Edge AI Hardware Market by Device, Processor (CPU, GPU, and ASIC), Function (Training, Inference), Power Consumption (Less than 1 W, 1-3 W, 3-5 W, 5-10 W, and more than 10 W), Vertical and Geography - Global Forecast to 2029

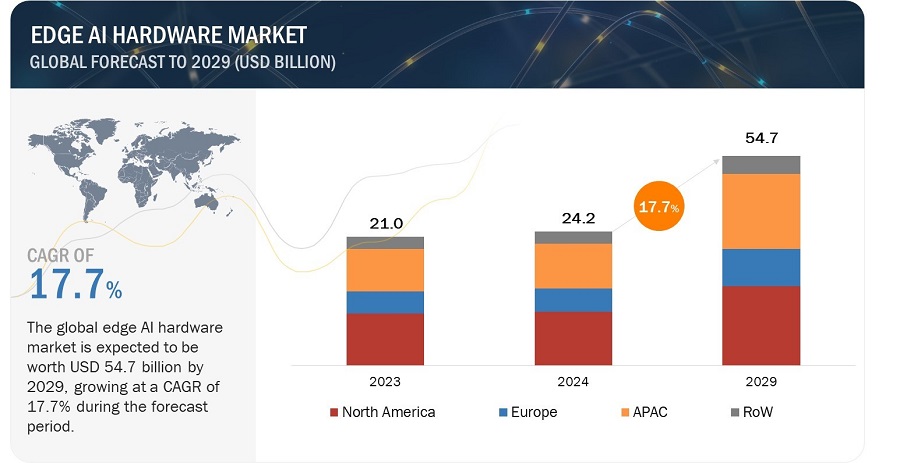

[200 Pages Report] The edge AI hardware market is projected to grow from USD 24.2 billion in 2024 and is expected to reach USD 54.7 billion by 2029, growing at a CAGR of 17.7% from 2024 to 2029. The rapid growth of Internet of Things (IoT) devices across various industries, including smart homes, industrial automation, healthcare, agriculture, and transportation, is a significant driver for edge AI hardware. Edge AI enables IoT devices to process data locally, make real-time decisions, and reduce reliance on centralized cloud computing.

The objective of the report is to define, describe, and forecast the edge AI hardware market based on Device, power consumption, processor, function, vertical, region.

Edge AI Hardware Market Forecast to 2029

To know about the assumptions considered for the study, Request for Free Sample Report

Edge AI Hardware Market Dynamics

Drivers: Growing demand for real-time data transmission in mission-critical applications

Edge AI hardware enables data to be processed locally at the edge of the network, reducing the time it takes for critical decisions to be made favoring mission-critical applications such as autonomous vehicles, industrial automation, healthcare monitoring, and emergency response systems to gather real-time data processing with minimal latency. Edge AI hardware enhances the reliability and resilience of mission-critical systems by reducing dependence on cloud connectivity. Local processing ensures that applications continue to function even in cases of intermittent or disrupted network connectivity. It also reduces the volume of data transmitted over the network by filtering and processing data locally. This optimizes network bandwidth and reduces congestion, particularly in scenarios where large volumes of data are generated continuously.

Restraint: Associated complications in building edge networks

Establishing edge networks requires a robust and distributed network infrastructure that can handle diverse edge devices and applications. Integrating edge nodes, gateways, and cloud resources while ensuring seamless connectivity and scalability can be complex and resource-intensive. Moreover, edge networks often consist of heterogeneous devices and technologies from different vendors. Ensuring interoperability and compatibility between hardware, software, and communication protocols across the edge ecosystem can be challenging, leading to integration issues and deployment delays.

Opportunity: Optimizing edge AI hardware with generative AI workloads

Generative AI specializes in tasks like creating realistic images, music, or text formats (like poems or code) based on existing data. In contrast, edge AI empowers devices to analyze and interpret data at the source rather than relying solely on the cloud for processing. Generative AI algorithms have specific computational needs. Generative AI can design chips with the right balance of processing power, memory, and specialized hardware accelerators for generative AI tasks, minimizing power consumption at the edge. By optimizing hardware for specific tasks, generative AI can help create smaller, more efficient edge devices ideal for applications with size and power limitations, like wearables or Internet of Things (IoT) devices. Generative AI models often require real-time processing, especially in image and speech generation applications. With its ability to perform computations locally on the device, Edge AI hardware reduces the latency associated with sending data to a remote server for processing. This is crucial for applications requiring real-time responses, such as autonomous vehicles, robotics, and augmented reality.

Challenge: Lack of effective standardization

Edge computing encompasses a wide array of devices, including sensors, gateways, edge servers, and specialized AI accelerators. The lack of standardized interfaces and protocols across these devices complicates integration and interoperability within edge networks. Moreover, edge AI hardware solutions vary in terms of hardware architectures, processing units (e.g., CPUs, GPUs, FPGAs, TPUs), memory configurations, and power consumption profiles. The absence of standardized hardware specifications makes it challenging for developers and solution providers to develop software and applications that can run efficiently across diverse edge devices.

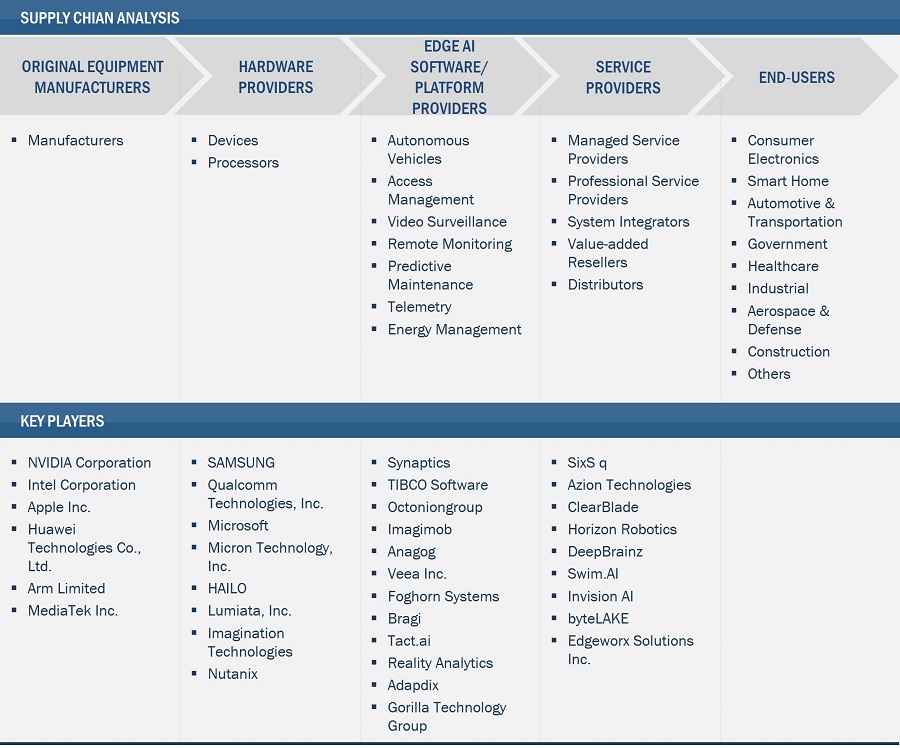

Edge AI hardware Map/Ecosystem:

Inference in the function segment of the edge AI hardware market is expected hold largest market size during the forecast period.

Many edge applications require low latency and real-time processing of data to enable immediate actions and responses. Inference at the edge enables devices to analyze data locally without relying on cloud connectivity, reducing latency and improving responsiveness for time-sensitive applications. Moreover, on-device inference can lead to high responsiveness, which is a major factor in the growth of the market for edge AI hardware products designed to draw inferences.

The GPU in the processor segment of edge AI hardware market to witness highest CAGR during the forecast period.

GPUs are specifically designed to accelerate matrix and vector operations commonly used in AI and machine learning algorithms. They offer high computational throughput and floating-point performance, making them well-suited for AI inference tasks at the edge. Moreover, modern GPUs are highly scalable and configurable, allowing edge AI hardware developers to optimize performance based on specific application requirements. GPUs can be integrated into various edge devices, from smartphones and IoT sensors to edge servers and industrial machines.

The healthcare segment is expected to witness highest growth rate in the edge AI hardware market during the forecast period.

The healthcare industry is increasingly adopting Internet of Things (IoT) devices for patient monitoring, remote care, asset tracking, and facility management. Healthcare applications require immediate insights and responses based on patient data, diagnostic images, sensor readings, and medical records. Edge AI hardware enables healthcare providers to analyze data locally and make critical decisions without relying solely on centralized servers. Moreover, edge AI hardware supports continuous patient monitoring and personalized healthcare services by processing data from wearable devices, medical sensors, and home-based monitoring systems.

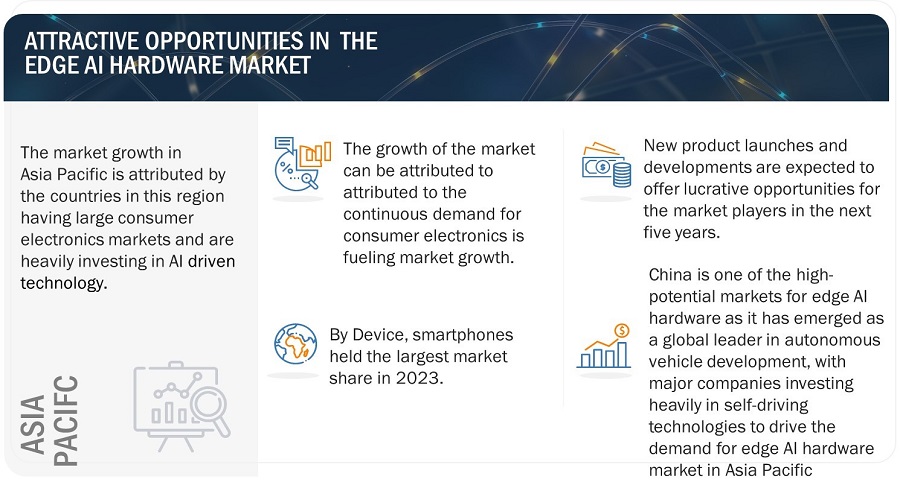

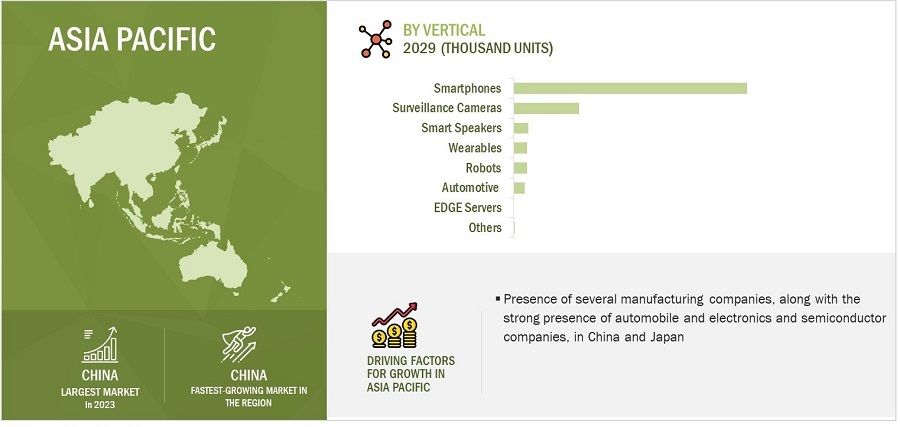

Edge AI hardware market in the Asia Pacific estimated to grow at the fastest rate during the forecast period.

Many countries in Asia Pacific, including China, Japan, South Korea, and India, are leading in technology adoption and innovation. These countries have large consumer electronics markets and are investing heavily in AI, driving the demand for edge AI hardware for smart devices and applications. For instance In 2024, according to an article by CNN Business, the South Korean government will invest USD 6.94 billion in artificial intelligence by 2027 as part of efforts to retain a leading global position in cutting-edge semiconductor chips. With this announcement, the government would support establishing a high-profile research center that would work as a "pivot" for the country's R&D activities in the artificial intelligence field.

Edge AI Hardware Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

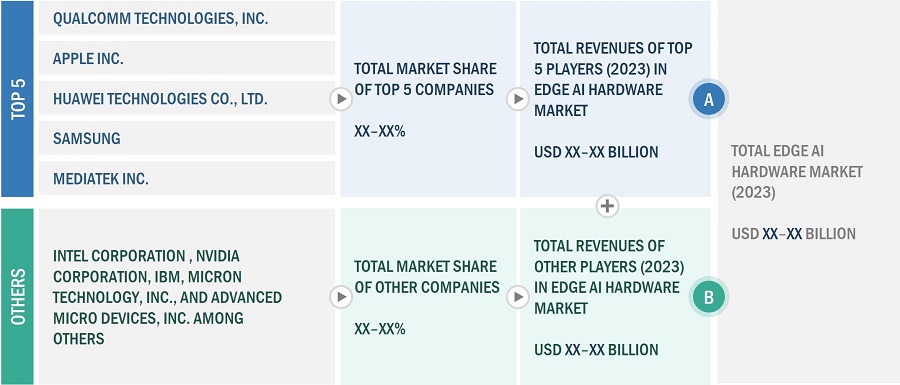

Major vendors in the edge AI hardware companies include Qualcomm Technologies, Inc. (US), Huawei Technologies Co., Ltd. (China), SAMSUNG (South Korea), Apple Inc. (US), MediaTek Inc. (Taiwan), Intel Corporation (US), NVIDIA Corporation (US), IBM (US), Micron Technology, Inc. (US), and Advanced Micro Devices, Inc. (US), among others.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size available for years |

2020-2029 |

|

Base year |

2023 |

|

Forecast period |

2024—2029 |

|

Forecast Units |

USD Million/USD Billion, Thousand/Million units |

|

Segments Covered |

By Device, Power consumption, Processor, Function, Vertical and Region |

|

Geographic regions covered |

North America, Europe, Asia Pacific, and RoW |

|

Companies covered |

Qualcomm Technologies, Inc. (US), Huawei Technologies Co., Ltd. (China), SAMSUNG (South Korea), Apple Inc. (US), MediaTek Inc. (Taiwan), Intel Corporation (US), NVIDIA Corporation (US), IBM (US), Micron Technology, Inc. (US), Advanced Micro Devices, Inc. (US), Meta (US), Tesla (US), Google (US), Microsoft (US), Imagination Technologies (UK), Cambricon (China), Tenstorrent (Canada), Blaize (US), General Vision, Inc (US), Mythic (US), Zero ASIC Corporation (US), Applied Brain Research, Inc. (Canada), Horizon Robotics (China), Ceva, Inc. (US), Graphcore (UK), SambaNova Systems, Inc. (US), HAILO (Israel), and Veridify Security Inc. (US) |

Edge AI Hardware Market Highlights

This research report categorizes the edge AI Hardware market based on Device, Power consumption, Processor, Function, Vertical and Region

|

Segment |

Subsegment |

|

By Device |

|

|

By Power Consumption |

|

|

By Processor |

|

|

By Function |

|

|

By Vertical |

|

|

By Region: |

|

Recent Developments

- In July 2023, Huawei Technologies Co., Ltd. and other partners officially launched the "Global Alliance on Artificial Intelligence for Industry and Manufacturing" (AIM Global). Led by UNIDO (Austria), AIM Global would integrate public and private partners to foster the use of and innovation around AI in industry and manufacturing.

- In April 2024, Apple plans to revolutionize its Mac lineup with the imminent production of M4 computer processors equipped with cutting-edge AI processing capabilities. According to Bloomberg, citing sources familiar with the matter, the company plans to equip every Mac model with this advanced TECHNOLOGY.

- In January 2024, IBM announced that Korea Quantum Computing (KQC) had engaged IBM to offer IBM's most advanced AI software and infrastructure and quantum computing services. KQC's ecosystem of users will have access to IBM's full stack solution for AI, including Watsonx, an AI and data platform to train, tune and deploy advanced AI models and software for enterprises.

Critical questions answered by this report::

What are the key strategies adopted by key companies in the edge AI hardware market?

Product launches, partnerships, and collaborations have been and continue to be some of the major strategies the key players adopt to grow in the edge AI hardware market.

Which region dominates the edge AI hardware market?

The Asia Pacific region is expected to dominate the edge AI hardware market.

Which device dominates the edge AI hardware market?

The smartphone segment is expected to dominate the edge AI hardware market.

Which vertical dominates the edge AI hardware market?

The consumer electronics segment is expected to have the largest market size during the forecast period.

Who are the major companies in the edge AI hardware market?

The major players in edge AI hardware include Qualcomm Technologies, Inc. (US), Huawei Technologies Co., Ltd. (China), SAMSUNG (South Korea), Apple Inc. (US), and MediaTek Inc. (Taiwan), among others.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

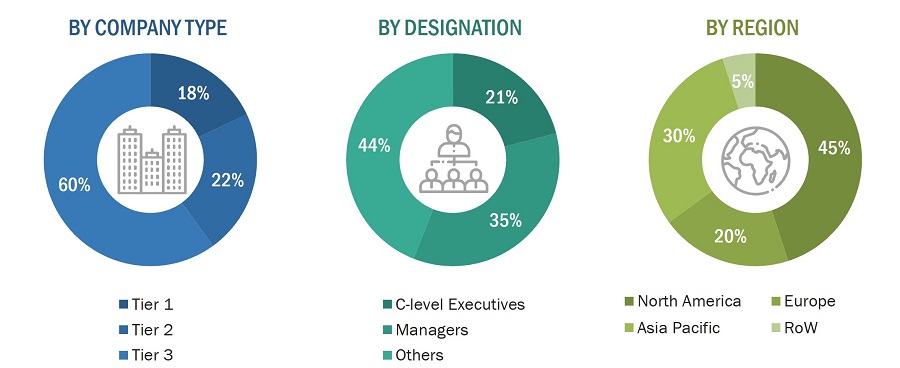

The research process for this study included systematic gathering, recording, and analysis of data about customers and companies operating in the edge AI hardware market. This process involved the extensive use of secondary sources, directories, and databases (Factiva, Oanda, and OneSource) for identifying and collecting valuable information for the comprehensive, technical, market-oriented, and commercial study of the edge AI hardware market. In-depth interviews were conducted with primary respondents, including experts from core and related industries and preferred manufacturers, to obtain and verify critical qualitative and quantitative information as well as to assess growth prospects. Key players in the edge AI hardware market were identified through secondary research, and their market rankings were determined through primary and secondary research. This research included studying annual reports of top players and interviewing key industry experts such as CEOs, directors, and marketing executives.

Secondary Research

In the secondary research process, various sources were used to identify and collect information important for this study. These include annual reports, press releases & investor presentations of companies, white papers, technology journals, certified publications, articles by recognized authors, directories, and databases.

Secondary research was mainly used to obtain key information about the industry's supply chain, the total pool of market players, the classification of the market according to industry trends to the bottom-most level, regional markets, and key developments from the market and technology-oriented perspectives.

Primary Research

Primary research was also conducted to identify the segmentation types, key players, competitive landscape, and key market dynamics, such as drivers, restraints, opportunities, challenges, and industry trends, along with key strategies adopted by players operating in the edge AI hardware market. Extensive qualitative and quantitative analyses were performed on the complete market engineering process to list key information and insights throughout the report.

Extensive primary research has been conducted after acquiring knowledge about the edge AI hardware market scenarios through secondary research. Several primary interviews have been conducted with experts from both demand (end users) and supply side (edge AI hardware manufacturers/providers) across four major geographic regions: North America, Europe, Asia Pacific, and RoW. Approximately 80% and 20% of the primary interviews were conducted from the supply and demand side, respectively. These primary data have been collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

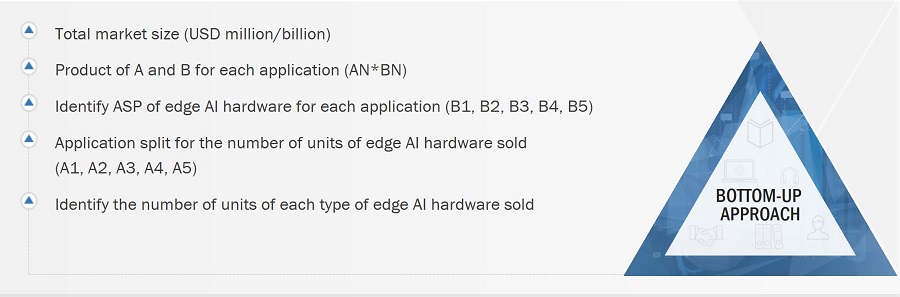

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches were implemented, along with several data triangulation methods, to estimate and validate the size of the edge AI hardware market and various other dependent submarkets. Key players in the market were identified through secondary research, and their market share in the respective regions was determined through primary and secondary research. This entire research methodology included the study of annual and financial reports of the top players, as well as interviews with experts (such as CEOs, VPs, directors, and marketing executives) for key insights (quantitative and qualitative).

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All the possible parameters that affect the markets covered in this research study were accounted for, viewed in detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Edge AI Hardware Market: Bottom-Up Approach

Edge AI Hardware Market: Top-down Approach

Data Triangulation

After arriving at the overall market size from the market size estimation process, as explained above, the total market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, market breakdown and data triangulation procedures have been employed, wherever applicable. The data have been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market has been validated using top-down and bottom-up approaches.

Market Definition

Artificial intelligence (AI) technology is now implemented in smartphones, automobiles, drones, and robots. Edge AI is the combination of edge computing and artificial intelligence. Edge AI is the implementation of AI applications in devices throughout the physical world. In this technique, the computation of AI is done near the user at the edge of the network, close to where the data is located, rather than centrally in a cloud computing facility or at private data centers. Edge AI offers a way to process data faster than cloud processing. The release of low-power and high-computing processors has led to the integration of AI algorithms into devices. Developing dedicated AI processors for edge devices has resulted in AI inference performed on devices rather than the cloud platform.

Key Stakeholders

- Semiconductor companies

- Technology providers

- Universities and research organizations

- System integrators

- AI solution providers

- AI platform providers

- AI system providers

- Investors and venture capitalists

- Manufacturers and people implementing AI technology

- Government agencies

- IoT providers

- Consulting firms

- Consulting firms

Report Objectives

- To define, describe, and forecast the edge artificial intelligence (AI) hardware market in terms of volume based by processor, power consumption, device, function, vertical, and region.

- To describe and forecast the market, in terms of value, by region—North America, Europe, Asia Pacific, and RoW (South America, GCC, and Rest of Middle East and Africa).

- To define, describe, and forecast the global edge AI hardware market in terms of value.

- To provide detailed information regarding factors (drivers, restraints, opportunities, and challenges) influencing market growth

- To provide a detailed overview of the process flow of the edge AI hardware market

- To analyze supply chain, market/ecosystem map, trend/disruptions impacting customer business, technology analysis, Porter's five force analysis, trade analysis, case study analysis, patent analysis, key conferences & events, and regulations related to the edge AI hardware market.

- To analyze opportunities for stakeholders in the edge AI hardware market by identifying the high growth segments

- To strategically analyze micro markets concerning individual growth trends, prospects, and contributions to the overall market

- To strategically profile the key players and comprehensively analyze their market shares and core competencies along with detailing the competitive leadership and analyzing growth strategies, such as product launches and developments, expansions, acquisitions, and partnerships, of leading players.

- Analyzing opportunities in the market for stakeholders and providing a competitive landscape for the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Edge AI Hardware Market