5G From Space Market by Components (Hardware (Satellites, User Terminals) and Services)), Application(Enhanced Mobile Broadband (Embb), Ultra-Reliable and Low Latency Communication (Urllc), Massive Machine-Type Communications (Mmtc)), Vertical and Region - Global Forecast to 2028

Update:: 19.11.24

The 5G Satellite Communication Market is revolutionizing global connectivity by integrating satellite-based networks with 5G technology. This innovation enables seamless communication across remote areas, ensuring robust coverage where traditional networks fall short. The Satellite-Based 5G Network Market is poised for significant growth, driven by advancements in low Earth orbit (LEO) satellites and increasing demand for high-speed, low-latency communication solutions.

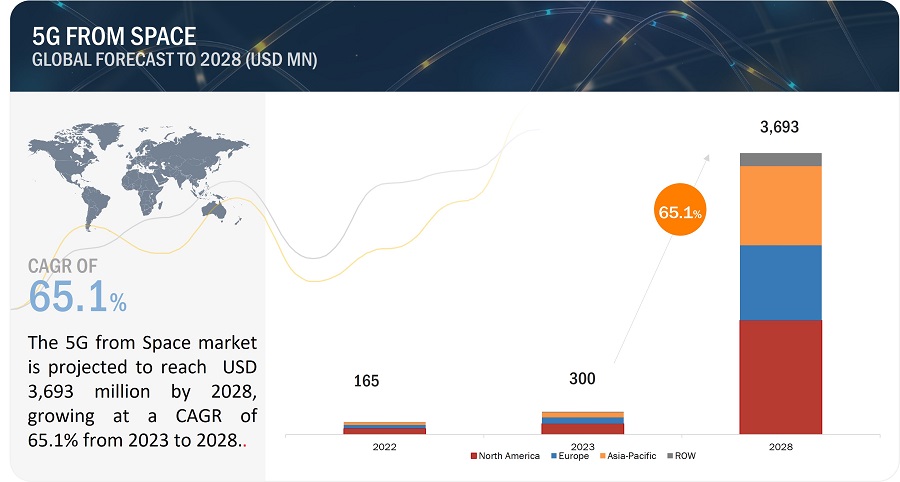

The 5G from Space Market size is projected to grow from USD 300 million in 2023 to USD 3,693 million by 2028, growing at a CAGR of 65.1% from 2023 to 2028. 5G from space is a revolutionary technology that combines the power of satellite communication with the capabilities of 5G networks. It provides global connectivity and high-speed, low-latency communication services from space, offering numerous benefits from various perspectives.

From a global connectivity standpoint, 5G from space technology has the potential to bridge the digital divide by extending high-speed internet access to remote and underserved areas. Traditional terrestrial networks often struggle to reach these regions, but with satellites deployed in low Earth orbit (LEO), 5G from space can provide seamless connectivity on a global scale.

5G From Space Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

5G From Space Market Dynamics

Driver: Development of new applications and services

The potential for innovative applications and services is a key driver behind the demand for 5G from Space Industry. Unlike existing satellite technologies, 5G from space has the capability to support advanced functionalities that were previously not feasible. This opens up possibilities such as real-time video streaming to aircraft and ships, allowing for enhanced communication and entertainment options. Additionally, the high-speed and low-latency connectivity provided by 5G from space can enable autonomous driving in remote areas, transforming transportation and expanding the reach of self-driving technologies. The ability of 5G from space to unlock these new applications and services is a significant motivating factor for businesses and industries seeking to leverage the potential of advanced satellite connectivity.

Restraints: Global chip shortage

The global chip shortage has emerged as a significant constraint for the 5G from the Space market. The shortage has presented challenges in the manufacturing of satellites, making it more difficult to meet the demand for satellite deployment. The limited availability of essential chips has led to delays and increased costs associated with building satellite constellations. As a result, the industry is grappling with supply chain disruptions and uncertainties, hindering the pace of progress in expanding the 5G from Space infrastructure. The chip shortage serves as a major constraint, impacting the market's growth potential and posing obstacles to the timely and cost-effective implementation of satellite-based 5G connectivity solutions. The demand for semiconductors has been increasing steadily in recent years. In 2021, the global semiconductor market was valued at $555.9 billion, and it is expected to reach $650.6 billion by 2026. This growth is being driven by the increasing demand for electronic devices, such as smartphones, laptops, and cars. As well as Geopolitical tensions have also contributed to the shortage. The trade war between the United States and China has led to increased uncertainty in the semiconductor market, which has made it more difficult for companies to secure supplies.

Opportunities: Growing adoption of the Internet of Things (IoT)

The growth of the Internet of Things (IoT) presents significant opportunities for 5G from space. As the IoT market expands at a rapid pace, 5G from space can play a crucial role in connecting and supporting IoT devices. The high-speed and reliable connectivity offered by 5G from space opens up new possibilities for seamless communication and interaction among IoT devices, enabling efficient data exchange and real-time decision-making. This creates a surge in demand for 5G from space as businesses and industries seek to leverage the potential of IoT technologies in various sectors, such as smart cities, industrial automation, agriculture, and healthcare. The integration of 5G from space with IoT applications not only drives innovation but also enhances productivity, efficiency, and resource management. With its capacity to provide robust and scalable connectivity, 5G from space holds immense opportunities to fuel the growth and expansion of the IoT market, revolutionizing industries and transforming the way we live and work.

Challenges: The latency of 5G signals from space is higher than the latency of terrestrial 5G signals.

The latency, or the time delay in transmitting data, is generally higher for 5G signals from space compared to terrestrial 5G signals. This increased latency can pose difficulties for applications that require real-time responsiveness, such as real-time gaming, virtual reality, or remote control of critical systems. The higher latency can result in noticeable delays and affect the overall user experience in these applications. While efforts are underway to minimize latency in satellite communications through technological advancements and optimization techniques, addressing this challenge remains a priority to ensure that 5G from space can effectively support latency-sensitive applications and meet the expectations of users who require instant and seamless interactions.

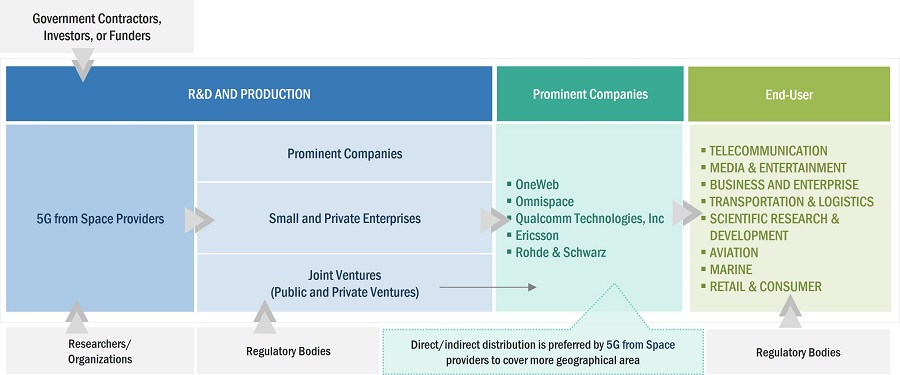

5G From Space Market Ecosystem:

Scientific research & development and Business forces lay a vital role in the 5G from space. As well as such, customers are engaged in procuring newly launched 5G Satellite internet for applications in national defense infrastructure.

Based on Components, the Service segment is estimated to lead the 5G from the space market in 2028.

Based on Components, the service segment is estimated to lead the 5G from Space market from 2023 to 2028. service providers offer system integration services, which involve integrating 5G from space solutions with existing infrastructure. This service ensures seamless interoperability and compatibility between different systems and networks. System integration allows organizations to maximize their investments, leverage their existing assets, and create a cohesive ecosystem that integrates various technologies and applications.

Based on the Application, Enhanced Mobile Broadband (EMBB) is estimated to account for the larger share of the 5G from Space market in 2023

EMBB in 5G from space technology revolutionizes global mobile broadband connectivity. It enables ubiquitous coverage, provides high-speed data rates, supports data-intensive applications, and empowers users across industries. With its transformative capabilities, eMBB in 5G from space technology is driving global connectivity, bridging the digital divide, and opening up new possibilities for communication, collaboration, and innovation on a global scale.

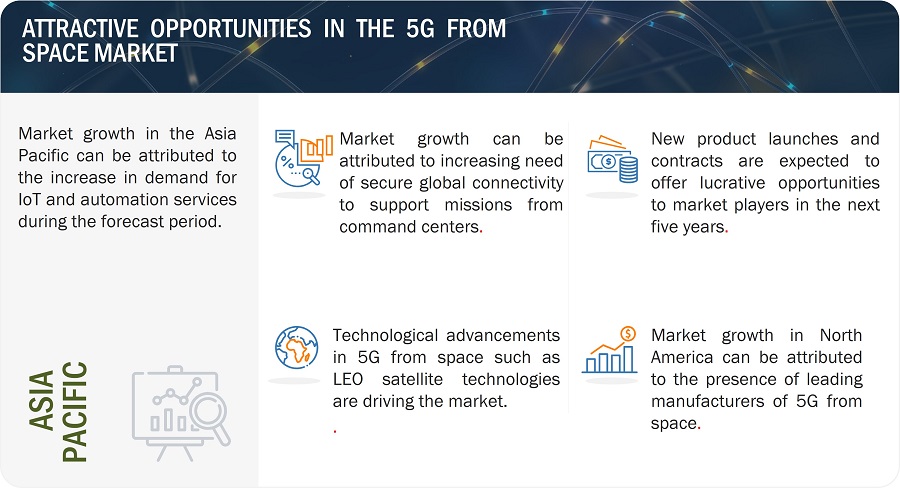

The Asia Pacific market is projected to grow at the highest CAGR during the forecast period in 2028 in the 5G from space market.

Governments in the Asia Pacific region are actively investing in infrastructure development and digital initiatives. They are recognizing the importance of advanced connectivity and digital transformation for economic growth and competitiveness. These initiatives create a conducive environment for the adoption and deployment of 5G from space technology, further fueling its growth in the region.

Considering these factors, the Asia Pacific region is poised for significant growth in the 5G from space market, with a strong projected CAGR. The region's diverse landscape, urbanization trends, consumer demands, industrial growth, and government support contribute to this growth, positioning the Asia Pacific region as a key player in leveraging the benefits of 5G from space technology.

5G From Space Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The 5G from space companies are dominated by a few globally established players such as Oneweb (UK), Omnispace(US), Qualcomm (US), Ericsson (Sweden), and Rohde & Schwarz (Germany) among others, are the key manufacturers that secured 5G from space. A major focus was given to the contracts and new product development due to the changing requirements of commercial, homeland security, and defense & space users across the world.

Scope of the Report

|

Report Metric |

Details |

|

Growth Rate |

65.1% |

|

Estimated Market Size in 2023 |

USD 300 Million |

|

Projected Market Size in 2028 |

USD 3,693 Million |

|

Market size available for years |

2020–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023-2028 |

|

Forecast units |

Value (USD Million) |

|

Segments Covered |

By Components, By Verticals, By Application, And By Region. |

|

Geographies covered |

North America, Europe, Asia Pacific, and ROW, including Middle East & Africa, and Latin America |

|

Companies covered |

OneWeb (UK), Omnispace(US), Qualcomm (US), Ericsson (Sweden), Rohde & Schwarz (Germany), Lynk Global, China Aerospace Science and Technology Corporation (CASC), Echostar Corporation, SES S.A., Lockheed Martin Corporation, keysight technologies, Inc., Telesat, Thales Alenia Space, Gilat Satellite Networks, Sateliot |

5G From Space Market Highlights

The study categorizes the 5G from the space market based on components, vertical, application, and region.

|

Segment |

Subsegment |

|

By Component |

|

|

By Vertical |

|

|

By Application |

|

|

By Region |

|

Frequently Asked Questions (FAQ):

Which are the major companies in the 5G from the Space market? What are their major strategies to strengthen their market presence

Some of the key players in the 5G from Space market are Oneweb (UK), Omnispace(US), Qualcomm (US), Ericsson (Sweden), and Rohde & Schwarz (Germany), among others, are the key manufacturers that secured 5G from Space contracts in the last few years. Contracts were the key strategies adopted by these companies to strengthen their 5G from Space market presence.

What are the drivers and opportunities for the 5G from Space market?

The demand for global connectivity, high-speed and low-latency connectivity, and ubiquitous coverage is increasing rapidly. Industries undergoing digital transformation seek advanced communication solutions, and 5G from space technology enables seamless integration and IoT connectivity. The market offers vast potential for innovation and collaboration, with governments investing in development and deployment. Emerging markets and industries present untapped opportunities, while enhanced user experiences drive the demand.

Which region is expected to grow at the highest rate in the next five years?

The market in Asia Pacific is projected to grow at the highest CAGR from 2023 to 2028, showcasing strong demand for 5G from Space in the region. One of the key factors driving the market in Asia Pacific is the rising demand for launch & early orbit support, TT&C services, and data handling & processing services.

Which type of 5G from Space is expected to lead significantly in the coming years?

The EMBB segment of the 5G from Space market is projected to witness the highest CAGR due to IoT and the increasing need for the fastest, most secure, and widest coverage of international and intercontinental data networks for enterprise systems between 2023 to 2028.

Which are the key technology trends prevailing in the 5G from Space market?

5G from space is an integral part of Non-Terrestrial Networks (NTNs), which encompass various satellite communication systems. As part of NTN design, 5G technology is being adapted and extended to provide connectivity and advanced network capabilities beyond terrestrial boundaries. The integration of 5G from space in the industrial sector opens new opportunities for enhanced automation, improved operational efficiency, and enhanced safety measures. Real-time connectivity enables smooth coordination between robotic systems, machinery, and sensors, resulting in streamlined workflows, minimized downtime, and informed decision-making. The low-latency capabilities of 5G from space also facilitate the implementation of emerging technologies like edge computing and the Internet of Things (IoT), enabling real-time data processing and analysis for various industrial applications. As this technology continues to evolve and mature, the industrial sector can anticipate even more transformative changes, unlocking new possibilities for growth, efficiency, and innovation

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing demand for high-speed internet access- Development of new applications and services- Advances in technology- Space exploration and researchRESTRAINTS- Global chip shortage- Government regulations on satellite systems in certain regionsOPPORTUNITIES- Increasing need for high-speed and reliable communication networks in remote areas- Promoting economic development- Growing adoption of Internet of ThingsCHALLENGES- Impact of latency on real-time applications- Security-related challenges associated with satellites- Building strong reliability for 5G from space

- 5.3 VALUE CHAIN ANALYSIS

-

5.4 TRENDS/DISRUPTION IMPACTING CUSTOMER BUSINESSREVENUE SHIFT AND NEW REVENUE POCKETS FOR 5G FROM SPACE

-

5.5 ECOSYSTEM ANALYSISPROMINENT COMPANIESPRIVATE AND SMALL ENTERPRISESMARKET ECOSYSTEM

-

5.6 PRICING ANALYSISAVERAGE SELLING PRICE TRENDS OF 5G FROM SPACE, BY COMPONENT

-

5.7 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

- 5.8 VOLUME ANALYSIS

- 5.9 REGULATORY LANDSCAPE

-

5.10 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 5.11 EVOLUTION OF TECHNOLOGY IN 5G FROM SPACE MARKET

- 5.12 TRADE ANALYSIS

- 5.13 KEY CONFERENCES AND EVENTS, 2023–2024

- 6.1 INTRODUCTION

-

6.2 TECHNOLOGY TRENDSREVOLUTIONARY IMPACTS OF 5G FROM SPACE ON RADIO ACCESS NETWORKS (RAN)ENABLING SEAMLESS INTEGRATION OF 5G FROM SPACE INTO CORE NETWORKSSTRENGTHENING SECURITY IN 5G FROM SPACEENABLING END-TO-END QUALITY OF SERVICE IN 5G FROM SPACELEVERAGING 5G FROM SPACE TO EMPOWER IOT CONNECTIVITYLEADING 5G CHIP MANUFACTURERS REVOLUTIONIZING SEMICONDUCTOR MARKETSATELLITE TO PHONE

-

6.3 TECHNOLOGY ANALYSIS5G-ENABLED SATCOM EQUIPMENT5G CHIP

-

6.4 USE CASE ANALYSISUSE CASE: LOGISTICSUSE CASE: EVENT SURGE AND SATELLITE RESPONSEUSE CASE: MARITIMEUSE CASE: MULTI-CONNECTIVITY ENVIRONMENTIMPACT OF MEGATRENDS- Exploring wide-ranging impact of IoT technology- Machine-to-machine communication- Delivering content and streaming- Business impact of global connectivity through 5G from spaceINNOVATIONS AND PATENT APPLICATIONS- Top applicants- Top 10 patent owners in 5G from space

- 6.5 INNOVATIONS AND PATENT REGISTRATIONS

- 7.1 INTRODUCTION

-

7.2 HARDWAREINCREASING USE OF HIGH-SPEED INTERNET TO PROVIDE SEAMLESS GLOBAL COVERAGE TO DRIVE MARKETSATELLITES- Satellites in 5G from space predominantly used for global connectivityUSER TERMINALS- Advancements in 5G chipsets to drive demand for 5G user terminals

-

7.3 SERVICESRISING DEMAND FOR 5G COVERAGE IN REMOTE LOCATIONS TO DRIVE SEGMENT

- 8.1 INTRODUCTION

-

8.2 COMMERCIALTELECOMMUNICATION- Increasing need for uninterrupted mobile broadband coverage in remote and far-flung regions to spur market growthMEDIA & ENTERTAINMENT- Increasing demand for on-demand and streaming information and entertainment to drive marketBUSINESS & ENTERPRISE- Extensive use of small satellites for commercialization and data transferability to drive marketTRANSPORTATION & LOGISTICS- Technological advancements in transport and logistics networks to boost demand for 5G from spaceSCIENTIFIC RESEARCH & DEVELOPMENT- Need for development of disaster early warning systems to generate demand for 5G from spaceAVIATION- Rising number of private aviation companies to favor market growthMARINE- Increasing need for broadband connections and VSAT connectivity to fuel demand for 5G from spaceRETAIL & CONSUMER- Need for uninterrupted connectivity in e-commerce to drive marketOTHERS

-

8.3 GOVERNMENT & DEFENSEMILITARY- Developments in military communications to drive demand for 5G from spaceHOMELAND SECURITY & EMERGENCY MANAGEMENT- Need for strong and effective connectivity for emergency response to propel demand for 5G from space

- 9.1 INTRODUCTION

-

9.2 ENHANCED MOBILE BROADBANDEMBB OFFERS HIGH SPEED AND HIGH BANDWIDTH FOR RELIABLE CONNECTIVITY ON-THE-MOVE

-

9.3 ULTRA-RELIABLE AND LOW-LATENCY COMMUNICATIONSINDUSTRIAL AUTOMATION USING URLLC APPLICATIONS CAN INCREASE PRODUCTIVITY

-

9.4 MASSIVE MACHINE-TYPE COMMUNICATIONS5G FROM SPACE EMPOWERS MASSIVE MACHINE-TYPE COMMUNICATIONS IN AUTOMATION APPLICATIONS

- 10.1 INTRODUCTION

- 10.2 REGIONAL RECESSION IMPACT ANALYSIS

-

10.3 NORTH AMERICAPESTLE ANALYSIS: NORTH AMERICAUS- Increasing spending by US defense organizations and private players to drive marketCANADA- Deployment of LEO constellations by Telesat to drive market

-

10.4 EUROPEPESTLE ANALYSIS: EUROPEUK- Increasing launches of LEO constellations and high-throughput satellites to drive marketGERMANY- Emergence of internet access in telecommunication to drive marketFRANCE- Increased government funding for space research to drive marketREST OF EUROPE

-

10.5 ASIA PACIFICPESTLE ANALYSIS: ASIA PACIFICCHINA- Increasing use of IoT in connectivity applications to drive marketINDIA- Increasing demand for satellite broadcast systems and telecommunication to drive marketSOUTH KOREA- Increased use of satellites for enhanced emergency services to drive marketREST OF ASIA PACIFIC

-

10.6 REST OF THE WORLDPESTLE ANALYSIS: REST OF THE WORLDMIDDLE EAST & AFRICALATIN AMERICA

- 11.1 INTRODUCTION

- 11.2 COMPANY OVERVIEW

- 11.3 RANKING ANALYSIS

-

11.4 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

11.5 START-UP/SME EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESSTARTING BLOCKSDYNAMIC COMPANIESCOMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

-

11.6 COMPETITIVE SCENARIOMARKET EVALUATION FRAMEWORKDEALSPRODUCT LAUNCHESOTHER DEVELOPMENTS

- 12.1 INTRODUCTION

-

12.2 KEY PLAYERSONEWEB- Business overview- Products/Solutions/Services offered- MnM viewOMNISPACE- Business overview- Products/Solutions/Services offered- MnM viewQUALCOMM TECHNOLOGIES INC.- Business overview- Products/Solutions/Services offered- MnM viewERICSSON- Business overview- Products/Solutions/Services offered- MnM viewROHDE & SCHWARZ- Business overview- Products/Solutions/Services offered- MnM viewLYNK GLOBAL INC.- Business overview- Products/Solutions/Services offered- Recent developmentsSATELIOT- Business overview- Products/Solutions/Services offered- Recent developmentsLOCKHEED MARTIN CORPORATION- Business overview- Products/Solutions/Services offered- Recent developmentsSES S.A.- Business overview- Products/Solutions/Services offeredTHALES ALENIA SPACE- Business overview- Products/Solutions/Services offeredGILAT SATELLITE NETWORKS- Business overview- Products/Solutions/Services offered- Recent developmentsKEYSIGHT TECHNOLOGIES, INC.- Business overview- Products/Solutions/Services offered- Recent developmentsECHOSTAR CORPORATION- Business overview- Products/Solutions/Services offeredCHINA AEROSPACE SCIENCE AND TECHNOLOGY CORPORATION- Business overview- Products/Solutions/Services offered- Recent developmentsTELESAT- Business overview- Products/Solutions/Services offered

-

12.3 OTHER PLAYERSKEPLER COMMUNICATIONSSPACEXANRITSUFOSSA SYSTEMSAMAZON KUIPEROQ TECHNOLOGIESAST SPACEMOBILENELCOGATEHOUSEZTE

- 13.1 DISCUSSION GUIDE

- 13.2 MARKET DEFINITION

- 13.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.4 CUSTOMIZATION OPTIONS

- 13.5 RELATED REPORTS

- 13.6 AUTHOR DETAILS

- TABLE 1 5G FROM SPACE MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 MARKET: ECOSYSTEM

- TABLE 3 AVERAGE SELLING PRICE TRENDS OF 5G FROM SPACE, BY COMPONENT (2022)

- TABLE 4 5G FROM SPACE MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 5 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER AGENCIES

- TABLE 6 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER AGENCIES

- TABLE 7 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER AGENCIES

- TABLE 8 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER AGENCIES

- TABLE 9 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP TWO VERTICALS (%)

- TABLE 10 KEY BUYING CRITERIA FOR TOP VERTICALS

- TABLE 11 COUNTRY-WISE IMPORTS, 2019–2021 (USD THOUSAND)

- TABLE 12 COUNTRY-WISE EXPORTS, 2019–2021 (USD THOUSAND)

- TABLE 13 KEY CONFERENCES AND EVENTS, 2023–2024

- TABLE 14 5G FROM SPACE MARKET, BY COMPONENT, 2020–2022 (USD MILLION)

- TABLE 15 MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 16 HARDWARE: MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 17 HARDWARE: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 18 5G FROM SPACE MARKET, BY VERTICAL, 2020–2022 (USD MILLION)

- TABLE 19 MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 20 COMMERCIAL: 5G FROM SPACE MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 21 COMMERCIAL: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 22 GOVERNMENT & DEFENSE: MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 23 GOVERNMENT AND DEFENSE: 5G FROM SPACE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 24 MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 25 MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 26 MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 27 5G FROM SPACE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 28 REGIONAL RECESSION IMPACT ANALYSIS

- TABLE 29 NORTH AMERICA: MARKET, BY COMPONENT, 2020–2022 (USD MILLION)

- TABLE 30 NORTH AMERICA: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 31 NORTH AMERICA: MARKET, BY VERTICAL, 2020–2022 (USD MILLION)

- TABLE 32 NORTH AMERICA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 33 NORTH AMERICA: MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 34 NORTH AMERICA: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 35 NORTH AMERICA: 5G FROM SPACE MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 36 NORTH AMERICA:MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 37 US: MARKET, BY COMPONENT, 2020–2022 (USD MILLION)

- TABLE 38 US: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 39 US: MARKET, BY VERTICAL, 2020–2022 (USD MILLION)

- TABLE 40 US: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 41 US: MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 42 US: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 43 CANADA: 5G FROM SPACE MARKET, BY COMPONENT, 2020–2022 (USD MILLION)

- TABLE 44 CANADA: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 45 CANADA: MARKET, BY VERTICAL, 2020–2022 (USD MILLION)

- TABLE 46 CANADA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 47 CANADA: MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 48 CANADA: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 49 EUROPE: MARKET, BY COMPONENT, 2020–2022 (USD MILLION)

- TABLE 50 EUROPE: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 51 EUROPE: MARKET, BY VERTICAL, 2020–2022 (USD MILLION)

- TABLE 52 EUROPE: 5G FROM SPACE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 53 EUROPE: MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 54 EUROPE: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 55 EUROPE: MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 56 EUROPE: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 57 UK: MARKET, BY COMPONENT, 2020–2022 (USD MILLION)

- TABLE 58 UK: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 59 UK: 5G FROM SPACE MARKET, BY VERTICAL, 2020–2022 (USD MILLION)

- TABLE 60 UK: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 61 UK: MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 62 UK: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 63 GERMANY: 5G FROM SPACE MARKET, BY COMPONENT, 2020–2022 (USD MILLION)

- TABLE 64 GERMANY: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 65 GERMANY: MARKET, BY VERTICAL, 2020–2022 (USD MILLION)

- TABLE 66 GERMANY: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 67 GERMANY: MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 68 GERMANY: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 69 FRANCE: MARKET, BY COMPONENT, 2020–2022 (USD MILLION)

- TABLE 70 FRANCE: 5G FROM SPACE MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 71 FRANCE: MARKET, BY VERTICAL, 2020–2022 (USD MILLION)

- TABLE 72 FRANCE: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 73 FRANCE: MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 74 FRANCE: 5G FROM SPACE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 75 REST OF EUROPE: MARKET, BY COMPONENT, 2020–2022 (USD MILLION)

- TABLE 76 REST OF EUROPE: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 77 REST OF EUROPE: MARKET, BY VERTICAL, 2020–2022 (USD MILLION)

- TABLE 78 REST OF EUROPE: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 79 REST OF EUROPE: MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 80 REST OF EUROPE: 5G FROM SPACE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 81 ASIA PACIFIC: MARKET, BY COMPONENT, 2020–2022 (USD MILLION)

- TABLE 82 ASIA PACIFIC: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 83 ASIA PACIFIC: MARKET, BY VERTICAL, 2020–2022 (USD MILLION)

- TABLE 84 ASIA PACIFIC: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 85 ASIA PACIFIC: MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 86 ASIA PACIFIC: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 87 ASIA PACIFIC: MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 88 ASIA PACIFIC: 5G FROM SPACE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 89 CHINA: MARKET, BY COMPONENT, 2020–2022 (USD MILLION)

- TABLE 90 CHINA: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 91 CHINA: MARKET, BY VERTICAL, 2020–2022 (USD MILLION)

- TABLE 92 CHINA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 93 CHINA: MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 94 CHINA: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 95 INDIA: 5G FROM SPACE MARKET, BY COMPONENT, 2020–2022 (USD MILLION)

- TABLE 96 INDIA: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 97 INDIA: MARKET, BY VERTICAL, 2020–2022 (USD MILLION)

- TABLE 98 INDIA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 99 INDIA: MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 100 INDIA: 5G FROM SPACE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 101 SOUTH KOREA: MARKET, BY COMPONENT, 2020–2022 (USD MILLION)

- TABLE 102 SOUTH KOREA: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 103 SOUTH KOREA: MARKET, BY VERTICAL, 2020–2022 (USD MILLION)

- TABLE 104 SOUTH KOREA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 105 SOUTH KOREA: MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 106 SOUTH KOREA: 5G FROM SPACE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 107 REST OF ASIA PACIFIC: MARKET, BY COMPONENT, 2020–2022 (USD MILLION)

- TABLE 108 REST OF ASIA PACIFIC: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 109 REST OF ASIA PACIFIC: MARKET, BY VERTICAL, 2020–2022 (USD MILLION)

- TABLE 110 REST OF ASIA PACIFIC: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 111 REST OF ASIA PACIFIC: MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 112 REST OF ASIA PACIFIC: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 113 REST OF THE WORLD: MARKET, BY COMPONENT, 2020–2022 (USD MILLION)

- TABLE 114 REST OF THE WORLD: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 115 REST OF THE WORLD: MARKET, BY VERTICAL, 2020–2022 (USD MILLION)

- TABLE 116 REST OF THE WORLD: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 117 REST OF THE WORLD: MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 118 REST OF THE WORLD: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 119 REST OF THE WORLD: 5G FROM SPACE MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 120 REST OF THE WORLD: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 121 MIDDLE EAST & AFRICA: MARKET, BY COMPONENT, 2020–2022 (USD MILLION)

- TABLE 122 MIDDLE EAST & AFRICA: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 123 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2020–2022 (USD MILLION)

- TABLE 124 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 125 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 126 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 127 LATIN AMERICA: 5G FROM SPACE MARKET, BY COMPONENT, 2020–2022 (USD MILLION)

- TABLE 128 LATIN AMERICA: MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 129 LATIN AMERICA: MARKET, BY VERTICAL, 2020–2022 (USD MILLION)

- TABLE 130 LATIN AMERICA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 131 LATIN AMERICA: MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 132 LATIN AMERICA: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 133 MARKET: KEY DEVELOPMENTS OF LEADING PLAYERS, 2020–2022

- TABLE 134 MARKET: LIST OF KEY START-UPS/SMES

- TABLE 135 MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

- TABLE 136 5G FROM SPACE MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS

- TABLE 137 DEALS, JANUARY 2020–MAY 2023

- TABLE 138 OTHERS, JUNE 2020–MAY 2023

- TABLE 139 ONEWEB: COMPANY OVERVIEW

- TABLE 140 ONEWEB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 141 ONEWEB: DEALS

- TABLE 142 OMNISPACE: COMPANY OVERVIEW

- TABLE 143 OMNISPACE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 144 OMNISPACE: DEALS

- TABLE 145 QUALCOMM TECHNOLOGIES INC.: COMPANY OVERVIEW

- TABLE 146 QUALCOMM TECHNOLOGIES INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 147 QUALCOMM TECHNOLOGIES INC.: DEALS

- TABLE 148 ERICSSON: COMPANY OVERVIEW

- TABLE 149 ERICSSON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 150 ERICSSON: DEALS

- TABLE 151 ROHDE & SCHWARZ: COMPANY OVERVIEW

- TABLE 152 ROHDE & SCHWARZ: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 153 ROHDE & SCHWARZ: DEALS

- TABLE 154 LYNK GLOBAL INC.: COMPANY OVERVIEW

- TABLE 155 LYNK GLOBAL INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 156 LYNK GLOBAL INC.: DEALS

- TABLE 157 SATELIOT: COMPANY OVERVIEW

- TABLE 158 SATELIOT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 159 SATELIOT: DEALS

- TABLE 160 SATELIOT: OTHERS

- TABLE 161 LOCKHEED MARTIN CORPORATION: COMPANY OVERVIEW

- TABLE 162 LOCKHEED MARTIN CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 163 LOCKHEED MARTIN CORPORATION: DEALS

- TABLE 164 SES S.A.: COMPANY OVERVIEW

- TABLE 165 SES S.A.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 166 SES S.A.: DEALS

- TABLE 167 SES S.A.: OTHERS

- TABLE 168 THALES ALENIA SPACE: COMPANY OVERVIEW

- TABLE 169 THALES ALENIA SPACE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 170 THALES ALENIA SPACE: DEALS

- TABLE 171 GILAT SATELLITE NETWORKS: COMPANY OVERVIEW

- TABLE 172 GILAT SATELLITE NETWORKS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 173 GILAT SATELLITE NETWORKS: DEALS

- TABLE 174 GILAT SATELLITE NETWORKS.: OTHERS

- TABLE 175 KEYSIGHT TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 176 KEYSIGHT TECHNOLOGIES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 177 KEYSIGHT TECHNOLOGIES, INC.: DEALS

- TABLE 178 ECHOSTAR CORPORATION: COMPANY OVERVIEW

- TABLE 179 ECHOSTAR CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 180 ECHOSTAR CORPORATION: DEALS

- TABLE 181 CHINA AEROSPACE SCIENCE AND TECHNOLOGY CORPORATION: COMPANY OVERVIEW

- TABLE 182 CHINA AEROSPACE SCIENCE AND TECHNOLOGY CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 183 CHINA AEROSPACE SCIENCE AND TECHNOLOGY CORPORATION: OTHERS

- TABLE 184 TELESAT: COMPANY OVERVIEW

- TABLE 185 TELESAT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 186 TELESAT: DEALS

- TABLE 187 KEPLER COMMUNICATIONS: COMPANY OVERVIEW

- TABLE 188 SPACEX: COMPANY OVERVIEW

- TABLE 189 ANRITSU: COMPANY OVERVIEW

- TABLE 190 FOSSA SYSTEMS: COMPANY OVERVIEW

- TABLE 191 AMAZON KUIPER: COMPANY OVERVIEW

- TABLE 192 OQ TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 193 AST SPACEMOBILE: COMPANY OVERVIEW

- TABLE 194 NELCO: COMPANY OVERVIEW

- TABLE 195 GATEHOUSE: COMPANY OVERVIEW

- TABLE 196 ZTE: COMPANY OVERVIEW

- FIGURE 1 5G FROM SPACE MARKET SEGMENTATION

- FIGURE 2 REPORT PROCESS FLOW

- FIGURE 3 MARKET: RESEARCH DESIGN

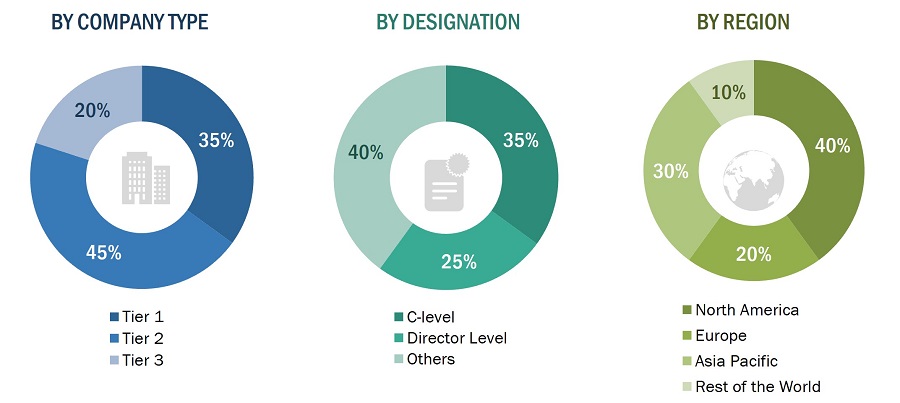

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 7 DATA TRIANGULATION

- FIGURE 8 ASSUMPTIONS FOR RESEARCH STUDY ON 5G FROM SPACE MARKET

- FIGURE 9 SERVICES SEGMENT TO EXHIBIT HIGHER CAGR THAN HARDWARE SEGMENT DURING FORECAST MARKET

- FIGURE 10 COMMERCIAL SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 11 EMBB SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 12 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SHARE IN 2023

- FIGURE 13 INCREASING DEMAND FOR IOT, GLOBAL CONNECTIVITY, AND AUTOMATION ACTIVITIES TO DRIVE MARKET

- FIGURE 14 HARDWARE SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 15 EMBB SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 16 COMMERCIAL SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 17 AVIATION SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 18 5G FROM SPACE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 19 NUMBER OF INTERNET USERS (BILLIONS)

- FIGURE 20 MARKET: VALUE CHAIN ANALYSIS

- FIGURE 21 MARKET: ECOSYSTEM ANALYSIS

- FIGURE 22 MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 23 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP TWO VERTICALS

- FIGURE 24 KEY BUYING CRITERIA FOR TOP TWO VERTICALS

- FIGURE 25 TECHNOLOGY EVOLUTION ROADMAP

- FIGURE 26 TOP 10 COMPANIES WITH MOST PATENT APPLICATIONS IN LAST FOUR YEARS

- FIGURE 27 SERVICES SEGMENT PROJECTED TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 28 COMMERCIAL SEGMENT TO LEAD 5G FROM SPACE MARKET DURING FORECAST PERIOD

- FIGURE 29 MMTC SEGMENT TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 30 NORTH AMERICA TO LEAD 5G FROM SPACE MARKET IN 2023

- FIGURE 31 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 32 EUROPE: 5G FROM PACE MARKET SNAPSHOT

- FIGURE 33 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 34 RANKING OF KEY PLAYERS IN 5G FROM SPACE MARKET, 2022

- FIGURE 35 5G FROM SPACE MARKET: COMPANY EVALUATION MATRIX, 2023

- FIGURE 36 MARKET (START-UPS/SMES): COMPANY EVALUATION MATRIX, 2023

- FIGURE 37 QUALCOMM TECHNOLOGIES INC.: COMPANY SNAPSHOT

- FIGURE 38 ERICSSON: COMPANY SNAPSHOT

- FIGURE 39 LOCKHEED MARTIN CORPORATION: COMPANY SNAPSHOT

- FIGURE 40 SES S.A.: COMPANY SNAPSHOT

- FIGURE 41 GILAT SATELLITE NETWORKS: COMPANY SNAPSHOT

- FIGURE 42 ECHOSTAR CORPORATION: COMPANY SNAPSHOT

- FIGURE 43 TELESAT: COMPANY SNAPSHOT

The study involved four major activities in estimating the current size of the 5G FROM SPACE MARKET Market. Exhaustive secondary research was done to collect information on the 5G from the space market, its adjacent markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Demand-side analyses were carried out to estimate the overall size of the market. Thereafter, market breakdown and data triangulation procedures were used to estimate the sizes of different segments and subsegments of the 5G from the space Market.

Secondary Research

The market ranking of companies was determined using the secondary data made available through paid and unpaid sources and by analyzing the product portfolios of major companies. These companies were rated on the basis of performance and quality of their products. These data points were further validated by primary sources.

Secondary sources referred to for this research study include financial statements of companies offering 5G from space and information from various trade, business, and professional associations. The secondary data was collected and analyzed to arrive at the overall size of the 5G from the space market, which was validated by primary respondents.

Primary Research

Extensive primary research was conducted after acquiring information regarding the 5G from the space market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, ROW, including the Middle East & Africa, and Latin America. Primary data was collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The market sizing of the market was undertaken from the demand side. The market was upsized based on procurements and modernizations in the land fixed, land mobile, airborne, naval, and portable platforms at a regional level. Such procurements provide information on the demand aspects of 5G from space, products, and services in each platform. For each platform, all possible application areas where 5G from space is integrated or installed were mapped.

The global market is a summation of the usage of 5G from space in commercial and government & defense verticals.

Note: An analysis of technological, military funding, year-on-year launches, and operational cost were carried out to arrive at the CAGR and understand the market dynamics of all countries in the report. The market share for all components, verticals, and applications was arrived at based on the current and upcoming launches of 5G from space products and services in every country from 2020 to 2028.

5G From Space Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size was validated using the top-down and bottom-up approaches.

Market Definition

5G from space (LEO) is a cutting-edge integration of 5G cellular technology with Low Earth Orbit (LEO) satellite constellations, offering advanced mobile communication capabilities and global broadband coverage. The business aspects of this innovative solution can be categorized into hardware and service segments. The hardware segment encompasses the manufacturing of LEO satellites, ground stations, and user terminals. The service segment focuses on delivering satellite-based 5G connectivity services, data plans, and tailored

Applications for industries and end-users, enabling high-speed broadband access, loT connectivity, and other mission-critical applications.

Market stakeholders

- Manufacturers of 5G from Space Chips

- System Integrators

- Original Equipment Manufacturers (OEM

- Service Providers

- Research Organizations

- Investors and Venture Capitalists

- Ministries of Defense

Report Objectives

- To define, describe, and forecast the size of the 5G from space market-based components, verticals, applications, and regions.

- To forecast the size of the various segments of the 5G from space market based on Four regions—North America, Europe, Asia Pacific, and ROW, including the Middle East & Africa, and Latin America—along with key countries in each of these regions

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the market

- To identify industry trends, market trends, and technology trends prevailing in the market

- To analyze micromarkets with respect to individual technological trends, prospects, and their contribution to the overall market

- To provide a detailed competitive landscape of the market and analyze competitive growth strategies such as product launches and developments, contracts, partnerships, agreements, and collaborations adopted by key players in the market

- To identify the detailed financial positions, product portfolios, and key developments of leading companies in the market

- To strategically profile key market players and comprehensively analyze their market rank analysis and core competencies

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of the 5G from Space Market

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the 5G from space Market

Growth opportunities and latent adjacency in 5G From Space Market