Acerola Extract Market by Application (Meat Products, Bakery Products, Confectioneries, Dairy & Frozen Desserts, and Beverages), Form (Dry and Liquid), Nature (Conventional and Organic), Functionality and Region - Global Forecast to 2026

Acerola Market Analysis and Report Summary, 2026

The global acerola extract market will experience significant expansion, with revenue projected to reach USD 24 million by 2026. Establishing a value of USD 16 million in 2021, this indicates a CAGR of 7.6%. The global market is a rapidly growing market due to the increasing demand for natural ingredients in the food and beverage industry. It is used as a natural preservative, colorant, and flavoring agent in food and beverage products, as well as in dietary supplements. Acerola extract, also known as Malpighia emarginata or Barbados cherry, is a rich source of vitamin C and other antioxidants. The market is expected to grow in the coming years due to the increasing awareness of the health benefits of vitamin C and the growing demand for natural ingredients.

Key Industry Development in Acerola Extract Market

Mergers and acquisitions: Companies in the acerola extract market are engaging in mergers and acquisitions to expand their product portfolio and increase their market share.

New product launches: Key players in the acerola extract market are launching new products to cater to the increasing demand for natural ingredients in the food and beverage industry.

Investment in R&D: Companies are investing in research and development to develop new and innovative products and to improve the quality and purity of acerola extract.

Expansion of production facilities: Companies are expanding their production facilities to meet the growing demand for acerola extract.

Increasing adoption of organic and non-GMO acerola extract: The market for organic and non-GMO acerola extract is growing due to increasing consumer demand for natural and healthy food products.

Impact of COVID-19 on Acerola Extract

The majority of the companies present in the food & beverage industry expect COVID-19 to impact their operations. Indeed, the sector's grim expectations become a reality amid plummeting raw material prices, supply chain bottlenecks, spending slowdowns, and jitters over the credit markets. Some major food & beverage companies have closed facilities and are mulling the extent of layoffs to help curb the spread of the virus and for economic reasons. For example, the food & beverage manufacturing sector, which employs several workers in the US, is poised to be hit hard during this outbreak, primarily for two reasons: (i) various jobs are on-site and cannot be carried out remotely; (ii) the slowed economic activity has reduced the supply. Safeguarding consumer and workforce health is the priority among businesses and governments. Plant closures (full or partial) could continue to be necessary for manufacturers in hard-hit regions for a prolonged period. For companies vulnerable to a viral outbreak within their ranks, this would be a critical time to explore a proactive deployment of automation technologies (collaborative robotics, autonomous materials movement, and industrial internet of things) to decrease worker density throughout their operations. The overall experimentation of different foods and beverages has dipped down due to the unavailability across retail stores and a higher demand for basic goods. The overall impact will not be significant as businesses are expected to improve in the coming months with manufacturers, wholesalers, and suppliers coming together to keep products in the inventory, meeting consumer demand without delay.

Acerola Extract Market Dynamics

Drivers: Health benefits provided by acerola extract and its increasing application in the food & beverage industry

Ascorbic acid is an important water-soluble vitamin. The majority of plants and animals can synthesize ascorbic acid, but humans cannot. Hence, humans require it as an essential supplement in their diet. Acerola is a rich natural source of vitamin C. This characteristic of acerola extract forces food & beverage manufacturers to incorporate acerola extract in their products. Along with being a rich source of ascorbic acid, acerola is one of the few fruits that contains several phytonutrients such as phenolics, flavonoids, anthocyanins, and carotenoids in a fair amount. All these phytonutrients help combat various diseases. Acerola promotes the inactivation of free radicals, directly related to the aging process and diseases, such as cancer and cardiovascular disorders, due to its high antioxidant capacity.

Restraints: Easy availability of substitutes

Acerola is one of the richest natural sources of ascorbic acid and contains several phytonutrients such as carotenoids, phenolics, anthocyanins, and flavonoids. Acerola has a reservoir of phytonutrients due to which the fruit exhibits a high antioxidant capacity and several other interesting properties. However, apart from acerola, there are several other natural sources, which possess high antioxidant functionality, including rosemary extract and green tea extracts. Rosemary extract is derived from the Mediterranean herb—rosmarinus officinalis. The phenolic compounds sourced from rosemary are responsible for the antioxidant characteristic of this plant. The major active constituents of rosemary extracts, which define its antioxidant potency, are rosmarinic and carnosic acids and carnosol, extremely effective radical quenchers. Green tea extracts, as antioxidants, are rich in polyphenolic compounds, predominantly catechins. A green tea extract is a natural alternative to chemical or synthetic antioxidants. Green tea extract may be used in food as a natural flavor agent with antioxidant properties. It helps delay lipid oxidation in food. Green tea extract contains several polyphenolic components with antioxidant properties, but the predominant active components are the flavanol monomers known as catechins, where epigallocatechin-3-gallate and epicatechin-3-gallate are the most effective antioxidant compounds. The availability of several substitutes restrains the growth of the acerola extract market.

Opportunities: Growing trend of clean label products across the global food & beverage industry

Clean label is the new norm when it comes to food & beverage products. Consumers have started preferring natural antioxidants in prepared food products, as they are constantly looking for ‘natural’ products, incorporating inherently natural, fresh, wholesome, and balanced nutrition. According to Ingredient Communications, 73% of consumers are willing to pay a higher retail price for a food or drink product made with ingredients they recognize and trust. Natural antioxidants are more likely to be accepted than synthetic antioxidants as consumers perceive natural ingredients to be safer and healthier. Acerola extract is gaining huge traction as a natural antioxidant in the food & beverage industry. The growing trend toward clean-label products, which is slowly becoming mandatory globally, creates various growth opportunities for acerola extract manufacturers in the food & beverage industry. Health-conscious consumers demand information on the ingredients used in the making of the food products they buy; hence, clean labeling of food items, where the product information is mentioned on the packaging, assures consumers that the product is healthy to consume. Manufacturers also try to incorporate innovative natural ingredients, in response to customers’ demand for simplicity and transparency in food products and usage of ingredients.

Challenges: Stringent government regulations are one of the major challenges of the market

Acerola extract is used as an antioxidant in various food applications, including meat products, bakery products, and beverages. The government in developed countries has strict policies related to the addition of food ingredients. According to the FDA, “The antioxidant nutrient must meet the requirements for nutrient content claims in 21 CFR 101.54(b), (c), or (e) for “High” claims, “Good Source” claims, and “More” claims, respectively. For example, to use a “High” claim, the food would have to contain 20% or more of the Daily Reference Value (DRV) or RDI per serving. For a “Good Source” claim, the food would have to contain between 10–19% of the DRV or RDI per serving [21 CFR 101.54(g)(3)].”

By application, the meat products segment is projected to account for the largest market share in the acerola extract market during the forecast period

The meat products segment is expected to account for the largest market share during the forecast period. Color is considered as the determining factor in the quality of fresh meat by consumers. Consumers rely on the color of the meat alone to determine its freshness. Hence, it is important for manufacturers to prevent color loss in their meat products to attract and retain consumers. The acerola extract helps delay color loss by effectively delaying the oxidation of the iron ion in the myoglobin molecule. It keeps fresh meat color (myoglobin) in its reduced state, allowing it to retain color. Due to this reason, the segment is forecasted to grow at a high rate in the market.

By form, the dry segment is projected to grow with the higher CAGR in the market during the forecast period

Based on form, the dry segment is projected to be the fastest-growing segment in the acerola extract market. Dry extracts are majorly available in powdered form. The dry form of the acerola extract has low moisture content, reducing the rate of quality degradation. Hence, these powders can be stored for a longer time than the liquid form. Owing to these factors, it is highly preferred by manufacturers.

By nature, organic segment is projected to grow fastest in the market during the forecast period

By nature, the organic segment is anticipated to grow fastest over the forecast period. Key players operating in the global market also support farmers to grow acerola organically by providing proper knowledge and helping them get certified for their produce.

To know about the assumptions considered for the study, download the pdf brochure

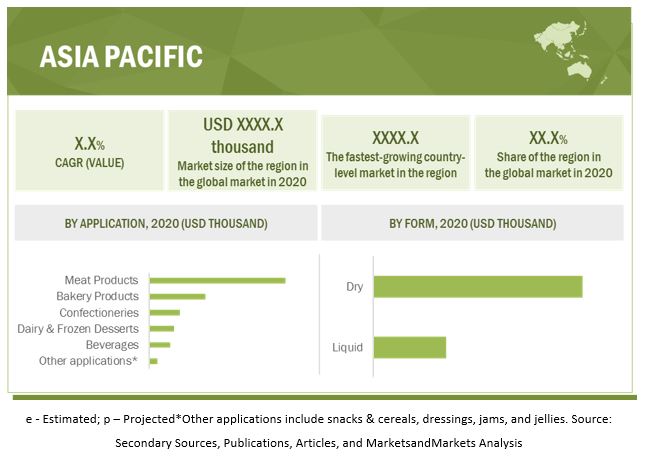

Asia Pacific’s growth is attributed to the increasing awareness of healthy dietary habits among consumers. The key factors driving growth in the Asia Pacific region include health benefits provided by acerola extract, demand for natural products, cost affordability, and the growing startups in market. China and India are the two major countries in region, which have high consumption of meat and bakery products, respectively. The rising meat and bakery industry is expected to drive the demand for acerola extract as an antioxidant.

Acerola Extract Market Key Players:

Key players in this market include DSM (Netherlands), Kemin Industries, Inc. (US), Dohler GmbH (Germany), The Green Labs LLC (US), Diana Food S.A.S. (France), Naturex S.A. (France), NutriBotanica (Brazil), Handary SA (Belgium), Foodchem International Corporation (China), Nichirei do Brasil Agrícola Ltda. (Brazil), Nexira (France), CAIF (US), Nutra Green Biotechnology CO., LTD. (China), Vidya Herbs Pvt Ltd (India), BR Ingredients (Brazil), Blue Macaw Flora (Brazil), Hangzhou Muhua BioTech Co., Ltd (China), Herbo Nutra (India), Herbal Creative (India), and Vital Herbs (India).

Scope of the report

|

Report Metric |

Details |

|

Market size estimation |

2019–2026 |

|

Base year considered |

2020 |

|

Forecast period considered |

2021–2026 |

|

Units considered |

Value (USD) and Volume (Ton) |

|

Segments covered |

Application, form, nature, and region |

|

Regions covered |

North America, Europe, Asia Pacific, South America and RoW |

|

Companies studied |

|

Target Audience:

- Processed food & beverage manufacturers

- Government and research organizations

- Marketing directors

- Key executives from various key companies and organizations in acerola extract market

This research report categorizes acerola extract market based on application, form, nature, and region.

By Application

- Meat Products

- Bakery Products

- Confectioneries

- Dairy & Frozen Desserts

- Beverages

- Other applications (snacks & cereals, dressings, jams, and jellies)

By Form

- Dry

- Liquid

By Nature

- Conventional

- Organic

By Region

- North America

- Europe

- Asia Pacific

- South America

-

Rest of the World (RoW)

- Middle East

- Africa

Acerola Extract Recent Developments

- In February 2021, Nexira launched natural & organic acerola extract solution, which helps delay meat discoloration by stabilizing myoglobin and its color due to its antioxidant properties.

- In September 2020, Diana Food S.A.S launched the first clean label, organic and Fair-Trade acerola powder. It would help the company meet the increasing consumer demand for natural and healthy products to support well-being.

- In June 2020, CAIF introduced a new acerola powder extract with a minimum of 32% of native vitamin C. This will help the company cater to extensive demand for its customers.

Frequently Asked Questions (FAQ):

What is Acerola Extract?

Acerola extract is derived from the acerola cherry, which is known for its high levels of vitamin C. It is commonly used as a dietary supplement and ingredient in skincare products.

What are the benefits of Acerola extract?

Acerola extract is a rich source of Vitamin C and antioxidants that support immune system, skin health and combat oxidative stress.

What is the demand for Acerola extract in the food and beverage industry?

The demand for Acerola extract in the food and beverage industry is growing due to increasing consumer demand for functional foods with high Vitamin C content and antioxidant properties.

I am interested in understanding the research methodology on how you arrived at the market size and segmental splits before making a purchase decision. Can you provide me with an explanation on the same?

Yes, detailed explanation of research methodology can be provided over a scheduled call, it will also enable us to explain all your queries in detail. For a brief overview and knowledge: Multiple approaches have been adopted to understand the holistic view of this market including:

- Bottom up approach

- Top down approach (Based on global market)

- Primary interviews with industry experts

- Data triangulation

What kind of information is provided in the competitive landscape section?

For the list of below mentioned players, company profiles provide insights such as business overview covering information on the company’s business segments, financials, geographic presence and revenue mix and business revenue mix. The company profiles section also provides information on product offerings, key developments associated with the company, SWOT analysis and MnM view to elaborate analyst view on the company. Some of the key players in the market include DSM (Netherlands), Kemin Industries, Inc. (US), Dohler GmbH (Germany), The Green Labs LLC (US), and Diana Food S.A.S. (France). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 28)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

FIGURE 1 MARKET SEGMENTATION

1.3.1 INCLUSIONS AND EXCLUSIONS

1.3.2 REGIONS COVERED

1.3.3 PERIODIZATION CONSIDERED

1.4 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES CONSIDERED, 2017–2020

1.5 VOLUME UNITS CONSIDERED

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 33)

2.1 RESEARCH DATA

FIGURE 2 MARKET FOR ACEROLA EXTRACT: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primary profiles

2.1.2.3 Key primary insights

2.2 MARKET SIZE ESTIMATION

2.2.1 APPROACH ONE – BOTTOM-UP (BASED ON REGIONS)

2.2.2 APPROACH TWO – TOP-DOWN (BASED ON THE GLOBAL MARKET)

2.3 DATA TRIANGULATION

FIGURE 3 DATA TRIANGULATION METHODOLOGY

2.4 ASSUMPTIONS FOR THE STUDY

2.5 LIMITATION AND RISK ASSESSMENT OF THE STUDY

2.6 MARKET SCENARIOS CONSIDERED FOR THE IMPACT OF COVID-19

2.6.1 OPTIMISTIC SCENARIO

2.6.2 REALISTIC & PESSIMISTIC SCENARIO

2.6.3 SCENARIO-BASED MODELING

2.7 INTRODUCTION TO COVID-19

2.8 COVID-19 HEALTH ASSESSMENT

FIGURE 4 COVID-19: GLOBAL PROPAGATION

FIGURE 5 COVID-19 PROPAGATION: SELECT COUNTRIES

2.9 COVID-19 ECONOMIC ASSESSMENT

FIGURE 6 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

2.9.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 7 CRITERIA IMPACTING GLOBAL ECONOMY

FIGURE 8 SCENARIOS IN TERMS OF RECOVERY OF GLOBAL ECONOMY

3 EXECUTIVE SUMMARY (Page No. - 49)

TABLE 2 MARKET SNAPSHOT, 2021 VS. 2026

FIGURE 9 IMPACT OF COVID-19 ON THE ACEROLA EXTRACT MARKET SIZE, BY SCENARIO, 2020 VS. 2021 (USD THOUSAND)

FIGURE 10 MARKET SIZE, BY APPLICATION, 2021 VS. 2026 (USD THOUSAND)

FIGURE 11 MARKET SIZE FOR ACEROLA EXTRACT, BY FORM, 2021 VS. 2026 (USD THOUSAND)

FIGURE 12 MARKET SIZE, BY NATURE, 2021 VS. 2026 (USD THOUSAND)

FIGURE 13 MARKET SHARE (VALUE), BY REGION, 2020

4 PREMIUM INSIGHTS (Page No. - 54)

4.1 ATTRACTIVE OPPORTUNITIES IN THE MARKET

FIGURE 14 INCREASING DEMAND FOR NATURAL ANTIOXIDANTS TO PROPEL THE MARKET

4.2 MARKET FOR ACEROLA EXTRACT, BY TYPE

FIGURE 15 CONVENTIONAL SEGMENT TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

4.3 MARKET FOR ACEROLA EXTRACT, BY FORM

FIGURE 16 DRY SEGMENT TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

4.4 NORTH AMERICA: MARKET FOR ACEROLA EXTRACT, BY APPLICATION AND COUNTRY

FIGURE 17 MEAT PRODUCTS SEGMENT AND THE UNITED STATES TO ACCOUNT FOR THE LARGEST SHARES IN THE NORTH AMERICAN MARKET IN 2020

4.5 MARKET FOR ACEROLA EXTRACT, BY APPLICATION

FIGURE 18 MEAT PRODUCTS SEGMENT TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

4.6 MARKET FOR ACEROLA EXTRACT, BY APPLICATION AND REGION

FIGURE 19 NORTH AMERICA TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

FIGURE 20 COVID-19 IMPACT ON THE ACEROLA EXTRACT MARKET: COMPARISON OF PRE-AND POST-COVID-19 SCENARIOS

5 MARKET OVERVIEW (Page No. - 59)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 21 ACEROLA EXTRACT MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Health benefits provided by acerola extract and its increasing applications in the food & beverage industry

5.2.1.2 Rising demand for food & beverage products with an extended shelf life

5.2.1.3 Rising demand for natural antioxidants in the meat & poultry industry

5.2.2 RESTRAINTS

5.2.2.1 Easy availability of substitutes

5.2.2.2 Side effects associated with the excessive consumption of acerola-based vitamin C

5.2.3 OPPORTUNITIES

5.2.3.1 Growing trend of clean-label products across the global food & beverage industry

5.2.4 CHALLENGES

5.2.4.1 Stringent government regulations are one of the major challenges of the market

5.2.5 COVID-19 IMPACT ANALYSIS: (MARKET DYNAMICS)

6 INDUSTRY TRENDS (Page No. - 64)

6.1 INTRODUCTION

6.2 VALUE CHAIN

6.2.1 RESEARCH & DEVELOPMENT

6.2.2 RAW MATERIAL SOURCING

6.2.3 PRODUCTION AND PROCESSING

6.2.4 PACKAGING

6.2.5 MARKETING & DISTRIBUTION

6.2.6 END-USE INDUSTRY

FIGURE 22 VALUE CHAIN ANALYSIS OF THE ACEROLA EXTRACT MARKET: RESEARCH & DEVELOPMENT AND RAW MATERIAL SOURCING ARE THE KEY CONTRIBUTORS

6.3 SUPPLY CHAIN ANALYSIS

FIGURE 23 SUPPLY CHAIN ANALYSIS OF THE MARKET

6.4 PRICING ANALYSIS: THE ACEROLA EXTRACT MARKET

TABLE 3 GLOBAL ACEROLA EXTRACT AVERAGE SELLING PRICE (ASP), BY FORM, 2019–2021 (USD/TONS)

TABLE 4 GLOBAL ACEROLA EXTRACT AVERAGE SELLING PRICE (ASP), BY REGION, 2019–2021 (USD/TONS)

6.5 MARKET MAP AND ECOSYSTEM ACEROLA EXTRACT MARKET

6.5.1 DEMAND SIDE

6.5.2 SUPPLY SIDE

FIGURE 24 ACEROLA EXTRACT: ECOSYSTEM VIEW

FIGURE 25 ACEROLA EXTRACT: MARKET MAP

TABLE 5 MARKET FOR ACEROLA EXTRACT: SUPPLY CHAIN (ECOSYSTEM)

6.6 TRENDS/DISRUPTIONS IMPACTING THE CUSTOMER’S BUSINESS

FIGURE 26 YC-YCC SHIFT FOR THE MARKET

6.7 PATENT ANALYSIS

FIGURE 27 NUMBER OF PATENTS GRANTED BETWEEN 2011 AND 2020

FIGURE 28 TOP TEN INVESTORS WITH THE HIGHEST NUMBER OF PATENT DOCUMENTS

FIGURE 29 TOP TEN APPLICANTS WITH THE HIGHEST NUMBER OF PATENT DOCUMENTS

TABLE 6 SOME OF THE PATENTS ABOUT ACEROLA EXTRACT, 2020–2021

6.8 PORTER’S FIVE FORCES ANALYSIS

TABLE 7 MARKET FOR ACEROLA EXTRACT: PORTER’S FIVE FORCES ANALYSIS

6.8.1 DEGREE OF COMPETITION

6.8.2 BARGAINING POWER OF SUPPLIERS

6.8.3 BARGAINING POWER OF BUYERS

6.8.4 THREAT OF SUBSTITUTES

6.8.5 THREAT OF NEW ENTRANTS

6.9 CASE STUDIES

6.9.1 INCREASING FRESH MEAT STABILITY

7 REGULATIONS (Page No. - 77)

7.1 NORTH AMERICA

7.1.1 UNITED STATES

7.1.1.1 Natural antioxidants

7.1.2 CANADA

TABLE 8 ADDITIVES AND THEIR PERMITTED USE IN VARIOUS FOOD APPLICATIONS IN CANADA

7.2 EUROPE

7.3 ASIA PACIFIC

7.3.1 AUSTRALIA

7.3.2 JAPAN

8 ACEROLA EXTRACT MARKET, BY APPLICATION (Page No. - 81)

8.1 INTRODUCTION

FIGURE 30 MARKET SIZE FOR ACEROLA EXTRACT, BY APPLICATION, 2021 VS. 2026 (USD THOUSAND)

TABLE 9 MARKET SIZE FOR ACEROLA EXTRACT, BY APPLICATION, 2019–2026 (USD THOUSAND)

TABLE 10 MARKET SIZE FOR ACEROLA EXTRACT, BY APPLICATION, 2019–2026 (TON)

8.1.1 COVID-19 IMPACT ON THE GLOBAL MARKET, BY APPLICATION

8.1.1.1 Optimistic scenario

TABLE 11 OPTIMISTIC SCENARIO: ACEROLA EXTRACT MARKET SIZE, BY APPLICATION, 2019–2022 (USD THOUSAND)

8.1.1.2 Realistic scenario

TABLE 12 REALISTIC SCENARIO: MARKET SIZE FOR ACEROLA EXTRACT, BY APPLICATION, 2019–2022 (USD THOUSAND)

8.1.1.3 Pessimistic scenario

TABLE 13 PESSIMISTIC SCENARIO: MARKET SIZE FOR ACEROLA EXTRACT, BY APPLICATION, 2019–2022 (USD THOUSAND)

8.2 MEAT PRODUCTS

8.2.1 USE OF THE ACEROLA EXTRACT AS AN NATURAL ANTIOXIDANT AND NATURAL CURE ACCELERATOR TO FOSTER THE GROWTH OF MEAT PRODUCTS

TABLE 14 MEAT PRODUCTS: ACEROLA EXTRACT MARKET SIZE, BY REGION, 2019–2026 (USD THOUSAND)

TABLE 15 MEAT PRODUCTS: MARKET SIZE FOR ACEROLA EXTRACT, BY REGION, 2019–2026 (TON)

TABLE 16 MEAT PRODUCTS: MARKET SIZE FOR ACEROLA EXTRACT, BY MEAT SUB-APPLICATION, 2019–2026 (USD THOUSAND)

8.2.1.1 Fresh meat

TABLE 17 FRESH MEAT: ACEROLA EXTRACT MARKET SIZE, BY REGION, 2019–2026 (USD THOUSAND)

8.2.1.2 Processed meat

TABLE 18 PROCESSED MEAT: MARKET SIZE FOR ACEROLA EXTRACT, BY REGION, 2019–2026 (USD THOUSAND)

8.3 BAKERY PRODUCTS

8.3.1 USE OF THE ACEROLA EXTRACT AS A DOUGH ENHANCER ENCOURAGES BAKERY MANUFACTURERS TO INCORPORATE IT IN THE PRODUCTION OF BAKERY PRODUCTS

TABLE 19 BAKERY PRODUCTS: MARKET SIZE FOR ACEROLA EXTRACT, BY REGION, 2019–2026 (USD THOUSAND)

TABLE 20 BAKERY PRODUCTS: MARKET SIZE FOR ACEROLA EXTRACT, BY REGION, 2019–2026 (TON)

TABLE 21 BAKERY PRODUCTS: MARKET SIZE FOR ACEROLA EXTRACT, BY BAKERY SUB-APPLICATION, 2019–2026 (USD THOUSAND)

8.3.1.1 Bread

TABLE 22 BREAD: ACEROLA EXTRACT MARKET SIZE, BY REGION, 2019–2026 (USD THOUSAND)

8.3.1.2 Sweet bakery

TABLE 23 SWEET BAKERY: MARKET SIZE FOR ACEROLA EXTRACT, BY REGION, 2019–2026 (USD THOUSAND)

8.4 CONFECTIONERIES

8.4.1 DUAL-PURPOSE USE OF THE ACEROLA EXTRACT AS AN ANTIOXIDANT AND NUTRITIONAL COMPONENT TO DRIVE ITS DEMAND IN CONFECTIONERIES

TABLE 24 CONFECTIONERIES: ACEROLA EXTRACT MARKET SIZE, BY REGION, 2019–2026 (USD THOUSAND)

TABLE 25 CONFECTIONERIES: MARKET SIZE FOR ACEROLA EXTRACT, BY REGION, 2019–2026 (TON)

8.5 DAIRY & FROZEN DESSERTS

8.5.1 BENEFITS OF ANTIOXIDANTS IN DAIRY PRODUCTS TO DRIVE THE DEMAND FOR ACEROLA EXTRACT

TABLE 26 DAIRY & FROZEN DESSERTS: ACEROLA EXTRACT MARKET SIZE, BY REGION, 2019–2026 (USD THOUSAND)

TABLE 27 DAIRY & FROZEN DESSERTS: MARKET SIZE FOR ACEROLA EXTRACT, BY REGION, 2019–2026 (TONS)

8.6 BEVERAGES

8.6.1 ACEROLA EXTRACT IS USED AS A TASTE AND SHEL-LIFE ENHANCER IN BEVERAGES DRIVING ITS DEMAND

TABLE 28 BEVERAGES: ACEROLA EXTRACT MARKET SIZE, BY REGION, 2019–2026 (USD THOUSAND)

TABLE 29 BEVERAGES: MARKET SIZE FOR ACEROLA EXTRACT, BY REGION, 2019–2026 (TONS)

8.7 OTHER APPLICATIONS

8.7.1 INCREASING DEMAND FOR NATURAL FOOD PRODUCTS TO DRIVE THE SEGMENT IN THE ACEROLA EXTRACT MARKET

TABLE 30 OTHER APPLICATIONS: ACEROLA EXTRACT MARKET SIZE, BY REGION, 2019–2026 (USD THOUSAND)

TABLE 31 OTHER APPLICATIONS: MARKET SIZE FOR ACEROLA EXTRACT, BY REGION, 2019–2026 (TONS)

9 ACEROLA EXTRACT MARKET, BY FORM (Page No. - 95)

9.1 INTRODUCTION

FIGURE 31 ACEROLA EXTRACT MARKET SIZE, BY FORM, 2021 VS. 2026 (USD THOUSAND)

TABLE 32 MARKET SIZE FOR ACEROLA EXTRACT, BY FORM, 2019–2026 (USD THOUSAND)

TABLE 33 MARKET SIZE FOR ACEROLA EXTRACT, BY FORM, 2019–2026 (TON)

9.1.1 COVID-19 IMPACT ON THE ACEROLA EXTRACT MARKET, BY FORM

9.1.1.1 Optimistic scenario

TABLE 34 OPTIMISTIC SCENARIO: ACEROLA EXTRACT MARKET SIZE, BY FORM, 2019–2022 (USD THOUSAND)

9.1.1.2 Realistic scenario

TABLE 35 REALISTIC SCENARIO: MARKET SIZE FOR ACEROLA EXTRACT, BY FORM, 2019–2022 (USD THOUSAND)

9.1.1.3 Pessimistic scenario

TABLE 36 PESSIMISTIC SCENARIO: MARKET SIZE FOR ACEROLA EXTRACT, BY FORM, 2019–2022 (USD THOUSAND)

9.2 DRY

9.2.1 DRY FORM OF ACEROLA EXTRACTS IS PREFERRED BECAUSE OF ITS EASE TO STORE AND HANDLE

TABLE 37 DRY: ACEROLA EXTRACT MARKET SIZE, BY REGION, 2019–2026 (USD THOUSAND)

TABLE 38 DRY: MARKET SIZE FOR ACEROLA EXTRACT, BY REGION, 2019–2026 (TON)

9.3 LIQUID

9.3.1 DEMAND FOR THE LIQUID ACEROLA EXTRACT TO BE LIMITED IN THE FUTURE, AS THEY DO NOT PROVIDE CONVENIENCE TO MANUFACTURERS

TABLE 39 LIQUID: ACEROLA EXTRACT MARKET SIZE, BY REGION, 2019–2026 (USD THOUSAND)

TABLE 40 LIQUID: MARKET SIZE FOR ACEROLA EXTRACT, BY REGION, 2019–2026 (USD TON)

10 ACEROLA EXTRACT MARKET, BY NATURE (Page No. - 101)

10.1 INTRODUCTION

FIGURE 32 ACEROLA EXTRACT MARKET SIZE, BY NATURE, 2021 VS. 2026 (USD THOUSAND)

TABLE 41 MARKET SIZE FOR ACEROLA EXTRACT, BY NATURE, 2019–2026 (USD THOUSAND)

TABLE 42 MARKET SIZE FOR ACEROLA EXTRACT, BY NATURE, 2019–2026 (TON)

10.1.1 COVID-19 IMPACT ON THE ACEROLA EXTRACT MARKET, BY NATURE

10.1.1.1 Optimistic scenario

TABLE 43 OPTIMISTIC SCENARIO: ACEROLA EXTRACT MARKET SIZE, BY NATURE, 2019–2022 (USD THOUSAND)

10.1.1.2 Realistic scenario

TABLE 44 REALISTIC SCENARIO: MARKET SIZE FOR ACEROLA EXTRACT, BY NATURE, 2019–2022 (USD THOUSAND)

10.1.1.3 Pessimistic scenario

TABLE 45 PESSIMISTIC SCENARIO: MARKET SIZE FOR ACEROLA EXTRACT, BY NATURE, 2019–2022 (USD THOUSAND)

10.2 CONVENTIONAL

10.2.1 INCREASED ACEROLA PRODUCE BY CONVENTIONAL FARMING TO DRIVE THE GROWTH OF THE CONVENTIONAL SEGMENT IN THE ACEROLA EXTRACT MARKET

TABLE 46 CONVENTIONAL: ACEROLA EXTRACT MARKET SIZE, BY REGION, 2019–2026 (USD THOUSAND)

TABLE 47 CONVENTIONAL: MARKET SIZE FOR ACEROLA EXTRACT, BY REGION, 2019–2026 (TON)

10.3 ORGANIC

10.3.1 INCREASING DEMAND FOR CLEAN-LABEL PRODUCTS TO BOOST THE ORGANIC SEGMENT IN THE MARKET

TABLE 48 ORGANIC: ACEROLA EXTRACT MARKET SIZE, BY REGION, 2019–2026 (USD THOUSAND)

TABLE 49 ORGANIC: MARKET SIZE FOR ACEROLA EXTRACT, BY REGION, 2019–2026 (USD TON)

11 ACEROLA EXTRACT MARKET, BY FUNCTIONALITY (Page No. - 107)

11.1 INTRODUCTION

11.2 ANTIOXIDANT

11.2.1 INCREASING DEMAND FOR NATURAL ANTIOXIDANTS TO BOOST THE SEGMENT GROWTH

11.3 FORTIFICATION

11.3.1 INCREASING HEALTH AWARENESS TO DRIVE THE GROWTH OF THE SEGMENT IN THE MARKET

12 ACEROLA EXTRACT MARKET, BY REGION (Page No. - 109)

12.1 INTRODUCTION

FIGURE 33 REGIONAL SNAPSHOT: CHINA AND INDIA TO ACCOUNT FOR THE HIGHEST CAGR IN THE ACEROLA EXTRACT MARKET IN 2020

TABLE 50 MARKET SIZE FOR ACEROLA EXTRACT, BY REGION, 2019–2026 (USD THOUSAND)

TABLE 51 MARKET SIZE FOR ACEROLA EXTRACT, BY REGION, 2019–2026 (TON)

12.2 COVID-19 IMPACT ON THE ACEROLA EXTRACT MARKET, BY REGION

12.2.1 OPTIMISTIC SCENARIO

TABLE 52 OPTIMISTIC SCENARIO: ACEROLA EXTRACT MARKET SIZE, BY REGION, 2019–2022 (USD THOUSAND)

12.2.2 REALISTIC SCENARIO

TABLE 53 REALISTIC SCENARIO: MARKET SIZE FOR ACEROLA EXTRACT, BY REGION, 2019–2022 (USD THOUSAND)

12.2.3 PESSIMISTIC SCENARIO

TABLE 54 PESSIMISTIC SCENARIO: MARKET SIZE FOR ACEROLA EXTRACT, BY REGION, 2019–2022 (USD THOUSAND)

12.3 NORTH AMERICA

FIGURE 34 NORTH AMERICA: ACEROLA EXTRACT MARKET SNAPSHOT

TABLE 55 NORTH AMERICA MARKET SIZE FOR ACEROLA EXTRACT, BY COUNTRY, 2019–2026 (USD THOUSAND)

TABLE 56 NORTH AMERICA: MARKET SIZE FOR ACEROLA EXTRACT, BY APPLICATION, 2019–2026 (USD THOUSAND)

TABLE 57 NORTH AMERICA: MARKET SIZE FOR ACEROLA EXTRACT, BY APPLICATION, 2019–2026 (TON)

TABLE 58 NORTH AMERICA: MARKET SIZE FOR ACEROLA EXTRACT, BY MEAT SUB-APPLICATION, 2019–2026 (USD THOUSAND)

TABLE 59 NORTH AMERICA: MARKET SIZE FOR ACEROLA EXTRACT, BY BAKERY SUB-APPLICATION, 2019–2026 (USD THOUSAND)

TABLE 60 NORTH AMERICA: MARKET SIZE FOR ACEROLA EXTRACT, BY FORM, 2019–2026 (USD THOUSAND)

TABLE 61 NORTH AMERICA: MARKET SIZE FOR ACEROLA EXTRACT, BY FORM, 2019–2026 (TON)

TABLE 62 NORTH AMERICA: MARKET SIZE FOR ACEROLA EXTRACT, BY NATURE, 2019–2026 (USD THOUSAND)

TABLE 63 NORTH AMERICA: MARKET SIZE FOR ACEROLA EXTRACT, BY NATURE, 2019–2026 (TON)

12.3.1 UNITED STATES

12.3.1.1 High consumption of meat & meat products to drive the demand for acerola extract in the US

12.3.1.2 Increasing export of the US bread

TABLE 64 UNITED STATES: ACEROLA EXTRACT MARKET SIZE, BY APPLICATION, 2019–2026 (USD THOUSAND)

12.3.2 CANADA

12.3.2.1 Increasing demand for natural and organic food & beverage products to contribute to the acerola extract market growth

TABLE 65 CANADA: MARKET SIZE FOR ACEROLA EXTRACT, BY APPLICATION, 2019–2026 (USD THOUSAND)

12.3.3 MEXICO

12.3.3.1 Large scale consumption of meat & meat products to drive the demand for acerola extract in the country

TABLE 66 MEXICO: ACEROLA EXTRACT MARKET SIZE, BY APPLICATION, 2019–2026 (USD THOUSAND)

12.4 EUROPE

TABLE 67 EUROPE: ACEROLA EXTRACT MARKET SIZE, BY COUNTRY, 2019–2026 (USD THOUSAND)

TABLE 68 EUROPE: MARKET SIZE FOR ACEROLA EXTRACT, BY APPLICATION, 2019–2026 (USD THOUSAND)

TABLE 69 EUROPE: MARKET SIZE FOR ACEROLA EXTRACT, BY APPLICATION, 2019–2026 (TON)

TABLE 70 EUROPE: MARKET SIZE FOR ACEROLA EXTRACT, BY MEAT SUB-APPLICATION, 2019–2026 (USD THOUSAND)

TABLE 71 EUROPE: MARKET SIZE FOR ACEROLA EXTRACT, BY BAKERY SUB-APPLICATION, 2019–2026 (USD THOUSAND)

TABLE 72 EUROPE: MARKET SIZE FOR ACEROLA EXTRACT, BY FORM, 2019–2026 (USD THOUSAND)

TABLE 73 EUROPE: MARKET SIZE FOR ACEROLA EXTRACT, BY FORM, 2019–2026 (TON)

TABLE 74 EUROPE: MARKET SIZE FOR ACEROLA EXTRACT, BY NATURE, 2019–2026 (USD THOUSAND)

TABLE 75 EUROPE: MARKET SIZE FOR ACEROLA EXTRACT, BY NATURE, 2019–2026 (TON)

12.4.1 GERMANY

12.4.1.1 High consumption of bakery products to drive the demand for acerola extract in the country

TABLE 76 GERMANY: ACEROLA EXTRACT MARKET SIZE, BY APPLICATION, 2019–2026 (USD THOUSAND)

12.4.2 UNITED KINGDOM

12.4.2.1 Large-scale meat consumption to propel the growth of the acerola extract market in the UK

TABLE 77 UNITED KINGDOM: MARKET SIZE FOR ACEROLA EXTRACT, BY APPLICATION, 2019–2026 (USD THOUSAND)

12.4.3 FRANCE

12.4.3.1 Presence of various bakery products as a daily staple in France to drive the growth of the market

TABLE 78 FRANCE: ACEROLA EXTRACT MARKET SIZE, BY APPLICATION, 2019–2026 (USD THOUSAND)

12.4.4 ITALY

12.4.4.1 Booming bakery & confectionery industry to drive the growth of the market in Italy

TABLE 79 ITALY: MARKET SIZE FOR ACEROLA EXTRACT, BY APPLICATION, 2019–2026 (USD THOUSAND)

12.4.5 SPAIN

12.4.5.1 High consumption of meat & meat products to drive the growth of the market

TABLE 80 SPAIN: ACEROLA EXTRACT MARKET SIZE, BY APPLICATION, 2019–2026 (USD THOUSAND)

12.4.6 REST OF EUROPE

TABLE 81 REST OF EUROPE: ACEROLA EXTRACT MARKET SIZE, BY APPLICATION, 2019–2026 (USD THOUSAND)

12.5 ASIA PACIFIC

FIGURE 35 ASIA PACIFIC: ACEROLA EXTRACT MARKET SNAPSHOT

TABLE 82 ASIA PACIFIC: MARKET SIZE FOR ACEROLA EXTRACT, BY COUNTRY, 2019–2026 (USD THOUSAND)

TABLE 83 ASIA PACIFIC: MARKET SIZE FOR ACEROLA EXTRACT, BY APPLICATION, 2019–2026 (USD THOUSAND)

TABLE 84 ASIA PACIFIC: MARKET SIZE FOR ACEROLA EXTRACT, BY APPLICATION, 2019–2026 (TON)

TABLE 85 ASIA PACIFIC: MARKET SIZE FOR ACEROLA EXTRACT, BY MEAT SUB-APPLICATION, 2019–2026 (USD THOUSAND)

TABLE 86 ASIA PACIFIC: MARKET SIZE FOR ACEROLA EXTRACT, BY BAKERY SUB-APPLICATION, 2019–2026 (USD THOUSAND)

TABLE 87 ASIA PACIFIC: MARKET SIZE FOR ACEROLA EXTRACT, BY FORM, 2019–2026 (USD THOUSAND)

TABLE 88 ASIA PACIFIC: MARKET SIZE FOR ACEROLA EXTRACT, BY FORM, 2019–2026 (TON)

TABLE 89 ASIA PACIFIC: MARKET SIZE FOR ACEROLA EXTRACT, BY NATURE, 2019–2026 (USD THOUSAND)

TABLE 90 ASIA PACIFIC: MARKET SIZE FOR ACEROLA EXTRACT, BY NATURE, 2019–2026 (TON)

12.5.1 CHINA

12.5.1.1 Rise in demand for meat products to foster the acerola extract market growth

TABLE 91 CHINA: ACEROLA EXTRACT MARKET SIZE, BY APPLICATION, 2019–2026 (USD THOUSAND)

12.5.2 INDIA

12.5.2.1 Increasing use of acerola extract in clean-label bakery products

TABLE 92 INDIA: MARKET SIZE FOR ACEROLA EXTRACT, BY APPLICATION, 2019–2026 (USD THOUSAND)

12.5.3 JAPAN

12.5.3.1 Increasing demand for poultry and pork meat to drive the demand for acerola extract in the country

TABLE 93 JAPAN: MARKET SIZE FOR ACEROLA EXTRACT, BY APPLICATION, 2019–2026 (USD THOUSAND)

12.5.4 AUSTRALIA & NEW ZEALAND

12.5.4.1 Acerola extract market is growing in the country as the demand for clean-label products is increasing

TABLE 94 AUSTRALIA & NEW ZEALAND: ACEROLA EXTRACT MARKET SIZE, BY APPLICATION, 2019–2026 (USD THOUSAND)

12.5.5 REST OF ASIA PACIFIC

TABLE 95 REST OF ASIA PACIFIC: ACEROLA EXTRACT MARKET SIZE, BY APPLICATION, 2019–2026 (USD THOUSAND)

12.6 SOUTH AMERICA

TABLE 96 SOUTH AMERICA: ACEROLA EXTRACT MARKET SIZE, BY COUNTRY, 2019–2026 (USD THOUSAND)

TABLE 97 SOUTH AMERICA: MARKET SIZE FOR ACEROLA EXTRACT, BY APPLICATION, 2019–2026 (USD THOUSAND)

TABLE 98 SOUTH AMERICA: MARKET SIZE FOR ACEROLA EXTRACT, BY APPLICATION, 2019–2026 (TON)

TABLE 99 SOUTH AMERICA: MARKET SIZE FOR ACEROLA EXTRACT, BY MEAT SUB-APPLICATION, 2019–2026 (USD THOUSAND)

TABLE 100 SOUTH AMERICA: MARKET SIZE FOR ACEROLA EXTRACT, BY BAKERY SUB-APPLICATION, 2019–2026 (USD THOUSAND)

TABLE 101 SOUTH AMERICA: MARKET SIZE FOR ACEROLA EXTRACT, BY FORM, 2019–2026 (USD THOUSAND)

TABLE 102 SOUTH AMERICA: MARKET SIZE FOR ACEROLA EXTRACT, BY FORM, 2019–2026 (TON)

TABLE 103 SOUTH AMERICA: MARKET SIZE FOR ACEROLA EXTRACT, BY NATURE, 2019–2026 (USD THOUSAND)

TABLE 104 SOUTH AMERICA: MARKET SIZE FOR ACEROLA EXTRACT, BY NATURE, 2019–2026 (TON)

12.6.1 BRAZIL

12.6.1.1 Rise in awareness about the benefits of acerola extract as a natural antioxidant boost the acerola extract market

TABLE 105 BRAZIL: MARKET SIZE FOR ACEROLA EXTRACT, BY APPLICATION, 2019–2026 (USD THOUSAND)

12.6.2 ARGENTINA

12.6.2.1 Increase in meat exports by the country to encourage the market growth

TABLE 106 ARGENTINA: ACEROLA EXTRACT MARKET SIZE, BY APPLICATION, 2019–2026 (USD THOUSAND)

12.6.3 REST OF SOUTH AMERICA

12.6.3.1 Increasing use of natural antioxidants to contribute to the growth of the market in the region

TABLE 107 REST OF SOUTH AMERICA: ACEROLA EXTRACT MARKET SIZE, BY APPLICATION, 2019–2026 (USD THOUSAND)

12.7 REST OF THE WORLD

TABLE 108 REST OF THE WORLD: ACEROLA EXTRACT MARKET SIZE, BY COUNTRY, 2019–2026 (USD THOUSAND)

TABLE 109 REST OF THE WORLD: MARKET SIZE FOR ACEROLA EXTRACT, BY APPLICATION, 2019–2026 (USD THOUSAND)

TABLE 110 REST OF THE WORLD: MARKET SIZE FOR ACEROLA EXTRACT, BY APPLICATION, 2019–2026 (TON)

TABLE 111 REST OF THE WORLD: MARKET SIZE FOR ACEROLA EXTRACT, BY MEAT SUB-APPLICATION, 2019–2026 (USD THOUSAND)

TABLE 112 REST OF THE WORLD: MARKET SIZE FOR ACEROLA EXTRACT, BY BAKERY SUB-APPLICATION, 2019–2026 (USD THOUSAND)

TABLE 113 REST OF THE WORLD: MARKET SIZE FOR ACEROLA EXTRACT, BY FORM, 2019–2026 (USD THOUSAND)

TABLE 114 REST OF THE WORLD: MARKET SIZE FOR ACEROLA EXTRACT, BY FORM, 2019–2026 (TON)

TABLE 115 REST OF THE WORLD: MARKET SIZE FOR ACEROLA EXTRACT, BY NATURE, 2019–2026 (USD THOUSAND)

TABLE 116 REST OF THE WORLD: MARKET SIZE FOR ACEROLA EXTRACT, BY NATURE, 2019–2026 (TON)

12.7.1 MIDDLE EAST

12.7.1.1 Increasing demand for meat products to drive the acerola extract market

TABLE 117 MIDDLE EAST: MARKET SIZE FOR ACEROLA EXTRACT, BY APPLICATION, 2019–2026 (USD THOUSAND)

12.7.2 AFRICA

12.7.2.1 Introduction of affordable range of plant-based meat products by key players in South Africa

TABLE 118 AFRICA: MARKET SIZE FOR ACEROLA EXTRACT, BY APPLICATION, 2019–2026 (USD THOUSAND)

13 COMPETITIVE LANDSCAPE (Page No. - 147)

13.1 OVERVIEW

13.2 MARKET SHARE ANALYSIS, 2020

TABLE 119 MARKET SHARE ANALYSIS, 2020

13.3 COVID-19- SPECIFIC COMPANY RESPONSE

13.4 COMPANY EVALUATION QUADRANT (KEY PLAYERS)

13.4.1 STARS

13.4.2 PERVASIVE PLAYERS

13.4.3 EMERGING LEADERS

13.4.4 PARTICIPANTS

FIGURE 36 ACEROLA EXTRACT MARKET, COMPANY EVALUATION QUADRANT, 2020 (KEY PLAYERS)

13.4.5 PRODUCT FOOTPRINT (KEY PLAYERS)

TABLE 120 COMPANY FOOTPRINT, BY APPLICATION (KEY PLAYERS)

TABLE 121 COMPANY FOOTPRINT, BY FORM (KEY PLAYERS)

TABLE 122 COMPANY REGIONAL, BY REGIONAL FOOTPRINT (KEY PLAYERS)

TABLE 123 OVERALL COMPANY FOOTPRINT (KEY PLAYERS)

13.5 MARKET FOR ACEROLA EXTRACT, START-UP/SME EVALUATION QUADRANT, 2020

13.5.1 PROGRESSIVE COMPANIES

13.5.2 STARTING BLOCKS

13.5.3 RESPONSIVE COMPANIES

13.5.4 DYNAMIC COMPANIES

FIGURE 37 MARKET FOR ACEROLA EXTRACT: COMPANY EVALUATION QUADRANT, 2020 (START-UP/SMES)

13.5.5 PRODUCT FOOTPRINT (START-UP/SMES)

TABLE 124 COMPANY FOOTPRINT, BY APPLICATION (START-UP/SMES)

TABLE 125 COMPANY FOOTPRINT, BY FORM (START-UP/SMES)

TABLE 126 COMPANY REGIONAL, BY REGION FOOTPRINT (START-UP/SMES)

TABLE 127 OVERALL COMPANY FOOTPRINT (START-UP/SMES)

13.6 COMPETITIVE SCENARIO

13.6.1 NEW PRODUCT LAUNCHES

TABLE 128 MARKET FOR ACEROLA EXTRACT: NEW PRODUCT LAUNCHES, 2020

14 COMPANY PROFILES (Page No. - 158)

(Business Overview, Products Offered, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

14.1 DSM

TABLE 129 DSM: BUSINESS OVERVIEW

FIGURE 38 DSM: COMPANY SNAPSHOT

TABLE 130 DSM: PRODUCT OFFERINGS

14.2 KEMIN INDUSTRIES, INC.

TABLE 131 KEMIN INDUSTRIES: BUSINESS OVERVIEW

TABLE 132 KEMIN INDUSTRIES: PRODUCT OFFERINGS

14.3 DOHLER GMBH

TABLE 133 DOHLER GMBH: BUSINESS OVERVIEW

TABLE 134 DOHLER GMBH: PRODUCT OFFERINGS

14.4 THE GREEN LABS

TABLE 135 THE GREEN LABS LLC: BUSINESS OVERVIEW

TABLE 136 THE GREEN LABS LLC: PRODUCT OFFERINGS

14.5 DIANA FOOD S.A.S.

TABLE 137 DIANA FOOD S.A.S.: BUSINESS OVERVIEW

TABLE 138 DIANA FOOD S.A.S. PRODUCT OFFERINGS

TABLE 139 DIANA FOOD S.A.S.: DEALS

14.6 NATUREX S.A.

TABLE 140 NATUREX S.A.: BUSINESS OVERVIEW

TABLE 141 NATUREX S.A.: PRODUCT OFFERINGS

14.7 NUTRIBOTANICA

TABLE 142 NUTRIBOTANICA: BUSINESS OVERVIEW

TABLE 143 NUTRIBOTANICA: PRODUCT OFFERINGS

14.8 HANDARY SA

TABLE 144 HANDARY SA: BUSINESS OVERVIEW

TABLE 145 HANDARY SA: PRODUCT OFFERINGS

14.9 FOODCHEM INTERNATIONAL CORPORATION

TABLE 146 FOODCHEM INTERNATIONAL CORPORATION: BUSINESS OVERVIEW

TABLE 147 FOODCHEM INTERNATIONAL CORPORATION: PRODUCT OFFERINGS

14.10 NICHIREI DO BRASIL AGRÍCOLA LTDA.

TABLE 148 NICHIREI DO BRASIL AGRÍCOLA LTDA.: BUSINESS OVERVIEW

TABLE 149 NICHIREI DO BRASIL AGRÍCOLA LTDA.: PRODUCT OFFERINGS

14.11 NEXIRA

TABLE 150 NEXIRA: BUSINESS OVERVIEW

TABLE 151 NEXIRA: PRODUCT OFFERINGS

TABLE 152 NEXIRA: DEALS

14.12 CAIF

TABLE 153 CAIF: BUSINESS OVERVIEW

TABLE 154 CAIF: PRODUCT OFFERINGS

TABLE 155 CAIF: DEALS

14.13 NUTRA GREEN BIOTECHNOLOGY CO., LTD.

TABLE 156 NUTRA GREEN BIOTECHNOLOGY: BUSINESS OVERVIEW

TABLE 157 NUTRA GREEN BIOTECHNOLOGY: PRODUCT OFFERINGS

14.14 VIDYA HERBS PVT LTD

TABLE 158 VIDYA HERBS: BUSINESS OVERVIEW

TABLE 159 VIDYA HERBS: PRODUCT OFFERINGS

14.15 BR INGREDIENTS

TABLE 160 BR INGREDIENTS: BUSINESS OVERVIEW

TABLE 161 BR INGREDIENTS: PRODUCT OFFERINGS

14.16 BLUE MACAW FLORA

14.17 HANGZHOU MUHUA BIO-TECH CO., LTD

14.18 HERBO NUTRA

14.19 HERBAL CREATIVE

14.20 VITAL HERBS

*Details on Business Overview, Products Offered, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

15 ADJACENT AND RELATED MARKETS (Page No. - 185)

15.1 INTRODUCTION

TABLE 162 ADJACENT MARKETS TO ACEROLA EXTRACT

15.2 LIMITATIONS

15.3 FOOD ANTIOXIDANTS MARKET

15.3.1 MARKET DEFINITION

15.3.2 MARKET OVERVIEW

TABLE 163 FOOD ANTIOXIDANTS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

15.4 BOTANICAL EXTRACTS MARKET

15.4.1 MARKET DEFINITION

15.4.2 MARKET OVERVIEW

TABLE 164 BOTANICAL EXTRACTS MARKET SIZE, BY SOURCE, 2015–2022 (USD MILLION)

16 APPENDIX (Page No. - 188)

16.1 DISCUSSION GUIDE

16.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

16.3 AVAILABLE CUSTOMIZATIONS

16.4 RELATED REPORTS

16.5 AUTHOR DETAILS

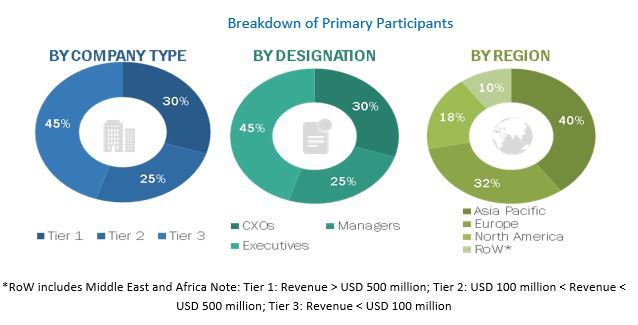

The study involved four major activities in estimating acerola extract market size. Exhaustive secondary research was conducted to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet, were referred to, to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold & silver standard websites, regulatory bodies, trade directories, and databases.

Primary Research

The market comprises several stakeholders in the supply chain, including processed food manufacturers, nutritional beverage manufacturers, meat manufacturers, bakery manufacturers, confectionery manufacturers, acerola and acerola extract manufacturers, food & beverages importers and exporters, and intermediary suppliers such as traders and distributors of food additives. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The primary interviewees from the supply side include acerola and acerola extract manufacturers. The primary sources from the demand side include distributors, importers, exporters, and end-use sectors.

Given below is the breakdown of the primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of acerola extracts market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size include the following:

- The key players were identified through extensive primary and secondary research.

- The value chain and market size of acerola extracts market, in terms of value and volume, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, newsletters of top market players, along with extensive interviews for opinions from key leaders, such as CEOs, directors, and marketing executives.

Data Triangulation

After arriving at the overall market size from the estimation process described above, the total market was split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all segments, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides. In addition, the market size was validated using both top-down and bottom-up approaches. It was then verified through primary interviews. Hence, three approaches were adopted—top-down approach, bottom-up approach, and the one involving expert interviews. Only when the values arrived at from the three points matches, the data is assumed to be correct.

Report Objectives

- To describe and forecast acerola extracts market, in terms of applications, form, nature, and region

- To describe and forecast acerola extracts market, in terms of value, by region–North America, Europe, Asia Pacific, South America, and the Rest of the World—along with their respective countries

- To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze micro-markets with respect to individual growth trends, prospects, and contributions to the overall market

- To study the complete value chain of acerola extracts market

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of acerola extracts market

- To strategically profile the key players and comprehensively analyze their market positions, in terms of ranking and core competencies, along with details on the competitive landscape of market leaders

- To analyze strategic approaches, such as expansions & investments, product launches & approvals, mergers & acquisitions, and agreements in acerola extracts market

Available Customizations

Based on the given market data, MarketsandMarkets offers customizations in the reports according to client-specific requirements. The available customization options are as follows:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakdown of the Rest of Asia Pacific acerola extract market, by key country

- Further breakdown of the Rest of European acerola extract market, by key country

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Acerola Extract Market