This research elucidates the approach used to compile this report on the LED Lighting Market. The study employs two fundamental information sources, secondary and primary sources, which collectively provide a comprehensive, technical, and commercial analysis of the LED Lighting Market. Secondary sources encompass data derived from sources like company websites, publications, industry associations, and databases such as OneSource, Factiva, and Bloomberg. Additionally, primary sources were tapped, including insights from key opinion leaders spanning various sectors, experts from governmental entities and associations, preferred suppliers, LED Lighting manufacturers, distributors, technology experts, subject matter specialists (SMEs), C-level executives of prominent firms, and industry consultants. These interviews were instrumental in acquiring, validating, and comprehending crucial information and in gauging the future prospects and trends within the LED Lighting Market. Key market players were identified through secondary research, and their market positioning was assessed via a combination of primary and secondary research methods. Furthermore, this research integrated an examination of the annual reports of market participants to pinpoint the leading players in the LED Lighting Market.

Secondary Research

In the secondary research phase, we referred to a variety of secondary sources to identify and collect pertinent information for this LED Lighting Market study. These secondary sources encompassed materials such as companies' annual reports, press releases, and investor presentations, as well as white papers, accredited publications, and articles authored by recognized experts. We also consulted directories and databases. The global size of the LED Lighting Market was determined through secondary data obtained from both paid and freely available sources. This involved evaluating the product portfolios of leading companies and assessing the quality of their offerings. The secondary research process was instrumental in gathering essential data related to the industry's supply chain, the financial aspects of the market, the total count of major market players, and the segmentation of the market in alignment with industry trends down to the most granular level, including geographic markets. Furthermore, this phase allowed for the identification and examination of industry trends and significant developments from both market and technology perspectives.

Primary Research

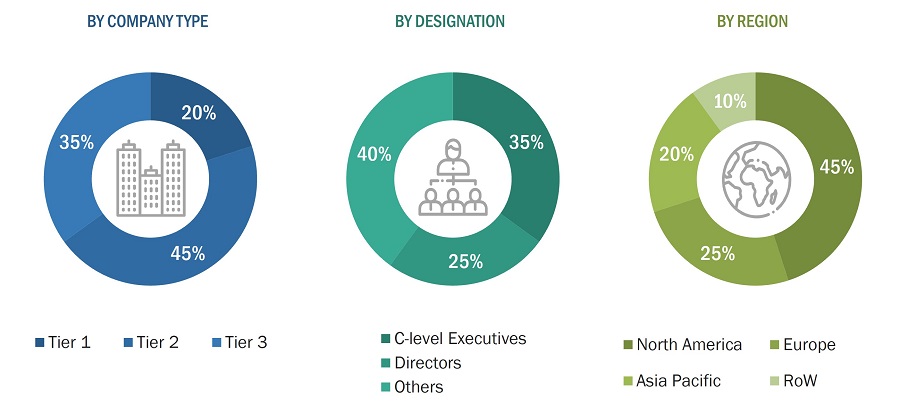

In the primary research phase, we conducted interviews with a range of primary sources to acquire both qualitative and quantitative data concerning the market in four primary regions: Asia Pacific, North America, Europe, and RoW (comprising the Middle East, Africa, and South America). On the supply side, primary sources included industry experts occupying various roles such as CEOs, vice presidents, marketing directors, technology directors, and other key executives from major companies and organizations operating within the LED Lighting Market or closely related sectors. This primary research was instrumental in gathering, verifying, and validating critical data that had been sourced from other channels following the market engineering phase.

Primary research also served to identify various market segments, industry trends, key players, the competitive landscape, and the pivotal market dynamics, encompassing factors such as drivers, constraints, opportunities, and challenges, as well as the key strategies adopted by market players. The majority of the primary interviews focused on engaging with the supply side of the market, and the collection of this primary data was carried out through questionnaires, email correspondence, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

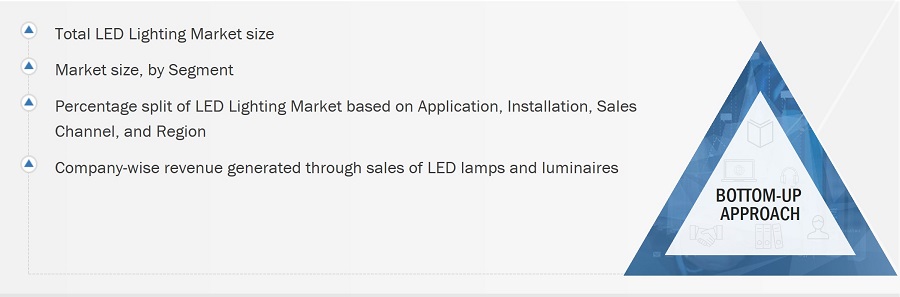

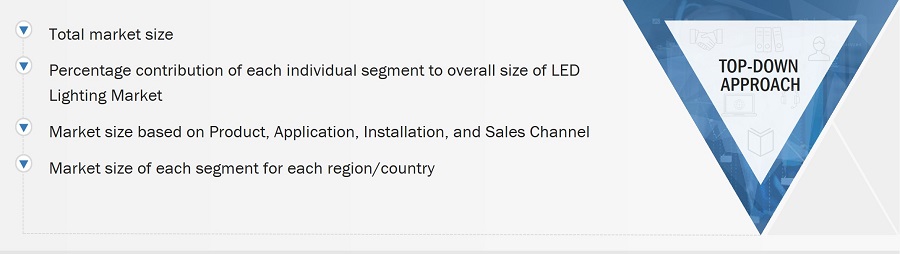

The market engineering process extensively employed both top-down and bottom-up approaches. Additionally, a range of data triangulation methods played a crucial role in conducting market forecasting and estimating values for both the overall market segments and their sub-segments, as detailed in the report. To extract vital insights throughout the report, multiple qualitative and quantitative analyses were executed within the market engineering process.

In the identification of key players within the LED Lighting Market, secondary research was instrumental. The revenues generated by these key players were determined through a combination of primary and secondary research methods. Their revenue figures were further dissected by geographical regions and market segments, leveraging financial statements and an analysis of the annual reports released by these prominent market players. Interviews with CEOs, VPs, directors, and marketing executives were also conducted to enrich our understanding of the key players and their role in the LED Lighting Market. Market shares, a critical aspect of the analysis, were estimated using a blend of secondary and primary research. This data was then consolidated, enhanced with comprehensive insights and analysis provided by MarketsandMarkets, and is presented in this report.

Global LED Lighting Market Size: Bottom-Up Approach

Global LED Lighting Market Size: Top-Down Approach

Data Triangulation

Following the determination of the comprehensive market size through the previously described market size estimation process, the entire market was subsequently divided into multiple segments and sub-segments. To accomplish this and attain precise statistical data for all segments and sub-segments, the market engineering process employed a data triangulation method. This triangulation involved a thorough examination of diverse factors and trends originating from both the demand and supply aspects of the market. In addition to this, the market's accuracy and reliability were substantiated through a combination of both top-down and bottom-up approaches.

Market Definition

A light-emitting diode (LED) is a semiconductor light source formed from a p–n junction diode. It emits light when a suitable voltage is applied across its leads. An LED lighting system is formed by integrating LED devices into a lamp to be used as a light bulb or light source in a lighting fixture. LED lighting solutions consist of high-efficiency fixtures and associated controls such as drivers and dimming switches, which adjust the lighting based on factors such as occupancy and daylight. LED lighting is increasingly implemented to control growing energy consumption in buildings and outdoor areas. Robust development is expected in smart lighting technology that involves the extensive use of LEDs and smart electronic components, such as sensors, and other semiconductor components.

Stakeholders

-

Raw material and wafer suppliers

-

System integrators

-

LED component manufacturers

-

Original equipment manufacturers (OEMs)

-

Integrated device manufacturers (IDMs)

-

Original design manufacturers (ODMs)

-

IoT components, AI-based services, and software providers

-

Assembling, testing, and packaging services providers

-

Suppliers and distributors

-

Governments and other regulatory bodies

-

Research institutes and organizations

-

Market research and consulting firms

Study Objectives

-

To describe and forecast the size of the LED lighting market based on product type, application, installation, sales channel, and region, in terms of value

-

To forecast the size of the LED lighting market based on installation and sales channel segments, in terms of value

-

To forecast the size of the LED lighting market based on product type, in terms of volume

-

To describe and forecast the market for four main regions, namely, the Americas, Asia Pacific, Europe, and Rest of the World (RoW), in terms of value

-

To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the market

-

To provide a detailed overview of the value chain of the LED lighting ecosystem, along with the average selling prices of product types

-

To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and their contributions to the overall market

-

To strategically analyze the ecosystem, Porter’s five forces, regulations, patent landscape, trade landscape, and case studies pertaining to the market under study

-

To analyze opportunities in the market for the stakeholders by identifying high-growth segments in the market

-

To strategically profile the key players and provide a detailed competitive landscape of the LED lighting market

-

To analyze strategic approaches adopted by the leading players in the LED lighting market, including product launches/developments/collaborations/partnerships/expansions, and mergers & acquisitions

Available Customizations:

With the given market data, MarketsandMarkets offers customizations based on the specific requirements of companies. The following customization options are available for the report:

Company Information

-

Market size based on different subsegments of the LED Lighting Market

-

Detailed analysis and profiling of additional market players (up to five)

Wouter

Aug, 2019

I would like to know the total LED lighting market sector in South Africa. If possible in Rand value as well as percentage. Looking forward to your quick response..

anil

Sep, 2019

Being in lighting field since more than 48 years interested to get more information which can help me in my role as consultant to lighting industry. Please let me know what all new trends, applications, technologies have been included in this report?.

David

Sep, 2018

Hi. I am writing a story for the media on railroad industry adoption of LED lighting. I am hoping to ask an industry analyst a question and use the quote for my story, which will be placed with targeted news media. Should only take a few minutes, but can really use an expert. Thank you..

Susan

Jun, 2019

What product types make up the total lighting retrofit market by percentage (i.e. linear fixtures, downlighting, high bay, low bay, etc). Please elaborate..

Hebatullah

Jul, 2019

We are a LED manufacturer based in Egypt, need to know how to compete with the Chinese companies in terms of pricing and exporting our products to other countries?.

Juan

Feb, 2017

My specific interest id LED Lighting Market by Installation Type (New Installation and Retrofit Installation) in North America and Asia Pacific. Do you provide quantitative analysis for these 2 regions only? .

Ross

Apr, 2017

I provide financing solutions for all types of energy efficiency projects, with a focus on LED lighting retrofits. Please let me know how I may be benefitted out of this report?.

Alice

Apr, 2017

What would the pricing for all quantitative tables related to Asia Pacific regions and top company profiles in this region? .

Ivy

Jan, 2018

We are the manufacturer of LED lights, we are looking for the information on LED panel lights, LED downlights, LED track lights, LED linear lights, and LED Strips. Do you have any specific study on this?.

Claudia

Jan, 2019

I am doing my final thesis of the masters in LED lighitng. I am interested in this report, what would the best price for this? Thank you very much in advance. .

Mark

Feb, 2017

Our interest is in the international LED High Bay market and the adoption of smart technologies such as sensors..

Renaldo

Jul, 2019

I am interested in Europre LED lighting market and want to understand, what is the current market size in Italy, France, Germany and UK in the European Market? What is the penetration of LED in the overall lighting in these countries?.

akhil

Nov, 2017

I am interested to know how is the competition among the system integrators within LED lighting industry? Does the report include market stategies adopted by major players within the ecosystem to get competitive edge in the market?.

ameen

Jul, 2019

Would like to understand the market potential for LED lighting in rural parts of India? Do you have such information qualitative or quantitative?.

mohsen

May, 2017

I am looking for the potential of LED Lighting across different indoor and outdoor applications. Does the report provide this information across prominent countries in all the regions?.

Shola

Feb, 2019

I am looking to do business as a LED Lighting distributor. This is a completely new venture for me and I will love to receive more insight on what I need to do to becoming a distributor/marketer of this product. I look forward to receiving your response. Thanks..