Acetaldehyde Market by Process (Wacker Process, Oxidation of Ethanol, Dehydrogenation of Ethanol), Derivative (Pyridine & Pyridine Bases, Pentaerythritol), Application (Food & Beverage, Chemicals, Paints & Coatings), and Region - Global Forecast to 2022

[114 Pages Report] acetaldehyde market was valued at USD 1.26 Billion in 2016 and is projected to reach USD 1.80 Billion by 2022, at a CAGR of 6.24% during the forecast period. In this report, 2016 is considered the base year and the forecast period is from 2017 to 2022.

Objectives of the Study:

- To analyze and forecast the size of the acetaldehyde market, in terms of value and volume

- To provide detailed information regarding key factors, such as drivers, restraints, opportunities, and challenges, influencing the growth of the acetaldehyde market

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and their contribution to the market

- To define, describe, and forecast the acetaldehyde market on the basis of process, derivatives, and application

- To forecast the size of market segments with respect to 5 main regions, namely, North America, Europe, Asia Pacific, the Middle East & Africa, and South America

- To analyze opportunities in the acetaldehyde market for stakeholders and provide a competitive landscape for market leaders

- To strategically profile key players and comprehensively analyze their market shares and core competencies2

Note1: Micromarkets are the subsegments of the acetaldehyde market included in the report.

Note2: Core competencies of companies are determined in terms of their key developments and key strategies adopted by them to sustain in the market.

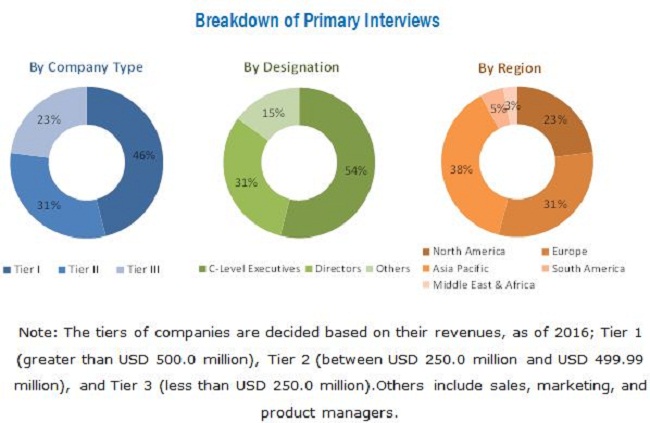

Top-down and bottom-up approaches were used to estimate and validate the size of the acetaldehyde market and to estimate the sizes of various other dependent submarkets. The research study involved the use of secondary sources that include directories and databases, such as Hoovers, Chemical Weekly, Factiva, Bloomberg Businessweek, and articles from recognized authors to identify and collect information useful for a technical, market-oriented, and commercial study of the acetaldehyde market.

To know about the assumptions considered for the study, download the pdf brochure

Key Players:- Celanese (US)

- Eastman (US)

- Merck KGaA (Germany)

- Sumitomo (Japan)

- Sekab (Sweden)

- Showa Denko (Japan)

- Jubilant Life Sciences (India)

- Lonza (Switzerland)

- LCY Chemical (Taiwan)

- Ashok Alco-chem (India)

Key Target Audience:

- Acetaldehyde Manufacturers

- Acetaldehyde Suppliers

- Paints & Coatings Companies

- Raw Material Suppliers

- Acetaldehyde Distributors

- Plastics & Composites Manufacturers

- Research Organizations

- Government Bodies

- End-use Companies

- Consulting Companies/Consultants in the Chemical and Material Sectors

This study answers several questions for stakeholders, primarily which market segments they should focus upon during the next 2 to 5 years to prioritize their efforts and investments.

Scope of the Report:

- This research report categorizes the acetaldehyde market based on process, derivatives, application, and region.

Based on Process:

- Oxidation of Ethylene (Wacker Process)

- Oxidation of Ethanol

- Dehydrogenation of Ethanol

- Others (Hydration of Acetylene and Hydroformylation of Methanol)

Based on Derivatives:

- Pyridine & Pyridine Bases

- Pentaerythritol

- Acetic Acid

- Ethyl Acetate

- Others (Butylene Glycol, Chloral, Peracetic Acid)

Based on Application:

- Chemicals

- Plastics & Synthetic Rubber

- Food & Beverage

- Paints & Coatings

- Pharmaceuticals & Cosmetics

- Paper & Pulp

- Water Treatment

- Others (Agriculture and Petrochemicals)

Based on Region:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America

- The market is further analyzed for key countries in each of these regions.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to a companys specific needs. The following customization options are available for the report:

Regional Analysis:

- Country-level analysis of the acetaldehyde market.

Company Information:

- Detailed analysis and profiles of additional market players.

The acetaldehyde market is estimated at USD 1.33 Billion in 2017 and is projected to reach USD 1.80 Billion by 2022, at a CAGR of 6.24% during the forecast period. This growth can be attributed to the increasing demand for acetaldehyde in the water treatment application. In addition, the demand for high-quality derivatives in emerging economies is another significant factor contributing to the growth of the acetaldehyde market.

Acetaldehyde, also known as ethanal, is an aldehyde used as a starting material for the production of its derivatives, other chemicals, and other applications. Acetaldehyde is manufactured mostly through the oxidation of ethylene, also known as the Wacker process. Other manufacturing processes include oxidation of ethanol, dehydrogenation of ethanol, hydroformylation of methanol, and hydration of acetylene. However, the use of the acetylene hydration process has declined, as byproducts are formed in large quantities due to the severe reactions.

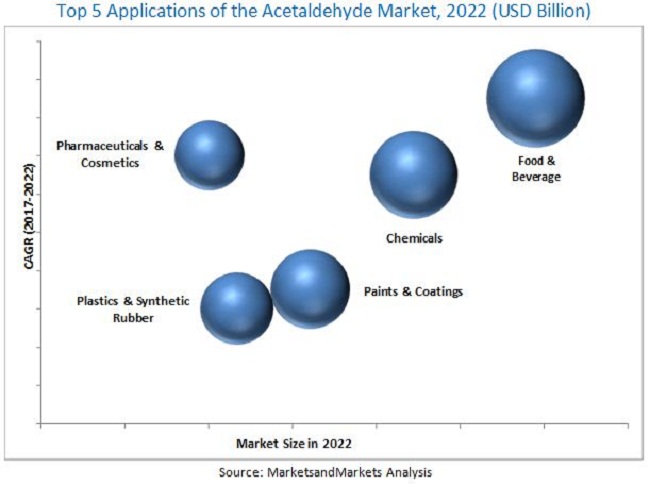

Based on application, acetaldehyde finds use in a wide range of applications, such as chemicals, plastics & synthetic rubber, food & beverage, paints & coatings, pharmaceuticals & cosmetics, paper & pulp, water treatment, and others. The food & beverage segment is the largest application segment of the acetaldehyde market. Moreover, the water treatment application segment is expected to grow at the highest CAGR during the forecast period. The food & beverage application leads the overall acetaldehyde market, due to its use as a flavoring agent in several food products.

The acetaldehyde market in the Asia Pacific region is projected to grow at the highest CAGR from 2017 to 2022. This growth can be attributed to the easy availability of raw materials used for the manufacture of acetaldehyde. The Asia Pacific region provides expansion opportunities for acetaldehyde manufacturers, owing to the low cost of manufacture in China, South Korea, and India. Limited regulations related to the use and manufacture of acetaldehyde in the Asia Pacific are further influencing the growth of the acetaldehyde market in this region.

The global demand for acetaldehyde is reducing, primarily due to the lower consumption of acetaldehyde for the manufacture of acetic acid. The acetic acid manufacturing industry continues to move towards the methanol carbonylation process which is more efficient compared to production using acetaldehyde. The phasing out of acetic acid production with the use of acetaldehyde is restraining the growth of acetaldehyde market.

Celanese (US), Eastman (US), Merck KGaA (Germany), Sumitomo (Japan), Sekab (Sweden), Showa Denko (Japan), Jubilant Life Sciences (India), Lonza (Switzerland), LCY Chemical (Taiwan), and Ashok Alco-chem (India) are the leading players in the acetaldehyde market. These companies have strengthened their market positions through diverse product portfolios, strategically positioned R&D centers, consistent development activities, and technological advancements. They are focused on the adoption of various organic and inorganic growth strategies, such as expansions, agreements, and acquisitions to increase their market shares.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table Of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.4 Years Considered for the Study

1.5 Currency

1.6 Units Considered

1.7 Limitations

1.8 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Assumptions

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 29)

4.1 Attractive Opportunities in Acetaldehyde Market

4.2 Acetaldehyde Market, By Derivative

4.3 APAC Acetaldehyde Market, By Country and Derivative

4.4 Acetaldehyde Market, By Application

4.5 Acetaldehyde Market, By Region

5 Market Overview (Page No. - 33)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Demand From Food & Beverage, Paper & Pulp, Pharmaceutical, and Water Treatment Applications

5.2.1.2 Increasing Use of Acetaldehyde in Derivatives Such as Pyridines and Pentaerythritol

5.2.2 Restraints

5.2.2.1 Phasing Out of Acetic Acid Production From Acetaldehyde

5.2.3 Challenge

5.2.3.1 Environmental and Health Hazards of Acetaldehyde

5.3 Porters Five Forces Analysis

5.3.1 Bargaining Power of Suppliers

5.3.2 Bargaining Power of Buyers

5.3.3 Threat of New Entrants

5.3.4 Threat of Substitutes

5.3.5 Intensity of Competitive Rivalry

6 Acetaldehyde Market, By Process (Page No. - 39)

6.1 Introduction

6.2 Oxidation of Ethylene (Hoechst-Wacker Process)

6.2.1 One-Stage Process

6.2.2 Two-Stage Process

6.3 Oxidation of Ethanol

6.4 Dehydrogenation of Ethanol

6.5 Others

6.5.1 Hydration of Acetylene

6.5.2 Hydroformylation of Methanol

7 Acetaldehyde Market, By Derivative (Page No. - 43)

7.1 Introduction

7.2 Pyridine & Pyridine Bases

7.3 Pentaerythritol

7.4 Acetic Acid

7.5 Ethyl Acetate

7.6 Others

7.6.1 Butylene Glycol

7.6.2 Chloral

7.6.3 Peracetic Acid

8 Acetaldehyde Market, By Application (Page No. - 50)

8.1 Introduction

8.2 Chemicals

8.3 Plastics & Synthetic Rubber

8.4 Food & Beverage

8.5 Paints & Coatings

8.6 Pharmaceuticals & Cosmetics

8.7 Paper & Pulp

8.8 Water Treatment

8.9 Others

9 Acetaldehyde Market, By Region (Page No. - 60)

9.1 Introduction

9.2 North America

9.2.1 US

9.2.2 Canada

9.2.3 Mexico

9.3 APAC

9.3.1 China

9.3.2 India

9.3.3 Japan

9.3.4 South Korea

9.3.5 Rest of APAC

9.4 Europe

9.4.1 Germany

9.4.2 France

9.4.3 Italy

9.4.4 UK

9.4.5 Spain

9.4.6 Rest of Europe

9.5 Middle East & Africa

9.5.1 Saudi Arabia

9.5.2 South Africa

9.5.3 UAE

9.5.4 Rest of Middle East & Africa

9.6 South America

9.6.1 Brazil

9.6.2 Argentina

9.6.3 Rest of South America

10 Competitive Landscape (Page No. - 85)

10.1 Overview

10.2 Market Ranking of Key Players

10.3 Competitive Scenario

10.3.1 Expansions,20132017

10.3.2 Agreements,20112017

10.3.3 Mergers & Acquisitions,20132017

11 Company Profiles (Page No. - 89)

11.1 Eastman

11.2 Celanese

11.3 Merck Kgaa

11.4 Sumitomo Chemical

11.5 Showa Denko

11.6 Ashok Alco - Chem

11.7 Jubilant Life Sciences

11.8 LCY Chemical

11.9 Lonza

11.10 Sekab

11.11 Other Players

11.11.1 Amadis Chemical

11.11.2 China National Petroleum Corporation

11.11.3 Chempure

11.11.4 Eurochem

11.11.5 Finetech Industry

11.11.6 Fisher Scientific

11.11.7 Godavari Biorefineries

11.11.8 Jiangsu Sanmu Group

11.11.9 Jinyimeng Group

11.11.10 Kanoria Chemicals & Industries

11.11.11 LOBA Chemie

11.11.12 Nantong Jinrui Chemical

11.11.13 Penta Manufacturing

11.11.14 Shandong Kunda Biotechnology

11.11.15 Tractus

12 Appendix (Page No. - 107)

12.1 Insights From Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets Subscription Portal

12.4 Introducing RT: Real-Time Market Intelligence

12.5 Available Customizations

12.6 Related Reports

12.7 Author Details

List of Tables (64 Tables)

Table 1 Acetaldehyde Market Size, By Process, 20152022 (USD Million)

Table 2 Acetaldehyde Market Size, By Process, 20152022 (Kiloton)

Table 3 Acetaldehyde Market Size, By Derivative, 20152022 (USD Million)

Table 4 Acetaldehyde Market Size, By Derivative, 20152022 (Kiloton)

Table 5 Pyridine & Pyridine Bases Market Size, By Region, 20152022 (USD Million)

Table 6 Pyridine & Pyridine Bases Market Size, By Region, 20152022 (Kiloton)

Table 7 Pentaerythritol Market Size, By Region, 20152022 (USD Million)

Table 8 Pentaerythritol Market Size, By Region, 20152022 (Kiloton)

Table 9 Acetic Acid Market Size, By Region, 20152022 (USD Million)

Table 10 Acetic Acid Market Size, By Region, 20152022 (Kiloton)

Table 11 Ethyl Acetate Market Size, By Region, 20152022 (USD Million)

Table 12 Ethyl Acetate Market Size, By Region, 20152022 (Kiloton)

Table 13 Others Market Size, By Region, 20152022 (USD Million)

Table 14 Others Market Size, By Region, 20152022 (Kiloton)

Table 15 Acetaldehyde Market Size, By Application, 20152022 (USD Million)

Table 16 Acetaldehyde Market Size, By Application, 20152022 (Kiloton)

Table 17 Acetaldehyde Market in Chemicals Application, By Region, 20152022 (USD Million)

Table 18 Acetaldehyde Market in Chemicals Application, By Region, 20152022(Kiloton)

Table 19 Acetaldehyde Market in Plastics & Synthetic Rubber Application, By Region, 20152022 (USD Million)

Table 20 Acetaldehyde Market in Plastics & Synthetic Rubber Application, By Region, 20152022(Kiloton)

Table 21 Acetaldehyde Market in Food & Beverage Application, By Region, 20152022 (USD Million)

Table 22 Acetaldehyde Market in Food & Beverage Application, By Region, 20152022(Kiloton)

Table 23 Acetaldehyde Market in Paints & Coatings Application, By Region, 20152022 (USD Million)

Table 24 Acetaldehyde Market in Paints & Coatings Application, By Region, 20152022 (Kiloton)

Table 25 Acetaldehyde Market in Pharmaceuticals & Cosmetics Application,By Region, 20152022 (USD Million)

Table 26 Acetaldehyde Market in Pharmaceuticals & Cosmetics Application,By Region, 20152022 (Kiloton)

Table 27 Acetaldehyde Market in Paper & Pulp Application, By Region, 20152022 (USD Million)

Table 28 Acetaldehyde Market in Paper & Pulp Application, By Region, 20152022 (Kiloton)

Table 29 Acetaldehyde Market in Water Treatment Application, By Region, 20152022 (USD Million)

Table 30 Acetaldehyde Market in Water Treatment Application, By Region, 20152022 (Kiloton)

Table 31 Acetaldehyde Market in Other Applications, By Region, 20152022 (USD Million)

Table 32 Acetaldehyde Market in Other Applications, By Region, 20152022 (Kiloton)

Table 33 Acetaldehyde Market, By Region, 20152022 (USD Million)

Table 34 Acetaldehyde Market, By Region, 20152022 (Kiloton)

Table 35 North America: Acetaldehyde Market Size, By Country, 20152022 (USD Million)

Table 36 North America: Acetaldehyde Market Size, By Country, 20152022 (Kiloton)

Table 37 North America: Acetaldehyde Market Size, By Derivative, 20152022 (USD Million)

Table 38 North America: Acetaldehyde Market Size, By Derivative, 20152022 (Kiloton)

Table 39 North America: Acetaldehyde Market Size, By Application, 20152022 (USD Million)

Table 40 North America: Acetaldehyde Market Size, By Application, 20152022 (Kiloton)

Table 41 APAC: Acetaldehyde Market Size, By Country, 20152022 (USD Million)

Table 42 APAC: Acetaldehyde Market Size, By Country, 20152022 (Kiloton)

Table 43 APAC: Acetaldehyde Market Size, By Derivative, 20152022 (USD Million)

Table 44 APAC: Acetaldehyde Market Size, By Derivative, 20152022 (Kiloton)

Table 45 APAC: Acetaldehyde Market Size, By Application, 20152022 (USD Million)

Table 46 APAC: Acetaldehyde Market Size, By Application, 20152022 (Kiloton)

Table 47 Europe: Acetaldehyde Market Size, By Country, 20152022 (USD Million)

Table 48 Europe: Acetaldehyde Market Size, By Country, 20152022 (Kiloton)

Table 49 Europe: Acetaldehyde Market Size, By Derivative, 20152022 (USD Million)

Table 50 Europe: Acetaldehyde Market Size, By Derivative, 20152022 (Kiloton)

Table 51 Europe: Acetaldehyde Market Size, By Application, 20152022 (USD Million)

Table 52 Europe: Acetaldehyde Market Size, By Application, 20152022 (Kiloton)

Table 53 Middle East & Africa: Acetaldehyde Market Size, By Country, 20152022 (USD Million)

Table 54 Middle East & Africa: Acetaldehyde Market Size, By Country, 20152022 (Kiloton)

Table 55 Middle East & Africa: Acetaldehyde Market Size, By Derivative, 20152022 (USD Million)

Table 56 Middle East & Africa: Acetaldehyde Market Size, By Derivative, 20152022 (Kiloton)

Table 57 Middle East & Africa: Acetaldehyde Market Size, By Application, 20152022 (USD Million)

Table 58 Middle East & Africa: Acetaldehyde Market Size, By Application, 20152022 (Kiloton)

Table 59 South America: Acetaldehyde Market Size, By Country, 20152022 (USD Million)

Table 60 South America: Acetaldehyde Market Size, By Country, 20152022 (Kiloton)

Table 61 South America: Acetaldehyde Market Size, By Derivative, 20152022 (USD Million)

Table 62 South America: Acetaldehyde Market Size, By Derivative, 20152022 (Kiloton)

Table 63 South America: Acetaldehyde Market Size, By Application, 20152022 (USD Million)

Table 64 South America: Acetaldehyde Market Size, By Application, 20152022 (Kiloton)

List of Figures (33 Figures)

Figure 1 Acetaldehyde Market: Research Design

Figure 2 Market Size Estimation: Bottom-Up Approach

Figure 3 Market Size Estimation: Top-Down Approach

Figure 4 Acetaldehyde Market: Data Triangulation

Figure 5 Oxidation of Ethylene Process to Dominate the Market

Figure 6 Pyridine & Pyridine Bases to Account for Largest Market Share

Figure 7 Food & Beverage Application to Dominate the Market

Figure 8 APAC Dominated the Acetaldehyde Market, 2016

Figure 9 Increasing Use of Acetaldehyde in Pyridine & Pyridine Bases and Pentaerythritol to Drive the Market

Figure 10 Pentaerythritol to Be the Fastest-Growing Derivative of Acetaldehyde Between 2017 and 2022

Figure 11 Pyridine & Pyridine Base Was the Largest Derivative in 2017

Figure 12 Food & Beverage Accounted for the Largest Market Share in 2016

Figure 13 APAC to Be the Fastest-Growing Acetaldehyde Market

Figure 14 Drivers, Restraints, Opportunities, and Challenges in the Acetaldehyde Market

Figure 15 Acetaldehyde Market: Porters Five Forces Analysis

Figure 16 Oxidation of Ethylene Process to Grow Rapidly Between 2017 and 2022

Figure 17 Water Treatment Application to Register the Highest Cagr

Figure 18 APAC to Be the Fastest-Growing Acetaldehyde Market, 20172022

Figure 19 North American Acetaldehyde Market Snapshot

Figure 20 APAC Acetaldehyde Market Snapshot

Figure 21 China to Be the Largest Acetaldehyde Market

Figure 22 European Acetaldehyde Market Snapshot

Figure 23 Companies Adopted Expansions as the Key Growth Strategy

Figure 24 Celanese Accounted for the Largest Market Share in 2016

Figure 25 Eastman: Company Snapshot

Figure 26 Celanese: Company Snapshot

Figure 27 Merck Kgaa: Company Snapshot

Figure 28 Sumitomo Chemical: Company Snapshot

Figure 29 Showa Denko: Company Snapshot

Figure 30 Jubilant Life Sciences: Company Snapshot

Figure 31 Ashok Alco-Chem: Company Snapshot

Figure 32 LCY Group: Company Snapshot

Figure 33 Lonza: Company Snapshot

Growth opportunities and latent adjacency in Acetaldehyde Market