Industrial Lighting Market by Light Source (LED, HID, Fluorescent), Offering (Lamps & Luminaires, Control Systems, Services), Installation Type (New, Replacement, Retrofit), Product, Application, and Geography - Global Forecast to 2023

The industrial lighting market was valued at USD 7.59 Billion in 2016 and is expected to be worth USD 13.17 Billion by 2023, growing at a CAGR of 7.82% between 2017 and 2023.

The objective of this report is to define, describe, and forecast the industrial lighting market size and growth potential of the industrial lighting market across different segments such as light source, offering, installation type, product, application, and geography. This report includes the forecast of the industrial lighting market size, in terms of value, with respect to four main regions North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW). The study identifies and analyzes the market dynamics such as drivers, restraints, opportunities, and industry-specific challenges for the market. It also profiles the key players operating in the market. The base year considered for this report is 2016, and the forecast period for the market has been considered between 2017 and 2023. The growth of industrial lighting market is driven by the factors such as increasing modernization and infrastructural development; growing penetration of LEDs, due to their reducing price, across diversified industrial applications; durability of LED lights for industrial usage; and low energy consumption by LEDs.

According to the MarketsandMarkets forecast, the industrial lighting market is expected to be worth USD 13.17 Billion by 2023, growing at a CAGR of 7.82% between 2017 and 2023. The major drivers for the market include modernization and infrastructural development, durability of LED lights for industrial usage, and low energy consumption by LEDs.

The report covers the industrial lighting market on the basis of light source, offering, installation type, product, application, and geography. The study identifies and analyzes the market dynamics such as drivers, restraints, opportunities, and industry-specific challenges for the market. It also profiles the key players operating in the industrial lighting market.

The factory and production lines application held a larger share of the industrial lighting market in 2016. Factory and production lines are upgrading to critical lighting solutions, such as LEDs and connected lighting solution, to receive an immediate payback on their investment through improved light quality and control. The factory and production lines is the largest application area for industrial lighting solutions. The variety of work performed in the industry can vary tremendously from production to machining. Therefore, every lighting solution needs to be customized according to the available space and the complexity of the task being performed.

On the basis of product, the flood lighting/area lighting held the largest share in 2016, while spot lighting is expected to grow at the highest rate during the forecast period. Flood lighting or area lighting solutions are increasingly being used for the applications such as warehouses, industrial outer premises, and parking areas. These lighting solutions provide bright light to these areas and ensure its safety and security. This lighting system is one of the common products offered by many companies in their product portfolio.

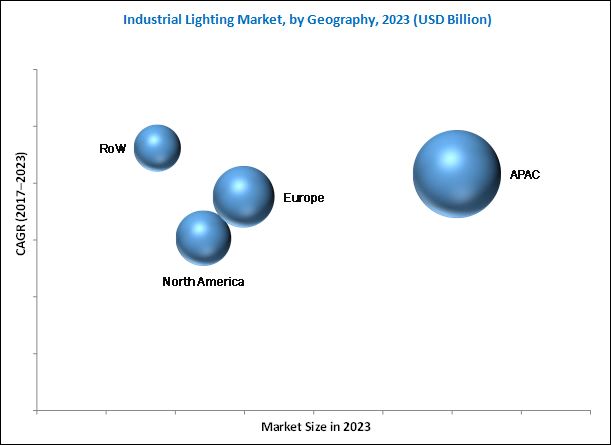

Asia Pacific (APAC) dominates the industrial lighting market; however, RoW is expected to grow at the highest rate during the forecast period. The countries in the RoW region are likely to witness an extensive growth in infrastructural building projects. Therefore, the market in this region is expected to exhibit a high growth.

Low profit margin of LED lighting products may appear as a challenge for manufacturers in the industrial lighting market. The major vendors in market are Philips Lighting Holding B.V. (Netherlands), Hubbell Lighting, Inc. (US), Emerson (US), Legrand (France), Acuity Brands Lighting, Inc. (US), TOYODA GOSEI Co., Ltd (Japan), Cree, Inc. (US), General Electric (US), Osram Licht AG (Germany), and Zumtobel Group (Austria). These players adopted various strategies such as product launches and developments, contracts, acquisitions, partnerships, and business expansions to cater to the needs of the industrial lighting market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Study Objectives

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Package Size

1.6 Limitations

1.7 Market Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 List of Major Secondary Sources

2.1.1.2 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Primary Interviews With Experts

2.1.2.2 Breakdown of Primaries

2.1.2.3 Key Data From Primary Sources

2.1.3 Secondary and Primary Research

2.1.3.1 Key Industry Insights

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.1.1 Approach for Capturing the Market Share By Bottom-Up Analysis (Demand Side)

2.2.2 Top-Down Approach

2.2.2.1 Approach for Capturing the Market Share By Top-Down Analysis (Supply Side)

2.3 Data Triangulation

2.4 Process Flow of Market Size Estimation

2.5 Research Assumptions

3 Executive Summary (Page No. - 30)

4 Premium Insights (Page No. - 37)

4.1 Major Opportunities in the Market During the Forecast Period

4.2 Market, By Light Source

4.3 Market in APAC, By Type and Country

4.4 Market, By Country

4.5 Market, By Application

5 Market Overview (Page No. - 40)

5.1 Introduction

5.2 Market Dynamics: Industrial Lighting Market

5.2.1 Drivers

5.2.1.1 Increasing Modernization and Infrastructural Development

5.2.1.2 Growing Penetration of LEDs, Due to Reducing Price, Across Diversified Industrial Applications

5.2.1.3 Durability of LED Lights for Industrial Usage

5.2.1.4 Low Energy Consumption By LEDs

5.2.2 Restraints

5.2.2.1 Lack of Standardization Across Industries

5.2.2.2 High Cost of Equipment and Implementation

5.2.3 Opportunities

5.2.3.1 Development of Wireless Control Platforms for LEDs

5.2.3.2 Use of LEDs in Wireless Data Transfer

5.2.4 Challenges

5.2.4.1 Low Profit Margin of LED Lighting Products

6 Industry Trends (Page No. - 47)

6.1 Introduction

6.2 Value Chain Analysis

6.2.1 Research and Product Developers

6.2.2 Lighting Chips and Packages

6.2.3 Key Technology Providers

6.2.4 Distributors

6.2.5 End-Users

6.3 Regulatory Standards

6.4 Government Initiative Programs

6.4.1 Digital Agenda for Europe

6.4.2 Findings From Green Paper on Ssl

6.4.3 Research and Development

6.4.4 Energy Conservation Initiatives in Africa

6.4.5 Unep-Lites.Asia (A Workshop on Regional Lighting Policy)

7 Industrial Lighting Market, By Light Source (Page No. - 52)

7.1 Introduction

7.2 LED Lighting

7.2.1 Types of LEDs

7.3 High Intensity Discharge (HID) Lighting

7.4 Fluorescent Lighting

7.5 Others

8 Industrial Lighting Market, By Offering (Page No. - 62)

8.1 Introduction

8.2 Lamps & Luminaires

8.3 Control Systems

8.4 Services

8.4.1 Pre-Installation

8.4.2 Post-Installation

9 Industrial Lighting Market, By Installation Type (Page No. - 68)

9.1 Introduction

9.2 New Installation

9.3 Replacement Installation

9.4 Retrofit Installation

10 Market, By Product (Page No. - 74)

10.1 Introduction

10.2 Industrial Linear Lighting

10.3 Spot Lighting

10.4 Flood Lighting/Area Lighting

10.5 High Bay Lighting

11 Market, By Application (Page No. - 82)

11.1 Introduction

11.2 Warehouse & Cold Storage

11.3 Factory & Production Lines

11.4 Outer Premises

11.5 Parking Areas

11.6 Hazardous Locations

11.7 Others

12 Geographical Analysis (Page No. - 95)

12.1 Introduction

12.2 North America

12.2.1 US

12.2.2 Canada

12.2.3 Mexico

12.3 Europe

12.3.1 Germany

12.3.2 UK

12.3.3 France

12.3.4 Rest of Europe

12.4 Asia-Pacific (APAC)

12.4.1 China

12.4.2 Japan

12.4.3 India

12.4.4 Rest of APAC

12.5 Rest of the World (RoW)

13 Competitive Landscape (Page No. - 116)

13.1 Introduction

13.2 Market Ranking of Players, 2016

13.3 Competitive Leadership Mapping

13.3.1 Visionary Leaders

13.3.2 Dynamic Differentiators

13.3.3 Emerging Companies

13.3.4 Innovators

13.4 Competitive Benchmarking

13.4.1 Strength of Product Portfolio (25 Companies)

13.4.2 Business Strategy Excellence (25 Companies)

Top Companies Analyzed for This Study are - Emerson; Philips Lighting Holding B.V.; General Electric; Schneider Electric; Acuity Brands Lighting, Inc.; Hubbell Incorporated; Legrand; Ushio America, Inc; Litetronics International, Inc.; Cree, Inc. ; Lg Innotek; Osram Licht Ag; Leviton Manufacturing Co., Inc.; Zumtobel Group Ag; Eaton; Dialight; Advanced Lighting Technologies, Inc.; Aixtron Se; LED Engin, Inc; Lumenpulse Group; TOYODA GOSEI Co., Ltd. the Luma Group, Inc.; Digital Lumens, Inc.; Fulham Co., Inc.; LED Lighting Systems

14 Company Profiles (Page No. - 121)

14.1 Introduction

(Business Overview, Products Offered & Services Strategies, Key Insights, Recent Developments, MnM View)*

14.2 Philips Lighting Holding B.V.

14.3 Emerson

14.4 Osram Licht AG

14.5 Cree, Inc.

14.6 Acuity Brands Lighting, Inc.

14.7 Legrand

14.8 Zumtobel Group AG

14.9 Hubbell Lighting, Inc.

14.10 General Electric Co.

14.11 TOYODA GOSEI Co., Ltd.

14.12 Key Innovators

14.12.1 Digital Lumens, Inc.

14.12.2 Fulham Co., Inc.

14.12.3 LED Engin, Inc

14.12.4 Lumenpulse Group

14.12.5 LED Lighting Systems, LLC

*Details on Business Overview, Products Offered & Services Strategies, Key Insights, Recent Developments, MnM View Might Not Be Captured in Case of Unlisted Companies.

15 Appendix (Page No. - 157)

15.1 Discussion Guide

15.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

15.3 Introducing RT: Real-Time Market Intelligence

15.4 Available Customizations

15.5 Related Reports

15.6 Author Details

List of Tables (70 Tables)

Table 1 The Trend of Declining LED Cost Price

Table 2 Factors Supporting the Adoption of LED Lighting Solution

Table 3 Recommended Levels of Illumination in Warehousing and Storage Industry

Table 4 Recommended Levels of Illumination in Textile Mills - Cotton Industry

Table 5 Recommended Levels of Illumination in Machine Work Shops

Table 6 Recommended Levels of Illumination in Paper Manufacturing Industry

Table 7 Industrial Lighting Market, By Light Source, 2014–2023 (USD Million)

Table 8 Market for LED, By Application, 2014–2023 (USD Million)

Table 9 Market for LED, By Region, 2014–2023 (USD Million)

Table 10 Market for HID, By Application, 2014–2023 (USD Million)

Table 11 Market for HID, By Region, 2014–2023 (USD Million)

Table 12 Market for Fluorescent Lighting, By Application, 2014–2023 (USD Million)

Table 13 Market for Fluorescent, By Region, 2014–2023 (USD Million)

Table 14 Market for Other Light Sources, By Application, 2014–2023 (USD Million)

Table 15 Market for Other Light Sources, By Region, 2014–2023 (USD Million)

Table 16 Market, By Offering, 2014–2023 (USD Million)

Table 17 Industrial LED Lighting Market for Lamps & Luminaires, 2014–2023 (USD Million, Million Units)

Table 18 Market for Lamps & Luminaires, By Region, 2014–2023 (USD Million)

Table 19 Market for Control Systems, By Region, 2014–2023 (USD Million)

Table 20 Market for Services, By Region, 2014–2023 (USD Million)

Table 21 Market, By Installation Type, 2014–2023 (USD Million)

Table 22 Market for New Installation, By Region, 2014–2023 (USD Million)

Table 23 Market for Replacement Installation, By Region, 2014–2023 (USD Million)

Table 24 Market for Retrofit Installation, By Region, 2014–2023 (USD Million)

Table 25 Market, By Product, 2014–2023 (USD Million)

Table 26 Market for Industrial Linear Lighting, By Application, 2014–2023 (USD Million)

Table 27 Market for Spot Lighting, By Region, 2014–2023 (USD Million)

Table 28 Market for Spot Lighting, By Application, 2014–2023 (USD Million)

Table 29 Market for Flood Lighting/Area Lighting, By Region, 2014–2023 (USD Million)

Table 30 Market for Flood Lighting/Area Lighting, By Application, 2014–2023 (USD Million)

Table 31 Market for High Bay Lighting, By Region, 2014–2023 (USD Million)

Table 32 Market for High Bay Lighting, By Application, 2014–2023 (USD Million)

Table 33 Market, By Application, 2014–2023 (USD Million)

Table 34 Illumination Level That Should Be Maintained in Warehouse and Cold Storage at Different Instances

Table 35 Market for Warehouse & Cold Storage, By Product, 2014–2023 (USD Million)

Table 36 Market for Warehouse & Cold Storage, By Light Source, 2014–2023 (USD Million)

Table 37 Illumination Level That Should Be Maintained in Factory at Different Instances

Table 38 Market for Factory & Production Lines, By Product, 2014–2023 (USD Million)

Table 39 Market for Factory & Production Lines, By Light Source, 2014–2023 (USD Million)

Table 40 Market for Outer Premises, By Product, 2014–2023 (USD Million)

Table 41 Market for Outer Premises, By Light Source, 2014–2023 (USD Million)

Table 42 Market for Parking Areas, By Product, 2014–2023 (USD Million)

Table 43 Market for Parking Areas, By Light Source, 2014–2023 (USD Million)

Table 44 Illumination Levels That Should Be Maintained in Hazardous Locations at Different Instances

Table 45 Market for Hazardous Locations, By Product, 2014–2023 (USD Million)

Table 46 Market for Hazardous Locations, By Light Source, 2014–2023 (USD Million)

Table 47 Market for Other Applications, By Product, 2014–2023 (USD Million)

Table 48 Market for Other Applications, By Light Source, 2014–2023 (USD Million)

Table 49 Market, By Region, 2014–2023 (USD Million)

Table 50 Industrial Lighting Market in North America, By Light Source, 2014–2023 (USD Million)

Table 51 Market in North America, By Offering, 2014–2023 (USD Million)

Table 52 Market in North America, By Installation Type, 2014–2023 (USD Million)

Table 53 Market in North America, By Product, 2014–2023 (USD Million)

Table 54 Market in North America, By Country, 2014–2023 (USD Million)

Table 55 Market in Europe, By Light Source, 2014–2023 (USD Million)

Table 56 Market in Europe, By Offering, 2014–2023 (USD Million)

Table 57 Market in Europe, By Installation Type, 2014–2023 (USD Million)

Table 58 Market in Europe, By Product, 2014–2023 (USD Million)

Table 59 Market in Europe, By Country, 2014–2023 (USD Million)

Table 60 Market in APAC, By Light Source, 2014–2023 (USD Million)

Table 61 Market in APAC, By Offering, 2014–2023 (USD Million)

Table 62 Market in APAC, By Installation Type, 2014–2023 (USD Million)

Table 63 Market in APAC, By Product, 2014–2023 (USD Million)

Table 64 Market in APAC, By Country, 2014–2023 (USD Million)

Table 65 Market in RoW, By Light Source, 2014–2023 (USD Million)

Table 66 Market in RoW, By Offering, 2014–2023 (USD Million)

Table 67 Market in RoW, By Installation Type, 2014–2023 (USD Million)

Table 68 Market in RoW, By Product, 2014–2023 (USD Million)

Table 69 Market in RoW, By Country, 2014–2023 (USD Million)

Table 70 Market Ranking for the Market, 2016

List of Figures (58 Figures)

Figure 1 Industrial Lighting Market: Research Design

Figure 2 Market Size Estimation Methodology: Bottom-Up Approach

Figure 3 Market Size Estimation Methodology: Top-Down Approach

Figure 4 Data Triangulation

Figure 5 Industrial Lighting Market, 2014–2023

Figure 6 LED Lighting Segment is Expected to Witness the Highest Growth Rate in the Market During the Forecast Period

Figure 7 Lamps & Luminaires Segment is Expected to Hold the Largest Share in the Market in 2017

Figure 8 Replacement Installation Segment is Estimated to Register the Highest Growth Rate in the Market During the Forecast Period

Figure 9 Spot Lighting Segment is Estimated to Grow at the Highest Rate in the Market During the Forecast Period

Figure 10 Factory & Production Line Segment is Expected to Hold the Largest Share in the Market in 2017

Figure 11 APAC Held the Largest Share of the Market in 2016

Figure 12 Market for LED Lighting is Expected to Witness the Highest Growth Rate During the Forecast Period

Figure 13 Flood Lighting/Area Lighting Segment Held the Largest Share of the Market in APAC in 2016

Figure 14 China Dominated the Market in 2016

Figure 15 Application in Hazardous Locations to Witness the Highest Growth in the Market During the Forecast Period

Figure 16 Industrial Lighting Market Dynamics

Figure 17 Value Chain Analysis: Major Value is Added During Chip Packaging and Technology Integration Stages

Figure 18 Market, By Light Source

Figure 19 Fluorescent Lighting Expected to Hold the Largest Share of the Market in 2017

Figure 20 APAC Expected to Hold the Largest Share of the LED Lighting Market in 2017

Figure 21 Factory & Production Lines to Hold the Largest Share of the Fluorescent Lighting Market in 2017

Figure 22 Market, By Offering

Figure 23 Lamps & Luminaires to Hold the Largest Share of the Market in 2017

Figure 24 Market, By Installation Type

Figure 25 Replacement Installation to Witness the Highest Growth Rate in the Market During the Forecast Period

Figure 26 APAC to Hold the Largest Market Share for the Replacement Installation in 2017

Figure 27 Market, By Product

Figure 28 Flood Lighting/Area Lighting Expected to Dominate the Market During the Forecast Period

Figure 29 Spot Lighting is Expected to Grow at the Highest Rate in Hazardous Locations During the Forecast Period

Figure 30 Market for Flood Lighting/Area Lighting in RoW Expected to Grow at the Highest Rate During the Forecast Period

Figure 31 Market, By Application

Figure 32 Factory & Production Lines Expected to Hold the Largest Share of the Market in 2017

Figure 33 LED Lighting Expected to Register High Growth Rate in the Warehouse & Cold Storage Application During the Forecast Period

Figure 34 Flood Lighting/Area Lighting Expected to Hold the Largest Market Share in the Outer Premises in 2017

Figure 35 Fluorescent Lighting Estimated to Hold the Largest Market Share in the Hazardous Locations in 2017

Figure 36 Market, By Geography

Figure 37 Geographic Snapshot of the Market

Figure 38 Market in North America

Figure 39 Snapshot of the Market in North America

Figure 40 Market in Europe

Figure 41 Snapshot of the Market in Europe

Figure 42 Market in APAC

Figure 43 Snapshot of the Market in APAC

Figure 44 Market in RoW

Figure 45 Snapshot of the Market in RoW

Figure 46 Key Growth Strategy Adopted By the Companies Between 2014 and 2017

Figure 47 Competitive Leadership Mapping, 2016

Figure 48 Geographic Revenue Mix of Major Companies, 2016

Figure 49 Philips Lighting Holding B. V.: Company Snapshot

Figure 50 Emerson: Company Snapshot

Figure 51 Osram Licht AG: Company Snapshot

Figure 52 Cree, Inc.: Company Snapshot

Figure 53 Acuity Brands Lighting, Inc.: Company Snapshot

Figure 54 Legrand: Company Snapshot

Figure 55 Zumtobel Group: Company Snapshot

Figure 56 Hubbell Lighting, Inc.: Company Snapshot

Figure 57 General Electric Co.: Company Snapshot

Figure 58 Toyoda Gosei Co., Ltd.: Company Snapshot

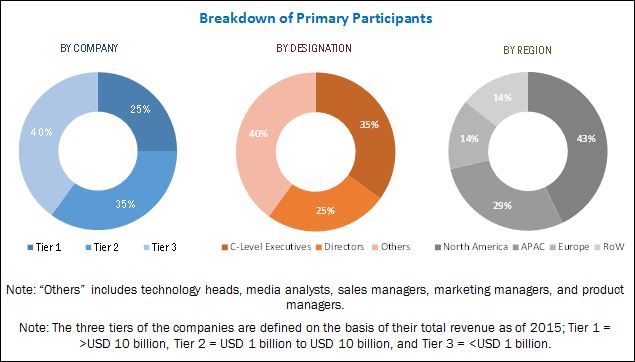

The research methodology used to estimate and forecast the industrial lighting market begins by capturing the revenues of the key players and their shares in the market. Few organizations associated with the market include Global Lighting Association, Lighting Controls Association, and LEDinside. Calculations based on this led to the overall market size. After arriving at the overall market size, the total industrial lighting market has been split into several segments and subsegments, which have then been verified through primary research by conducting extensive interviews with industry experts such as CEOs, VPs, directors, and executives. The data triangulation and market breakdown procedures have been employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The breakdown of profiles of the primary respondents is depicted in the following figure:

To know about the assumptions considered for the study, download the pdf brochure

The value chain of the overall industrial lighting market includes various activities and factors that help achieve a high level of performance with respect to a service or a product. The key players operating across the value chain of the market are Philips Lighting Holding B.V. (Netherlands), Hubbell Lighting, Inc. (US), Emerson (US), Legrand (France), Acuity Brands Lighting, Inc. (US), TOYODA GOSEI Co., Ltd (Japan), Cree, Inc. (US), General Electric (US) , Osram Licht AG (Germany), and Zumtobel Group (Austria).

Scope of the Report:

|

Report Metric |

Details |

|

Base year |

2016 |

|

Forecast period |

2017–2023 |

|

Units |

Value (USD) |

|

Segments covered |

Type, End User, Offerings, and Region |

|

Geographic regions covered |

North America, APAC, Europe, and RoW |

|

Companies covered |

Philips Lighting Holding B.V. (Netherlands), Hubbell Lighting, Inc. (US), Emerson (US), Legrand (France), Acuity Brands Lighting, Inc. (US), TOYODA GOSEI Co., Ltd (Japan), Cree, Inc. (US), General Electric (US) , Osram Licht AG (Germany), and Zumtobel Group (Austria) |

Key Target Audience:

- Component and equipment suppliers

- Original equipment manufacturers (OEMs)

- Original design manufacturers (ODMs)

- Installers and maintenance service providers

- Research organizations

- Component integrators

- Technology providers

Scope of the Report:

The industrial lighting market has been covered in detail in this report. To provide a holistic picture, the current market demand and forecasts have also been included in the report. In this report, the market has been segmented as follows:

Industrial Lighting Market, By Light Source

- LED Lighting

- High Intensity Discharge (HID) Lighting

- Fluorescent Lighting

- Others

Industrial Lighting Market, by Offering

- Lamps & Luminaires

- Control Systems

- Services

Industrial Lighting Market, by Installation Type

- New Installation

- Replacement Installation

- Retrofit Installation

Industrial Lighting Market, by Product

- Industrial Linear Lighting

- Spot Lighting

- Flood Lighting/Area Lighting

- High Bay Lighting

Industrial Lighting Market, by Application

- Warehouse & Cold Storage

- Factory & Production Lines

- Outer Premises

- Parking Areas

- Hazardous Locations

- Others

Geographic Analysis

- North America

- Europe

- Asia Pacific (APAC)

- Rest of the World (RoW)

Available Customizations:

With the given industrial lighting market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

- Country-wise breakdown of all regions by application

- Detailed analysis and profiling of additional five market players

Growth opportunities and latent adjacency in Industrial Lighting Market

Does the report provide marekt share analysis by region? Which are the top players in this space?