IoT Fleet Management Market by Platform (Device Management, Application Enablement Platform, and Network Management), Services (Professional, Managed), Cloud Deployment (Public, Private, Hybrid), Solutions, Fleet Type, and Region - Global Forecast to 2021

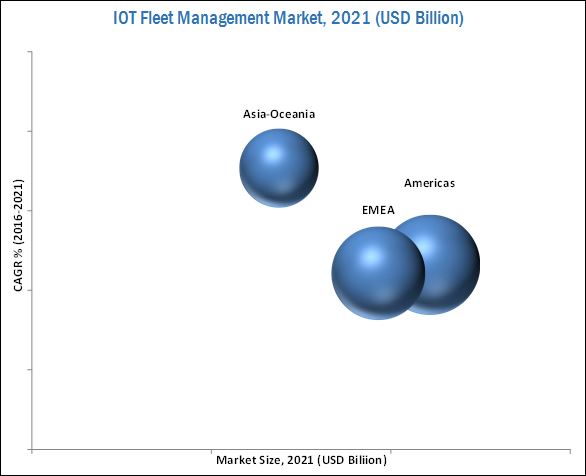

The global IoT fleet management market is projected to grow at a CAGR of 21.26% during the forecast period, to reach a market size of USD 8.28 billion by 2021. With the growing number of fleet vehicles, increased maintenance cost, and volatile fuel prices across the globe, there is an increased concern for fleet companies to achieve high operational efficiency with reduced cost. According to a research study conducted by Argonne National Laboratory in 2015, approximately 1 billion gallons of fuel was wasted because of excessive truck idling, which cost around USD 3 billion yearly. The implementation of IoT would play a crucial role to counter the above-mentioned concerns. IoT allows real-time monitoring and data transmission with the help of a decent connectivity technology such as 4G or upcoming 5G over the cloud server. It offers predictive maintenance and analysis of data into useful information to achieve optimum results. The base year considered for the study is 2015, and the forecast period is 2016 to 2021.

Increasing global fleet vehicle sizes, and rising need of improved operational efficiency and reduced maintenance cost is expected to spur the growth of Market

With the growing number of fleet vehicles, the increasing road freight traffic, and environmental pollution level all over the world, it becomes a challenge for the fleet owners to keep watch of their fleets. According to the Organisation Internationale des Constructeurs d'Automobiles (OICA) statistics, the sales of commercial vehicles had experienced a significant growth of approximately 20% during the period of 2011–2016 worldwide. Also, as per the same OICA publication, global vehicle parc increased from 1.02 billion units in 2010 to 1.24 billion units in 2015. As the paradigm shift toward cloud based subscription based solutions and constant increase in the vehicle sales and vehicle parc requires the deployment of Internet of Things enabled fleet management solutions

Market Dynamics:

Drivers

- Need for optimum operational efficiencies

- Rising trends towards smartphone integration with vehicles

- Implementation of ELD mandate and other anticipated government regulations

Restraints

- Cost sensitivity of small and medium sized fleet owners

- Lack of IoT infrastructure in emerging countries

Opportunities

- Platooning connected trucks

- Cloud and fog computing analytics

- New prospects for data driven services and telecommunication service providers

Challenges

- Data security and safety issues

- Concerns about driver privacy

The following are the major objectives of the study.

- To describe and forecast the market, in terms of value, by solutions, platform, services, and cloud deployment model

- To describe and forecast the agriculture equipment market, in terms of value, by region– Americas, EMEA, and Asia-Oceania along with their respective countries

- To provide detailed information regarding major factors influencing market growth (drivers, restraints, opportunities, and challenges)

- To strategically profile key players and comprehensively analyze their detailing competitive landscape for key market players

- To analyze strategic approaches such as product launches, acquisitions, contracts, agreements, and partnerships in the Internet of Things fleet management market

Some of the key players in IoT fleet management market include AT&T, Inc. (U.S.), Cisco Systems, Inc. (U.S.), Verizon Communications, Inc. (U.S.), TomTom International BV ( Netherlands), Trimble, Inc. (U.S.), IBM Corporation (U.S.), Omnitracs (U.S.), Sierra Wireless (Canada), Intel Corporation (U.S.), and Telefónica S.A. (Spain). AT&T, Inc. has adopted new product development and collaboration strategies to retain its market position. Cisco Systems, Inc. followed the strategies of partnerships and acquisitions to emerge as a prominent player in the market.

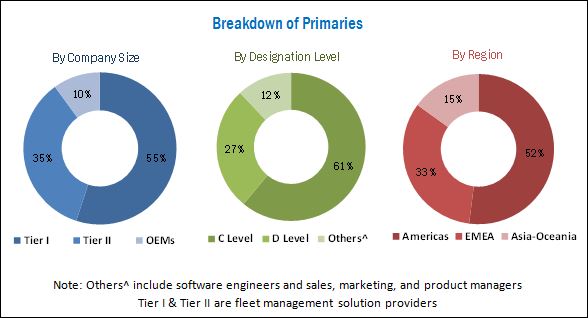

During this research study, key players operating in the market across various regions have been identified, and their offerings, regional presence, and distribution channels have been analyzed through in-depth discussions. The report follows both top-down and bottom-up approaches to derive the global market. The top-down approach has been used to estimate and validate the size of the global market, by platform, services, and solutions. The market size, by value, has been derived by identifying the global value of each type of solutions, services, and platform. The regional-level and country-level penetrations have been confirmed through primary and secondary sources, leading to the regional-level market. The regional market is further estimated to derive the country-level market of Internet of Things fleet management, by solutions. Additionally, the bottom-up approach has been used to derive the global market, by vehicle type. The approach considers the regional-level fleet size numbers, and regional-level penetration of fleet management systems through secondary sources followed by primary validation to estimate and project the market size of the global market, by fleet type.

The research methodology used in the report involves various secondary sources such as company annual reports/presentations, industry association publications such as the U.S. National Association of Fleet Administrators (NAFA), Automotive Fleet & Leasing Association (AFLA), and the International Council on Clean Transportation (ICCT), magazine articles such as Automotive Fleet and Green Fleet Magazine, directories, technical handbooks, World Economic Outlook, trade websites, technical articles, and press releases, along with paid databases.

To know about the assumptions considered for the study, download the pdf brochure

Market Developments

- In January 2017, Cisco Systems, Inc. launched its Cisco Jasper IoT services in collaboration with Asia-Pacific Telecom, China in the Taiwan market. This expansion will help the company to increase its market presence in the Asia-Pacific region.

- In September 2016, TomTom International introduced ‘TomTom Pro 2020’, a driver terminal solution that offers monitoring and controlling of the entire fleet system. This product includes features such as driver ID, digital logbook, working time log, and driver performance improvement module.

- In August 2016, Verizon Communications, Inc. acquired Fleetmatics Group PLC (U.S.), a global provider of fleet management solutions. The acquisition, worth USD 2.4 billion, became a part of Verizon Telematics business. This acquisition would help the company to extend its offerings in network and fleet solutions. It also provides an opportunity to serve the existing customer base of Fleetmatics with approximately 826,000 subscribers

Target Audience

- Fleet management solution providers

- Software developers and providers

- Telecommunication service providers

- Fleet operators

- Transportation authorities

- Mass transit authorities

- Legal and regulatory authorities

Scope of the Report

Market, By Platform

- Device management

- Application Enablement Platform (AEP)

- Network management

Market, By Services

- Professional

- Managed

Market, By Solutions

- Drive Time Analysis

- Driver Information System

- Fleet Analytics

- Fuel Management

- Remote Diagnostics

- Routing Management

- Tracking and monitoring

- Vehicle Maintenance

Market, By Cloud Deployment Model

- Hybrid

- Private

- Public

Market, By Fleet Type

- Commercial Vehicles (CV)

- Passenger Cars (PC)

- Public buses

Market, By Region

- Americas

- EMEA

- Asia-Oceania

Critical Questions:

- What is the percentage contribution of the following segments to the IoT fleet management platform market? What are the key factors that would drive the growth of the market segments during the next five years?

- The study indicates that routing management and vehicle maintenance are expected to dominate the market, by solutions. What are the key factors that would drive these market segments during the next five years?

Available Customizations

With the given market data, MarketsandMarkets offers customizations in accordance with the company’s specific needs.

Market, By Connectivity Technology, By Region

- Satellite GNSS, By Region

- Cellular System, By Region

(Region – Americas, EMEA, and Asia-Oceania)

Market, By Components, By Region

- Telematics Control Unit, By Region

- GPS Devices, By Region

- Surveillance Camera, By Region

(Region – Americas, EMEA, and Asia-Oceania)

- Detailed Analysis & Profiling of Additional Market Players (Up To 5)

The market is projected to grow at a CAGR of 21.26% during the forecast period, to reach a market size of USD 8.28 billion by 2021. The growing demand for operational efficiency, real-time fleet monitoring, process automation, predictive maintenance, and fleet analytics are some of the key drivers for this market.

The hybrid cloud deployment model is expected to be the fastest growing market during the forecast period. This is due to its benefits such as easy accessibility, higher flexibility, and data implementation options at lower costs. The hybrid model reduces the cloud risk by using cloud bursting and disaster recovery architecture. Also, the “Fog computing” concept is in the initial stage and will have a positive impact on the market in the coming years. Fleet companies, which are moving toward the hybrid model due to cost-effective and on-time delivery features, will further drive the growth of the hybrid deployment model market.

The device management platform is expected to dominate the mentioned market. It is estimated to be the largest and fastest growing market during the review period. It enables device authentication, remote access, monitoring, and troubleshooting and offers security features against hacking and malware attacks. The OAuth 2.0 and OpenID Connect 1.0 are the authorization models that enhance the device authentication that works with IoT server. Also, the increased use of personalized devices such as smartphones and tablets will boost the market for device management platform in IoT fleet.

The managed services segment is estimated to grow at the highest CAGR from 2016 to 2021. The factors that contribute to the growth of this market are continuously changing client needs, increasing complexity of infrastructure, and reduced maintenance cost. The advent of IoT brought a paradigm shift in the fleet management industry by handling multiple operations through a single network.

The Americas region is estimated to dominate the market. The Americas market is growing owing to the high adoption rate of technologically advanced products, rigorous regulatory compliances, and strong network infrastructure (3G/4G or upcoming 5G connectivity). The growing number of passenger cars, public buses, and heavy trucks in the Americas region would require the faster exchange of data for better analytics and decision making. Hence, IoT will help the fleet companies to cope with government regulations related to emission and fleet safety, which in turn would boost the demand for the IoT fleet in this region.

Growing commercial vehicle parc, and rising safety and fuel economy related norms drives the market for commercial vehicle

Heavy trucks in the commercial vehicles segment are expected to hold the largest share in the mentioned market during the review period. The factors that drives the growth are increasing commercial vehicle parc, improved regulatory mandates for safety and fuel economy, global commercialized trade, and increased need of reduced maintenance cost and improved operational efficiency. Alternatively, Mentioned market in public buses is growing at a relatively slower pace, as compared to passenger cars and heavy trucks. Moreover, with the rising safety related mandates of passenger would bring new spectrum of opportunities in public buses segment. IoT will help these fleets by providing real-time tracking, effective fuel management, intelligent routing management, and reduced maintenance and operational cost.

Critical Questions:

-

- What is the percentage contribution of the following segments to the IoT fleet management platform market? What are the key factors that would drive the growth of the market segments during the next five years?

- The study indicates that routing management and vehicle maintenance are expected to dominate the Mentioned market, by solutions. What are the key factors that would drive these market segments during the next five years?

The key factors restraining the growth of the market include the cost sensitivity of small and medium-sized fleet companies and the lack of IoT infrastructure in developing economies. Also, the compliances related to data sharing from different regional governments would become a challenge for the fleet management solution providers. This would have a negative impact on the overall market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 IoT Fleet Management Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.2 Secondary Data

2.2.1 Primary Data

2.2.2 Sampling Techniques & Data Collection Methods

2.2.3 Primary Participants

2.3 Factor Analysis

2.3.1 Introduction

2.3.2 Demand-Side Analysis

2.3.2.1 Impact of GDP on Roadways Infrastructure Spending

2.3.2.2 Increasing Traffic Congestions

2.3.3 Supply-Side Analysis

2.3.3.1 Technological Advancements

2.4 Market Estimation

2.5 Market Breakdown & Data Triangulation

2.6 Assumptions

3 Executive Summary (Page No. - 30)

3.1 Introduction

3.2 IoT Fleet Management Market, By Region

3.3 Market, By Services

3.4 Market, By Platform

3.5 Market, By Solutions

3.6 Market, By Cloud Deployment Model

3.7 Market, By Fleet Type

4 Premium Insights (Page No. - 37)

4.1 IoT Fleet Management Market Size, 2016 vs 2021 (USD Billion)

4.2 Market, By Solutions, Services & Platform, 2016 vs 2021 (USD Billion)

4.3 Market, By Region & Solution, 2016 (USD Billion)

4.4 Market, By Services, 2016 (USD Billion)

4.5 Market, By Platform, 2016 vs 2021 (USD Billion)

4.6 Market, By Cloud Deployment Model, 2016 (USD Billion)

4.7 Market, By Solutions, 2016 vs 2021 (USD Billion)

4.8 Market, By Type, 2016 vs 2021 (USD Billion)

5 IoT Fleet Management Market Overview (Page No. - 42)

5.1 Introduction

5.2 Market Segmentation

5.2.1 Segmentation

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Need for Optimum Operational Efficiencies

5.3.1.2 Rising Trends Towards Smartphone Integration With Vehicles

5.3.1.3 Implementation of Eld Mandate and Other Anticipated Government Regulations

5.3.2 Restraints

5.3.2.1 Cost Sensitivity of Small and Medium Sized Fleet Owners

5.3.2.2 Lack of IoT Infrastructure in Emerging Countries

5.3.3 Opportunities

5.3.3.1 Truck Platooning

5.3.3.2 Cloud and Fog Computing Analytics

5.3.3.3 New Prospects for Data Driven Services and Telecommunication Service Providers

5.3.4 Challenges

5.3.4.1 Data Security and Safety Issues

5.3.4.2 Concerns About Driver Privacy

5.4 Burning Issues

5.4.1 Increased Adoption By Banking and Insurance

5.5 Porter’s Five Forces Analysis

5.5.1 Competitive Rivalry

5.5.2 Bargaining Power of Buyers

5.5.3 Bargaining Power of Suppliers

5.5.4 Threat of Substitutes

5.5.5 Threat of New Entrants

6 IoT Fleet Management Market, By Cloud Deployment Model (Page No. - 63)

6.1 Introduction

6.2 Market, By Cloud Deployment Model & Region

6.2.1 Market for Hybrid Cloud Deployment Model, By Region

6.2.2 Market for Private Cloud Deployment Model, By Region

6.2.3 Market for Public Cloud Deployment Model, By Region

7 IoT Fleet Management Market, By Platform (Page No. - 67)

7.1 Introduction

7.2 Market, By Platform & Region

7.2.1 Device Management Platform Market, By Region

7.2.2 Application Enablement Platform Market, By Region

7.2.3 Network Management Platform Market, By Region

8 IoT Fleet Management Market, By Services (Page No. - 72)

8.1 Introduction

8.2 Market, By Services & Region

8.2.1 Professional Services Market, By Type

8.2.1.1 Integration and Deployment Services Market, By Region

8.2.1.2 Support and Maintenance Market, By Region

8.2.1.3 Consulting Services Market, By Region

8.2.2 Managed Services Market, By Region

9 IoT Fleet Management Market, By Solutions (Page No. - 78)

9.1 Introduction

9.1.1 Market, By Solutions

9.1.2 Solutions Market, By Region

9.1.2.1 Tracking and Monitoring Market, By Region

9.1.2.1.1 The Americas Tracking and Monitoring Market, By Country

9.1.2.1.2 EMEA Tracking and Monitoring Market, By Country

9.1.2.1.3 Asia-Oceania Tracking and Monitoring Market, By Country

9.1.2.2 Fuel Management Market, By Region

9.1.2.2.1 The Americas Fuel Management Market, By Country

9.1.2.2.2 EMEA Fuel Management Market, By Country

9.1.2.2.3 Asia-Oceania Fuel Management Market, By Country

9.1.2.3 Vehicle Maintenance Market, By Region

9.1.2.3.1 The Americas Vehicle Maintenance Market, By Country

9.1.2.3.2 EMEA Vehicle Maintenance Market, By Country

9.1.2.3.3 Asia-Oceania Vehicle Maintenance Market, By Country

9.1.2.4 Routing Management Market, By Region

9.1.2.4.1 The Americas Routing Management Market, By Country

9.1.2.4.2 EMEA Routing Management Market, By Country

9.1.2.4.3 Asia-Oceania Routing Management Market, By Country

9.1.2.5 Fleet Analytics Market, By Region

9.1.2.5.1 The Americas Fleet Analytics Market, By Country

9.1.2.5.2 EMEA Fleet Analytics Market, By Country

9.1.2.5.3 Asia-Oceania Fleet Analytics Market, By Country

9.1.2.6 Driver Information System Market, By Region

9.1.2.6.1 The Americas Driver Information System Market, By Country

9.1.2.6.2 EMEA Driver Information System Market, By Country

9.1.2.6.3 Asia-Oceania Driver Information System Market, By Country

9.1.2.7 Drive Time Analysis Market, By Region

9.1.2.7.1 The Americas Drive Time Analysis Market, By Country

9.1.2.7.2 EMEA Drive Time Analysis Market, By Country

9.1.2.7.3 Asia-Oceania Drive Time Analysis Market, By Country

9.1.2.8 Remote Diagnostics Market, By Region

9.1.2.8.1 The Americas Remote Diagnostics Market, By Country

9.1.2.8.2 EMEA Remote Diagnostics Market, By Country

9.1.2.8.3 Asia-Oceania Remote Diagnostics Market, By Country

10 IoT Fleet Management Market, By Fleet Type (Page No. - 97)

10.1 Introduction

10.1.1 Market, By Fleet Type

10.1.1.1 Market, By Fleet Type, 2015–2021 (‘000 Units)

10.1.1.2 Market, By Fleet Type, 2015–2021 (USD Million)

10.1.2 Commercial Vehicle Fleet Management Market, By Region

10.1.2.1 Commercial Vehicles Market, By Region, 2015–2021 ('000 Units)

10.1.2.2 Commercial Vehicles Market, By Region, 2015–2021 (USD Million)

10.1.3 Passenger Cars Internet of Things Fleet Management Market, By Region

10.1.3.1 Passenger Cars Market, By Region, 2015–2021 ('000 Units)

10.1.3.2 Passenger Cars Market, By Region, 2015–2021 (USD Million)

10.1.4 Passenger Cars Market, By Propulsion Type & Region

10.1.4.1 Passenger Cars Market, By Propulsion Type, 2015–2021 (‘000 Units)

10.1.4.1.1 Electric Vehicle: Passenger Cars Market, By Region, 2015–2021 (‘000 Units)

10.1.4.1.2 Internal Combustion Engines: Passenger Cars Market, By Region, 2015–2021 (‘000 Units)

10.1.4.2 Passenger Cars IoT Fleet Management Market, By Propulsion Type, 2015–2021 (USD Million)

10.1.4.2.1 Electric Vehicle: Passenger Cars Market, By Region, 2015-2021 (USD Million)

10.1.4.2.2 Internal Combustion Engines: Passenger Cars Market, By Region, 2015–2021 (USD Million)

10.1.5 Public Buses IoT Fleet Management Market, By Region

10.1.5.1 Public Buses Market, By Region, 2015–2021 ('000 Units)

10.1.5.2 Public Buses Market, By Region, 2015–2021 (USD Million)

11 IoT Fleet Management Market, By Region (Page No. - 107)

11.1 Introduction

11.2 Market, By Region

11.2.1 Market, By Region, 2015–2021 (USD Million)

11.3 The Americas Market

11.3.1 The Americas Market, By Components

11.4 Asia-Oceania Market

11.4.1 Asia-Oceania Market, By Components

11.5 EMEA Market

11.5.1 EMEA Market, By Components

12 Competitive Landscape (Page No. - 115)

12.1 Overview

12.2 Market Ranking Analysis: Market

12.3 New Product Launch

12.4 Partnerships / Collaborations

12.5 Expansion and Supply Contracts

12.6 Mergers & Acquisitions

13 Company Profiles (Page No. - 123)

(Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments)*

13.1 Introduction

13.2 AT&T, Inc.

13.3 Cisco Systems, Inc.

13.4 Verizon Communications, Inc.

13.5 Trimble, Inc.

13.6 Tomtom International BV

13.7 International Business Machines Corporation (IBM)

13.8 Telefonica, S.A.

13.9 Intel Corporation

13.10 Sierra Wireless

13.11 Omnitracs

*Details on Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 149)

14.1 Insights of Industry Experts

14.2 Additional Developments

14.3 Discussion Guide

14.4 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.5 Introducing RT: Real Time Market Intelligence

14.6 Available Customizations

14.6.1 IoT Fleet Management Market, By Connectivity Technology, By Region

14.6.1.1 Satellite Gnss, By Region

14.6.1.2 Cellular System, By Region

14.6.2 Market, By Components

14.6.2.1 Telematics Control Unit, By Region

14.6.2.2 GPS Devices, By Region

14.6.2.3 Surveillance Camera, By Region

14.6.3 Detailed Analysis and Profiling of Additional Market Players (Upto 5)

14.7 Related Reports

14.8 Author Details

List of Tables (78 Tables)

Table 1 USD Exchange Rates

Table 2 Anticipated Regulations in Countries/Region

Table 3 Key Players in the Global Truck Platooning Systems Market

Table 4 Top 10 Countries Making Most Use of Information Technology

Table 5 Fastest Growing Applications of IoT Across Regions

Table 6 Porter’s Five Forces Analysis

Table 7 IoT Fleet Management Market, By Cloud Deployment Model, 2015–2021 (USD Million)

Table 8 Hybrid Model: Market, By Region, 2015–2021 (USD Million)

Table 9 Private Model: Market, By Region, 2015–2021 ( USD Million)

Table 10 Public Model: Market, By Region, 2015–2021 ( USD Million)

Table 11 Market, By Platform, 2015–2021 (USD Million)

Table 12 Market, By Region, 2015–2021 (USD Million)

Table 13 Market for Device Management Platform, By Region, 2015–2021 (USD Million)

Table 14 Market for Application Enablement Platform, By Region, 2015–2021 (USD Million)

Table 15 Market for Network Management Platform, By Region, 2015–2021 (USD Million)

Table 16 Market, By Services, 2015–2021 (USD Million)

Table 17 Professional Services: Market, By Type, 2015–2021 (USD Million)

Table 18 Integration and Deployment Services: Market, By Region, 2015–2021 (USD Million)

Table 19 Support and Maintenance: Market, By Region, 2015–2021 (USD Million)

Table 20 Consulting Services: Market, By Region, 2015-2021 (USD Million)

Table 21 Managed Service: Market, By Region, 2015–2021 (USD Million)

Table 22 Market, By Solutions, 2015–2021 (USD Million)

Table 23 Solutions Market, By Region, 2015–2021 (USD Million)

Table 24 Tracking and Monitoring Market, By Region, 2015-2021 (USD Million)

Table 25 The Americas Tracking and Monitoring Market, By Country, 2015–2021 (USD Million)

Table 26 EMEA Tracking and Monitoring Market, By Country, 2015–2021 (USD Million)

Table 27 Asia-Oceania Tracking and Monitoring Market, By Country, 2015–2021 (USD Million)

Table 28 Fuel Management Market, By Region, 2015–2021 (USD Million)

Table 29 The Americas Fuel Management Market, By Country, 2015–2021 (USD Million)

Table 30 EMEA Fuel Management Market, By Country, 2015–2021 (USD Million)

Table 31 Asia-Oceania Fuel Management Market, By Country, 2015–2021 (USD Million)

Table 32 Vehicle Maintenance Market, By Region, 2015–2021 (USD Million)

Table 33 The Americas Vehicle Maintenance Market, By Country, 2015–2021 (USD Million)

Table 34 EMEA Vehicle Maintenance Market, By Country, 2015–2021 (USD Million)

Table 35 Asia-Oceania Vehicle Maintenance Market, By Country, 2015–2021 (USD Million)

Table 36 Routing Management Market, By Region, 2015–2021 (USD Million)

Table 37 The Americas Routing Management Market, By Country, 2015–2021 (USD Million)

Table 38 EMEA Routing Management Market, By Country, 2015–2021 (USD Million)

Table 39 Asia-Oceania Routing Management Market, By Country, 2015–2021 (USD Million)

Table 40 Fleet Analytics Market, By Region, 2015-2021 (USD Million)

Table 41 The Americas Fleet Analytics Market, By Country, 2015–2021 (USD Million)

Table 42 EMEA Fleet Analytics Market, By Country, 2015–2021 (USD Million)

Table 43 Asia-Oceania Fleet Analytics Market, By Country, 2015–2021 (USD Million)

Table 44 Driver Information System Market, By Region, 2015–2021 (USD Million)

Table 45 The Americas Driver Information System Market, By Country, 2015–2021 (USD Million)

Table 46 EMEA Driver Information System Market, By Country, 2015–2021 (USD Million)

Table 47 Asia-Oceania Driver Information System Market, By Country, 2015–2021 (USD Million)

Table 48 Drive Time Analysis Market, By Region, 2015–2021 (USD Million)

Table 49 The Americas Drive Time Analysis Market, By Country, 2015–2021 (USD Million)

Table 50 EMEA Drive Time Analysis Market, By Country, 2015–2021 (USD Million)

Table 51 Asia-Oceania Drive Time Analysis Market, By Country, 2015–2021 (USD Million)

Table 52 Remote Diagnostics Market, By Region, 2015–2021 (USD Million)

Table 53 The Americas Remote Diagnostics Market, By Country, 2015–2021 (USD Million)

Table 54 EMEA Remote Diagnostics Market, By Country, 2015–2021 (USD Million)

Table 55 Asia-Oceania Remote Diagnostics Market, By Country, 2015–2021 (USD Million)

Table 56 Market, By Fleet Type, 2015–2021 (‘000 Units)

Table 57 Market, By Fleet Type, 2015–2021 (USD Million)

Table 58 Commercial Vehicles Market, By Region, 2015–2021 (‘000 Units)

Table 59 Commercial Vehicles Market, By Region, 2015–2021 (USD Million)

Table 60 Passenger Cars Market, By Region, 2015–2021 (‘000 Units)

Table 61 Passenger Cars Market, By Region, 2015–2021 (USD Million)

Table 62 Passenger Cars Market, By Propulsion Type, 2015–2021 (‘000 Units)

Table 63 Electric Vehicle : Passenger Cars Market, By Region, 2015–2021 (‘000 Units)

Table 64 Internal Combustion Engines: Passenger Cars Market, By Region, 2015–2021 (‘000 Units)

Table 65 Passenger Cars Market, By Propulsion Type, 2015–2021 (USD Million)

Table 66 Electric Vehicle : Passenger Cars Market, By Region, 2015–2021 (USD Million)

Table 67 Internal Combustion Engines: Passenger Cars Market, By Region, 2015–2021 (USD Million)

Table 68 Public Buses Market, By Region, 2015–2021 (‘000 Units)

Table 69 Public Buses Market, By Region, 2015–2021 (USD Million)

Table 70 IoT Fleet Management Market, By Region, 2015–2021 ( USD Million)

Table 71 The Americas Market, By Components, 2015–2021 (USD Million)

Table 72 Asia-Oceania Market, By Components, 2015–2021 (USD Million)

Table 73 EMEA Market, By Components, 2015–2021 (USD Million)

Table 74 Market Ranking, 2015

Table 75 New Product Launch, 2016

Table 76 Partnerships/Collaborations, 2014–2017

Table 77 Expansion and Supply Contracts, 2016–2017

Table 78 Mergers & Acquisitions, 2015–2016

List of Figures (58 Figures)

Figure 1 - IoT Fleet Management Market Segmentation

Figure 2 Market: Research Design

Figure 3 Research Design Model

Figure 4 Breakdown of Primary Interviews: By Company Type, Designation, & Region

Figure 5 Gross Domestic Product (GDP) vs Road Infrastructure Percentage (2014)

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Market Size Estimation Methodology: Bottom-Up Approach

Figure 8 Data Triangulation

Figure 9 Asia Oceania Estimated to Be the Fastest Growing Market During the Forecast Period, 2016 vs 2021

Figure 10 Professional Services Estimated to Hold the Larger Market Share, 2016 vs 2021 (USD Billion)

Figure 11 Device Management Platform Estimated to Hold the Largest Market Share, 2016 vs 2021 (USD Billion)

Figure 12 Routing Management Estimated to Hold the Largest Market Share, 2016 vs 2021 (USD Billion)

Figure 13 Hybrid Model is Estimated to Be the Fastest Growing Market, 2016 vs 2021 (USD Billion)

Figure 14 Commercial Vehicles Segment to Have the Higher Adoption Rate of Fleet Management, 2016 vs 2021 (USD Billion)

Figure 15 Attractive Market Opportunities for Market

Figure 16 Solutions Segment Expected to Hold the Largest Market Share in Market

Figure 17 Americas Led the Market of IoT Fleet Management

Figure 18 Professional Services Constituted Majority of Share in the Market

Figure 19 Device Management Expected to Dominate the Platform Market

Figure 20 Public Model Dominated the Market, 2016 (USD Billion)

Figure 21 Routing Management Expected to Dominate the Market, By Solutions, 2016 vs 2021 (USD Billion)

Figure 22 Commercial Vehicles Expected to Hold the Largest Revenue Pocket of the Market, By Fleet Type, 2016 vs 2021 (USD Billion)

Figure 23 Ecosystem: System

Figure 24 IoT Fleet Management Market: Market Dynamics

Figure 25 Benefits of IoT in Fleet Management

Figure 26 U.S.: Large Trucks and Bus Crashes on the Rise (2013 – 2015)

Figure 27 On Road Light and Heavy Duty Vehicles Emission Regulations Outlook

Figure 28 Mobile Broadband Subscriptions Per 100 Inhabitants, 2010 – 2014

Figure 29 Porter’s Five Forces Analysis: Market

Figure 30 Bargaining Power of Buyers and Competitive Rivalry are High in the Market

Figure 31 High Impact of Degree of Competition on the Market

Figure 32 High Impact of Bargaining Power of Buyers in the Market

Figure 33 Medium Impact of Bargaining Power of Suppliers on the Market

Figure 34 Medium Impact of Threat of Substitutes on the Market

Figure 35 Low Impact of Threat of New Entrants in the Market

Figure 36 Hybrid Model Expected to Grow at the Highest CAGR, 2016–2021 (USD Million)

Figure 37 Device Management Platform is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 38 Managed Services Segment is Expected to Grow at A Higher CAGR, 2016 vs 2021

Figure 39 Routing Management Estimated to Hold the Largest Market Share, 2016 vs 2021

Figure 40 Commercial Vehicles Estimated to Hold the Largest Market Share, 2016–2021 (USD Million)

Figure 41 Asia-Oceania Will Be an Attractive Destination for Market, 2016 vs 2021 (USD Million)

Figure 42 Companies Adopted New Product Development as A Key Growth Strategy From 2014 to 2016

Figure 43 Market Evaluation Framework: Agreements/ Partnerships/ Supply Contracts/ Joint Ventures Fuelled Market Growth From 2013 to 2016

Figure 44 Battle for Market Share: New Product Development Was the Key Strategy

Figure 45 AT&T, Inc. : Company Snapshot

Figure 46 SWOT Analysis: AT&T, Inc.

Figure 47 Cisco Systems, Inc. : Company Snapshot

Figure 48 SWOT Analysis: Cisco Systems, Inc.

Figure 49 Verizon Communications, Inc. : Company Snapshot

Figure 50 SWOT Analysis: Verizon Communications, Inc.

Figure 51 Trimble, Inc. : Company Snapshot

Figure 52 SWOT Analysis: Trimble, Inc.

Figure 53 Tomtom International BV : Company Snapshot

Figure 54 SWOT Analysis: Tomtom International BV

Figure 55 IBM Corporation : Company Snapshot

Figure 56 Telefonica, S.A. : Company Snapshot

Figure 57 Intel Corporation : Company Snapshot

Figure 58 Sierra Wireless: Company Snapshot

Growth opportunities and latent adjacency in IoT Fleet Management Market