5G Testing Market Size, Share & Industry Trends Growth Analysis Report by Offering (Hardware, Service), End-user Industry (IDMs & ODMs, Telecom Equipment Manufacturers, Telecom Service Providers), and Region (North America, Europe, Asia Pacific and Rest of the World) - Global Forecast to 2028

Updated on : Sep 24, 2024

5G Testing Market Size & Share

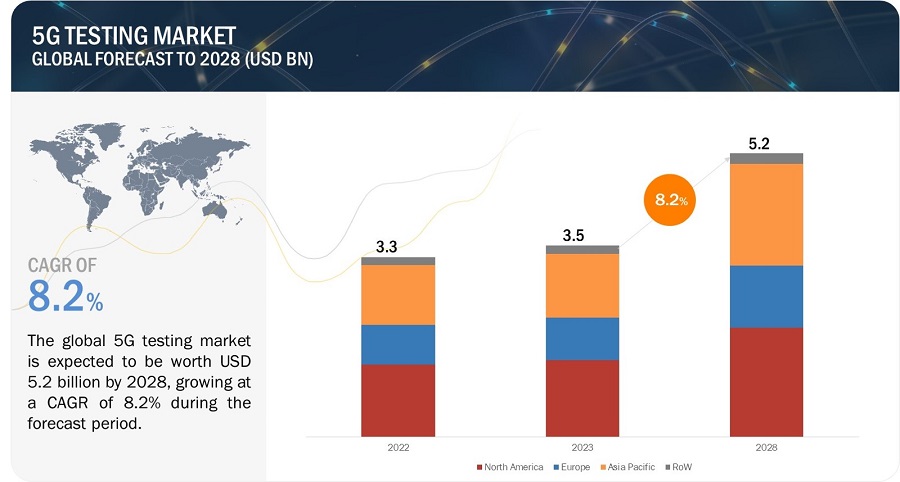

[244 Pages Report] The global 5G Testing Market is expected to be valued at USD 3.5 Billion in 2023 and is projected to reach USD 5.2 Billion by 2028; it is expected to grow at a CAGR of 8.2% from 2023 to 2028.

Product launches, acquisitions, partnerships, collaborations, strategic alliances, and expansions are the major growth strategies the market players adopt. These strategies have enabled them to efficiently fulfill the growing demand for 5G testing from different end-user industries and expand their global footprint by offering products in all the major regions.

5G Testing Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

5G Testing Market Trends

Driver: Increasing demand for high-speed data transfer

The demand for high-speed data transfer necessitates rigorous testing of 5G networks to ensure their capacity and throughput capabilities. Network operators and service providers need to validate that the networks can handle the increasing data traffic and deliver the promised data transfer speeds.

Testing helps identify any bottlenecks or performance issues that may hinder the network's ability to meet the high-speed data transfer requirements. To achieve high-speed data transfer, 5G networks require effective optimization. Testing plays a crucial role in identifying areas of the network that need optimization to enhance data transfer speeds.

Restraint: High Cost

Setting up and maintaining a 5G testing environment requires significant investment in infrastructure, including base stations, antennas, and network equipment. The cost can vary based on the size of the testing area and the number of testing sites. Specialized testing equipment is necessary to evaluate the performance and reliability of 5G networks. This includes spectrum analyzers, signal generators, channel emulators, and network analyzers. The cost of these instruments can be substantial.

Opportunity: Rising demand for 5g networks in automobiles, smart cities, and healthcare

5G technology is expected to play a crucial role in the development of autonomous vehicles and connected car applications. Testing becomes vital to ensure the reliability, low latency, and high-speed connectivity required for these applications.

5G testing can help assess the performance of vehicle-to-vehicle (V2V) and vehicle-to-infrastructure (V2X) communications and evaluate the security and reliability of connected car services. As the automotive industry increasingly adopts 5G technology, the demand for testing services and solutions specific to this industry will grow.

5G networks are crucial to enabling the infrastructure and services in smart cities, such as intelligent transportation systems, public safety applications, energy management, and smart grid solutions. Testing ensures seamless connectivity, network reliability, and interoperability across various devices, sensors, and applications. As cities worldwide invest in transforming into smart cities, the need for robust 5G testing solutions will increase.

Challenge: Complex network infrastructure

5G networks employ a heterogeneous architecture consisting of multiple frequency bands, small cells, massive MIMO (Multiple Input Multiple Output) systems, and network slicing. This diversity introduces complexities in testing, as each component requires specific testing methodologies and tools. Ensuring seamless interoperability and performance across these heterogeneous elements is challenging for the testing market.

5G networks utilize millimeter-wave frequencies (mmWave) for enhanced capacity and throughput. However, mmWave signals have a shorter range and are more susceptible to blockages. Testing the performance and coverage of mmWave frequencies poses challenges regarding signal propagation, interference, and antenna design. Specialized testing equipment and expertise are required to address these challenges.

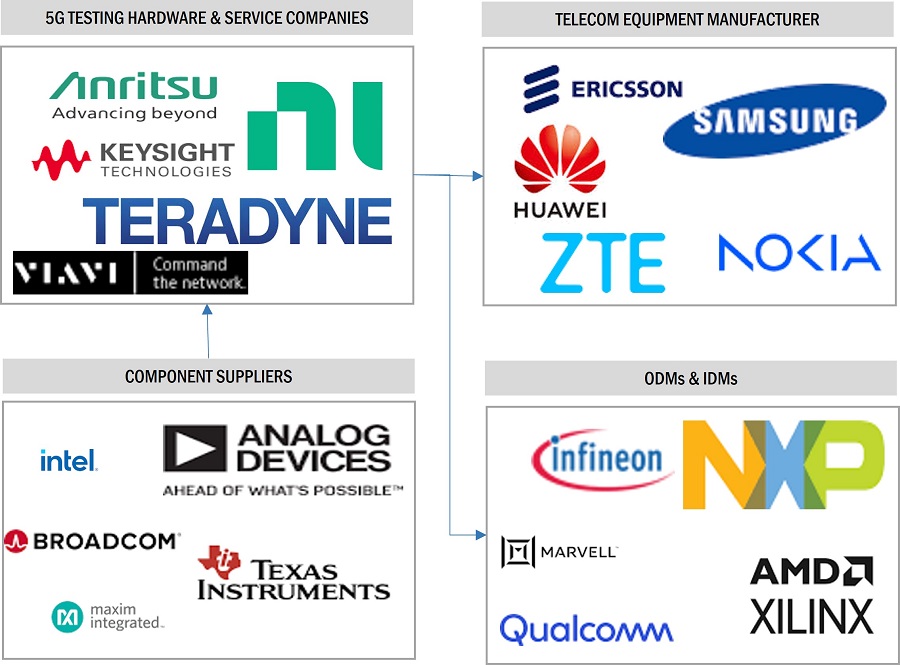

5G Testing Equipment Market Ecosystem

The 5G testing industry is dominated by established and financially sound manufacturers with extensive experience in the industry. These companies have diversified product portfolios, cutting-edge technologies, and strong global sales and marketing networks. Leading players in the market include Anritsu, Keysight Technologies, Teradyne Inc., National Instruments Corporation, and Spirent Communications.

5G Testing Market Segment

Based on hardware, the spectrum analyzers market for device testing to hold the highest market share during the forecast period

5G networks operate across a wide frequency range, including traditional cellular bands, sub-6 GHz frequencies, and mmWave bands. Spectrum analyzers are essential tools for analyzing and measuring the frequency spectrum, identifying signal interference, and ensuring proper allocation and utilization of the available frequency bands.

With the increased complexity of 5G frequency bands, the demand for spectrum analyzers is expected to grow. In 5G networks, spectrum analyzers play a crucial role in analyzing signal quality, identifying noise sources, and assessing the network’s overall performance.

Telecom equipment manufacturers’ end-user industry for the 5G Testing Market to grow at the highest CAGR from 2023 to 2028

The exponential growth in data traffic, driven by the proliferation of connected devices, IoT applications, video streaming, and cloud computing, has resulted in a higher demand for network infrastructure.

Telecom equipment manufacturers provide the essential components, such as base stations, antennas, routers, switches, and optical fiber equipment, that form the backbone of communication networks. As network operators upgrade and expand their infrastructure to meet the growing data demands, the market for telecom equipment manufacturers expands.

The rollout of 5G networks is a significant driver for the growth of telecom equipment manufacturers. 5G technology requires new and advanced infrastructure components to support higher data speeds, low latency, and increased connectivity.

Telecom equipment manufacturers develop and provide the necessary 5G-specific equipment, such as 5G base stations, Massive MIMO systems, and advanced antenna solutions. As 5G deployments continue globally, the demand for telecom equipment manufacturers' products increases.

5G Testing Market Regional Analysis

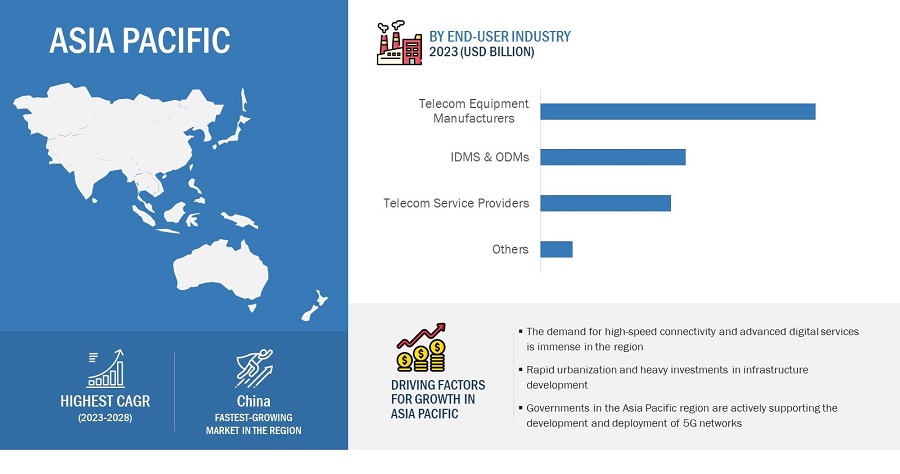

5G Testing Market in Asia Pacific to hold the highest CAGR during the forecast period

Asia Pacific is at the forefront of 5G network deployments, with several countries actively rolling out 5G infrastructure. Countries like China, South Korea, and Japan have made significant progress deploying 5G networks, creating a strong demand for 5G testing solutions. The large-scale deployment of 5G networks in these countries and others in the region has fueled the growth of the 5G testing equipment market.

The Asia Pacific region has a massive population and a rapidly growing mobile subscriber base. The increasing number of mobile subscriptions, coupled with the growing consumption of data-intensive applications and services, has led to a surge in data traffic. To accommodate this increasing demand and ensure the performance and reliability of 5G networks, extensive testing is required. As a result, the demand for 5G testing services and solutions has risen significantly in the region.

Various industry verticals in the Asia Pacific region, including manufacturing, healthcare, automotive, and smart cities, are actively adopting 5G technology to transform their operations. These industries require specialized testing to validate the performance, security, and reliability of their 5G-enabled applications and services. The demand for industry-specific testing solutions has driven the growth of the 5G testing equipment market in Asia Pacific.

5G Testing Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Top 5G Testing Companies - Key Market Players:

The 5G testing companies is dominated by players such as

- Anritsu (Japan),

- Keysight Technologies (US),

- Teradyne Inc. (US),

- National Instruments Corporation (US),

- Spirent Communications (UK), and others.

5G Testing Equipment Market Report Scope

|

Report Metric |

Details |

|

Estimated Market Size |

USD 3.5 Billion in 2023 |

|

Projected Market Size |

USD 5.2 Billion by 2028 |

|

Growth Rate |

CAGR of 8.2% |

|

Market size available for years |

2019-2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023-2028 |

|

Forecast units |

Value (USD Billion) |

|

Segments covered |

By Offering, and End-user Industry |

|

Geographies covered |

North America, Europe, Asia Pacific, and RoW |

|

Companies covered |

The major market players include Anritsu (Japan), Keysight Technologies (US), Teradyne Inc. (US), National Instruments Corporation (US), Spirent Communications (UK), Viavi Solutions Inc. (US), Macom (US), Rohde & Schwarz (Germany), GL Communications Inc. (US), Exfo Inc. (Canada). (Total 25 players are profiled) |

5G Testing Market Highlights

|

Segment |

Subsegment |

|

5G testing market, by offering |

|

|

5G testing market, by end-user industry |

|

|

5G testing market, By region |

|

Recent Developments in 5G Testing Equipment Industry

- In March 2023, Anritsu announced the release of the MS2070A, the latest model of a handheld spectrum analyzer with excellent cost performance. With frequency coverage up to 3 GHz, many features, and high performance, it enables reliable and accurate RF measurements in construction sites, labs, and production lines.

- In February 2023, Keysight announced the release of its new E7515R solution based on its 5G Network Emulation Solutions platform, a streamlined network emulator designed explicitly for protocol, radio frequency (RF), and functional testing of all cellular Internet of things (CIoT) technologies.

- In January 2023, Rohde & Schwarz announced the launch of R&S PVT360A, a one-stop solution for FR1 base station, small cell, and RF component testing.

- In November 2022, National Instruments Corp. announced the 3rd generation PXIe-5842 Vector Signal Transceiver (VST). It offers continuous frequency coverage from 50MHz to 23 GHz, doubles the available instantaneous bandwidth from 1GHz to 2 GHz, and provides best-in-class RF performance on key metrics such as Error Vector Magnitude (EVM) and average noise density.

- In October 2022, Anritsu announced the launch of the World’s First Single Sweep VNA-Spectrum Analyzer Solution, which supports 70 kHz to 220 GHz and extends its VectorStar vector network analyzer (VNA) family.

- In October 2022, Keysight Technologies expanded its 5G testing portfolio by introducing Nemo Testing Suite. This device allows users to receive comprehensive, realistic, and flexible 5G network performance validation and end-user Quality of Experience (QoE) assessment.

Frequently Asked Questions (FAQ):

What are the major driving factors and opportunities in the 5G testing market?

Some of the major driving factors for the growth of this market include Increasing demand for high-speed data transfer, Increasing demand for virtual and augmented reality applications, Growing investments in 5G technology, and rising number of connected devices. Moreover, Increasing demand for high-speed internet, 5G networks in IoT with the emergence of cloud services, and Rising demand for 5G networks in automobiles, smart cities, and the healthcare sector are some of the critical opportunities for the 5G testing market.

Which region is expected to hold the highest market share?

The market in North America will dominate the market share in 2023, showcasing strong demand for 5G testing in the region. Strong research and development, the presence of leading telecom operators and telecom equipment manufacturers, and investments and funding are key factors driving the growth of the 5G testing market in the region.

Who are the leading players in the global 5G testing market?

Companies such as Anritsu (Japan), Keysight Technologies (US), Teradyne Inc. (US), National Instruments Corporation (US), and Spirent Communications (UK) are the leading players in the market. Moreover, these companies rely on strategies that include new product launches and developments, partnerships and collaborations, and acquisitions. Such advantages give these companies an edge over other companies in the market.

What are some of the technological advancements in the market?

5G networks utilize higher frequency bands in the mmWave range to deliver ultra-high data speeds. Testing solutions have been enhanced to address the unique challenges of mmWave propagation, such as signal blockage, attenuation, and path loss. These solutions include advanced channel modeling, beamforming optimization, and link budget analysis for mmWave frequencies.

What is the impact of the global recession on the market?

The 5G testing market is expected to be impacted significantly by the recession and rising inflation in 2023. The recession is expected to reduce investments in telecommunications infrastructure

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing demand for high-speed data transfer- Rising popularity of virtual and augmented reality applications- Growing investments in 5G technology- Increase in number of connected devicesRESTRAINTS- High cost of deployment- Increasing security concernsOPPORTUNITIES- Rising demand for high-speed internet- Growing adoption of cloud services in IoT- Increasing need for 5G networks across industriesCHALLENGES- Lack of standardization- Complex network infrastructure

-

5.3 VALUE CHAIN ANALYSIS

-

5.4 ECOSYSTEM ANALYSIS

-

5.5 PORTER'S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.6 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.8 AVERAGE SELLING PRICE ANALYSIS

-

5.9 CASE STUDY ANALYSIS

-

5.10 TECHNOLOGY ANALYSISKEY TECHNOLOGIES- Network Emulation- Protocol Testing- Conformance and Certification TestingCOMPLEMENTARY TECHNOLOGIES- Massive MIMO- Millimeter Wave (mmWave) Testing- Open RAN (Radio Access Network)ADJACENT TECHNOLOGIES- Network Function Virtualization (NFV)- Internet of Things (IoT)- Software-defined Networking (SDN)- Big Data Analytics

-

5.11 PATENT ANALYSIS

- 5.12 TRADE ANALYSIS

- 5.13 TARIFF ANALYSIS

-

5.14 STANDARDS AND REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSSTANDARDS & REGULATIONS RELATED TO 5G TESTING MARKET- Europe- US

- 5.15 KEY CONFERENCES AND EVENTS, 2023–2024

- 6.1 INTRODUCTION

-

6.2 5G NR (NEW RADIO)PROVIDES SIGNIFICANTLY IMPROVED PERFORMANCE

-

6.3 MMWAVEIDEALLY SUITED TO LOW LATENCY 5G NETWORKS

-

6.4 MIMO (MULTIPLE-INPUT MULTIPLE-OUTPUT)INCREASES DATA CAPACITY AND IMPROVES LINK RELIABILITY

-

6.5 BEAMFORMINGHELPS INCREASE 5G NETWORK COVERAGE

-

6.6 NETWORK SLICINGEVALUATES INDIVIDUAL 5G NETWORKS FOR BETTER EFFICIENCY

- 7.1 INTRODUCTION

-

7.2 LOW BAND (BELOW 1 GHZ)OFFERS BETTER COVERAGE AND SIGNAL PENETRATION

-

7.3 MID BAND (BETWEEN 1 GHZ AND 6 GHZ)REQUIRED FOR LARGE IOT DEPLOYMENTS

-

7.4 HIGH BAND (ABOVE 24 GHZ)SUITED TO VR AND AR APPLICATIONS

- 8.1 INTRODUCTION

-

8.2 HARDWAREDEVICE TESTING- Oscilloscopes- Spectrum Analyzers- Signal Generators- Network analyzers- OthersNETWORK TESTING- Network Scanners- Network Testers- OTA Testers

-

8.3 SERVICESUSE OF DEVICE TESTING AND APPLICATION TESTING TO ENHANCE PERFORMANCE

- 9.1 INTRODUCTION

-

9.2 IDMS (INTEGRATED DEVICE MANUFACTURERS) & ODMS (ORIGINAL DEVICE MANUFACTURERS)GROWING USE OF 5G TESTING FOR MULTIPLE APPLICATIONS

-

9.3 TELECOM EQUIPMENT MANUFACTURERSINCREASING DEMAND FOR 5G TESTING OF TELECOM INFRASTRUCTURE

-

9.4 TELECOM SERVICE PROVIDERS (TSP)GROWING ADOPTION OF 5G TESTING TO OPTIMIZE NETWORK PERFORMANCE

-

9.5 OTHERSGROWING ADOPTION OF 5G TECHNOLOGY BY GOVERNMENTS

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICANORTH AMERICA: RECESSION IMPACTUS- Growing investments in 5G infrastructure to drive marketCANADA- Increasing adoption of 5G technology to drive demandMEXICO- Government initiatives to support market growth

-

10.3 EUROPEEUROPE: RECESSION IMPACTUK- Growing government support to propel marketGERMANY- High 5G adoption rate to fuel marketFRANCE- High demand from autonomous and connected car manufacturers to drive marketREST OF EUROPE

-

10.4 ASIA PACIFICASIA PACIFIC: RECESSION IMPACTCHINA- Widespread 5G deployment to boost marketJAPAN- Thriving IT and telecom industries to create demand for 5G testingSOUTH KOREA- Increasing PPP activities related to 5G mobile networks to drive marketREST OF ASIA PACIFIC

-

10.5 REST OF THE WORLD (ROW)ROW: RECESSION IMPACTMIDDLE EAST & AFRICA- Growing demand for 5G testing equipment to fuel market growthSOUTH AMERICA- Rising demand for 5G networks to drive market

- 11.1 INTRODUCTION

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 11.3 COMPANY REVENUE ANALYSIS, 2020–2022

- 11.4 MARKET SHARE ANALYSIS, 2022

-

11.5 COMPANY EVALUATION QUADRANTSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

11.6 STARTUP/SME EVALUATION QUADRANTPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

-

11.7 COMPANY PRODUCT FOOTPRINT ANALYSIS

-

11.8 STARTUP/SME EVALUATION MATRIXSTARTUP/SME MATRIX: KEY STARTUPS/SMESSTARTUP PRODUCT FOOTPRINT ANALYSIS

-

11.9 COMPETITIVE SCENARIOS & TRENDS

-

12.1 KEY PLAYERSANRITSU- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewKEYSIGHT TECHNOLOGIES- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewTERADYNE INC.- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewNATIONAL INSTRUMENTS CORPORATION- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewSPIRENT COMMUNICATIONS- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewVIAVI SOLUTIONS INC.- Business overview- Products/Services/Solutions offered- Recent developmentsMACOM- Business overview- Products/Services/Solutions offered- Recent developmentsROHDE & SCHWARZ- Business overview- Products/Services/Solutions offered- Recent developmentsGL COMMUNICATIONS INC.- Business overview- Products/Services/Solutions offered- Recent developmentsEXFO INC.- Business overview- Products/Services/Solutions offered- Recent developments

-

12.2 OTHER PLAYERSINNOWIRELESS CO., LTD.PCTEL INC.COHU, INCMARVIN TEST SOLUTIONS, INC.GAO TEK INC. & GAO GROUPCONSULTIX WIRELESSVALID8.COM INC.SIMNOVUSTEKTRONIX INC.EMITEARTIZA NETWORKS, INC.ACCEDIANMAVENIRANOKIWAVE, INCPARALLEL WIRELESS

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 RISK FACTOR ANALYSIS

- TABLE 2 ASSUMPTIONS: RECESSION

- TABLE 3 ROLE OF COMPANIES IN ECOSYSTEM/VALUE CHAIN

- TABLE 4 IMPACT OF PORTER’S FIVE FORCES ON 5G TESTING MARKET

- TABLE 5 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 END USERS (%)

- TABLE 6 KEY BUYING CRITERIA FOR TOP 3 END USERS

- TABLE 7 SELLING PRICE SAMPLES OF 5G TESTING EQUIPMENT, BY COMPANY

- TABLE 8 USE CASE: TELSTRA SUCCESSFULLY USES 5G TESTING TECHNOLOGY FROM ERICSSON

- TABLE 9 USE CASE: ANRITSU PROVIDES SAMSUNG TESTING SOLUTION FOR 5G DEVICES

- TABLE 10 USE CASE: QUALCOMM INTEGRATES 5G TEST SOLUTION FROM KEYSIGHT TECHNOLOGIES

- TABLE 11 USE CASE: CHINA MOBILE UTILIZES 5G TESTING SOLUTION FROM SPIRENT COMMUNICATIONS

- TABLE 12 USE CASE: NOKIA AND KEYSIGHT DEVELOP SOLUTION TO TEST QUALITY OF 5G NETWORKS AND DEVICES

- TABLE 13 PATENTS IN 5G TESTING MARKET, 2020-2022

- TABLE 14 IMPORT DATA, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 15 EXPORT DATA, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 16 MFN TARIFFS FOR HS CODE: 903040 EXPORTED BY US

- TABLE 17 MFN TARIFFS FOR HS CODE: 903040 EXPORTED BY CHINA

- TABLE 18 MFN TARIFFS FOR HS CODE: 903040 EXPORTED BY JAPAN

- TABLE 19 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 23 5G TESTING MARKET: CONFERENCES AND EVENTS

- TABLE 24 MARKET, BY SPECTRUM, 2019–2022 (USD MILLION)

- TABLE 25 MARKET, BY SPECTRUM, 2023–2028 (USD MILLION)

- TABLE 26 MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 27 MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 28 HARDWARE: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 29 HARDWARE: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 30 HARDWARE: MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 31 HARDWARE: MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 32 DEVICE TESTING:MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 33 DEVICE TESTING: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 34 DEVICE TESTING: MARKET, BY TYPE, 2019–2022 (THOUSAND UNITS)

- TABLE 35 DEVICE TESTING: MARKET, BY TYPE, 2023–2028 (THOUSAND UNITS)

- TABLE 36 NETWORK TESTING: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 37 NETWORK TESTING: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 38 5G TESTING MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 39 MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 40 IDMS & ODMS: MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 41 IDMS & ODMS: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 42 IDMS & ODMS: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 43 IDMS & ODMS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 44 IDMS & ODMS: NORTH AMERICA MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 45 IDMS & ODMS: NORTH AMERICA MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 46 IDMS & ODMS: EUROPE MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 47 IDMS & ODMS: EUROPE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 48 IDMS & ODMS: ASIA PACIFIC MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 49 IDMS & ODMS: ASIA PACIFIC MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 50 IDMS & ODMS: ROW MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 51 IDMS & ODMS: ROW MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 52 TELECOM EQUIPMENT MANUFACTURERS: 5G TESTING MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 53 TELECOM EQUIPMENT MANUFACTURERS: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 54 TELECOM EQUIPMENT MANUFACTURERS: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 55 TELECOM EQUIPMENT MANUFACTURERS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 56 TELECOM EQUIPMENT MANUFACTURERS: NORTH AMERICA MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 57 TELECOM EQUIPMENT MANUFACTURERS: NORTH AMERICA MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 58 TELECOM EQUIPMENT MANUFACTURERS: EUROPE MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 59 TELECOM EQUIPMENT MANUFACTURERS: EUROPE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 60 TELECOM EQUIPMENT MANUFACTURERS: ASIA PACIFIC MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 61 TELECOM EQUIPMENT MANUFACTURERS: ASIA PACIFIC MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 62 TELECOM EQUIPMENT MANUFACTURERS: ROW MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 63 TELECOM EQUIPMENT MANUFACTURERS: ROW MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 64 TELECOM SERVICE PROVIDERS: 5G TESTING MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 65 TELECOM SERVICE PROVIDERS: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 66 TELECOM SERVICE PROVIDERS: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 67 TELECOM SERVICE PROVIDERS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 68 TELECOM SERVICE PROVIDERS: NORTH AMERICA MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 69 TELECOM SERVICE PROVIDERS: NORTH AMERICA MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 70 TELECOM SERVICE PROVIDERS: EUROPE MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 71 TELECOM SERVICE PROVIDERS: EUROPE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 72 TELECOM SERVICE PROVIDERS: ASIA PACIFIC MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 73 TELECOM SERVICE PROVIDERS: ASIA PACIFIC MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 74 TELECOM SERVICE PROVIDERS: ROW MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 75 TELECOM SERVICE PROVIDERS: ROW MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 76 OTHERS: 5G TESTING MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 77 OTHERS: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 78 OTHERS: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 79 OTHERS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 80 OTHERS: NORTH AMERICA MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 81 OTHERS: NORTH AMERICA MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 82 OTHERS: EUROPE MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 83 OTHERS: EUROPE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 84 OTHERS: ASIA PACIFIC MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 85 OTHERS: ASIA PACIFIC MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 86 OTHERS: ROW MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 87 OTHERS: ROW MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 88 5G TESTING MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 89 MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 90 NORTH AMERICA: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 91 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 92 NORTH AMERICA: MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 93 NORTH AMERICA: MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 94 US: MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 95 US: MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 96 CANADA: MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 97 CANADA: MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 98 MEXICO: MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 99 MEXICO: MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 100 EUROPE: 5G TESTING MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 101 EUROPE: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 102 EUROPE: MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 103 EUROPE: MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 104 UK: MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 105 UK: MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 106 GERMANY: MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 107 GERMANY: MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 108 FRANCE: MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 109 FRANCE: MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 110 REST OF EUROPE: MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 111 REST OF EUROPE: MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 112 ASIA PACIFIC: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 113 ASIA PACIFIC: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 114 ASIA PACIFIC: MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 115 ASIA PACIFIC: MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 116 CHINA: 5G TESTING MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 117 CHINA: MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 118 JAPAN: MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 119 JAPAN: MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 120 SOUTH KOREA: MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 121 SOUTH KOREA: MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 122 REST OF ASIA PACIFIC: MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 123 REST OF ASIA PACIFIC: MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 124 ROW: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 125 ROW: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 126 ROW: MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 127 ROW: MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 128 MIDDLE EAST & AFRICA: MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 129 MIDDLE EAST & AFRICA: MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 130 SOUTH AMERICA: MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 131 SOUTH AMERICA: MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 132 OVERVIEW OF STRATEGIES ADOPTED BY COMPANIES IN MARKET

- TABLE 133 5G TESTING MARKET: DEGREE OF COMPETITION

- TABLE 134 COMPANY PRODUCT FOOTPRINT

- TABLE 135 COMPANY OFFERING FOOTPRINT

- TABLE 136 COMPANY END-USE INDUSTRY FOOTPRINT

- TABLE 137 COMPANY REGION FOOTPRINT

- TABLE 138 STARTUP/SME MATRIX: KEY STARTUPS

- TABLE 139 STARTUP PRODUCT FOOTPRINT

- TABLE 140 STARTUP OFFERING FOOTPRINT

- TABLE 141 STARTUP END-USE INDUSTRY FOOTPRINT

- TABLE 142 STARTUP REGION FOOTPRINT

- TABLE 143 MARKET: TOP PRODUCT LAUNCHES AND DEVELOPMENTS, MARCH 2020 TO MARCH 2023

- TABLE 144 MARKET: TOP DEALS AND OTHER DEVELOPMENTS, MARCH 2020 TO MARCH 2023

- TABLE 145 ANRITSU: BUSINESS OVERVIEW

- TABLE 146 ANRITSU: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 147 ANRITSU: PRODUCT LAUNCHES

- TABLE 148 ANRITSU: DEALS

- TABLE 149 ANRITSU: OTHERS

- TABLE 150 KEYSIGHT TECHNOLOGIES: BUSINESS OVERVIEW

- TABLE 151 KEYSIGHT TECHNOLOGIES: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 152 KEYSIGHT TECHNOLOGIES: PRODUCT LAUNCHES

- TABLE 153 KEYSIGHT TECHNOLOGIES: DEALS

- TABLE 154 TERADYNE INC.: BUSINESS OVERVIEW

- TABLE 155 TERADYNE INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 156 TERADYNE INC.: DEALS

- TABLE 157 NATIONAL INSTRUMENTS CORPORATION: BUSINESS OVERVIEW

- TABLE 158 NATIONAL INSTRUMENTS CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 159 NATIONAL INSTRUMENTS CORPORATION: PRODUCT LAUNCHES

- TABLE 160 NATIONAL INSTRUMENTS CORPORATION: DEALS

- TABLE 161 NATIONAL INSTRUMENTS CORPORATION: OTHERS

- TABLE 162 SPIRENT COMMUNICATIONS: BUSINESS OVERVIEW

- TABLE 163 SPIRENT COMMUNICATIONS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 164 SPIRENT COMMUNICATIONS: PRODUCT LAUNCHES

- TABLE 165 SPIRENT COMMUNICATIONS: DEALS

- TABLE 166 VIAVI SOLUTIONS INC.: BUSINESS OVERVIEW

- TABLE 167 VIAVI SOLUTIONS INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 168 VIAVI SOLUTIONS INC.: PRODUCT LAUNCHES

- TABLE 169 VIAVI SOLUTIONS INC.: DEALS

- TABLE 170 MACOM: BUSINESS OVERVIEW

- TABLE 171 MACOM: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 172 MACOM: PRODUCT LAUNCHES

- TABLE 173 MACOM: DEALS

- TABLE 174 ROHDE & SCHWARZ: BUSINESS OVERVIEW

- TABLE 175 ROHDE & SCHWARZ: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 176 ROHDE & SCHWARZ: PRODUCT LAUNCHES

- TABLE 177 ROHDE & SCHWARZ: DEALS

- TABLE 178 ROHDE & SCHWARZ: OTHERS

- TABLE 179 GL COMMUNICATIONS INC.: BUSINESS OVERVIEW

- TABLE 180 GL COMMUNICATIONS INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 181 GL COMMUNICATIONS INC.: PRODUCT LAUNCHES

- TABLE 182 EXFO INC.: BUSINESS OVERVIEW

- TABLE 183 EXFO INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 184 EXFO INC.: PRODUCT LAUNCHES

- TABLE 185 EXFO INC.: DEALS

- FIGURE 1 MARKET SEGMENTATION

- FIGURE 2 GDP GROWTH PROJECTION FOR MAJOR ECONOMIES UNTIL 2023

- FIGURE 3 5G TESTING MARKET: RESEARCH DESIGN

- FIGURE 4 RESEARCH FLOW FOR MARKET SIZE ESTIMATION

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE): REVENUE FROM SALES OF 5G TESTING PRODUCTS AND SOLUTIONS

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 7 TOP-DOWN APPROACH

- FIGURE 8 DATA TRIANGULATION

- FIGURE 9 HARDWARE SEGMENT TO HOLD HIGHER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 10 TELECOM EQUIPMENT MANUFACTURERS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 11 NORTH AMERICA ACCOUNTED FOR LARGEST SHARE OF MARKET IN 2022

- FIGURE 12 INCREASING USE OF 5G TESTING IN DEVICE & NETWORK TESTING TO DRIVE MARKET GROWTH

- FIGURE 13 US AND TELECOM EQUIPMENT MANUFACTURERS SEGMENT EXPECTED TO LEAD NORTH AMERICAN MARKET IN 2023

- FIGURE 14 CHINA TO HOLD LARGEST SHARE OF MARKET DURING FORECAST PERIOD

- FIGURE 15 MARKET IN CHINA TO RECORD HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 16 5G TESTING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 17 IMPACT OF DRIVERS ON MARKET

- FIGURE 18 IMPACT OF RESTRAINTS ON MARKET

- FIGURE 19 IMPACT OF OPPORTUNITIES ON MARKET

- FIGURE 20 IMPACT OF CHALLENGES ON MARKET

- FIGURE 21 VALUE CHAIN ANALYSIS: 5G TESTING

- FIGURE 22 KEY PLAYERS IN MARKET

- FIGURE 23 PORTER'S FIVE FORCES ANALYSIS: MARKET

- FIGURE 24 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 END USERS

- FIGURE 25 KEY BUYING CRITERIA FOR TOP 3 END USERS

- FIGURE 26 REVENUE SHIFT FOR PLAYERS IN MARKET

- FIGURE 27 AVERAGE SELLING PRICE FOR 5G TESTING, BY EQUIPMENT TYPE

- FIGURE 28 AVERAGE SELLING PRICE TRENDS IN MARKET, BY EQUIPMENT TYPE

- FIGURE 29 NUMBER OF PATENTS GRANTED IN MARKET, 2012-2022

- FIGURE 30 IMPORT DATA, BY COUNTRY, 2018–2022 (USD MILLION)

- FIGURE 31 EXPORT DATA, BY COUNTRY, 2018–2022 (USD MILLION)

- FIGURE 32 HIGH BAND SEGMENT TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 33 SERVICES SEGMENT TO RECORD HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 34 TELECOM EQUIPMENT MANUFACTURERS SEGMENT TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 35 5G TESTING MARKET IN ASIA PACIFIC TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 36 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 37 EUROPE: MARKET SNAPSHOT

- FIGURE 38 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 39 THREE-YEAR REVENUE ANALYSIS OF TOP PLAYERS IN MARKET

- FIGURE 40 MARKET SHARES OF LEADING PLAYERS IN MARKET, 2022

- FIGURE 41 MARKET (GLOBAL): COMPANY EVALUATION QUADRANT, 2022

- FIGURE 42 MARKET: STARTUP/SME EVALUATION QUADRANT, 2022

- FIGURE 43 ANRITSU: COMPANY SNAPSHOT

- FIGURE 44 KEYSIGHT TECHNOLOGIES: COMPANY SNAPSHOT

- FIGURE 45 TERADYNE INC.: COMPANY SNAPSHOT

- FIGURE 46 NATIONAL INSTRUMENTS CORPORATION: COMPANY SNAPSHOT

- FIGURE 47 SPIRENT COMMUNICATIONS: COMPANY SNAPSHOT

- FIGURE 48 VIAVI SOLUTIONS INC.: COMPANY SNAPSHOT

- FIGURE 49 MACOM: COMPANY SNAPSHOT

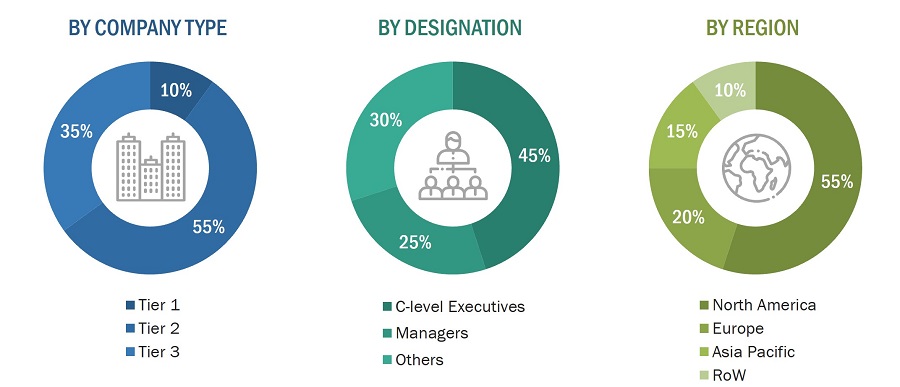

The study involved four major activities in estimating the current size of the 5G testing market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources for this research study included corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers; certified publications; articles by recognized authors; directories; and databases. The secondary data was collected and analyzed to determine the overall market size, further validated through primary research.

List of major secondary sources

|

SOURCE |

WEB LINK |

|

Federal Communications Commission (FCC) |

|

|

National Institute of Standards and Technology (NIST) |

|

|

Ministry of Electronics and Information Technology (MeitY) |

|

|

Ministry of Industry and Information Technology (MIIT) |

|

|

Ministry of Internal Affairs and Communications (MIC) |

Primary Research

Extensive primary research was conducted after gaining knowledge about the current scenario of the 5G testing market through secondary research. Several primary interviews were conducted with experts from both demand and supply sides across four major regions—North America, Europe, Asia Pacific, and RoW. This primary data was collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the 5G testing market and its various dependent submarkets. The key players in the market were identified through secondary research, and their market share in the respective regions was determined through primary and secondary research. This entire procedure involved the study of annual and financial reports of top players and extensive interviews with industry leaders such as chief executive officers (CEOs), vice presidents (VPs), directors, and marketing executives. All percentage shares and breakdowns were determined using secondary sources and verified through primary sources. All the possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Bottom-Up Approach

The bottom-up approach was used to arrive at the overall size of the 5G testing market from the revenues of the key players and their shares in the market. The overall market size was calculated based on the revenues of the key players identified in the market.

- Identifying various end-user industries using or expected to implement 5G testing

- Analyzing each end-user industry and application, along with the major related companies and 5G testing hardware and service providers

- Estimating the 5G testing market for end-user industries

- Understanding the demand generated by companies operating across different end-use applications

- Tracking the ongoing and upcoming implementation of projects based on 5G testing technology by end-user industries and forecasting the market based on these developments and other critical parameters

- Carrying out multiple discussions with the key opinion leaders to understand the type of 5G testing-based products designed and developed by end-user industries. This information would help analyze the breakdown of the scope of work carried out by each major company in the 5G testing market

- Arriving at the market estimates by analyzing 5G testing companies as per their countries, and subsequently combining this information to arrive at the market estimates by region

- Verifying and cross-checking the estimates at every level through discussions with the key opinion leaders, including CXOs, directors, and operations managers, and finally with domain experts at MarketsandMarkets

- Studying various paid and unpaid sources of information, such as annual reports, press releases, white papers, and databases

Top-Down Approach

In the top-down approach, the overall market size has been used to estimate the size of the individual markets (mentioned in the market segmentation) through percentage splits from secondary and primary research.

To calculate the market size of specific segments, the most appropriate immediate parent market size has been used to implement the top-down approach. The top-down approach was implemented for the data extracted from the secondary research to validate the market size obtained.

The market share of each company was estimated to verify the revenue shares used earlier in the top-down approach. The overall parent market size and individual market sizes were determined and confirmed in this study by the data triangulation method and the validation of data through primaries. The data triangulation method used in this study is explained in the next section.

- Focusing on top-line investments and expenditures being made in the ecosystems of various end-user industries. Additionally, listing key developments, analyzing updated technology in the marketplace, as well as evaluating the market by further splitting it into various image detection techniques

- Building and developing the information related to the market revenue generated by key 5G testing companies

- Conducting multiple on-field discussions with the key opinion leaders involved in the development of 5G testing products in various end-user industries

- Estimating geographic splits using secondary sources based on various factors, such as the number of players in a specific country and region, the offering of 5G testing, and the level of solutions offered in end-user industries

- Impact of the recession on the steps mentioned above has also been considered

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the overall market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, the data triangulation procedure has been employed wherever applicable. The data has been triangulated by studying various factors and trends from both demand and supply sides. Along with this, the market size has been validated using top-down and bottom-up approaches.

Market Definition

5G testing refers to the process of evaluating and validating the performance, functionality, and reliability of 5G network infrastructure, devices, and applications. It involves conducting various tests and measurements to ensure that the network meets the desired specifications and can deliver the promised capabilities of 5G technology. 5G testing helps identify and address issues related to network coverage, capacity, latency, and data rates. It ensures that the network is optimized to deliver high-speed, low-latency connectivity required by emerging applications.

5G testing ensures that devices and equipment from different vendors can interoperate smoothly, allowing seamless connectivity and compatibility across the ecosystem. Interoperability testing helps prevent issues arising from incompatible implementations.

Key Stakeholders

- Telecommunication Companies/Network Operators

- Device Manufacturers

- Testing Equipment Vendors

- Testing Service Providers

- Regulatory Authorities

- Industry Associations and Standards Organizations

- Application Developers

- System Integrators

- Research Institutions

Report Objectives

- To define, describe, and forecast the 5G testing market based on offering, and end-user industry.

- To forecast the shipment data of 5G testing market based on hardware.

- To forecast the size of the market segments for four major regions—North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW)

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the total market

- To study the complete value chain and allied industry segments and perform a value chain analysis of the market

- To strategically profile the key players and comprehensively analyze their market shares and core competencies

- To analyze the opportunities in the market for stakeholders and describe the competitive landscape of the market

- To analyze competitive developments such as joint ventures, collaborations, agreements, contracts, partnerships, mergers & acquisitions, product developments, and research & development (R&D) in the market

- To analyze the impact of the recession on the 5G testing market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players (up to 5)

- Additional country-level analysis of the 5G testing market

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the 5G testing market.

Growth opportunities and latent adjacency in 5G Testing Market