1,3-Propanediol (PDO) Market by Application (Polytrimethylene terephthalate (PTT), Cosmetics, Personal Care & Cleaning Products, Polyurethane (PU)) and Region (Americas, APAC, Europe, Middle East & Africa (EMEA)) - Global Forecast to 2025

Updated on : June 18, 2024

1,3 Propanediol Market

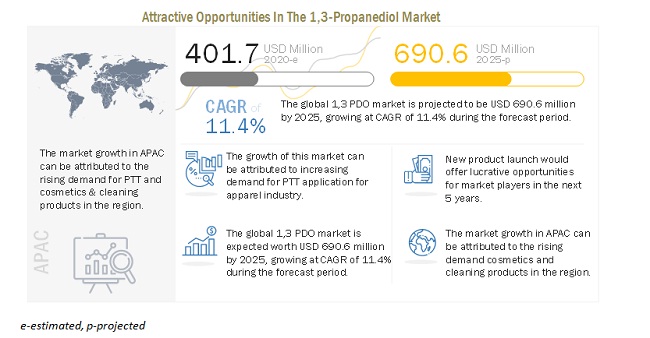

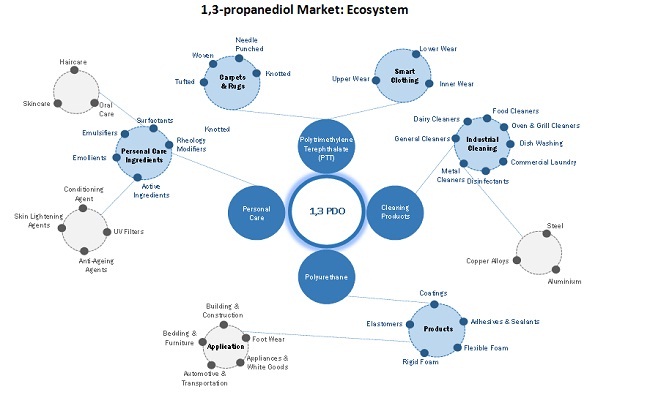

The global 1,3 propanediol market is projected to reach USD 690.6 million by 2025, at a cagr 11.4%. Increasing use of 1,3-propanediol in various applications such as polytrimethylene terephthalate (PTT), polyurethane (PU), cosmetics, personal care, and cleaning products is expected to drive the market growth. The Americas is the largest market for 1,3-propanediol, followed by APAC and Europe, Middle East & Africa.

Impact of COVID-19 on 1,3-propanediol Market

1,3 PDO is majorly used in Polytrimethylene terephthalate (PTT), which is further used in the manufacturing of carpet, leisure & sportswear, and other textile applications. COVID-19 has impacted the demand for PTT from end-use applications due to nationwide lockdown and partial production operations in the industry. Moreover, demand for leisure & sportswear and other apparel has witnessed declined due to lockdown. Similarly, 1,3 PDO is widely used as an ingredient in personal care and cosmetic industry. The demand for 1,3 PDO is directly related to the consumption of cosmetic products. COVID-19 has impacted to cosmetic and beauty products industry abruptly as demand from professional and domestic users has dropped significantly. Lockdown in different countries and restrictions in operating beauty parlors and salons has resulted in a decrease in demand from professional users, and the same has been impacted the demand from domestic users.

1,3 Propanediol Market Dynamics

Driver: High Demand for Environment Friendly, Bio-Based Products

A gradual paradigm shift in consumer preference for bio-based products is witnessed across the world. The growing awareness of consumers, increasingly stringent government regulations, and depletion of conventional sources have prompted companies to innovate and market sustainable products. PDO is one such biochemical which is estimated to have high demand. Bio-based PDO utilizes renewable feedstock, such as corn sugar and crude glycerin, making it more sustainable.

Restraint: Availability of substitute at comparatively lower cost

1,3-PDO is used as a replacement for petroleum-based glycols such as propylene glycol, butylene glycol, and glycerin. These products are available at a comparatively lower price than PDO, which is used in cosmetics, personal care & cleaning products, pharmaceutical & dietary supplements, and food & flavor applications. Moreover, the promotion of bio-based PDO is difficult in countries where there are no regulations regarding the adoption of bio-based products in various end-use applications.

Opportunities: New Application Area of 1,3-PDO

The growing use of PDO as feedstock in various potential applications will drive the growth of the market. It will lead to an increase in the production and consumption of PDO. PDO has the potential to replace glycols such as propylene glycol, butylene glycol, and glycerin in applications such as cosmetics, personal care, and food & flavors.

Challenges: Lack of awareness about benefits of 1,3-PDO in Industrial applications

In developing economies like Pakistan, Sri Lanka, Iraq, Iran, Indonesia, Taiwan, Bangladesh, Malaysia, Maldives, Chile, Colombia, Peru, the Philippines, Vietnam, and Romania, there is still very limited awareness about the usage of PDO. In these countries, the use of PDO is mostly limited to cosmetics, personal care products, and pharmaceutical products. In countries such as India, it is mainly used in cosmetics & personal care products, and people are not aware of its usage in applications such as PU and food & flavors.

The PTT segment is projected to be the largest application of 1,3-propanediol during the forecast period.

The PTT application is projected to dominate the overall 1,3-propanediol market during the forecast period. The growing demand for PTT in various applications, such as carpets and apparel, due to its long-lasting, quick-drying, fade resistance, good stretch & recovery, and wrinkle resistance properties, are driving its demand.

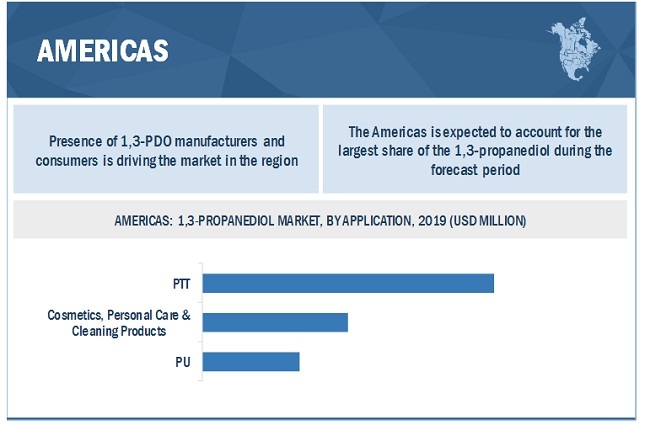

Americas estimated to account for the largest share of the 1,3-propanediol market.

The Americas is expected to account for the largest share of the 1,3-propanediol during the forecast period in terms of value. The presence of DuPont Tate & Lyle Bio Products Company, LLC, the largest manufacturer of 1,3-propanediol in the region, has a positive impact on the market. In addition, growing demand for 1,3-propanediol in applications such as cosmetics, personal care, cleaning products, and PTT in the region is increasing the demand for 1,3-propanediol.

1,3 Propanediol Market Players

The key market players profiled in the report include as DuPont Tate & Lyle Bio Products Company, LLC (US), Zhangjiagang Glory Biomaterial Co., Ltd. (China), Haihang Industry Company Ltd. (China), Tokyo Chemical Industry Co., Ltd. (Japan), Zouping Mingxing Chemical Co., Ltd. (China), and Merck KGgA (Germany), In addition, players such as METabolic EXplorer (France) and Sheng Hong Group Holdings Ltd. (China) who are planning to enter 1,3-propanediol market have also been profiled.

DuPont Tate & Lyle Bio Products Company, LLC (US), is the largest manufacturer of bio-based 1,3-propanediol, globally. The company has a strong distribution network in the Americas, Europe, Middle East & Africa (EMEA), and APAC. The company focuses on enhancing its geographic presence and is strengthening its foothold in the different regions through strategic alliances. The company is also concentrating on developing products for emerging end-use applications. It is partnering with end-users for the development of products that effectively utilize bio-based 1,3-propanediol.

Zhangjiagang Glory Biomaterial Co., Ltd. (China) focuses on increasing the production capacity of 1,3-propanediol. The company started the 1,3-propanediol program in 2011. The company plans to combine the 1,3-propanediol plant and PTT plant organically to increase profitability.

1,3 Propanediol Market Report Scope

|

Report Metric |

Details |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

This report categorizes the global 1,3-propanediol market based on application and region.

Based on the application:

- Polytrimethylene terephthalate (PTT)

- Polyurethane (PU)

- Cosmetics, personal care, and cleaning products

- Others

Based on the region:

- APAC

- Americas

- Europe, Middle East & Arica (EMEA)

Recent Developments

- In May 2019, DuPont Tate & Lyle Bio Products Company, LLC (US), Corbion (Netherlands), INOLEX Inc. (US), and ACT Solutions Corp (US) collaborated to create a bio-based content formulation for personal care products. This partnership helped the company meet the growing demand for natural products.

- In October 2018, DuPont Tate & Lyle Bio Products Company, LLC (US) opened a warehouse and distribution center in its manufacturing site in Loudon, Tennessee, US.

- In March 2018, DuPont Tate & Lyle Bio Products Company, LLC (US) announced plans to increase its annual production of bio-based 1,3-propanediol by 35 million pounds at its manufacturing facility in Tennessee, US.

- In October 2017, DuPont (US), INVISTA (US), and DuPont Tate & Lyle Bio Products Company, LLC entered into a partnership to develop a series of innovative and enhanced sustainable textile solutions for workwear and outdoor wear.

Frequently Asked Questions (FAQ):

How is the market of 1,3-Propanediol aligned?

The 1,3-Propanediol market is consolidated with the presence of a small number of players. The market is dominated by DuPont Tate & Lyle Bio Products Company, LLC, which is the largest manufacturer of bio-based PDO, globally.

Does the existing players in the market face threat from new entrants?

The 1,3-Propanediol market is majorly driven by advancement in technology and patented know-how for the production and use of PDO in different applications. The existing technologies are protected by patents, and the new entrants have to invest heavily in R&D. However, a few new players (which are very few in number) are entering the market and have announced to manufacture PDO. The threat may increase in the near future.

What are the emerging applications of 1,3-PDO?

1,3-PDO are majorly used in PTT, cosmetics, and PU applications. The emerging application of 1,3-PDO coolants, anti-icing fluid, food application, and pharmaceutical

How 1,3-PDO are manufactured using bio process?

1,3-PDO is manufactured by fermenting the corn syrup and by-product of bio-diesel .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 23)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 1,3-PROPANEDIOL MARKET: INCLUSIONS & EXCLUSIONS

1.3 MARKET SCOPE

FIGURE 1 MARKET SEGMENTATION

1.3.1 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 UNITS CONSIDERED

1.6 LIMITATIONS

1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 26)

2.1 BASE NUMBER CALCULATION

2.1.1 SUPPLY-SIDE APPROACH

2.1.1.1 Approach 1

2.1.1.2 Approach 2

2.1.2 DEMAND-SIDE APPROACH

2.2 FACTORS IMPACTING THE 1,3-PDO MARKET IN 2020

2.3 FORECAST NUMBER CALCULATION

2.3.1 MARKET FORECAST (SCENARIO 1)

2.3.2 MARKET FORECAST (SCENARIO 2)

2.4 MARKET ENGINEERING PROCESS

2.4.1 BOTTOM-UP APPROACH

FIGURE 2 1,3-PROPANEDIOL MARKET: BOTTOM-UP APPROACH

2.4.2 TOP-DOWN APPROACH

FIGURE 3 1,3-PROPANEDIOL MARKET: TOP-DOWN APPROACH

2.5 DATA TRIANGULATION

2.6 ASSUMPTIONS

2.7 SECONDARY DATA

2.8 PRIMARY DATA

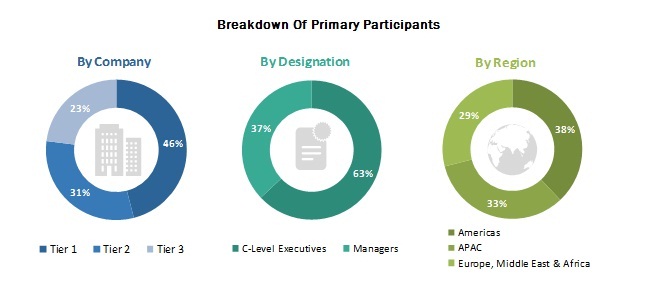

2.8.1 BREAKDOWN OF PRIMARY INTERVIEWS

2.8.2 KEY INDUSTRY INSIGHTS

3 EXECUTIVE SUMMARY (Page No. - 33)

FIGURE 4 PTT ACCOUNTED FOR THE LARGEST SHARE OF THE

1,3-PROPANEDIOL MARKET IN 2019 33

FIGURE 5 THE AMERICAS ACCOUNTED FOR THE LARGEST SHARE OF

THE 1,3-PROPANEDIOL MARKET IN 2019 34

FIGURE 6 1,3-PDO MARKET: PRE-COVID-19 VS. POST-COVID-19 SCENARIO

4 PREMIUM INSIGHTS (Page No. - 36)

4.1 ATTRACTIVE OPPORTUNITIES IN THE 1,3-PROPANEDIOL MARKET

FIGURE 7 GROWING DEMAND FOR PTT TO DRIVE THE 1,3-PROPANEDIOL MARKET

4.2 1,3-PROPANEDIOL MARKET, BY REGION

FIGURE 8 APAC TO BE THE FASTEST-GROWING REGIONAL SEGMENT IN THE 1,3-PROPANEDIOL MARKET

4.3 AMERICAS: 1,3-PROPANEDIOL MARKET, BY APPLICATION

FIGURE 9 PTT ACCOUNTED FOR THE LARGEST MARKET SHARE IN 2019

4.4 1,3-PROPANEDIOL MARKET, BY APPLICATION

FIGURE 10 PTT WAS THE LARGEST APPLICATION OF 1,3-PROPANEDIOL GLOBALLY

5 MARKET OVERVIEW (Page No. - 38)

5.1 INTRODUCTION

TABLE 1 1,3-PROPANEDIOL: PHYSICAL & CHEMICAL PROPERTIES

5.2 EVOLUTION

FIGURE 11 1,3-PROPANDEDIOL PRODUCTION TREND: INCREASED FOCUS ON BIOPROCESSING

5.3 MARKET DYNAMICS

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN THE 1,3-PROPANEDIOL MARKET

5.3.1 DRIVERS

5.3.1.1 High demand for environment-friendly, bio-based products

FIGURE 13 GREENHOUSE GAS EMISSIONS: BIO-BASED PDO HAS LOWEST EMISSIONS

FIGURE 14 NON-RENEWABLE ENERGY CONSUMPTION: BIO-BASED PDO PRODUCTION HAS LOWEST ENERGY CONSUMPTION

5.3.1.2 Increasing use in resin applications

5.3.1.3 Growing demand for PTT

TABLE 2 COMPARISON OF FIBERS, BY PROPERTY

5.3.2 RESTRAINTS

5.3.2.1 Availability of substitutes at comparatively lower costs

5.3.3 OPPORTUNITIES

5.3.3.1 High growth potential in emerging economies

5.3.3.2 New application areas of 1,3-PDO

5.3.3.3 Genetically engineered microorganisms for glycerol fermentation

5.3.4 CHALLENGES

5.3.4.1 Lack of awareness about the benefits of 1,3-propanediol in industrial applications

5.4 PATENT ANALYSIS

TABLE 3 PATENTS FOR PDO PRODUCTION

TABLE 4 PATENTS FOR USE OF PDO IN PERSONAL CARE AND COSMETIC APPLICATIONS

TABLE 5 PATENTS FOR USE OF PDO IN OTHER APPLICATIONS

5.5 RAW MATERIAL ANALYSIS

5.5.1 GLYCEROL

TABLE 6 BIODIESEL PRODUCTION, BY COUNTRY, 2014-2017 (KILOTON)

5.5.2 CORN

TABLE 7 CORN PRODUCTION AND CONSUMPTION, BY COUNTRY, 2019 (MILLION TONS)

5.6 PORTER'S FIVE FORCES ANALYSIS

FIGURE 15 THREAT FROM NEW PLAYERS ENTERING THE 1,3-PROPANEDIOL MARKET LIKELY TO BE SIGNIFICANT

5.6.1 THREAT FROM SUBSTITUTES

5.6.2 BARGAINING POWER OF SUPPLIERS

5.6.3 BARGAINING POWER OF BUYERS

5.6.4 THREAT FROM NEW ENTRANTS

5.6.5 INTENSITY OF COMPETITIVE RIVALRY

5.7 COVID-19 IMPACT ON THE 1,3-PDO MARKET

5.7.1 DISRUPTION IN PTT APPLICATIONS

5.7.2 DISRUPTION IN THE COSMETICS AND CLEANING INDUSTRY

5.7.3 DISRUPTION IN THE POLYURETHANE INDUSTRY

6 1,3-PROPANEDIOL MARKET, BY APPLICATION (Page No. - 54)

6.1 INTRODUCTION

FIGURE 16 PTT APPLICATION SEGMENT TO LEAD THE OVERALL

1,3-PROPANEDIOL MARKET 55

TABLE 8 SCENARIO 1: 1,3-PROPANEDIOL MARKET SIZE, BY APPLICATION, 2016-2019 (KILOTON)

TABLE 9 SCENARIO 1: 1,3-PROPANEDIOL MARKET SIZE, BY APPLICATION, 2020-2025 (KILOTON)

TABLE 10 SCENARIO 1: 1,3-PROPANEDIOL MARKET SIZE, BY APPLICATION, 2016-2019 (USD MILLION)

TABLE 11 SCENARIO 1: 1,3-PROPANEDIOL MARKET SIZE, BY APPLICATION, 2020-2025 (USD MILLION)

TABLE 12 SCENARIO 2: 1,3-PROPANEDIOL MARKET SIZE, BY APPLICATION, 2016-2019 (KILOTON)

TABLE 13 SCENARIO 2: 1,3-PROPANEDIOL MARKET SIZE, BY APPLICATION, 2020-2025 (KILOTON)

TABLE 14 SCENARIO 2: 1,3-PROPANEDIOL MARKET SIZE, BY APPLICATION, 2016-2019 (USD MILLION

TABLE 15 SCENARIO 2: 1,3-PROPANEDIOL MARKET SIZE, BY APPLICATION, 2020-2025 (USD MILLION)

6.2 POLYTRIMETHYLENE TEREPHTHALATE (PTT)

6.2.1 DEMAND FOR 1,3-PROPANEDIOL IN PPT APPLICATIONS DRIVEN BY THE APPAREL AND CARPET INDUSTRY

FIGURE 17 MANUFACTURING PROCESS OF BIO-PTT

FIGURE 18 THE AMERICAS TO LEAD THE 1,3-PROPANEDIOL MARKET IN PTT APPLICATION

TABLE 16 RECENT ACTIVITIES IN THE 1,3-PROPANEDIOL MARKET IN PTT APPLICATIONS

TABLE 17 SCENARIO 1: 1,3-PROPANEDIOL MARKET SIZE IN PTT, 2016-2019 (VOLUME & VALUE)

TABLE 18 SCENARIO 1: 1,3-PROPANEDIOL MARKET SIZE IN PTT, 2020-2025 (VOLUME & VALUE)

TABLE 19 SCENARIO 2: 1,3-PROPANEDIOL MARKET SIZE IN PTT, 2016-2019 (VOLUME & VALUE)

TABLE 20 SCENARIO 2: 1,3-PROPANEDIOL MARKET SIZE IN PTT, 2020-2025 (VOLUME & VALUE)

TABLE 21 SCENARIO 1: 1,3-PROPANEDIOL MARKET SIZE IN PTT, BY REGION, 2016-2019 (KILOTON)

TABLE 22 SCENARIO 1: 1,3-PROPANEDIOL MARKET SIZE IN PTT, BY REGION, 2020-2025 (KILOTON)

TABLE 23 SCENARIO 1: 1,3-PROPANEDIOL MARKET SIZE IN PTT, BY REGION, 2016-2019 (USD MILLION)

TABLE 24 SCENARIO 1: 1,3-PROPANEDIOL MARKET SIZE IN PTT, BY REGION, 2020-2025 (USD MILLION)

TABLE 25 SCENARIO 2: 1,3-PROPANEDIOL MARKET SIZE IN PTT, BY REGION, 2016-2019 (KILOTON)

TABLE 26 SCENARIO 2: 1,3-PROPANEDIOL MARKET SIZE IN PTT, BY REGION, 2020-2025 (KILOTON)

TABLE 27 SCENARIO 2: 1,3-PROPANEDIOL MARKET SIZE IN PTT, BY REGION, 2016-2019 (USD MILLION)

TABLE 28 SCENARIO 2: 1,3-PROPANEDIOL MARKET SIZE IN PTT, BY REGION, 2020-2025 (USD MILLION)

6.3 COSMETICS, PERSONAL CARE, AND CLEANING PRODUCTS

6.3.1 PERSONAL CARE

6.3.1.1 Changing lifestyles and increasing purchasing power will drive the personal care application segment

6.3.2 INDUSTRIAL AND INSTITUTIONAL CLEANING

6.3.2.1 Increasing awareness about workplace hygiene will drive the market

FIGURE 19 EMEA TO LEAD THE 1,3-PROPANEDIOL MARKET IN COSMETICS, PERSONAL CARE, AND CLEANING PRODUCTS APPLICATIONS

TABLE 29 RECENT ACTIVITIES IN THE 1,3-PROPANEDIOL MARKET IN COSMETICS, PERSONAL CARE, AND CLEANING PRODUCTS APPLICATIONS

TABLE 30 SCENARIO 1: 1,3-PROPANEDIOL MARKET SIZE IN COSMETICS, PERSONAL CARE, AND CLEANING PRODUCTS, 2016-2019 (VOLUME & VALUE)

TABLE 31 SCENARIO 1: 1,3-PROPANEDIOL MARKET SIZE IN COSMETICS, PERSONAL CARE, AND CLEANING PRODUCTS, 2020-2025 (VOLUME & VALUE)

TABLE 32 SCENARIO 2: 1,3-PROPANEDIOL MARKET SIZE IN COSMETICS, PERSONAL CARE, AND CLEANING PRODUCTS, 2016-2019 (VOLUME & VALUE)

TABLE 33 SCENARIO 2: 1,3-PROPANEDIOL MARKET SIZE IN COSMETICS, PERSONAL CARE, AND CLEANING PRODUCTS, 2020-2025 (VOLUME & VALUE)

TABLE 34 SCENARIO 1: 1,3-PROPANEDIOL MARKET SIZE IN COSMETICS, PERSONAL CARE, AND CLEANING PRODUCTS, BY REGION, 2016-2019 (KILOTON)

TABLE 35 SCENARIO 1: 1,3-PROPANEDIOL MARKET SIZE IN COSMETICS, PERSONAL CARE, AND CLEANING PRODUCTS, BY REGION, 2020-2025 (KILOTON)

TABLE 36 SCENARIO 1: 1,3-PROPANEDIOL MARKET SIZE IN COSMETICS, PERSONAL CARE, AND CLEANING PRODUCTS, BY REGION, 2016-2019 (USD MILLION)

TABLE 37 SCENARIO 1: 1,3-PROPANEDIOL MARKET SIZE IN COSMETICS, PERSONAL CARE, AND CLEANING PRODUCTS, BY REGION, 2020-2025 (USD MILLION)

TABLE 38 SCENARIO 2: 1,3-PROPANEDIOL MARKET SIZE IN COSMETICS, PERSONAL CARE, AND CLEANING PRODUCTS, BY REGION, 2016-2019 (KILOTON)

TABLE 39 SCENARIO 2: 1,3-PROPANEDIOL MARKET SIZE IN COSMETICS, PERSONAL CARE, AND CLEANING PRODUCTS, BY REGION, 2020-2025 (KILOTON)

TABLE 40 SCENARIO 2: 1,3-PROPANEDIOL MARKET SIZE IN COSMETICS, PERSONAL CARE, AND CLEANING PRODUCTS, BY REGION, 2016-2019 (USD MILLION)

TABLE 41 SCENARIO 2: 1,3-PROPANEDIOL MARKET SIZE IN COSMETICS, PERSONAL CARE, AND CLEANING PRODUCTS, BY REGION, 2020-2025 (USD MILLION)

6.4 POLYURETHANE

6.4.1 HIGH DEMAND FROM THE FURNITURE AND FOOTWEAR INDUSTRIES TO DRIVE THE MARKET FOR 1,3-PDO IN PU APPLICATIONS

FIGURE 20 APAC TO BE THE FASTEST-GROWING MARKET FOR 1,3-PROPANEDIOL IN PU APPLICATION

TABLE 42 RECENT ACTIVITIES IN 1,3-PROPANEDIOL MARKET IN PU APPLICATION

TABLE 43 SCENARIO 1: 1,3-PROPANEDIOL MARKET SIZE IN PU, 2016-2019 (VOLUME & VALUE)

TABLE 44 SCENARIO 1: 1,3-PROPANEDIOL MARKET SIZE IN PU, 2020-2025 (VOLUME & VALUE)

TABLE 45 SCENARIO 2: 1,3-PROPANEDIOL MARKET SIZE IN PU, 2016-2019 (VOLUME & VALUE)

TABLE 46 SCENARIO 2: 1,3-PROPANEDIOL MARKET SIZE IN PU, 2020-2025 (VOLUME & VALUE)

TABLE 47 SCENARIO 1: 1,3-PROPANEDIOL MARKET SIZE IN PU, BY REGION, 2016-2019 (KILOTON)

TABLE 48 SCENARIO 1: 1,3-PROPANEDIOL MARKET SIZE IN PU, BY REGION, 2020-2025 (KILOTON)

TABLE 49 SCENARIO 1: 1,3-PROPANEDIOL MARKET SIZE IN PU, BY REGION, 2016-2019 (USD MILLION)

TABLE 50 SCENARIO 1: 1,3-PROPANEDIOL MARKET SIZE IN PU, BY REGION, 2020-2025 (USD MILLION)

TABLE 51 SCENARIO 2: 1,3-PROPANEDIOL MARKET SIZE IN PU, BY REGION, 2016-2019 (KILOTON)

TABLE 52 SCENARIO 2: 1,3-PROPANEDIOL MARKET SIZE IN PU, BY REGION, 2020-2025 (KILOTON)

TABLE 53 SCENARIO 2: 1,3-PROPANEDIOL MARKET SIZE IN PU, BY REGION, 2016-2019 (USD MILLION)

TABLE 54 SCENARIO 2: 1,3-PROPANEDIOL MARKET SIZE IN PU, BY REGION, 2020-2025 (USD MILLION)

6.5 OTHERS

FIGURE 21 EMEA TO BE THE FASTEST-GROWING MARKET FOR 1,3-PROPANEDIOL IN OTHER APPLICATIONS

TABLE 55 RECENT ACTIVITIES IN 1,3-PROPANEDIOL MARKET IN OTHER APPLICATIONS

TABLE 56 SCENARIO 1: 1,3-PROPANEDIOL MARKET SIZE IN OTHER APPLICATIONS, 2016-2019 (VOLUME & VALUE)

TABLE 57 SCENARIO 1: 1,3-PROPANEDIOL MARKET SIZE IN OTHER APPLICATIONS, 2020-2025 (VOLUME & VALUE)

TABLE 58 SCENARIO 2: 1,3-PROPANEDIOL MARKET SIZE IN OTHER APPLICATIONS, 2016-2019 (VOLUME & VALUE)

TABLE 59 SCENARIO 2: 1,3-PROPANEDIOL MARKET SIZE IN OTHER APPLICATIONS, 2020-2025 (VOLUME & VALUE)

TABLE 60 SCENARIO 1: 1,3-PROPANEDIOL MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2016-2019 (KILOTON)

TABLE 61 SCENARIO 1: 1,3-PROPANEDIOL MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2020-2025 (KILOTON)

TABLE 62 SCENARIO 1: 1,3-PROPANEDIOL MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2016-2019 (USD MILLION)

TABLE 63 SCENARIO 1: 1,3-PROPANEDIOL MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2020-2025 (USD MILLION)

TABLE 64 SCENARIO 2: 1,3-PROPANEDIOL MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2016-2019 (KILOTON)

TABLE 65 SCENARIO 2: 1,3-PROPANEDIOL MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2020-2025 (KILOTON)

TABLE 66 SCENARIO 2: 1,3-PROPANEDIOL MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2016-2019 (USD MILLION)

TABLE 67 SCENARIO 2: 1,3-PROPANEDIOL MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2020-2025 (USD MILLION)

7 1,3-PROPANEDIOL MARKET, BY REGION (Page No. - 78)

7.1 INTRODUCTION

FIGURE 22 AMERICAS TO BE THE LARGEST MARKET FOR 1,3-PROPANEDIOL DURING THE FORECAST PERIOD

TABLE 68 SCENARIO 1: 1,3-PROPANEDIOL MARKET SIZE, 2016-2019 (VOLUME & VALUE)

TABLE 69 SCENARIO 1: 1,3-PROPANEDIOL MARKET SIZE, 2020-2025 (VOLUME & VALUE)

TABLE 70 SCENARIO 2: 1,3-PROPANEDIOL MARKET SIZE, 2016-2019 (VOLUME & VALUE)

TABLE 71 SCENARIO 2: 1,3-PROPANEDIOL MARKET SIZE, 2020-2025 (VOLUME & VALUE)

TABLE 72 SCENARIO 1: 1,3-PROPANEDIOL MARKET SIZE, BY REGION, 2016-2019 (KILOTON)

TABLE 73 SCENARIO 1: 1,3-PROPANEDIOL MARKET SIZE, BY REGION, 2020-2025 (KILOTON)

TABLE 74 SCENARIO 1: 1,3-PROPANEDIOL MARKET SIZE, BY REGION, 2016-2019 (USD MILLION)

TABLE 75 SCENARIO 1: 1,3-PROPANEDIOL MARKET SIZE, BY REGION, 2020-2025 (USD MILLION)

TABLE 76 SCENARIO 2: 1,3-PROPANEDIOL MARKET SIZE, BY REGION, 2016-2019 (KILOTON)

TABLE 77 SCENARIO 2: 1,3-PROPANEDIOL MARKET SIZE, BY REGION, 2020-2025 (KILOTON)

TABLE 78 SCENARIO 2: 1,3-PROPANEDIOL MARKET SIZE, BY REGION, 2016-2019 (USD MILLION)

TABLE 79 SCENARIO 2: 1,3-PROPANEDIOL MARKET SIZE, BY REGION, 2020-2025 (USD MILLION)

7.2 AMERICAS

7.2.1 PRESENCE OF SOME OF THE LARGEST MANUFACTURERS OF BIO-BASED PDO DRIVE THE MARKET IN THIS REGION

FIGURE 23 AMERICAS: 1,3-PROPANEDIOL MARKET SNAPSHOT

TABLE 80 SCENARIO 1: AMERICAS 1,3-PROPANEDIOL MARKET SIZE, 2016-2019 (VOLUME & VALUE)

TABLE 81 SCENARIO 1: AMERICAS 1,3-PROPANEDIOL MARKET SIZE, 2020-2025 (VOLUME & VALUE)

TABLE 82 SCENARIO 2: AMERICAS 1,3-PROPANEDIOL MARKET SIZE, 2016-2019 (VOLUME & VALUE)

TABLE 83 SCENARIO 2: AMERICAS 1,3-PROPANEDIOL MARKET SIZE, 2020-2025 (VOLUME & VALUE)

TABLE 84 SCENARIO 1: AMERICAS 1,3-PROPANEDIOL MARKET SIZE, BY APPLICATION, 2016-2019 (KILOTON)

TABLE 85 SCENARIO 1: AMERICAS 1,3-PROPANEDIOL MARKET SIZE, BY APPLICATION, 2020-2025 (KILOTON)

TABLE 86 SCENARIO 1: AMERICAS 1,3-PROPANEDIOL MARKET SIZE, BY APPLICATION, 2016-2019 (USD MILLION)

TABLE 87 SCENARIO 1: AMERICAS 1,3-PROPANEDIOL MARKET SIZE, BY APPLICATION, 2020-2025 (USD MILLION)

TABLE 88 SCENARIO 2: AMERICAS 1,3-PROPANEDIOL MARKET SIZE, BY APPLICATION, 2016-2019 (KILOTON)

TABLE 89 SCENARIO 2: AMERICAS 1,3-PROPANEDIOL MARKET SIZE, BY APPLICATION, 2020-2025 (KILOTON)

TABLE 90 SCENARIO 2: AMERICAS 1,3-PROPANEDIOL MARKET SIZE, BY APPLICATION, 2016-2019 (USD MILLION)

TABLE 91 SCENARIO 2: AMERICAS 1,3-PROPANEDIOL MARKET SIZE, BY APPLICATION, 2020-2025 (USD MILLION)

7.3 APAC

7.3.1 INCREASED MANUFACTURING OF PTT IN CHINA TO DRIVE THE PDO MARKET

FIGURE 24 APAC: 1,3-PROPANEDIOL MARKET SNAPSHOT

TABLE 92 SCENARIO 1: APAC 1,3-PROPANEDIOL MARKET SIZE, 2016-2019 (VOLUME & VALUE)

TABLE 93 SCENARIO 1: APAC 1,3-PROPANEDIOL MARKET SIZE, 2020-2025 (VOLUME & VALUE)

TABLE 94 SCENARIO 2: APAC 1,3-PROPANEDIOL MARKET SIZE, 2016-2019 (VOLUME & VALUE)

TABLE 95 SCENARIO 2: APAC 1,3-PROPANEDIOL MARKET SIZE, 2020-2025 (VOLUME & VALUE)

TABLE 96 SCENARIO 1: APAC 1,3-PROPANEDIOL MARKET SIZE, BY APPLICATION, 2016-2019 (KILOTON)

TABLE 97 SCENARIO 1: APAC 1,3-PROPANEDIOL MARKET SIZE, BY APPLICATION, 2020-2025 (KILOTON)

TABLE 98 SCENARIO 1: APAC 1,3-PROPANEDIOL MARKET SIZE, BY APPLICATION, 2016-2019 (USD MILLION)

TABLE 99 SCENARIO 1: APAC 1,3-PROPANEDIOL MARKET SIZE, BY APPLICATION, 2020-2025 (USD MILLION)

TABLE 100 SCENARIO 2: APAC 1,3-PROPANEDIOL MARKET SIZE, BY APPLICATION, 2016-2019 (KILOTON)

TABLE 101 SCENARIO 2: APAC 1,3-PROPANEDIOL MARKET SIZE, BY APPLICATION, 2020-2025 (KILOTON)

TABLE 102 SCENARIO 2: APAC 1,3-PROPANEDIOL MARKET SIZE, BY APPLICATION, 2016-2019 (USD MILLION)

TABLE 103 SCENARIO 2: APAC 1,3-PROPANEDIOL MARKET SIZE, BY APPLICATION, 2020-2025 (USD MILLION)

7.4 EUROPE, MIDDLE EAST AFRICA

7.4.1 PDO MARKET IN EMEA TO WITNESS HIGHEST GROWTH IN COSMETICS, PERSONAL CARE, AND CLEANING PRODUCTS APPLICATIONS

FIGURE 25 EMEA: 1,3-PROPANEDIOL MARKET SNAPSHOT

TABLE 104 SCENARIO 1: EMEA 1,3-PROPANEDIOL MARKET SIZE, 2016-2019 (VOLUME & VALUE)

TABLE 105 SCENARIO 1: EMEA 1,3-PROPANEDIOL MARKET SIZE, 2020-2025 (VOLUME & VALUE)

TABLE 106 SCENARIO 2: EMEA 1,3-PROPANEDIOL MARKET SIZE, 2016-2019 (VOLUME & VALUE)

TABLE 107 SCENARIO 2: EMEA 1,3-PROPANEDIOL MARKET SIZE, 2020-2025 (VOLUME & VALUE)

TABLE 108 SCENARIO 1: EMEA 1,3-PROPANEDIOL MARKET SIZE, BY APPLICATION, 2016-2019 (KILOTON)

TABLE 109 SCENARIO 1: EMEA 1,3-PROPANEDIOL MARKET SIZE, BY APPLICATION, 2020-2025 (KILOTON)

TABLE 110 SCENARIO 1: EMEA 1,3-PROPANEDIOL MARKET SIZE, BY APPLICATION, 2016-2019 (USD MILLION)

TABLE 111 SCENARIO 1: EMEA 1,3-PROPANEDIOL MARKET SIZE, BY APPLICATION, 2020-2025 (USD MILLION)

TABLE 112 SCENARIO 2: EMEA 1,3-PROPANEDIOL MARKET SIZE, BY APPLICATION, 2016-2019 (KILOTON)

TABLE 113 SCENARIO 2: EMEA 1,3-PROPANEDIOL MARKET SIZE, BY APPLICATION, 2020-2025 (KILOTON)

TABLE 114 SCENARIO 2: EMEA 1,3-PROPANEDIOL MARKET SIZE, BY APPLICATION, 2016-2019 (USD MILLION)

TABLE 115 SCENARIO 2: EMEA 1,3-PROPANEDIOL MARKET SIZE, BY APPLICATION, 2020-2025 (USD MILLION)

8 COMPETITIVE LANDSCAPE (Page No. - 96)

8.1 OVERVIEW

FIGURE 26 EXPANSION WAS THE KEY GROWTH STRATEGY ADOPTED BY

THE MARKET PLAYERS BETWEEN 2014 AND 2019 96

8.2 MARKET SHARE ANALYSIS

8.3 COMPETITIVE SITUATION AND TRENDS

8.3.1 EXPANSIONS

TABLE 116 EXPANSIONS, 2014-2019

8.3.2 INNOVATIONS

TABLE 117 INNOVATIONS, 2014-2019

8.3.3 PARTNERSHIPS

TABLE 118 PARTNERSHIPS, 2014-2019

9 COMPANY PROFILES (Page No. - 99)

9.1 EXISTING PLAYERS

(Business Overview, Products Offered, Winning Imperatives, Short-term Strategies: COVID-19 Impact Recent Developments, Long-term Strategies, Threat from Competition, and Right to Win)*

9.1.1 DUPONT TATE & LYLE BIO PRODUCTS COMPANY, LLC

FIGURE 27 DUPONT TATE & LYLE BIO PRODUCTS COMPANY, LLC: WINNING IMPERATIVES

9.1.2 ZHANGJIAGANG GLORY BIOMATERIAL CO., LTD.

FIGURE 28 ZHANGJIAGANG GLORY BIOMATERIAL CO., LTD: WINNING IMPERATIVES

9.1.3 ZOUPING MINGXING CHEMICAL CO., LTD.

FIGURE 29 ZOUPING MINGXING CHEMICAL CO., LTD.: WINNING IMPERATIVES

9.1.4 HAIHANG INDUSTRY CO., LTD.

9.1.5 MERCK KGAA

FIGURE 30 MERCK KGGA: COMPANY SNAPSHOT

9.1.6 TOKYO CHEMICAL INDUSTRY CO., LTD.

9.2 UPCOMING PLAYERS

9.2.1 METABOLIC EXPLORER

9.2.2 SHENG HONG GROUP HOLDINGS LTD.

* Business Overview, Products Offered, Winning Imperatives, Short-term Strategies: COVID-19 Impact Recent Developments, Long-term Strategies, Threat from Competition, and Right to Win might not be captured in case of unlisted companies.

10 ADJACENT & RELATED MARKETS (Page No. - 114)

10.1 INTRODUCTION

10.2 LIMITATIONS

10.3 1,3-PDO ECOSYSTEM AND INTERCONNECTED MARKETS

FIGURE 31 1,3-PDO: CONNECTED MARKETS

10.4 PERSONAL CARE INGREDIENTS MARKET

10.4.1 MARKET DEFINITION

10.4.2 MARKET OVERVIEW

FIGURE 32 PERSONAL CARE INGREDIENTS MARKET IS EXPECTED TO WITNESS STEADY GROWTH

10.5 PERSONAL CARE INGREDIENTS MARKET, BY APPLICATION

10.5.1 INTRODUCTION

10.5.2 SKIN CARE

TABLE 119 PERSONAL CARE INGREDIENTS MARKET SIZE IN SKIN CARE APPLICATION, BY REGION, 2015-2022 (USD MILLION)

10.5.3 HAIR CARE

TABLE 120 PERSONAL CARE INGREDIENTS MARKET SIZE IN HAIR CARE APPLICATION, BY REGION, 2015-2022 (USD MILLION)

10.5.4 ORAL CARE

TABLE 121 PERSONAL CARE INGREDIENTS MARKET SIZE IN ORAL CARE APPLICATION, BY REGION, 2015-2022 (USD MILLION)

10.5.5 MAKE-UP

TABLE 122 PERSONAL CARE INGREDIENTS MARKET SIZE IN MAKE-UP APPLICATION, BY REGION, 2015-2022 (USD MILLION)

10.5.6 OTHERS

TABLE 123 PERSONAL CARE INGREDIENTS MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2015-2022 (USD MILLION)

10.6 PERSONAL CARE INGREDIENTS MARKET, BY REGION

10.6.1 INTRODUCTION

TABLE 124 PERSONAL CARE INGREDIENTS MARKET SIZE, BY REGION, 2015-2022 (USD MILLION)

10.6.2 ASIA PACIFIC

TABLE 125 ASIA PACIFIC: PERSONAL CARE INGREDIENTS MARKET SIZE, BY APPLICATION, 2015-2022 (USD MILLION)

TABLE 126 ASIA PACIFIC: PERSONAL CARE INGREDIENTS MARKET SIZE, BY COUNTRY, 2015-2022 (USD MILLION)

10.6.2.1 China

TABLE 127 CHINA: PERSONAL CARE INGREDIENTS MARKET SIZE, BY APPLICATION, 2015-2022 (USD MILLION)

10.6.2.2 Japan

TABLE 128 JAPAN: PERSONAL CARE INGREDIENTS MARKET SIZE, BY APPLICATION, 2015-2022 (USD MILLION)

10.6.2.3 South Korea

TABLE 129 SOUTH KOREA: PERSONAL CARE INGREDIENTS MARKET SIZE, BY APPLICATION, 2015-2022 (USD MILLION)

10.6.3 EUROPE

TABLE 130 EUROPE: PERSONAL CARE INGREDIENTS MARKET SIZE, BY APPLICATION, 2015-2022 (USD MILLION)

TABLE 131 EUROPE: PERSONAL CARE INGREDIENTS MARKET SIZE, BY COUNTRY, 2015-2022(USD MILLION)

10.6.3.1 France

TABLE 132 FRANCE: PERSONAL CARE INGREDIENTS MARKET SIZE, BY APPLICATION, 2015-2022 (USD MILLION)

10.6.3.2 Germany

TABLE 133 GERMANY: PERSONAL CARE INGREDIENTS MARKET SIZE, BY APPLICATION, 2015-2022 (USD MILLION)

10.6.3.3 UK

TABLE 134 UK: PERSONAL CARE INGREDIENTS MARKET SIZE, BY APPLICATION, 2015-2022 (USD MILLION)

10.6.4 NORTH AMERICA

TABLE 135 NORTH AMERICA: PERSONAL CARE INGREDIENTS MARKET SIZE, BY APPLICATION, 2015-2022 (USD MILLION)

TABLE 136 NORTH AMERICA: PERSONAL CARE INGREDIENTS MARKET SIZE, BY COUNTRY, 2015-2022 (USD MILLION)

10.6.4.1 US

TABLE 137 US: PERSONAL CARE INGREDIENTS MARKET SIZE, BY APPLICATION, 2015-2022 (USD MILLION)

10.6.4.2 Canada

TABLE 138 CANADA: PERSONAL CARE INGREDIENTS MARKET SIZE, BY APPLICATION, 2015-2022 (USD MILLION)

10.6.4.3 Mexico

TABLE 139 MEXICO: PERSONAL CARE INGREDIENTS MARKET SIZE, BY APPLICATION, 2015-2022 (USD MILLION)

10.6.5 MIDDLE EAST & AFRICA

TABLE 140 MIDDLE EAST & AFRICA: PERSONAL CARE INGREDIENTS MARKET SIZE, BY APPLICATION, 2015-2022 (USD MILLION)

TABLE 141 MIDDLE EAST & AFRICA: PERSONAL CARE INGREDIENTS MARKET SIZE, BY COUNTRY, 2015-2022 (USD MILLION)

10.6.5.1 Turkey

TABLE 142 TURKEY: PERSONAL CARE INGREDIENTS MARKET SIZE, BY APPLICATION, 2015-2022 (USD MILLION)

10.6.5.2 Iran

TABLE 143 IRAN: PERSONAL CARE INGREDIENTS MARKET SIZE, BY APPLICATION, 2015-2022 (USD MILLION)

10.6.5.3 Saudi Arabia

TABLE 144 SAUDI ARABIA: PERSONAL CARE INGREDIENTS MARKET SIZE, BY APPLICATION, 2015-2022 (USD MILLION)

10.6.6 SOUTH AMERICA

TABLE 145 SOUTH AMERICA: PERSONAL CARE INGREDIENTS MARKET SIZE, BY APPLICATION, 2015-2022 (USD MILLION)

TABLE 146 SOUTH AMERICA: PERSONAL CARE INGREDIENTS MARKET SIZE, BY COUNTRY, 2015-2022 (USD MILLION)

10.6.6.1 Brazil

TABLE 147 BRAZIL: PERSONAL CARE INGREDIENTS MARKET SIZE, BY APPLICATION, 2015-2022 (USD MILLION)

10.6.6.2 Argentina

TABLE 148 ARGENTINA: PERSONAL CARE INGREDIENTS MARKET SIZE, BY APPLICATION, 2015-2022 (USD MILLION)

11 APPENDIX (Page No. - 135)

11.1 DISCUSSION GUIDE

11.2 KNOWLEDGE STORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

11.3 AVAILABLE CUSTOMIZATIONS

11.4 RELATED REPORTS

11.5 AUTHOR DETAILS

The study involved four major activities for estimating the market size for 1,3-propanediol. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

Secondary sources used in this study included annual reports, sustainability report, press releases, and investor presentations of companies; white papers; certified publications; articles from recognized authors; and gold standard & silver standard websites such as Factiva, ICIS, Bloomberg, United Nations Statistical Commission, National Corn Growers Association, and United States Department of Agriculture (USDA). The findings of this study were verified through primary research by conducting extensive interviews with key officials such as CEOs, VPs, directors, and other executives.

Primary Research

The 1,3-propanediol market comprises several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by the development of polytrimethylene terephthalate (PTT); polyurethane (PU); cosmetics, personal care, cleaning products; and other applications. The supply side is characterized by advancements in technology and diverse end-use applications. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The breakdown of profiles of the primary interviewees is illustrated in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the 1,3-propanediol market. These methods were also used extensively to estimate the size of the market in each application. The research methodology used to estimate the market size includes the following:

The key players in the industry were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value and volume, were determined through primary and secondary research processes.

- All percentage shares splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments. To complete the overall market engineering process and arrive at the exact statistics of each segment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To analyze and forecast the size of the 1,3-propanediol market in terms of value and volume

- To provide detailed information regarding key factors such as drivers, restraints, and opportunities influencing the growth of the market

- To define, describe, and segment the 1,3-propanediol market based on application

- To forecast the size of the market for regions such as APAC, the Americas, and Europe, Middle East & Africa

- To strategically analyze the segmented markets with respect to individual growth trends, prospects, and contribution to the overall market

- To identify and analyze opportunities for stakeholders in the market

- To analyze competitive developments such as expansion, innovation, and partnership in the 1,3-propanediol market

- To strategically profile key players and comprehensively analyze their core competencies

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country or application

Company Information

- Detailed analysis and profiles of additional market players (up to five)

Growth opportunities and latent adjacency in 1,3-Propanediol (PDO) Market

Market information on 1,3-propandiol for polyurethane applications for the Switzerland

General information on uses of 1,3-propanediol for polyurethane applications

Application of 1,3-propanediol for polyurethane applications in Switzerland

Data on Application of 1,3-propanediol for polyurethane in Switzerland and neighboring countries.

How to cite this report?

1,3-Propanediol (PDO) production cost and gross margin, prices analyses, with product specifications, new product launches, current state of manufacturers and suppliers, final product applications.

Need to understand coverage of european players in 1,3-PDO market report

Sepcific information on 1,3-Propanediol (PDO) prices, ourput by country, and competitive landscape

General information required for 1,3 PDO

General information required for 1,3 PDO

Looking for information on waterwaste management

Specific information on maufacturers production capacity

Raw material and value chain analysis, with market size of 1,3-Propanediol (PDO) by application, in South and North America.