IoT Technology Market by Node Component (Sensor, Memory Device, Connectivity IC, Processor, Logic Devices), Software Solution (Remote Monitoring, Data Management), Platform, Service, End-use Application, Geography - Global Forecast to 2029

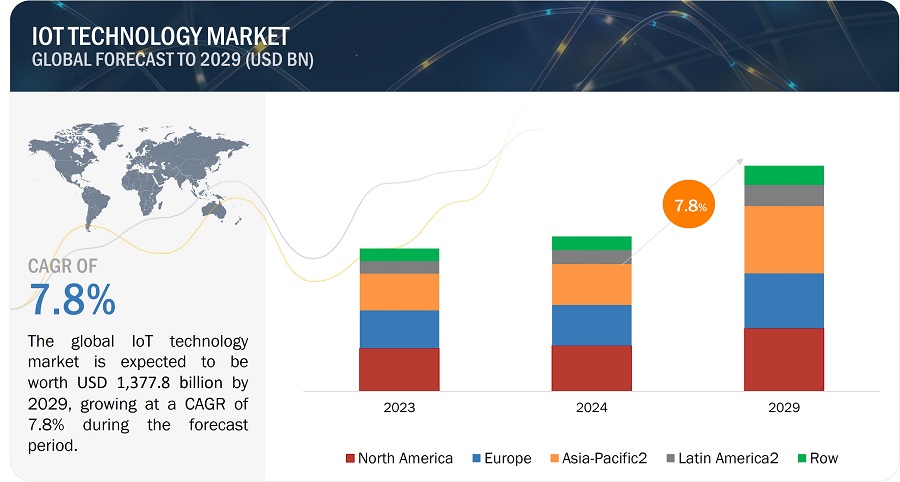

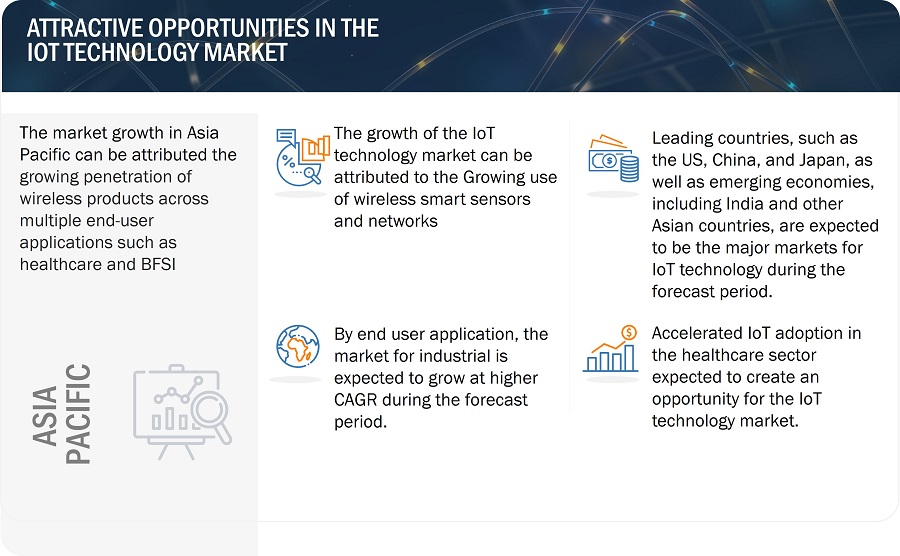

[299 Pages Report] The global IoT technology market size is projected to grow from USD 945.6 billion in 2024 to USD 1,377.8 billion by 2029, registering a CAGR of 7.8% during the forecast period. The growing use of wireless smart sensors and networks and increasing necessity of data centers due to rising adoption of cloud platforms are expected to propel the IoT technology market share in the next five years. However, high power consumption by wireless sensor terminals/connected devices will likely pose challenges for industry players.

The objective of the report is to define, describe, and forecast the IoT technology market size based on node component, services, platform, software solution, end user application, and region.

IoT Technology Market Forecast to 2029

To know about the assumptions considered for the study, Request for Free Sample Report

IoT technology market dynamics.

Driver: Emergence of 5G communications technology

The launch of the fifth generation of cellular mobile communications or 5G is having a positive impact on the IoT technology industry. This is mostly because 5G networks significantly enhance the dependability and performance of these linked gadgets. The requirement for a quicker, more capable network that can meet connection demands is addressed by 5G. The frequencies on which digital cellular technologies will carry data are expanded by the 5G spectrum. 5G and IoT technologies together have a wide spectrum that boosts the total bandwidth and allows a vast amount of loT devices to connect. This wider spectrum that is available for use raises the overall capacity of cellular networks, allowing additional devices to connect. With the increasing Internet penetration rate, IoT is finding applications in retail, consumer electronics, agriculture, automotive and transportation, and other sectors. The continuous increase in the number of Internet users across the world is expected to strengthen the overall market for IoT, owing to the growth in Internet-enabled smart devices such as radio frequency identification (RFID), barcode scanners, and mobile computers.

Restraint: Data security and privacy concerns

The Internet of Things gateway manages a vast number of devices and the data that is sent back and forth between edge devices and cloud servers. It acts as a communication layer between these devices. The lot gateway must protect data secrecy while translating protocols. Because Internet of Things communication occurs over both public and private networks, a secure network is necessary. Data privacy is a challenge for the IoT gateway when translating protocols. Data security can be achieved by using encryption security keys, but managing those keys would still be an important concern. Despite advances in hardware and software security, many systems and solutions remain vulnerable to cyber threats. Furthermore, the need for hardware for Internet of Things applications is anticipated to be impacted by the ongoing data security concerns. This will need the development of more secure and highly encrypted hardware chipsets and networking solutions (such gateways) in the future.

Opportunities: Increased potential for the incorporation of IoT in electric and hybrid vehicles

The automotive industry has made technological improvements to lower the harmful exhaust emissions from vehicles as a result of the strict global emission regulations. One of the most significant advances in the automobile industry's efforts to safeguard the environment is the introduction of EVs. Since these cars don't use traditional fuel, they don't release any toxic emissions. The demand for electric vehicles has increased as a result of all these causes, particularly in industrialized nations like North America and Europe. These cars employ a lot more technological gadgets as they are entirely dependent on an electrical power source. Power electronics is a crucial component of hybrid vehicles and accounts for 20% of the overall cost of ownership, providing an opportunity for semiconductor technology. Currently in the introduction stage, these new technologies are expected to have an impact on the automotive semiconductor market in the upcoming years. Automotive semiconductors are becoming more and more necessary as EVs and HEVs become more popular. Many governments provide various incentives to encourage the use of electric and hybrid vehicles domestically, including those in Germany, the US, Denmark, China, France, Sweden, the UK, and India. Thus, there is now more opportunity for electrification due to new features and improved technologies. Original equipment manufacturers (OEMs) are consequently equipping high-end electric vehicles with an increasing number of ICs, microprocessors, and loT sensors.

Challenges: High power consumption by wireless sensor terminals/connected devices

Sensors and other peripherals in the Internet of Things consume a lot of power. IoT devices must have effective power management and minimize power consumption despite the availability of technology like wireless networking, ultra-low-power processors, and tiny mobile sensors. Another significant issue would be connectivity burden because multiple devices must be linked simultaneously. For example, a typical smart house may include between 50 and 100 connected lights, thermostats, appliances, and other devices—each of which needs a certain amount of power. The line power efficiency would be increased by the usage of devices like smart meters. The main challenge is the power management of devices using wireless technologies like Wi-Fi, as it is not practical to manually change the batteries of hundreds of sensors, actuators, and other linked devices within loT systems on a regular basis. The production of ultra-low-power chips and modules is already a priority for semiconductor makers, but battery technology and wearable and portable devices power management remain areas that require innovation.

Market Map/Ecosystem

IoT technology Market : Key Trends.

The prominent players in the IoT technology market share are Intel Corporation (US), Qualcomm (US), Texas Instruments Incorporated (US), Cisco Systems, Inc. (US), Hewlett Packard Enterprise (US), IBM (US), STMicroelectronics (Switzerland), Microsoft, PTC Inc. (US), and Amazon Web Services (US), among others. These companies boast mixing trends with a comprehensive product portfolio and strong geographic footprint.

Managed service is expected to grow at the highest CARG in the IoT technology market during the forecast period.

The managed service segment is expected to account for a significant share and grow at the highest CAGR during the forecast period. All the pre- and post-deployment queries and needs of customers are addressed under the managed services unit. Companies mainly outsource such services to offer customers on-time delivery. Integrated facility management, consultancy, round-the-clock help desk, finance, and accounts are some of the upcoming managed services required by operators. This segment is mainly driven by the increasing adoption of outsourced managed services in the IoT market size . Managed services increase productivity and help in mitigating risks.

The aerospace & defense segment under industrial application is expected to witness the highest CAGR of the IoT technology market during the forecast period.

The aerospace & defense segment is expected to witness the highest CAGR during the forecast period. IoT in the aerospace and defense segment in industrial application provides connectivity and integration and equips the manufacturer with wide-ranging views of their operations. The aerospace and defense end-user application makes use of sensors to capture comprehensive machine data. These sensors can be used on key equipment, machines, and vehicles. IoT offers numerous opportunities to airlines for the improvement of baggage handling and equipment monitoring.

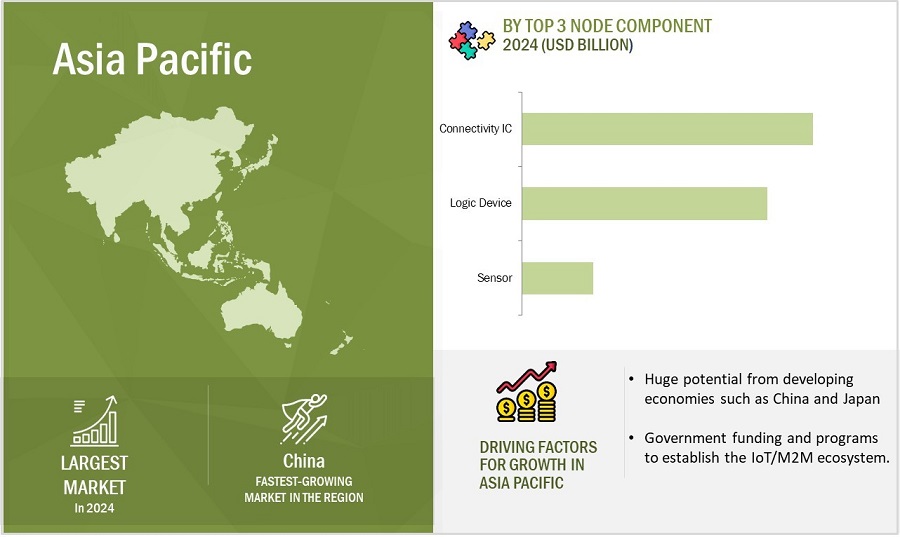

The IoT technology market is expected to have a largest market share in China from the Asia Pacific region during the forecast period.

The Asia Pacific region continues to be a significant market for IoT technology. Government policies have played a pivotal role in China’s success in IoT. Initiatives such as the “Made in China 2025” plan have prioritized high-tech industries, including IoT, as key areas for development. This government backing has catalyzed research and innovation in IoT, paving the way for its integration into various sectors of the economy. The country has emerged as global manufacturing and an innovation hub for various end-use industries, such as semiconductors, automotive, and consumer electronics. Therefore, it has immense potential for the production and sales of sensor-based devices. China is also the largest automotive manufacturer in the world. It is a leading producer of consumer devices and appliances. The developing economy of the country and the growing deployment of sensors in its most sectors are factors driving the growth of the IoT sensors market in China. The Internet Plus strategy of the country that aims to integrate its IoT initiatives, mobile Internet, cloud computing, and big data is expected to extensively promote the application of IoT and smart technologies.

Furthermore, as China is the major hub for semiconductor fabrication and manufacturing industries, its involvement in the implementation and development of IoT is crucial for the growth of these markets. China is a manufacturing hub and is the leading producer of manufactured goods such as textiles, electronic equipment, and agricultural products. In the production process, IoT is used to monitor the machinery, employees, and environmental conditions. The data can be further used to analyze, control, and prevent risks and avoid economic losses. End-to-end automation is a new concept gaining momentum in the current technology market in China.

IoT Technology Market and Statistics by Region

To know about the assumptions considered for the study, download the pdf brochure

Top IoT Technology Companies - Key Market Players:

Major vendors in the IoT technology companies include Intel Corporation (US), Qualcomm (US), Texas Instruments Incorporated (US), Cisco Systems, Inc. (US), Hewlett Packard Enterprise (US), IBM (US), STMicroelectronics (Switzerland), Microsoft, PTC Inc. (US), and Amazon Web Services (US), among others.

IoT Technology Market Report Scope :

|

Report Metric |

Details |

| Estimated Market Size | USD 945.6 billion in 2024 |

| Projected Market Size |

USD 1,377.8 billion by 2029

|

| Growth Rate | CAGR of 7.8% |

|

Market Size Available for Years |

2020–2029 |

|

Base Year |

2023 |

|

Forecast Period |

2024–2029 |

|

Units |

Value (USD Million/USD Billion), Volume (Million Units) |

|

Segments Covered |

Platform,Node Component, Software Solution, Servies, End Use Application, and Region |

|

Regions Covered |

North America, Europe, Asia Pacific, Latin America, and RoW |

|

Companies Covered |

Intel Corporation (US), Qualcomm (US), Texas Instruments Incorporated (US), Cisco Systems, Inc. (US), Hewlett Packard Enterprise (US), IBM (US), STMicroelectronics (Switzerland), Microsoft, PTC Inc. (US), and Amazon Web Services (US), among others. |

IoT Technology Market Highlights

This report categorizes the IoT technology market based on platform, node component, software solution, servies, end use application, and region.

|

Segment |

Subsegment |

|

By Platform |

|

|

By Node Component |

|

|

By Services |

|

|

By Software Solution |

|

|

By End Use Application |

|

|

By Region |

|

Recent Developments in IoT Technology Industry:

- In January 2024, Texas Instruments (US) introduced new semiconductors designed to improve automotive safety and intelligence. The AWR2544 77GHz millimeter-wave radar sensor chip is the industry’s first for satellite radar architectures, enabling higher levels of autonomy by improving sensor fusion and decision-making in ADAS.

- In October 2023, Sasken Technologies (India), announced a collaboration with Qualcomm Technologies (US), Inc through the Qualcomm® IoT Accelerator Program. This collaboration marks a significant milestone in the realm of Internet of Things (IoT) innovation and underscores both companies’ commitment to shaping the future of connected devices and services. This collaboration aims to address the challenges faced by various industries in their IoT endeavors, such as achieving seamless integration, scalability, and security.

- In January 2023, Intel Corporation (US) announced its full Intel Core 14th Gen mobile and desktop processor lineup, including powerful new HX-series mobile processors and mainstream 65-watt and 35-watt desktop processors. Additionally, Intel introduced its new Intel Core mobile processor Series 1 family, led by the Intel Core 7 processor 150U, for performant mainstream thin-and-light mobile systems.

Frequently Asked Questions :

Which are the major companies in the IoT technology market? What are their primary strategies to strengthen their market presence?

Intel Corporation, Qualcomm, Texas Instruments Incorporated, Cisco Systems, Inc., Hewlett Packard Enterprise are among the leading players in the market. These companies have adopted organic and inorganic growth strategies such as product launches, partnerships and acquisitions, to gain a competitive advantage in the market.

Which is the potential market for the end-user application?

Consumer is end-user application industries with high growth opportunities owing to advancements in technology.

What are the opportunities for new market entrants?

Factors such as government incentives and aids for development of IoT technologies and increased potential for the incorporation of IoT in electric and hybrid vehicles are creating opportunities for the players in the market.

Which nodetype is expected to drive market growth in the next six years?

Logic devices are expected to remain the major technology driving IoT technology demand.

What are the major strategies adopted by IoT technology companies?

The IoT technology companies have adopted product launches, acquisitions, expansions, and contracts to strengthen their position in the IoT technology market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

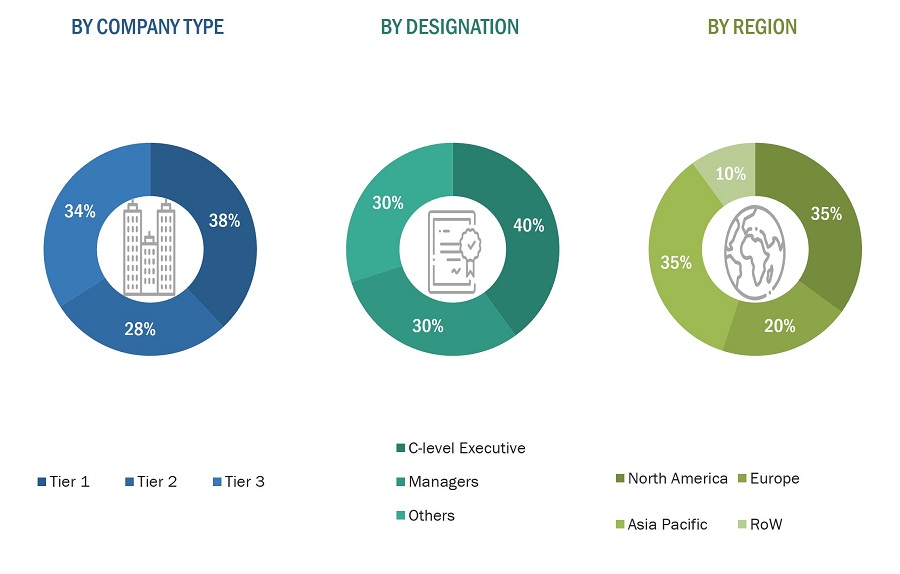

The research process for this study included systematic gathering, recording, and analysis of data about customers and companies operating in the IoT technology market. This process involved the extensive use of secondary sources, directories, and databases (Factiva, Oanda, and OneSource) for identifying and collecting valuable information for the comprehensive, technical, market-oriented, and commercial study of the IoT technology market. In-depth interviews were conducted with primary respondents, including experts from core and related industries and preferred manufacturers, to obtain and verify critical qualitative and quantitative information as well as to assess growth prospects. Key players in the IoT technology market were identified through secondary research, and their market rankings were determined through primary and secondary research. This research included studying annual reports of top players and interviewing key industry experts such as CEOs, directors, and marketing executives.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information important for this study. Secondary sources included corporate filings, such as annual reports, investor presentations, and financial statements; trade, business, and professional associations; white papers; IoT technology products-related journals; certified publications; articles by recognized authors; directories; and databases.

Secondary research was conducted to obtain key information about the industry supply chain, market value chain, key players, market classification and segmentation as per industry trends to the bottom-most level, geographic markets, and key developments from both market- and technology-oriented perspectives. Data from secondary research was collected and analyzed to determine the overall market size, which was further validated by primary research.

Primary Research

In the primary research process, various primary sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side included industry experts such as CEOs, VPs, marketing directors, technology & innovation directors, and key executives from major companies in the IoT technology market.

After going through market engineering (which includes calculations for market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers obtained. Primary research was conducted to identify segmentation types, industry trends, key players, competitive landscape, and key market dynamics such as drivers, restraints, opportunities, and challenges, along with the key strategies adopted by players operating in the market.

To know about the assumptions considered for the study, download the pdf brochure

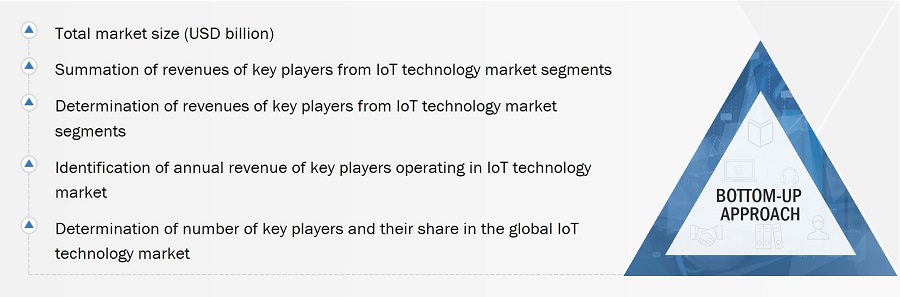

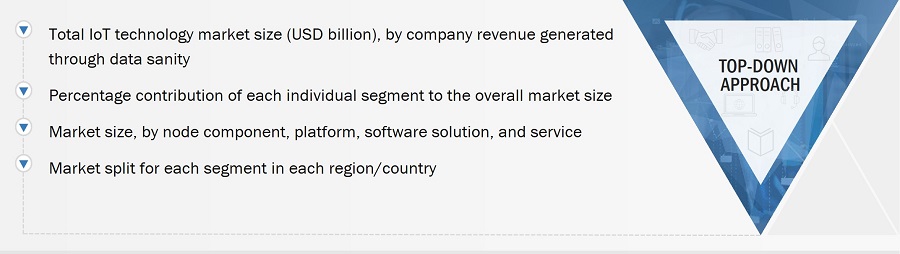

Market size Estimation

In the complete market engineering process, both top-down and bottom-up approaches were used, along with several data triangulation methods, to estimate and forecast the size of the market and its segments and subsegments listed in the report. Extensive qualitative and quantitative analyses were carried out on the complete market engineering process to list the key information/insights pertaining to the IoT technology market.

The key players in the market were identified through secondary research, and their rankings in the respective regions were determined through primary and secondary research. This entire procedure involved the study of the annual and financial reports of top players, as well as interviews with industry experts such as chief executive officers, vice presidents, directors, and marketing executives for quantitative and qualitative key insights. All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated and enhanced with detailed inputs and analysis from MarketsandMarkets and presented in this report.

IoT Technology Market: Bottom-up Approach

IoT Technology Market: Top-Down Approach

Data Triangulation

After arriving at the overall size of the IoT technology market from the market size estimation process explained above, the total market was split into several segments and subsegments. Where applicable, the market breakdown and data triangulation procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size was validated using top-down and bottom-up approaches.

Market Definition

IoT is a key digital transformation technology, enabling businesses to increase their operational efficiency. Other technologies, such as edge computing, digital twin, Wi-Fi, and big data analytics, are spurring the demand for the digital transformation of businesses. Various application areas, such as retail, manufacturing, transportation, and healthcare, are undergoing digital transformation. Hence, the growing demand for IoT-based digital transformation of businesses is expected to provide growth opportunities for the IoT technology market during the forecast period.

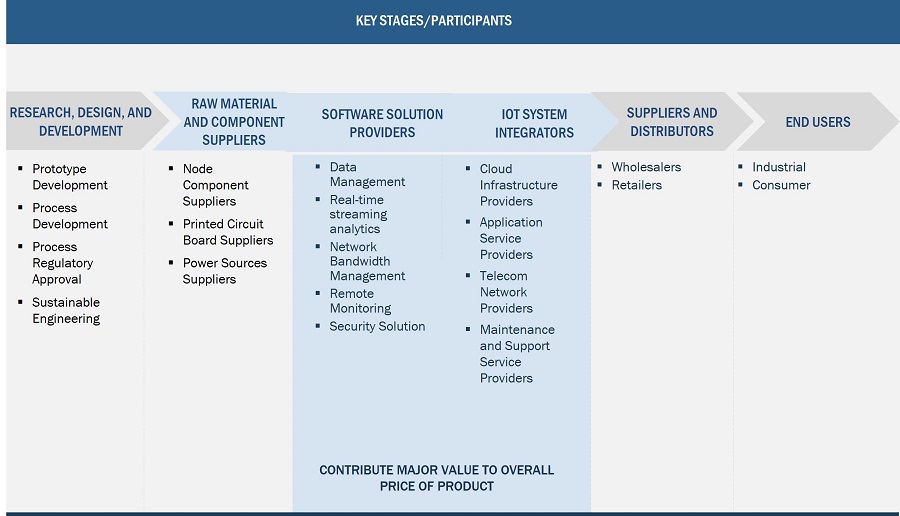

Key Stakeholders

- Original technology designers and suppliers

- System integrators

- Electronic hardware equipment manufacturers

- Technical universities

- Government research agencies and private research organizations

- Research institutes and organizations

- Market research and consulting firms

- Sensor manufacturers

- Technology standard organizations, forums, alliances, and associations

- Raw material and manufacturing equipment suppliers

- Semiconductor wafer vendors

- Fabless players

- EDA and IP core vendors

- Foundry players

- Original equipment manufacturers (OEMs)

- Original design manufacturers (ODM) and OEM technology solution providers

- Distributors and retailers

- Technology investors

- Operating system (OS) vendors

- Content providers

- Software providers

Report Objectives

- To define and forecast the IoT technology market size, by node component, software solution, platform, service, and end-use application, in terms of value.

- To describe and forecast the global IoT technology market, by node components, in terms of volume.

- To describe and forecast the market size for various segments with regard to four main regions—North America, Latin America, Europe, Asia Pacific, and the Rest of the World (RoW), in terms of value.

- To provide detailed information regarding major factors, such as drivers, restraints, opportunities, and challenges influencing the market growth

- To analyze the supply chain, trends/disruptions impacting customer business, market/ecosystem map, pricing analysis, and regulatory landscape pertaining to the IoT technology market.

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the market

- To describe in brief the value chain of IoT technology solutions.

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market

- To profile key players and comprehensively analyze their market position in terms of their ranking and core competencies2, along with the detailed competitive landscape of the market.

- To analyze competitive developments, such as product launches and developments, partnerships, agreements, expansions, acquisitions, contracts, alliances, and research & development (R&D), undertaken in the IoT technology market.

- To benchmark market players using the proprietary ‘Company Evaluation Matrix,’ which analyzes market players on various parameters within the broad categories of business strategy excellence and strength of product portfolio.

- To analyze the probable impact of the recession on the market.

Available customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies.

Product analysis

- Detailed analysis and profiling of additional market players

The following customization options are available for the report:

- Market sizing and forecast for additional countries

- Additional five companies profiling

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in IoT Technology Market

Is SIGFOX a good solution for international business at IOT Field?