Wearable Computing Market by Application (Fitness and Wellness, Medical and Healthcare, Enterprise and Industrial, Infotainment, and Others), by Technology (Computing, Display, Networking, and Others), & Geography - Global Forecast to 2020

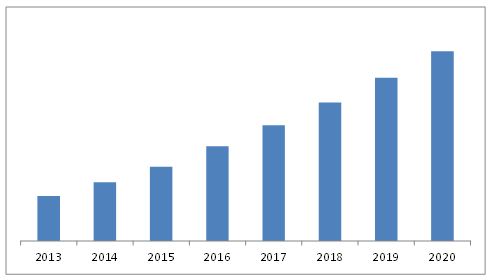

The total wearable computing market is expected to reach up to $34.61 Billion by 2020, growing at a CAGR of 20.7% between 2015 and 2020.

Wearable computers or products are small electronic devices worn by users which enable mobile computing and wireless networking. Wearable technology is poised to revolutionize the way humans interact with the world around them. Wearable products comprise smart devices equipped with microchips, sensors, and wireless communication capabilities. These devices collect data, track activities, and provide customized experiences to users needs and desires.

The wearable computing market in this report is segmented into fitness and wellness, medical and healthcare, enterprise and industrial, infotainment, and other applications. The infotainment application is expected to grow at the highest value of $16.7 Billion by 2020. The increasing adoption of wearable devices such as smartwatches and augmented devices in the consumer market is contributing to the growth of the wearable market.

The wearable computing market by geography is categorized into four regions including the Americas, Europe, Asia-Pacific (APAC), and Rest of the World (RoW). During the forecast period between 2015 and 2020, APAC region is expected to grow at the highest CAGR with 33.9% mainly due to the rapid expansion of Chinese economy as its government is planning to modernize its economic infrastructure.

On the other hand, the factors that slow down the growth of the wearable computing market are the high initial prices for various products including activity trackers, smartwatches, and smart glasses among others. Thus, the wearable device is limited to only high-end consumer space in most of the products.

This report profiles all the major companies involved in the wearable computing market such as Adidas AG (Germany), Apple, Inc. (U.S.), Fitbit, Inc. (U.S.), Pebble Technology Corporation (U.S.), Garmin Ltd. (U.S.), Jawbone (U.S.), LG Electronics Inc. (South Korea), Motorola Mobility Holdings, Inc. (U.S.), Sony Corporation (Japan), Samsung Electronics Co., Ltd. (South Korea) and Zephyr Technology Corporation (U.S.)., among others.

Scope of the report:

This report categorizes the global wearable computing market for wearable computing on the basis of application, technology, and geography.

Market segmentation by application:

The wearable computing market on the basis of application is segmented into Fitness and Wellness, Medical and Healthcare, Enterprise and Industrial, Infotainment, and Others. These applications are further classified into various products.

Market segmentation by technology:

The wearable computing market on the basis of technology is segmented into various computing technologies, display technologies, networking technologies, and others.

Market segmentation by geography:

The geographic analysis covers the Americas, Europe, Asia-Pacific, and rest of the world (RoW). The cross segmentation data included in the report provides an in-depth insight into the regional markets.

This report on the wearable computing market is aimed towards analyzing the major industry segments such as fitness and wellness, medical and healthcare, enterprise and industrial, and infotainment industries for the same.

The factors such as, increasing adoption of smartwatches, activity trackers and new product launches are driving the wearable computing market. The growth of wearable computing market is driven by increasing number of applications and growing investments in the wearable market. This report profiles all the major companies involved in the wearable market such as Apple, Inc. (U.S.), Fitbit, Inc. (U.S.), Pebble Technology Corporation (U.S.), Garmin Ltd. (U.S.), Jawbone (U.S.), LG Corporation (South Korea), Motorola Mobility Holdings, Inc. (U.S.), Sony Corporation (Japan), and Samsung Electronics Co., Ltd. (South Korea) among others.

The wearable computing market has been classified based on application, technology, and geography. In terms of application, the market has been segmented into fitness and wellness, medical and healthcare, enterprise and industrial, infotainment, and others. These applications are further categorized into major products such as, wristbands, smart clothing, foot wear, continuous glucose monitors, drug delivery products, ECG monitors, hand-worn terminals, smartwatches, and augmented realty devices among others. In terms of technology, the market has been segmented into computing, display, networking, and other technologies. The growth of the market in the APAC region can be attributed to the increasing adoption of these products in multiple application areas.

Wearable Computing Market (2013 - 2020)

Source: MarketsandMarkets Analysis

Table of Contents

1 Introduction (Page No. - 15)

1.1 Study Objectives

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries Interviews: By Company Type, Designation, and Region

2.2 Factor Analysis

2.2.1 Introduction

2.2.2 Demand-Side Analysis

2.2.2.1 Growing Demand for Wearable Devices

2.2.3 Supply-Side Analysis

2.2.3.1 Increase in the Number of Product Launches in the Market

2.2.3.2 Growing Usage of Wearable Devices in Military

2.3 Market Size Estimation

2.3.1 Bottom-Up Approach

2.3.2 Top-Down Approach

2.4 Market Breakdown and Data Triangulation

2.5 Assumptions

3 Executive Summary (Page No. - 29)

4 Premium Insights (Page No. - 35)

4.1 Attractive Market Opportunities in Wearable Computing

4.2 Market: By Application

4.3 Market in the Asia-Pacific Region

4.4 Wearable Computing Fitness and Wellness Application Market, By Geography

4.5 Life Cycle Analysis, By Geography

5 Market Overview (Page No. - 39)

5.1 Market Segmentation

5.1.1 Market, By Application

5.1.2 Market, By Technology

5.1.3 Market, By Geography

5.2 Market Evolution

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increasing Adoption of Smartwatches and Wristbands in Consumer Market

5.3.1.2 Rising Focus Towards Communication, Networking, and Recognition Technologies for Wearables

5.3.1.3 Growing Popularity of Internet of Things

5.3.1.4 Increasing Popularity of Wearable Health and Medical Devices.

5.3.2 Restraints

5.3.2.1 High Initial Price Range of Body and Eye Wear

5.3.2.2 Power Consumption and Limited Battery Life

5.3.2.3 Social Acceptance Factor

5.3.3 Opportunities

5.3.3.1 Penetration of Smart Clothing in the European Region With Increased Funding

5.3.3.2 Development of Key Enabling Technologies

5.3.3.3 Increasing Adoption of Wearables in Multiple Application Areas

5.3.4 Challenges

5.3.4.1 Technical Difficulties

5.3.4.2 Device Protection and Thermal Consideration

5.3.5 Burning Issue

5.3.5.1 Unaddressed Regulatory Issues

5.3.6 Winning Imperative

5.3.6.1 Investment From Major Players Such as Google, Microsoft, Apple, Motorola, and Various Fitness Devices Manufacturers

6 Industry Trends (Page No. - 52)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Porters Five Forces Analysis

6.3.1 Intensity of Competitive Rivalry

6.3.2 Threat of Substitutes

6.3.3 Bargaining Power of Buyers

6.3.4 Bargaining Power of Suppliers

6.3.5 Threat of New Entrants

6.4 Strategic Benchmarking

6.4.1 Technology Integration and Product Enhancement

7 Wearable Computing Market, By Application (Page No. - 62)

7.1 Introduction

7.2 Fitness and Wellness Application

7.2.1 Wristbands

7.2.2 Smart Clothing

7.2.3 Footwear

7.2.4 Others

7.3 Medical and Healthcare

7.3.1 Continuous Glucose Monitors

7.3.2 Drug Delivery Products

7.3.3 ECG Monitoring

7.3.4 Others

7.4 Enterprise and Industrial

7.4.1 Hand-Worn Terminals

7.4.2 Others

7.5 Infotainment

7.5.1 Smartwatches

7.5.2 Augmented Reality Devices

7.5.2.1 Head-Up Displays

7.5.2.2 Head-Mounted Displays

7.5.2.3 Smart Glasses

7.6 Others

8 Wearable Computing Market, By Technology (Page No. - 90)

8.1 Introduction

8.1.1 Computing Technologies

8.1.1.1 Wearable Computers

8.1.2 Display Technologies

8.1.2.1 Virtual Reality

8.1.2.2 Augmented Reality

8.1.3 Networking Technologies

8.1.3.1 Bluetooth

8.1.3.2 Wi-Fi

8.1.3.3 Others

8.1.4 Other Technologies

9 Geographic Analysis (Page No. - 96)

9.1 Introduction

9.2 The Americas

9.2.1 U.S.

9.2.2 Canada

9.2.3 Mexico

9.3 Europe

9.3.1 U.K.

9.3.2 Germany

9.3.3 France

9.3.4 Rest of Europe

9.4 Asia-Pacific

9.4.1 China

9.4.2 Japan

9.4.3 South Korea

9.4.4 India

9.4.5 Rest of APAC

9.5 Rest of the World (RoW)

9.5.1 Middle East

9.5.2 Africa

10 Competitive Landscape (Page No. - 127)

10.1 Overview

10.2 Market Ranking for Wearable Computing Market, 2014

10.3 Competitive Scenario

10.4 Recent Developments

10.4.1 New Product Launches

10.4.2 Partnerships, Agreements, and Contracts & Collaborations

10.4.3 Mergers and Acquisitions

11 Company Profiles (Page No. - 134)

(Overview, Products and Services, Financials, Strategy & Development)*

11.1 Introduction

11.2 Adidas AG

11.3 Apple Inc.

11.4 Boston Scientific Corporation

11.5 Fitbit Inc.

11.6 Garmin, Ltd.

11.7 Jawbone

11.8 LG Electronics, Inc.

11.9 Motorola Mobility Holdings, Inc.

11.10 Nike, Inc.

11.11 Pebble Technology, Corporation

11.12 Samsung Electronics Co., Ltd

11.13 Sony Corporation

11.14 Zephyr Technology Corporation

*Details on Overview, Products and Services, Financials, Strategy & Development Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 164)

12.1 Insights of Industry Experts

12.2 Discussion Guide

12.3 Introducing RT: Real Time Market Intelligence

12.4 Available Customizations

12.5 Related Reports

List of Tables (71 Tabls)

Table 1 Adoption of Smartwatches and Wristbands in the Consumer Market Propels the Growth of Market

Table 2 High Initial Price S Act as A Hindrance to the Market

Table 3 Penetration of Smart Clothing in the European Region With Increased Funding, is A Huge Opportunity for the Market

Table 4 List of Projects Funded By the European Union

Table 5 The Porters Five Forces Analysis: High Degree of Competition is Likely to Have Maximum Impact on the Overall Market,2014

Table 6 Wearable Computing Market, By Application, 2013 2020 ($Million)

Table 7 Market, By Application, 2013 2020 (Million Units)

Table 8 Wearable Fitness & Wellness Computing Application Market, 2013 2020 ($Million)

Table 9 Wearable Fitness & Wellness Computing Application Market, 2013 2020 (Million Units)

Table 10 Wearable Fitness & Wellness Computing Market, By Geography, 2013 2020 ($Million)

Table 11 Wearable Fitness & Wellness Computing Market, By Geography, 2013 2020 (Million Units)

Table 12 Wearable Medical & Healthcare Application Market, 2013 2020 ($Million)

Table 13 Wearable Medical & Healthcare Application Market, 2013 2020 (Thousand Units)

Table 14 Wearable Medical & Healthcare Application Market, By Geography, 2013 2020 ($Million)

Table 15 Wearable Medical & Healthcare Application Market, By Geography, 2013 2020 (Thousand Units)

Table 16 Wearable Enterprise & Industrial Application Market, 2013 2020 ($Million)

Table 17 Wearable Enterprise & Industrial Application Market, 2013 2020 (Thousand Units)

Table 18 Wearable Enterprise & Industrial Market, By Geography, 2013 2020 ($Million)

Table 19 Wearable Enterprise & Industrial Market, By Geography, 2013 2020 (Thousand Units)

Table 20 Wearable Infotainment Application Market, 2013 2020 ($Million)

Table 21 Wearable Infotainment Application Market, 2013 2020 (Million Units)

Table 22 Wearable Infotainment Application Market, By Augmented Reality Devices, 2013 2020 ($Million)

Table 23 Wearable Infotainment Application Market, By Augmented Reality Devices, 2013 2020 (Thousand Units)

Table 24 Wearable Infotainment Application Market, By Geography, 2013 2020 ($Million)

Table 25 Wearable Infotainment Application Market, By Geography, 2013 2020 (Million Units)

Table 26 Wearable Computing Others Application Market, 2013 2020 ($Million)

Table 27 Wearable Computing Others Application Market, 2013 2020 (Million Units)

Table 28 Wearable Computing Others Application Market, By Geography, 2013 2020 ($Million)

Table 29 Wearable Computing Others Application Market, By Geography, 2013 2020 (Thousand Units)

Table 30 Market, By Geography, 2013 2020 ($Million)

Table 31 Market, By Geography, 2013 2020 (Million Units)

Table 32 The Americas Market, By Region, 2013 2020 ($Million)

Table 33 The Americas Market, By Region, 2013 2020 (Million Units)

Table 34 The Americas Market, By Country, 2013 2020 ($Million)

Table 35 The Americas Market, By Country, 2013 2020 (Million Units)

Table 36 The Americas Market, By Application, 2013 2020 ($Million)

Table 37 The Americas Market, By Application, 2013 2020 (Million Units)

Table 38 The Americas Market, By Fitness & Wellness Application, 2013 2020 ($Million)

Table 39 The Americas Market, By Medical & Healthcare Application, 2013 2020 ($Million)

Table 40 The Americas Market, By Enterprise & Industrial Application, 2013 2020 ($Million)

Table 41 The Americas Market, By Infotainment Application, 2013 2020 ($Million)

Table 42 The Americas Market, By Others Application, 2013 2020 ($Million)

Table 43 Europe Market, By Country, 2013 2020 ($Million)

Table 44 Europe Market, By Country, 2013 2020 (Million Units)

Table 45 Europe Market, By Application, 2013 2020 ($Million)

Table 46 Europe Market, By Application, 2013 2020 (Thousand Units)

Table 47 Europe Market, By Fitness & Wellness Application, 2013 2020 ($Million)

Table 48 Europe Market, By Medical & Healthcare Application, 2013 2020 ($Million)

Table 49 Europe Market, By Enterprise & Industrial Application, 2013 2020 ($Million)

Table 50 Europe Market, By Infotainment Application, 2013 2020 ($Million)

Table 51 Europe Market, By Others Application, 2013 2020 ($Million)

Table 52 APAC Market, By Country, 2013 2020 ($Million)

Table 53 APAC Market, By Country, 2013 2020 (Million Units)

Table 54 APAC Market, By Application, 2013 2020 ($Million)

Table 55 APAC Market, By Application, 2013 2020 (Thousand Units)

Table 56 APAC Market, By Fitness & Wellness Application, 2013 2020 ($Million)

Table 57 APAC Market, By Medical & Healthcare Application, 2013 2020 ($Million)

Table 58 APAC Market, By Enterprise & Industrial Application, 2013 2020 ($Million)

Table 59 APAC Market, By Infotainment Application, 2013 2020 ($Million)

Table 60 APAC Market, By Others Application, 2013 2020 ($Million)

Table 61 RoW Market, By Region, 2013 2020 ($Million)

Table 62 RoW Market, By Region, 2013 2020 (Million Units)

Table 63 RoW Market, By Application, 2013 2020 ($Million)

Table 64 RoW Market, By Application, 2013 2020 (Thousand Units)

Table 65 RoW Market, By Fitness & Wellness Application, 2013 2020 ($Million)

Table 66 RoW Market, By Medical & Healthcare Application, 2013 2020 ($Million)

Table 67 RoW Market, By Enterprise & Industrial Application, 2013 2020 ($Million)

Table 68 RoW Market, By Infotainment Application, 2013 2020 ($Million)

Table 69 RoW Market, By Others Application, 2013 2020 ($Million)

Table 70 Market Ranking of the Top 5 Players in the Market, 2014

Table 71 New Product Launches, 2013-2015

List of Figures (84 Figures)

Figure 1 Research Design

Figure 2 Wearable Devices Market Size, 2010-2012

Figure 3 Product Launches in the Market, 2013-2015

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Assumptions for the Research Study

Figure 7 Infotainment Application Accounted for the Maximum Market Share in Market in 2014

Figure 8 Smartwatches Segment is Expected to Witness Higher Growth Rate in Comparison to Augmented Reality Devices Segment

Figure 9 Hand-Worn Terminals Segment is Estimated to Account for the Highest Market Value in the Enterprise and Industrial Application During the Forecast Period

Figure 10 APAC Region Market Analysis, By Country, 2014

Figure 11 Global Market Share, By Geography, 2014

Figure 12 Increasing Adoption of Smartwatches, Fitness Bands, and Smart Clothing Provide Opportunities in Wearable Computing

Figure 13 The Enterprise and Industrial Segment is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 14 Wristbands Market for Wearable Computing is Estimated to Capture the Lions Share in the Emerging Asia-Pacific Market, 2015

Figure 15 APAC is Projected to Grow at the Highest CAGR as Compared to Other Regions From 2015 to 2020

Figure 16 The Market is in Growing Stage in the APAC Region, 2015

Figure 17 Wearable Computing Market: Segmentation

Figure 18 By Application

Figure 19 By Technology

Figure 20 By Geography

Figure 21 Evolution of the Market

Figure 22 Market Dynamics: Overview

Figure 23 Smartwatch Shipments By Company, 2014

Figure 24 Share of Americans, Who Owned Different Medical and Health Wearable Devices in 2014

Figure 25 Average Market Prices for Various Wearable Devices

Figure 26 Life Cycle of Wearable Products, 2014

Figure 27 Value Chain Analysis: Major Value is Added During the Assembly and Distribution Phases

Figure 28 The Porters Five Forces Analysis:

Figure 29 Market: Porters Five Forces Analysis

Figure 30 Intensity of Competitive Rivalry: High Competition in the Market Due to the New Product Launches and Innovations

Figure 31 Threat of Substitutes Will Be High Due to Availability of Substitute Products

Figure 32 Bargaining Power of Buyers: As the Adoption Rate of Buyers is High, They Will Have A High Bargaining Power

Figure 33 Bargaining Power of Suppliers: Technological Factors in Wearables Will Drive the Market for Suppliers During the Forecast Period

Figure 34 Threat of New Entrants: With Innovative Product Developments New Entrants are Likely to Enter This Market

Figure 35 Strategic Benchmarking: Key Players Largely Adopted Organic Growth Strategies Such as New Product Launches

Figure 36 Segmentation of the Market: By Application

Figure 37 Infotainment Application: Largest Market Share in the Market Between 2014 and 2020

Figure 38 Segmentation of the Market: By Fitness and Wellness Application

Figure 39 Smart Clothing is Expected to Grow at the Highest CAGR in Fitness and Wellness Application Market From 2014 to 2020

Figure 40 The Americas: Expected to Grow at A Highest Market Value in the Fitness and Wellness Market Between 2014 and 2020

Figure 41 Segmentation of the Market: By Medical and Healthcare Application

Figure 42 ECG Monitors: Expected to Grow at the Highest CAGR in the Medical and Healthcare Application Market Between 2014 and 2020

Figure 43 The Americas: Expected to Grow at the Highest Market Value in the Medical and Healthcare Application Market Between 2014 and 2020

Figure 44 Segmentation of the Market: By Enterprise and Industrial Application

Figure 45 Hand-Worn Terminals Segment is Expected to Grow at the Highest Market Value in the Enterprise and Industrial Market From 2014 to 2020

Figure 46 APAC Region is Expected to Grow at the Highest Rate in the Enterprise and Industrial Application Market Between 2014 and 2020

Figure 47 Segmentation of the Market: By Infotainment Application

Figure 48 Segmentation of the Wearable Computing Augmented Reality Devices

Figure 49 Smartwatches are Projected to Increase at the Highest CAGR in the Infotainment Application Market Between 2014 and 2020

Figure 50 Smart Glasses are Expected to Grow at the Highest Market Value in the Augmented Reality Devices Market From 2014 to 2020

Figure 51 The Americas are Expected to Grow at the Highest Market Value Between 2014 and 2020 in the Infotainment Application Market

Figure 52 Segmentation of the Market: By Other Application

Figure 53 Ties and Collars Segment is Projected to Grow at the Highest Market Value in Others Application Market Between 2014 and 2020

Figure 54 The Americas are Projected to Grow at the Highest Market Value in Others Application Market From 2014 to 2020

Figure 55 Segmentation of the Market: By Technology

Figure 56 Segmentation of the Display Technology

Figure 57 Segmentation of the Networking Technology

Figure 58 Wearable Computing Market, By Region

Figure 59 Geographic Snapshot (2014) - APAC Region is Estimated to Register the Highest Growth Rate During the Forecast Period

Figure 60 Among All Countries, the U.S. is Considered to Dominate in the Market Between 2014 and 2020

Figure 61 The Americas Market Snapshot: The Market Would Be Driven By the Growing Demand From Medical and Healthcare Applications During the Forecast Period

Figure 62 Segmentation: Americas

Figure 63 Europe Market Snapshot: The Demand for Wearable Computing Would Be Driven By Wide Opportunities Coming Up in the Various Application Markets

Figure 64 Segmentation: Europe

Figure 65 APAC Market Snapshot: The Demand Would Be Driven By the Presence of Various Major Players in the Region and the Growing Regional Economy

Figure 66 Segmentation: APAC

Figure 67 Segmentation: RoW

Figure 68 Key Growth Strategies Adopted By the Top Companies Between 2012 and 2015

Figure 69 Market Evaluation Framework: New Product Launches Fuelled Growth and Innovation in 2013 and 2014

Figure 70 Battle for Market Share: New Product Launches Was the Key Strategy

Figure 71 Geographic Revenue Mix of Major Market Players

Figure 72 Adidas AG: Company Snapshot

Figure 73 Apple Inc.: Company Snapshot

Figure 74 Boston Scientific Corp.: Company Snapshot

Figure 75 Garmin Ltd.: Company Snapshot

Figure 76 Garmin, Ltd.: SWOT Analysis

Figure 77 LG Electronics Inc.: Company Snapshot

Figure 78 LG Electronics, Inc.: SWOT Analysis

Figure 79 Motorola Mobility Holdings, Inc.: SWOT Analysis

Figure 80 Nike, Inc.: Company Snapshot

Figure 81 Pebble Technology Corp.: SWOT Analysis

Figure 82 Samsung Electronics Co., Ltd.: Company Snapshot

Figure 83 Samsung Electronics Co., Ltd.: SWOT Analysis

Figure 84 Sony Corporation: Company Snapshot

Growth opportunities and latent adjacency in Wearable Computing Market