BUSINESS OVERVIEW

FIGURE 41 ASHLAND GLOBAL HOLDINGS, INC: COMPANY SNAPSHOT

TABLE 112 ASHLAND GLOBAL HOLDINGS, INC.: PRODUCT/SOLUTION/SERVICE OFFERED

TABLE 113 ASHLAND GLOBAL HOLDINGS, INC.: DEALS

10.2 OTHER KEY PLAYERS

10.2.1 THE LUBRIZOL CORPORATION

TABLE 114 THE LUBRIZOL CORPORATION: BUSINESS OVERVIEW

10.2.2 CHEMIPOL, S.A.

TABLE 115 CHEMIPOL, S.A.: BUSINESS OVERVIEW

10.2.3 ANSHIKA POLYSURF LIMITED

TABLE 116 ANSHIKA POLYSURF LIMITED: COMPANY OVERVIEW

10.2.4 MCTRON

TABLE 117 MCTRON: COMPANY OVERVIEW

10.2.5 WEIFANG RUIGUANG CHEMICAL

TABLE 118 WEIFANG RUIGUANG CHEMICAL: COMPANY OVERVIEW

10.2.6 PIKA INDIA TECHNOLOGIES

TABLE 119 PIKA INDIA TECHNOLOGIES: COMPANY OVERVIEW

10.2.7 NOURYON

TABLE 120 NOURYON: COMPANY OVERVIEW

10.2.8 GELLNER INDUSTRIAL

TABLE 121 GELLNER INDUSTRIAL: COMPANY OVERVIEW

10.2.9 GROUPE PROTEX INTERNATIONAL

TABLE 122 GROUPE PROTEX INTERNATIONAL: COMPANY OVERVIEW

10.2.10 ANHUI NEWMAN FINE CHEMICALS CO., LTD.

TABLE 123 ANHUI NEWMAN FINE CHEMICALS CO., LTD.: COMPANY OVERVIEW

10.2.11 MAXWELL ADDITIVES PRIVATE LIMITED

TABLE 124 MAXWELL ADDITIVES PRIVATE LIMITED: COMPANY OVERVIEW

10.2.12 SOLVAY SA

TABLE 125 SOLVAY: COMPANY OVERVIEW

10.2.13 SHANGHAI BAOLIJIA CHEMICAL LIMITED

TABLE 126 SHANGHAI BAOLIJIA CHEMICAL LIMITED: COMPANY OVERVIEW

10.2.14 KAMSONS CHEMICALS PVT. LTD.

TABLE 127 KAMSONS CHEMICALS PVT. LTD.: COMPANY OVERVIEW

10.2.15 STI POLYMER

TABLE 128 STI POLYMER: COMPANY OVERVIEW

10.2.16 MICHELMAN

TABLE 129 MICHELMAN: COMPANY OVERVIEW

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

11 APPENDIX (Page No. - 139)

11.1 DISCUSSION GUIDE

11.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

11.3 AVAILABLE CUSTOMIZATIONS

11.4 RELATED REPORTS

11.5 AUTHOR DETAILS

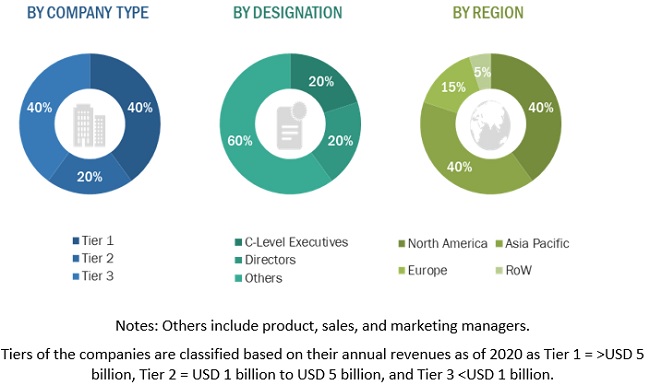

This research study involved the use of extensive secondary sources, directories, and databases, such as Hoovers, ICIS articles, Factiva, and Bloomberg Businessweek, to identify and gather information for a technical, market-oriented, and commercial study of the Acrylic Polymer Market for Cleaning Application. The primary sources included industry experts from core and related industries and preferred suppliers, regulatory bodies, and organizations related to all segments of this industry's value chain. In-depth interviews have been conducted with different primary respondents, such as key industry participants, Subject Matter Experts (SMEs), C-Level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information and to assess growth prospects.

Secondary Research

In the secondary research process, sources such as annual reports, press releases, and investor presentations of companies; white papers; publications from recognized websites; and databases have been referred to for identifying and collecting information. Secondary research has been used to obtain key information about the supply chain of the industry, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both the market- and technology-oriented perspectives.

Primary Research

After the complete market estimation process (which includes calculations for market statistics, market breakdown, market size estimations, market forecast, and data triangulation), extensive primary research has been conducted to gather information and to verify and validate the critical numbers arrived at. Primary research has also been conducted to identify the segmentation, industry trends, Porter’s Five Forces analysis, key players, competitive landscape, industry trends, strategies of key players, and key market dynamics such as drivers, restraints, opportunities, and challenges.

In the primary research process, different primary sources from the supply and demand sides have been interviewed to obtain qualitative and quantitative information. The primary sources included industry experts such as CEOs, vice presidents, marketing directors, technology & innovation directors, and related key executives from various companies and organizations operating in the acrylic polymer market for cleaning application.

Following is the breakdown of primary respondents

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the supply-side and demand-side approaches were extensively used, along with several data triangulation methods, for market size estimation and forecast of the overall market segments listed in this report. Extensive qualitative and quantitative data were analyzed to list key information/insights throughout the report. In the bottom-up approach, the overall demand for acrylic polymer for cleaning application in several countries was ascertained for the current and historical years. Then, information pertaining to end-use industry growth, new capacity addition, detergent supply-demand scenario, trade, and countries & regional shares were gathered from the public domain. Through this, the share of each country in the respective region was ascertained. Moreover, based on industry experts' opinions, the share of the region such as Europe and North America in the global acrylic polymer market for cleaning application was assessed to quantify the global market size for the current and historical years.

Data Triangulation

After arriving at the total market size from the process explained above, the overall market was split into several segments and sub-segments. To complete the overall market size estimation process and arrive at the exact statistics for all the segments and sub-segments, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides. In addition, the market size was validated using both the top-down and bottom-up approaches.

Report Objectives

- To define, describe, and forecast the global acrylic polymer market for cleaning application in terms of value and volume

- To provide detailed information regarding the key factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To analyze the market segmentation and forecast the market size based on type and application

- To analyze and forecast the market segments with respect to four main regions, namely, North America, Europe, Asia Pacific, and the Rest of World, along with the major countries in each region

- To strategically analyze micromarkets1 with respect to individual growth trends, growth prospects, and contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape

- To strategically profile the leading players and comprehensively analyze their key developments, such as product launches, expansions, mergers & acquisitions, and partnerships, in the acrylic polymer market

Available Customizations:

Along with the given market data, MarketsandMarkets offers customizations as per the specific needs of the companies. The following customization options are available for the report:

Product Analysis:

- Product Matrix which gives a detailed comparison of the product portfolio of each company

Regional Analysis:

- Further breakdown of the Rest of APAC acrylic polymer market for cleaning application market

- Further breakdown of Rest of Europe acrylic polymer market for cleaning application market

Company Information:

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Acrylic Polymer Market