Advanced Metering Infrastructure Market by Device (Smart Electric, Water, & Gas Meters), by Solution (MDM, Meter Data Analytics, AMI Security, and Meter Communication Infrastructure), by Service, and by Regions - Global Forecast to 2020

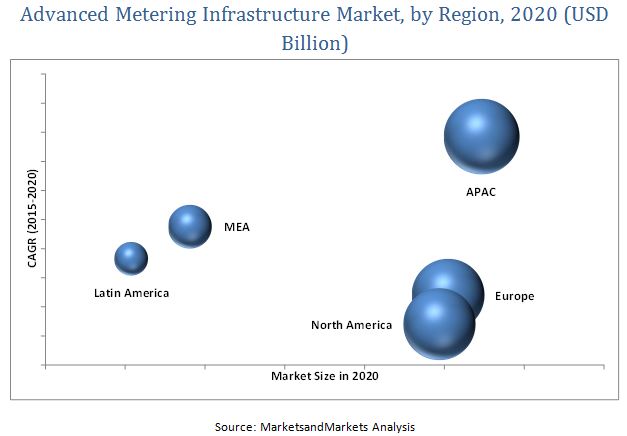

[114 Pages Report] The Advanced Metering Infrastructure Market is expected to grow from USD 4.48 Billion in 2015 to USD 9.19 Billion by 2020, at a Compound Annual Growth Rate (CAGR) of 15.5% during the forecast period. The deployment of advanced metering infrastructure solutions enables energy utilities to align energy shortages, revenue protection, load management, and customer service improvement. With the growing energy needs in developing economies and improved customer service level and utility efficiency, the demand for advanced metering infrastructure solutions and services has grown tremendously across all countries. Increasing adoption of Internet of Things (IoT) is driving this market. For the forecast period, the advanced metering infrastructure analytics segment is expected to grow significantly. Presently, Europe is the largest market for advanced metering infrastructure solutions and services.

The report aims at estimating the advanced metering infrastructure market size and future growth potential of the market across different segments, such as devices, solutions, services, and regions.

The years considered for the study are as follows:

- Base year 2014

- Estimated year 2015

- Projected year 2020

- Forecast period 2015 to 2020

For company profiles in the report, 2014 has been considered. Where information is unavailable for the base year, the prior year has been considered.

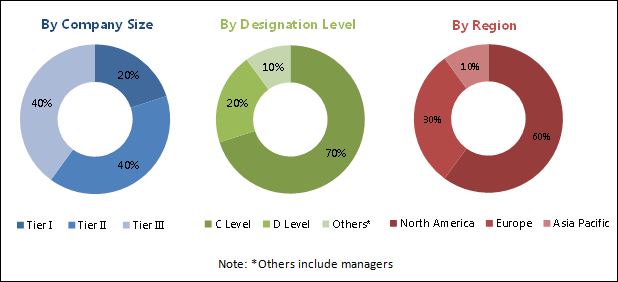

The research methodology used to estimate and forecast the Advanced Metering Infrastructure market begins with capturing data on key vendor revenues through secondary research, such as National Electrical Manufacturers Association (NEMA), Interoperable Device Interface Specifications (IDIS), and American Public Power Association. The vendor offerings are also taken into consideration to determine the market segmentation. The bottom-up procedure was employed to arrive at the overall market size of the global advanced metering infrastructure market from the revenue of the key players in the market. After arriving at the overall market size, the total market was split into several segments and subsegments, which were then verified through primary research by conducting extensive interviews with key industry personnel, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and executives. The data triangulation and market breakdown procedures were employed to complete the overall market engineering process and to arrive at the exact statistics for all segments and subsegments. The breakdown of profiles of the primary discussion participants is depicted in the below figure:

To know about the assumptions considered for the study, download the pdf brochure

Some of the key players in the Advanced Metering Infrastructure market ecosystem that offer meter data management, advanced metering infrastructure security, and smart meters solutions are Cisco Systems, Inc. (California, U.S.), IBM Corporation (New York, U.S.), General Electric (Connecticut, U.S.), Schneider Electric SE (Rueil-Malmaison, France), Itron, Inc. (Washington, U.S.), Aclara Technologies LLC (Missouri, U.S.), Elster Group GmbH (Essen, Germany), Sensus (Raleigh, U.S.), Tieto Corporation (Helsinki, Finland), and Trilliant, Inc. (California, U.S.).

Key Target Audience

- Utility companies (gas, water, and electric)

- Consumers (C&I and residential)

- Meter manufacturers

- Advanced metering infrastructure system vendors

- National regulatory authorities

- Enterprise Resource Planning (ERP) solution providers to utilities

- System integrators

- Managed service providers for utility companies

- Advanced metering infrastructure software vendors

- Investment research firms

Scope of the Report

The research report categorizes the advanced metering infrastructure market to forecast the revenues and analyze the trends in each of the following submarkets:

By Device

- Smart gas meters

- Smart water meters

- Smart electric meters

By Service

- System integration

- Meter deployment

- Program management and consulting

By Solution

- Meter data management

- Meter data analytics

- Advanced Metering Infrastructure security

- Meter communication infrastructure

By Region

- North America

- Europe

- Asia-Pacific (APAC)

- Middle East and Africa (MEA)

- Latin America

Available Customizations

With the given market data, MarketsandMarkets offers customization as per the companys specific requirements. The following customization options are available for the report:

Product Analysis

- Product matrix provides a detailed information and product comparison

Geographic Analysis

- Further breakdown of the North American Advanced Metering Infrastructure market

- Further breakdown of the European market

- Further breakdown of the APAC advanced metering infrastructure market

- Further breakdown of the MEA market

- Further breakdown of the Latin American advanced metering infrastructure market

Company Information

- Detailed analysis and profiling of additional market players

The advanced metering infrastructure market size is expected to grow from USD 4.48 Billion in 2015 to USD 9.19 Billion by 2020, at a Compound Annual Growth Rate (CAGR) of 15.5%. advanced metering infrastructure is one of the primary steps for smart grid optimization. advanced metering infrastructure assists utility companies to manage energy demands by identifying the peak time of load. Moreover, advanced metering infrastructure also helps consumers manage their energy consumption as well as Time-Of-Use (TOU) rate. This has led to increased implementation of advanced metering infrastructure.

Government organizations all across the globe are issuing regulatory mandates and legislative directives regarding construction of smart grids as well as deployment of smart meters. In line with this, the European Union mandate aims to replace 80% of all the traditional power meters with advanced metering infrastructure, by 2020. Moreover, in Japan, the Tokyo Electric Power Company (TEPCO) plans to deploy 27 million electric smart meters and create an integrated energy management platform that connects to smart devices in homes and businesses. These government mandates are the major drivers of the Advanced Metering Infrastructure market landscape across the globe. In addition, rising energy demand and the need for improved customer service level and utility efficiency also aid the growth of the advanced metering infrastructure market.

The meter data management solution is expected to account for the highest market share in the Advanced Metering Infrastructure market globally. Meter Data Management (MDM) maintains the meter data repository for a limited amount of time before it goes to a data warehouse and makes this data available to authorized systems. Vendors of MDM are now adopting a modular approach by developing modules that would help utilities in a number of different applications, such as customer billing, credit management, outage management, and meter asset management.

North America is estimated to hold the largest market share and dominate the Advanced Metering Infrastructure market in the year 2015. Further, North America is expected to decrease slightly during the forecast period, as most of the advanced metering infrastructure projects funded by the American Recovery and Reinvestment Act (ARRA) 2009 for investor-owned larger utilities in the U.S. are expected to reach completion by early 2018. The advanced metering infrastructure security solution is expected to have the least growth rate during the forecast period. However, Asia-Pacific (APAC) is projected to have the highest growth rate during the forecast period.

Inadequate financial incentives for utilities, and interoperability and standard interface are the major restraints of the advanced metering infrastructure market. The major vendors in the Advanced Metering Infrastructure market include IBM Corporation (U.S.), General Electric (U.S.), Elster Group GmbH (Germany), Schneider Electric (France), Sensus (U.S.), and Tieto Corporation (U.S.). These players have adopted various growth strategies, such as new product launches, partnerships, contracts, collaborations, acquisitions, and expansions to increase their footprints globally.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Market Forecast Assumptions

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 30)

4.1 Attractive Market Opportunities in the advanced metering infrastructure Market

4.2 Advanced Metering Infrastructure Market: By Solution and Region

4.3 Life Cycle Analysis, By Region

5 Market Overview (Page No. - 32)

5.1 Introduction

5.2 Evolution

5.3 Market Segmentation

5.3.1 By Device

5.3.2 By Solution

5.3.3 By Service

5.3.4 By Region

5.4 Market Dynamics

5.4.1 Drivers

5.4.1.1 Government Regulations and Legislative Mandates

5.4.1.2 Rise in Global Energy Demand

5.4.1.3 Need for Improved Customer Service Level and Utility Efficiency

5.4.1.4 Carbon Savings

5.4.2 Restraints

5.4.2.1 Inadequate Financial Incentives for Utilities

5.4.2.2 Interoperability and Standard Interface

5.4.3 Opportunities

5.4.3.1 Integration of Advanced Metering Infrastructure With Smart Devices

5.4.3.2 Advanced Metering Infrastructure for Water Utilities

5.4.3.3 Rising Demand in Growing Economies

5.4.4 Challenges

5.4.4.1 Structuring of Initial Gathered Data

5.4.4.2 Cyber Security Challenges

6 Industry Trends (Page No. - 42)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Porters Five Forces Analysis

6.3.1 Bargaining Power of Suppliers

6.3.2 Bargaining Power of Buyers

6.3.3 Threat of New Entrants

6.3.4 Threat of Substitutes

6.3.5 Intensity of Rivalry

6.4 Supply Chain Analysis

6.5 Protocol Analysis: Advanced Metering Infrastructure Applications

6.6 Advanced Metering Infrastructure: Ecosystem

6.7 Strategic Benchmarking: Advanced Metering Infrastructure

7 Advanced Metering Infrastructure Market Analysis, By Device (Page No. - 51)

7.1 Introduction

7.2 Smart Meters

7.2.1 Smart Electric Meters

7.2.2 Smart Water Meters

7.2.3 Smart Gas Meters

8 Advanced Metering Infrastructure Market Analysis, By Solution (Page No. - 57)

8.1 Introduction

8.2 Meter Data Management

8.3 Meter Data Analytics

8.4 Advanced Metering Infrastructure Security

8.5 Meter Communication Infrastructure

9 Advanced Metering Infrastructure Market Analysis, By Service (Page No. - 64)

9.1 Introduction

9.2 System Integration

9.3 Meter Deployment

9.4 Program Management and Consulting

10 Geographic Analysis (Page No. - 69)

10.1 Introduction

10.2 North America

10.3 Europe

10.4 Asia-Pacific

10.5 Middle East and Africa

10.6 Latin America

11 Competitive Landscape (Page No. - 80)

11.1 Overview

11.2 Competitive Situation and Trends

11.3 Partnerships, Agreements, Joint Ventures, and Collaborations

11.4 Business Expansions

11.5 New Product Developments

11.6 Mergers and Acquisitions

12 Company Profiles (Page No. - 85)

12.1 Introduction

(Overview, Financials, Products & Services, Strategy, and Developments)*

12.2 Cisco Systems, Inc.

12.3 General Electric Corporation

12.4 IBM Corporation

12.5 Itron Inc.

12.6 Schneider Electric SE

12.7 Aclara Technologies LLC.

12.8 Elster Group GmbH

12.9 Sensus

12.10 Tieto Corporation

12.11 Trilliant Inc.

*Details on Overview, Financials, Product & Services, Strategy, and Developments Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 111)

13.1 Discussion Guide

13.2 Introducing RT: Real-Time Market Intelligence

13.3 Available Customizations

13.4 Related Reports

List of Tables (48 Tables)

Table 1 Advanced Metering Infrastructure Market Size, By Type, 20132020 (USD Billion)

Table 2 Market Summary of Drivers

Table 3 Market Summary of Restraints

Table 4 Market Summary of Opportunities

Table 5 Market Summary of Challenges

Table 6 Protocol Analysis: Coap, XMPP, Restful HTTP, and MQTT

Table 7 Advanced Metering Infrastructure: Ecosystem

Table 8 Smart Meters: Advanced Metering Infrastructure Shipment, By Meter Type, 20132020 (Thousand Units)

Table 9 Smart Meters: Advanced Metering Infrastructure Market Size, By Meter Type, 20132020 (USD Million)

Table 10 Smart Meters: Advanced Metering Infrastructure Shipment, By Region, 20132020 (Thousand Units)

Table 11 Smart Meters: Advanced Metering Infrastructure Market Size, By Region, 20132020 (USD Million)

Table 12 Smart Electric Meters Shipment, By Region, 20132020 (Thousand Units)

Table 13 Smart Electric Meters Market Size, By Region, 20132020 (USD Million)

Table 14 Smart Water Meters Shipment, By Region, 20132020 (Thousand Units)

Table 15 Smart Water Meters Market Size, By Region, 20132020 (USD Million)

Table 16 Smart Gas Meters Shipment, By Region, 20132020 (Thousand Units)

Table 17 Smart Gas Meters Market Size, By Region, 20132020 (USD Million)

Table 18 Solutions: Market Size, By Type 20132020 (USD Million)

Table 19 Solutions: Market Size, By Region, 20132020 (USD Million)

Table 20 Meter Data Management: Market Size, By Region, 20132020 (USD Million)

Table 21 Meter Data Analytics: Market Size, By Region, 20132020 (USD Million)

Table 22 Advanced Metering Infrastructure Security: Market Size, By Region, 20132020 (USD Million)

Table 23 Meter Communication Infrastructure: Market Size, By Region, 20132020 (USD Million)

Table 24 Services: Market Size, By Type, 20132020 (USD Million)

Table 25 Services: Market Size, By Region, 20132020 (USD Million)

Table 26 System Integration: Market Size, By Region, 20132020 (USD Million)

Table 27 Meter Deployment: Market Size, By Region, 20132020 (USD Million)

Table 28 Program Management and Consulting: Market Size, By Region, 20132020 (USD Million)

Table 29 Advanced Metering Infrastructure Market Size, By Region, 20132020 (USD Million)

Table 30 North America: Market Size, By Type, 20132020 (USD Million)

Table 31 North America: Market Size, By Solution, 20132020 (USD Million)

Table 32 North America: Market Size, By Service, 20132020 (USD Million)

Table 33 Europe: Market Size, By Type, 20132020 (USD Million)

Table 34 Europe: Market Size, By Solution, 20132020 (USD Million)

Table 35 Europe: Market Size, By Service, 20132020 (USD Million)

Table 36 Asia-Pacific: Market Size, By Type, 20132020 (USD Million)

Table 37 Asia-Pacific: Market Size, By Solution, 20132020 (USD Million)

Table 38 Asia-Pacific: Market Size, By Service, 20132020 (USD Million)

Table 39 Middle East and Africa: Market Size, By Type, 20132020 (USD Million)

Table 40 Middle East and Africa: Market Size, By Solution, 20132020 (USD Million)

Table 41 Middle East and Africa: Market Size, By Service, 20132020 (USD Million)

Table 42 Latin America: Advanced Metering Infrastructure Market Size, By Type, 20132020 (USD Million)

Table 43 Latin America: Market Size, By Solution, 20132020 (USD Million)

Table 44 Latin America: Market Size, By Service, 20132020 (USD Million)

Table 45 Partnerships, Agreements, Joint Ventures, and Collaborations, 20142015

Table 46 Business Expansions, 20142015

Table 47 New Product Launches, 20142015

Table 48 Mergers and Acquisitions, 20142015

List of Figures (43 Figures)

Figure 1 Advanced Metering Infrastructure Market: Research Design

Figure 2 Breakdown of Primary Interviews: By Company, Designation, and Region

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Data Triangulation

Figure 6 Global Market Analysis, 2015-2020 (USD Million, Y-O-Y %)

Figure 7 Advanced Metering Infrastructure Market Solution Snapshot (2015 vs 2020)

Figure 8 North America is Expected to Hold the Largest Market Share in 2015

Figure 9 North America vs Europe Advanced Metering Infrastructure Market Comparison

Figure 10 Increasing Global Energy Demand is Boosting the Growth of the Market

Figure 11 Meter Data Management is Expected to Account for the Largest Share Among Solutions in 2015

Figure 12 Asia-Pacific and Middle East and Africa are Expected to Be in the High Growth Phase in the Coming Years

Figure 13 Evolution of Advanced Metering Infrastructure Market

Figure 14 Market Segmentation By Device

Figure 15 Market Segmentation By Solution

Figure 16 Market Segmentation By Service

Figure 17 Market Segmentation By Region

Figure 18 Market Drivers, Restraints, Opportunities and Challenges

Figure 19 Advanced Metering Infrastructure Communication Market: Value Chain Analysis

Figure 20 Porters Five Forces Analysis

Figure 21 Advanced Metering Infrastructure: Supply Chain Analysis

Figure 22 Enterprises are Spending Huge Proportion of Revenue for Organic and Inorganic Growth

Figure 23 Meter Data Management is Expected to Be the Leading Solution During the Forecast Period

Figure 24 System Integration Services Segment is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 25 Regional Snapshot (2015): Latin America Expected to Exhibit the Highest Growth Rate

Figure 26 Asia-Pacific is Expected to Dominate the Advanced Metering Infrastructure Market By 2020

Figure 27 North America Market Snapshot

Figure 28 Asia-Pacific Market Snapshot

Figure 29 Companies Adopted Partnerships, Joint Ventures, and Collaborations as the Key Growth Strategy From 2013-2015

Figure 30 Market Evaluation Framework

Figure 31 Battle for Market Share: Joint Ventures, Collaboration, and Alliances are the Key Strategies Adopted By Companies in the Advanced Metered Infrastructure Market 2013-2015

Figure 32 Geographic Revenue Mix of the Top Five Market Players

Figure 33 Cisco Systems, Inc.: Company Snapshot

Figure 34 Cisco Systems, Inc. : SWOT Analysis

Figure 35 General Electric Corporation: Company Snapshot

Figure 36 General Electric Corporation: SWOT Analysis

Figure 37 IBM Corporation: Company Snapshot

Figure 38 IBM Corporation: SWOT Analysis

Figure 39 Itron Inc.: Company Snapshot

Figure 40 Itron Inc.: SWOT Analysis

Figure 41 Schneider Electric SE: Company Snapshot

Figure 42 Schneider Electric SE.: SWOT Analysis

Figure 43 Tieto Corporation: Company Snapshot

Growth opportunities and latent adjacency in Advanced Metering Infrastructure Market

Gather insights into smart grids and smart metering philosophy to all the utilities, professionals, etc.

Require region-wise competitive intelligence on the AMI market

Interested in the market opportunity and growth forecast of Advanced Metering Infrastructure (AMI) and Distributed Energy Resource Management System (DERMS) market in USA.

Need market intelligence on Smart Meters and distribution of the different markets between the meter manufacturers and about the model of meters deployed for each manufacturers specific to country wise.