5G Materials Market Size, Share & Industry Analysis, By Material (Organic, Inorganic), By Product (Polytetrafluoroethylene, Polymide, Polyether ether ketone, Liquid Crystel Polyment and other product types), By Application (PCB/Component, Package Level, Wafer Level) & Region - Global Forecast to 2029

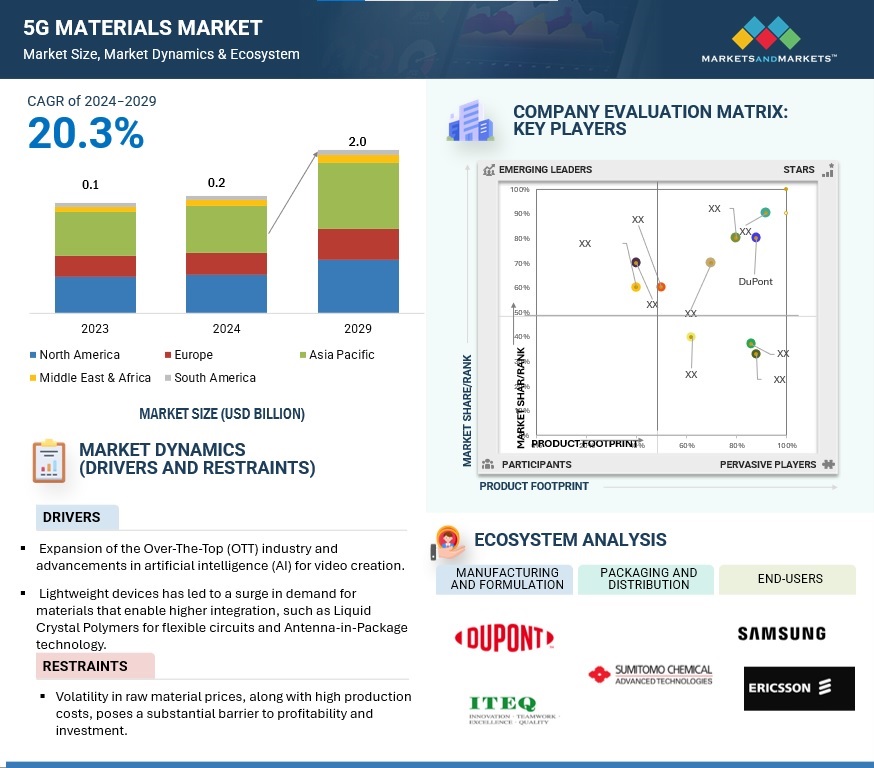

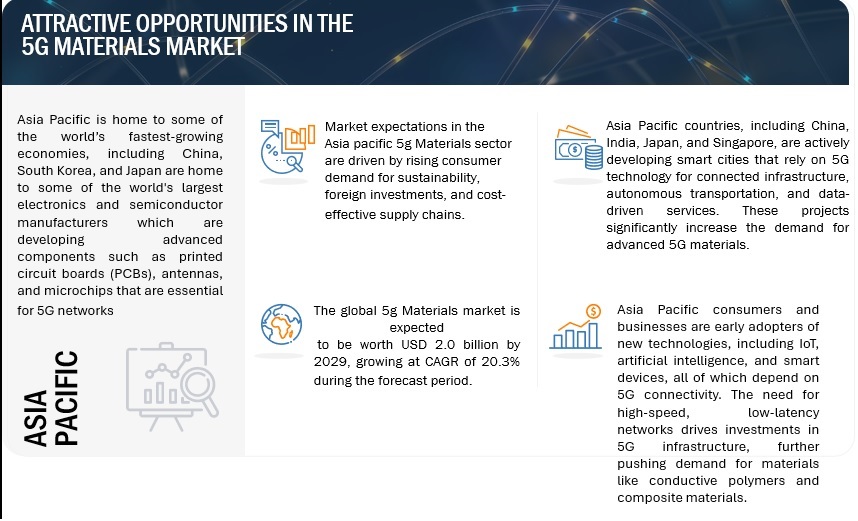

The 5g Materials market is projected to reach USD 2.0 billion by 2029, at a CAGR of 20.3% from USD 0.2 billion in 2024 during the forecast period. The market of 5G materials involves special materials that are the enablers for smooth high-frequency and high-speed operations in 5G networks. They should be capable of offering low dielectric loss, high thermal stability, and efficient signal transmission. This is to support the millimeter-wave frequencies to enable continuous communication without interruptions. Factors that drive the growth of the 5G materials market include global deployment of 5G networks, rising data traffic, and increasing demand for high-performance communication equipment. Other drivers include miniaturization of electronic devices, advancements in millimeter-wave technology, and requirement of efficient thermal management. Materials such as LCP have gained considerable momentum as it could fulfill the demands of flexible circuits, antenna-in-package, and high-density integration within compact devices. On the other hand, PTFE holds the largest share in terms of performance of the material in RF components and infrastructure of base stations. Along with this, increased IoT devices and smart electronics will create new opportunities for novel material solutions.

ATTRACTIVE OPPORTUNITIES IN THE ELECTRONICS CHEMICALS 5G MATERIALS MARKET

To know about the assumptions considered for the study, Request for Free Sample Report

5G Materials Market Dynamics

Driver: Expansion of the Over-The-Top (OTT) industry and advancements in artificial intelligence (AI) for video creation

The growth of the Over-The-Top (OTT) industry, coupled with the developments in artificial intelligence for video production, is one of the major growth drivers for the 5G materials market. When consumer demand for high-quality video content increases, the need for robust network infrastructure becomes critical. 5G technology will provide a significant leap in terms of speed, bandwidth, and latency, allowing OTT platforms to deliver seamless streaming experiences, including high-definition and ultra-high-definition content without buffering. This enhanced capability fosters higher consumption of OTT services, directly correlating with an increased demand for 5G materials that support this advanced infrastructure. Additionally, AI has revolutionized video production by automating the editing and filming processes while providing personalized content recommendations that enhance user engagement. With an increase in AI-generated content, the demand for data transfer speeds also increases, calling for sophisticated 5G materials that can withstand the bandwidth intensity of these applications. More than this, 5G also gives birth to technologies like VR and AR, which rely heavily on bandwidth and latency for successful operation. OTT companies are bound to adopt innovative formats that might attract more viewers, increasing their dependence on 5G materials. In addition, the advent of 5G networks will also reduce operational costs for OTT service providers as they will be able to transmit higher volumes of data more efficiently, thus making premium streaming services more accessible to a larger audience. This cycle of investment and growth creates a positive feedback loop that benefits both industries. It's this interplay between the burgeoning OTT landscape and AI-driven video creation that will determine the role of 5G infrastructure in shaping the future of digital content consumption.

Restraints: Volatility in raw material prices, along with high production costs, poses a substantial barrier to profitability and investment.

Volatility in the pricing of raw materials along with the high production costs drastically limits the expansion of 5G material markets. Such volatility is mainly caused due to factors like disruptions caused by supply chains, geopolitics or other factors resulting in surge in prices of basic and crucial materials, which consist of ceramics and polymers in 5G infrastructure networks. Manufacturers suffer due to a lack of profitability amid this. If raw material prices shoot up suddenly, the suppliers and OEMs are put in a very difficult position. They need to decide whether to raise the product prices to recover the costs from the customers or absorb them, thereby reducing their profit margins. Such uncertainty deters investment in new projects or expansions in the 5G sector because companies do not want to commit resources in an unstable economic environment. Also, the requirement for highly specialized materials to support the challenging performance parameters of 5G exacerbates high production costs. Besides resisting high frequencies, such materials need to have low dielectric constants and very minor losses in transmission. Therefore, with high raw material cost and complicated processes to produce the end product, production expenses are highly raised overall. This, therefore, limits the ability of companies to innovate or adopt new technologies that could improve their competitive edge in the market.

Opportunity: The expansion of millimeter wave (mmWave) applications presents significant opportunities for the growth of the 5G materials market

Expansion of mmWave applications stands as an enormous growth opportunity for the 5G materials market, with continuously increasing demand for high frequency materials that minimize signal losses. As mmWave technology remains part and parcel of 5G networks, it allows unprecedent data rates and ultra-low latency, which is instrumental for advanced applications such as Autonomous vehicles, smart cities and immersive AR experiences. The unique features of mmWave technology operating at frequencies from 24 GHz up provide a much larger bandwidth and connection density than sub-6 GHz traditional frequencies. It is this capability that allows the support of a large number of devices in densely populated areas and supports real-time data transmission needed for mission-critical applications. As industries progress and more embrace mmWave technology, they face a great need to adopt materials that can adequately carry high frequencies with the lowest possible degradation of signals. Manufacturers of 5G materials find this as a robust market opportunity for developing innovative solutions catering specifically to the needs of such applications of mmWave technology. Also, demand for advanced materials comes in with the small cell, which is essential to the enhancement of mmWave coverage in urban environments.

Challenges: The privacy issue and security challenges are one of the major concerns of 5G materials.

The privacy issues and security threats of 5G networks greatly hinder the expansion of the 5G materials market. As 5G technology advances, it opens a complex network of vulnerabilities that compromise user privacy and data security. The lack of inherent security in 5G networks has left them vulnerable to a range of attacks, including IMSI capturing. In such attacks, the malicious actors can intercept mobile traffic in order to track users' activities and disclose their identities, hence giving rise to serious location tracking and unauthorized access of personal information. This creates a trust environment that may discourage people from adopting 5G technologies, fearing breaches of their privacy. The massive amounts of data generated by connected devices also amplify these concerns over privacy. With the proliferation of Internet of Things devices, each one collecting and transmitting sensitive data, the risks of unauthorized access increase. The complexity of 5G networks based on virtualization and software-defined networking introduces additional vulnerabilities that cybercriminals can exploit. Therefore, the organizations are forced to spend heavily on security solutions to reduce these risks, which takes resources away from innovation and development in the materials sector.

5G Materials Market Ecosystem

Prominent companies in this market include well-established, financially stable service providers of 5g Materials. These companies have been operating in the market for several years and possess diversified service product portfolios and strong global sales and marketing networks.

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

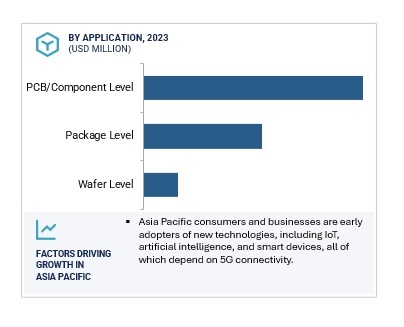

PCB/Component Level, Application Drive Growth with their Essential Role in 5g materials Market.

The 5G materials market can be segmented based on the PCB/component-level application. The largest demand for such materials is for PCB and component-level applications, as both these elements are very widely used in 5G network infrastructure and in end-user devices. High frequency and low-loss materials must be applied to handle fast data transmission without signal distortion in deploying 5G networks. Such materials as PTFE, PI, and LCP are essential in making advanced PCBs for base stations, antennas, and consumer electronics, such as smartphones. It is important to connect several components of a device in order to ensure smooth communication, which is in accordance with the 5G requirement of higher speeds and greater volumes of data.Besides their applications in 5G infrastructure, multilayer and high-density interconnect (HDI) PCBs are enabling advancements in the designs that support smaller, lighter, and more efficient devices. The rapid expansion of 5G network towers across the globe and the growing demand for routers, modems, and IoT equipment are factors that have contributed to the dominance of this segment. The continued investments by telecom companies in upgrading their network infrastructure and the growing deployment of small cells in urban areas highlight the need for efficient PCBs. With 5G network deployments increasing around the globe, PCB/component-level applications will remain the leaders. Material innovation and manufacturing capabilities that support performance and reliability standards in 5G communication systems will drive this advancement.

“Polytetrafluoro ethylene accounted for the largest product type of the 5g Materials market in 2024 in terms of value.”

Poly (tetrafluoro ethylene) is the leading product type in the 5G materials market since its superior physical and electrical properties have led it to be an essential part for high-frequency applications. The low dielectric constant inherent with ultra-low loss tangent, critical for maintaining signal integrity in high-frequency communication systems, especially at mmWave frequencies of 5G, makes PTFE a leading product. Its superior thermal stability provides constant performance even under the most challenging conditions, and that is what 5G base stations and outdoor infrastructure need. PTFE-based materials are highly applied in printed circuit boards, antenna substrates, and RF filters because of their unmatched capability to reduce signal attenuation and power loss. This makes PTFE suitable for 5G network deployment where efficient, high-speed data transfer is needed.

The increasing demand for small cells, massive MIMO antennas, and other forms of communication equipment that 5G infrastructure is taking is also driving PTFE to lead in the market. It provides the telecom companies and equipment producers with strength, chemical resistance, low dielectric loss and therefore lower energy consumption while offering efficient performance in the data transmission. The wide versatility and the ability of the material to work with different frequency ranges make the material of choice for both core infrastructure devices and the end-user devices. With the rapid roll-out of 5G in all regions and the continuous demand for low-loss materials to sustain the advanced technology, PTFE remains one of the market leaders.

“Organic accounted for the largest material type of the 5g Materials market in 2024 in terms of value.”

Organic raw materials currently have the most significant market share in 5G materials primarily due to its massive application in the synthesis of advanced polymers and composites, which play a major role in the infrastructure and devices of 5G. Materials, such as PI, LCP, PTFE, and epoxy resins, are fundamental for printed circuit boards (PCBs), antenna substrates, and component packaging. Organic materials are primarily preferred due to their ultimate flexibility, light weightiness, and excellent dielectric properties that can easily perform signal transmission with less losses at high frequencies. All these match well with the needs for 5G networks; such networks require materials, which should support the transfer of data at a very high speed, and this must not depreciate in performance. Organics also have an overwhelming advantage because of cost-effective and scalable manufacturing processes. Organic polymers are also relatively efficient in production and can be mass-produced for the increasing demand for 5G-enabled devices and infrastructures around the world. Organic raw materials are widely used in high-density interconnect (HDI) PCBs, flexible circuits, and antenna systems, all of which are crucial parts of 5G smartphones, IoT devices, and base stations. With the telecom sector readily adopting advanced materials to have a shrinking device size and weight, with increased performance, organic materials are in the basis of development with 5G technology. Organic materials also possess outstanding thermal stability, the rate of moisture absorption is quite low, and chemicals possess resistance to such that reliability is guaranteed over long periods under extreme environments. With the advent of worldwide 5G roll-outs, the need for materials that are light and capable of high performance is soaring, and organic raw material is leading the market; they are a staple that has proven itself for flexing applications with high frequencies and cost optimisation requirements.

“Based on region, North America was the largest market in 2023.”

North America is the biggest regional segment in the 5G materials market due to its early adoption of 5G technologies, robust infrastructure, and high investment in R&D. The United States has been the leader in 5G deployment, and leading telecommunication giants like AT&T, Verizon, and T-Mobile have driven it. These companies have invested hugely in the expansion of 5G infrastructure, leading to a high demand for advanced materials like polyimides, ceramics, and liquid crystal polymers, which are essential for 5G antennas, printed circuit boards, and semiconductor packaging. Another reason that North America leads is due to the presence of these leading technology companies and manufacturers. The semiconductor, telecommunication equipment, and advanced materials segments are highly concentrated in this region, thus allowing smooth innovation and seamless supply chains. North America's intensive focus on the development of autonomy in vehicles, smart cities, and industrial automation leads to a constant demand for 5G infrastructure-which in turn creates ongoing demand for high-performance material. The region receives robust government support, such as programmes undertaken by the U.S. government in 5G leadership and investments on home-based manufacturing capabilities.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

DuPont de Nemours, Inc (USA) ITEQ CORPORATION (Taiwan) Asahi Kasei Corporation (Japan) Panasonic Industry Co., Ltd. (Japan) KURARAY CO., LTD.(Japan) Avient Corporation (USA) Covestro AG (Germany) Celanese Corporation (USA) 3M (USA) Syensqo (Belgium)

Recent Developments in 5G Materials Market

- In June 25, 2020, Flexible copper-clad laminates are a key material in the development of 5G applications such as high-frequency printed circuit boards. Specialty chemicals producer Kuraray is building a new manufacturing plant for flexible copper-clad laminates (FCCL) based on its VECSTAR™ high-performance liquid crystal polymer (LCP) film at its plant in Kashima, Japan.

- In March 2021, DuPont announced it has agreed to acquire Laird Performance Materials from Advent International, a leading private equity firm, for $2.3 billion in cash, using existing cash balances. This acquisition expands DuPont's leadership in advanced electronic materials in the key markets of 5G telecommunications, artificial intelligence, the Internet of Things (IoT), and high-performance computing.

- In July 2021, Avient Expands 5G RF Material Portfolio with PREPERM ™ Low-Loss Dielectric Thermoplastics: Avient announces the launch of PREPERM™ low-loss dielectric thermoplastics, which expands its growing portfolio of materials that meet emerging needs of 5G applications.

- In June 2023, In June 2023, Celanese declared an extended collaboration with Taiwan's Industrial Technology Research Institute (ITRI). The new collaboration focuses on the development of AiP modules with Celanese's GreenTape 9KC LTCC system. Micromax Electronic Inks and Pastes, gained recognition for development of 5G mmWave wireless devices using Celanese's materials.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Frequently Asked Questions:

What are the factors influencing the growth of the 5G Materials market?

The growth in the 5G materials market is driven by rising deployment of 5G infrastructure, increasing demand for high-performance materials such as polyimides, ceramics, and composites, advances in telecommunication technology, and rising investments in smart devices, autonomous vehicles, and IoT. The further need for faster data transmission and low-latency networks accelerates market growth even more.

Define 5G Materials market.

The 5G materials market is centered on specialized materials that enable high-frequency and high-speed smooth functioning within 5G networks. These materials help in giving low dielectric loss along with high thermal stability and efficient signal transmission, which are essential for guaranteed communication at mmWave frequencies. Materials for 5G are broadly classified into polytetrafluoroethylene (PTFE), polyimide (PI), liquid crystal polymer (LCP), ceramics, and glass. These materials are used in applications such as printed circuit boards (PCBs), antenna substrates, RF filters, system-in-package (SiP), and redistribution layers.

Which region is expected to have the largest market share in the 5G Materials market?

The North America region will acquire the largest share of the 5G Materials market during the forecast period.

What are the major market players covered in the report?

The key players in this market are DuPont de Nemours, Inc (USA), ITEQ CORPORATION (Taiwan), Asahi Kasei Corporation (Japan), Panasonic Industry Co., Ltd. (Japan), KURARAY CO., LTD. (Japan), Avient Corporation (USA), Covestro AG (Germany), Celanese Corporation (USA), 3M (USA), and Syensqo (Belgium).

How big is the global 5G Materials market?

The 5G Materials market is projected to reach USD 2.0 billion by 2029, at a CAGR of 20.3% from USD 0.2 billion in 2024 during the forecast period.

5G Materials Market

Growth opportunities and latent adjacency in 5G Materials Market