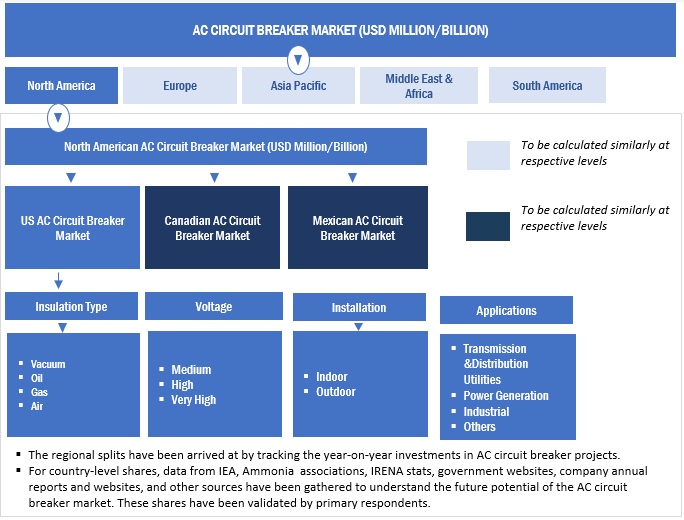

AC Circuit Breaker Market by Insulation Type (Air, Gas, Vacuum), Voltage (Medium, High, Very-high), Installation (Indoor, Outdoor), End-Use Industry (Transmission & Distribution Utilities, Power Generation, Industrial) & Region - Global Forecast to 2028

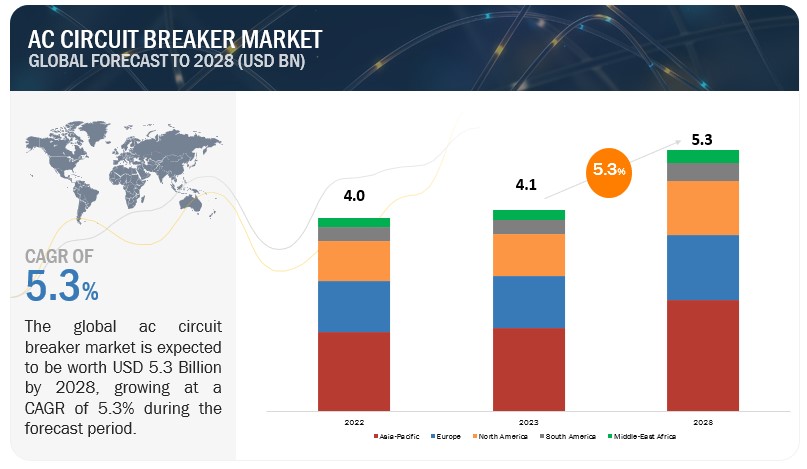

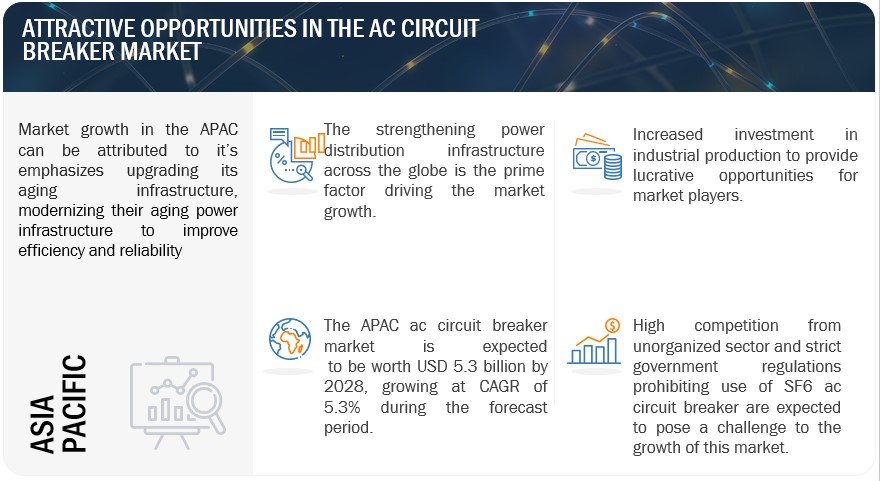

[265 Pages Report] The global AC circuit breaker market is expected to grow from an estimated USD 4.1 billion in 2023 to USD 5.3 billion by 2028, at a CAGR of 5.3% from 2023 to 2028. Strengthening of power distribution infrastructure is driving the demand of ac circuit breaker market. This progress is due to the rising per capita income, growing middle-class population, expanding urbanization, and increasing access to electricity in remotely located areas. Rural electrification in some developing countries is expected to bypass large national grids in favor of distributed power generation. For instance, the Indian Government is focusing on increasing the penetration of power supply in villages with the help of schemes such as the Restructured Accelerated Power Development and Reforms Program (R-APDRP) and Deendayal Upadhyaya Gram Jyoti Yojana (DDUGJY). These schemes are providing an excellent opportunity for the ac circuit breakers market.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

AC Circuit Breaker Market Dynamics

Driver: Increasing capacity additions and enhancements for T&D networks

Developing countries such as India and China and countries in Southeast Asia are witnessing a continuous increase in the demand for electricity. These countries have a high rate of urbanization and industrialization, requiring additional capacity to support the increased loads. The Indian Government is also planning on adding generation capacity along with its T&D infrastructure. Therefore, the AC circuit breaker market is expected to have the highest growth in India. Once the power is generated, it needs to be distributed to end users such as renewable companies and industries. As AC circuit breakers are required to distribute power networks, capacity addition and enhancement plans are expected to drive the circuit breaker market.

Restraint: Competition from unorganized sector

Major AC circuit breaker manufacturers face tough competition from unorganized market players that supply cheap and low-quality products. Unorganized players in the market include local players and gray market players. Local players sell goods manufactured in-house with their local brand name, whereas gray market players refer to the import and sale of goods by unauthorized dealers.

These market players from the unorganized sector overpower the big players in terms of price competitiveness and the local supply network they maintain, which is difficult for global players to achieve. The growth in AC circuit breaker sales from the gray market deteriorates the brand name of the market leaders if cheap-quality goods are sold under their brand name. Increasing sales from both local and gray market players reduce the opportunity for global players to increase their revenue (market share).

Opportunity : Emerging smart technologies and digitalization systems

A smart grid is a digital technology that modernizes electricity networks by providing 2-way communication between the utility and its customers. Global power utilities are increasingly investing in smart grid technologies to control and protect power equipment. At the end-user level, smart grids can enable demand flexibility and consumer participation in energy system operations through distributed generation and storage.

The expansion of the IoT has fostered the development of smart technologies in fields such as power transmission and distribution systems (as is the smart grid). The network communication infrastructure for a smart AC circuit breaker system has high requirements from functionality, performance, and security point of view, given the large amount of distributed connected elements and the real-time information transmission and system management. In addition, smart AC circuit breakers (SCB) can offer improved protection as well as “smart” detection and management of grid faults.

Challenge : Risk of cybersecurity attacks and installation of modernized circuit breakers

AC circuit breakers face various cybersecurity threats, such as grid instability, data theft, or security breach, which can be done by bypassing securities on remote access, leading to blackouts and power outages. These outages are the result of incorrect settings in a relay or AC circuit breaker, which determines the response (or non-response) of the device. Incorrect settings may have serious effects on the power system operation. This can be avoided by developing dedicated secure networks for monitoring and controlling the devices/equipment. Developing such a network and assuring control of elements pose a challenge as well as provide opportunities for industry players to develop a secure and safe solution for data acquisition and monitoring along with new-age devices.

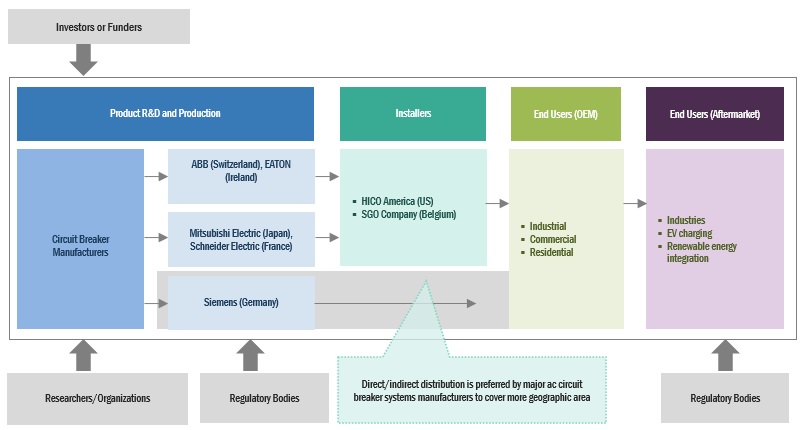

AC Circuit Breaker Market Ecosystem

Prominent companies in this market include well-established, financially stable manufacturers of ac circuit breakers Market and components. These companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Prominent companies in this market include Eaton (Ireland), ABB (Switzerland), Siemens (Germany), Mitsubishi Electric (Japan), and Schneider Electric (France).

The high voltage segment by voltage holds the second largest segment in 2022

The These AC circuit breakers are manufactured based on a modular design with identical interrupter units, operating mechanisms, and control elements for all types, whether for GIS or AIS applications. GIS between 72.5 kV and 220 kV are mostly used in transmission systems; with the growing global demand for electricity, an increase in demand for these circuit breakers is expected.

According to the IEA, in 2022, the total global energy consumption grew by 2.3%, twice as fast as the average rate over the last 10 years. Investments in the transmission infrastructure are driven by emerging economies such as India, China, the UAE, and Argentina, which is likely to strengthen the market for circuit breakers under this segment.

Indoor segment by installation is estimated to be the second-largest segment for ac circuit breaker market

Medium-voltage indoor AC circuit breakers are approximately from 1.1 to 36 kV. They find applications in large commercial buildings (skyscrapers, airports, and hospitals) and industrial plants (chemical plants, cement plants, food & beverage plants, and power grid distribution systems). These AC circuit breakers are also suitable for generator operations and industrial applications.

Oil segment by insulation type is estimated to be the fourth largest segment for ac circuit breaker market

Gas-insulated ac circuit breaker systems accounted for a 41.3% market share in 2022. Oil AC circuit breakers use oil as a dielectric or insulating medium for arc extinction. In oil AC circuit breakers, the contacts of the breaker are separated within an insulating oil. When a fault occurs in the system, the contacts of the circuit breaker are opened under the insulating oil, an arc is developed between them, and the heat of the arc is evaporated in the surrounding oil. The oil AC circuit breaker is divided into two categories, namely, bulk oil AC circuit breaker and low oil AC circuit breaker. Oil AC circuit breakers offer the advantage of oil having a high dielectric strength, which provides insulation between the contacts after the arc has been extinguished. The oil used in the AC circuit breaker provides a small clearance between the conductors and the earth components. The hydrogen gas is formed in the tank, which has a high diffusion rate and good cooling properties.

Power generation segment by end-use industry is estimated to be the second-largest segment for ac circuit breaker market

AC circuit breaker protect assets such as generators and transformers used in power generation plants. AC circuit breakers detect faults caused due to a short circuit on the power transmission system and disconnect the equipment from the grid. The need for increased safety and reliability of power plants are the major factors driving the AC circuit breaker market for power generation.

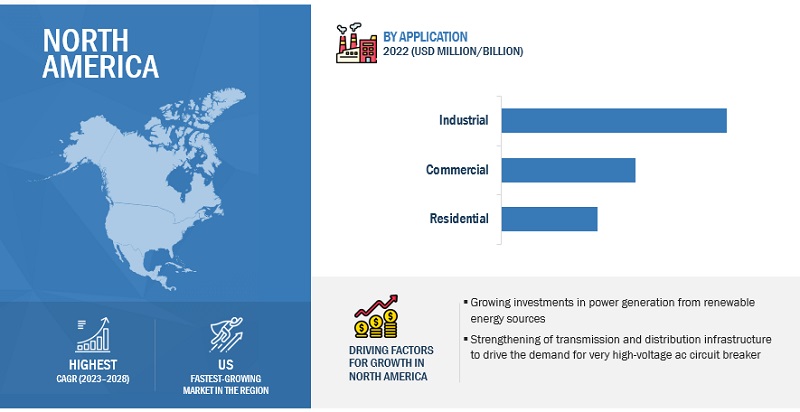

North America is expected to account for third-largest market size during the forecast period.

Key Market Players

The market is dominated by a few major players that have a wide regional presence. The major players in the AC circuit breaker market are Eaton (Ireland), ABB (Switzerland), Schneider Electric (France), Siemens (Germany), and Mitsubishi Electric (Japan). Between 2018 and 2022, Strategies such as product launches, contracts, agreements, partnerships, collaborations, alliances, acquisitions, and expansions are followed by these companies to capture a larger share of the market.

Scope of the report

|

Report Metric |

Details |

|

Market Size available for years |

2021–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD Million/Billion) |

|

Segments covered |

By Insulation Type, By Installation, By Voltage, By End-Use Industry |

|

Geographies covered |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies covered |

ABB (Switzerland), Eaton (Ireland) Siemens (Germany), Schneider Electric (France), Eaton (US), Mitsubishi Electric (Japan), General Electric (US), Rockwell Automation (US), BRUSH Group (UK), HD Hyundai Electric Co., Ltd. (South Korea), Chint Electrics (China), Suntree Electric Group Co., Ltd. (China), Toshiba Corporation (Japan), Shanghai Liangxin Electric Co., Ltd. (China), Sécheron Hasler Group (Switzerland), Panasonic Corporation (Japan), Fuji Electric (Japan), Powell Industries (US), Legrand (France), Alstom (France), and TE Connectivity (Switzerland). |

This research report categorizes the AC circuit breaker market based on insulation type, voltage, installation, end-use industry, and region.

By Insulation Type

- Air

- Gas

- Vacuum

- Oil

By Installation

- Indoor

- Outdoor

By Voltage

- Medium

- High

- Very-High

By End-Use Industry

- Transmission & Distribution Utilities

- Power Generation

- Industrial

- Others

By Region

- North America

- Asia Pacific

- South America

- Europe

- Middle East & Africa

Recent Developments

- In Nov 2021, Siemens Smart Infrastructure is enhancing its Sentron portfolio of air circuit breakers with the new 3WA series. Being an important element of low-voltage power distribution, the 3WA series protects electrical installations in buildings, infrastructure, and industrial facilities from damage caused by overload, short circuits, or ground faults.

- In Jan 2021, ABB India launched Formula DIN-Rail, a complete range of miniature circuit breakers (MCBs), residual current circuit breakers (RCCBs), and isolators for the retail electrical market estimated to be worth USD 250 million in India. ABB Formula DIN-Rail portfolio, with its contemporary design, provides optimum protection to electrical circuits from possible damages caused by overload, short circuits, and earth leakages in buildings. The MCBs are available with a 7-year warranty. This range meets international standards and is manufactured in ABB India's smart buildings factory in Bengaluru (Karnataka), with a production capacity of 12 million poles of MCBs per year.

- In September 2019, Eaton launched Power management specialist Eaton announced the global launch at InnoTrans 2018 of ADR, a new product family from Eaton's Heinemann Hydraulic Magnetic Circuit Breakers (HMCB) range.

- In February 2019, Schneider Electric Friday announced the launch of Master pact MTZ, the next generation high-power low voltage circuit-breakers assembled in the Indian market. Master pact MTZ is a first-of-its-kind air circuit breaker that provides customers with enhanced performance, reliability, and safety. A circuit breaker is an automatically operated electrical switch that protects an electrical circuit from damage caused by overload.

Frequently Asked Questions (FAQ):

What is the current size of the ac circuit breaker market?

The current market size of global ac circuit breaker market is estimated to be USD 4.1 billion in 2023.

What are the major drivers for ac circuit breaker market?

This progress is due to the rising per capita income, growing middle-class population, expanding urbanization, and increasing access to electricity in remotely located areas. Rural electrification in some developing countries is expected to bypass large national grids in favor of distributed power generation. For instance, the Indian Government is focusing on increasing the penetration of power supply in villages with the help of schemes such as the Restructured Accelerated Power Development and Reforms Program (R-APDRP) and Deendayal Upadhyaya Gram Jyoti Yojana (DDUGJY). These schemes are providing an excellent opportunity for the AC circuit breaker market.

What is the major restraint for ac circuit breaker market?

SF6 is also classified as a "greenhouse gas" (GHG). SF6 is the most potent GHG in global warming potential (GWP) among the group of chemicals known as fluorinated gases. Strict measures have been put in place to limit SF6 emissions, including restrictions on its use. In 1997, the Environmental Protection Agency (EPA) began looking into SF6 in the US. It became mandatory to record equipment with a nameplate capacity of 17,820 lb or higher in 2012. As a result, emissions have decreased significantly.

Which is the largest-growing region during the forecasted period in ac circuit breaker market?

APAC is expected to account for the largest market size during the forecast period. Many countries in the Asia Pacific region are focusing on modernizing their aging power infrastructure to improve efficiency and reliability. This involves replacing outdated AC circuit breakers with advanced technologies that offer better performance, monitoring capabilities, and safety features. Key players in the Asia Pacific circuit breaker market include ABB, Schneider Electric, Siemens, Mitsubishi Electric, Eaton, and Toshiba, among others.

These companies offer a wide range of AC circuit breakers, including medium-voltage, high-voltage, and very high-voltage AC circuit breakers, catering to various industry requirements. Countries such as China and India have witnessed rapid industrialization, leading to increased demand for AC circuit breakers in manufacturing facilities, chemical plants, oil & gas refineries, and other industrial sectors. The expansion of industries necessitates reliable protection mechanisms for electrical equipment and systems. Governments in the Asia Pacific region are investing heavily in infrastructure projects, including power plants, renewable energy installations, smart grids, and transportation systems.

Which is the largest-growing segment, by insulation type during the forecasted period in ac circuit breaker market?

The gas segment, by insulation type, is projected to hold the highest market share during the forecast period. SF6 is utilized in gas-insulated switchgear at pressures ranging from 400 to 600 kPa absolute. The pressure is selected so the SF6 will not condense into a liquid when the equipment experiences low temperatures. SF6 has two to three times greater insulating property than air at the same pressure; additionally, SF6 is about 100 times better than air for interrupting arcs. It is now used universally as an interrupting medium for high voltage AC circuit breakers, replacing the older mediums of oil and air.

The gas circuit breaker market in Asia Pacific is expected to grow at the highest CAGR of 6.1% during the forecast period. Increasing investments in renewable energy resulting in the demand for the upgrades of the existing substations or the installation of new ones are expected to drive the market for SF6-based gas-insulated switchgear, increasing the demand for gas-insulated AC circuit breakers.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Growing investments in power generation from renewable energy sources- Increasing capacity additions and enhancements for T&D networks- Strengthening of power distribution infrastructure- Increased investments in industrial productionRESTRAINTS- Regulations restricting SF6 gas emissions- Competition from unorganized sectorOPPORTUNITIES- Emerging smart technologies and digitalization- Growing usage of high-voltage direct current systems- Replacement of aging grid infrastructure and need for reliable T&D networksCHALLENGES- Risk of cybersecurity attacks and installation of modernized circuit breakers- High temperature, arc flashing, and overpressure during operation

-

5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESSREVENUE SHIFT AND NEW REVENUE POCKETS FOR AC CIRCUIT BREAKER PROVIDERS

-

5.4 VALUE CHAIN ANALYSISRAW MATERIAL PROVIDERS/SUPPLIERSCOMPONENT MANUFACTURERSAC CIRCUIT BREAKER MANUFACTURERS/ASSEMBLERSDISTRIBUTORS (BUYERS)/END USERSPOST-SALES SERVICE PROVIDERS

- 5.5 MARKET MAP

-

5.6 TECHNOLOGY ANALYSISTECHNOLOGY TRENDS FOR VARIOUS CIRCUIT BREAKER TECHNOLOGIES

-

5.7 PATENT ANALYSIS

- 5.8 AC CIRCUIT BREAKERS MARKET: TARIFFS, CODES, AND REGULATIONS

-

5.9 PORTER’S FIVE FORCES ANALYSISTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF NEW ENTRANTSINTENSITY OF COMPETITIVE RIVALRY

-

5.10 CASE STUDY ANALYSISCIRCUIT BREAKERS FOR ENERGY MARKET- ABB introduced SACE Emax (low voltage air and molded-case circuit breakers) to transform energy market- Schneider engineers shrank their design by 25% with Enventive concept

- 5.11 AVERAGE SELLING PRICE TREND

-

5.12 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESS

- 5.13 BUYING CRITERIA

- 5.14 KEY CONFERENCES AND EVENTS IN 2023–2024

- 6.1 INTRODUCTION

-

6.2 MEDIUM VOLTAGEGROWING POWER DISTRIBUTION INFRASTRUCTURES TO DRIVE MARKET

-

6.3 HIGH VOLTAGEINVESTMENTS IN ELECTRICAL TRANSMISSION NETWORKS TO PROPEL DEMAND

-

6.4 VERY HIGH VOLTAGESTRENGTHENING OF TRANSMISSION AND DISTRIBUTION INFRASTRUCTURE TO BOOST MARKET GROWTH

- 7.1 INTRODUCTION

-

7.2 VACUUMENVIRONMENT-FRIENDLINESS AND LONG SERVICE LIFE TO INCREASE DEMAND

-

7.3 AIRRISING DEMAND FOR ENERGY STORAGE TO DRIVE MARKET

-

7.4 GASHIGH DIELECTRIC PROPERTY AND LESS SPACE REQUIREMENT FOR INSTALLATION TO INCREASE DEMAND

-

7.5 OILHIGH DIELECTRIC STRENGTH AND INSULATION TO BOOST MARKET GROWTH

- 8.1 INTRODUCTION

-

8.2 INDOOR INSTALLATIONGROWING INDUSTRIAL AND COMMERCIAL SECTORS IN EMERGING ECONOMIES TO BOOST MARKET GROWTH

-

8.3 OUTDOOR INSTALLATIONINCREASING INSTALLATIONS OF SOLAR AND WIND POWER PLANTS TO DRIVE MARKET

- 9.1 INTRODUCTION

-

9.2 TRANSMISSION & DISTRIBUTION UTILITIESINCREASING DEMAND FOR ELECTRICITY AND REPLACEMENT OF AGING INFRASTRUCTURE TO DRIVE MARKET

-

9.3 POWER GENERATIONRISING SAFETY AND RELIABILITY REQUIREMENTS OF POWER PLANTS TO PROPEL MARKET GROWTH

-

9.4 INDUSTRIALSTRENGTHENING OF TRANSMISSION AND DISTRIBUTION INFRASTRUCTURE TO DRIVE DEMAND

- 9.5 OTHERS

- 10.1 INTRODUCTION

-

10.2 ASIA PACIFICRECESSION IMPACT ON ASIA PACIFIC MARKETBY VOLTAGEBY INSULATION TYPEBY INSTALLATIONBY APPLICATION- By voltage- By insulation type- By installationBY COUNTRY- China- India- Japan- Rest of Asia Pacific

-

10.3 EUROPERECESSION IMPACT ON EUROPEAN MARKETBY VOLTAGEBY INSULATION TYPEBY INSTALLATIONBY APPLICATION- By voltage- By insulation type- By installationBY COUNTRY- Germany- UK- Italy- France- Spain- Rest of Europe

-

10.4 NORTH AMERICARECESSION IMPACT ON NORTH AMERICAN MARKETBY VOLTAGEBY INSULATION TYPEBY INSTALLATIONBY APPLICATION- By voltage- By insulation type- By installationBY COUNTRY- US- Canada- Mexico

-

10.5 SOUTH AMERICARECESSION IMPACT ON SOUTH AMERICAN MARKETBY VOLTAGEBY INSULATION TYPEBY INSTALLATIONBY APPLICATION- By voltage- By insulation type- By installationBY COUNTRY- Brazil- Argentina- Rest of South America

-

10.6 MIDDLE EAST & AFRICARECESSION IMPACT ON MIDDLE EAST & AFRICAN MARKETBY VOLTAGEBY INSULATION TYPEBY INSTALLATIONBY APPLICATION- By voltage- By insulation type- By installationBY COUNTRY- Saudi Arabia- South Africa- UAE- Rest of Middle East & Africa

- 11.1 OVERVIEW

- 11.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 11.3 MARKET SHARE ANALYSIS OF TOP 5 PLAYERS

- 11.4 REVENUE ANALYSIS OF TOP 5 MARKET PLAYERS

-

11.5 KEY COMPANY EVALUATION QUADRANTSTARSPERVASIVE PLAYERSEMERGING LEADERSPARTICIPANTS

-

11.6 STARTUP/SME EVALUATION QUADRANTPROGRESSIVE COMPANIESRESPONSIVE COMPANIESSTARTING BLOCKSDYNAMIC COMPANIESCOMPETITIVE BENCHMARKING

- 11.7 MARKET: COMPANY FOOTPRINT

- 11.8 COMPETITIVE SCENARIO

-

12.1 KEY PLAYERSABB LTD.- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewSIEMENS LIMITED- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewSCHNEIDER ELECTRIC- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewEATON- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewMITSUBISHI ELECTRIC- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewGENERAL ELECTRIC- Business overview- Products/Services/Solutions offered- Recent developmentsROCKWELL AUTOMATION- Business overview- Products/Services/Solutions offered- Recent developmentsBRUSH GROUP- Business overview- Products/Services/Solutions offeredHD HYUNDAI ELECTRIC CO., LTD.- Business overview- Products/Services/Solutions offeredCHINT ELECTRICS- Business overview- Products/Services/Solutions offeredSUNTREE ELECTRIC GROUP CO., LTD.- Business overview- Products/Services/Solutions offeredTOSHIBA CORPORATION- Business overview- Products/Services/Solutions offered- Recent developmentsSHANGHAI LIANGXIN ELECTRIC CO., LTD.- Business overview- Products/Services/Solutions offeredSÉCHERON HASLER GROUP- Business overview- Products/Services/Solutions offered- Recent developmentsPANASONIC CORPORATION- Business overview- Products/Services/Solutions offered- Recent developments

-

12.2 OTHER PLAYERSFUJI ELECTRICPOWELL INDUSTRIESLEGRANDALSTOMTE CONNECTIVITY

- 13.1 INSIGHTS FROM INDUSTRY EXPERTS

- 13.2 DISCUSSION GUIDE

- 13.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.4 CUSTOMIZATION OPTIONS

- 13.5 RELATED REPORTS

- 13.6 AUTHOR DETAILS

- TABLE 1 SNAPSHOT OF AC CIRCUIT BREAKER MARKET

- TABLE 2 GLOBAL WARMING POTENTIAL OF GREENHOUSE GASES (100-YEAR TIME HORIZON)

- TABLE 3 MARKET: ROLE IN ECOSYSTEM

- TABLE 4 MARKET: INNOVATIONS AND PATENT REGISTRATIONS, APRIL 2020–MAY 2023

- TABLE 5 AC CIRCUIT BREAKER MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 6 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS (%)

- TABLE 7 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

- TABLE 8 MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

- TABLE 9 AC CIRCUIT BREAKER MARKET, BY VOLTAGE, 2021–2028 (USD MILLION)

- TABLE 10 MARKET, BY VOLTAGE, 2021–2028 (UNITS)

- TABLE 11 TRANSMISSION & DISTRIBUTION UTILITIES: AC CIRCUIT BREAKER MARKET, BY VOLTAGE, 2021–2028 (USD MILLION)

- TABLE 12 TRANSMISSION & DISTRIBUTION UTILITIES: CIRCUIT BREAKERS MARKET, BY VOLTAGE, 2021–2028 (UNITS)

- TABLE 13 POWER GENERATION: CIRCUIT BREAKER MARKET, BY VOLTAGE, 2021–2028 (USD MILLION)

- TABLE 14 POWER GENERATION: CIRCUIT BREAKERS MARKET, BY VOLTAGE, 2021–2028 (UNITS)

- TABLE 15 INDUSTRIAL: CIRCUIT BREAKER MARKET, BY VOLTAGE, 2021–2028 (USD MILLION)

- TABLE 16 INDUSTRIAL: CIRCUIT BREAKERS MARKET, BY VOLTAGE, 2021–2028 (UNITS)

- TABLE 17 OTHERS: CIRCUIT BREAKER MARKET, BY VOLTAGE, 2021–2028 (USD MILLION)

- TABLE 18 OTHERS: CIRCUIT BREAKERS MARKET, BY VOLTAGE, 2021–2028 (UNITS)

- TABLE 19 MEDIUM VOLTAGE: CIRCUIT BREAKER MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 20 MEDIUM VOLTAGE: CIRCUIT BREAKERS MARKET, BY REGION, 2021–2028 (UNITS)

- TABLE 21 HIGH VOLTAGE: AC CIRCUIT BREAKERS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 22 HIGH VOLTAGE: CIRCUIT BREAKER MARKET, BY REGION, 2021–2028 (UNITS)

- TABLE 23 VERY HIGH VOLTAGE: MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 24 VERY HIGH VOLTAGE: CIRCUIT BREAKERS MARKET, BY REGION, 2021–2028 (UNITS)

- TABLE 25 AC CIRCUIT BREAKERS MARKET, BY INSULATION TYPE, 2021–2028 (USD MILLION)

- TABLE 26 AC CIRCUIT BREAKER MARKET, BY INSULATION TYPE, 2021–2028 (UNITS)

- TABLE 27 TRANSMISSION & DISTRIBUTION UTILITIES: CIRCUIT BREAKERS MARKET, BY INSULATION TYPE, 2021–2028 (USD MILLION)

- TABLE 28 TRANSMISSION & DISTRIBUTION UTILITIES: CIRCUIT BREAKER MARKET, BY INSULATION TYPE, 2021–2028 (UNITS)

- TABLE 29 POWER GENERATION: CIRCUIT BREAKER MARKET, BY INSULATION TYPE, 2021–2028 (USD MILLION)

- TABLE 30 POWER GENERATION: CIRCUIT BREAKERS MARKET, BY INSULATION TYPE, 2021–2028 (UNITS)

- TABLE 31 INDUSTRIAL: CIRCUIT BREAKER MARKET, BY INSULATION TYPE, 2021–2028 (USD MILLION)

- TABLE 32 INDUSTRIAL: CIRCUIT BREAKERS MARKET, BY INSULATION TYPE, 2021–2028 (UNITS)

- TABLE 33 OTHERS: CIRCUIT BREAKER MARKET, BY INSULATION TYPE, 2021–2028 (USD MILLION)

- TABLE 34 OTHERS: CIRCUIT BREAKERS MARKET, BY INSULATION TYPE, 2021–2028 (UNITS)

- TABLE 35 VACUUM: CIRCUIT BREAKER MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 36 VACUUM: CIRCUIT BREAKERS MARKET, BY REGION, 2021–2028 (UNITS)

- TABLE 37 AIR: CIRCUIT BREAKER MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 38 AIR: CIRCUIT BREAKERS MARKET, BY REGION, 2021–2028 (UNITS)

- TABLE 39 GAS: CIRCUIT BREAKER MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 40 GAS: CIRCUIT BREAKERS MARKET, BY REGION, 2021–2028 (UNITS)

- TABLE 41 OIL: CIRCUIT BREAKER MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 42 OIL: CIRCUIT BREAKERS MARKET, BY REGION, 2021–2028 (UNITS)

- TABLE 43 AC CIRCUIT BREAKERS MARKET, BY INSTALLATION, 2021–2028 (USD MILLION)

- TABLE 44 AC CIRCUIT BREAKER MARKET, BY INSTALLATION, 2021–2028 (UNITS)

- TABLE 45 TRANSMISSION & DISTRIBUTION UTILITIES: CIRCUIT BREAKER MARKET, BY INSTALLATION, 2021–2028 (USD MILLION)

- TABLE 46 TRANSMISSION & DISTRIBUTION UTILITIES: CIRCUIT BREAKERS MARKET, BY INSTALLATION, 2021–2028 (UNITS)

- TABLE 47 POWER GENERATION: CIRCUIT BREAKER MARKET, BY INSTALLATION, 2021–2028 (USD MILLION)

- TABLE 48 POWER GENERATION: CIRCUIT BREAKERS MARKET, BY INSTALLATION, 2021–2028 (UNITS)

- TABLE 49 INDUSTRIAL: CIRCUIT BREAKER MARKET, BY INSTALLATION, 2021–2028 (USD MILLION)

- TABLE 50 INDUSTRIAL: CIRCUIT BREAKERS MARKET, BY INSTALLATION, 2021–2028 (UNITS)

- TABLE 51 OTHERS: CIRCUIT BREAKER MARKET, BY INSTALLATION, 2021–2028 (USD MILLION)

- TABLE 52 OTHERS: CIRCUIT BREAKERS MARKET, BY INSTALLATION, 2021–2028 (UNITS)

- TABLE 53 INDOOR INSTALLATION: CIRCUIT BREAKER MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 54 INDOOR INSTALLATION: CIRCUIT BREAKERS MARKET, BY REGION, 2021–2028 (UNITS)

- TABLE 55 OUTDOOR INSTALLATION: CIRCUIT BREAKER MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 56 OUTDOOR INSTALLATION: CIRCUIT BREAKERS MARKET, BY REGION, 2021–2028 (UNITS)

- TABLE 57 AC CIRCUIT BREAKER MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 58 AC CIRCUIT BREAKERS MARKET, BY APPLICATION, 2021–2028 (UNITS)

- TABLE 59 TRANSMISSION & DISTRIBUTION UTILITIES: CIRCUIT BREAKER MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 60 TRANSMISSION & DISTRIBUTION UTILITIES: CIRCUIT BREAKERS MARKET, BY REGION, 2021–2028 (UNITS)

- TABLE 61 POWER GENERATION: CIRCUIT BREAKER MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 62 POWER GENERATION: CIRCUIT BREAKERS MARKET, BY REGION, 2021–2028 (UNITS)

- TABLE 63 INDUSTRIAL: CIRCUIT BREAKER MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 64 INDUSTRIAL: CIRCUIT BREAKERS MARKET, BY REGION, 2021–2028 (UNITS)

- TABLE 65 OTHERS: CIRCUIT BREAKER MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 66 OTHERS: CIRCUIT BREAKERS MARKET, BY REGION, 2021–2028 (UNITS)

- TABLE 67 AC CIRCUIT BREAKER MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 68 ASIA PACIFIC: AC CIRCUIT BREAKER MARKET, BY VOLTAGE, 2021–2028 (USD MILLION)

- TABLE 69 ASIA PACIFIC: BREAKER , BY VOLTAGE, 2021–2028 (UNITS)

- TABLE 70 ASIA PACIFIC: BREAKER , BY INSULATION TYPE, 2021–2028 (USD MILLION)

- TABLE 71 ASIA PACIFIC: BREAKER , BY INSULATION TYPE, 2021–2028 (UNITS)

- TABLE 72 ASIA PACIFIC: BREAKER , BY INSTALLATION, 2021–2028 (USD MILLION)

- TABLE 73 ASIA PACIFIC: BREAKER , BY INSTALLATION, 2021–2028 (UNITS)

- TABLE 74 ASIA PACIFIC: BREAKER , BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 75 ASIA PACIFIC: BREAKER , BY APPLICATION, 2021–2028 (UNITS)

- TABLE 76 TRANSMISSION & DISTRIBUTION UTILITIES: BREAKER IN ASIA PACIFIC, BY VOLTAGE, 2021–2028 (USD MILLION)

- TABLE 77 TRANSMISSION & DISTRIBUTION UTILITIES: BREAKER IN ASIA PACIFIC, BY VOLTAGE, 2021–2028 (UNITS)

- TABLE 78 POWER GENERATION: BREAKER IN ASIA PACIFIC, BY VOLTAGE, 2021–2028 (USD MILLION)

- TABLE 79 POWER GENERATION: BREAKER IN ASIA PACIFIC, BY VOLTAGE, 2021–2028 (UNITS)

- TABLE 80 INDUSTRIAL: BREAKER IN ASIA PACIFIC, BY VOLTAGE, 2021–2028 (USD MILLION)

- TABLE 81 INDUSTRIAL: BREAKER IN ASIA PACIFIC, BY VOLTAGE, 2021–2028 (UNITS)

- TABLE 82 OTHERS: BREAKER IN ASIA PACIFIC, BY VOLTAGE, 2021–2028 (USD MILLION)

- TABLE 83 OTHERS: BREAKER IN ASIA PACIFIC, BY VOLTAGE, 2021–2028 (UNITS)

- TABLE 84 TRANSMISSION & DISTRIBUTION UTILITIES: BREAKER IN ASIA PACIFIC, BY INSULATION TYPE, 2021–2028 (USD MILLION)

- TABLE 85 TRANSMISSION & DISTRIBUTION UTILITIES: BREAKER IN ASIA PACIFIC, BY INSULATION TYPE, 2021–2028 (UNITS)

- TABLE 86 POWER GENERATION: BREAKER IN ASIA PACIFIC, BY INSULATION TYPE, 2021–2028 (USD MILLION)

- TABLE 87 POWER GENERATION: BREAKER IN ASIA PACIFIC, BY INSULATION TYPE, 2021–2028 (UNITS)

- TABLE 88 INDUSTRIAL: BREAKER IN ASIA PACIFIC, BY INSULATION TYPE, 2021–2028 (USD MILLION)

- TABLE 89 INDUSTRIAL: BREAKER IN ASIA PACIFIC, BY INSULATION TYPE, 2021–2028 (UNITS)

- TABLE 90 OTHERS: BREAKER IN ASIA PACIFIC, BY INSULATION TYPE, 2021–2028 (USD MILLION)

- TABLE 91 OTHERS: BREAKER IN ASIA PACIFIC, BY INSULATION TYPE, 2021–2028 (UNITS)

- TABLE 92 TRANSMISSION & DISTRIBUTION UTILITIES: BREAKER IN ASIA PACIFIC, BY INSTALLATION, 2021–2028 (USD MILLION)

- TABLE 93 TRANSMISSION & DISTRIBUTION UTILITIES: BREAKER IN ASIA PACIFIC, BY INSTALLATION, 2021–2028 (UNITS)

- TABLE 94 POWER GENERATION: BREAKER IN ASIA PACIFIC, BY INSTALLATION, 2021–2028 (USD MILLION)

- TABLE 95 POWER GENERATION: BREAKER IN ASIA PACIFIC, BY INSTALLATION, 2021–2028 (UNITS)

- TABLE 96 INDUSTRIAL: BREAKER IN ASIA PACIFIC, BY INSTALLATION, 2021–2028 (USD MILLION)

- TABLE 97 INDUSTRIAL: BREAKER IN ASIA PACIFIC, BY INSTALLATION, 2021–2028 (UNITS)

- TABLE 98 OTHERS: BREAKER IN ASIA PACIFIC, BY INSTALLATION, 2021–2028 (USD MILLION)

- TABLE 99 OTHERS: BREAKER IN ASIA PACIFIC, BY INSTALLATION, 2021–2028 (UNITS)

- TABLE 100 ASIA PACIFIC: MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 101 CHINA: BREAKER , BY VOLTAGE, 2021–2028 (USD MILLION)

- TABLE 102 INDIA: BREAKER , BY VOLTAGE, 2021–2028 (USD MILLION)

- TABLE 103 JAPAN: BREAKER , BY VOLTAGE, 2021–2028 (USD MILLION)

- TABLE 104 REST OF ASIA PACIFIC: BREAKER , BY VOLTAGE, 2021–2028 (USD MILLION)

- TABLE 105 EUROPE: AC CIRCUIT BREAKER MARKET, BY VOLTAGE, 2021–2028 (USD MILLION)

- TABLE 106 EUROPE: BREAKER , BY VOLTAGE, 2021–2028 (UNITS)

- TABLE 107 EUROPE: BREAKER , BY INSULATION TYPE, 2021–2028 (USD MILLION)

- TABLE 108 EUROPE: BREAKER , BY INSULATION TYPE, 2021–2028 (UNITS)

- TABLE 109 EUROPE: BREAKER , BY INSTALLATION, 2021–2028 (USD MILLION)

- TABLE 110 EUROPE: BREAKER , BY INSTALLATION, 2021–2028 (UNITS)

- TABLE 111 EUROPE: BREAKER , BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 112 EUROPE: BREAKER , BY APPLICATION, 2021–2028 (UNITS)

- TABLE 113 TRANSMISSION & DISTRIBUTION UTILITIES: BREAKER IN EUROPE, BY VOLTAGE, 2021–2028 (USD MILLION)

- TABLE 114 TRANSMISSION & DISTRIBUTION UTILITIES: BREAKER IN EUROPE, BY VOLTAGE, 2021–2028 (UNITS)

- TABLE 115 POWER GENERATION: BREAKER IN EUROPE, BY VOLTAGE, 2021–2028 (USD MILLION)

- TABLE 116 POWER GENERATION: BREAKER IN EUROPE, BY VOLTAGE, 2021–2028 (UNITS)

- TABLE 117 INDUSTRIAL: BREAKER IN EUROPE, BY VOLTAGE, 2021–2028 (USD MILLION)

- TABLE 118 INDUSTRIAL: BREAKER IN EUROPE, BY VOLTAGE, 2021–2028 (UNITS)

- TABLE 119 OTHERS: BREAKER IN EUROPE, BY VOLTAGE, 2021–2028 (USD MILLION)

- TABLE 120 OTHERS: BREAKER IN EUROPE, BY VOLTAGE, 2021–2028 (UNITS)

- TABLE 121 TRANSMISSION & DISTRIBUTION UTILITIES BREAKER IN EUROPE, BY INSULATION TYPE, 2021–2028 (USD MILLION)

- TABLE 122 TRANSMISSION & DISTRIBUTION UTILITIES: BREAKER IN EUROPE, BY INSULATION TYPE, 2021–2028 (UNITS)

- TABLE 123 POWER GENERATION: BREAKER IN EUROPE, BY INSULATION TYPE, 2021–2028 (USD MILLION)

- TABLE 124 POWER GENERATION: BREAKER IN EUROPE, BY INSULATION TYPE, 2021–2028 (UNITS)

- TABLE 125 INDUSTRIAL: BREAKER IN EUROPE, BY INSULATION TYPE, 2021–2028 (USD MILLION)

- TABLE 126 INDUSTRIAL: BREAKER IN EUROPE, BY INSULATION TYPE, 2021–2028 (UNITS)

- TABLE 127 OTHERS: BREAKER IN EUROPE, BY INSULATION TYPE, 2021–2028 (USD MILLION)

- TABLE 128 OTHERS: BREAKER IN EUROPE, BY INSULATION TYPE, 2021–2028 (UNITS)

- TABLE 129 TRANSMISSION & DISTRIBUTION UTILITIES: BREAKER IN EUROPE, BY INSTALLATION, 2021–2028 (USD MILLION)

- TABLE 130 TRANSMISSION & DISTRIBUTION UTILITIES: BREAKER IN EUROPE, BY INSTALLATION, 2021–2028 (UNITS)

- TABLE 131 POWER GENERATION: BREAKER IN EUROPE, BY INSTALLATION, 2021–2028 (USD MILLION)

- TABLE 132 POWER GENERATION: BREAKER IN EUROPE, BY INSTALLATION, 2021–2028 (UNITS)

- TABLE 133 INDUSTRIAL: BREAKER IN EUROPE, BY INSTALLATION, 2021–2028 (USD MILLION)

- TABLE 134 INDUSTRIAL: BREAKER IN EUROPE, BY INSTALLATION, 2021–2028 (UNITS)

- TABLE 135 OTHERS: BREAKER IN EUROPE, BY INSTALLATION, 2021–2028 (USD MILLION)

- TABLE 136 OTHERS: BREAKER IN EUROPE, BY INSTALLATION, 2021–2028 (UNITS)

- TABLE 137 EUROPE: BREAKER , BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 138 GERMANY: MARKET, BY VOLTAGE, 2021–2028 (USD MILLION)

- TABLE 139 UK: AC CIRCUIT BREAKER MARKET, BY VOLTAGE, 2021–2028 (USD MILLION)

- TABLE 140 ITALY: BREAKER , BY VOLTAGE, 2021–2028 (USD MILLION)

- TABLE 141 FRANCE: BREAKER , BY VOLTAGE, 2021–2028 (USD MILLION)

- TABLE 142 SPAIN: BREAKER , BY VOLTAGE, 2021–2028 (USD MILLION)

- TABLE 143 REST OF EUROPE: BREAKER , BY VOLTAGE, 2021–2028 (USD MILLION)

- TABLE 144 NORTH AMERICA: AC CIRCUIT BREAKER MARKET, BY VOLTAGE, 2021–2028 (USD MILLION)

- TABLE 145 NORTH AMERICA: BREAKER , BY VOLTAGE, 2021–2028 (UNITS)

- TABLE 146 NORTH AMERICA: BREAKER , BY INSULATION TYPE, 2021–2028 (USD MILLION)

- TABLE 147 NORTH AMERICA: BREAKER , BY INSULATION TYPE, 2021–2028 (UNITS)

- TABLE 148 NORTH AMERICA: BREAKER , BY INSTALLATION, 2021–2028 (USD MILLION)

- TABLE 149 NORTH AMERICA: BREAKER , BY INSTALLATION, 2021–2028 (UNITS)

- TABLE 150 NORTH AMERICA: BREAKER , BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 151 NORTH AMERICA: BREAKER , BY APPLICATION, 2021–2028 (UNITS)

- TABLE 152 TRANSMISSION & DISTRIBUTION UTILITIES: BREAKER IN NORTH AMERICA, BY VOLTAGE, 2021–2028 (USD MILLION)

- TABLE 153 TRANSMISSION & DISTRIBUTION UTILITIES: BREAKER IN NORTH AMERICA, BY VOLTAGE, 2021–2028 (UNITS)

- TABLE 154 POWER GENERATION: BREAKER IN NORTH AMERICA, BY VOLTAGE, 2021–2028 (USD MILLION)

- TABLE 155 POWER GENERATION: BREAKER IN NORTH AMERICA, BY VOLTAGE, 2021–2028 (UNITS)

- TABLE 156 INDUSTRIAL: BREAKER IN NORTH AMERICA, BY VOLTAGE, 2021–2028 (USD MILLION)

- TABLE 157 INDUSTRIAL: BREAKER IN NORTH AMERICA, BY VOLTAGE, 2021–2028 (UNITS)

- TABLE 158 OTHERS: BREAKER IN NORTH AMERICA, BY VOLTAGE, 2021–2028 (USD MILLION)

- TABLE 159 OTHERS: BREAKER IN NORTH AMERICA, BY VOLTAGE, 2021–2028 (UNITS)

- TABLE 160 TRANSMISSION & DISTRIBUTION UTILITIES: BREAKER IN NORTH AMERICA, BY INSULATION TYPE, 2021–2028 (USD MILLION)

- TABLE 161 TRANSMISSION & DISTRIBUTION UTILITIES: BREAKER IN NORTH AMERICA, BY INSULATION TYPE, 2021–2028 (UNITS)

- TABLE 162 POWER GENERATION: BREAKER IN NORTH AMERICA, BY INSULATION TYPE, 2021–2028 (USD MILLION)

- TABLE 163 POWER GENERATION: BREAKER IN NORTH AMERICA, BY INSULATION TYPE, 2021–2028 (UNITS)

- TABLE 164 INDUSTRIAL: BREAKER IN NORTH AMERICA, BY INSULATION TYPE, 2021–2028 (USD MILLION)

- TABLE 165 INDUSTRIAL: BREAKER IN NORTH AMERICA, BY INSULATION TYPE, 2021–2028 (UNITS)

- TABLE 166 OTHERS: BREAKER IN NORTH AMERICA, BY INSULATION TYPE, 2021–2028 (USD MILLION)

- TABLE 167 OTHERS: BREAKER IN NORTH AMERICA, BY INSULATION TYPE, 2021–2028 (UNITS)

- TABLE 168 TRANSMISSION & DISTRIBUTION UTILITIES: BREAKER IN NORTH AMERICA, BY INSTALLATION, 2021–2028 (USD MILLION)

- TABLE 169 TRANSMISSION & DISTRIBUTION UTILITIES: BREAKER IN NORTH AMERICA, BY INSTALLATION, 2021–2028 (UNITS)

- TABLE 170 POWER GENERATION: BREAKER IN NORTH AMERICA, BY INSTALLATION, 2021–2028 (USD MILLION)

- TABLE 171 POWER GENERATION: BREAKER IN NORTH AMERICA, BY INSTALLATION, 2021–2028 (UNITS)

- TABLE 172 INDUSTRIAL: BREAKER IN NORTH AMERICA, BY INSTALLATION, 2021–2028 (USD MILLION)

- TABLE 173 INDUSTRIAL: BREAKER IN NORTH AMERICA, BY INSTALLATION, 2021–2028 (UNITS)

- TABLE 174 OTHERS: BREAKER IN NORTH AMERICA, BY INSTALLATION, 2021–2028 (USD MILLION)

- TABLE 175 OTHERS: BREAKER IN NORTH AMERICA, BY INSTALLATION, 2021–2028 (UNITS)

- TABLE 176 NORTH AMERICA: BREAKER , BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 177 US: AC CIRCUIT BREAKER MARKET, BY VOLTAGE, 2021–2028 (USD MILLION)

- TABLE 178 CANADA: BREAKER , BY VOLTAGE, 2021–2028 (USD MILLION)

- TABLE 179 MEXICO: BREAKER , BY VOLTAGE, 2021–2028 (USD MILLION)

- TABLE 180 SOUTH AMERICA: AC CIRCUIT BREAKER BREAKER , BY VOLTAGE, 2021–2028 (USD MILLION)

- TABLE 181 SOUTH AMERICA: BREAKER , BY VOLTAGE, 2021–2028 (UNITS)

- TABLE 182 SOUTH AMERICA: MARKET, BY INSULATION TYPE, 2021–2028 (USD MILLION)

- TABLE 183 SOUTH AMERICA: BREAKER , BY INSULATION TYPE, 2021–2028 (UNITS)

- TABLE 184 SOUTH AMERICA: BREAKER , BY INSTALLATION, 2021–2028 (USD MILLION)

- TABLE 185 SOUTH AMERICA: BREAKER , BY INSTALLATION, 2021–2028 (UNITS)

- TABLE 186 SOUTH AMERICA: BREAKER , BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 187 SOUTH AMERICA: BREAKER , BY APPLICATION, 2021–2028 (UNITS)

- TABLE 188 TRANSMISSION & DISTRIBUTION UTILITIES: BREAKER IN SOUTH AMERICA, BY VOLTAGE, 2021–2028 (USD MILLION)

- TABLE 189 TRANSMISSION & DISTRIBUTION UTILITIES: BREAKER IN SOUTH AMERICA, BY VOLTAGE, 2021–2028 (UNITS)

- TABLE 190 POWER GENERATION: BREAKER IN SOUTH AMERICA, BY VOLTAGE, 2021–2028 (USD MILLION)

- TABLE 191 POWER GENERATION: BREAKER IN SOUTH AMERICA, BY VOLTAGE, 2021–2028 (UNITS)

- TABLE 192 INDUSTRIAL: BREAKER IN SOUTH AMERICA, BY VOLTAGE, 2021–2028 (USD MILLION)

- TABLE 193 INDUSTRIAL: BREAKER IN SOUTH AMERICA, BY VOLTAGE, 2021–2028 (UNITS)

- TABLE 194 OTHERS: BREAKER IN SOUTH AMERICA, BY VOLTAGE, 2021–2028 (USD MILLION)

- TABLE 195 OTHERS: BREAKER IN SOUTH AMERICA, BY VOLTAGE, 2021–2028 (UNITS)

- TABLE 196 TRANSMISSION & DISTRIBUTION UTILITIES: BREAKER IN SOUTH AMERICA, BY INSULATION TYPE, 2021–2028 (USD MILLION)

- TABLE 197 TRANSMISSION & DISTRIBUTION UTILITIES: BREAKER IN SOUTH AMERICA, BY INSULATION TYPE, 2021–2028 (UNITS)

- TABLE 198 POWER GENERATION: BREAKER IN SOUTH AMERICA, BY INSULATION TYPE, 2021–2028 (USD MILLION)

- TABLE 199 POWER GENERATION: BREAKER IN SOUTH AMERICA, BY INSULATION TYPE, 2021–2028 (UNITS)

- TABLE 200 INDUSTRIAL: BREAKER IN SOUTH AMERICA, BY INSULATION TYPE, 2021–2028 (USD MILLION)

- TABLE 201 INDUSTRIAL: BREAKER IN SOUTH AMERICA, BY INSULATION TYPE, 2021–2028 (UNITS)

- TABLE 202 OTHERS: BREAKER IN SOUTH AMERICA, BY INSULATION TYPE, 2021–2028 (USD MILLION)

- TABLE 203 OTHERS: BREAKER IN SOUTH AMERICA, BY INSULATION TYPE, 2021–2028 (UNITS)

- TABLE 204 TRANSMISSION & DISTRIBUTION UTILITIES: BREAKER IN SOUTH AMERICA, BY INSTALLATION, 2021–2028 (USD MILLION)

- TABLE 205 TRANSMISSION & DISTRIBUTION UTILITIES: BREAKER IN SOUTH AMERICA, BY INSTALLATION, 2021–2028 (UNITS)

- TABLE 206 POWER GENERATION: BREAKER IN SOUTH AMERICA, BY INSTALLATION, 2021–2028 (USD MILLION)

- TABLE 207 POWER GENERATION: BREAKER IN SOUTH AMERICA, BY INSTALLATION, 2021–2028 (UNITS)

- TABLE 208 INDUSTRIAL: BREAKER IN SOUTH AMERICA, BY INSTALLATION, 2021–2028 (USD MILLION)

- TABLE 209 INDUSTRIAL: BREAKER IN SOUTH AMERICA, BY INSTALLATION, 2021–2028 (UNITS)

- TABLE 210 OTHERS: BREAKER IN SOUTH AMERICA, BY INSTALLATION, 2021–2028 (USD MILLION)

- TABLE 211 OTHERS: BREAKER IN SOUTH AMERICA, BY INSTALLATION, 2021–2028 (UNITS)

- TABLE 212 SOUTH AMERICA: BREAKER , BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 213 BRAZIL: BREAKER , BY VOLTAGE, 2021–2028 (USD MILLION)

- TABLE 214 ARGENTINA: BREAKER , BY VOLTAGE, 2021–2028 (USD MILLION)

- TABLE 215 REST OF SOUTH AMERICA: BREAKER , BY VOLTAGE, 2021–2028 (USD MILLION)

- TABLE 216 MIDDLE EAST & AFRICA: AC CIRCUIT BREAKER MARKET, BY VOLTAGE, 2021–2028 (USD MILLION)

- TABLE 217 MIDDLE EAST & AFRICA: BREAKER , BY VOLTAGE, 2021–2028 (UNITS)

- TABLE 218 MIDDLE EAST & AFRICA: BREAKER , BY INSULATION TYPE, 2021–2028 (USD MILLION)

- TABLE 219 MIDDLE EAST & AFRICA: BREAKER , BY INSULATION TYPE, 2021–2028 (UNITS)

- TABLE 220 MIDDLE EAST & AFRICA: BREAKER , BY INSTALLATION, 2021–2028 (USD MILLION)

- TABLE 221 MIDDLE EAST & AFRICA: BREAKER , BY INSTALLATION, 2021–2028 (UNITS)

- TABLE 222 MIDDLE EAST & AFRICA: BREAKER , BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 223 MIDDLE EAST & AFRICA: BREAKER , BY APPLICATION, 2021–2028 (UNITS)

- TABLE 224 TRANSMISSION & DISTRIBUTION UTILITIES: BREAKER IN MIDDLE EAST & AFRICA, BY VOLTAGE, 2021–2028 (USD MILLION)

- TABLE 225 TRANSMISSION & DISTRIBUTION UTILITIES: BREAKER IN MIDDLE EAST & AFRICA, BY VOLTAGE, 2021–2028 (UNITS)

- TABLE 226 POWER GENERATION: BREAKER IN MIDDLE EAST & AFRICA, BY VOLTAGE, 2021–2028 (USD MILLION)

- TABLE 227 POWER GENERATION: BREAKER IN MIDDLE EAST & AFRICA, BY VOLTAGE, POWER GENERATION, 2021–2028 (UNITS)

- TABLE 228 INDUSTRIAL: BREAKER IN MIDDLE EAST & AFRICA, BY VOLTAGE, 2021–2028 (USD MILLION)

- TABLE 229 INDUSTRIAL: BREAKER IN MIDDLE EAST & AFRICA, BY VOLTAGE, INDUSTRIAL, 2021–2028 (UNITS)

- TABLE 230 OTHERS: BREAKER IN MIDDLE EAST & AFRICA, BY VOLTAGE, 2021–2028 (USD MILLION)

- TABLE 231 OTHERS: BREAKER IN MIDDLE EAST & AFRICA, BY VOLTAGE, 2021–2028 (UNITS)

- TABLE 232 TRANSMISSION & DISTRIBUTION UTILITIES: BREAKER IN MIDDLE EAST & AFRICA, BY INSULATION TYPE, 2021–2028 (USD MILLION)

- TABLE 233 TRANSMISSION & DISTRIBUTION UTILITIES: BREAKER IN MIDDLE EAST & AFRICA, BY INSULATION TYPE, 2021–2028 (UNITS)

- TABLE 234 POWER GENERATION: BREAKER IN MIDDLE EAST & AFRICA, BY INSULATION TYPE, 2021–2028 (USD MILLION)

- TABLE 235 POWER GENERATION: BREAKER IN MIDDLE EAST & AFRICA, BY INSULATION TYPE, POWER GENERATION, 2021–2028 (UNITS)

- TABLE 236 INDUSTRIAL: BREAKER IN MIDDLE EAST & AFRICA, BY INSULATION TYPE, 2021–2028 (USD MILLION)

- TABLE 237 INDUSTRIAL: BREAKER IN MIDDLE EAST & AFRICA, BY INSULATION TYPE, 2021–2028 (UNITS)

- TABLE 238 OTHERS: BREAKER IN MIDDLE EAST & AFRICA, BY INSULATION TYPE, 2021–2028 (USD MILLION)

- TABLE 239 OTHERS: BREAKER IN MIDDLE EAST & AFRICA, BY INSULATION TYPE, 2021–2028 (UNITS)

- TABLE 240 TRANSMISSION & DISTRIBUTION UTILITIES: BREAKER IN MIDDLE EAST & AFRICA, BY INSTALLATION, 2021–2028 (USD MILLION)

- TABLE 241 TRANSMISSION & DISTRIBUTION UTILITIES: BREAKER IN MIDDLE EAST & AFRICA, BY INSTALLATION, 2021–2028 (UNITS)

- TABLE 242 POWER GENERATION: BREAKER IN MIDDLE EAST & AFRICA, BY INSTALLATION, 2021–2028 (USD MILLION)

- TABLE 243 POWER GENERATION: BREAKER IN MIDDLE EAST & AFRICA, BY INSTALLATION, 2021–2028 (UNITS)

- TABLE 244 INDUSTRIAL: BREAKER IN MIDDLE EAST & AFRICA, BY INSTALLATION, 2021–2028 (USD MILLION)

- TABLE 245 INDUSTRIAL: BREAKER IN MIDDLE EAST & AFRICA, BY INSTALLATION, 2021–2028 (UNITS)

- TABLE 246 OTHERS: BREAKER IN MIDDLE EAST & AFRICA, BY INSTALLATION, 2021–2028 (USD MILLION)

- TABLE 247 OTHERS: BREAKER IN MIDDLE EAST & AFRICA, BY INSTALLATION, 2021–2028 (UNITS)

- TABLE 248 MIDDLE EAST & AFRICA: BREAKER , BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 249 SAUDI ARABIA: BREAKER , BY VOLTAGE, 2021–2028 (USD MILLION)

- TABLE 250 SOUTH AFRICA: BREAKER , BY VOLTAGE, 2021–2028 (USD MILLION)

- TABLE 251 UAE: BREAKER , BY VOLTAGE, 2021–2028 (USD MILLION)

- TABLE 252 REST OF MIDDLE EAST & AFRICA: BREAKER , BY VOLTAGE, 2021–2028 (USD MILLION)

- TABLE 253 OVERVIEW OF KEY STRATEGIES DEPLOYED BY TOP PLAYERS, APRIL 2018–APRIL 2022

- TABLE 254 AC CIRCUIT BREAKER MARKET: DEGREE OF COMPETITION

- TABLE 255 BREAKER : DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 256 BREAKER : DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 257 COMPANY FOOTPRINT: BY VOLTAGE

- TABLE 258 COMPANY FOOTPRINT: BY APPLICATION

- TABLE 259 COMPANY FOOTPRINT: BY REGION

- TABLE 260 OVERALL COMPANY FOOTPRINT

- TABLE 261 BREAKER : PRODUCT LAUNCHES, AUGUST 2020–MARCH 2022

- TABLE 262 BREAKER : DEALS, OCTOBER 2021–APRIL 2022

- TABLE 263 ABB: COMPANY OVERVIEW

- TABLE 264 ABB: PRODUCT/SERVICE/SOLUTION OFFERINGS

- TABLE 265 ABB: PRODUCT LAUNCHES

- TABLE 266 SIEMENS LIMITED: COMPANY OVERVIEW

- TABLE 267 SIEMENS LIMITED: PRODUCT/SERVICE/SOLUTION OFFERINGS

- TABLE 268 SIEMENS LIMITED: PRODUCT LAUNCHES

- TABLE 269 SCHNEIDER ELECTRIC: COMPANY OVERVIEW

- TABLE 270 SCHNEIDER ELECTRIC: PRODUCT/SERVICE/SOLUTION OFFERINGS

- TABLE 271 SCHNEIDER ELECTRIC: PRODUCT LAUNCHES

- TABLE 272 EATON: COMPANY OVERVIEW

- TABLE 273 EATON: PRODUCT/SERVICE/SOLUTION OFFERINGS

- TABLE 274 EATON: PRODUCT LAUNCHES

- TABLE 275 MITSUBISHI ELECTRIC: COMPANY OVERVIEW

- TABLE 276 MITSUBISHI ELECTRIC: PRODUCT/SERVICE/SOLUTION OFFERINGS

- TABLE 277 MITSUBISHI ELECTRIC: PRODUCT LAUNCHES

- TABLE 278 MITSUBISHI ELECTRIC: DEALS

- TABLE 279 GENERAL ELECTRIC: COMPANY OVERVIEW

- TABLE 280 GENERAL ELECTRIC: PRODUCT/SERVICE/SOLUTION OFFERINGS

- TABLE 281 GENERAL ELECTRIC: PRODUCT LAUNCHES

- TABLE 282 ROCKWELL AUTOMATION: COMPANY OVERVIEW

- TABLE 283 ROCKWELL AUTOMATION: PRODUCT/SERVICE/SOLUTION OFFERINGS

- TABLE 284 ROCKWELL AUTOMATION: PRODUCT LAUNCHES

- TABLE 285 BRUSH GROUP: COMPANY OVERVIEW

- TABLE 286 BRUSH GROUP: PRODUCT/SERVICE/SOLUTION OFFERINGS

- TABLE 287 HD HYUNDAI ELECTRIC CO., LTD.: COMPANY OVERVIEW

- TABLE 288 HD HYUNDAI ELECTRIC CO., LTD.: PRODUCT/SERVICE/SOLUTION OFFERINGS

- TABLE 289 CHINT ELECTRICS: COMPANY OVERVIEW

- TABLE 290 CHINT ELECTRIC: PRODUCT/SERVICE/SOLUTION OFFERINGS

- TABLE 291 SUNTREE ELECTRIC GROUP CO., LTD.: COMPANY OVERVIEW

- TABLE 292 SUNTREE ELECTRIC GROUP CO., LTD.: PRODUCT/SERVICE/SOLUTION OFFERINGS

- TABLE 293 TOSHIBA CORPORATION: COMPANY OVERVIEW

- TABLE 294 TOSHIBA CORPORATION: PRODUCT/SERVICE/SOLUTION OFFERINGS

- TABLE 295 TOSHIBA CORPORATION: DEALS

- TABLE 296 SHANGHAI LIANGXIN ELECTRIC CO., LTD.: COMPANY OVERVIEW

- TABLE 297 SHANGHAI LIANGXIN ELECTRIC CO., LTD.: PRODUCT/SERVICE/SOLUTION OFFERINGS

- TABLE 298 SÉCHERON HASLER GROUP: COMPANY OVERVIEW

- TABLE 299 SÉCHERON HAZLER GROUP: PRODUCT/SERVICE/SOLUTION OFFERINGS

- TABLE 300 SÉCHERON HASLER GROUP: PRODUCT LAUNCHES

- TABLE 301 PANASONIC CORPORATION: COMPANY OVERVIEW

- TABLE 302 PANASONIC CORPORATION: PRODUCT/SERVICE/SOLUTION OFFERINGS

- TABLE 303 PANASONIC CORPORATION: PRODUCT LAUNCHES

- FIGURE 1 BREAKER SEGMENTATION

- FIGURE 2 AC CIRCUIT BREAKER MARKET: RESEARCH DESIGN

- FIGURE 3 BREAKER : RESEARCH DATA

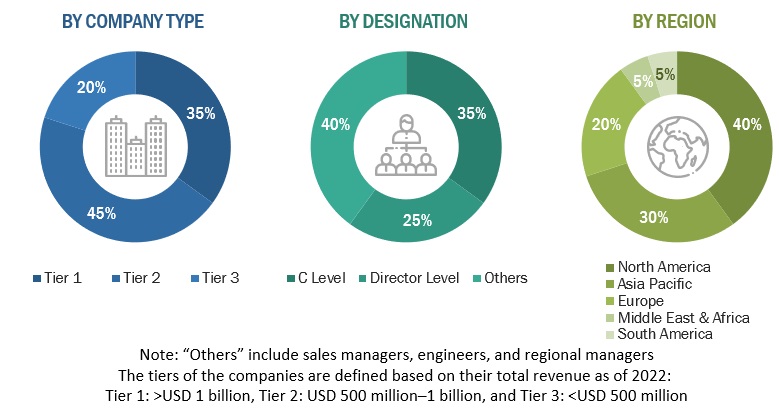

- FIGURE 4 BREAKDOWN OF PRIMARIES

- FIGURE 5 BREAKER : BOTTOM-UP APPROACH

- FIGURE 6 BREAKER : TOP-DOWN APPROACH

- FIGURE 7 METRICS CONSIDERED FOR ANALYZING DEMAND FOR AC CIRCUIT BREAKERS

- FIGURE 8 KEY STEPS CONSIDERED FOR ASSESSING SUPPLY OF AC CIRCUIT BREAKERS

- FIGURE 9 BREAKER : SUPPLY-SIDE ANALYSIS

- FIGURE 10 HIGH VOLTAGE SEGMENT TO ACCOUNT FOR LARGEST SHARE OF AC CIRCUIT BREAKER MARKET, BY VOLTAGE, IN 2028

- FIGURE 11 GAS AC CIRCUIT BREAKERS TO DOMINATE MARKET, BY INSULATION TYPE, IN 2028

- FIGURE 12 OUTDOOR SEGMENT TO EXHIBIT HIGHER CAGR IN CIRCUIT BREAKER MARKET, BY INSTALLATION, DURING FORECAST PERIOD

- FIGURE 13 INDUSTRIAL APPLICATIONS TO GROW AT FASTEST RATE IN AC CIRCUIT BREAKERS MARKET, BY APPLICATION, DURING FORECAST PERIOD

- FIGURE 14 ASIA PACIFIC ACCOUNTED FOR LARGEST SHARE OF MARKET IN 2022

- FIGURE 15 GROWING EMPHASIS ON UPGRADING AGING INFRASTRUCTURE TO DRIVE AC CIRCUIT BREAKER MARKET FROM 2023 TO 2028

- FIGURE 16 CHINA AND GAS AC CIRCUIT BREAKERS HELD LARGEST SHARES OF ASIA PACIFIC MARKET IN 2022

- FIGURE 17 HIGH-VOLTAGE SEGMENT HELD LARGEST SHARE OF GLOBAL AC CIRCUIT BREAKER MARKET IN 2022

- FIGURE 18 GAS AC CIRCUIT BREAKERS CAPTURED MAJOR MARKET SHARE IN 2022

- FIGURE 19 OUTDOOR AC CIRCUIT BREAKERS ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

- FIGURE 20 TRANSMISSION & DISTRIBUTION UTILITIES ACCOUNTED FOR LARGEST SHARE OF CIRCUIT BREAKER MARKET IN 2022

- FIGURE 21 ASIA PACIFIC TO RECORD HIGHEST CAGR IN MARKET

- FIGURE 22 AC CIRCUIT BREAKER MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 23 INSTALLED RENEWABLE ENERGY CAPACITY (2016–2021)

- FIGURE 24 GLOBAL GDP GROWTH (2010–2022)

- FIGURE 25 INVESTMENTS IN DIGITAL INFRASTRUCTURE IN TRANSMISSION & DISTRIBUTION ELECTRICITY GRIDS, 2015–2021 (USD BILLION)

- FIGURE 26 REVENUE SHIFT FOR AC CIRCUIT BREAKER PROVIDERS

- FIGURE 27 AC CIRCUIT BREAKERS MARKET: VALUE CHAIN ANALYSIS

- FIGURE 28 MARKET MAP

- FIGURE 29 PORTER’S FIVE FORCES ANALYSIS FOR AC CIRCUIT BREAKERS

- FIGURE 30 AVERAGE SELLING PRICE TREND (2020–2023)

- FIGURE 31 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS

- FIGURE 32 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

- FIGURE 33 HIGH VOLTAGE SEGMENT TO DOMINATE AC CIRCUIT BREAKERS MARKET IN 2022

- FIGURE 34 GAS AC CIRCUIT BREAKERS DOMINATED MARKET IN 2022

- FIGURE 35 OUTDOOR SEGMENT DOMINATED MARKET IN 2022

- FIGURE 36 TRANSMISSION & DISTRIBUTION UTILITIES SEGMENT DOMINATED AC CIRCUIT BREAKERS MARKET IN 2022

- FIGURE 37 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 38 AC CIRCUIT BREAKER MARKET SHARE (VALUE), BY REGION, 2022

- FIGURE 39 ASIA PACIFIC: AC CIRCUIT BREAKERS MARKET SNAPSHOT

- FIGURE 40 EUROPE: AC CIRCUIT BREAKERS MARKET SNAPSHOT

- FIGURE 41 AC CIRCUIT BREAKER MARKET SHARE ANALYSIS, 2022

- FIGURE 42 TOP PLAYERS IN AC CIRCUIT BREAKERS MARKET, 2018–2022

- FIGURE 43 COMPETITIVE LEADERSHIP MAPPING OF KEY PLAYERS: AC CIRCUIT BREAKERS MARKET, 2022

- FIGURE 44 COMPETITIVE LEADERSHIP MAPPING OF STARTUPS/SMES: MARKET, 2022

- FIGURE 45 ABB: COMPANY SNAPSHOT

- FIGURE 46 SIEMENS LIMITED: COMPANY SNAPSHOT

- FIGURE 47 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

- FIGURE 48 EATON: COMPANY SNAPSHOT

- FIGURE 49 MITSUBISHI ELECTRIC: COMPANY SNAPSHOT

- FIGURE 50 GENERAL ELECTRIC: COMPANY SNAPSHOT

- FIGURE 51 ROCKWELL AUTOMATION: COMPANY SNAPSHOT

- FIGURE 52 HD HYUNDAI ELECTRIC CO., LTD.: COMPANY SNAPSHOT

- FIGURE 53 TOSHIBA CORPORATION: COMPANY SNAPSHOT

- FIGURE 54 PANASONIC CORPORATION: COMPANY SNAPSHOT

This study involved major activities in estimating the current size of the AC circuit breaker market. Comprehensive secondary research was done to collect information on the market, peer market, and parent market. The next step involved was validation of these findings, assumptions, and market sizing with industry experts across the value chain through primary research. The total market size was estimated through country-wise analysis. Then, the market breakdown and data triangulation were performed to estimate the market size of the segments and sub-segments.

Secondary Research

The secondary research involved the use of extensive secondary sources, directories, and databases, such as Hoover’s, Bloomberg BusinessWeek, Factiva, and OneSource, to identify and collect information useful for a technical, market-oriented, and commercial study of the global AC circuit breaker market. The other secondary sources comprised press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturers, associations, trade directories, and databases.

Primary Research

The AC circuit breakers market comprises several stakeholders, such as product manufacturers, service providers, distributors, and end-users in the supply chain. The demand-side of this market is characterized by industrial end-users. Moreover, the demand is also fueled by the growing demand of underground distribution systems. The supply side is characterized by rising demand for contracts from the industrial sector, and mergers & acquisitions among big players. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

- The bottom-up approach has been used to estimate and validate the size of the market.

- In this approach, the AC circuit breaker production statistics for each product type have been considered at a country and regional level.

- Extensive secondary and primary research has been carried out to understand the global market scenario for various types of AC circuit breakers.

- Several primary interviews have been conducted with key opinion leaders related to AC circuit breaker system development, including key OEMs and Tier I suppliers.

- Qualitative aspects such as market drivers, restraints, opportunities, and challenges have been taken into consideration while calculating and forecasting the market size.

AC Circuit Breaker Market Size: Tow-Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

The overall market size is estimated using the market size estimation processes as explained above, followed by splitting of the market into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the AC circuit breakers market ecosystem.

Market Defenition

A circuit breaker is designed to protect equipment in an electric circuit from damage caused by excessive current, typically caused by overload or short circuit. It is an automatically operated device that is used to open and close circuits. The device is operated manually to perform maintenance or will automatically trip if a short circuit occurs. Circuit breakers are of two types namely, AC and DC.

An AC circuit breaker is a switch that interrupts or breaks the flow of electrical energy. The AC power system uses alternating current (AC), and it must be interrupted by an approved device for safety reasons. It can also be used to incrementally break the electric current instead of switching off abruptly.

The growth of the market during the forecast period can be attributed to the increasing capacity additions and enhancements of T&D networks across major countries in North America, South America, Europe, Asia Pacific, and the Middle East & Africa.

Key Stakeholders

- Government Utility Providers

- Independent Power Producers

- Circuit Breaker manufacturers

- Power equipment and garden tool manufacturers

- Consulting companies in the energy & power sector

- Distribution utilities

- Government and research organizations

- Organizations, forums, and associations

- Raw material suppliers

- State and national regulatory authorities

- Switchgear manufacturers, distributors, and suppliers

- Switchgear and circuit breaker original equipment manufacturers (OEMs)

Objectives of the Study

- To define, describe, and forecast the size of the market by insulation type, by installation, by voltage, by end-use industry, and region, in terms of value and volume

- To estimate and forecast the global AC circuit breaker market for various segments with respect to 5 main regions, namely, North America, Europe, Asia Pacific (APAC), South America, Middle East & Africa, in terms of value and volume

- To provide comprehensive information about the drivers, restraints, opportunities, and industry-specific challenges that affect the market growth

- To provide a detailed overview of the AC circuit breaker value chain, along with industry trends, use cases, security standards, and Porter’s five forces

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contribution to the total market

- To analyze the opportunities in the market for stakeholders by identifying high-growth segments and detail the competitive landscape for market players

- To strategically profile key players and comprehensively analyze their market rankings and core competencies

- To analyze competitive developments, such as joint ventures, mergers and acquisitions, contracts, and agreements, and new product launches, in the AC circuit breakers market

- To benchmark players within the market using the proprietary competitive leadership mapping framework, which analyzes market players on various parameters within the broad categories of business strategy excellence and strength of product portfolio

- This report covers the AC circuit breaker market size in terms of value and volume.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Product Analysis

- Product Matrix, which provides a detailed comparison of the product portfolio of each company

Company Information

- Detailed analyses and profiling of additional market players

Growth opportunities and latent adjacency in AC Circuit Breaker Market