Air Conditioning Market by Technology (Manual/Semi-Automatic and Automatic),Component (Compressor, Evaporator, Drier/Receiver, and Condenser, Vehicle Type (PC, LCV, HCV, Off-Highway and Locomotive), and by Region - Global Trend and Forecast to 2020

[153 Pages Report] The increasing demand for technologies to reduce carbon dioxide emissions and preserve the environment, has meant that companies are now developing air conditioning systems that are more efficient and environment friendly. The new air conditioning systems would reduce the compressor's power consumption by 25 per cent, compared to conventional air conditioning systems, and thus contribute to fuel savings. One of the key factors is growing customer expectation for better cooling. In Off-Highway vehicles, tractors are gaining traction in the air conditioning market. The demand for air conditioning in off-highway application has gone up due to the need for comfort in harsh operating conditions. This will act as a catalyst in increasing operator efficiency. However there is one major constraint that affects the application of automotive air conditioning in off-highway vehicles i.e. the space available for the installation of the system. Various OEMs are engaged in developing lighter, efficient and smaller automotive air conditioning systems that would fit easily in off-highway vehicles.

The air conditioning market is projected to grow at a CAGR of 6.69% from 2015 to 2020 to reach USD 24.28 Billion by 2020.

The air conditioning systems are an integral part of the passenger car and also an important comfort feature which influences the customer’s purchasing behaviour. Technological advancement has made it possible for us to use a fully automatic air conditioning system at a lesser cost. Today, almost all the vehicles that are manufactured are equipped with an air conditioning system. Thus there is a tough competition between automakers to provide enhanced comfort. This competition has increased pressure on the OEMs to deliver technologically advanced automotive air conditioning systems. Asia-Pacific is estimated to dominate the market, which is the largest vehicle manufacturing region. The market for locomotive air conditioning in the Asia-Pacific region will grow at the fastest rate, owing to the strong rail networks in India and China. Agricultural tractors are projected to lead the global off-highway air conditioning market followed by construction equipment in 2015.

The automotive air conditioning market comprises of a limited number of players, who have a strong position at the global level. Market players have adopted several strategies such as new product development and launches, regional expansions, acquisitions, mergers, partnerships, and collaborations to grow in the market. Some of the key players dominating the air conditioning market include Denso Corporation (Japan), Hanon Systems (South Korea), Keihin Corporation (Japan), MAHLE GmBH (Germany), and Calsonic Kansei Corporation (Japan) among others.

Scope of the report

The automotive air conditioning market has been broadly categorized into the following segments and sub-segments:

- By Technology

- Manual/Semi-automatic Air conditioning

- Automatic air conditioning

- By component

- Compressor

- Evaporator

- Drier/Receiver

- Condenser

- By Vehicle Type

- Passenger cars

- LCVs

- HCVs

- Locomotive Air conditioning System Market

- By Type

- Diesel Locomotive

- Electric Locomotive

- By Type

- Off-Highway Air conditioning Market

- Construction Equipment

- Agricultural Tractors

- By Region

- Asia-Oceania

- North America

- Europe

- RoW

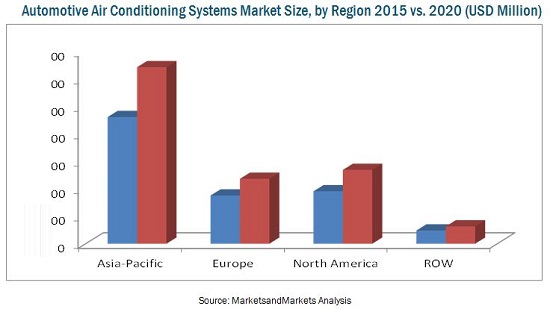

The global market in terms of value is projected to grow at a CAGR of 6.69% from 2015 to 2020, during the forecast period. The market for automotive air conditioning systems in Asia-Pacific is estimated to grow at a CAGR of 6.86% from a value of USD 9.24 Billion in 2015 to USD 12.88 Billion by 2020. Owing to the increasing demand for vehicles in Asia-Pacific, this region has the highest value. The European automotive air conditioning systems market with a value of USD 3.52 billion in 2015 and is projected to grow to USD 4.74 billion by 2020.

The market for manual/semi-automatic air conditioning has attained maturity and is on the decline. The market for automatic air conditioning is at the growth stage. Air conditioning systems are one of the important aspects of the cabin experience. It not only provides cooling but also provides warm air required while driving in cold weather. The air conditioning market has seen a gradual progress in technology; soon the manual/semi-automatic operated air conditioning system will be replaced by fully automatic systems. The automatic air conditioning systems is expected to grow at a CAGR of 6.12% during the forecast period due technological advancement and advanced features.

The major components that have been considered in this report are compressor, evaporator, drier/receiver and condenser. The market for the automotive air conditioning components is growing at almost similar CAGR in which evaporators are growing at a highest CAGR of 6.84% during the forecast period. On the other hand, driers/receivers and condensers are growing at a CAGR of 6.80% and 6.76% respectively, from 2015to 2020.

A rise in automobile production and higher requirements of consumers for comfort will drive the automotive air conditioning market. Key drivers for the automotive air conditioning systems are increasing demand for vehicles, coupled with rising per capita income, and advancing technology. Some of the key players dominating the automotive air conditioning market include Denso Corporation (Japan), Hanon Systems (South Korea), Keihin Corporation (Japan), MAHLE GmBH (Germany), and Calsonic Kansei Corporation (Japan)

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objective of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Market Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Package Size

1.6 Limitation

1.7 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.2 Secondary Data

2.2.1 Key Secondary Sources

2.2.2 Key Data From Secondary Sources

2.3 Primary Data

2.3.1 Sampling Techniques and Data Collection Methods

2.3.2 Primary Participants

2.3.2.1 Key Industry Insights

2.4 Factor Analysis

2.4.1 Introduction

2.4.2 Demand Side Analysis

2.4.2.1 Impact of GDP on Total Vehicle Sales

2.4.2.2 Urbanization vs Passenger Cars Per 1000 People

2.4.2.3 Infrastructure: Roadways

2.4.2.4 Increasing Vehicle Production in Developing Countries

2.4.3 Supply Side Analysis

2.4.3.1 Technological Advancements

2.5 Market Size Estimation

2.6 Data Triangulation

2.7 Assumptions

3 Executive Summary (Page No. - 31)

4 Premium Insight (Page No. - 36)

4.1 Opportunities in this Market

4.2 Regional Analysis for the Automotive Air Conditioning Systems Market, 2015 & 2020.

4.3 Automotive AC Systems Market, By Component 2015 & 2020.

4.4 Market, By Vehicle Type 2015-2020

4.5 Regional Analysis of Off Highway Air Conditioning Systems Market, 2015-2020

4.6 Automotive AC Systems Product Life Cycle

4.7 Who Supplies to Whom

5 Market Overview (Page No. - 40)

5.1 Introduction

5.2 Market Segmentation

5.2.1 Automotive Air Conditioning Systems Market, By Type

5.2.2 Market,By Vehicle Type

5.2.3 Market, By Region

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increasing Vehicle Production

5.3.1.2 Increasing Demand for Better Driving Comfort

5.3.2 Restraints

5.3.2.1 High Chance of Mechanical Failure

5.3.3 Opportunities

5.3.3.1 Comfort Features That are Easy on the Pocket

5.3.4 Challenges

5.3.4.1 High Maintenance Cost

5.3.5 Burning Issues

5.3.5.1 Environmental Effects of Refrigerants Used in Automotive Air Conditioning

5.4 Value Chain

5.5 Porter’s Five Forces Analysis

5.5.1 Threat of New Entrants

5.5.2 Threat of Substitutes

5.5.3 Bargaining Power of Suppliers

5.5.4 Bargaining Power of Buyers

5.5.5 Intensity of Competitive Rivalry

6 Technological Overview (Page No. - 51)

6.1 Denso’s First Standardised Hvac Unit for Wide Variety of Vehicle Lines & Models

6.2 Halla Visteon’s Centrifugal Air Compressor

6.3 Integrated Front & Rear Hvac Units By Delphi Thermal

6.4 New Hvac System By Delphi Will Increase Ev/Hev Range With Reduction in Co2 Emissions

6.5 Innovative Water-Cooled Condenser for Hvac System By Valeo SA

6.6 Greener Hvac System By Valeo SA

6.7 New Refrigerant R-1234yf for Automotive Air Conditioning Systems

6.8 Air Conditioning Technologies for Off-Highway Application

7 Automotive Air Conditioning Market, By Technology (Page No. - 54)

7.1 Introduction

7.2 Air Conditioning Market, By Type

7.3 Market, By Region

7.4 Manual/Semi-Automatic Air Conditioning Market, By Region

7.5 Air Conditioning Market, By Climate Zone Type

7.5.1 Single Zone Automatic AC Market, By Region

7.5.2 Multizone Automatic AC Market, By Region

8 Automotive Air Conditioning Market, By Component (Page No. - 62)

8.1 Introduction

8.2 Automotive Air Conditioning Compressors Market, By Region

8.3 Automotive Air Conditioning Evaporator Market, By Region

8.4 Automotive Air Conditioning Drier/Receiver Market, By Region

8.5 Automotive Air Conditioning Condenser Market, By Region

9 Automotive Air Conditioing Type, By Vehicle Type (Page No. - 67)

9.1 Introduction

9.2 Passenger Car

9.2.1 Asia-Pacific

9.2.2 Europe

9.2.3 North America

9.2.4 RoW

9.3 LCV

9.3.1 Asia-Pacific

9.3.2 Europe

9.3.3 North America

9.3.4 RoW

9.4 HCV

9.4.1 Asia-Pacific

9.4.2 Europe

9.4.3 North America

9.4.4 RoW

10 Automotive Air Conditioning Market, By Region (Page No. - 80)

10.1 Pest Analysis

10.1.1 Political Factors

10.1.1.1 Europe

10.1.1.2 Asia-Pacific

10.1.1.3 North America

10.1.1.4 Rest of the World

10.1.2 Economic Factors

10.1.2.1 Europe

10.1.2.2 Asia-Pacific

10.1.2.3 North America

10.1.2.4 Rest of the World

10.1.3 Social Factors

10.1.3.1 Europe

10.1.3.2 Asia-Pacific

10.1.3.3 North America

10.1.3.4 Rest of the World

10.1.4 Technological Factors

10.1.4.1 Europe

10.1.4.2 Asia-Pacific

10.1.4.3 North America

10.1.4.4 Rest of the World

10.2 Automotive Air Coditionng Market, By Region

10.3 Asia-Pacific

10.3.1 China

10.3.2 Japan

10.3.3 South Korea

10.3.4 India

10.4 Europe

10.4.1 Germany

10.4.2 France

10.4.3 U.K.

10.4.4 Spain

10.5 North America

10.5.1 U.S.

10.5.2 Canada

10.5.3 Mexico

10.6 RoW

10.6.1 Brazil

10.6.2 Russia

11 Conditioning Systems Market for Off-Highway (Page No. - 98)

11.1 Introduction

11.2 Off-Highway Air Conditioning Market, By Region

11.3 Construction Vehicle Air Conditioning Market, By Region

11.4 Tractor Air Conditioning in Market, By Region

12 Locomotive Air Conditioning Market (Page No. - 103)

12.1 Introduction

12.2 Locomotive AC Market, By Region

12.3 Diesel Locomotive AC Market, By Region

12.4 Electric Locomotive AC Market, By Region

13 Competitive Landscape (Page No. - 107)

13.1 Market Share Analysis: Automotive Air Conditioning Systems Market

13.2 Competitive Situation &Trends

13.3 Expansions

13.4 Agreements/Joint Ventures/Supply Contracts/Partnerships

13.5 Mergers & Acquisition

13.6 New Product Launches/Development

14 Company Profiles (Page No. - 117)

14.1 Introduction

14.2 Denso Corporation

14.2.1 Business Overview

14.2.2 Products Offered

14.2.3 Recent Developments

14.2.4 SWOT Analysis

14.2.5 MnM View

14.3 Hanon Systems

14.3.1 Business Overview

14.3.2 Products

14.3.3 Recent Developments

14.3.4 SWOT Analysis

14.3.5 MnM View

14.4 Mahle GmbH

14.4.1 Business Overview

14.4.2 Products and Services

14.4.3 Recent Developments

14.4.4 SWOT Analysis

14.4.5 MnM View

14.5 Keihin Corporation

14.5.1 Business Overview

14.5.2 Products

14.5.3 Recent Developments

14.5.4 SWOT Analysis

14.5.5 MnM View

14.6 Valeo SA

14.6.1 Business Overview

14.6.2 Products and Services

14.6.3 SWOT Analysis

14.6.4 Recent Developments

14.6.5 MnM View

14.7 Eberspächer Group

14.7.1 Business Overview

14.7.2 Products and Services

14.7.3 Recent Developments

14.7.4 MnM View

14.8 Calsonic Kansei Corporation

14.8.1 Business Overview

14.8.2 Products and Services

14.8.3 Recent Developments

14.8.4 MnM View

14.9 Sanden Holdings Corporation

14.9.1 Business Overview

14.9.2 Products and Services

14.9.3 Recent Developments

14.9.4 MnM View

14.10 Mitsubishi Heavy Industries Ltd.

14.10.1 Business Overview

14.10.2 Products and Services

14.10.3 Recent Developments

14.10.4 MnM View

14.11 Subros Limited

14.11.1 Business Overview

14.11.2 Products & Services

14.11.3 Recent Developments

14.11.4 MnM View

15 Appendix (Page No. - 151)

15.1 Insights of Industry Experts

15.2 Discussion Guide

15.3 Available Customization

15.3.1 Automotive Compressors Market

15.3.1.1 Fixed Displacement

15.3.1.2 Variable Displacement

15.4 Introducing Rt:Real Time Market Intelligence

15.5 Related Reports

List of Tables (95 Tables)

Table 1 Impact of Drivers on the Automotive Air Conditoning Systems Market

Table 2 Air Conditioning Market, By Type (‘000 Units)

Table 3 Market, By Type (USD Million)

Table 4 Automatic AC Market, By Region (‘000 Units)

Table 5 Market, By Region (USD Million)

Table 6 Manual/Semi-Automatic Air Conditioning Market, By Region (‘000 Units)

Table 7 Manual/Semi-Automatic AC Market, By Region (USD Million)

Table 8 Air Conditioning Market, By Climate Zone Type (‘000 Units)

Table 9 Market, By Climate Zone (USD Million)

Table 10 Single Zone Automatic Air Conditioning Market, By Region (‘000 Units)

Table 11 Single Zone Automatic AC Market, By Region (USD Million)

Table 12 Multi-Zone Automatic Air Conditioning Market, By Region (‘000 Units)

Table 13 Multi-Zone Automatic AC Market, By Region (USD Million)

Table 14 Automotive Air Conditioning Compressors Market, By Region (‘000 Units)

Table 15 Automotive Air Conditioning Compressors Market, By Region (USD Million)

Table 16 Automotive Air Conditioning Evaporator Market, By Region (‘000 Units)

Table 17 Automotive Air Conditioning Evaporator Market, By Region (USD Million)

Table 18 Automotive Air Conditioning Drier/Receiver Market, By Region (‘000 Units)

Table 19 Automotive Air Conditioning Drier/Receiver Market, By Region (USD Million)

Table 20 Automotive Air Conditioning Condenser Market, By Region (‘000 Units)

Table 21 Automotive Air Conditioning Condenser Market, By Region (USD Million)

Table 22 Global Passenger Car Air Conditioning Market, By Type (‘000 Units)

Table 23 Global Passenger Car AC Market, By Type (USD Million)

Table 24 Asia-Pacific Passenger Car Air Conditioning Market, By Type (‘000 Units)

Table 25 Asia-Pacific Passenger Car AC Market, By Type (USD Million)

Table 26 Europe Passenger Car Air Conditioning Market, By Type (‘000 Units)

Table 27 Europe Passenger Car AC Market, By Type (USD Million)

Table 28 North America Passenger Car Air Conditioning Market, By Type (‘000 Units)

Table 29 North America Passenger Car AC Market, By Type (USD Million)

Table 30 RoW Passenger Car AC Market, By Type (‘000 Units)

Table 31 RoW Passenger Car AC Market, By Type (USD Million)

Table 32 Global LCV Air Conditioning Market, By Type (‘000 Units)

Table 33 Global LCV AC Market, By Type (USD Million)

Table 34 Asia-Pacific LCV AC Market, By Type (‘000 Units)

Table 35 Asia-Pacific LCV AC Market, By Type (USD Million)

Table 36 Europe LCV AC Market, By Type (‘000 Units)

Table 37 Europe LCV AC Market, By Type (USD Million)

Table 38 North America LCV Air Conditioning Market, By Type (‘000 Units)

Table 39 North America LCV AC Market, By Type (USD Million)

Table 40 RoW LCV AC Market, By Type (‘000 Units)

Table 41 RoW LCV AC Market, By Type (USD Million)

Table 42 Global HCV Air Conditioning Market, By Type (‘000 Units)

Table 43 Global HCV AC Market, By Type (USD Million)

Table 44 Asia-Pacific HCV Air Conditioning Market, By Type (‘000 Units)

Table 45 Asia-Pacific HCV AC Market, By Type (USD Million)

Table 46 Europe HCV AC Market, By Type (‘000 Units)

Table 47 Europe HCV AC Market, By Type (USD Million)

Table 48 North America HCV Air Conditioning Market, By Type (‘000 Units)

Table 49 North America HCV AC Market, By Type (USD Million)

Table 50 RoW HCV AC Market, By Type (‘000 Units)

Table 51 RoW HCV AC Market, By Type (USD Million)

Table 52 Automotive Air Conditioning Market, By Region (‘000 Units)

Table 53 Automotive AC Market, By Region (USD Million)

Table 54 China: AC Market, By Vehicle Type (‘000 Units)

Table 55 China: Market, By Vehicle Type (USD Million)

Table 56 Japan: Air Conditioning Market, By Vehicle Type (‘000 Units)

Table 57 Japan: Market, By Vehicle Type (USD Million)

Table 58 South Korea: AC Market, By Vehicle Type (‘000 Units)

Table 59 South Korea: Market, By Vehicle Type (USD Million)

Table 60 India: Air Conditioning Market, By Vehicle Type (‘000 Units)

Table 61 India: Market, By Vehicle Type (USD Million)

Table 62 Germany: Air Conditioning Market, By Vehicle Type (‘000 Units)

Table 63 Germany: Market, By Vehicle Type (USD Million)

Table 64 France: Air Conditioning Market, By Vehicle Type (‘000 Units)

Table 65 France: Market, By Vehicle Type (USD Million)

Table 66 U.K.: Air Conditioning Market, By Vehicle Type (‘000 Units)

Table 67 U.K.: Market, By Vehicle Type (USD Million)

Table 68 Spain: Air Conditioning Market, By Vehicle Type (‘000 Units)

Table 69 Spain: Market, By Vehicle Type (USD Million)

Table 70 U.S.: Air Conditioning Market, By Vehicle Type (‘000 Units)

Table 71 U.S.: Market, By Vehicle Type (USD Million)

Table 72 Canada: Air Conditioning Market, By Vehicle Type (‘000 Units)

Table 73 Canada: Market, By Vehicle Type (USD Million)

Table 74 Mexico: Air Conditioning Market, By Vehicle Type (‘000 Units)

Table 75 Mexico: Market, By Vehicle Type (USD Million)

Table 76 Brazil: Air Conditioning Market, By Vehicle Type (‘000 Units)

Table 77 Brazil: Market, By Vehicle Type (USD Million)

Table 78 Russia: Air Conditioning Market, By Vehicle Type (‘000 Units)

Table 79 Russia: Market, By Vehicle Type (USD Million)

Table 80 Off-Highway AC Market, By Region ('000 Units)

Table 81 Off-Highway AC Market, By Region (USD Million)

Table 82 Construction Vehicles Air Conditioning in Market, By Region (‘000 Units)

Table 83 Construction Vehicles AC in Market, By Region (USD Million)

Table 84 Tractor AC Market, By Region (‘000 Units)

Table 85 Tractor AC Market, By Region (USD Million)

Table 86 Locomotive Air Conditioning Market, By Region (‘000 Units)

Table 87 Locomotive AC Market, By Region (USD Million)

Table 88 Diesel Locomotive AC Market, By Region (‘000 Units)

Table 89 Diesel Locomotive AC Market, By Region (USD Million)

Table 90 Electric Locomotive AC Market, By Region (‘000 Units)

Table 91 Electric Locomotive AC Market, By Region (USD Million)

Table 92 Expansions, 2010-2015

Table 93 Agreements/Joint Ventures/Supply Contracts/Partnerships, 2010–2015

Table 94 Mergers & Acquisition, 2014–2015

Table 95 New Product Launches/Development

List of Figures (57 Figures)

Figure 1 Air Conditioning Systems: Market Covered

Figure 2 Research Design

Figure 3 Research Methodology Model:

Figure 4 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 5 Gross Domestic Product (GDP) vs Total Vehicle Sales

Figure 6 Urbanization vs Passenger Cars Per 1,000 People

Figure 7 Vehicle Production 2010-2014

Figure 8 Market Size Estimation Methodology: Bottom Up Approach

Figure 9 Market Size Estimation Methodology: Top Down Approach

Figure 10 LCV is Fastest Growing Segment in Automotive AC Market, By Value 2015 to 2020

Figure 11 Automotive AC Market, By Type 2015-2020

Figure 12 Evaporator Projected to Be the Fastest Growing Component for Automotive AC Market From 2015-2020

Figure 13 North America Projected to Be the Fatest Growing Market for Automotive Air Conditioning From 2015to 2020

Figure 14 Asia-Pacific Dominates the Off-Highway AC Market, By Value 2015 to 2020

Figure 15 Increasing Vehicle Production to Drive the Market for Automotive AC Systems Market

Figure 16 Global Vehicle Production, 2012–2020

Figure 17 Value Chain Analysis: Major Value is Added During the Manufacturing and Assembly Phases

Figure 18 Porter’s Five Force Analysis (2015): Automotive Air Conditoning Systems Market:

Figure 19 Climate Control Unit

Figure 20 Manual/Semi-Automatic Type of Air Conditioning has the Largest Market Share in 2015

Figure 21 Asia-Pacific Region Will Have the Highest Share in 2015

Figure 22 Multi-Zone Automatic AC Market Will Retain the Largest Share in 2020

Figure 23 Asia-Pacific Region has the Fastest CAGR From 2015 to 2020

Figure 24 North American Region Will Witness the Fastest Growth

Figure 25 Asia-Pacific Will Have the Largest Market Share in 2020 for the Automotive Air Conditioning Condenser Market

Figure 26 Automatic AC System Will Lead the Market in 2020

Figure 27 LCV Automatic AC Market Will Have the Fastest CAGR From 2015-2020

Figure 28 The Market Share for HCVs With Automatic AC Systems Will Increase By 2020

Figure 29 Regional Snapshot: Rapid Growing Markets (China) Emerging as New Hotspots

Figure 30 China Estimated to Lead the Asia-Pacific Automotive AC Market

Figure 31 U.S. to Dominate the North American Automotive AC Market

Figure 32 Asia-Pacific has the Largest Market Share in 2015

Figure 33 Asia-Pacific Region to Have the Fastest CAGR From 2015-2020

Figure 34 Asia-Pacific Region is Expected to Have the Largest Share in Global Tractor AC Market in 2020

Figure 35 Asia-Pacific Region has the Largest Share in 2020

Figure 36 Companies Have Adopted Expansions as the Key Growth Strategy Over 2010-2015

Figure 37 Automotive AC Systems Market, 2014

Figure 38 Market Evaluation Frame Work: Expansions has Fuelled the Demand for Automotive AC Systems Market

Figure 39 Hanon Systems Grew at the Fastest Rate Between 2010 and 2014

Figure 40 Battle for Market Share: Expansion Was the Key Strategy

Figure 41 Region-Wise Revenue Mix of Top Five Market Players

Figure 42 Competitive Benchmarking of Key Market Players

Figure 43 Denso Corporation: Business Overview

Figure 44 Denso Corporation: SWOT Analysis

Figure 45 Hanon Systems : Business Overview

Figure 46 Hanon Systems: SWOT Analysis

Figure 47 Mahle GmbH: Company Snapshot

Figure 48 Mahle GmbH: SWOT Analysis

Figure 49 Keihin Corporation : Business Overview

Figure 50 Keihin Corporation: SWOT Analysis

Figure 51 Valeo: Company Snapshot

Figure 52 Valeo SA: SWOT Analysis

Figure 53 Eberspächer Group: Company Snapshot

Figure 54 Calsonic Kansei Corporation: Company Snapshot

Figure 55 Sanden Holdings Corporation: Company Snapshot

Figure 56 Mitsubishi Heavy Industries Ltd: Business Overview

Figure 57 Subros Limited: Company Snapshot

Growth opportunities and latent adjacency in Air Conditioning Market