Inoculants Market by Type (Agricultural Inoculants and Silage Inoculants), Microbe (Bacterial and Fungal), Crop Type (Cereals & Grains, Oilseeds & Pulses, Fruits & Vegetables, and Forage Crops), Form (Liquid and Dry) and Region - Global Forecast to 2027

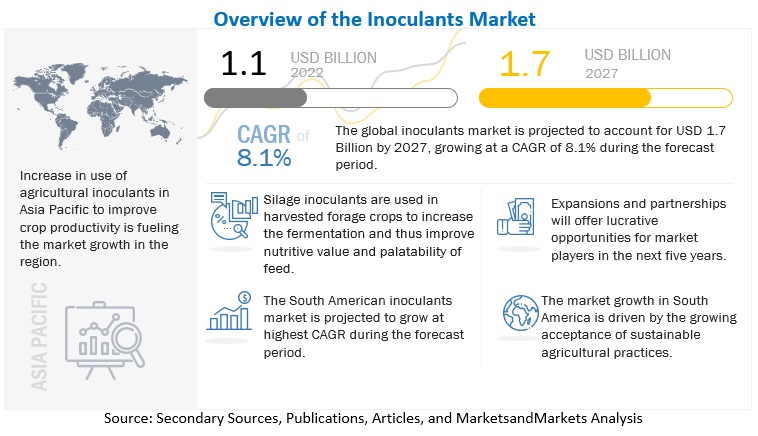

[274 Pages Report] According to MarketsandMarkets, the global inoculants market size is estimated to be valued at USD 1.1 billion in 2022. It is anticipated to reach USD 1.7 billion by 2027, recording a CAGR of 8.1% in value. The global demand for inoculants is increasing significantly due to the growing awareness among farmers about the various benefits offered by inoculants in increasing farm profitability. The ability of inoculants to improve the quality of soil and enhance the growth of crops has led to the growth of inoculants.

The inoculants market is projected to grow at a high rate due to factors such as increased demand for organic food products. The increase in global awareness about sustainable agriculture—which demands a step-by-step reduction in the cost of farming and meeting environmental safety norms—has resulted in an increase in the use of agricultural inoculants.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

Drivers: Shift in trend toward adoption of organic and environment-friendly farming practices

There has been a significant change in eating habits and preferences among people globally. Consumers are now more inclined toward their health, the nutrient content and the quality of the food they eat. Owing to these concerns, they have gradually begun shifting towards organic food, even though organic foods are priced higher than conventional foods. This awareness among consumers further boosts the organic market as consumers are willing to pay for them if it benefits their health and wellness. Due to this the area under organic farming is increasing globally. The need of organic inputs to improve crop productivity is growing at a robust rate fueling the growth of the inoculants market. There is increase in use of inoculants in farming to grow crop which have resistance towards abiotic stress. Moreover, governments of various developing economies such as India are supporting farmers to shift to organic and sustainable agricultural practices. This is projected to drive the global inoculants market.

Restraints: Limited awareness regarding both agricultural and silage inoculants

Most farmers are unaware of or have limited knowledge about agricultural inoculants and their usefulness in increasing cost-yield sustainability. In most regions, agricultural inoculants are perceived by farmers to have a gradual positive effect compared to chemical fertilizers. The acceptance of agricultural inoculants is very low in most countries, such as India, South Africa, and the Middle East. In these countries, agriculture is the major source of income for more than half of the country’s population; farmers are not willing to take risks regarding the production capacity. Thus, there has been very little acceptance of agricultural inoculants among farmers. According to the Institute of Management Development and Research (IMDR), in India, small retailers and shopkeepers are unwilling to stock and sell agricultural inoculants in the country as they feel their quality is unreliable. Awareness of inoculants, lack of availability, and slow results are the major problems farmers face in using agricultural inoculants. Therefore, unawareness about agricultural inoculants among farmers is a major hindrance to market growth. A similar case is seen with livestock farmers for silage inoculants.

Opportunities: Expansion of grassland pastures in South America

Land use for livestock production varies by country and can account for up to half of the total land area in continental regions. In Brazil, beef livestock is a major economic activity, with pasturelands amounting to about 2.5 times the area for other crops. According to the Brazilian Association of Meat Exporting Industries (ABIEC, Associação Brasileira de Indústrias Exportadoras de Carnes), considering the inputs, services, and revenue of the whole meat business chain, livestock was responsible for 10% of the Brazilian total Gross Domestic Product (GDP) in 2019. Brazil is the largest world beef exporter, with 2.2 million tons and 14.4% of the international market share. The land area occupied by grass pasture is far more than that of other crops. The use of elite plant growth-promoting microorganisms (PGPM) as inoculants represents an important strategy to achieve qualitative and quantitative improvements in forage biomass, increasing the productivity and sustainability of livestock production.

Challenges: Limited usage of inoculants worldwide

Despite the several advantages of microbial inoculant technology over the use of agrochemicals, its widespread utilization is limited globally. Microbial inoculants have been applied in the forms of liquids (as sprays, root dips, drenches) or as dry formulations with huge successes recorded, but most of these techniques are not practicable on a large scale. This is because a large amount is required for the optimum functionality of the inoculants. Plant growth-promoting microbes (PGPR) are highly selective and targeted, unlike chemical inputs that are broad-spectrum products. It only impacts a selected or targeted organism. Thus, results in the inconsistency of quality and efficacy under field conditions comprising various organisms acting simultaneously.

By type, agricultural inoculants is anticipated to grow at the higher CAGR during the study period

Agricultural inoculants help in fixing atmospheric nitrogen and mobilizing soil nutrients. Agricultural inoculants improve the quality of soil, enhance the growth of crops, and increase yield by improving the uptake of nutrients. They also increase the efficiency of crop protection chemicals and manures. These benefits offered by inoculants is forecasted to propel the global inoculants market. Moreover, the agricultural inoculants market is also anticipated to be driven by the rising food demand caused by rising populations.

By microbe, bacterial is forecasted to grow at the highest CAGR during the research period

Bacteria are used by both agricultural and silage inoculants. Among the bacterial microbes, rhizobacteria are utilized by agricultural inoculant manufacturers, while Lactobacillus is preferred by silage inoculants manufacturers. Key players such as BASF (Germany) and Novozymes A/S (Denmark) offer agricultural inoculants formulated with rhizobia. Apart from this, Kemin Industries (US) provides silage inoculants that contain a mixture of lactic acid bacteria. Thus, bacterial segment is projected to grow at highest CAGR during the inoculants market during the forecast period.

By crop type, oilseeds & pulses is projected to grow at the highest CAGR during the study period

Oilseeds are important cash crops in developing countries where they are grown abundantly. The most important crops in this category are soybean, canola, lentils, and beans. The global demand for soybean is increasing, as it is a rich source of protein for vegetarians. The demand for high-yielding and disease-resistant soybean seeds is also increasing, as it is a cash crop of premium value. Due to these factors, the oilseeds & pulses segment is anticipated to grow at highest CAGR, during the review period.

By form, liquid is forecasted to grow at the higher CAGR during the research period

Culture broths or formulations mostly made of water, minerals, or organic oils are used in liquid formulations. Before planting or transplanting, seeds and seedlings can be submerged in the inoculant. For the biocontrol of pathogens or physiological stimulation, they can also be sprayed directly onto the soil or dusted on the leaves of established plants. Liquid inoculants are simple to inoculate, and their application is very practical when used in irrigation or sprinkler systems. It is applied directly to crops without going through any other processes after fermentation. Ease in application is projected to foster the growth of liquid segment

To know about the assumptions considered for the study, download the pdf brochure

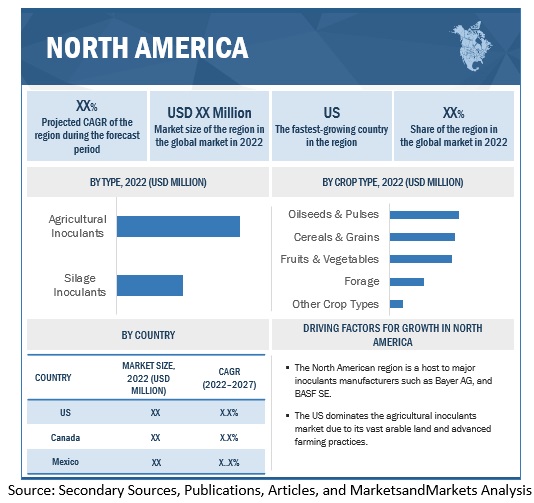

North America is projected to gain the largest market share in the global inoculants market. Due to the shrinking agriculture growth and public settlements, farmers are adopting new technologies to increase the productivity of soil and the yield of crops. The US dominates the agricultural inoculants market due to its vast arable land and advanced farming practices. In order to maintain the fertility of the soil, as well as the yield of the crop, farmers prefer opting for organic agricultural practices. This has increased the demand and consumption of agricultural inoculants in this region. ADM Animal Nutrition, Cargill, Agri King, Chr. Hansen Holding AS, and Corteva Agriscience are the major companies with a significant presence in North America.

Key Market Players:

Key players in this market include Corteva Agriscience (US), BASF SE (Germany), Bayer AG (Germany), Novozymes A/S (Denmark), Cargill, Incorporated (US), Archer Daniels Midland Company (US), DSM (Netherlands), Chr. Hansen Holding A/S (Denmark), Lallemand Inc. (Canada), Kemin Industries, Inc (US), Verdesian Life Sciences (US), BIO-CAT (US), Microbial Biological Fertilizers International (South Africa), Agrauxine (US), and Provita Supplements GmbH (Germany).

Scope of the Report

|

Report Metric |

Details |

|

Market size estimation |

2017–2027 |

|

Base year considered |

2021 |

|

Forecast period considered |

2022–2027 |

|

Units considered |

Value (USD) |

|

Segments covered |

Type, microbe, crop type, form, and region |

|

Regions covered |

North America, Europe, Asia Pacific, South America, and Rest of the world |

|

Companies studied |

|

Target Audience:

- Inoculants manufacturers

- Government and research organizations

- Suppliers and distributors of inoculants

- Marketing directors

- Key executives from various key companies and organizations in the inoculants market

Report Scope:

This research report categorizes the inoculants market based on type, microbe, crop type, form, and region.

By Type

- Agricultural inoculants

- Silage inoculants

By Microbe

- Bacterial

- Fungal

- Other microbes

By Crop Type

- Cereals & grains

- Oilseeds & pulses

- Fruits & vegetables

- Forage

- Other crop types

By Form

- Dry

- Liquid

Recent Developments

- In November 2022, Corteva Agriscience announced the acquisition of The Stoller Group, Inc., one of the largest independent biologicals companies in the industry. This acquisition would help the company with immediate scale and profitability, with EBITDA margins accretive to Corteva.

- In March 2022, BASF SE announced a collaboration with AMVAC Chemical Corp to develop a Rhizo-Flo soybean inoculant solution for SIMPAS-applied solutions.

- In September 2021, Novozymes A/S launched Optimize FXC to increase nitrogen fixation, accessibility to soil nutrients, and water absorption in soybean plants, thereby reducing the need for fertilizer.

Frequently Asked Questions (FAQ):

Which are the major types considered in this study, and which types are projected to have promising growth rates in the future?

The major types considered in this study are agricultural inoculants and silage inoculants. Agricultural inoculants segment is projected to have promising growth rates in the future.

I am interested in the Asia Pacific market for inoculants. Which countries are included in this region?

Exclusive insights on below Asia Pacific countries will be provided:

- China

- Japan

- India

- Australia & New Zealand

- Indonesia

- Rest of Asia Pacific (Malaysia, South Korea, and Vietnam)

What are some of the drivers fuelling the growth of the inoculants market?

Global inoculants market is characterized by the following drivers:

- Rise in environmental concerns with usage of synthetic fertilizers and pesticides

- Increase in feed grain and compound feed prices

I am interested in understanding the research methodology on how you arrived at the market size and segmental splits before making a purchase decision. Can you provide me with an explanation on the same?

Yes, detailed explanation of research methodology can be provided over a scheduled call, it will also enable us to explain all your queries in detail. For a brief overview and knowledge: Multiple approaches have been adopted to understand the holistic view of this market including:

- Bottom up approach

- Top down approach (Based on global market)

- Primary interviews with industry experts

- Data triangulation

What kind of information is provided in the competitive landscape section?

For the list of below-mentioned players, company profiles provide insights such as a business overview covering information on the company’s business segments, financials, geographic presence, revenue mix, and business revenue mix. The company profiles section also provides information on product offerings, key developments associated with the company, and MnM view to elaborate analyst view on the company. Some of the key players in the market include Corteva Agriscience (US), BASF SE (Germany), Bayer AG (Germany), Novozymes A/S (Denmark), Cargill, Incorporated (US), Archer Daniels Midland Company (US), DSM (Netherlands), Chr. Hansen Holding A/S (Denmark), and Lallemand Inc. (Canada), Kemin Industries, Inc (US).

To know about the assumptions considered for the study, download the pdf brochure

- 5.1 INTRODUCTION

-

5.2 MACROECONOMIC INDICATORSINCREASE IN DEMAND FOR MILK & MEAT PRODUCTS

-

5.3 MARKET DYNAMICSDRIVERS- Shift in trend toward adoption of organic and environment-friendly farming practices- Rise in environmental concerns with higher usage of synthetic fertilizers and pesticides- Increase in feed grain and compound feed prices- Expansion in livestock industry, owing to increased demand for animal-based productsRESTRAINTS- Limited awareness regarding both agricultural and silage inoculants- Shelf life of agricultural inoculantsOPPORTUNITIES- Expansion of grassland pastures in South America- South America: Key producer of soybean and key revenue generator for agricultural inoculantsCHALLENGES- Limited usage of inoculants worldwide- Silage losses due to fungi and mycotoxins

- 6.1 INTRODUCTION

-

6.2 VALUE CHAIN ANALYSISRESEARCH AND PRODUCT DEVELOPMENTSOURCINGPRODUCTION AND PROCESSINGPACKAGING & STORAGEMARKETING & SALES

- 6.3 SUPPLY CHAIN ANALYSIS

-

6.4 TECHNOLOGY ANALYSISBIOENCAPSULATION OF INOCULANTSBIOENCAPSULATED BACTERIABIOENCAPSULATED FUNGIBIOENCAPSULATION PROCESS

-

6.5 PRICE TREND ANALYSISAVERAGE SELLING PRICE, BY TYPE

-

6.6 MARKET MAPPING AND ECOSYSTEM ANALYSISSUPPLY-SIDE ANALYSISDEMAND-SIDE ANALYSIS

-

6.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.8 TRADE ANALYSIS

-

6.9 PATENT ANALYSIS

-

6.10 PORTER’S FIVE FORCES ANALYSISDEGREE OF COMPETITIONBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF SUBSTITUTESTHREAT OF NEW ENTRANTS

-

6.11 CASE STUDIES

- 6.12 KEY CONFERENCES AND EVENTS

- 6.13 TARIFF AND REGULATORY LANDSCAPE

-

6.14 REGULATORY FRAMEWORKNORTH AMERICA- US- CanadaEUROPEASIA PACIFIC- China- Australia & New Zealand- IndiaSOUTH AMERICA- Brazil

-

6.15 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 7.1 INTRODUCTION

-

7.2 AGRICULTURAL INOCULANTSPLANT GROWTH-PROMOTING MICROORGANISMS- PGPM to help improve crop productivity by enhancing nutrient uptake and soil quality improvementBIOCONTROL AGENTS- Increase in usage to suppress a broad spectrum of bacterial, fungal, and nematodal diseasesPLANT-RESISTANCE STIMULANTS- Stimulants to reduce water consumption, enhance appearance of crops, increase yield, and protect plants from diseases

-

7.3 SILAGE INOCULANTSHOMOFERMENTATIVE- Homofermentative inoculants to help in faster and more efficient fermentation producing mostly lactic acidHETEROFERMENTATIVE- Heterofermentative inoculants to aid in keeping silage from heating in warm weather

- 8.1 INTRODUCTION

-

8.2 BACTERIALBACTERIAL INOCULANTS TO REPLACE FERTILIZERS TO INCREASE CROP PRODUCTIVITYMODE OF ACTION- Nitrogen fixation- Phosphate solubilization- Sequestering iron- Modulating phytohormone levelsTYPES OF BACTERIAL SOURCES- Rhizobacteria- Phosphobacteria- Azotobacter- Lactobacillus- Pediococcus- Enterococcus- Other bacterial

-

8.3 FUNGALINOCULANTS TO RELEASE ENZYMES THAT HELP PLANTS BREAK DOWN NUTRIENTS INTO MORE EASILY UTILIZED FORMSTYPES OF FUNGAL SOURCES- Trichoderma spp.- Mycorrhiza- Other fungal

- 8.4 OTHER MICROBES

- 9.1 INTRODUCTION

-

9.2 CEREALS & GRAINSRISE IN DEMAND FOR CORN AND WHEAT TO FUEL MARKET

-

9.3 OILSEEDS & PULSESINCREASED DEMAND FOR SOYBEAN, CANOLA, PEAS, BEANS, AND OTHER LEGUME CROPS

-

9.4 FRUITS & VEGETABLESGREATER USE OF ORGANIC INPUTS FOR FRUIT & VEGETABLE PRODUCTION

-

9.5 FORAGEINOCULANTS TO IMPROVE SILAGE QUALITY BY FACILITATING ENSILING PROCESS

- 9.6 OTHER CROP TYPES

- 10.1 INTRODUCTION

-

10.2 DRYLOW PRICE AND EASY STORAGE PROPERTIES TO DRIVE DEMAND

-

10.3 LIQUIDEASE IN APPLICATION TO FOSTER SEGMENT GROWTH

- 11.1 INTRODUCTION

- 11.2 SEED TREATMENT

- 11.3 SOIL TREATMENT

- 11.4 OTHER MODES OF APPLICATION

- 12.1 INTRODUCTION

-

12.2 NORTH AMERICARECESSION IMPACT ANALYSISUS- US to be largest market for inoculants due to awareness of advantages and high silage productionCANADA- Increase in demand for meat and dairy products to contribute to market growthMEXICO- Advantages of inoculants in combating silage losses to offer high growth opportunities

-

12.3 EUROPERECESSION IMPACT ANALYSISGERMANY- Rise in demand for organic foods to drive marketFRANCE- Increase in growth of organic farmland area year-on-year to fuel marketUK- Continuous rise in sale of organic food products to foster marketRUSSIA- Increased focus on organic food and meat production to boost marketSPAIN- Ranked among top ten markets for organic productsITALY- Higher organic food consumption due to rise in health concernsDENMARK- Investments by government in organic farming to propel marketREST OF EUROPE

-

12.4 ASIA PACIFICRECESSION IMPACT ANALYSISCHINA- Increase in organic food market to drive demand for agricultural inoculantsINDIA- Growth in poultry industry to foster demand for silage inoculantsJAPAN- Significant demand for both agricultural and silage inoculants to make it fastest-growing Asia Pacific marketAUSTRALIA & NEW ZEALAND- Australia’s booming organic food industry and New Zealand’s dairy industry to drive demand for inoculantsINDONESIA- Growth in demand for meat to fuel demand for silage inoculantsREST OF ASIA PACIFIC

-

12.5 SOUTH AMERICARECESSION IMPACT ANALYSISBRAZIL- Demand for organic food products to lead to an increase in organic farming in regionARGENTINA- Increase in demand for organic products to fuel growthCHILE- Shift toward organic farming due to increasing demand from consumers and exports to propel marketREST OF SOUTH AMERICA

-

12.6 REST OF THE WORLD (ROW)RECESSION IMPACT ANALYSISMIDDLE EAST- Advancements in agricultural industry in Israel, Egypt, and Morocco to boost growthAFRICA- Rise in focus on production of cereals & grains to drive market

- 13.1 OVERVIEW

- 13.2 STRATEGIES ADOPTED BY KEY PLAYER

- 13.3 MARKET SHARE ANALYSIS

- 13.4 REVENUE SHARE ANALYSIS OF KEY PLAYERS

-

13.5 COMPANY EVALUATION QUADRANT (KEY PLAYERS)STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

- 13.6 PRODUCT FOOTPRINT

-

13.7 STARTUP/SME EVALUATION QUADRANT (OTHER PLAYERS)PROGRESSIVE COMPANIESSTARTING BLOCKSRESPONSIVE COMPANIESDYNAMIC COMPANIESCOMPETITIVE BENCHMARKING OF OTHER PLAYERS

-

13.8 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALSOTHERS

-

14.1 KEY COMPANIESCORTEVA AGRISCIENCE- Business overview- Products offered- Recent developments- MnM viewBASF SE- Business overview- Products offered- Recent developments- MnM viewBAYER AG- Business overview- Products offered- Recent developments- MnM viewNOVOZYMES A/S- Business overview- Products offered- Recent developments- MnM viewCARGILL, INCORPORATED- Business overview- Products offered- Recent developments- MnM viewARCHER DANIELS MIDLAND COMPANY (ADM)- Business overview- Products offered- Recent developments- MnM viewDSM- Business overview- Products offered- Recent developments- MnM viewCHR. HANSEN HOLDING A/S- Business overview- Products offered- Recent developments- MnM viewLALLEMAND INC.- Business overview- Products offered- Recent developments- MnM viewKEMIN INDUSTRIES, INC.- Business overview- Products offered- Recent developments- MnM viewVERDESIAN LIFE SCIENCES- Business overview- Products offered- Recent developments- MnM viewBIO-CAT- Business overview- Products offered- Recent developments- MnM viewMBFI- Business overview- Products offered- Recent developments- MnM viewAGRAUXINE- Business overview- Products offered- Recent developments- MnM viewPROVITA SUPPLEMENTS GMBH- Business overview- Products offered- Recent developments- MnM view

-

14.2 OTHER PLAYERSNEUGEN BIOLOGICALS PVT LTD- Business overview- Products offered- Recent developmentsPRECISION LABORATORIES, LLC- Business overview- Products offered- Recent developmentsQUEENSLAND AGRICULTURAL SEEDS- Business overview- Products offered- Recent developmentsXITEBIO TECHNOLOGIES INC.- Business overview- Products offered- Recent developmentsTERRAMAX, INC.- Business overview- Products offered- Recent developmentsSOIL TECHNOLOGIES CORPORATIONHORTICULTURAL ALLIANCE, LLC.AGRI LIFESTRONG MICROBIALSPRIONS BIO TECH

- 15.1 INTRODUCTION

- 15.2 STUDY LIMITATIONS

-

15.3 BIOSTIMULANTS MARKETMARKET DEFINITIONMARKET OVERVIEW

-

15.4 BIOFERTILIZERS MARKETMARKET DEFINITIONMARKET OVERVIEW

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES CONSIDERED, 2018–2021

- TABLE 2 INOCULANTS MARKET SNAPSHOT, 2022 VS. 2027

- TABLE 3 GLOBAL SOYBEAN PRODUCTION, DECEMBER 2022 (MILLION TONS)

- TABLE 4 AGRICULTURAL INOCULANTS: AVERAGE SELLING PRICE (ASP), BY REGION, 2020–2022 (USD/TON)

- TABLE 5 SILAGE INOCULANT: AVERAGE SELLING PRICE (ASP), BY REGION, 2020–2022 (USD/TON)

- TABLE 6 AVERAGE SELLING PRICES OF KEY MARKET PLAYERS, BY TYPE, 2021 (USD/TON)

- TABLE 7 INOCULANTS MARKET: SUPPLY CHAIN ECOSYSTEM

- TABLE 8 EXPORT VALUE OF SEAWEEDS AND OTHER ALGAE BIOSTIMULANTS, BY KEY COUNTRY, 2021 (USD)

- TABLE 9 IMPORT VALUE OF SEAWEEDS AND OTHER ALGAE BIOSTIMULANTS, BY KEY COUNTRY, 2021 (USD)

- TABLE 10 IMPORT VALUE OF AMINO ACIDS AND THEIR ESTERS, BY KEY COUNTRY, 2021 (USD)

- TABLE 11 EXPORT VALUE OF AMINO ACIDS AND THEIR ESTERS, BY KEY COUNTRY, 2021 (USD)

- TABLE 12 PATENTS PERTAINING TO INOCULANTS, 2012–2022

- TABLE 13 INOCULANTS MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 14 BASF SE LAUNCHED NODULAID FOR STIMULATING NODULATION

- TABLE 15 NOVOZYMES A/S INTRODUCED BIONIQ FOR CEREAL & CANOLA CROP INOCULATION

- TABLE 16 KEY CONFERENCES AND EVENTS IN INOCULANTS MARKET, 2023

- TABLE 17 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 SOUTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 ENVIRONMENTAL STUDY ISSUES TO BE CONSIDERED IN APPLICATION

- TABLE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE CROP TYPES

- TABLE 23 KEY CRITERIA FOR SELECTING SUPPLIERS/VENDORS

- TABLE 24 INOCULANTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 25 INOCULANTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 26 INOCULANTS MARKET, BY TYPE, 2017–2021 (KT)

- TABLE 27 INOCULANTS MARKET, BY TYPE, 2022–2027 (KT)

- TABLE 28 AGRICULTURAL INOCULANTS MARKET, BY SUBTYPE, 2017–2021 (USD MILLION)

- TABLE 29 AGRICULTURAL INOCULANTS MARKET, BY SUBTYPE, 2022–2027 (USD MILLION)

- TABLE 30 AGRICULTURAL INOCULANTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 31 AGRICULTURAL INOCULANTS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 32 AGRICULTURAL INOCULANTS MARKET, BY REGION, 2017–2021 (KT)

- TABLE 33 AGRICULTURAL INOCULANTS MARKET, BY REGION, 2022–2027 (KT)

- TABLE 34 SILAGE INOCULANTS MARKET, BY SUBTYPE, 2017–2021 (USD MILLION)

- TABLE 35 SILAGE INOCULANTS MARKET, BY SUBTYPE, 2022–2027 (USD MILLION)

- TABLE 36 SILAGE INOCULANTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 37 SILAGE INOCULANTS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 38 SILAGE INOCULANTS MARKET, BY REGION, 2017–2021 (KT)

- TABLE 39 SILAGE INOCULANTS MARKET, BY REGION, 2022–2027 (KT)

- TABLE 40 INOCULANTS MARKET, BY MICROBE, 2017–2021 (USD MILLION)

- TABLE 41 INOCULANTS MARKET, BY MICROBE, 2022–2027 (USD MILLION)

- TABLE 42 BACTERIAL INOCULANTS MARKET, BY SUBTYPE, 2017–2021 (USD MILLION)

- TABLE 43 BACTERIAL INOCULANTS MARKET, BY SUBTYPE, 2022–2027 (USD MILLION)

- TABLE 44 BACTERIAL INOCULANTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 45 BACTERIAL INOCULANTS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 46 FUNGAL INOCULANTS MARKET, BY SUBTYPE, 2017–2021 (USD MILLION)

- TABLE 47 FUNGAL INOCULANTS MARKET, BY SUBTYPE, 2022–2027 (USD MILLION)

- TABLE 48 FUNGAL INOCULANTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 49 FUNGAL INOCULANTS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 50 OTHER MICROBIAL INOCULANTS MARKET, BY SUBTYPE, 2017–2021 (USD MILLION)

- TABLE 51 OTHER MICROBIAL INOCULANTS MARKET, BY SUBTYPE, 2022–2027 (USD MILLION)

- TABLE 52 OTHER MICROBIAL INOCULANTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 53 OTHER MICROBIAL INOCULANTS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 54 INOCULANTS MARKET, BY CROP TYPE, 2017–2021 (USD MILLION)

- TABLE 55 INOCULANTS MARKET, BY CROP TYPE, 2022–2027 (USD MILLION)

- TABLE 56 CEREAL & GRAIN CROPS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 57 CEREAL & GRAIN CROPS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 58 OILSEED & PULSE CROPS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 59 OILSEED & PULSE CROPS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 60 FRUIT & VEGETABLE CROPS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 61 FRUIT & VEGETABLE CROPS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 62 FORAGE CROPS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 63 FORAGE CROPS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 64 OTHER CROP TYPES MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 65 OTHER CROP TYPES MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 66 INOCULANTS MARKET, BY FORM, 2017–2021 (USD MILLION)

- TABLE 67 INOCULANTS MARKET, BY FORM, 2022–2027 (USD MILLION)

- TABLE 68 DRY INOCULANTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 69 DRY INOCULANTS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 70 LIQUID INOCULANTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 71 LIQUID INOCULANTS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 72 INOCULANTS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 73 INOCULANTS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 74 INOCULANTS MARKET, BY REGION, 2017–2021 (KT)

- TABLE 75 INOCULANTS MARKET, BY REGION, 2022–2027 (KT)

- TABLE 76 NORTH AMERICA: INOCULANTS MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 77 NORTH AMERICA: INOCULANTS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 78 NORTH AMERICA: INOCULANTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 79 NORTH AMERICA: INOCULANTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 80 NORTH AMERICA: INOCULANTS MARKET, BY TYPE, 2017–2021 (KT)

- TABLE 81 NORTH AMERICA: INOCULANTS MARKET, BY TYPE, 2022–2027 (KT)

- TABLE 82 NORTH AMERICA: AGRICULTURAL INOCULANTS MARKET, BY SUBTYPE, 2017–2021 (USD MILLION)

- TABLE 83 NORTH AMERICA: AGRICULTURAL INOCULANTS MARKET, BY SUBTYPE, 2022–2027 (USD MILLION)

- TABLE 84 NORTH AMERICA: SILAGE INOCULANTS MARKET, BY SUBTYPE, 2017–2021 (USD MILLION)

- TABLE 85 NORTH AMERICA: SILAGE INOCULANTS MARKET, BY SUBTYPE, 2022–2027 (USD MILLION)

- TABLE 86 NORTH AMERICA: INOCULANTS MARKET, BY FORM, 2017–2021 (USD MILLION)

- TABLE 87 NORTH AMERICA: INOCULANTS MARKET, BY FORM, 2022–2027 (USD MILLION)

- TABLE 88 NORTH AMERICA: INOCULANTS MARKET, BY MICROBE, 2017–2021 (USD MILLION)

- TABLE 89 NORTH AMERICA: INOCULANTS MARKET, BY MICROBE, 2022–2027 (USD MILLION)

- TABLE 90 NORTH AMERICA: INOCULANTS MARKET, BY CROP TYPE, 2017–2021 (USD MILLION)

- TABLE 91 NORTH AMERICA: INOCULANTS MARKET, BY CROP TYPE, 2022–2027 (USD MILLION)

- TABLE 92 US: INOCULANTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 93 US: INOCULANTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 94 CANADA: INOCULANTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 95 CANADA: INOCULANTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 96 MEXICO: INOCULANTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 97 MEXICO: INOCULANTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 98 EUROPE: INOCULANTS MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 99 EUROPE: INOCULANTS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 100 EUROPE: INOCULANTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 101 EUROPE: INOCULANTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 102 EUROPE: INOCULANTS MARKET, BY TYPE, 2017–2021 (KT)

- TABLE 103 EUROPE: INOCULANTS MARKET, BY TYPE, 2022–2027 (KT)

- TABLE 104 EUROPE: AGRICULTURAL INOCULANTS MARKET, BY SUBTYPE, 2017–2021 (USD MILLION)

- TABLE 105 EUROPE: AGRICULTURAL INOCULANTS MARKET, BY SUBTYPE, 2022–2027 (USD MILLION)

- TABLE 106 EUROPE: SILAGE INOCULANTS MARKET, BY SUBTYPE, 2017–2021 (USD MILLION)

- TABLE 107 EUROPE: SILAGE INOCULANTS MARKET, BY SUBTYPE, 2022–2027 (USD MILLION)

- TABLE 108 EUROPE: INOCULANTS MARKET, BY FORM, 2017–2021 (USD MILLION)

- TABLE 109 EUROPE: INOCULANTS MARKET, BY FORM, 2022–2027 (USD MILLION)

- TABLE 110 EUROPE: INOCULANTS MARKET, BY MICROBE, 2017–2021 (USD MILLION)

- TABLE 111 EUROPE: INOCULANTS MARKET, BY MICROBE, 2022–2027 (USD MILLION)

- TABLE 112 EUROPE: INOCULANTS MARKET, BY CROP TYPE, 2017–2021 (USD MILLION)

- TABLE 113 EUROPE: INOCULANTS MARKET, BY CROP TYPE, 2022–2027 (USD MILLION)

- TABLE 114 GERMANY: INOCULANTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 115 GERMANY: INOCULANTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 116 FRANCE: INOCULANTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 117 FRANCE: INOCULANTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 118 UK: INOCULANTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 119 UK: INOCULANTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 120 RUSSIA: INOCULANTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 121 RUSSIA: INOCULANTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 122 SPAIN: INOCULANTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 123 SPAIN: INOCULANTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 124 ITALY: INOCULANTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 125 ITALY: INOCULANTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 126 DENMARK: INOCULANTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 127 DENMARK: INOCULANTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 128 REST OF EUROPE: INOCULANTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 129 REST OF EUROPE: INOCULANTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 130 ASIA PACIFIC: INOCULANTS MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 131 ASIA PACIFIC: INOCULANTS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 132 ASIA PACIFIC: INOCULANTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 133 ASIA PACIFIC: INOCULANTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 134 ASIA PACIFIC: INOCULANTS MARKET, BY TYPE, 2017–2021 (KT)

- TABLE 135 ASIA PACIFIC: INOCULANTS MARKET, BY TYPE, 2022–2027 (KT)

- TABLE 136 ASIA PACIFIC: AGRICULTURAL INOCULANTS MARKET, BY SUBTYPE, 2017–2021 (USD MILLION)

- TABLE 137 ASIA PACIFIC: AGRICULTURAL INOCULANTS MARKET, BY SUBTYPE, 2022–2027 (USD MILLION)

- TABLE 138 ASIA PACIFIC: SILAGE INOCULANTS MARKET, BY SUBTYPE, 2017–2021 (USD MILLION)

- TABLE 139 ASIA PACIFIC: SILAGE INOCULANTS MARKET, BY SUBTYPE, 2022–2027 (USD MILLION)

- TABLE 140 ASIA PACIFIC: INOCULANTS MARKET, BY FORM, 2017–2021 (USD MILLION)

- TABLE 141 ASIA PACIFIC: INOCULANTS MARKET, BY FORM, 2022–2027 (USD MILLION)

- TABLE 142 ASIA PACIFIC: INOCULANTS MARKET, BY MICROBE, 2017–2021 (USD MILLION)

- TABLE 143 ASIA PACIFIC: INOCULANTS MARKET, BY MICROBE, 2022–2027 (USD MILLION)

- TABLE 144 ASIA PACIFIC: INOCULANTS MARKET, BY CROP TYPE, 2017–2021 (USD MILLION)

- TABLE 145 ASIA PACIFIC: INOCULANTS MARKET, BY CROP TYPE, 2022–2027 (USD MILLION)

- TABLE 146 CHINA: INOCULANTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 147 CHINA: INOCULANTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 148 INDIA: INOCULANTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 149 INDIA: INOCULANTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 150 JAPAN: INOCULANTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 151 JAPAN: INOCULANTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 152 AUSTRALIA & NEW ZEALAND: INOCULANTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 153 AUSTRALIA & NEW ZEALAND: INOCULANTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 154 INDONESIA: INOCULANTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 155 INDONESIA: INOCULANTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 156 REST OF ASIA PACIFIC: INOCULANTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 157 REST OF ASIA PACIFIC: INOCULANTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 158 SOUTH AMERICA: INOCULANTS MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 159 SOUTH AMERICA: INOCULANTS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 160 SOUTH AMERICA: INOCULANTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 161 SOUTH AMERICA: INOCULANTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 162 SOUTH AMERICA: INOCULANTS MARKET, BY TYPE, 2017–2021 (KT)

- TABLE 163 SOUTH AMERICA: INOCULANTS MARKET, BY TYPE, 2022–2027 (KT)

- TABLE 164 SOUTH AMERICA: AGRICULTURAL INOCULANTS MARKET, BY SUBTYPE, 2017–2021 (USD MILLION)

- TABLE 165 SOUTH AMERICA: AGRICULTURAL INOCULANTS MARKET, BY SUBTYPE, 2022–2027 (USD MILLION)

- TABLE 166 SOUTH AMERICA: SILAGE INOCULANTS MARKET, BY SUBTYPE, 2017–2021 (USD MILLION)

- TABLE 167 SOUTH AMERICA: SILAGE INOCULANTS MARKET, BY SUBTYPE, 2022–2027 (USD MILLION)

- TABLE 168 SOUTH AMERICA: INOCULANTS MARKET, BY FORM, 2017–2021 (USD MILLION)

- TABLE 169 SOUTH AMERICA: INOCULANTS MARKET, BY FORM, 2022–2027 (USD MILLION)

- TABLE 170 SOUTH AMERICA: INOCULANTS MARKET, BY MICROBE, 2017–2021 (USD MILLION)

- TABLE 171 SOUTH AMERICA: INOCULANTS MARKET, BY MICROBE, 2022–2027 (USD MILLION)

- TABLE 172 SOUTH AMERICA: INOCULANTS MARKET, BY CROP TYPE, 2017–2021 (USD MILLION)

- TABLE 173 SOUTH AMERICA: INOCULANTS MARKET, BY CROP TYPE, 2022–2027 (USD MILLION)

- TABLE 174 BRAZIL: INOCULANTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 175 BRAZIL: INOCULANTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 176 ARGENTINA: INOCULANTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 177 ARGENTINA: INOCULANTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 178 CHILE: INOCULANTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 179 CHILE: INOCULANTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 180 REST OF SOUTH AMERICA: INOCULANTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 181 REST OF SOUTH AMERICA: INOCULANTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 182 ROW: INOCULANTS MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 183 ROW: INOCULANTS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 184 ROW: INOCULANTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 185 ROW: INOCULANTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 186 ROW: INOCULANTS MARKET, BY TYPE, 2017–2021 (KT)

- TABLE 187 ROW: INOCULANTS MARKET, BY TYPE, 2022–2027 (KT)

- TABLE 188 ROW: AGRICULTURAL INOCULANTS MARKET, BY SUBTYPE, 2017–2021 (USD MILLION)

- TABLE 189 ROW: AGRICULTURAL INOCULANTS MARKET, BY SUBTYPE, 2022–2027 (USD MILLION)

- TABLE 190 ROW: SILAGE INOCULANTS MARKET, BY SUBTYPE, 2017–2021 (USD MILLION)

- TABLE 191 ROW: SILAGE INOCULANTS MARKET, BY SUBTYPE, 2022–2027 (USD MILLION)

- TABLE 192 ROW: INOCULANTS MARKET, BY FORM, 2017–2021 (USD MILLION)

- TABLE 193 ROW: INOCULANTS MARKET, BY FORM, 2022–2027 (USD MILLION)

- TABLE 194 ROW: INOCULANTS MARKET, BY MICROBE, 2017–2021 (USD MILLION)

- TABLE 195 ROW: INOCULANTS MARKET, BY MICROBE, 2022–2027 (USD MILLION)

- TABLE 196 ROW: INOCULANTS MARKET, BY CROP TYPE, 2017–2021 (USD MILLION)

- TABLE 197 ROW: INOCULANTS MARKET, BY CROP TYPE, 2022–2027 (USD MILLION)

- TABLE 198 MIDDLE EAST: INOCULANTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 199 MIDDLE EAST: INOCULANTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 200 AFRICA: INOCULANTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 201 AFRICA: INOCULANTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 202 STRATEGIES ADOPTED BY KEY PLAYERS IN INOCULANTS MARKET

- TABLE 203 GLOBAL INOCULANTS MARKET: DEGREE OF COMPETITION

- TABLE 204 COMPANY PRODUCT FOOTPRINT, BY TYPE

- TABLE 205 COMPANY PRODUCT FOOTPRINT, BY MICROBE

- TABLE 206 COMPANY PRODUCT FOOTPRINT, BY CROP TYPE

- TABLE 207 COMPANY PRODUCT FOOTPRINT, BY REGION

- TABLE 208 OVERALL COMPANY PRODUCT FOOTPRINT

- TABLE 209 DETAILED LIST OF OTHER PLAYERS

- TABLE 210 COMPETITIVE BENCHMARKING (OTHER PLAYERS), 2021

- TABLE 211 INOCULANTS MARKET: NEW PRODUCT LAUNCHES, 2018–2022

- TABLE 212 INOCULANTS MARKET: DEALS, 2018–2022

- TABLE 213 INOCULANTS MARKET: OTHERS, 2018–2022

- TABLE 214 CORTEVA AGRISCIENCE: COMPANY OVERVIEW

- TABLE 215 CORTEVA AGRISCIENCE: PRODUCTS OFFERED

- TABLE 216 CORTEVA AGRISCIENCE: DEALS

- TABLE 217 BASF SE: BUSINESS OVERVIEW

- TABLE 218 BASF SE: PRODUCTS OFFERED

- TABLE 219 BASF SE: PRODUCT LAUNCHES

- TABLE 220 BASF SE: DEALS

- TABLE 221 BAYER AG: BUSINESS OVERVIEW

- TABLE 222 BAYER AG: PRODUCTS OFFERED

- TABLE 223 BAYER AG: DEALS

- TABLE 224 NOVOZYMES A/S: BUSINESS OVERVIEW

- TABLE 225 NOVOZYMES A/S: PRODUCTS OFFERED

- TABLE 226 NOVOZYMES A/S: PRODUCT LAUNCHES

- TABLE 227 CARGILL, INCORPORATED: BUSINESS OVERVIEW

- TABLE 228 CARGILL, INCORPORATED: PRODUCTS OFFERED

- TABLE 229 ARCHER DANIELS MIDLAND COMPANY: BUSINESS OVERVIEW

- TABLE 230 ARCHER DANIELS MIDLAND COMPANY: PRODUCTS OFFERED

- TABLE 231 ARCHER DANIELS MIDLAND COMPANY: DEALS

- TABLE 232 DSM: BUSINESS OVERVIEW

- TABLE 233 DSM: PRODUCTS OFFERED

- TABLE 234 CHR. HANSEN HOLDING A/S: BUSINESS OVERVIEW

- TABLE 235 CHR. HANSEN HOLDING A/S: PRODUCTS OFFERED

- TABLE 236 CHR. HANSEN HOLDING A/S: DEALS

- TABLE 237 LALLEMAND INC.: BUSINESS OVERVIEW

- TABLE 238 LALLEMAND INC: PRODUCTS OFFERED

- TABLE 239 LALLEMAND INC.: PRODUCT LAUNCHES

- TABLE 240 KEMIN INDUSTRIES, INC.: BUSINESS OVERVIEW

- TABLE 241 KEMIN INC: PRODUCTS OFFERED

- TABLE 242 KEMIN INDUSTRIES, INC.: OTHERS

- TABLE 243 VERDESIAN LIFE SCIENCES: BUSINESS OVERVIEW

- TABLE 244 VERDESIAN LIFE SCIENCES: PRODUCTS OFFERED

- TABLE 245 VERDESIAN LIFE SCIENCES: PRODUCT LAUNCHES

- TABLE 246 VERDESIAN LIFE SCIENCES: DEALS

- TABLE 247 BIO-CAT: BUSINESS OVERVIEW

- TABLE 248 BIO-CAT: PRODUCTS OFFERED

- TABLE 249 BIO-CAT: OTHERS

- TABLE 250 MICROBIAL BIOLOGICAL FERTILIZERS INTERNATIONAL: BUSINESS OVERVIEW

- TABLE 251 MICROBIAL BIOLOGICAL FERTILIZERS INTERNATIONAL: PRODUCTS OFFERED

- TABLE 252 AGRAUXINE: BUSINESS OVERVIEW

- TABLE 253 AGRAUXINE: PRODUCTS OFFERED

- TABLE 254 AGRAUXINE: DEALS

- TABLE 255 PROVITA SUPPLEMENTS GMBH: BUSINESS OVERVIEW

- TABLE 256 PROVITA SUPPLEMENTS GMBH: PRODUCTS OFFERED

- TABLE 257 NEUGEN BIOLOGICALS PVT LTD: BUSINESS OVERVIEW

- TABLE 258 NEUGEN BIOLOGICALS PVT LTD: PRODUCTS OFFERED

- TABLE 259 PRECISION LABORATORIES, LLC: BUSINESS OVERVIEW

- TABLE 260 PRECISION LABORATORIES, LLC: PRODUCTS OFFERED

- TABLE 261 QUEENSLAND AGRICULTURAL SEEDS: BUSINESS OVERVIEW

- TABLE 262 QUEENSLAND AGRICULTURAL SEEDS: PRODUCTS OFFERED

- TABLE 263 XITEBIO TECHNOLOGIES INC.: BUSINESS OVERVIEW

- TABLE 264 XITEBIO TECHNOLOGIES INC.: PRODUCTS OFFERED

- TABLE 265 XITEBIO TECHNOLOGIES INC.: PRODUCT LAUNCHES

- TABLE 266 TERRAMAX, INC.: BUSINESS OVERVIEW

- TABLE 267 TERRAMAX, INC.: PRODUCTS OFFERED

- TABLE 268 SOIL TECHNOLOGIES CORPORATION: COMPANY OVERVIEW

- TABLE 269 HORTICULTURAL ALLIANCE, LLC.: COMPANY OVERVIEW

- TABLE 270 AGRI LIFE: COMPANY OVERVIEW

- TABLE 271 STRONG MICROBIALS: COMPANY OVERVIEW

- TABLE 272 PRIONS BIOTECH PVT LTD.: COMPANY OVERVIEW

- TABLE 273 ADJACENT MARKETS TO INOCULANTS MARKET

- TABLE 274 BIOSTIMULANTS MARKET, BY ACTIVE INGREDIENT, 2020–2027 (USD MILLION)

- TABLE 275 BIOFERTILIZERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

- FIGURE 1 MARKET SEGMENTATION

- FIGURE 2 INOCULANTS MARKET: RESEARCH DESIGN

- FIGURE 3 DATA TRIANGULATION METHODOLOGY

- FIGURE 4 INOCULANTS MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

- FIGURE 5 INOCULANTS MARKET, BY MICROBE, 2022 VS. 2027 (USD MILLION)

- FIGURE 6 INOCULANTS MARKET, BY CROP TYPE, 2022 VS. 2027 (USD MILLION)

- FIGURE 7 INOCULANTS MARKET SIZE, BY FORM, 2022 VS. 2027 (USD MILLION)

- FIGURE 8 INOCULANTS MARKET SHARE (VALUE), BY REGION, 2021

- FIGURE 9 SOUTH AMERICA TO ACCOUNT FOR HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 10 GERMANY AND CEREALS & GRAINS SEGMENTS ACCOUNTED FOR LARGEST RESPECTIVE SHARES IN EUROPEAN INOCULANTS MARKET IN 2021

- FIGURE 11 AGRICULTURAL INOCULANTS TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 12 BACTERIAL INOCULANTS TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 13 CEREALS & GRAINS TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 14 LIQUID INOCULANTS TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 15 NORTH AMERICA AND CEREALS & GRAINS TO DOMINATE DURING FORECAST PERIOD

- FIGURE 16 MILK AND BEEF & BUFFALO MEAT PRODUCTION, 2017-2021 (TON)

- FIGURE 17 INOCULANTS MARKET DYNAMICS

- FIGURE 18 FEED GRAIN PRICES, 2017–2022 (USD/TON)

- FIGURE 19 VALUE CHAIN ANALYSIS OF INOCULANTS MARKET

- FIGURE 20 INOCULANTS MARKET: SUPPLY CHAIN

- FIGURE 21 GLOBAL AVERAGE SELLING PRICE, BY TYPE, 2020–2022 (USD/TON)

- FIGURE 22 INOCULANTS MARKET MAPPING

- FIGURE 23 TRENDS/DISRUPTIONS IMPACTING CUSTOMER’S BUSINESS

- FIGURE 24 PATENTS GRANTED FOR INOCULANTS MARKET, 2012–2022

- FIGURE 25 REGIONAL ANALYSIS OF PATENT GRANTED FOR INOCULANTS MARKET, 2012–2022

- FIGURE 26 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY CROP TYPE

- FIGURE 27 KEY CRITERIA FOR SELECTING SUPPLIERS/VENDORS

- FIGURE 28 INOCULANTS MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

- FIGURE 29 INOCULANTS MARKET, BY MICROBE, 2022 VS. 2027 (USD MILLION)

- FIGURE 30 INOCULANTS MARKET BY CROP TYPE, 2022 VS. 2027 (USD MILLION)

- FIGURE 31 INOCULANTS MARKET, BY FORM, 2022 VS. 2027 (USD MILLION)

- FIGURE 32 INOCULANTS MARKET GROWTH RATE, BY KEY COUNTRY, 2022–2027

- FIGURE 33 NORTH AMERICA: INOCULANTS MARKET SNAPSHOT

- FIGURE 34 NORTH AMERICA: RECESSION IMPACT ANALYSIS

- FIGURE 35 EUROPE: RECESSION IMPACT ANALYSIS

- FIGURE 36 ASIA PACIFIC: RECESSION IMPACT ANALYSIS

- FIGURE 37 SOUTH AMERICA: INOCULANTS MARKET SNAPSHOT

- FIGURE 38 SOUTH AMERICA: RECESSION IMPACT ANALYSIS

- FIGURE 39 ROW: RECESSION IMPACT ANALYSIS

- FIGURE 40 REVENUE ANALYSIS OF KEY PLAYERS, 2019–2021 (USD BILLION)

- FIGURE 41 INOCULANTS MARKET: COMPANY EVALUATION QUADRANT, 2021 (KEY PLAYERS)

- FIGURE 42 INOCULANTS MARKET: COMPANY EVALUATION QUADRANT, 2021 (OTHER PLAYERS)

- FIGURE 43 CORTEVA AGRISCIENCE: COMPANY SNAPSHOT

- FIGURE 44 BASF SE: COMPANY SNAPSHOT

- FIGURE 45 BAYER AG: COMPANY SNAPSHOT

- FIGURE 46 NOVOZYMES A/S: COMPANY SNAPSHOT

- FIGURE 47 CARGILL, INCORPORATED: COMPANY SNAPSHOT

- FIGURE 48 ARCHER DANIELS MIDLAND COMPANY: COMPANY SNAPSHOT

- FIGURE 49 DSM: COMPANY SNAPSHOT

- FIGURE 50 CHR. HANSEN HOLDING A/S: COMPANY SNAPSHOT

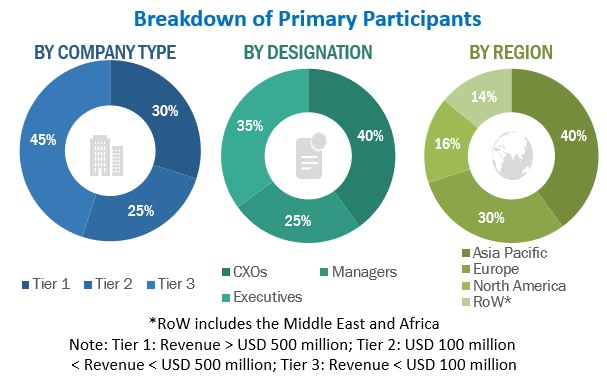

The study involved four major activities in estimating the inoculants market size. Exhaustive secondary research was conducted to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet, were referred to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold & silver standard websites, regulatory bodies, trade directories, and databases.

Primary Research

The market comprises several stakeholders in the supply chain, including inoculant manufacturers, organic food manufacturers, suppliers, farmers/growers, importers and exporters, and intermediary suppliers such as traders and distributors of inoculants products. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The primary interviewees from the supply side include inoculant manufacturers, suppliers, importers, and exporters. The primary sources from the demand side include farmers/growers, organic food manufacturers, intermediary traders, and distributors of inoculants products.

Given below is the breakdown of the primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the inoculants market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players were identified through extensive primary and secondary research.

- The value chain and market size of the inoculants market, in terms of value, were determined through primary and secondary research.

- All percentage shares splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from key leaders, such as CEOs, directors, and marketing executives.

Data Triangulation

After arriving at the overall market size from the estimation process described above, the total market was split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all segments, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides. In addition, the market size was validated using both top-down and bottom-up approaches. It was then verified through primary interviews. Hence, three approaches were adopted—top-down approach, bottom-up approach, and the one involving expert interviews. Only when the values arrived at from the three points matches, the data is assumed to be correct.

Report Objectives

- To describe and forecast the inoculants market in terms of type, microbe, crop type, form, and region

- To describe and forecast the inoculants market, in terms of value, by region–North America, Europe, Asia Pacific, South America, and the rest of the world—along with their respective countries

- To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze micro-markets with respect to individual growth trends, prospects, and contributions to the overall market

- To study the complete value chain of the inoculants market

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the inoculants market

- To strategically profile the key players and comprehensively analyze their market positions, in terms of ranking and core competencies, along with details on the competitive landscape of market leaders

- To analyze strategic approaches, such as expansions & investments, product launches & approvals, mergers & acquisitions, and agreements in the inoculants market

Available Customizations:

Based on the given market data, MarketsandMarkets offers customizations in the reports according to client-specific requirements. The available customization options are as follows:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakdown of the Rest of Europe inoculants market into Greece and Eastern European countries

- Further breakdown of the Rest of Asia Pacific inoculants market into the Vietnam, Singapore, and Thailand

- Further breakdown of other countries in the Rest of the World inoculants market by key countries

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Inoculants Market