HVAC Controls Market Size, Share and Analysis, 2025 To 2030

HVAC Controls Market by Component (Sensor, Control Valve, Heating & Cooling Coil, Damper, Actuator, Smart Vent, Controller, Thermostat, Pump), Control Type (Manual, Smart), System (Temperature, Ventilation, Humidity, Integrated) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The HVAC Controls market is projected to reach USD 39.07 billion by 2030 from USD billion 25.81 in 2025, at a CAGR of 8.6% from 2025 to 2030. The HVAC controls refers to systems and components that regulate heating, ventilation, and air conditioning operations to optimize indoor climate, energy efficiency, and comfort.

KEY TAKEAWAYS

- Asia Pacific HVAC Controls market accounted for a 36.8% revenue share in 2024.

- By Component, the sensors segment is projected to grow at the highest CAGR of 10.6%.

- By Control Type, the smart and automated controls segment is expected to register the highest CAGR of 9.3%.

- By System, temperature control system is expected to dominate the market growing at the CAGR of 8.8%.

- By Implementation Type, the new construction is expected to grow at the highest CAGR of 10.2%.

- By End User, the commercial segment will grow the fastest at 9.5% during the forecast period.

- Johnson Controls, Honeywell International Inc., and Siemens were identified as some of the star players in the HVAC Controls Market (global), given their strong market share and product footprint.

- Azbil Corporation, Regin Controls, and Computrols, Inc. among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

The HVAC Controls Market is projected to grow rapidly over the next decade, driven by the growing demand for energy-efficient and smart building solutions, along with stricter government regulations on energy consumption and emissions. Rising urbanization and the expansion of commercial and residential infrastructure are accelerating the adoption of automated climate control systems. Additionally, advancements in IoT, AI, and wireless communication technologies are enabling real-time monitoring, predictive maintenance, and enhanced comfort, further propelling market growth.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

HVAC controls is expected to bring new revenue sources for the providers of supply chain solutions. While several companies are still slow to cash in on opportunities in the market, a few have already engaged in R&D.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growing number of smart homes

-

Rising emphasis on adopting energy-efficient systems

Level

-

High costs associated with implementing HVAC control systems

-

Shortage of skilled professionals

Level

-

Integration of cloud computing and IoT in HVAC systems

-

Integration of smart devices with HVAC systems

Level

-

Complexities associated with upgrading HVAC systems

-

Insufficient awareness of HVAC standards among contractors

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growing number of smart homes

Smart building technologies, such as building automation, are increasingly adopted to automate processes, improve HVAC system efficiency, eliminate energy wastage, and reduce costs. Post-COVID-19, as organizations resume office operations, the high energy consumption of conventional HVAC systems and lighting in large office spaces has led to a focus on cost reduction. Companies are adopting smart building automation technologies that detect occupancy in specific areas, allowing HVAC and lighting systems to operate only in occupied spaces. This targeted approach significantly reduces energy usage and operational costs.

Restraint: High costs associated with implementing HVAC control systems

Investing in a new HVAC system is a significant decision for residential buyers, as the cost is spread over the system's lifespan. Upgrading and developing innovative HVAC control systems demand substantial capital, creating entry barriers for small and mid-sized enterprises (SMEs) in the HVAC controls market. HVAC systems require precise fine-tuning and custom fabrication during installation to ensure efficient operation and prevent failures, necessitating professional expertise. Improper installation by unskilled personnel can lead to inefficiencies, increased operational costs, and potential repair expenses over time. The need for skilled labor further adds to the overall installation cost, potentially deterring adoption.

Opportunity: Integration of cloud computing and IoT in HVAC systems

The adoption of cloud computing has revolutionized various industries, including HVAC, by offering advanced artificial intelligence (AI) capabilities for diverse applications. In HVAC systems, contractors often manage data such as HVAC loads, building equipment details, proposals, and maintenance records, which are typically stored across disconnected systems. Manually gathering this data increases the risk of data loss and confusion. Cloud computing addresses these challenges by providing a unified platform accessible to all stakeholders involved in a project. It streamlines the sharing updated project information, client requirements, equipment selection, and control decisions. Additionally, cloud platforms facilitate regulatory compliance, optimize the selection of energy-efficient HVAC systems, analyze HVAC loads, and maintain comprehensive sales and technician data for future reference.

Challenge: Complexities associated with upgrading HVAC systems

Governments worldwide have implemented policies and regulations to enhance the safety of older buildings and ensure their HVAC systems comply with environmental standards. However, upgrading these systems involves a detailed analysis of existing setups and meticulous planning to integrate modern HVAC controls, making the process highly complex, time-intensive, and expensive.

HVAC Controls Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Implementation of Fr. Sauter AG’s smart actuator system at 52Nijmegen to achieve intelligent, decentralized HVAC control for enhanced energy management and automation. | Improved energy efficiency, reduced maintenance costs, and seamless real-time monitoring supporting sustainable building operations. |

|

Deployment of Eaton’s advanced power management system at Wagner Müller to enhance energy efficiency, power stability, and operational reliability in manufacturing operations. | Improved energy efficiency, minimized downtime, and ensured stable power distribution for cost-effective and reliable production. |

|

Implementation of Siemens’ integrated building automation system at Kantonsspital Baden to optimize HVAC, lighting, and energy management for a healthcare environment. | Improved energy efficiency, precise climate control, and real-time monitoring for sustainable and reliable hospital operations. |

|

NETR Inc. installed a ductless mini-split HVAC system with three comfort zones to provide efficient heating and cooling for an older condo lacking proper temperature control. | Enhanced comfort through zoned temperature control, improved air quality with humidity and filtration features, and year-round energy savings. |

|

Daikin implemented an advanced temperature control solution for a French intercity high-speed rail service by installing 10 VRV systems, an Intelligent Touch Manager, D-AHU Modular R+ with DX Coil, and SkyAir units to ensure optimal airflow and cooling in control rooms. | Prevented equipment overheating and malfunctions, ensured continuous and safe railway operations, and delivered high energy efficiency with reduced operational costs. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

This section describes the HVAC Controls market ecosystem, the adoption of HVAC controls across diverse industries, and the impact of emerging technologies on them. HVAC finds applications across various industries, facilitating the development of efficient end-to-end ecosystems. These industries include residential, commercial, and industrial. The HVAC controls market ecosystem encompasses multiple companies operating in different stages, such as Honeywell International Inc. (US), Johnson Controls (Ireland), Siemens (Germany), Emerson Electric Co. (US), and Schneider Electric (France).

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

HVAC Controls Market, By Component

Controllers and Controlled Equipment accounted for the largest share of the overall market in 2024, and the trend is expected to continue during the forecast period. The segment is driven by the rising need for efficient and accurate temperature, humidity, and airflow regulation in modern HVAC systems. These components play a vital role in optimizing energy use and maintaining consistent indoor comfort across commercial, residential, and industrial spaces. Growing adoption of advanced digital controllers, sensors, and actuators—alongside integration with building management systems (BMS)—is enhancing automation and energy savings, fueling strong market demand.

HVAC Controls Market, By Control Type

The Smart and Automated Controls segment is expected to lead the overall HVAC controls market during the forecast period, due to the increasing integration of IoT, AI, and cloud-based technologies that enable real-time monitoring, remote control, and predictive maintenance of HVAC systems. These intelligent solutions enhance operational efficiency, lower energy consumption, and improve user comfort. The shift toward smart buildings and sustainability initiatives worldwide is further driving the demand for automated HVAC controls.

HVAC Controls Market, By System

The Temperature Control Systems segment is expected to lead the overall HVAC controls market during the forecast period, as end users prioritize comfort and energy optimization in residential, commercial, and industrial environments. These systems use advanced thermostats, sensors, and variable-speed drives to maintain ideal temperatures with minimal energy waste. The growing adoption of smart thermostats and zoning systems, supported by regulatory incentives for energy conservation, continues to drive this segment’s growth globally.

HVAC Controls Market, By ImplementationType

The New Construction segment is expected to lead the overall HVAC controls market during the forecast period, due to rapid urbanization, rising investments in commercial complexes, and government-led green building initiatives. Builders are increasingly integrating HVAC control systems during construction to meet energy efficiency standards and sustainability goals. The demand for smart, connected building infrastructure further accelerates the adoption of advanced HVAC controls in new developments.

HVAC Controls Market, By End User

The Commercial segment is expected to grow at the highest rate during the forecast period, fueled by the need for energy-efficient solutions in offices, malls, hospitals, and educational institutions. Facility managers are adopting smart HVAC control systems to reduce operating costs, enhance occupant comfort, and comply with environmental regulations. Continuous modernization of commercial infrastructure and focus on sustainability are key factors supporting growth in this segment.

REGION

Asia Pacific is expected to be the fastest-growing region in the global HVAC Controls market during the forecast period.

The Asia Pacific region is expected to lead the HVAC Controls market, expanding to the highest CAGR during the forecast period. The market is driven due to booming construction activities, expanding industrial base, and rising demand for energy-efficient climate control systems. Countries like China, Japan, and India are investing heavily in smart cities and green building projects, driving large-scale adoption of automated HVAC systems. Additionally, supportive government policies promoting energy conservation and technological advancements are strengthening regional market growth.

HVAC Controls Market: COMPANY EVALUATION MATRIX

In the HVAC Controls market matrix, Johnson Controls (Star) leads with a strong market presence and a wide product portfolio, driving large-scale adoption across industries like commercial, and residential. LG Electronics (Emerging Leader) is gaining traction with HVAC controls solutions.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2024 | USD 23.96 Billion |

| Revenue Forecast in 2030 | USD 39.07 Billion |

| Growth Rate | CAGR of 8.6% from 2025-2030 |

| Actual data | 2021-2030 |

| Base year | 2024 |

| Forecast period | 2025-2030 |

| Units considered | Value (USD Billion) and Volume (Million Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regional Scope | North America, Europe, Asia Pacific, the Middle East & Africa, and South America |

WHAT IS IN IT FOR YOU: HVAC Controls Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| US-based Building Automation Firm |

|

|

| Europe Green Building Developers |

|

|

| Asian Commercial Complex Operators |

|

|

| Middle East Infrastructure Developers |

|

|

| Asia Pacific Residential Solutions Provider |

|

|

RECENT DEVELOPMENTS

- October 2024 : Johnson Controls (Ireland) partnered with Neustadt municipality (Germany) to deliver Germany's first seawater heat pump, the SABROE DualPAC. This innovative system utilizes Baltic Sea water to generate up to 700 kW of green energy, contributing to the city's sustainable heat supply and serving as a model for energy transition efforts.

- August 2024 : Honeywell International Inc. (US) partnered with Cisco Systems, Inc. (US) to develop an AI-driven solution that dynamically adjusts building systems based on real-time occupancy data, aiming to reduce energy consumption and enhance occupant comfort.

- June 2024 : Danfoss (Denmark) partnered with Hewlett Packard Enterprise Development LP (US) to reduce energy consumption in data centers and repurpose excess heat. This partnership focuses on innovative solutions that improve energy efficiency and sustainability, enabling data centers to operate more effectively while contributing to circular energy systems.

- May 2024 : Lennox International Inc. (US) partnered with Samsung (South Korea) to focus on ductless heating and cooling solutions. This partnership combines Samsung's cutting-edge technology with Lennox's expertise in HVAC systems to deliver innovative, energy-efficient solutions for residential and commercial markets.

Table of Contents

Methodology

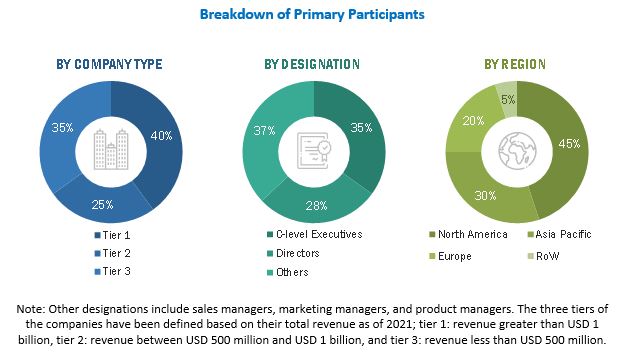

This research study involved the extensive use of secondary sources, directories, and databases such as Hoovers, Bloomberg, Businessweek, Factiva, and OneSource, to identify and collect information useful for a technical, market-oriented, and commercial study of the HVAC controls market. Primary sources were several experts from core and related industries and preferred suppliers, manufacturers, distributors, service providers, technology developers, and organizations related to all the segments of the value chain of the HVAC controls ecosystem.

In-depth interviews with various primary respondents such as key industry participants, subject matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, were conducted to obtain and verify critical qualitative and quantitative information as well as to assess future market prospects.

Secondary Research

Secondary sources referred to for this research study included corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers; certified publications; articles by recognized authors; directories; and databases. The secondary data was collected and analyzed to arrive at the overall market size, which was further validated through primary research.

List of Major Secondary Sources

|

Report Metric |

Details |

|

International Energy Agency (IEA) |

https://www.iea.org/ |

|

Japan Refrigeration and Air-conditioning Industry Association (JRAIA) |

https://www.jraia.or.jp/english/ |

|

American Society of Heating, Refrigerating, and Air Conditioning Engineers (ASHRAE) |

https://www.ashrae.org/ |

|

Air Conditioning Contractors of America Association (ACCA) |

|

|

Air-Conditioning, Heating, and Refrigeration Institute (AHRI) |

|

|

Representatives of European Heating and Ventilation Associations (REHVA) |

https://www.rehva.eu/ |

|

Eurovent |

https://eurovent.eu/ |

|

European Heat Pump Association (EHPA) |

https://www.ehpa.org/ |

Primary Research

Extensive primary research was conducted after gaining knowledge about the current scenario of the HVAC controls market through secondary research. Several primary interviews were conducted with experts from both demand and supply sides across four major regions—North America, Europe, Asia Pacific, and RoW. This primary data was collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the HVAC controls market and its various dependent submarkets. The key players in the market were identified through secondary research, and their market share in the respective regions was determined through primary and secondary research. This entire procedure involved the study of annual and financial reports of top players and extensive interviews with industry leaders such as chief executive officers (CEOs), vice presidents (VPs), directors, and marketing executives. All percentage shares and breakdowns were determined using secondary sources and verified through primary sources. All the possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Bottom-Up Approach

The bottom-up approach was used to arrive at the overall size of the HVAC controls market from the revenues of key players and their shares in the market. The overall market size was calculated based on the revenues of key players identified in the market.

- Analyzing the size of the global HVAC controls market by identifying segmental and subsegmental revenue related to the market

- Identifying the total number of HVAC control components shipped globally, which include various types of sensors, controllers, and controlled equipment

- Estimating the ASP of sensors, controllers, and controlled equipment

- Estimating the size of the HVAC controls market, by component (HVAC controls component shipment * ASP of HVAC control components)

- Estimating the market size of other segments of the HVAC controls market (system, implementation type, application, and region)

- Identifying the upcoming projects related to HVAC controls by various companies in different regions and forecasting the market size based on these developments and other important parameters.

Top-Down Approach

In the top-down approach, the overall size of the HVAC controls market that was derived through percentage splits obtained from secondary and primary research was used to estimate the size of the individual markets (mentioned in the market segmentation).

For the calculation of the size of specific market segments, the overall size of the HVAC controls market was considered to implement the top-down approach. The bottom-up approach was also implemented for the data extracted from secondary research to validate the obtained market size of different segments.

The market share of each company was estimated to verify the revenue share used earlier in the bottom-up approach. With the data triangulation procedure and validation of data through primaries, the sizes of the overall parent market and each market were determined and confirmed in this study. The data triangulation procedure used for this study is explained in the next section.

- Information related to revenues obtained from key manufacturers and providers of HVCA controls was studied and analyzed to estimate the global size of the HVAC controls market.

- The HVAC controls market is expected to observe a linear growth trend during the forecast period because it is a mature market with a number of well-established players serving various applications.

- Components, geographic presence, and key applications, as well as different types of systems of all identified players in the HVAC controls market, were studied to estimate and arrive at the percentage split of different segments of the market.

- All major players in each category of the HVAC controls market were identified through secondary research and duly verified through brief discussions with the industry experts.

- Multiple discussions with key opinion leaders of all major companies involved in the development of HVAC controls were conducted to validate the market split based on component, system, implementation type, application, and region.

- Geographic splits were estimated using secondary sources, based on various factors such as the number of players offering HVAC controls in a specific country or region and the type of HVAC control equipment offered by these players.

Data Triangulation

After arriving at the overall size of the HVAC controls market from the market size estimation process explained above, the total market was split into several segments and subsegments. Data triangulation procedures were employed wherever applicable to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both, demand and supply sides. In addition to this, the market size was validated using top-down and bottom-up approaches

Study Objectives

- To define and forecast the HVAC controls market size, by system, component, implementation type, and application, in terms of value and volume.

- To describe and forecast the HVAC controls market size for four key regions, namely, North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW), along with their respective countries

- To describe the types of control loops and control systems in an HVAC system

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the market

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market

- To study the complete value chain of the HVAC controls market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the HVAC control ecosystem

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies2, and provide details of the competitive landscape

- To analyze strategic approaches such as product launches, collaborations, contracts, acquisitions, agreements, expansions, and partnerships in the HVAC controls market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the HVAC Controls Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in HVAC Controls Market