Direct-fed Microbials (DFM) Market by Type (Lactic Acid Bacteria and Bacillus), Livestock (Pork/Swine, Poultry, Ruminant, and Aquatic Animals), Form (Dry and Liquid), and Region - Global Forecast to 2022

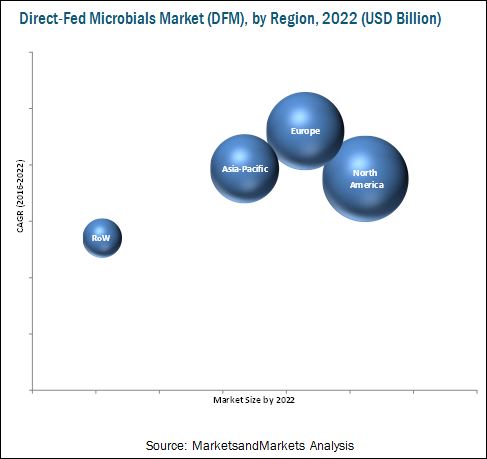

[152 Pages Report] The global direct-fed microbials (DFM) market is estimated to be valued at USD 934.5 Million in 2016 and projected to reach USD 1,399.6 Million by 2022, at a CAGR of 6.96% from 2016. Direct-fed microbial-based feed plays a vital role in providing health and medicinal benefits to animals such as preclusion and cure of diseases in addition to the basic nutritional components found in feedstuff. A decline in the usage of antibiotic growth promoters across the globe is driving the sales of direct-fed microbials. In 2006, the European Union was the first to impose a ban on the use of antibiotics for promoting growth in animals. This has led Europe to become the fastest-growing market for direct-fed microbials, which are widely used as an alternative. The increasing instances of bans on antibiotics in other parts of the world have also further fueled market growth, with North America now being the largest market for direct-fed microbials.

The global direct-fed microbials market has been segmented on the basis of type, livestock, and form. It has been further segmented on the basis of region into North America, Europe, Asia-Pacific, and the Rest of the World (RoW). The main objectives of the report are to define, segment, and project the size of the global market for direct-fed microbials, with respect to the above-mentioned segmentations and to provide a detailed study of key factors influencing the growth of the market, along with profiling the key players in the market along with their core competencies.

Years considered for this report are as follows:

2015 – Base Year

2016 – Estimated Year

2022 – Projected Year

Research Methodology

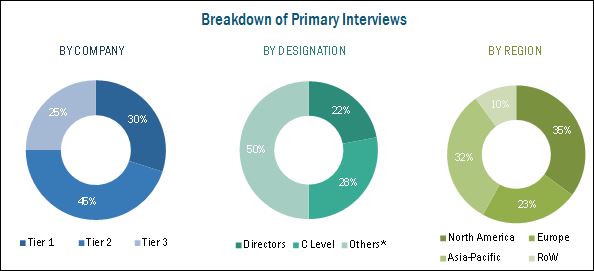

This report includes estimations of market sizes for value (USD million) with the base year as 2015, and forecast period from 2016 to 2022. Top-down and bottom-up approaches have been used to estimate and validate the size of the direct-fed microbials (DFM) market and to estimate the size of various other dependent submarkets. In-depth interviews have been conducted with various primary respondents to obtain & verify critical qualitative & quantitative information as well as to assess future prospects. All percentage shares, splits, and breakdowns have been determined using secondary sources and were verified through primary sources.

To know about the assumptions considered for the study, download the pdf brochure

Target Audience

The stakeholders for the report are as follows:

- Direct-fed microbial manufacturers

- Feed manufacturers

- Animal pharmaceutical companies

- Direct-fed microbial raw material suppliers

- Direct-fed microbial product exporters & importers

- Educational institutions

- Regulatory authorities

- Consulting firms

“The study answers several questions for stakeholders, primarily which market segments to focus on in the next two to six years for prioritizing efforts and investments.”

Scope of the Report

The direct-fed microbials (DFM) market has been segmented as follows:

On the basis of Type:

- Lactic acid bacteria

- Bacillus

- Others (Prevotella bryantii, live beneficial bacteria, and Propionibacterium)

On the basis of Livestock:

- Poultry

- Swine

- Ruminants

- Aquatic animals

- Others (equine and pets)

On the basis of Form

- Dry

- Liquid (paste and gel)

On the basis of Region:

- North America

- Europe

- Asia-Pacific

- RoW (Latin America and the Middle East and Africa)

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to client-specific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players (up to five)

The direct-fed microbials market is driven by factors such as increase in awareness about feed quality and safety, rising demand for manufactured animal feed, growth in demand for animal protein, changes in farming practices and technology, and replacing antibiotic growth promoters (AGPs) with direct-fed microbials. The continuous rise in the population has also resulted in an increase in the demand for food and the necessity for direct-fed microbials, to increase meat and milk production in a sustainable manner.

The consumption of direct-fed microbials is increasing significantly with various government regulations being adopted to improve animal health. The ban on the use of antibiotics as growth promoters in the European Union has created massive demand for direct-fed microbials. On the basis of type, the lactic acid bacteria segment is expected to be the fastest-growing, as these direct-fed microbials are highly effective.

On the basis of livestock type, the direct-fed microbials (DFM) market has been segmented into swine, poultry, ruminants, aquatic animals, and others, which include equine and pets. The poultry segment is projected to be the fastest-growing, because direct-fed microbials provide poultry birds with protein and this increases their growth rate. With the high demand for poultry meat across the world due to their high nutrient value, the demand for direct-fed microbials is also expected to increase.

Direct-fed microbials are available in dry and liquid forms. The dry form has a longer shelf life compared to the liquid form, which varies according to the type of direct-fed microbials used in animal feed. Dry microbials have more advantages and are used in various animal feed additive products. Liquid microbials are preferred by farmers as they are easily mixable and do not affect the texture of the feed.

In 2015, North America accounted for the largest share in the direct-fed microbials (DFM) market, followed by Europe, and the Asian-Pacific region. France and Germany constituted the largest country-level markets in the European region in 2015. Increase in awareness about the benefits of direct-fed microbials, among livestock producers and a rise in population is leading to the growth of the market in this region. The direct-fed microbials market in the Asia-Pacific region is projected to grow with investments from several multinational manufacturers. The market is also projected to grow due to the increase in advanced agricultural technologies and export of key products in animal feed. Extensive R&D initiatives are also being undertaken to explore new varieties of direct-fed microbials to be used in animal feed.

Stringent international quality standards and government regulations for direct-fed microbial products act as a restraint for the market. The key players identified in this market include Archer Daniels Midland Company (U.S.), E. I. du Pont de Nemours and Company (U.S.), Koninklijke DSM N. V. (Netherlands), Novozymes (Denmark), Chr. Hansen A/S (Denmark), Kemin Industries (U.S.), BIOMIN Holding GmbH (Austria), Lallemand Inc. (Canada), Novus International, Inc. (U.S.), and Bio-vet (U.S.) also attained strong position in the global direct-fed microbials (DFM) market.

Most key participants have been exploring new markets through new product launches, expansions, and investments across the globe. Since 2011, the direct-fed microbials (DFM) market has witnessed an increase in demand, especially in countries such as the U.S., Germany, France, Brazil, India, and China.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 12)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Market Covered

1.3.2 Periodization

1.4 Currency

1.5 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Introduction

2.2 Research Data

2.2.1 Secondary Data

2.2.1.1 Key Data From Secondary Sources

2.2.2 Primary Data

2.2.2.1 Key Data From Primary Sources

2.2.2.2 Key Industry Insights

2.2.2.3 Breakdown of Primary Interviews

2.3 Market Size Estimation

2.3.1 Bottom-Up Approach

2.3.2 Top-Down Approach

2.4 Market Breakdown & Data Triangulation

2.5 Research Assumptions & Limitations

2.5.1 Assumptions

2.5.2 Limitations

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 30)

4.1 Attractive Opportunities in the Direct-Fed Microbials Market

4.2 Direct-Fed Microbials Market, By Livestock

4.3 Life Cycle Analysis: Direct-Fed Microbials Market, By Region

4.4 Direct-Fed Microbials Market, By Type

4.5 Direct-Fed Microbials Market, By Key Country

4.6 Direct-Fed Microbials Market, By Form & Region, 2015

5 Market Overview (Page No. - 34)

5.1 Macroindicators

5.1.1 Introduction

5.1.1.1 Growing Population and Rising Demand for Diversified Food

5.1.1.2 Increase in Meat Production/Consumption

5.1.1.3 Growing Livestock Population

5.1.1.4 Parent Market Analysis: Animal Feed Industry

5.2 Market Segmentation

5.2.1 By Type

5.2.2 By Form

5.2.3 By Livestock

5.2.4 By Region

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increasing Awareness About Animal Health

5.3.1.2 Rise in Global Meat and Milk Consumption

5.3.1.3 Increased Demand for Quality Animal Products

5.3.1.4 Increase in Demand for Animal Protein

5.3.2 Restraints

5.3.2.1 Varying Regulations Pertaining to Consumption of Bacteria in Food and Feed

5.3.3 Opportunities

5.3.3.1 Ban on the Usage of Antibiotic Growth Promoters (AGP)

5.3.3.2 Health Benefits for Livestock in the Wake of Rising Animal Health Concerns

5.3.4 Challenges

5.3.4.1 Increasing Cost of Production and Operations

6 Industry Trends (Page No. - 48)

6.1 Introduction

6.2 Global Direct-Fed Microbials in Animal Feed Market: Supply Chain Analysis

6.3 Industry Insights

6.4 Direct-Fed Microbials in Animal Feed Market: Porter’s Five Forces Analysis

6.4.1 Intensity of Competitive Rivalry

6.4.2 Bargaining Power of Suppliers

6.4.3 Bargaining Power of Buyers

6.4.4 Threat of Substitutes

6.4.5 Threat of New Entrants

7 Direct-Fed Microbials Market, By Type (Page No. - 54)

7.1 Introduction

7.2 Lactic Acid Bacteria

7.2.1 Lactobacilli

7.2.1.1 Research on Lactobacilli

7.2.2 Bifidobacteria

7.2.2.1 Research on Bifidobacteria

7.2.3 Streptococcus thermophilus

7.3 Bacillus subtilis

7.3.1 Bacillus licheniformis

7.4 Other Bacteria

8 Direct-Fed Microbials Market, By Livestock (Page No. - 60)

8.1 Introduction

8.2 Swine

8.3 Poultry

8.4 Ruminants

8.5 Aquatic Animals

8.6 Others

9 Direct-Fed Microbials Market, By Form (Page No. - 69)

9.1 Introduction

9.1.1 Dry Form

9.1.2 Liquid Form

10 Direct-Fed Microbials Market, By Region (Page No. - 74)

10.1 Introduction

10.2 North America

10.2.1 U.S.

10.2.2 Canada

10.2.3 Mexico

10.3 Europe

10.3.1 U.K.

10.3.2 Germany

10.3.3 France

10.3.4 Italy

10.3.5 Spain

10.3.6 Rest of Europe

10.4 Asia-Pacific

10.4.1 China

10.4.2 India

10.4.3 Japan

10.4.4 Rest of Asia-Pacific

10.5 Rest of the World (RoW)

10.5.1 Latin America

10.5.2 MEA

11 Competitive Landscape (Page No. - 114)

11.1 Overview

11.2 Direct-Fed Microbials Market: Company Ranking

11.3 Competitive Situation & Trends

11.4 Expansions & Investments: the Key Strategy, 2011–2016

11.4.1 Expansions & Investments

11.4.2 Mergers & Acquisitions

11.4.3 New Product Launches

11.4.4 Agreements, Partnerships, Collaborations, and Joint Ventures

12 Company Profiles (Page No. - 123)

12.1 Archer Daniels Midland Company

12.1.1 Business Overview

12.1.2 Products Offered

12.1.3 Recent Developments

12.1.4 MnM View

12.1.4.1 SWOT Analysis

12.1.4.2 Key Strategies

12.2 E.I. Dupont De Nemours and Company

12.2.1 Business Overview

12.2.2 Products Offered

12.2.3 Recent Developments

12.2.4 MnM View

12.2.4.1 SWOT Analysis

12.2.4.2 Key Strategies

12.3 Koninklijke DSM N.V.

12.3.1 Business Overview

12.3.2 Products Offered

12.3.3 Recent Developments

12.3.4 MnM View

12.3.4.1 SWOT Analysis

12.3.4.2 Key Strategies

12.4 Novozymes

12.4.1 Business Overview

12.4.2 Products Offered

12.4.3 Recent Developments

12.4.4 MnM View

12.4.4.1 SWOT Analysis

12.4.4.2 Key Strategies

12.5 Chr. Hansen Holding A/S

12.5.1 Business Overview

12.5.2 Products Offered

12.5.3 Recent Developments

12.5.4 MnM View

12.5.4.1 SWOT Analysis

12.5.4.2 Key Strategies

12.6 Kemin Industries, Inc.

12.6.1 Business Overview

12.6.2 Products Offered

12.6.3 Recent Developments

12.7 Biomin Holding GmbH

12.7.1 Business Overview

12.7.2 Products Offered

12.7.3 Recent Developments

12.8 Lallemand, Inc.

12.8.1 Business Overview

12.8.2 Products Offered

12.8.3 Recent Developments

12.9 Novus International, Inc.

12.9.1 Business Overview

12.9.2 Products Offered

12.9.3 Recent Developments

12.10 Bio-Vet

12.10.1 Business Overview

12.10.2 Products Offered

13 Appendix (Page No. - 150)

13.1 Discussion Guide

13.1.1 Expansions & Investments

13.1.2 Mergers & Acquisitions

13.2 Available Customizations

13.3 Related Reports

List of Tables (72 Tables)

Table 1 Per Capita Consumption of Meat Through 2030

Table 2 Per Capita Protein Supply for Key Countries, 2006-2009 (Grams/Day)

Table 3 Industry Insights: Leading Trends Among Key Players

Table 4 Direct-Fed Microbials Market Size, By Type, 2014-2022 (USD Million)

Table 5 Lactic Acid Bacteria Market Size, By Region, 2014-2022 (USD Million)

Table 6 Bacillus Subtilis Market Size, By Region, 2014-2022 (USD Million)

Table 7 Other Bacteria Market Size, By Region, 2014-2022 (USD Million)

Table 8 Market Size for Direct-Fed Microbials, By Livestock, 2014–2022 (USD Million)

Table 9 Swine: Direct-Fed Microbials Market Size, By Region, 2014–2022 (USD Million)

Table 10 Poultry: Market Size, By Region, 2014–2022 (USD Million)

Table 11 Ruminants: Market Size for Direct-Fed Microbials, By Region, 2014–2022 (USD Million)

Table 12 Aquatic Animals: Market Size, By Region, 2014–2022(USD Million)

Table 13 Others: Direct-Fed Microbials Market Size, By Region, 2014–2022 (USD Million)

Table 14 Market Size for Direct-Fed Microbials, By Form, 2014–2022 (USD Million)

Table 15 Dry Direct-Fed Microbials Market Size, By Region, 2014–2022 (USD Million)

Table 16 Liquid Direct-Fed Microbials Market Size, By Region, 2014–2022 (USD Million)

Table 17 Market Size for Direct-Fed Microbials, By Region, 2014–2022 (USD Million)

Table 18 Market Size for Direct-Fed Microbials, By Type, 2014–2022 (USD Million)

Table 19 Market Size for Direct-Fed Microbials, By Livestock, 2014–2022 (USD Million)

Table 20 Market Size for Direct-Fed Microbials, By Form, 2014–2022 (USD Million)

Table 21 North America: Direct-Fed Microbials Market Size, By Country, 2014–2022 (USD Million)

Table 22 North America: Market Size, By Type, 2014–2022 (USD Million)

Table 23 North America: Market Size, By Livestock, 2014–2022 (USD Million)

Table 24 North America: Market Size, By Form, 2014–2022 (USD Million)

Table 25 U.S.: Direct-Fed Microbials Market Size, By Type, 2014–2022 (USD Million)

Table 26 U.S.: Market Size, By Livestock, 2014–2022 (USD Million)

Table 27 Canada: Market Size for Direct-Fed Microbials, By Type, 2014–2022 (USD Million)

Table 28 Canada: Market Size, By Livestock, 2014–2022 (USD Million)

Table 29 Mexico: Direct-Fed Microbials Market Size, By Type, 2014–2022 (USD Million)

Table 30 Mexico: Market Size, By Livestock, 2014–2022 (USD Million)

Table 31 Europe: Market Size for Direct-Fed Microbials, By Country, 2014–2022 (USD Million)

Table 32 Europe: Market Size, By Type, 2014–2022 (USD Million)

Table 33 Europe: Market Size, By Livestock, 2014–2022 (USD Million)

Table 34 Europe: Market Size, By Form, 2014–2022 (USD Million)

Table 35 U.K.: Market Size for Direct-Fed Microbials, By Type, 2014–2022 (USD Million)

Table 36 U.K.: Market Size, By Livestock, 2014–2022 (USD Million)

Table 37 Germany: Direct-Fed Microbials Market Size, By Type, 2014–2022 (USD Million)

Table 38 Germany: Market Size, By Livestock, 2014–2022 (USD Million)

Table 39 France: Direct-Fed Microbials Market Size, By Type, 2014–2022 (USD Million)

Table 40 France: Market Size, By Livestock, 2014–2022 (USD Million)

Table 41 Italy: Market Size for Direct-Fed Microbials, By Type, 2014–2022 (USD Million)

Table 42 Italy: Market Size, By Livestock, 2014–2022 (USD Million)

Table 43 Spain: Direct-Fed Microbials Market Size, By Type, 2014–2022 (USD Million)

Table 44 Spain: Market Size, By Livestock, 2014–2022 (USD Million)

Table 45 Rest of Europe: Market Size for Direct-Fed Microbials, By Type, 2014–2022 (USD Million)

Table 46 Rest of Europe: Market Size, By Livestock, 2014–2022 (USD Million)

Table 47 Asia-Pacific: Direct-Fed Microbials Market Size, By Country, 2014–2022 (USD Million)

Table 48 Asia-Pacific: Market Size, By Type, 2014–2022 (USD Million)

Table 49 Asia-Pacific: Market Size for Direct-Fed Microbials, By Livestock, 2014–2022 (USD Million)

Table 50 Asia-Pacific: Market Size, By Form, 2014–2022 (USD Million)

Table 51 China: Direct-Fed Microbials Market Size, By Type, 2014–2022 (USD Million)

Table 52 China: Market Size, By Livestock, 2014–2022 (USD Million)

Table 53 India: Market Size, By Type, 2014–2022 (USD Million)

Table 54 India: Market Size, By Livestock, 2014–2022 (USD Million)

Table 55 Japan: Market Size, By Type, 2014–2022 (USD Million)

Table 56 Japan: Market Size, By Livestock, 2014–2022 (USD Million)

Table 57 Rest of Asia-Pacific: Market Size for Direct-Fed Microbials, By Type, 2014–2022 (USD Million)

Table 58 Rest of Asia-Pacific: Market Size, By Livestock, 2014–2022 (USD Million)

Table 59 RoW: Direct-Fed Microbials Market Size, By Country, 2014–2022 (USD Million)

Table 60 RoW: Market Size, By Type, 2014–2022 (USD Million)

Table 61 RoW: Market Size, By Livestock, 2014–2022 (USD Million)

Table 62 RoW: Market Size, By Form, 2014–2022 (USD Million)

Table 63 Latin America: Market Size for Direct-Fed Microbials, By Type, 2014–2022 (USD Million)

Table 64 Latin America: Market Size, By Livestock, 2014–2022 (USD Million)

Table 65 MEA: Direct-Fed Microbials Market Size, By Type, 2014–2022 (USD Million)

Table 66 MEA: Market Size, By Livestock, 2014–2022 (USD Million)

Table 67 Expansions & Investments, 2011–2016

Table 68 Mergers & Acquisitions, 2011–2016

Table 69 New Product Launches, 2011–2016

Table 70 Agreements, Partnerships, Collaborations, and Joint Ventures, 2011–2016

Table 71 Expansions & Investments, 2011–2016

Table 72 Mergers & Acquisitions, 2011–2016

List of Figures (47 Figures)

Figure 1 Market Segmentation

Figure 2 Research Design

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Data Triangulation

Figure 6 Direct-Fed Microbials Market Size, By Livestock, 2016 vs 2022 (USD Million)

Figure 7 Lactic Acid Bacteria Projected to Account for the Largest Share of this Market From 2016 to 2022

Figure 8 Dry Form is Projected to Dominate the Global Market Through 2022

Figure 9 North America Accounted for the Largest Market Share for Direct-Fed Microbials in 2015

Figure 10 Direct-Fed Microbials Market: an Emerging Market With Promising Growth Potential, 2016-2022

Figure 11 Poultry Accounted for the Largest Share in this Market, 2016-2022

Figure 12 Direct-Fed Microbials Market in North America is Experiencing High Growth

Figure 13 Lactic Acid Bacteria is Expected to Dominate the Market Throughout the Forecast Period

Figure 14 Germany is Projected to Be Fastest-Growing Market, 2016-2022

Figure 15 Europe Accounted for the Largest Share in the Form Segment of the Direct-Fed Microbials Market in 2015

Figure 16 Population Growth Trend, 1961-2050

Figure 17 Global Ruminants Population, 2000-2015, Billion Heads

Figure 18 Direct-Fed Microbials Market, By Type

Figure 19 Market, By Form

Figure 20 Market, By Livestock

Figure 21 Market, By Region

Figure 22 Market Dynamics Snapshot

Figure 23 Strain Development and Marketing and Sales Play A Vital Role in the Supply Chain of Direct-Fed Microbials in Animal Feed

Figure 24 Direct-Fed Microbials Market: Porter’s Five Forces Analysis

Figure 25 Lactic Acid Bacteria Segment to Be the Fastest-Growing By 2022

Figure 26 Direct-Fed Microbials Market Size, By Livestock, 2016-2022

Figure 27 Dry Segment to Dominate the Global Market Through 2022

Figure 28 U.S. Accounted for the Largest Share in the North American Direct-Fed Microbials Market

Figure 29 Europe: Direct-Fed Microbials Market Snapshot

Figure 30 Global Direct-Fed Microbials Company Rankings (2015)

Figure 31 Battle for Market Share: Expansions and Investments Was the Most Popular Growth Strategy

Figure 32 Expansions & Investments Fueled Growth and Innovation (2014–2016)

Figure 33 Archer Daniels Midland Company: Company Snapshot

Figure 34 Archer Daniels Midland Company: SWOT Analysis

Figure 35 E.I. Dupont De Nemours and Company: Company Snapshot

Figure 36 E. I. Du Pont De Nemours and Company: SWOT Analysis

Figure 37 Koninklijke DSM N.V.: Company Snapshot

Figure 38 Koninklijke DSM N.V.: SWOT Analysis

Figure 39 Novozymes: Company Snapshot

Figure 40 Novozymes: SWOT Analysis

Figure 41 Chr. Hansen A/S: Company Snapshot

Figure 42 Chr. Hansen A/S: SWOT Analysis

Figure 43 Kemin Industries, Inc.: Company Snapshot

Figure 44 Biomin Holding GmbH: Company Snapshot

Figure 45 Lallemand Inc.: Company Snapshot

Figure 46 Novus International, Inc.: Company Snapshot

Figure 47 Bio-Vet.: Company Snapshot

Growth opportunities and latent adjacency in Direct-fed Microbials (DFM) Market