Process Analyzer Market (Liquid), by Type (pH/ORP, Conductivity, Near-Infrared, Turbidity, Dissolved Oxygen, Chlorine, Liquid Density, MLSS, TOC, Aluminium, and Ammonia), Service (Pre-sale and Post-sale), Industry, and Geography - Global Forecast to 2022

The global process analyzer market (liquid) is expected to reach USD 2.39 Billion by 2022, at a CAGR of 5.67% between 2016 and 2022. The growth of this market is majorly driven by the increase in the shale gas production in the U.S. and growing demand for wastewater treatment plants. In addition, increasing demand for analytical instruments in the emerging market such as China and India is further contributing to the growth of this market.

The report aims at estimating the size and future growth potential of the process analyzers market (liquid). The base year considered for the study is 2015 and the market size has been forecasted from 2016 to 2022.

The global process analyzers market (liquid) is expected to grow from USD 1.61 Billion in 2015 to USD 2.39 Billion by 2022, at a CAGR of 5.67% between 2016 and 2022. The market is majorly driven by the increase in the shale gas production in the U.S. and growing demand for water & wastewater treatment. In addition, factors such as increasing usage of process liquid analyzers in the emerging markets, including China and India, and competition among the well-established process liquid analyzer manufacturers provide significant growth opportunities for the global process analyzer market (liquid).

PH/ORP, conductivity, near-infrared, turbidity, dissolved oxygen, and chlorine analyzers among others are some of the analyzer types that have been considered for the study of the process analyzer market (liquid). Among these analyzers, the market for pH/ORP analyzers is expected to grow at the highest rate during the forecast period. Some of the major reasons for the growth of this market include the wide adoption of pH/ORP analyzers across various process industries such as water & wastewater, refining, pulp & paper, food & beverages, and pharmaceuticals among others. In addition, increasing number of product launches in this segment would further contribute to the growth of this market.

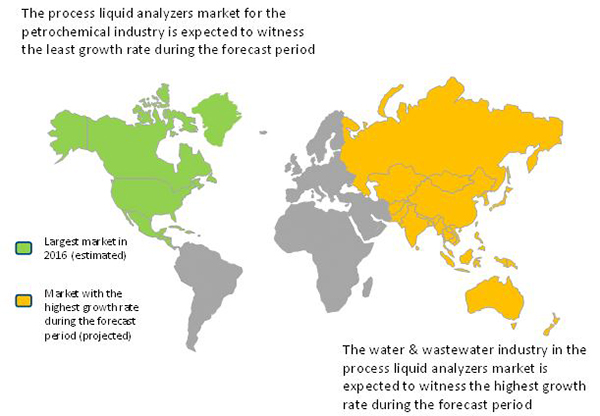

The water & wastewater, food & beverages, pharmaceuticals, petrochemical, power generation, and oil & gas industries are some of the key application areas of process analyzers (liquid). The process analyzers market (liquid) for the water & wastewater industry held the highest market share in 2015, followed by the market for the food & beverages, petrochemical, and pharmaceuticals industries. The major factors contributing to the growth of these markets include the growing demand for water treatment and distribution worldwide and stringent drug safety directions set forth by the international regulation bodies such as the U.S. Food and Drug Administration, World Health Organization, and European Medicines Agency for manufacturing and processing food and pharmaceutical products.

The process analyzer market (liquid) in the Americas held the highest size in terms of value in 2015; while the market in APAC is expected to exhibit the fastest growth rate between 2016 and 2022. The factors contributing to the growth of this market include the increasing initiatives from the governments of China and India to improve drinking water facilities. For instance, in May 2015, the government of China announced a comprehensive water pollution control plan to improve the management of water resources throughout China, which includes strict regulation of industry effluent discharges, combined with market-based incentives, investments in new water treatment facilities, and promotion of efficient and clean technologies. In addition, investments from major players in various process industries such as pharmaceuticals, food & beverages, and petrochemical, and oil & gas in the region would further accelerate the growth of the process analyzers market (liquid).

However, high infrastructure costs and lack of maintenance of the installed analyzers may hinder the growth of the market. This is because process analyzer (liquid) continually monitor various liquid parameters involved in a manufacturing process. These analyzers may become production risks if they are not maintained properly and transmit unreliable data, resulting in high production costs and delay in delivering results. Some of the major companies profiled in this report are ABB Ltd. (Switzerland), Endress+Hauser AG (Switzerland), GE Analytical Instruments (U.S.), Hach Lange GmbH (Germany), Honeywell International, Inc. (U.S.), Mettler-Toledo International Inc. (U.S.), Teledyne Technologies, Inc. (U.S.), The Emerson Electric Company (U.S.), Thermo Fisher Scientific, Inc. (U.S.), and Yokogawa Electric Corp. (Japan) among others.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Study Objectives

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency & Pricing

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

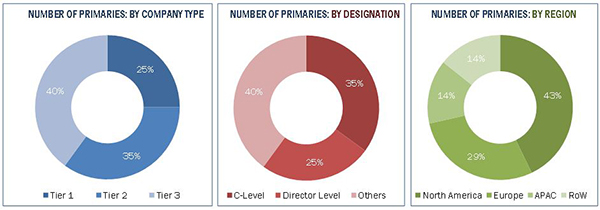

2.1.2.3 Breakdown of Primaries Interviews: By Company Type, Designation, and Region

2.2 Factor Analysis

2.2.1 Introduction

2.2.2 Demand-Side Analysis

2.2.2.1 Stringent Regulations Would Drive the Demand for Process Liquid Analyzers in the Food Processing Industry

2.2.3 Supply-Side Analysis

2.2.3.1 Increase in the Number of Products Launched in the Market

2.3 Market Size Estimation

2.3.1 Bottom-Up Approach

2.3.2 Top-Down Approach

2.4 Market Breakdown and Data Triangulation

2.5 Research Assumptions

2.5.1 Assumptions

3 Executive Summary (Page No. - 29)

4 Premium Insights (Page No. - 33)

4.1 Attractive Opportunities for the Process Liquid Analyzers Market

4.2 Process Liquid Analyzers Market, By Industry

4.3 Process Liquid Analyzers Market in APAC

4.4 Life Cycle Analysis, By Geography

5 Market Overview (Page No. - 36)

5.1 Market Segmentation

5.1.1 Process Liquid Analyzer Market: By Component

5.1.2 Process Liquid Analyzer Market: By Service

5.1.3 Process Liquid Analyzer Market, By Process Analysis

5.1.4 Process Liquid Analyzer Market, By Type

5.1.5 Process Liquid Analyzer Market, By Industry

5.1.6 Process Liquid Analyzer Market, By Geography

5.2 Market Evolution

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increase in the U.S. Shale Gas Production

5.3.1.2 Growing Demand for Water & Wastewater Treatment Plants in China

5.3.1.3 High Competition Among Key Players Leading to Technologically Advanced and Better-Quality Products

5.3.2 Restraints

5.3.2.1 Lack of Skilled Professionals

5.3.2.2 Declining Oil Prices

5.3.2.3 High Capital Expenditure and Infrastructure Costs

5.3.3 Opportunities

5.3.3.1 Increasing Demand for Analytical Instruments in Emerging Markets

5.3.3.2 Growth in the Pharmaceuticals Industry in India

5.3.4 Challenges

5.3.4.1 Issues Related to Instrumentation Safety

5.4 Burning Issue

5.4.1 Need for Continuous Support and Maintenance of Installed Analyzers

6 Industry Trends (Page No. - 48)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Porter’s Five Forces Analysis

6.3.1 Intensity of Competitive Rivalry

6.3.2 Threat of Substitutes

6.3.3 Bargaining Power of Buyers

6.3.4 Bargaining Power of Suppliers

6.3.5 Threat of New Entrants

6.4 Strategic Benchmarking

6.4.1 Technology Integration and Product Enhancement

7 Market, By Service (Page No. - 58)

7.1 Introduction

7.2 Pre-Sale Services

7.2.1 Start-Up & Commissioning Services

7.2.2 Technical Support Services

7.3 Post-Sale Services

7.3.1 Parts & Spares Services

7.3.2 Preventive Maintenance Services

7.3.3 On-Site Training Services

8 Market, By Type (Page No. - 63)

8.1 Introduction

8.2 PH/ORP Analyzers

8.3 Conductivity Analyzers

8.4 Near-Infrared Analyzers

8.5 Turbidity Analyzers

8.6 Dissolved Oxygen Analyzers

8.7 Chlorine Analyzers

8.8 Liquid Density Analyzers

8.9 MLSS Analyzers

8.10 TOC Analyzers

8.11 Aluminum Analyzers

8.12 Ammonia Analyzers

8.13 Fluoride Analyzers

8.14 Others

9 Market, By Industry (Page No. - 93)

9.1 Introduction

9.2 Oil & Gas

9.3 Petrochemical

9.4 Pharmaceutical

9.5 Water & Wastewater

9.6 Power Generation

9.7 Food & Beverages

9.8 Semiconductor Processing

9.9 Pulp & Paper

9.10 Metal & Mining

9.11 Others

10 Market, By Geography (Page No. - 121)

10.1 Introduction

10.2 Americas

10.2.1 North America

10.2.1.1 U.S.

10.2.1.1.1 Discovery of Large Gas Shales in the U.S.

10.2.1.2 Canada

10.2.1.2.1 Process Driven Industries to Stimulate the Liquid Analyzers Growth

10.2.1.3 Mexico

10.2.1.3.1 Growing Semiconductor Exports May Further Drive the Liquid Analyzers Market

10.2.2 South America

10.3 Europe

10.3.1 Germany

10.3.1.1 Known for Manufacturing Capabilities

10.3.2 U.K.

10.3.2.1 Highest Growth Rate in the Process Liquid Analyzers Market in Europe

10.3.3 France

10.3.3.1 Third-Largest Market in the Process Liquid Analyzers Market in Europe

10.3.4 Italy

10.3.4.1 Chemicals and Food Processing Industries to Significantly Contribute to the Process Liquid Analyzers Market in Italy

10.3.5 Spain

10.3.5.1 Chemicals and Food Processing Industries to Significantly Contribute to the Process Liquid Analyzers Market in Spain

10.3.6 Rest of Europe

10.3.6.1 Growing Economic Conditions

10.4 Asia-Pacific

10.4.1 Japan

10.4.1.1 A Substantial Mature Market

10.4.2 China

10.4.2.1 Second Largest Market in the Asia-Pacific Process Liquid Analyzers

10.4.3 South Korea

10.4.3.1 Growth From Chemical & Petrochemical Industries

10.4.4 India

10.4.4.1 Prominent Growth in Food & Beverages and Water Treatment Industries

10.4.5 Rest of APAC

10.4.5.1 Australia & Indonesia are Emerging Markets With Significant Potential

10.5 Rest of the World (RoW)

10.5.1 Middle East

10.5.1.1 Israel

10.5.1.1.1 Industrial Sector May Propel the Growth of Process Liquid Analyzers Market

10.5.1.2 Saudi Arabia

10.5.1.2.1 Huge Oil & Gas Reserves Would Drive the Process Liquid Analyzers Market

10.5.1.3 Qatar

10.5.1.3.1 Petroleum & Liquefied Natural Gas Sectors are the Major Contributors for Process Liquid Analyzers Market

10.5.2 Africa

10.5.2.1 Emerging Region for Various Process Sectors

11 Competitive Landscape (Page No. - 145)

11.1 Overview

11.2 Market Ranking of Players in the Process Liquid Analyzers Market, 2015

11.3 Competitive Scenario

11.4 Recent Developments

12 Company Profiles (Page No. - 152)

(Overview, Products and Services, Financials, Strategy & Development)*

12.1 Introduction

12.2 ABB Ltd.

12.3 Endress+Hauser AG

12.4 GE Analytical Instruments

12.5 Hach Lange GmbH

12.6 Honeywell International, Inc.

12.7 Mettler-Toledo International Inc.

12.8 Teledyne Technologies, Inc.

12.9 The Emerson Electric Company

12.10 Thermo Fisher Scientific, Inc.

12.11 Yokogawa Electric Corp.

*Details on Overview, Products and Services, Financials, Strategy & Development Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 180)

13.1 Insights of Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.4 Introducing RT: Real Time Market Intelligence

13.5 Available Customizations

13.6 Related Reports

List of Tables (72 Tables)

Table 1 Growing Shale Gas Production in the U.S. Expected to Drive the Process Liquid Analyzers Market

Table 2 Lack of Skilled Professionals Act as A Hindrance to the Growth of the Process Liquid Analyzers Market

Table 3 Growing Demand From Emerging Markets Such as China and India Expected to Propel the Growth of the Process Liquid Analyzers Market

Table 4 Porter’s Five Forces Analysis: Threat of New Entrants has Minimum Impact on the Overall Market in 2015

Table 5 Process Liquid Analyzer Market, By Service, 2013–2022 ( USD Million)

Table 6 Process Liquid Analyzer Market, By Pre-Sale Service, 2013–2022 ( USD Million)

Table 7 Process Liquid Analyzer Market, By Post-Sale Service, 2013–2022 ( USD Million)

Table 8 Process Liquid Analyzer Market, By Type, 2013–2022 (USD Million)

Table 9 Process Liquid Analyzer Market, By Type, 2013–2022 (Thousand Units)

Table 10 PH/ORP Analyzers Market, By Industry, 2013–2022 (USD Million)

Table 11 PH/ORP Analyzers Market, By Region, 2013–2022 (USD Million)

Table 12 Conductivity Analyzer Market, By Industry, 2013–2022 (USD Million)

Table 13 Conductivity Analyzer Market, By Region, 2013–2022 (USD Million)

Table 14 Near-Infrared Analyzer Market, By Industry, 2013–2022 (USD Million)

Table 15 Near-Infrared Analyzer Market, By Region, 2013–2022 (USD Million)

Table 16 Turbidity Analyzers Market, By Industry, 2013–2022 (USD Million)

Table 17 Turbidity Analyzers Market, By Region, 2013–2022 (USD Million)

Table 18 Dissolved Oxygen Analyzers Market, By Industry, 2013–2022 (USD Million)

Table 19 Dissolved Oxygen Analyzers Market, By Region, 2013–2022 (USD Million)

Table 20 Chlorine Analyzer Market, By Industry, 2013–2022 (USD Million)

Table 21 Chlorine Analyzer Market, By Region, 2013–2022 (USD Million)

Table 22 Liquid Density Analyzers Market, By Industry, 2013–2022 (USD Million)

Table 23 Liquid Density Analyzers Market, By Region, 2013–2022 (USD Million)

Table 24 MLSS Analyzer Market, By Industry, 2013–2022 (USD Million)

Table 25 MLSS Analyzers Market, By Region, 2013–2022 (USD Million)

Table 26 TOC Analyzers Market, By Industry, 2013–2022 (USD Million)

Table 27 TOC Analyzers Market, By Region, 2013–2022 (USD Million)

Table 28 Aluminum Analyzers Market, By Industry, 2013–2022 (USD Million)

Table 29 Aluminum Analyzers Market, By Region, 2013–2022 (USD Million)

Table 30 Ammonia Analyzers Market, By Industry, 2013–2022 (USD Million)

Table 31 Ammonia Analyzers Market, By Region, 2013–2022 (USD Million)

Table 32 Fluoride Analyzers Market, By Industry, 2013–2022 (USD Million)

Table 33 Fluoride Analyzers Market, By Region, 2013–2022 (USD Million)

Table 34 Other Analyzers Market, By Industry, 2013–2022 (USD Million)

Table 35 Other Analyzers Market, By Region, 2013–2022 (USD Million)

Table 36 Market, By Industry, 2013–2022 (USD Million)

Table 37 Market, By Industry, 2013–2022 (Thousand Units)

Table 38 Market for Oil & Gas Industry, By Type, 2013–2022 (USD Million)

Table 39 Market for Oil & Gas Industry, By Region, 2013–2022 (USD Million)

Table 40 Market for Petrochemical Industry, By Type, 2013–2022 (USD Million)

Table 41 Market for Petrochemical Industry, By Region, 2013–2022 (USD Million)

Table 42 Market for Pharmaceutical Industry, By Type, 2013–2022 (USD Million)

Table 43 Market for Pharmaceutical Industry, By Region, 2013–2022 (USD Million)

Table 44 Market for Water & Wastewater Industry, By Type, 2013–2022 (USD Million)

Table 45 Market for Water & Wastewater Industry, By Region, 2013–2022 (USD Million)

Table 46 Market for Power Generation Industry, By Type, 2013–2022 (USD Million)

Table 47 Market for Power Generation Industry, By Region, 2013–2022 (USD Million)

Table 48 Market for Food & Beverages Industry, By Type, 2013–2022 (USD Million)

Table 49 Market for Food & Beverages Industry, By Region, 2013–2022 (USD Million)

Table 50 Market for Semiconductor Processing Industry, By Type, 2013–2022 (USD Million)

Table 51 Market for Semiconductor Processing Industry, By Region, 2013–2022 (USD Million)

Table 52 Market for Pulp & Paper Industry, By Type, 2013–2022 (USD Million)

Table 53 Market for Pulp & Paper Industry, By Region, 2013–2022 (USD Million)

Table 54 Market for Metal & Mining Industry, By Type, 2013–2022 (USD Million)

Table 55 Market for Metal & Mining Industry, By Region, 2013–2022 (USD Million)

Table 56 Market for Others Industry, By Type, 2013–2022 (USD Million)

Table 57 Market for Other Industries, By Region, 2013–2022 (USD Million)

Table 58 Market, By Region, 2013–2022 (USD Million)

Table 59 Americas: Process Liquid Analyzers Market, By Region, 2013–2022 (USD Million)

Table 60 North America: Process Liquid Analyzers Market, By Country, 2013–2022 (USD Million)

Table 61 Process Liquid Analyzer Market in Americas, By Industry, 2013–2022 (USD Million)

Table 62 Europe: Process Liquid Analyzers Market, By Geography, 2013–2022 (USD Million)

Table 63 Process Liquid Analyzers Market in Europe, By Industry, 2013–2022 (USD Million)

Table 64 APAC: Process Liquid Analyzers Market, By Geography, 2013–2022 (USD Million)

Table 65 Process Liquid Analyzers Market in APAC, By Industry, 2013–2022 (USD Million)

Table 66 RoW: Process Liquid Analyzers Market, By Region, 2013–2022 (USD Million)

Table 67 Middle East: Process Liquid Analyzers Market, By Country, 2013–2022 (USD Million)

Table 68 Process Liquid Analyzers Market in RoW, By Industry, 2013–2022 (USD Million)

Table 69 Market Ranking of the Top 5 Players in the Process Liquid Analyzers Market in 2015

Table 70 Contracts, Agreements, Partnerships, 2014-2015

Table 71 New Product Launches, 2014-2015

Table 72 Mergers and Acquisitions, 2014-2015

List of Figures (108 Figures)

Figure 1 Research Design & Factor Analysis

Figure 2 Product Launches in the Process Liquid Analyzers Market, 2014–2015

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Data Triangulation

Figure 6 Process Liquid Analyzer Market for the Water & Wastewater Industry Expected to Witness the Highest Growth During the Forecast Period

Figure 7 PH/ORP Analyzers Expected to Have the Highest Market Value Between 2016 and 2022

Figure 8 Post-Sale Services of Process Liquid Analyzers Expected to Have High Demand During the Forecast Period

Figure 9 Process Liquid Analyzer Market, By Region, 2015

Figure 10 Increasing Adoption of Liquid Process Analyzers for Various Applications Expected to Drive the Market During the Forecast Period

Figure 11 Water & Wastewater Industry Expected to Dominate the Process Liquid Analyzers Market in 2016

Figure 12 Water & Wastewater Industry Expected to Dominate the Process Liquid Analyzers Market in APAC in 2016

Figure 13 APAC Process Liquid Analyzers Market Was at Growth Phase in 2015

Figure 14 By Geography

Figure 15 Evolution of the Process Analyzer Market

Figure 16 Market Dynamics: Overview

Figure 17 Shale Gas Production in Us, 2009-2014

Figure 18 Decline in Oil Prices, 2014-2015

Figure 19 Value Chain Analysis: Major Value is Added During the Manufacturing and Assembly Phases

Figure 20 Porter’s Five Forces Analysis (2015):

Figure 21 Process Liquid Analyzer Market: Porter’s Five Forces Analysis

Figure 22 Intensity of Competitive Rivalry: Medium Competition in the Market Due to Presence of Large and Established Companies

Figure 23 Threat of Substitutes Would Be Medium Due to Unavailability of A Direct Substitute Technology

Figure 24 Bargaining Power of Buyers is Medium Due to the Availability of Numerous Players in the Process Liquid Analyzers Market

Figure 25 Bargaining Power of Suppliers is Low Due to the Presence of Major Players

Figure 26 New Entrants are Less Likely to Enter This Market Due to the High Capital Requirements and Technological Costs

Figure 27 Strategic Benchmarking: Key Players Largely Adopted Organic Growth Strategies for New Product and Technology Development

Figure 28 Process Liquid Analyzers Market, By Service

Figure 29 Start-Up & Commissioning Services Expected to Have the Highest Demand During the Forecast Period

Figure 30 Parts & Spare Services Expected to Have the Highest Demand Between 2016 and 2022

Figure 31 Process Liquid Analyzers Market, By Type

Figure 32 PH/ORP Analyzers Typeexpected to Hold the Largest Market Size in Terms of Value of the Process Liquid Analyzer Market During the Forecast Period

Figure 33 Water & Wastewater Indsutry is Expected to Hold the Largest Market Size for PH/ORP Analyzers During the Forecast Period

Figure 34 Americas Expected to Hold the Larget Market Size Forph/ORP Analzyers During the Forecast Period

Figure 35 Water & Wastewater Industry Estimated to Hold the Largest Market Size for Conducitivty Analyzers Between 2016 and 2022

Figure 36 Conductivity Analyzers are Expected to Dominate the Process Liquid Analyzers Market in Americas Between 2016 and 2020

Figure 37 The Near-Infrared Analyzers Market for Petrochemical Industry Estimated to Grow at the Highest CAGR During the Forecast Period

Figure 38 The Near-Infrared Analyzers Market in APAC Expected to Witness the Highest CAGR Between 2016 and 2022

Figure 39 Turbidity Analyzers Expected to Dominate the Market for Water & Wastewater Industry in During the Forecast Period

Figure 40 The Turbidity Analyzer Market in APAC Estimated to Witness the Highest CAGR Between 2016 and 2022

Figure 41 The Dissolved Oxygen Analzyers Market for Water & Wastewater Industry Expected to Grow at the Highest Rate During the Forecast Period

Figure 42 Americas Expected to Dominate the Dissolved Oxygen Analyzers Market Between 2016 and 2022

Figure 43 The Chlorine Analyzers Market for Water & Wastewater Industry is Estimated to Grow at the Highest Rate During the Forecst Period

Figure 44 The Chlorine Analyzers Market in APAC Estimated to Witness the Highest Growth Rate During the Forecast Period

Figure 45 The Liquid Density Analyzers Market in APAC Estimated to Grow at the Highest Rate Between 2016 and 2022

Figure 46 Americas is Estimated to Dominate the MLSS Analyzers Market During the Forecast Period

Figure 47 Water & Wastewater Industry is Estimated to Grow at the Highest CAGR Rate in the TOC Analyzers Market During the Forecast Period

Figure 48 The TOC Analyzers Market in APAC Estimated to Grow at the Highest Rate During the Forecast Period

Figure 49 Americas Estimated to Dominatethe Aliminium Analyzers Market Between 2016 and 2022

Figure 50 The Ammonia Analyzers Market in APAC Expected to Grow at the Highest Rate During the Forecast Period

Figure 51 Americas Expected to Dominate the Fluoride Analyzers Market During the Forecast Period

Figure 52 Process Liquid Analyzer Market: Segmentation

Figure 53 Water & Wastewater Industry Expected to Dominate the Process Liquid Analyzers Market Between 2016 and 2022

Figure 54 PH/ORP Analyzers Expected to Dominate the Market for Oil & Gas Industry During the Forecast Period

Figure 55 The Market in APAC for Oil & Gas Industry Expected to Witness the Highest Growth Rate During the Forecast Period

Figure 56 Near-Infrared Analyzers Market for Petrochemical Industry Expected to Grow at the Highest Ratebetween 2016 and 2022

Figure 57 Americas Expected to Dominate the Market for Petrochemical Industry Between 2016 and 2022

Figure 58 PH/ORP Analyzers Market in Pharmaceutical Industry Expected to Grow at the Highest Rate During the Forecast Period

Figure 59 APAC Market for Pharmaceutical Industryexpected to Grow at the Highest Rate Between 2016 and 2022

Figure 60 PH/ORP Analyzers Market for Water & Wastewater Industry Expected to Grow at the Highest Ratebetween 2016 and 2022

Figure 61 Americas is Expected to Dominate the Market for Water & Wastewater Industry During the Forecast Period

Figure 62 TOC Analyzers Expected to Dominate the Market for Power Generation Industry During the Forecast Period

Figure 63 APAC Market for Power Generation Industry Expected to Grow at the Highest Rate Between 2016 and 2022

Figure 64 Conductivity Analyzers Market for Food & Beverages Industry Expected to Grow at the Highest Rate During the Forecast Period

Figure 65 Americas Expected to Dominate the Market Forfood & Beverages Industry During the Forecast Period

Figure 66 TOC Analyzers Expected to Dominate the Market Forsemiconductor Processing Industry Between 2016 and 2022

Figure 67 APAC Market for Semiconductor Processing Industry Expected to Grow at the Highest Rate Between 2016 and 2022

Figure 68 PH/ORP Analyzers Marketfor Pulp & Paper Industry Expected to Grow at the Highest CAGR During the Forecast Period

Figure 69 Americas is Expected to Dominate the Market for Pulp & Paper Industry During the Forecast Period

Figure 70 Conductivity Analyzers Expected to Dominate the Market for Metal & Mining Industry Between 2016 and 2022

Figure 71 APAC Market for Metal & Mining Industry Expected to Grow at the Highest Rate Between 2016 and 2022

Figure 72 PH/ORP Analyzers Market for Other Industries is Expected to Grow at the Highest Rate Between 2016 and 2022

Figure 73 APAC Market for Other Industries Expected to Witness the Highest Growth Rate During the Forecast Period

Figure 74 Process Liquid Analyzers Market, By Region

Figure 75 Americas Expected to Dominate the Global Process Liquid Analyzers Market During the Forecast Period

Figure 76 Snapshot of the Process Liquid Analyzers Market in the Americas: Expected to Be Driven By the Growing Demand From Water & Wastewater and Food & Beverage Industries During the Forecast Period

Figure 77 The Process Liquid Analyzers Market in the Americas

Figure 78 The Process Liquid Analyzers Market in the U.S. Expected to Hold the Largest Market Value During the Forecast Period

Figure 79 Water & Wastewater Industry Expected to Dominate the Americas Process Liquid Analyzers Market Between 2016 and 2022

Figure 80 Snapshot of the Process Analyzers Market in Europe: Demand to Be Driven By the Potential Growth Opportunities Pertaining to the Water & Wastetwater Treatment Plants

Figure 81 The Process Liquid Analyzers Market in Europe

Figure 82 U.K. Expected to Witness the Highest Growth Rate in the Process Liquid Analyzers Market in Europe Between 2016 and 2022

Figure 83 Water & Wastewater to Hold the Largest Market for Process Liquid Analyzers in Europe During the Forecast Period

Figure 84 APAC Market Snapshot: Demand to Be Driven By the Growing Usage of Process Liquid Analyzers in Food & Beverages Industry

Figure 85 The Process Liquid Analyzers Market in Asia-Pacific

Figure 86 India Expected to Witness the Highest Growth Rate in the Process Liquid Analyzers Market in APAC Between 2016 and 2022

Figure 87 The Process Liquid Analyzer Markets in the RoW

Figure 88 Middle East to Hold the Largest Market for Process Liquid Analyzers Market in RoW During the Forecast Period

Figure 89 Qatar Expected to Witness the Highest Growth Rate in the Process Liquid Analzyers Market in Middle East Between 2016 and 2022

Figure 90 Key Growth Strategies Adopted By the Top Companies Between 2013 and 2015

Figure 91 Market Evaluation Framework: New Product Launches Fuelled the Growth and Innovation in 2014 and 2015

Figure 92 Battle for Market Share: Contracts, Agreements, & Partnerships Was the Key Strategy

Figure 93 Geographic Revenue Mix of Major Players in the Process Liquid Analyzers Market, 2014

Figure 94 ABB Ltd.: Company Snapshot

Figure 95 ABB Ltd: SWOT Analysis

Figure 96 Endress+Hauser AG: Company Snapshot

Figure 97 Hach Lange GmbH: SWOT Analysis

Figure 98 Honeywell International, Inc.: Company Snapshot

Figure 99 Mettler-Toledo International Inc.: Company Snapshot

Figure 100 Mettler-Toledo International Inc.: SWOT Analysis

Figure 101 Teledyne Technologies, Inc.: Company Snapshot

Figure 102 The Emerson Electric Company: Company Snapshot

Figure 103 The Emerson Electric Company: SWOT Analysis

Figure 104 Thermo Fisher Scientific, Inc.: Company Snapshot

Figure 105 Yokogawa Electric Corp.: Company Snapshot

Figure 106 Yokogawa Electric Corp.: SWOT Analysis

Figure 107 Marketsandmarkets Knowledge Store Snapshot

Figure 108 Marketsandmarkets Knowledge Store: Semiconductor & Electronics Industry Snapshot

The research methodology used to estimate and forecast the process analyzer market (liquid) begins with gathering data on key vendor revenues through secondary research. The top-down and bottom-up approaches have been used to estimate and validate the size of the global process analyzers market (liquid). The research methodology also includes the study of annual and financial reports of top market players as well as interviews of industry experts (such as CEOs, VPs, directors, and marketing executives) for key insights (both, quantitative and qualitative) on the process analyzers market (liquid). All percentage shares, splits, and breakdowns have been determined by using secondary sources and verified through primary sources. The data triangulation and market breakdown procedures have been employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The breakdown of profiles of primary is depicted in the following figure.

To know about the assumptions considered for the study, download the pdf brochure

The process analyzers (liquid) ecosystem comprises hardware component manufacturers, prototype designers, software developers, and original equipment manufacturers (OEMs). The prototype designers design process equipment pertaining to the industry needs, and the hardware component manufacturers provide I/O boards, power supply units, and process probes among others. The software developers provide analytical software solutions required for automated control of instrumentation, data acquisition, and analysis. The OEMs integrate these hardware and software components into final product.

Target Audience of the Report:

The intended audience for this report includes:

- Process analyzer (liquid) equipment products and solutions providers

- Process analyzer (liquid) systems related service providers

- Research organizations and consulting companies

- Associations, organizations, forums, and alliances related to process liquid analyzers

- Government bodies such as regulating authorities and policy makers

- Venture capitalists, private equity firms, and start-up companies

- End-users who want to know more about the process liquid analyzers market

Scope of the Report:

This report categorizes the global process analyzers market (liquid) on the basis of type, industry, service, and geography.

By Type:

- pH/ORP Analyzers

- Conductivity Analyzers

- Near-Infrared Analyzers

- Turbidity Analyzers

- Dissolved Oxygen Analyzers

- Chlorine Analyzers

- Liquid Density Analyzers

- MLSS Analyzers

- TOC Analyzers

- Aluminum Analyzers

- Ammonia Analyzers

- Fluoride Analyzers

- Others

By Industry:

- Oil & Gas

- Petrochemical

- Pharmaceuticals

- Water & Wastewater

- Power Generation

- Food & Beverages

- Semiconductor Processing

- Pulp & Paper

- Metal & Mining

- Others

By Service:

-

Pre-Sales

- Start-Up & Commissioning Services

- Technical Support Services

-

Post-Sales

- Parts & Spares Services

- Preventive Maintenance Services

- On-Site Training Services

Available customizations:

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Market Analysis

- Further breakdown of the global process analyzers market (liquid), by geography

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Process Analyzer Market