Enterprise Information Archiving Market by Type (Content Type (Email, Database, Social Media, Instant Messaging, Mobile Communication) and Services), Deployment Mode, Organization Size, Vertical & Region - Global Forecast to 2027

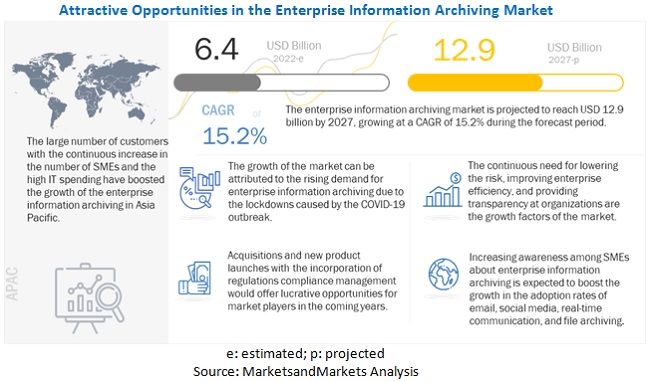

The global Enterprise Information Archiving Market size was valued at USD 6.4 billion in 2022 and is expected to grow at a CAGR of 15.2% from 2022 to 2027. The revenue forecast for 2027 is projected to reach $12.9 billion. The base year for estimation is 2021, and the historical data spans from 2022 to 2027. The growth in the enterprise information archiving market has been impelled due to the increasing need for cost-effective storage solutions for inactive data to meet compliance and legal requirements. Another growth driving factor for the enterprise information archiving market is the demand for improved business processes through segregation of less valuable data from the online enterprise data. Further, cloud-based archiving creates new growth opportunities in the enterprise information archiving market.

Enterprise information archiving is an important need for any enterprise to stay protected from litigations accusing the enterprise for fraud or disclosure of customer’s confidential information. With the development of sophisticated computing and communication systems, new laws are getting defined on a regular basis to safeguard customer’s private information and promote ethical run of business processes. Enterprise information archiving has also helped organizations worldwide to automatically improve business performance by segregating old and less useful data on a tertiary storage and keeping useful data on secondary storage for faster access and processing. In the recent years, there has been a substantial growth in the enterprise information archiving market. Vendors in the market now provide a single platform to archive and manage a wider range of enterprise data, from traditional office files to enterprise communication media contents, such as email, instant messaging, social media, and mobile communication. Datacenters have been established with cloud support that offers scalable archiving at low price.

To know about the assumptions considered for the study, Request for Free Sample Report

Enterprise Information Archiving Market Dynamics

Driver: Data volumes of enterprises are growing at an exponential rate

The enormous volume of enterprise information generated by exponential increase in data from emails, instant messaging, database, social media, web, mobile communication files, and enterprise file synchronization sharing is posing a serious challenge for businesses, thus increasing the need for enterprise information archiving solutions and services. It is difficult to capture, preserve, and produce records of business decisions and communications across a range of content, sources, and data types. As per Cisco Annual Internet Report nearly 300 million mobile applications will be downloaded by 2023. Social media, gaming, and business applications will be the most popular downloads. The IT infrastructure is becoming increasingly complicated as more diversified end-user devices and IoT connections are added it can produce a large amount of information. The installation of this devices is increasing and growing at a rapid pace and will require additional storage space. Thus, creating a need for EIA solutions to empower businesses with the ability to capture information from all platforms and devices and ability to efficiently and securely archive information.

Restraint: Lack of awareness about enterprise information archiving solutions with significant reliance on a legacy archiving method

Large enterprises have been adopting various advanced solutions to manage their enterprise information, considering the large pool of digital enterprise information available with them. However, various enterprises stick to traditional and time-consuming methods, such as manually managing digital enterprise information, due to budget constraints and the lack of awareness of enterprise information archiving. Thus, various SMEs depend on manual and other traditional approaches/tactical system archiving to manage their enterprise information. The lack of training and capabilities to manage advanced enterprise information archiving solutions is one of the major factors expected to reduce the pace of their adoption. These capabilities differ from region to region, and therefore, the adoption of advanced enterprise information archiving solutions in North America and Europe is higher as compared to other regions. Resistance to changes is another factor that restricts employees from adopting enterprise information archiving solutions.

Opportunity: Disruptive technologies, such as of cloud-native platforms and AI, will enable enterprise information archiving solutions gain more adoption

Enterprises adopt disruptive technologies, such as cloud, communication channels, IoT, and AI, to increase operational efficiency. To survive in the age of digital transformation, enterprises must adopt digital strategies and technologies to operate efficiently. These disruptive technologies generate and access a huge amount of information. As AI is envisioned to be utilized everywhere from edge to core to cloud. AI platforms and apps are allowing businesses to take use of ML capabilities to improve accuracy and optimize processing for business-critical analysis. Cloud, hyperconverged infrastructure, AI, and edge storage are impacting the enterprise information archiving market. The enterprise data act as the input for these technologies. These technologies analyze data generated by various applications and devices to get insightful information. They analyze enterprise information to get patterns/loopholes useful to plan enterprise strategies digital transformation across verticals has accelerated the adoption of cloud native platforms. Enterprises adopt cloud-native archiving solutions to reduce or eliminate infrastructure and related cost to achieve the predictable cost mode OPEX vs. CAPEX.

Challenge: Cybersecurity and data protection risks are on the rise and will likely continue to evolve with emerging technologies

Enterprise information, especially financial data and business-generated transactional data, plays a crucial role in planning enterprise strategies. Hence, enterprises are reluctant to move their confidential data as well as business operations to cloud and prefer on-premises or traditional information management methods, which inhibit the growth of the enterprise information archiving market. Though enterprise information archiving solutions have evolved in the recent years, the information security capabilities of such solutions pose a major challenge for this market. Enterprises are extremely sensitive when it comes to their communication channels, such as emails, mobile communication, and instant messaging, as they directly affect the security and privacy of the enterprise data. In the enterprise information archiving market, security-related concerns over enterprise information are substantial as businesses are fully dependent on the enterprise data. In case of any disruption to the enterprise data, businesses would suffer a major setback. Hence, enterprise information archiving solutions need to be monitored continuously to minimize risks and improve security features. These solutions ensure the safety of sensitive data while interacting via different systems, such as Enterprise Resource Planning (ERP) and Customer Relationship Management (CRM).

The enterprise data helps in redefining intelligence and strategies. As data plays an important role and is a significant asset for any enterprise, various organizations are strict with the security of their data and hesitate to store it on third-party storage or archiving systems. Cloud-based archiving solution providers need to define appropriate security and privacy measures so that more and more customers get the security assurance of their enterprise data. Due to the lack of security of cloud-based archiving solutions, hybrid archiving solutions are gaining traction. These solutions help store very old and the least important data on cloud-based archives, and important and recent data on-premises.

Content Type segment to hold a larger market size during the forecast period

The Content type segment for enterprise information archiving is expected to grow at a higher CAGR. Various industry enterprises demand archiving solutions as per their content type from enterprise information archiving solution providers. The content types include structured and unstructured data that is generated by an enterprises’ IT infrastructure. Enterprise information archiving vendors offer enterprise information archiving solutions as per content types that include email, database, social media, instant messaging, web, mobile communication, and file and EFSS.

On-premises deployment mode to hold a larger market size in 2022

The enterprise information archiving market is segmented by deployment mode into on-premises and cloud. On-premises segment is expected to hold a higher share of the enterprise information archiving market . It is witnessing growth due to the ownership of private individual data and the digital rights management associated with the digital assets of the private individuals, such as payment details. Enterprise information archiving through on-premises deployment mode reduces the turnaround time and query processing time significantly. On-premises deployment is the most reliable deployment mode when it comes to enterprise information archiving, due to the criticality and confidentiality involved in analyzing different data types generated by enterprises. Most organizations prefer the private individual data to lie on servers and mainframes physically installed in the enterprise to minimize the cost of troubleshooting the system in case of a single point of failures as well as security concerns associated with the private data of consumers.

Large Enterprises to hold a majority of the market share during the forecast period

Enterprises with more than 1,000 employees are categorized as large enterprises. The adoption of enterprise information archiving solutions in large enterprises is higher as compared to SMEs, due to the high volumes of data to be managed. This trend is expected to continue during the forecast period. Large enterprises have multiple offices and divisions across the world. These enterprises benefit from centralized, cloud-based enterprise information archiving solutions to monitor offices and divisions from enterprise headquarters. The emergence of the cloud-based enterprise information archiving solutions enables the storage of incidents on the cloud.

Large enterprises are keen on investing in new and latest technologies, such as AI, cloud, and 5G, to optimize and analyze enterprise information archiving. The high spending capacity of large enterprises is another factor increasing the adoption of the enterprise information archiving across the globe.

BFSI industry vertical to grow at the highest CAGR during the forecast period

Financial service institutes and enterprises are continuously facing problems to meet regulatory compliance requirements defined by various regulatory bodies, such as Financial Industry Regulatory Authority (FINRA), SEC, Federal Financial Institutions Examination Council (FFIEC), Federal Deposit Insurance Corporation (FDIC), and Dodd-Frank Act. These regulations ensure financial service organizations work according to standards and maintain fair transactions with customers. This helps financial service organizations effectively communicate with customers, monitor, and preserve all communications done through emails, social media, or mobile communications. To accomplish this, financial services organizations need to incorporate solutions, which can capture, archive, and provide easy access to the required information, enabling the organization to respond to an agency information request.

To know about the assumptions considered for the study, download the pdf brochure

Asia Pacific (APAC) to grow at the highest CAGR during the forecast period

APAC is estimated to be the fastest-growing enterprise information archiving market due to the rise in the adoption of new technologies, high investments for digital transformation, the rapid expansion of domestic enterprises, extensive development of infrastructures, and increasing GDP of various countries. Rapidly growing economies, such as China, Japan, Singapore, and India, are implementing enterprise information archiving solutions across multiple business processes to secure and achieve enterprise information. Asia is the hub of IT industries and is growing at a faster pace. The increasing need for optimization and monitoring of the business process has mandated the use of enterprise information archiving solutions to avoid the policy and regulatory breaches.

Key Market Players

The enterprise information archiving market vendors have implemented various types of organic as well as inorganic growth strategies, such as new product launches, product upgradations, partnerships and agreements, business expansions, and mergers and acquisitions, to strengthen their offerings in the market. The major vendors offering enterprise information archiving solutions and services globally are Microsoft (US), HPE (US), IBM (US), Google (US), DELL (US), Veritas (US), Barracuda (US), proofpoint (US), Smarsh (US), Mimecast (UK), ZL Technologies (US), Global Relay (Canada), Micro Focus (UK), OpenText (Canada), Commvault (US), Solix (US), Archive360 (US), Everteam (France), Pagefreezer (Canada), Jatheon (Canada), Unified Global Archiving (US), Hornetsecurity (Germany), SKYSITE (US), Zovy Archiving Solutions (US), txtsmarter (US), SPAMBRELLA (US), THETA LAKE (US), Mithi (India), Odaseva(US), Mirrorweb (UK), Bloomberg (US).

The study includes an in-depth competitive analysis of key players in the enterprise information archiving market with their company profiles, recent developments, COVID-19 developments, and key market strategies.

Scope of the report

|

Report Metric |

Details |

|

Market size available for years |

2017–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Forecast units |

Billion (USD) |

|

Segments covered |

Type (Content Type [Email, Database, Social Media, Instant Messaging, Web, Mobile Communication, File & enterprise file synchronization and sharing] and Services), Deployment Mode, Organization Size, Vertical, and Region |

|

Geographies covered |

North America, APAC, Europe, MEA, and Latin America |

|

Companies covered |

Microsoft (US), HPE (US), IBM (US), Google (US), DELL (US), Veritas (US), Barracuda (US), proofpoint (US), Smarsh (US), Mimecast (UK), ZL Technologies (US), Global Relay (Canada), Micro Focus (UK), OpenText (Canada), Commvault (US), Solix (US), Archive360 (US), Everteam (France), Pagefreezer (Canada), Jatheon (Canada), Unified Global Archiving (US), Hornetsecurity (Germany), SKYSITE (US), Zovy Archiving Solutions (US), txtsmarter (US), SPAMBRELLA (US), THETA LAKE (US), Mithi (India), Odaseva(US), Mirrorweb (UK), Bloomberg (US) |

This research report categorizes the enterprise information archiving market based on types, deployment mode, organization size, vertical, and region.

Based on the type:

-

Content Type

- Database

- Social Media

- Instant Messaging

- Web

- Mobile Communication

- File & enterprise file synchronization and sharing

-

Services

- Consulting

- System Integration

- Training Support and Maintenance

Based on the deployment mode:

- On-premises

- Cloud

Based on the organization size:

- Large Enterprises

- SMEs

Based on the vertical:

- Government And Defense

- BFSI

- Retail And Ecommerce

- Education And Research

- Healthcare And Pharmaceutical

- Manufacturing

- Media And Entertainment

- IT and Telecommunications

- Other Verticals

Based on the region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- Rest of Europe

-

APAC

- China

- Japan

- India

- Rest of APAC

-

MEA

- Saudi Arabia

- UAE

- Rest of MEA

-

Latin America

- Brazil

- Rest of Latin America

Recent Developments

- In January 2022, Proofpoint acquired Dathena, an innovator in AI-powered data protection to strengthens its cloud-based people-centric security solutions by adding AI-based data classification to its information and cloud security offerings.

- In November 2021, Smarsh launched next generation of its enterprise electronic communications capture, archiving and oversight offering, the Communications Intelligence Platform. The AI-powered solution enables financial services firms and other highly regulated enterprises to collect and analyze communications data at scale, quickly identify risks, recognize business insights, and improve operational systems.

- In October 2021, Amazon Web Services Smarsh Collaborated with Amazon Web Services, Inc. (AWS) in Canada to deliver its Capture and Enterprise Archive solutions. The move accelerates the company’s growth strategy in the country, adding to a range of offerings available to Canadian enterprises already leveraging Smarsh technology for their archiving strategies, including some of the largest banks and financial services firms.

- In June 2021, Veritas acquired Globanet, which offers compliance solutions that enable customers to streamline compliance with global regulatory requirements and capture content from over 80+ data sources. The aim of this acquisition is to extend its digital compliance portfolio for email archiving migrations, custom add-ons, and project-based consulting.

Frequently Asked Questions (FAQ):

How big is the Enterprise information archiving market?

What is growth rate of the Enterprise information archiving market?

Who are the key players in Enterprise information archiving market?

Who will be the leading hub for Enterprise information archiving market?

What is the Enterprise information archiving market segmentation?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 42)

1.1 INTRODUCTION TO COVID-19

1.2 COVID-19 HEALTH ASSESSMENT

FIGURE 1 COVID-19: THE GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

1.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GDP FORECASTS FOR SELECT G20 COUNTRIES IN 2020

1.3.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 4 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF THE GLOBAL ECONOMY

1.4 OBJECTIVES OF THE STUDY

1.5 MARKET DEFINITION

1.5.1 INCLUSIONS AND EXCLUSIONS

1.6 MARKET SCOPE

1.6.1 MARKET SEGMENTATION

1.6.2 REGIONS COVERED

1.6.3 YEARS CONSIDERED FOR THE STUDY

1.7 CURRENCY CONSIDERED

TABLE 1 UNITED STATES DOLLAR EXCHANGET RATE, 2018–2021

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 52)

2.1 RESEARCH DATA

FIGURE 6 ENTERPRISE INFORMATION ARCHIVING MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakup of primary profiles

FIGURE 7 BREAKUP OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.1.2.2 Primary respondents: enterprise information archiving market

2.1.2.3 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 9 ENTERPRISE INFORMATION ARCHIVING MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

FIGURE 10 MARKET SIZE ESTIMATION METHODOLOGY – APPROACH 1 (SUPPLY SIDE): REVENUE OF ENTERPRISE INFORMATION ARCHIVING FROM VENDORS

FIGURE 11 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH (SUPPLY SIDE): COLLECTIVE REVENUE OF ENTERPRISE INFORMATION ARCHIVING VENDORS

FIGURE 12 MARKET SIZE ESTIMATION METHODOLOGY – (SUPPLY SIDE): ILLUSTRATION OF VENDOR REVENUE ESTIMATION

FIGURE 13 MARKET SIZE ESTIMATION METHODOLOGY – (SUPPLY SIDE): CAGR PROJECTIONS FROM THE SUPPLY SIDE

FIGURE 14 MARKET SIZE ESTIMATION METHODOLOGY – APPROACH 2 (DEMAND SIDE): REVENUE GENERATED FROM ENTERPRISE INFORMATION ARCHIVING AND SERVICES

2.4 MARKET FORECAST

2.4.1 FACTOR ANALYSIS

2.5 ASSUMPTIONS FOR THE STUDY

2.6 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 64)

FIGURE 15 ENTERPRISE INFORMATION ARCHIVING MARKET: GLOBAL SNAPSHOT

FIGURE 16 TOP GROWING SEGMENTS IN THE MARKET

FIGURE 17 ENTERPRISE INFORMATION ARCHIVING SOLUTION SEGMENT TO HOLD A LARGER MARKET SIZE DURING THE FORECAST PERIOD

FIGURE 18 LARGE ENTERPRISES SEGMENT TO HOLD A LARGER MARKET SIZE DURING THE FORECAST PERIOD

FIGURE 19 CLOUD SEGMENT TO HOLD A LARGER MARKET SIZE DURING THE FORECAST PERIOD

FIGURE 20 TOP VERTICALS IN THE MARKET (USD MILLION)

FIGURE 21 NORTH AMERICA TO HOLD THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 70)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN THE ENTERPRISE INFORMATION ARCHIVING MARKET

FIGURE 22 DRASTIC GEOGRAPHIC CHANGE AND TECHNOLOGICAL EVOLUTION TO DRIVE ENTERPRISE INFORMATION ARCHIVING GROWTH

4.2 MARKET, BY COMPONENT (2022 VS. 2027)

FIGURE 23 CONTENT TYPE SEGMENT TO HOLD A LARGER MARKET SHARE DURING THE FORECAST PERIOD

4.3 MARKET, BY ORGANIZATION SIZE (2022 VS. 2027)

FIGURE 24 LARGE ENTERPRISES TO HOLD A LARGER MARKET SIZE DURING THE FORECAST PERIOD

4.4 MARKET, BY DEPLOYMENT MODE (2022 VS. 2027)

FIGURE 25 ON-PREMISES SEGMENT TO HOLD A LARGER MARKET SHARE DURING THE FORECAST PERIOD

4.5 MARKET, BY VERTICAL (2021 VS. 2026)

FIGURE 26 BANKING, FINANCIAL SERVICES AND INSURANCE VERTICAL TO SHOW THE HIGHEST GROWTH RATE DURING THE FORECAST PERIOD

4.6 MARKET INVESTMENT SCENARIO

FIGURE 27 ASIA PACIFIC TO EMERGE AS THE BEST MARKET FOR INVESTMENTS IN THE NEXT FIVE YEARS

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 73)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 28 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: ENTERPRISE INFORMATION ARCHIVING MARKET

5.2.1 DRIVERS

5.2.1.1 Data volumes of enterprises are growing at an exponential rate

5.2.1.2 Regulatory, legal, and competitive business environments drive businesses to seek innovative ways to archive enterprise information

5.2.1.3 5G, AI, big data, and other technologies bolster both the supply and demand for data

5.2.1.4 Need to use more cost-effective storage resources for inactive data

5.2.2 RESTRAINTS

5.2.2.1 Lack of awareness about enterprise information archiving solutions with significant reliance on a legacy archiving method

5.2.3 OPPORTUNITIES

5.2.3.1 Rising internet adoption and mobile devices at enterprises WHICH are creating opportunities for archiving solutions

FIGURE 29 GLOBAL INTERNET USER GROWTH

FIGURE 30 GLOBAL ENTERPRISE INFORMATION TECHNOLOGY SPENDING, 2018–2025, (USD BILLION)

5.2.3.2 Disruptive technologies, such as cloud-native platforms and AI, will enable enterprise information archiving solutions to gain more adoption

5.2.4 CHALLENGES

5.2.4.1 Cybersecurity and data protection risks are on the rise and will likely continue to evolve with emerging technologies

FIGURE 31 TOP ENTERPRISE SECURITY ISSUES

5.3 PORTER’S FIVE FORCES ANALYSIS

TABLE 2 PORTER’S FIVE FORCES ANALYSIS: ENTERPRISE INFORMATION ARCHIVING MARKET

FIGURE 32 PORTER’S FIVE FORCES ANALYSIS: MARKET

5.3.1 THREAT OF NEW ENTRANTS

5.3.2 THREAT OF SUBSTITUTES

5.3.3 BARGAINING POWER OF SUPPLIERS

5.3.4 BARGAINING POWER OF BUYERS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 PATENT ANALYSIS

5.4.1 METHODOLOGY

FIGURE 33 TOP TEN COMPANIES WITH THE HIGHEST NUMBER OF PATENT APPLICATIONS

TABLE 3 TOP TWENTY PATENT OWNERS

FIGURE 34 NUMBER OF PATENTS GRANTED IN A YEAR, 2012–2021

5.5 TECHNOLOGICAL OUTLOOK

5.5.1 ARTIFICIAL INTELLIGENCE AND AUTOMATION

5.5.2 IOT TECHNOLOGY

5.5.3 AUGMENTED REALITY

5.5.4 BLOCKCHAIN TECHNOLOGY

5.6 USE CASES

5.6.1 USE CASE 1: FINANCIAL SERVICES

5.6.2 USE CASE 2: RETAIL

5.6.3 USE CASE 3: MANUFACTURING

5.6.4 USE CASE 4: GOVERNMENT

5.7 COVID-19-DRIVEN MARKET DYNAMICS

5.7.1 DRIVERS AND OPPORTUNITIES

5.7.2 RESTRAINTS AND CHALLENGES

5.8 INDUSTRY TRENDS

5.8.1 VALUE CHAIN ANALYSIS

FIGURE 35 ENTERPRISE INFORMATION ARCHIVING MARKET: VALUE CHAIN

5.8.2 ECOSYSTEM

TABLE 4 MARKET: ECOSYSTEM

5.8.3 PRICING ANALYSIS

TABLE 5 MARKET: PRICING LEVELS

5.8.4 AVERAGE SELLING PRICES OF KEY PLAYERS BY APPLICATION

FIGURE 36 AVERAGE SELLING PRICES OF KEY PLAYERS, BY APPLICATIONS

5.8.5 AVERAGE SELLING PRICE TREND

5.9 REGULATORY LANDSCAPE

5.9.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 6 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 7 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 8 ASIA-PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 9 REST OF WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.9.2 REGULATORY IMPLICATIONS AND INDUSTRY STANDARDS

5.9.3 GENERAL DATA PROTECTION REGULATION

5.9.4 SEC RULE 17A-4

5.9.5 ISO/IEC 27001

5.9.6 SYSTEM AND ORGANIZATION CONTROLS 2 TYPE II COMPLIANCE

5.9.7 FINANCIAL INDUSTRY REGULATORY AUTHORITY

5.9.8 FREEDOM OF INFORMATION ACT

5.9.9 HEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT PLAY

5.10 KEY CONFERENCES AND EVENTS IN 2022–2023

TABLE 10 ENTERPRISE INFORMATION ARCHIVING: DETAILED LIST OF CONFERENCES AND EVENTS

5.11 KEY STAKEHOLDERS AND BUYING CRITERIA

5.11.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 37 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP BUSINESS FUNCTIONS

TABLE 11 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP BUSINESS FUNCTIONS (%)

TABLE 12 BUYING PROCESS FOR TOP BUSINESS FUNCTIONS

5.11.2 BUYING CRITERIA

FIGURE 38 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

TABLE 13 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

5.12 TRENDS/DISRUPTIONS IMPACTING BUYERS

FIGURE 39 MARKET: TRENDS/DISRUPTIONS IMPACTING BUYERS

6 ENTERPRISE INFORMATION ARCHIVING MARKET, BY TYPE (Page No. - 105)

6.1 INTRODUCTION

6.1.1 TYPES: MARKET DRIVERS

FIGURE 40 CONTENT TYPE SEGMENT TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

TABLE 14 MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 15 MARKET, BY TYPE, 2022–2027 (USD MILLION)

6.2 CONTENT TYPE

FIGURE 41 EMAIL SEGMENT TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

TABLE 16 MARKET, BY CONTENT TYPE, 2017–2021 (USD MILLION)

TABLE 17 MARKET, BY CONTENT TYPE, 2022–2027 (USD MILLION)

6.2.1 EMAIL

TABLE 18 EMAIL: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 19 EMAIL: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.2.2 DATABASE

TABLE 20 DATABASE: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 21 DATABASE: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.2.3 SOCIAL MEDIA

TABLE 22 SOCIAL MEDIA: ENTERPRISE INFORMATION ARCHIVING MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 23 SOCIAL MEDIA: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.2.4 INSTANT MESSAGING

TABLE 24 INSTANT MESSAGING: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 25 INSTANT MESSAGING: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.2.5 WEB

TABLE 26 WEB: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 27 WEB: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.2.6 MOBILE COMMUNICATION

TABLE 28 MOBILE CONNECTION ACROSS THE MAJOR COUNTRIES (MILLION)

TABLE 29 MOBILE COMMUNICATION: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 30 MOBILE COMMUNICATION: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.2.7 FILE AND ENTERPRISE FILE SYNCHRONIZATION AND SHARING

TABLE 31 FILE AND EFSS: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 32 FILE AND EFSS: ENTERPRISE INFORMATION ARCHIVING MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3 SERVICES

FIGURE 42 SYSTEM INTEGRATION SERVICES TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

TABLE 33 MARKET, BY SERVICE, 2017–2021 (USD MILLION)

TABLE 34 MARKET, BY SERVICE, 2022–2027 (USD MILLION)

6.3.1 CONSULTING

TABLE 35 CONSULTING: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 36 CONSULTING: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3.2 SYSTEM INTEGRATION

TABLE 37 SYSTEM INTEGRATION: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 38 SYSTEM INTEGRATION: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3.3 TRAINING, SUPPORT, AND MAINTENANCE

TABLE 39 TRAINING, SUPPORT, AND MAINTENANCE: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 40 TRAINING, SUPPORT, AND MAINTENANCE: MARKET, BY REGION, 2022–2027 (USD MILLION)

7 ENTERPRISE INFORMATION ARCHIVING MARKET, BY DEPLOYMENT MODE (Page No. - 121)

7.1 INTRODUCTION

7.1.1 DEPLOYMENT MODES: MARKET DRIVERS

7.1.2 DEPLOYMENT MODES: COVID-19 IMPACT

FIGURE 43 ON-PREMISES SEGMENT TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

TABLE 41 MARKET, BY DEPLOYMENT MODE, 2017–2021 (USD MILLION)

TABLE 42 MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

7.2 CLOUD

TABLE 43 CLOUD: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 44 CLOUD: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.3 ON-PREMISES

TABLE 45 ON-PREMISES: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 46 ON-PREMISES: MARKET, BY REGION, 2022–2027 (USD MILLION)

8 ENTERPRISE INFORMATION ARCHIVING MARKET, BY ORGANIZATION SIZE (Page No. - 126)

8.1 INTRODUCTION

8.1.1 ORGANIZATION SIZE: MARKET DRIVERS

FIGURE 44 SMALL AND MEDIUM-SIZED ENTERPRISES SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 47 MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 48 MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

8.2 SMALL AND MEDIUM-SIZED ENTERPRISES

TABLE 49 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 50 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.3 LARGE ENTERPRISES

TABLE 51 LARGE ENTERPRISES: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 52 LARGE ENTERPRISES: MARKET, BY REGION, 2022–2027 (USD MILLION)

9 ENTERPRISE INFORMATION ARCHIVING MARKET, BY VERTICAL (Page No. - 131)

9.1 INTRODUCTION

9.1.1 VERTICALS: MARKET DRIVERS

TABLE 53 GLOBAL VOLUME OF ELECTRONIC PAYMENTS (USD BILLION)

TABLE 54 WORLD POPULATION (BILLION)

FIGURE 45 BANKING, FINANCIAL SERVICES AND INSURANCE VERTICAL TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

TABLE 55 MARKET SIZE, BY VERTICAL, 2017–2021 (USD MILLION)

TABLE 56 MARKET SIZE, BY VERTICAL, 2022–2027 (USD MILLION)

9.2 GOVERNMENT AND DEFENSE

9.2.1 NEED TO ESTABLISH ROBUST AND TRANSPARENT DATA GOVERNANCE PROCESS ON THE COLLECTION, STORAGE, AND USE OF DATA WILL DRIVE ENTERPRISE INFORMATION ARCHIVING ACROSS THE VERTICAL

9.2.2 GOVERNMENT AND DEFENSE: MARKET DRIVERS

9.2.3 GOVERNMENT AND DEFENSE: COVID-19 IMPACT

TABLE 57 GOVERNMENT AND DEFENSE: ENTERPRISE INFORMATION ARCHIVING MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 58 GOVERNMENT AND DEFENSE: ENTERPRISE INFORMATION ARCHIVING MANAGEMENT MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

9.3 BANKING, FINANCIAL SERVICES AND INSURANCE

9.3.1 FINANCIAL INDUSTRY IS HEAVILY REGULATED, AND THE NEED TO SECURE AND COMPLY WITH ALL REGULATIONS FOR REVIEW, AUDITS, EDISCOVERY, LITIGATION, AND COMPLIANCE WILL DRIVE THE VERTICAL

9.3.2 BANKING, FINANCIAL SERVICES AND INSURANCE: MARKET DRIVERS

9.3.3 BANKING, FINANCIAL SERVICES AND INSURANCE: COVID-19 IMPACT

TABLE 59 BANKING, FINANCIAL SERVICES AND INSURANCE: MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 60 BANKING, FINANCIAL SERVICES AND INSURANCE: ENTERPRISE INFORMATION ARCHIVING MANAGEMENT MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

9.4 RETAIL AND ECOMMERCE

9.4.1 GROWING DIGITALIZATION ACROSS RETAIL AND ECOMMERCE WITH INCREASING RETAIL TRANSACTIONS LINKED TO ELECTRONIC PAYMENTS WILL DRIVE THE VERTICAL

9.4.2 RETAIL AND ECOMMERCE: ENTERPRISE INFORMATION ARCHIVING MARKET DRIVERS

9.4.3 RETAIL AND ECOMMERCE: COVID-19 IMPACT

TABLE 61 RETAIL AND ECOMMERCE: MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 62 RETAIL AND ECOMMERCE: ENTERPRISE INFORMATION ARCHIVING MANAGEMENT MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

9.5 EDUCATION AND RESEARCH

9.5.1 NEED TO DEAL WITH MASSIVE DATABASE, HIGH STORAGE USAGE, INCREASED STORAGE COSTS, PERFORMANCE DEGRADATION, AND LONG-TERM DATA RETENTION CHALLENGES WILL DRIVE THE VERTICAL

9.5.2 EDUCATION AND RESEARCH: MARKET DRIVERS

9.5.3 EDUCATION AND RESEARCH: COVID-19 IMPACT

TABLE 63 EDUCATION AND RESEARCH: MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 64 EDUCATION AND RESEARCH: ENTERPRISE INFORMATION ARCHIVING MANAGEMENT MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

9.6 HEALTHCARE AND PHARMACEUTICAL

9.6.1 NEED TO ARCHIVE SIGNIFICANT NUMBER OF MEDICAL IMAGES AND OTHER PATIENT DATA WILL DRIVE THE VERTICAL

9.6.2 HEALTHCARE AND PHARMACEUTICAL: ENTERPRISE INFORMATION ARCHIVING MARKET DRIVERS

9.6.3 HEALTHCARE AND PHARMACEUTICAL: COVID-19 IMPACT

TABLE 65 HEALTHCARE AND PHARMACEUTICAL: MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 66 HEALTHCARE AND PHARMACEUTICAL: ENTERPRISE INFORMATION ARCHIVING MANAGEMENT MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

9.7 MANUFACTURING

9.7.1 NEED TO OVERCOME THE CHALLENGES FACED BY MANUFACTURING, SUCH AS INTELLIGENCE SECURITY, STORAGE MANAGEMENT, AND COMPLIANCE, WILL DRIVE THE MARKET

9.7.2 MANUFACTURING: MARKET DRIVERS

9.7.3 MANUFACTURING: COVID-19 IMPACT

TABLE 67 MANUFACTURING: MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 68 MANUFACTURING: ENTERPRISE INFORMATION ARCHIVING MANAGEMENT MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

9.8 MEDIA AND ENTERTAINMENT

9.8.1 GROWING NEED TO STORE MASSIVE VOLUMES OF DIGITAL DATA AND ENSURE ENHANCED WORKFLOW ACROSS MEDIA AND ENTERTAINMENT CHANNELS ACROSS THE VERTICAL

9.8.2 MEDIA AND ENTERTAINMENT: ENTERPRISE INFORMATION ARCHIVING MARKET DRIVERS

9.8.3 MEDIA AND ENTERTAINMENT: COVID-19 IMPACT

TABLE 69 MEDIA AND ENTERTAINMENT: MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 70 MEDIA AND ENTERTAINMENT: ENTERPRISE INFORMATION ARCHIVING MANAGEMENT MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

9.9 IT AND TELECOMMUNICATIONS

9.9.1 IT AND TELECOMMUNICATION: MARKET DRIVERS

9.9.2 IT AND TELECOMMUNICATION: COVID-19 IMPACT

9.9.3 NEED TO AUTOMATE WORKFLOW AND REDUCE OPERATIONAL COST WOULD DRIVE THE ADOPTION OF ENTERPRISE INFORMATION ARCHIVING

TABLE 71 IT AND TELECOMMUNICATIONS: MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 72 IT AND TELECOMMUNICATIONS: ENTERPRISE INFORMATION ARCHIVING MANAGEMENT MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

9.10 OTHER VERTICALS

TABLE 73 OTHER VERTICALS: MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 74 OTHER VERTICALS: ENTERPRISE INFORMATION ARCHIVING MANAGEMENT MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

10 ENTERPRISE INFORMATION ARCHIVING MARKET, BY REGION (Page No. - 148)

10.1 INTRODUCTION

FIGURE 46 ASIA PACIFIC TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 75 MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 76 MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

10.2 NORTH AMERICA

10.2.1 NORTH AMERICA: ENTERPRISE INFORMATION ARCHIVING MANAGEMENT MARKET DRIVERS

10.2.2 NORTH AMERICA: COVID-19 IMPACT

10.2.3 NORTH AMERICA: REGULATORY LANDSCAPE

FIGURE 47 NORTH AMERICA: MARKET SNAPSHOT

TABLE 77 NORTH AMERICA: ENTERPRISE INFORMATION ARCHIVING MARKET SIZE BY TYPE, 2017–2021 (USD MILLION)

TABLE 78 NORTH AMERICA: MARKET BY TYPE, 2022–2027 (USD MILLION)

TABLE 79 NORTH AMERICA: MARKET SIZE, BY CONTENT TYPE, 2017–2021 (USD MILLION)

TABLE 80 NORTH AMERICA: MARKET SIZE, BY CONTENT TYPE, 2022–2027 (USD MILLION)

TABLE 81 NORTH AMERICA: MARKET SIZE, BY SERVICES, 2017–2021 (USD MILLION)

TABLE 82 NORTH AMERICA: MARKET SIZE, BY SERVICES, 2022–2027 (USD MILLION)

TABLE 83 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT MODE 2017–2021 (USD MILLION)

TABLE 84 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 85 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 86 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 87 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 2017–2021 (USD MILLION)

TABLE 88 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 89 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 90 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

10.2.4 UNITED STATES

10.2.4.1 Rising adoption of advanced digital technologies to retain data and simplify compliance to drive the adoption of the enterprise information archiving market in the US

TABLE 91 UNITED STATES: MARKET SIZE, BY DEPLOYMENT MODE, 2017–2021 (USD MILLION)

TABLE 92 UNITED STATES: MARKET SIZE, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 93 UNITED STATES: MARKET SIZE, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 94 UNITED STATES: MARKET SIZE, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.2.5 CANADA

10.2.5.1 Rising adoption of cloud-based technologies and data compliance practices to boost the growth of the enterprise information archiving market in Canada

TABLE 95 CANADA: MARKET SIZE, BY DEPLOYMENT MODE, 2017–2021 (USD MILLION)

TABLE 96 CANADA: MARKET SIZE, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 97 CANADA: MARKET SIZE, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 98 CANADA: MARKET SIZE, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.3 EUROPE

10.3.1 EUROPE: MARKET DRIVERS

10.3.2 EUROPE: COVID-19 IMPACT

10.3.3 EUROPE: REGULATORY LANDSCAPE

TABLE 99 EUROPE: ENTERPRISE INFORMATION ARCHIVING MARKET SIZE, BY TYPE, 2017–2021 (USD MILLION)

TABLE 100 EUROPE: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 101 EUROPE MARKET SIZE, BY CONTENT TYPE, 2017–2021 (USD MILLION)

TABLE 102 EUROPE: MARKET SIZE, BY CONTENT TYPE, 2022–2027 (USD MILLION)

TABLE 103 EUROPE: MARKET SIZE, BY SERVICE, 2017–2021 (USD MILLION)

TABLE 104 EUROPE: MARKET SIZE, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 105 EUROPE: MARKET SIZE, BY DEPLOYMENT MODE, 2017–2021 (USD MILLION)

TABLE 106 EUROPE: MARKET SIZE, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 107 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 108 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 109 EUROPE: MARKET SIZE, BY VERTICAL, 2017–2021 (USD MILLION)

TABLE 110 EUROPE: MARKET SIZE, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 111 EUROPE: MARKET SIZE, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 112 EUROPE: MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

10.3.4 UNITED KINGDOM

10.3.4.1 Rising technology adoption and increasing demand for robust solutions to enhance the organization’s performance and increase operational efficiency to drive the adoption of enterprise information archiving solutions in the UK

TABLE 113 UK: ENTERPRISE INFORMATION ARCHIVING MARKET SIZE, BY DEPLOYMENT MODE, 2017–2021 (USD MILLION)

TABLE 114 UK: MARKET SIZE, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 115 UK: MARKET SIZE, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 116 UK: MARKET SIZE, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.3.5 GERMANY

10.3.5.1 Growing need to streamline business processes for workflow management and record management to create a demand for market in Germany

TABLE 117 GERMANY: ENTERPRISE INFORMATION ARCHIVING MARKET SIZE, BY DEPLOYMENT MODE, 2017–2021 (USD MILLION)

TABLE 118 GERMANY: MARKET SIZE, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 119 GERMANY: MARKET SIZE, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 120 GERMANY: MARKET SIZE, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.3.6 REST OF EUROPE

TABLE 121 REST OF EUROPE: MARKET SIZE, BY DEPLOYMENT MODE, 2017–2021 (USD MILLION)

TABLE 122 REST OF EUROPE: MARKET SIZE, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 123 REST OF EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 124 REST OF EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.4 ASIA PACIFIC

10.4.1 ASIA PACIFIC: MARKET DRIVERS

10.4.2 ASIA PACIFIC: COVID-19 IMPACT

10.4.3 ASIA PACIFIC: REGULATORY LANDSCAPE

FIGURE 48 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 125 ASIA PACIFIC: ENTERPRISE INFORMATION ARCHIVING MARKET SIZE BY TYPE, 2017–2021 (USD MILLION)

TABLE 126 ASIA PACIFIC: MARKET BY TYPE, 2022–2027 (USD MILLION)

TABLE 127 ASIA PACIFIC: MARKET SIZE, BY CONTENT TYPE, 2017–2021 (USD MILLION)

TABLE 128 ASIA PACIFIC: MARKET SIZE, BY CONTENT TYPE, 2022–2027 (USD MILLION)

TABLE 129 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2017–2021 (USD MILLION)

TABLE 130 ASIA PACIFIC MARKET SIZE, BY SERVICES, 2022–2027 (USD MILLION)

TABLE 131 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODE, 2017–2021 (USD MILLION)

TABLE 132 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 133 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 134 ASIA PACIFIC MARKET SIZE, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 135 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2017–2021 (USD MILLION)

TABLE 136 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 137 ASIA PACIFIC MARKET SIZE, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 138 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

10.4.4 CHINA

10.4.4.1 Increased adoption of new technologies, such as IoT, mobile, and cloud, drives the demand for enterprise information archiving solutions across industries in China

TABLE 139 CHINA: ENTERPRISE INFORMATION ARCHIVING MARKET SIZE, BY DEPLOYMENT MODE, 2017–2021 (USD MILLION)

TABLE 140 CHINA: MARKET SIZE, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 141 CHINA: MARKET SIZE, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 142 CHINA: MARKET SIZE, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.4.5 JAPAN

10.4.5.1 Enterprises’ shift toward digital transformation and focus on streamlining the business process to drive the adoption of the market in Japan

TABLE 143 JAPAN: MARKET SIZE, BY DEPLOYMENT MODE, 2017–2021 (USD MILLION)

TABLE 144 JAPAN: MARKET SIZE, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 145 JAPAN: MARKET SIZE, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 146 JAPAN: MARKET SIZE, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.4.6 INDIA

10.4.6.1 Increase in adoption of eGovernance, eBanking, eEducation, and eHealth will drive the market in India

TABLE 147 INDIA: ENTERPRISE INFORMATION ARCHIVING MARKET SIZE, BY DEPLOYMENT MODE, 2017–2021 (USD MILLION)

TABLE 148 INDIA: MARKET SIZE, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 149 INDIA: MARKET SIZE, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 150 INDIA: MARKET SIZE, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.4.7 REST OF ASIA PACIFIC

TABLE 151 REST OF APAC: MARKET SIZE, BY DEPLOYMENT MODE, 2017–2021 (USD MILLION)

TABLE 152 REST OF APAC: MARKET SIZE, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 153 REST OF APAC: MARKET SIZE, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 154 REST OF APAC: MARKET SIZE, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.5 MIDDLE EAST AND AFRICA

10.5.1 MIDDLE EAST AND AFRICA: ENTERPRISE INFORMATION ARCHIVING MARKET DRIVERS

10.5.2 MIDDLE EAST AND AFRICA: COVID-19 IMPACT

10.5.3 MIDDLE EAST AND AFRICA: REGULATORY LANDSCAPE

TABLE 155 MIDDLE EAST AND AFRICA: MARKET SIZE, BY TYPE, 2017–2021 (USD MILLION)

TABLE 156 MIDDLE EAST AND AFRICA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 157 MIDDLE EAST AND AFRICA: MARKET SIZE, BY CONTENT TYPE, 2017–2021 (USD MILLION)

TABLE 158 MIDDLE EAST AND AFRICA: MARKET SIZE, BY CONTENT TYPE, 2022–2027 (USD MILLION)

TABLE 159 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2017–2021 (USD MILLION)

TABLE 160 MIDDLE EAST AND AFRICA :INFORMATION ARCHIVING MARKET SIZE, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 161 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT MODE, 2017–2021 (USD MILLION)

TABLE 162 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 163 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 164 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 165 MIDDLE EAST AND AFRICA: MARKET SIZE, BY VERTICAL, 2017–2021 (USD MILLION)

TABLE 166 MIDDLE EAST AND AFRICA: MARKET SIZE, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 167 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 168 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

10.5.4 KINGDOM OF SAUDI ARABIA

10.5.4.1 Stringent regulatory framework and compliance standards to boost the growth of the enterprise information archiving market in Saudi Arabia

TABLE 169 KSA: MARKET SIZE, BY DEPLOYMENT MODE, 2017–2021 (USD MILLION)

TABLE 170 KSA: MARKET SIZE, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 171 KSA: MARKET SIZE, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 172 KSA: MARKET SIZE, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.5.5 UNITED ARAB EMIRATES

10.5.5.1 Rising need to cope with enormous volumes of information, accelerate information time to value, manage the information from capture to archive, and reduce the IT support burden tend to drive the market in the UAE

TABLE 173 UNITED ARAB EMIRATES: MARKET SIZE, BY DEPLOYMENT MODE, 2017–2021 (USD MILLION)

TABLE 174 UNITED ARAB EMIRATES: MARKET SIZE, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 175 UNITED ARAB EMIRATES: MARKET SIZE, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 176 UNITED ARAB EMIRATES: MARKET SIZE, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.5.6 REST OF MIDDLE EAST AND AFRICA

TABLE 177 REST OF MIDDLE EAST AND AFRICA: ENTERPRISE INFORMATION ARCHIVING MARKET SIZE, BY DEPLOYMENT MODE, 2017–2021 (USD MILLION)

TABLE 178 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 179 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 180 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.6 LATIN AMERICA

10.6.1 LATIN AMERICA: MARKET DRIVERS

10.6.2 LATIN AMERICA: COVID-19 IMPACT

10.6.3 LATIN AMERICA: REGULATORY LANDSCAPE

TABLE 181 LATIN AMERICA: ENTERPRISE INFORMATION ARCHIVING MARKET SIZE BY TYPE, 2017–2021 (USD MILLION)

TABLE 182 LATIN AMERICA: MARKET BY TYPE, 2022–2027 (USD MILLION)

TABLE 183 LATIN AMERICA: MARKET SIZE, BY CONTENT TYPE, 2017–2021 (USD MILLION)

TABLE 184 LATIN AMERICA MARKET SIZE, BY CONTENT TYPE, 2022–2027 (USD MILLION)

TABLE 185 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2017–2021 (USD MILLION)

TABLE 186 LATIN AMERICA: INFORMATION ARCHIVING MARKET SIZE, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 187 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2017–2021 (USD MILLION)

TABLE 188 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 189 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 190 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 191 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2017–2021 (USD MILLION)

TABLE 192 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 193 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 194 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

10.6.4 BRAZIL

10.6.4.1 Rapid digital transformation initiatives and the need to strengthen digital security fuel the adoption of enterprise information archiving solutions in Brazil

TABLE 195 BRAZIL: ENTERPRISE INFORMATION ARCHIVING MARKET SIZE, BY DEPLOYMENT MODE, 2017–2021 (USD MILLION)

TABLE 196 BRAZIL: MARKET SIZE, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 197 BRAZIL: MARKET SIZE, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 198 BRAZIL: MARKET SIZE, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.6.5 REST OF LATIN AMERICA

TABLE 199 REST OF LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2017–2021 (USD MILLION)

TABLE 200 REST OF LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 201 REST OF LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 202 REST OF LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 199)

11.1 INTRODUCTION

FIGURE 49 MARKET EVALUATION FRAMEWORK

11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

11.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY ENTERPRISE INFORMATION ARCHIVING VENDORS

11.3 MARKET RANKING

FIGURE 50 MARKET RANKING IN 2021

11.4 MARKET SHARE OF TOP VENDORS

TABLE 203 ENTERPRISE INFORMATION ARCHIVING: DEGREE OF COMPETITION

FIGURE 51 ENTERPRISE INFORMATION ARCHIVING MARKET: VENDOR SHARE ANALYSIS

11.5 HISTORICAL REVENUE ANALYSIS OF TOP VENDORS

FIGURE 52 HISTORICAL REVENUE ANALYSIS

11.6 COMPANY EVALUATION QUADRANT

FIGURE 53 COMPANY EVALUATION MATRIX: CRITERIA WEIGHTAGE

11.6.1 STAR

11.6.2 EMERGING LEADER

11.6.3 PERVASIVE

11.6.4 PARTICIPANT

FIGURE 54 ENTERPRISE INFORMATION ARCHIVING MARKET (GLOBAL): COMPANY EVALUATION QUADRANT

TABLE 204 COMPANY END USER FOOTPRINT

TABLE 205 COMPANY REGION FOOTPRINT

TABLE 206 COMPANY FOOTPRINT

11.7 STARTUP/SME EVALUATION QUADRANT

FIGURE 55 STARTUP/SME EVALUATION MATRIX: CRITERIA WEIGHTAGE

11.7.1 RESPONSIVE VENDORS

11.7.2 PROGRESSIVE VENDORS

11.7.3 DYNAMIC VENDORS

11.7.4 STARTING BLOCKS

FIGURE 56 STARTUP EVALUATION MATRIX, ENTERPRISE PERFORMANCE MANAGEMENT MARKET

TABLE 207 STARTUP/SME COMPANY END USER FOOTPRINT

TABLE 208 STARTUP/SME COMPANY REGION FOOTPRINT

TABLE 209 STARTUP/SME COMPANY FOOTPRINT

11.7.5 COMPETITIVE BENCHMARKING

TABLE 210 ENTERPRISE INFORMATION ARCHIVING MARKET: DETAILED LIST OF KEY STARTUP/SMES

11.8 COMPETITIVE SCENARIO

TABLE 211 MARKET: NEW LAUNCHES, 2020–2021

TABLE 212 MARKET: DEALS, 2019–2022

12 COMPANY PROFILES (Page No. - 214)

12.1 KEY PLAYERS

(Business Overview, Products Offered, Recent developments, Response to COVID-19, MnM View, Key strengths/right to win, Strategic choices made, and Weaknesses and competitive threats)*

12.1.1 MICROSOFT

TABLE 213 MICROSOFT: BUSINESS OVERVIEW

FIGURE 57 MICROSOFT: COMPANY SNAPSHOT

TABLE 214 MICROSOFT: SOLUTIONS AND SERVICES OFFERED

TABLE 215 MICROSOFT: NEW SOLUTION/SERVICE LAUNCHES

12.1.2 HPE

TABLE 216 HPE: BUSINESS OVERVIEW

FIGURE 58 HPE: COMPANY SNAPSHOT

TABLE 217 HPE: SOLUTIONS AND SERVICES OFFERED

TABLE 218 HPE: NEW SOLUTION/SERVICE LAUNCHES

TABLE 219 HPE: DEALS

12.1.3 IBM

TABLE 220 IBM: BUSINESS OVERVIEW

FIGURE 59 IBM: COMPANY SNAPSHOT

TABLE 221 IBM: SOLUTIONS AND SERVICES OFFERED

TABLE 222 IBM: OTHERS

12.1.4 GOOGLE

TABLE 223 GOOGLE: BUSINESS OVERVIEW

FIGURE 60 GOOGLE: COMPANY SNAPSHOT

TABLE 224 GOOGLE: SOLUTIONS AND SERVICES OFFERED

TABLE 225 GOOGLE: NEW SOLUTION/SERVICE LAUNCHES

12.1.5 DELL

FIGURE 61 DELL: COMPANY SNAPSHOT

TABLE 226 DELL: SOLUTIONS AND SERVICES OFFERED

12.1.6 VERITAS

TABLE 227 VERITAS: BUSINESS OVERVIEW

TABLE 228 VERITAS: SOLUTIONS AND SERVICES OFFERED

TABLE 229 VERITAS: DEALS

12.1.7 BARRACUDA

TABLE 230 BARRACUDA: BUSINESS OVERVIEW

TABLE 231 BARRACUDA: SOLUTIONS AND SERVICES OFFERED

TABLE 232 BARRACUDA: OTHERS

12.1.8 PROOFPOINT

TABLE 233 PROOFPOINT: BUSINESS OVERVIEW

TABLE 234 PROOFPOINT: SOLUTIONS AND SERVICES OFFERED

TABLE 235 PROOFPOINT: NEW SOLUTION/SERVICE LAUNCHES

TABLE 236 PROOFPOINT: DEALS

12.1.9 SMARSH

TABLE 237 SMARSH: BUSINESS OVERVIEW

TABLE 238 SMARSH: SOLUTIONS AND SERVICES OFFERED

TABLE 239 SMARSH: NEW SOLUTION/SERVICE LAUNCHES

TABLE 240 SMARSH: DEALS

12.1.10 MIMECAST

TABLE 241 MIMECAST: BUSINESS OVERVIEW

FIGURE 62 MIMECAST: COMPANY SNAPSHOT

TABLE 242 MIMECAST: SOLUTIONS AND SERVICES OFFERED

TABLE 243 MIMECAST: DEALS

TABLE 244 MIMECAST: OTHERS

12.2 OTHER PLAYERS

12.2.1 ZL TECHNOLOGIES

12.2.2 GLOBAL RELAY

12.2.3 MICRO FOCUS

12.2.4 OPENTEXT

12.2.5 COMMVAULT

12.2.6 SOLIX TECHNOLOGIES

12.2.7 EVERTEAM

12.2.8 HORNETSECURITY

12.2.9 JATHEON

12.2.10 MITHI

12.2.11 BLOOMBERG

12.3 SMES/START-UPS

12.3.1 ARCHIVE360

12.3.2 PAGEFREEZER

12.3.3 UNIFIED GLOBAL ARCHIVING

12.3.4 SKYSITE TECHNOLOGIES

12.3.5 ZOVY ARCHIVING SOLUTIONS

12.3.6 TXTSMARTER

12.3.7 SPAMBRELLA

12.3.8 THETA LAKE

12.3.9 ODASEVA

12.3.10 MIRRORWEB

*Details on Business Overview, Products Offered, Recent developments, Response to COVID-19, MnM View, Key strengths/right to win, Strategic choices made, and Weaknesses and competitive threats might not be captured in case of unlisted companies.

13 ADJACENT/RELATED MARKET (Page No. - 253)

13.1 INTRODUCTION

13.1.1 RELATED MARKET

13.1.2 LIMITATIONS

13.2 ENTERPRISE CONTENT MANAGEMENT MARKET

TABLE 245 ENTERPRISE CONTENT MANAGEMENT MARKET SIZE, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 246 ENTERPRISE CONTENT MANAGEMENT MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 247 BANKING, FINANCIAL SERVICES, AND INSURANCE: ENTERPRISE CONTENT MANAGEMENT MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 248 BANKING, FINANCIAL SERVICES, AND INSURANCE: ENTERPRISE CONTENT MANAGEMENT MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 249 CONSUMER GOODS AND RETAIL: ENTERPRISE CONTENT MANAGEMENT MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 250 CONSUMER GOODS AND RETAIL: ENTERPRISE CONTENT MANAGEMENT MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 251 ENERGY AND UTILITIES: ENTERPRISE CONTENT MANAGEMENT MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 252 ENERGY AND UTILITIES: ENTERPRISE CONTENT MANAGEMENT MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 253 GOVERNMENT AND PUBLIC SECTOR: ENTERPRISE CONTENT MANAGEMENT MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 254 GOVERNMENT AND PUBLIC SECTOR: ENTERPRISE CONTENT MANAGEMENT MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 255 HEALTHCARE AND LIFE SCIENCES: ENTERPRISE CONTENT MANAGEMENT MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 256 HEALTHCARE AND LIFE SCIENCES: ENTERPRISE CONTENT MANAGEMENT MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 257 IT AND ITES: ENTERPRISE CONTENT MANAGEMENT MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 258 IT AND ITES: ENTERPRISE CONTENT MANAGEMENT MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 259 MANUFACTURING: ENTERPRISE CONTENT MANAGEMENT MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 260 MANUFACTURING: ENTERPRISE CONTENT MANAGEMENT MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 261 MEDIA AND ENTERTAINMENT: ENTERPRISE CONTENT MANAGEMENT MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 262 MEDIA AND ENTERTAINMENT: ENTERPRISE CONTENT MANAGEMENT MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 263 TELECOMMUNICATION: ENTERPRISE CONTENT MANAGEMENT MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 264 TELECOMMUNICATION: ENTERPRISE CONTENT MANAGEMENT MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 265 OTHER VERTICALS: ENTERPRISE CONTENT MANAGEMENT MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 266 OTHER VERTICALS: ENTERPRISE CONTENT MANAGEMENT MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

13.3 EGRC MARKET

TABLE 267 ENTERPRISE GOVERNANCE, RISK, AND COMPLIANCE MARKET SIZE, BY END USER, 2015–2020 (USD MILLION)

TABLE 268 ENTERPRISE GOVERNANCE, RISK, AND COMPLIANCE MARKET SIZE, BY END USER, 2020–2026 (USD MILLION)

TABLE 269 ENTERPRISE GOVERNANCE, RISK, AND COMPLIANCE MARKET SIZE IN BANKING, FINANCIAL SERVICES, AND INSURANCE, BY REGION, 2015–2020 (USD MILLION)

TABLE 270 ENTERPRISE GOVERNANCE, RISK, AND COMPLIANCE MARKET SIZE IN BANKING, FINANCIAL SERVICES, AND INSURANCE, BY REGION, 2020–2026 (USD MILLION)

TABLE 271 ENTERPRISE GOVERNANCE, RISK, AND COMPLIANCE MARKET SIZE IN TELECOMMUNICATION, BY REGION, 2015–2020 (USD MILLION)

TABLE 272 ENTERPRISE GOVERNANCE, RISK, AND COMPLIANCE MARKET SIZE IN TELECOMMUNICATION, BY REGION, 2020–2026 (USD MILLION)

TABLE 273 ENTERPRISE GOVERNANCE, RISK, AND COMPLIANCE MARKET SIZE IN ENERGY AND UTILITIES, BY REGION, 2015–2020 (USD MILLION)

TABLE 274 ENTERPRISE GOVERNANCE, RISK, AND COMPLIANCE MARKET SIZE IN ENERGY AND UTILITIES, BY REGION, 2020–2026 (USD MILLION)

TABLE 275 ENTERPRISE GOVERNANCE, RISK, AND COMPLIANCE MARKET SIZE IN GOVERNMENT, BY REGION, 2015–2020 (USD MILLION)

TABLE 276 ENTERPRISE GOVERNANCE, RISK, AND COMPLIANCE MARKET SIZE IN GOVERNMENT, BY REGION, 2020–2026 (USD MILLION)

TABLE 277 ENTERPRISE GOVERNANCE, RISK, AND COMPLIANCE MARKET SIZE IN HEALTHCARE, BY REGION, 2015–2020 (USD MILLION)

TABLE 278 ENTERPRISE GOVERNANCE, RISK, AND COMPLIANCE MARKET SIZE IN HEALTHCARE, BY REGION, 2020–2026 (USD MILLION)

TABLE 279 ENTERPRISE GOVERNANCE, RISK, AND COMPLIANCE MARKET SIZE IN MANUFACTURING, BY REGION, 2015–2020 (USD MILLION)

TABLE 280 ENTERPRISE GOVERNANCE, RISK, AND COMPLIANCE MARKET SIZE IN MANUFACTURING, BY REGION, 2020–2026 (USD MILLION)

TABLE 281 ENTERPRISE GOVERNANCE, RISK, AND COMPLIANCE MARKET SIZE IN MINING AND NATURAL RESOURCES, BY REGION, 2015–2020 (USD MILLION)

TABLE 282 ENTERPRISE GOVERNANCE, RISK, AND COMPLIANCE MARKET SIZE IN MINING AND NATURAL RESOURCES, BY REGION, 2020–2026 (USD MILLION)

TABLE 283 ENTERPRISE GOVERNANCE, RISK, AND COMPLIANCE MARKET SIZE IN RETAIL AND CONSUMER GOODS, BY REGION, 2015–2020 (USD MILLION)

TABLE 284 ENTERPRISE GOVERNANCE, RISK, AND COMPLIANCE MARKET SIZE IN RETAIL AND CONSUMER GOODS, BY REGION, 2020–2026 (USD MILLION)

TABLE 285 ENTERPRISE GOVERNANCE, RISK, AND COMPLIANCE MARKET SIZE IN IT, BY REGION, 2015–2020 (USD MILLION)

TABLE 286 ENTERPRISE GOVERNANCE, RISK, AND COMPLIANCE MARKET SIZE IN IT, BY REGION, 2020–2026 (USD MILLION)

TABLE 287 ENTERPRISE GOVERNANCE, RISK, AND COMPLIANCE MARKET SIZE IN TRANSPORT AND LOGISTICS, BY REGION, 2015–2020 (USD MILLION)

TABLE 288 ENTERPRISE GOVERNANCE, RISK, AND COMPLIANCE MARKET SIZE IN TRANSPORT AND LOGISTICS, BY REGION, 2020–2026 (USD MILLION)

14 APPENDIX (Page No. - 270)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

The study involved four major activities in estimating the current size of the global Enterprise information archiving market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total Enterprise information archiving market size. After that, the market breakup and data triangulation techniques were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as Bloomberg and BusinessWeek, have been referred to identify and collect information for this study. The secondary sources included annual reports, press releases, and investor presentations of companies; white papers; and journals, such as Linux Journal and Container Journal, and articles from recognized authors, directories, and databases.

Primary Research

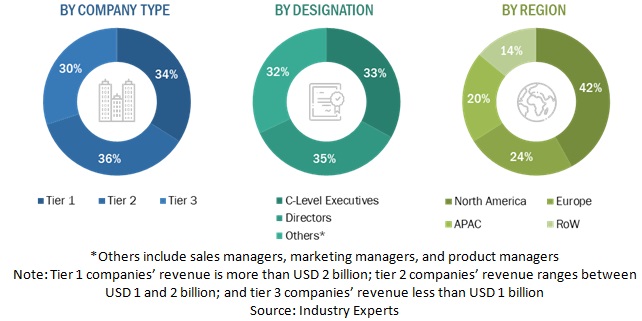

Various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Chief Marketing Officers (CMO), Vice Presidents (VPs), Managing Directors (MDs), technology and innovation directors, and related key executives from various key companies and organizations operating in the enterprise information archiving market along with the associated service providers, and system integrators operating in the targeted regions. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. Following is the breakup of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

For making market estimates and forecasting the enterprise information archiving market and other dependent submarkets, the top-down and bottom-up approaches were used. The bottom-up procedure was used to arrive at the overall market size of the global market using key companies’ revenue and their offerings in the market. The research methodology used to estimate the market size includes the following:

- The key players in the enterprise information archiving market have been identified through extensive secondary research.

- The market size, in terms of value, has been determined through primary and secondary research processes.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

Data Triangulation

With data triangulation and validation through primary interviews, the exact value of the overall parent market size was determined and confirmed using this study. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Report Objectives

- To define, describe, and forecast the enterprise information archiving market based on types, deployment modes, organization size, verticals, and regions

- To forecast the market size of five main regions: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To strategically analyze the market’s subsegments with respect to individual growth trends, prospects, and contribution to the total market

- To provide detailed information related to major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for major players

- To comprehensively analyze the core competencies of key players

- To track and analyze COVID-19 and competitive developments, such as mergers and acquisitions, new product developments, and partnerships and collaborations, in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of an additional five market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Enterprise Information Archiving Market