Vendor Neutral Archive (VNA) & PACS Market Size by Product Type (Department, Multi-Department, Multi-Site), Modality (CT, MRI, X-rays, Ultrasound, Mammo, PET), Application (Cardio, Onco, Neuro), End User (Hospital, ASC, Diag Center) & Region - Global Forecast to 2029

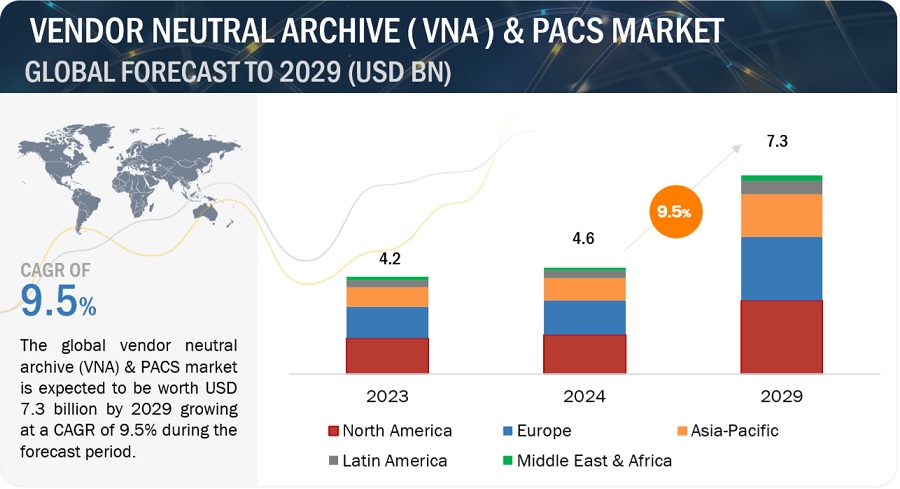

The size of global Vendor Neutral Archive (VNA) & PACS market in terms of revenue was estimated to be worth $4.6 billion in 2024 and is poised to reach $7.3 billion by 2029, growing at a CAGR of 9.5% from 2024 to 2029. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market.

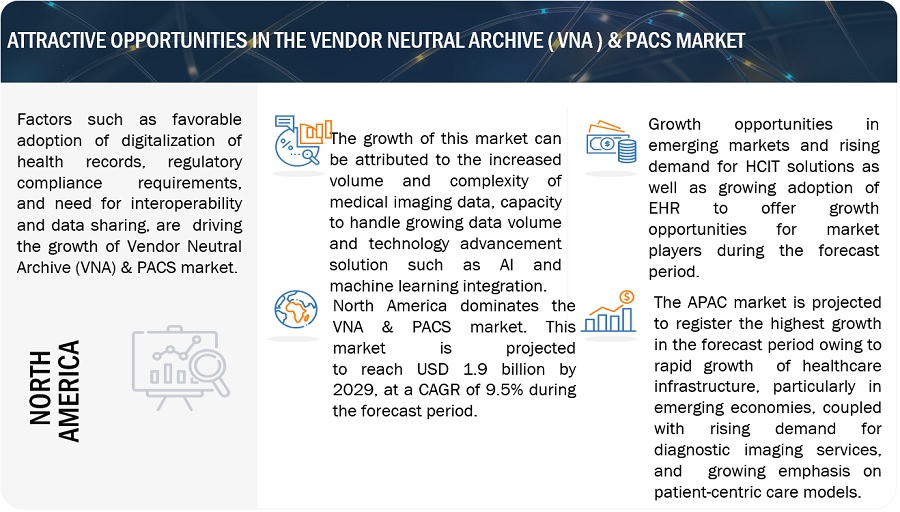

Growth of the market is mainly driven by increasing volumes of medical imaging data, regulatory mandates for electronic health records (EHRs). Moreover, the shift towards value-based care models, and technological advancements such as cloud storage and AI-driven analytics are further driving adoption of VNA & PACS solution to enhance clinical workflows and improve patient care outcomes.

Global Vendor Neutral Archive (VNA) & PACS Market Trend

To know about the assumptions considered for the study, Request for Free Sample Report

Global Vendor Neutral Archive (VNA) & PACS Market Dynamics

DRIVER: Growing demand for streamlined healthcare data management solutions

The exponential growth of medical imaging data, propelled by advancements in imaging technology and the digitization of healthcare records, necessitates robust data management solutions. Healthcare providers deal with vast amounts of imaging data, ranging from X-rays and MRIs to CT scans, creating a need for efficient storage, retrieval, and sharing mechanisms. Moreover, the shift towards value-based care models, which prioritize quality outcomes and cost-effectiveness, underscores the importance of data-driven decision-making and coordinated care delivery. VNA and PACS solutions play a pivotal role in enabling healthcare providers to leverage medical imaging data for diagnostic accuracy, treatment planning, and monitoring patient progress. By facilitating efficient data management and analysis, these solutions contribute to improved clinical workflows, reduced diagnostic errors, and enhanced patient outcomes. As the demand for improved patient care and safety continues to rise alongside advancements in healthcare technology, the Vendor Neutral Archive (VNA) & PACS market is expected to experience significant growth in forecasted period.

Restraint: Lack of standardized protocols and interoperability frameworks

The lack of standardized protocols and interoperability frameworks complicates data sharing and collaboration among healthcare providers, hindering the seamless exchange of medical images and patient records. As a result, healthcare professionals encounters interoperability issues while accessing patient data from different systems or transferring images between facilities, leading to inefficiencies in clinical workflows and potentially compromising patient care. Moreover, the high implementation and maintenance costs associated with deploying VNA and PACS systems, including investments in infrastructure, software, and training, restrain the adoption, particularly in resource-constrained healthcare settings. Thus, the ongoing expenses related to system maintenance, upgrades, and cybersecurity measures further add to the financial strain on healthcare institutions.

OPPORTUNITY: Increasing Medical Imaging Procedures and Large Imaging Data Silos

The increase in medical imaging procedures has led to growth opportunities in the VNA and PACS solution market, as healthcare providers seek scalable and efficient solutions to cope with the growing volumes of imaging data. Moreover, these solutions offer healthcare organizations a comprehensive approach to address the complexities of imaging data management as well as a centralized repository for storing medical images and associated metadata in a standardized format, breaking down data silos and enabling seamless interoperability and data exchange across disparate systems and departments. Moreover, the growing adoption of AI and analytics integration within VNA and PACS systems presents growing opportunities for enhanced automated image analysis, predictive analytics, and clinical decision support. This advancement significantly improves diagnostic accuracy and efficiency. Additionally, leveraging natural language processing with VNA and PACS solutions fosters the development of novel applications, further enhancing diagnostic precision and workflow efficiency. As these technologies continue to evolve and demonstrate their value in optimizing healthcare processes, the demand for VNA and PACS solutions is poised to surge, driven by the increasing need for advanced imaging capabilities and improved clinical outcome.

CHALLENGE: Data security issues

Data security remains a paramount concern within the Vendor Neutral Archive (VNA) and Picture Archiving and Communication System (PACS) market, as healthcare organizations grapple with safeguarding sensitive patient information amidst evolving cybersecurity threats. For instance, according to Greenbone Security 2019 Report revealed that the unprotected PACS server accounted for 1.19 billion medical images leaked in span of three months. Such breaches not only compromise patient privacy but also erode trust in healthcare systems and expose organizations to regulatory penalties and legal repercussions. Moreover, data security and privacy concerns remain significant challenges in cloud-based solutions, as healthcare organizations need robust security measures to protect sensitive patient information in the cloud. Thus, the potential security concerns related to HCIT system has the potential to impede the adoption of new technologies potentially limiting the growth of the Vendor Neutral Archive (VNA) & PACS market.

Vendor Neutral Archive (VNA) & PACS Market Ecosystem

The Vendor Neutral Archive (VNA) & PACS market is highly competitive with a large number of intermediaries involved in the market. The market includes the VNA and PACS vendors, ranging from large enterprises to niche players, that develops and provides innovative solutions for storing and managing medical imaging data. These vendors navigate regulatory frameworks set by government bodies like the FDA, EMA, and Health Canada, ensuring compliance with standards and guidelines related to data security, interoperability, and patient privacy. Moreover, government bodies such as the Department of Health and Human Services (HHS) and the National Health Service (NHS) influence market dynamics through policy decisions, funding initiatives, and regulatory oversight. Meanwhile, end-users, comprising healthcare providers such as hospitals, clinics, and imaging centers, drive demand for VNA and PACS solutions to streamline workflow efficiency, improve diagnostic accuracy, and enhance patient care delivery. This interconnected ecosystem relies on collaboration, innovation, and adherence to regulatory requirements to ensure the seamless integration and effective utilization of VNA and PACS solutions within the healthcare landscape.

Source: Secondary Literature, Interviews with Experts, and MarketsandMarkets Analysis

The global Vendor Neutral Archive (VNA) & PACS Industry is segmented by platform, component, deployment mode, application, end user, and region

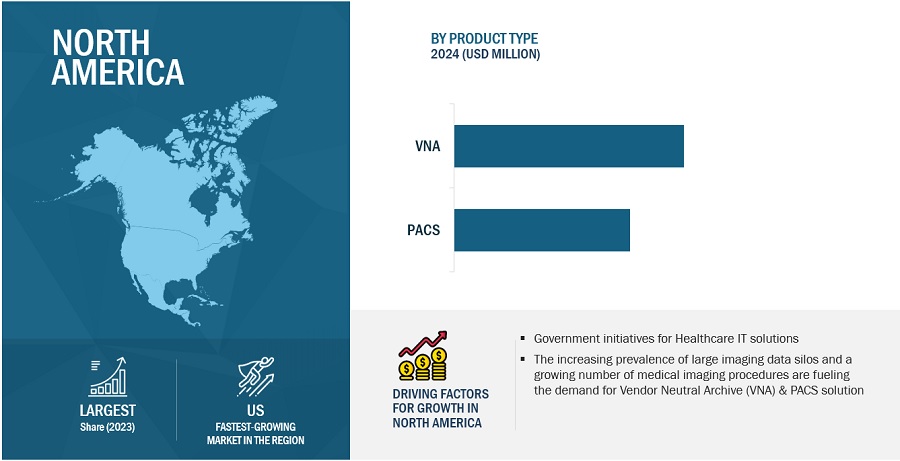

By product type, The Vendor Neutral Archive (VNA) segment accounted for the largest share of the VNA & PACS industry in 2023.

By product type, the Vendor Neutral Archive (VNA) & PACS market is segmented into VNA and PACS solution. The Vendor Neutral Archive (VNA) segment accounted for the largest market share in 2023. This segment is further sub segmented into department VNA, multi-department VNA and multi-site VNA solutions. Vendor Neutral Archive solution offers a centralized repository for storing medical images and associated metadata in a standardized format, independent of specific imaging modalities or vendors. This vendor-agnostic approach enables seamless data exchange across disparate systems and healthcare facilities, facilitating collaboration and care coordination among healthcare providers. Moreover, the shift towards value-based care models emphasizes the importance of comprehensive data management solutions like VNA. As healthcare organizations are increasingly leveraging medical imaging data for population health management, predictive analytics, and personalized medicine initiatives these VNA solutions plays a pivotal role in shaping the future of medical imaging and healthcare informatics. In addition, VNA solutions provide the infrastructure needed to aggregate, analyze, and derive insights from large volumes of imaging data, supporting data-driven decision-making, and improving patient outcomes for enhanced quality of care.

The cloud based deployment model is the fastest growing segment in the Vendor Neutral Archive (VNA) & PACS industry.

Based on deployment, the Vendor Neutral Archive (VNA) & PACS market is segmented into on-premises, cloud-based based and hybrid model. The cloud-based Vendor Neutral Archive (VNA) and Picture Archiving and Communication System (PACS) market is poised for significant growth in the forecast period. As these solutions eliminate the need for extensive on-premises infrastructure investments, allowing healthcare providers to scale their storage capacity and computing resources based on demand. In addition, the cloud service providers implement robust security measures, including encryption, access controls, and regular security audits, to safeguard patient information and ensure compliance with industry regulations such as HIPAA (Health Insurance Portability and Accountability Act) and GDPR (General Data Protection Regulation). This scalability enables healthcare organizations to accommodate growing volumes of medical imaging data generated from diagnostic procedures, such as X-rays, MRIs, and CT scans, without the constraints of data hacking and traditional storage infrastructure. Moreover, cost-effectiveness, and ease of remote and real-time monitoring are some of the factors attributing to the growth of the segment.

Hospitals & clinics accounted for the largest share of the Vendor Neutral Archive (VNA) & PACS industry in 2023.

Based on end-users, the Vendor Neutral Archive (VNA) & PACS market is segmented into hospitals & clinics, diagnostic centers, ambulatory surgical centers, and other end-users which includes research and academic institutes. The hospitals & clinics dominate the end-user segment of the Vendor Neutral Archive (VNA) & PACS market as these healthcare facilities generate vast volumes of medical imaging data daily, necessitating robust solutions for managing, storing, and accessing this data efficiently. Moreover, these solutions provide a centralized repository for storing medical images and associated metadata in a standardized format, enabling seamless access and retrieval of patient information across different departments and facilities within hospitals and clinics. Owing to the increasing demand for personalized, data-driven care, hospitals and clinics segment will remain at the forefront of innovation and investment in VNA and PACS solutions to meet the evolving needs of patients and healthcare professionals alike.

North America accounts the largest share of Vendor Neutral Archive (VNA) & PACS industry in 2023.

Based on the region, the Vendor Neutral Archive (VNA) & PACS market is segmented into North America, Europe, Asia Pacific, Latin America, and Middle East and Africa. In 2023 North America accounted for the largest share of the Vendor Neutral Archive (VNA) & PACS market due to its highly developed healthcare infrastructure, strong emphasis on digital transformation and interoperability, robust ecosystem of VNA and PACS vendors, and growing demand for diagnostic imaging services. As North American healthcare organizations continue to prioritize investments in data management solutions and embrace digital innovation, the region is poised to maintain its leadership position in the VNA and PACS market.

To know about the assumptions considered for the study, download the pdf brochure

Prominent players in Vendor Neutral Archive (VNA) & PACS market include Hyland Software, Inc. (US), Agfa-Gevaert Group. (Belgium), Intelerad Medical Systems Inc (Canada), CANON MEDICAL SYSTEMS CORPORATION (Japan), FUJIFILM Holdings Corporation (Japan), GE HEALTHCARE TECHNOLOGIES INC. (US), Merative (US), Sectra AB (Sweden), Siemens Healthcare Limited (Germany), BridgeHead Software Ltd. (UK), Canopy Partners. (US), Novarad Corporation.(US), POSTDICOM (Netherlands), AdvaHealth Solutions Pte Ltd (Singapore), CrelioHealth (India), Medicasoft. (US), Esaote SPA (Italy), PaxeraHealth (US), VISUS Health IT GmbH (Germany), ASPYRA, LLC (US), Dedalus S.p.A. (Italy), SoftTeam Solutions Pvt Ltd. (India), ARO Systems (Australia), Central Data Networks (Australia), and ONEPACS (US).

Scope of the Vendor Neutral Archive (VNA) & PACS Industry:

|

Report Metric |

Details |

|

Market Revenue in 2024 |

$4.6 billion |

|

Projected Revenue by 2029 |

$7.3 billion |

|

Revenue Rate |

Poised to Grow at a CAGR of 9.5% |

|

Market Driver |

Growing demand for streamlined healthcare data management solutions |

|

Market Opportunity |

Increasing Medical Imaging Procedures and Large Imaging Data Silos |

The study categorizes the Vendor Neutral Archive (VNA) & PACS Market based on platform, component, deployment, application, end user, at regional and global level.

By Product Type

-

VNA

- Department VNA

- Multi-Department VNA

- Multi-Site VNA

-

PACS

- Department PACS

- Multi-Department PACS

- Multi-Site PACS

By Modality

- CT

- Mammography

- MRI

- Ultrasound

- X-Rays

- PET

By Deployment

- On-Premise

- Cloud-Based

- Hybrid Model

By Vendor Type

- Independent Vendor

- Third-party Vendor

By Application

- Cardiology

- Orthopedic

- Oncology

- Neurology

- Obstetrics and Gynecology

- Other (Dental, Respiratory, Urology and Nephrology)

By End User

- Hospitals & Clinics

- Diagnostic Centers

- Others (Academic and Research Institutes)

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- RoE

-

Asia Pacific

- Japan

- China

- India

- RoAPAC

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

-

Middle East and Africa

- GCC Countries

- Rest of Middle East and Africa

Recent Developments of Vendor Neutral Archive (VNA) & PACS Industry:

- In January 2024, RamSoft (Canada) launched imaging EMR solution, named OmegaAI. The solution is a cloud-native, serverless imaging EMR software platform that consolidates VNA, Enterprise Imaging, PACS, RIS, simplified image exchange/sharing, routing & storage, a zero-footprint (ZFP) viewer, unified worklist, radiology reporting, document management, peer, patient portal, and a real-time business intelligence and analytics solution.

- In November 2023, InsiteOne (US) announced to acquire BRIT Systems cloud native RIS/PACS/VNA solution to advance imaging workflows. This acquisition will continue to focus on developing cost-effective solutions that improve operational productivity while enhancing patient care.

- In November 2022, GE HEALTHCARE TECHNOLOGIES INC. (US) collaborated with Tribun Health (Paris), to offer digital pathology departmental solutions that give healthcare providers a comprehensive perspective of patient records, this collaboration aims to integrate Tribun’s Health Suite data with GE Healthcare’s solutions, including its vendor-neutral archive (VNA) solution portfolio.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global Vendor Neutral Archive (VNA) & PACS market?

The global Vendor Neutral Archive (VNA) & PACS market boasts a total revenue value of $7.3 billion by 2029.

What is the estimated growth rate (CAGR) of the global Vendor Neutral Archive (VNA) & PACS market?

The global Vendor Neutral Archive (VNA) & PACS market has an estimated compound annual growth rate (CAGR) of 9.5% and a revenue size in the region of $4.6 billion in 2024. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

The study involved five major activities to estimate the current size of the Vendor Neutral Archive (VNA) & PACS market. Exhaustive secondary research was done to collect information on the market and its different subsegments. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard & silver-standard websites, regulatory bodies, and databases (such as D&B Hoovers, Bloomberg Business, and Factiva) were referred to in order to identify and collect information for the study of Vendor Neutral Archive (VNA) & PACS Market. It was also used to obtain important information about the top players, market classification, and segmentation according to industry trends to the bottom-most level, geographic markets, and key developments related to the market. A database of the key industry leaders was also prepared using secondary research.

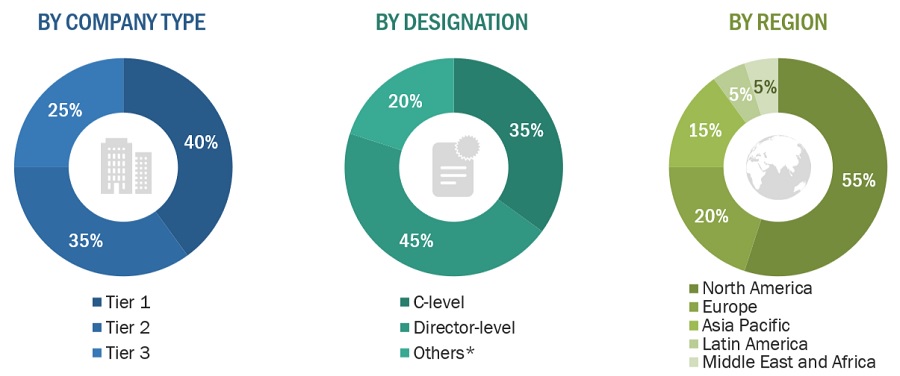

Primary Research

Extensive primary research was conducted after acquiring basic knowledge about the global Vendor Neutral Archive (VNA) & PACS market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand side (Hospital directors, Hospital Vice Presidents, Department heads, and Critical care specialists ) and supply side (such as C-level and D-level executives, technology experts, product managers, marketing and sales managers, among others) across five major regions—North America, Europe, the Asia Pacific, Latin America, Middle East, and Africa. This primary data was collected through questionnaires, e-mails, online surveys, personal interviews, and telephonic interviews

The following is a breakdown of the primary respondents:

Breakdown of Primary Participants:

Note 1: Others include sales managers, marketing managers, and product managers.

Note 2: Tiers of companies are defined on the basis of their total revenues in 2023. Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = <USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the Vendor Neutral Archive (VNA) & PACS market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global Vendor Neutral Archive (VNA) & PACS Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Vendor Neutral Archive (VNA) & PACS Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall market size—using the market size estimation processes—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub-segment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the Vendor Neutral Archive (VNA) & PACS Market.

Market Definition:

Vendor Neutral Archive (VNA) & PACS market refers to medical imaging technology that provides economical storage and convenient access to images from multiple modalities designed to store, manage, and access medical imaging data efficiently and securely. VNAs and PACS solutions serve as integral components of modern healthcare IT infrastructure, facilitating the digitization, storage, retrieval, and sharing of medical images.

Key Stakeholders:

- Vendor Neutral Archive (VNA) & PACS Vendors

- Government Bodies

- Healthcare Service Providers

- Clinical/Physician Centers

- Healthcare Professionals

- Health IT service Providers

- Healthcare Associations/Institutes

- Ambulatory Care Centers

- Venture Capitalists

- Distributors And Resellers

- Maintenance And Support Service Providers

- Integration Service Providers

- Healthcare Payers

- Advocacy Groups

- Data Security And Privacy Experts

- Investors And Financial Institutions

- Industry Associations And Trade Groups

Report Objectives

- To define, describe, and forecast the global Vendor Neutral Archive (VNA) & PACS market based on product type, modality, deployment, vendor type, application, end user, and region.

- To provide detailed information regarding the major factors (such as drivers, restraints, opportunities, and challenges) influencing the market growth

- To strategically analyze micro-markets with respect to individual growth trends, prospects, and contributions to the overall Vendor Neutral Archive (VNA) & PACS market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders.

- To strategically analyze the market structure profile the key players of the Vendor Neutral Archive (VNA) & PACS market and comprehensively analyze their core competencies.

- To forecast the size of the market segments with respect to five regions, namely, North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

- To track and analyze competitive developments such as product launches and enhancements and investments, partnerships, collaborations, acquisitions, expansions, agreements, sales contracts, and alliances in the Vendor Neutral Archive (VNA) & PACS market during the forecast period.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

- Product Analysis: Product matrix, which gives a detailed comparison of the product portfolios of each company.

- Geographic Analysis: Further breakdown of the Latin American Vendor Neutral Archive (VNA) & PACS into specific countries and, the Middle East, and Africa Vendor Neutral Archive (VNA) & PACS into specific countries and further breakdown of the European Vendor Neutral Archive (VNA) & PACS into specific countries

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Vendor Neutral Archive (VNA) & PACS Market