Managed Network Services Market by Type ( Managed LAN, Managed Wi-Fi, Managed WAN, Managed IP/VPN, Managed Network Security), Vertical, and Region( North America, Asia Pacific, Europe, Middle East Africa, Latin America) - Global Forecast to 2028

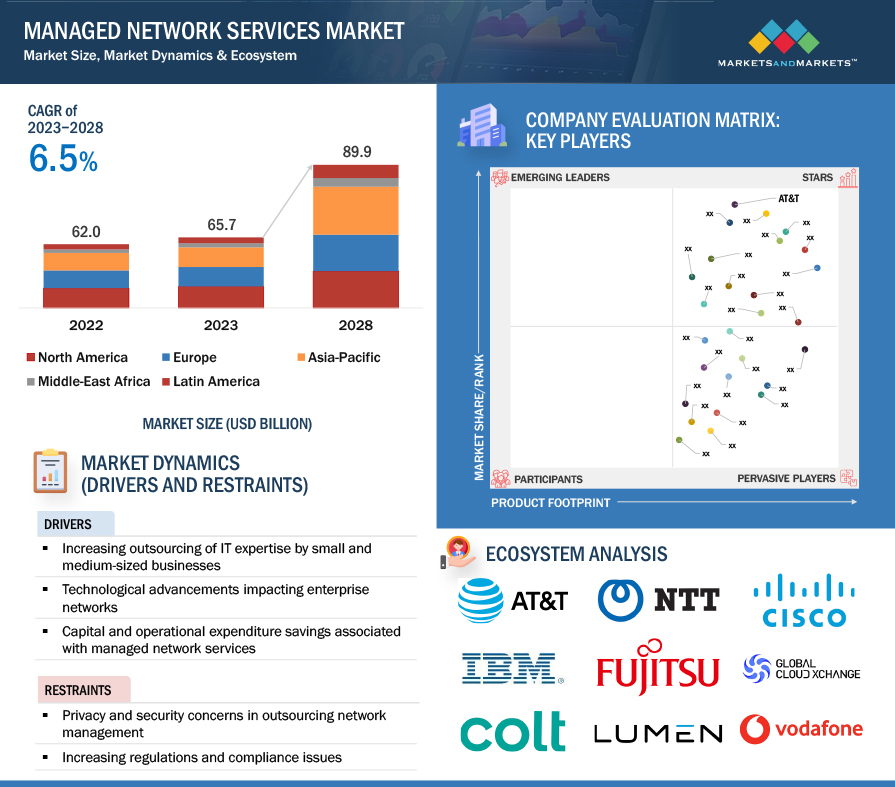

[236 Pages Report] The Managed Network Services market size is projected to grow from USD 65.7 billion in 2023 to USD 89.9 billion by 2028 at a CAGR of 6.5% during the forecast period. Managed network services are an attractive alternative to the costly, time-consuming business of in-house network management services, which are difficult to install and manage for SMEs where cost is a significant factor.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Managed Network Services Market Dynamics

Driver: Increasing trend of digital transformation across the globe

Digitalization is sweeping industries and necessitates networks with remarkable agility to deliver unparalleled customer experiences. Recognizing this critical imperative, global enterprises embark on ambitious digital journeys, embracing cutting-edge technologies to transform their operations and customer interactions. These transformative endeavors, however, demand skilled resources and global reach that often exceed internal capabilities. MNS providers emerge as strategic partners in this evolving landscape, adeptly bridging skill gaps and facilitating access to new markets through innovative solutions. Their comprehensive expertise empowers organizations to navigate the multifaceted digital terrain, encompassing cloud, mobile, and emerging technologies. This strategic alliance fosters a surge in MNS adoption as organizations seek agile networks and skilled resources to fuel their digital metamorphosis. Further propelling this trend are advancements in cloud technologies, accelerated mobile device penetration, a growing appetite for technological adoption, and the strategic initiatives undertaken by multinational corporations. These converging forces create a fertile ground for global MNS market growth, empowering organizations to thrive in the dynamic digital ecosystem.

Restraint: Concerns over data privacy and security

One of the major restraining factors in outsourcing network functions management is the risk of exposing critical business details. Data privacy and security are primary criteria enterprises consider when selecting managed network services. Enterprises believe managed network services can disclose their sensitive data and cause them to lose control over their infrastructure. Data storage control is partially or entirely under the vendors’ control, and they may get access to customer’s data when enterprises select managed network services for their networks. Network security is an imperative consideration that can guarantee the privacy of the client’s data. Outsourcing network services can also generate issues in organizational security among clients. However, managed network service providers never misuse client’s confidential documents unless access has been given to them by the client itself. Taking appropriate security and proactive control measures becomes hectic for enterprises when data access and control rests with the vendor. The data is also vulnerable to data breaches, and companies do not trust vendors. Enterprises must constantly enforce robust security and compliance protocols to limit access to sensitive and critical content and safeguard the information against threats. This aspect is a major restraining factor for enterprises adopting managed network services.

Opportunity: Opportunity to provide value-added services above and beyond core network infrastructure and become true business partners

In today's hypercompetitive environment, more is needed for a managed network service provider to be solely a network infrastructure provider. Nowadays, enterprises want their service providers to help drive digital transformation solutions. They expect managed network service providers to help them achieve more with the advanced technologies to better engage with their customers and radically improve performance. As more enterprises begin the digital transformation process, managed network service providers have an opportunity to provide value-added services above and beyond core network infrastructure and become true business partners.

Challenge: Monitoring complex, multi-technology physical and virtual networks across customer networks

As cloud networks and service offerings continue to expand, large businesses and SMEs have opted to outsource the management and assurance of their network. This challenges Managed Service Providers (MSPs) to continuously monitor complex, multi-technology physical and virtual networks across customer networks. The managed network service provider is expected to meet diverse customer requirements with varying networks and ensure proper regulatory compliance while offering managed network services to customers. MSPs should practice appropriate security and regulatory policies, as non-compliance with regulations and standards can directly affect the services they provide to enterprises, leading to significant financial and business risks to clients and their business processes. As technology evolves, it becomes more work for service providers to keep up with the constantly changing technology and government regulations. This is a significant challenge for managed network service providers and enterprises in this market.

By type, Manged LAN will account for the largest market size during the forecast.

Managed network service providers offer various services to monitor, maintain, and protect organizations' network infrastructure while reducing network operating costs. Providers roll out new network business tools to connect users in different geographical locations and increase communication efficiency. Managed LAN is an industrialized service that comprehensively addresses the LAN and WLAN infrastructure at organizations’ small branch offices, big campuses, and data centers. Managed LAN services boost productivity by minimizing downtime, and the ongoing support frees IT teams to concentrate on organizations’ other projects and priorities. Managed LAN services from MSPs comprise planning, on-demand provisioning, and the management of organizations' LAN ports, including roll-out to all sites, software and hardware maintenance, proactive monitoring, service level reporting, and support. Managed LAN services cut both infrastructure and operational costs for an enterprise.

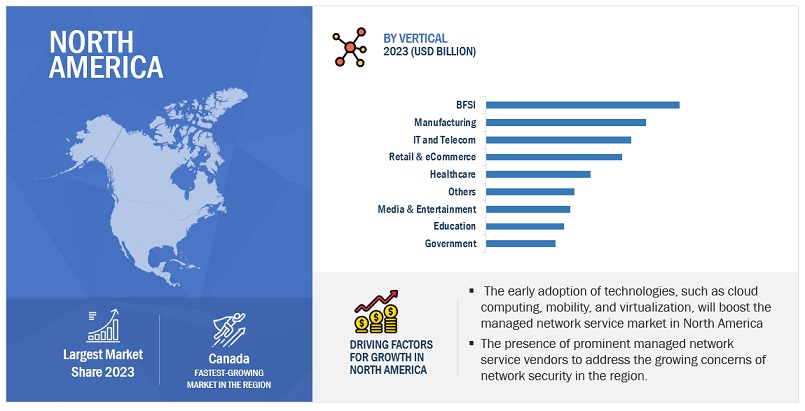

Based on region, North America is expected to hold the largest market size during the forecast.

North America houses the headquarters of the major players in the MNS market, such as Cisco, IBM, Verizon, and AT&T. The region witnesses a considerable demand for the SD-WAN solution because of the rising demand for the next-generation 5G network. Due to the rapidly changing technological landscape, enterprises are inclined toward managed SD-WAN services. North America remains a leader in the market due to the rising demand for high-speed networks, the increasing competition among major players in the networking industry to provide better customer experience, and the growing adoption of cloud networking. Mobile penetration in the region is high.

Market Players:

The major vendors in this market include are IBM (US), Cisco (US), Ericsson (Sweden), Verizon (US), Huawei (China), AT&T (US), BT Group (UK), Telefonica (Spain), T-Systems (Germany), NTT (Japan), Orange (France), Vodafone (UK), Fujitsu (Japan), Lumen (US), Masergy (US), Colt Technology Services (UK), Telstra (Australia), CommScope (US), etc. These players have adopted various growth strategies, such as partnerships, agreements and collaborations, new product launches and enhancements, and acquisitions to expand their MNS footprint.

Want to explore hidden markets that can drive new revenue in Managed Network Services Market?

Scope of the Report

Want to explore hidden markets that can drive new revenue in Managed Network Services Market?

|

Report Metrics |

Details |

|

Market size available for years |

2017-2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD) Million/Billion |

|

Segments Covered |

By Type, Verticals, and region |

|

Region covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

|

Companies covered |

The major players in the managed network services market are IBM (US), Cisco (US), Ericsson (Sweden), Verizon (US), Huawei (China), AT&T (US), BT Group (UK), Telefonica (Spain), T-Systems (Germany), NTT (Japan), Orange (France), Vodafone (UK), Fujitsu (Japan), Lumen (US), Masergy (US), Colt Technology Services (UK), Telstra (Australia), CommScope (US). |

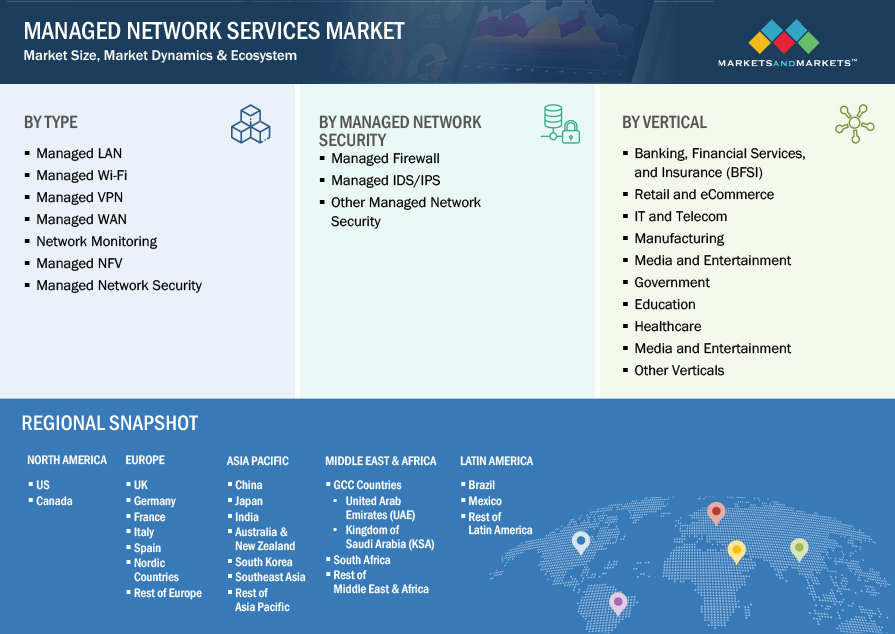

This research report categorizes the managed network services market to forecast revenues and analyze trends in each of the following submarkets:

Based on Type:

- Managed LAN

- Managed Wi-Fi

- Managed VPN

- Managed WAN

- Network Monitoring

- Managed NFV

- Managed Network Security

Based on Network Security:

- Managed Firewall

- Managed IDS/IPS

- Other Managed Network Security

Based on Verticals:

- Banking, Financial Services and Insurance

- Retail and Ecommerce

- IT and Telecom

- Manufacturing

- Government

- Education

- Healthcare

- Media and Entertainment

- Other Verticals

By Region:

-

North America

- US

- Canada

-

Europe

- UK

- France

- Germany

- Spain

- Italy

- Nordics

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Australia and New Zealand

- South East Asia

- Rest of Asia Pacific

-

Middle East and Africa

-

GCC Countries

- UAE

- KSA

- Rest of GCC Countries

- South Africa

- Rest of the Middle East & Africa

-

GCC Countries

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In May 2023, NTT announced the Next Generation Platform for Managed Network Services. The platform provides customers a direct pathway towards network transformation, underpinned by NTT’s managed services experience, expertise, and expansive technical resources.

- In Feb 2023, Huawei launched the digitally managed network solution to boost new growth for carriers' B2B services.

- In June 2021, with Cisco, AT&T Business introduced Webex Calling with AT&T – Enterprise to Cisco’s Unified Communications Manager – Cloud (UCMC), helping businesses optimize operations and accelerate digital transformation in any environment.

- In May 2021, Cisco Webex, one of the leading providers of cloud-based collaboration solutions, and Box, one of the leading Content Clouds, announced new and deepened integrations between the two technology platforms to make it easier for customers to work securely and effectively in the cloud.

Frequently Asked Questions (FAQ):

What are Managed Network Services?

Managed network services refer to outsourcing/offloading network-related operations of organizations to an expert third-party organization such as Managed Service Providers (MSPs). MSPs are responsible for a few or entire networking needs, including monitoring and management of network infrastructure components, network security management, networking applications, and functions. They also offer value-added services apart from managing networks, thus looking after organizations’ IT services and processes, helping them stay focused on their core business uninterrupted

What is the market size of the Managed Network Services market?

The Managed Network Services market size is projected to grow from USD 65.7 billion in 2023 to USD 89.9 billion by 2028 at a CAGR of 6.5% during the forecast period.

What are the major drivers in the Managed Network Services market?

The latest technological breakthroughs, such as big data and analytics, IoT, AI, and Machine Learning (ML), have made systems and network demands more connected and complex. Enterprises need expertise to implement such technologies into their business functions. They also need more infrastructure to execute these technologies. Hence, buying the latest equipment and managing them in-house becomes quite expensive. Enterprises have become more open to adopting Bring Your Own Device (BYOD) policies due to the increase in mobile application users in the workforce. Employees use mobile devices to connect with the corporate database in BYOD. Even though organizations rapidly adopt this technology, the primary challenge is to build networks that are more secure and accessible. User experience in BYOD is strongly dependent on the availability of continuous and robust wireless connections. Customers are leveraging cloud-based applications in their organizations, which are often bandwidth-intensive, enhancing network pressure. Engaging managed network service providers is wise for enterprises to achieve business agility. This, in turn, represents a significant opportunity for MSPs. MSPs use the latest technologies and equipment and provide strategic advice to keep enterprise businesses moving forward. They even manage enterprise systems remotely via managed services platforms, which helps enterprises boost their growth.

Who are the key Managed Network Services market players?

The key vendors operating in the Managed Network Services market include are IBM (US), Cisco (US), Ericsson (Sweden), Verizon (US), Huawei (China), AT&T (US), BT Group (UK), Telefonica (Spain), T-Systems (Germany), NTT (Japan), Orange (France), Vodafone (UK), Fujitsu (Japan), Lumen (US), Masergy (US), Colt Technology Services (UK), Telstra (Australia), CommScope (US) etc.

What are the opportunities for new market entrants in the Managed Network Services market?

Global IP traffic is increasing at an unprecedented rate. Network infrastructure trends, such as enterprise mobility, cloud services, and Voice over Internet Protocol (VoIP), have generated tremendous network traffic. Internet traffic is growing tremendously due to the proliferation of smartphones and Over-The-Top (OTT) players. This significantly burdens network administrators to effectively manage and utilize network resources, creating an opportunity for managed network service providers. Managed network service providers can provide a network with fast speed, excellent Quality of Service (QoS), and reliable and geographically diverse infrastructure to ensure ongoing business continuity. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing outsourcing of IT expertise by small and medium-sized businesses- Technological advancements impacting enterprise networks- Capital and operational expenditure savings associated with managed network servicesRESTRAINTS- Privacy and security concerns in outsourcing network management- Increasing regulations and compliance issuesOPPORTUNITIES- Exponential growth in global IP traffic and cloud traffic- Ability to provide value-added services above and beyond core network infrastructure- Increasing demand for managed network services among small and medium-sized enterprisesCHALLENGES- Establishing clear expectations and requirements- Navigating customer support- Challenges associated with marketing and sales efforts

- 5.3 MANAGED NETWORK SERVICES MARKET: BRIEF HISTORY

-

5.4 ECOSYSTEM ANALYSIS

-

5.5 CASE STUDY ANALYSISCASE STUDY 1: NORTH AMERICAN FOOD MANUFACTURER UPGRADES ITS NETWORK FOR BUSINESS GROWTH WITH KYNDRYLCASE STUDY 2: COMMUNICATIONS COSTS REDUCED TO AN INDUSTRY LOW OF ABOUT 1% OF OPERATING BUDGET WITH NTTCASE STUDY 3: EVOLUTION OF ENTERPRISE DATA MANAGEMENT IN HEALTH

- 5.6 VALUE CHAIN ANALYSIS

-

5.7 REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS- North America- Europe- Asia Pacific- Middle East & Africa- Latin America

-

5.8 PATENT ANALYSIS

-

5.9 TECHNOLOGY ANALYSISKEY TECHNOLOGIES- Software-defined networking (SDN)- Network functions virtualization (NFV)- Artificial intelligence (AI) and machine learning (ML)- Security automation and orchestration (SAO)ADJACENT TECHNOLOGIES- Cloud computing- Internet of Things (IoT)- Edge computing- BlockchainCOMPLEMENTARY TECHNOLOGIES- Big data analytics- Cyber security automation tools- Collaboration platforms

- 5.10 PRICING ANALYSIS

-

5.11 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF BUYERSBARGAINING POWER OF SUPPLIERSCOMPETITIVE RIVALRY

- 5.12 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

-

5.13 KEY STAKEHOLDERS & BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 5.14 KEY CONFERENCES & EVENTS IN 2024–2025

-

5.15 TECHNOLOGY ROADMAP FOR MANAGED NETWORK SERVICES MARKETSHORT-TERM ROADMAP (2023–2025)MID-TERM ROADMAP (2026–2028)LONG-TERM ROADMAP (2029–2030)

- 5.16 BEST PRACTICES TO IMPLEMENT MANAGED NETWORK SERVICES MARKET

- 5.17 CURRENT & EMERGING BUSINESS MODELS

- 5.18 TOOLS, FRAMEWORKS, AND TECHNIQUES USED IN MANAGED NETWORK SERVICES

- 5.19 INVESTMENT AND FUNDING SCENARIO

-

6.1 INTRODUCTIONMANAGED NETWORK SERVICES MARKET, BY TYPE: DRIVERS

-

6.2 MANAGED LANIMPROVED EFFICIENCY, REDUCED DOWNTIME, AND OTHER BENEFITS TO DRIVE RELIANCE ON MANAGED LAN

-

6.3 MANAGED WI-FION-CALL SUPPORT, HIGH PERFORMANCE, AND SECURITY TO SUPPORT ADOPTION OF MANAGED WI-FI

-

6.4 MANAGED VPNFOCUS ON SAFE, SECURE END-TO-END SOLUTIONS TO DRIVE ADOPTION

-

6.5 MANAGED WANCOMPLEX, TIME-CONSUMING MANAGEMENT TO DRIVE CUSTOMERS TOWARD OUTSOURCING WAN SERVICES

-

6.6 NETWORK MONITORINGNEED TO ENSURE ERROR-FREE NETWORK AND AVOID DOWNTIME

-

6.7 MANAGED NFVABILITY TO ADAPT TO CHANGING REQUIREMENTS AND FREE UP INTERNAL RESOURCES TO SUPPORT DEMAND

-

6.8 MANAGED NETWORK SECURITYNEED TO ENSURE STRONG SECURITY AND RISK MITIGATION TO DRIVE MARKET

-

7.1 INTRODUCTIONNETWORK SECURITY: MARKET DRIVERS

-

7.2 MANAGED FIREWALLFIREWALL OPERATION, ADMINISTRATION, MONITORING, AND MAINTENANCE OF FIREWALL INFRASTRUCTURE TO DRIVE DEMAND

-

7.3 MANAGED IDS/IPSNEED TO PREVENT HARMFUL TRAFFIC FROM ENTERING TRUSTED AREAS OF NETWORK AND SYSTEM TO SUPPORT ADOPTION

- 7.4 OTHER MANAGED NETWORK SECURITY

-

8.1 INTRODUCTIONVERTICALS: MANAGED NETWORK SERVICES MARKET DRIVERS

-

8.2 BANKING, FINANCIAL SERVICES AND INSURANCEBFSI TO HOLD LARGEST SHARE OF MANAGED NETWORK SERVICES MARKET

-

8.3 RETAIL AND ECOMMERCENEED FOR ROBUST NETWORK AND CUSTOMER EXPERIENCE IMPROVEMENTS TO SUPPORT ADOPTION

-

8.4 IT AND TELECOMCUSTOMER SATURATION, SLOW INNOVATION, AND OTHER CHALLENGES TO DRIVE USERS TOWARD OUTSOURCING

-

8.5 MANUFACTURINGENHANCED PRODUCT LIFE CYCLE, INNOVATION, AND COST REDUCTION BENEFITS TO DRIVE ADOPTION

-

8.6 GOVERNMENTRISING DATA GENERATION AND CONCERNS OVER SECURITY BREACHES TO DRIVE DEMAND FOR OUTSOURCING

-

8.7 EDUCATIONDIGITAL MEDIA TO OFFER PERSONALIZED ELEARNING CONTENT

-

8.8 HEALTHCAREGREATER EFFICIENCY AND REDUCED OPERATING COSTS TO DRIVE HEALTHCARE CUSTOMERS TOWARD MANAGED NETWORK SERVICES

-

8.9 MEDIA AND ENTERTAINMENTSHIFTING CONSUMPTION TRENDS TO DRIVE MEDIA HOUSES TOWARD DIGITAL DISTRIBUTION AND HIGH-SPEED CONNECTIVITY

- 8.10 OTHER VERTICALS

- 9.1 INTRODUCTION

-

9.2 NORTH AMERICANORTH AMERICA: MANAGED NETWORK SERVICES MARKET DRIVERSNORTH AMERICA: RECESSION IMPACTUS- US to hold larger share of North American marketCANADA- Technological advancements, growing network complexities to favor market growth

-

9.3 EUROPEEUROPE: MANAGED NETWORK SERVICES MARKET DRIVERSEUROPE: RECESSION IMPACTUK- Infrastructural development and high mobile subscriber count to support market growthGERMANY- Strong presence of auto and manufacturing companies, wide Wi-Fi usage to favor demand for managed network servicesFRANCE- Rising adoption of advanced technologies to drive demand for servicesITALY- Development of digital landscape and growing demand for services to drive marketSPAIN- Government initiatives to support demand growthNORDIC COUNTRIES- Rising cyber threats and stringent requirements to drive marketREST OF EUROPE

-

9.4 ASIA PACIFICASIA PACIFIC: MANAGED NETWORK SERVICES MARKET DRIVERSASIA PACIFIC: RECESSION IMPACTCHINA- China to dominate APAC marketINDIA- Growing adoption of industry 4.0 and emphasis on network transformation to drive marketJAPAN- Shortage of professionals in IT and security to slow market growthAUSTRALIA AND NEW ZEALAND- Emphasis on digital transformation to favor demand for servicesSOUTH KOREA- Advancements in cloud computing to drive adoption of managed network servicesSOUTHEAST ASIA- Rapid digital transformation, need for robust infrastructure to support demand growthREST OF ASIA PACIFIC

-

9.5 MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA: MANAGED NETWORK SERVICES MARKET DRIVERSMIDDLE EAST & AFRICA: RECESSION IMPACTMIDDLE EAST- KSA- UAE- Kuwait- Bahrain- Rest of Middle EastAFRICA- Shifting toward cloud-based technologies to boost market growth

-

9.6 LATIN AMERICALATIN AMERICA: MANAGED NETWORK SERVICES MARKET DRIVERSLATIN AMERICA: RECESSION IMPACTMEXICO- Government initiatives and infrastructural development to drive marketBRAZIL- Strong revenue, investments in core networks to support growthREST OF LATIN AMERICA

- 10.1 OVERVIEW

-

10.2 STRATEGIES ADOPTED BY KEY PLAYERS/RIGHT TO WINOVERVIEW OF STRATEGIES DEPLOYED BY KEY MANAGED NETWORK SERVICE VENDORS

- 10.3 REVENUE ANALYSIS

- 10.4 MARKET SHARE ANALYSIS

-

10.5 COMPANY EVALUATION MATRIX: KEY PLAYERSSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT: KEY PLAYERS

-

10.6 COMPANY EVALUATION MATRIX: STARTUPS/SMESPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING

-

10.7 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALS

- 10.8 BRAND/PRODUCT COMPARISON

- 10.9 COMPANY VALUATION AND FINANCIAL METRICS

-

11.1 MAJOR PLAYERSCISCO- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewERICSSON- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewAT&T- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewBT GROUP- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewVERIZON- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewIBM- Business overview- Products/Solutions/Services offered- Recent developmentsHUAWEI- Business overview- Products/Solutions/Services offered- Recent developmentsTELEFÓNICA- Business overview- Products/Solutions/Services offered- Recent developmentsNTT- Business overview- Products/Solutions/Services offered- Recent developmentsT-SYSTEMS- Business overview- Products/Solutions/Services offered- Recent developmentsORANGE BUSINESSVODAFONEFUJITSULUMENMASERGYCOLT TECHNOLOGY SERVICESTELSTRASINGAPORE TELECOMMUNICATIONS LIMITEDGTT COMMUNICATIONSGLOBAL CLOUD XCHANGEBRENNAN ITSIFYARYAKA NETWORKSDXC TECHNOLOGYWIPROCOMARCHCOMMSCOPE

-

11.2 STARTUP/SME PLAYERSINTRODUCTIONSERVSYSFLEXIWANOMAN DATA PARKSCLOUDXBIGLEAF NETWORKS

-

12.1 INTRODUCTIONLIMITATIONSNETWORK MANAGEMENT SYSTEM- Market definition- Network management system market, by component- Network management system market, by deployment mode- Network management system market, by organization size- Network management system market, by end userNETWORK AS A SERVICE MARKET- Market definition- Network as a service market, by type- Network as a service market, by application- Network as a service market, by organization size- Network as a service market, by end user

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES, 2021–2023

- TABLE 2 RISK ASSESSMENT ANALYSIS

- TABLE 3 RESEARCH ASSUMPTIONS

- TABLE 4 MANAGED NETWORK SERVICES MARKET: ECOSYSTEM

- TABLE 5 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 INDICATIVE PRICING ANALYSIS, BY SERVICE (USD PER USER/MONTH)

- TABLE 10 AVERAGE SELLING PRICE

- TABLE 11 MANAGED NETWORK SERVICES MARKET: PORTER’S FIVE FORCES MODEL

- TABLE 12 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS (%)

- TABLE 13 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- TABLE 14 MANAGED NETWORK SERVICES MARKET: DETAILED LIST OF CONFERENCES & EVENTS IN 2024–2025

- TABLE 15 MANAGED NETWORK SERVICES MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 16 MANAGED NETWORK SERVICES MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 17 MANAGED LAN: MANAGED NETWORK SERVICES MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 18 MANAGED LAN: MANAGED NETWORK SERVICES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 19 MANAGED WI-FI: MANAGED NETWORK SERVICES MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 20 MANAGED WI-FI: MANAGED NETWORK SERVICES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 21 MANAGED VPN: MANAGED NETWORK SERVICES MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 22 MANAGED VPN: MANAGED NETWORK SERVICES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 23 MANAGED WAN: MANAGED NETWORK SERVICES MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 24 MANAGED WAN: MANAGED NETWORK SERVICES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 25 NETWORK MONITORING: MANAGED NETWORK SERVICES MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 26 NETWORK MONITORING: MANAGED NETWORK SERVICES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 27 MANAGED NFV: MANAGED NETWORK SERVICES MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 28 MANAGED NFV: MANAGED NETWORK SERVICES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 29 MANAGED NETWORK SECURITY: MANAGED NETWORK SERVICES MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 30 MANAGED NETWORK SECURITY: MANAGED NETWORK SERVICES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 31 MANAGED NETWORK SERVICES MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 32 MANAGED NETWORK SERVICES MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 33 BANKING, FINANCIAL SERVICES AND INSURANCE: MANAGED NETWORK SERVICES MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 34 BANKING, FINANCIAL SERVICES AND INSURANCE: MANAGED NETWORK SERVICES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 35 RETAIL AND ECOMMERCE: MANAGED NETWORK SERVICES MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 36 RETAIL AND ECOMMERCE: MANAGED NETWORK SERVICES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 37 IT AND TELECOM: MANAGED NETWORK SERVICES MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 38 IT AND TELECOM: MANAGED NETWORK SERVICES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 39 MANUFACTURING: MANAGED SECURITY SERVICES MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 40 MANUFACTURING: MANAGED SECURITY SERVICES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 41 GOVERNMENT: MANAGED NETWORK SERVICES MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 42 GOVERNMENT: MANAGED NETWORK SERVICES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 43 EDUCATION: MANAGED NETWORK SERVICES MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 44 EDUCATION: MANAGED NETWORK SERVICES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 45 HEALTHCARE: MANAGED NETWORK SERVICES MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 46 HEALTHCARE: MANAGED NETWORK SERVICES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 47 MEDIA AND ENTERTAINMENT: MANAGED NETWORK SERVICES MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 48 MEDIA AND ENTERTAINMENT: MANAGED NETWORK SERVICES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 49 OTHER VERTICALS: MANAGED NETWORK SERVICES MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 50 OTHER VERTICALS: MANAGED NETWORK SERVICES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 51 MANAGED NETWORK SERVICES MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 52 MANAGED NETWORK SERVICES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 53 NORTH AMERICA: MANAGED NETWORK SERVICES MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 54 NORTH AMERICA: MANAGED NETWORK SERVICES MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 55 NORTH AMERICA: MANAGED NETWORK SERVICES MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 56 NORTH AMERICA: MANAGED NETWORK SERVICES MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 57 NORTH AMERICA: MANAGED NETWORK SERVICES MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 58 NORTH AMERICA: MANAGED NETWORK SERVICES MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 59 US: MANAGED NETWORK SERVICES MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 60 US: MANAGED NETWORK SERVICES MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 61 US: MANAGED NETWORK SERVICES MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 62 US: MANAGED NETWORK SERVICES MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 63 CANADA: MANAGED NETWORK SERVICES MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 64 CANADA: MANAGED NETWORK SERVICES MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 65 CANADA: MANAGED NETWORK SERVICES MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 66 CANADA: MANAGED NETWORK SERVICES MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 67 EUROPE: MANAGED NETWORK SERVICES MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 68 EUROPE: MANAGED NETWORK SERVICES MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 69 EUROPE: MANAGED NETWORK SERVICES MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 70 EUROPE: MANAGED NETWORK SERVICES MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 71 EUROPE: MANAGED NETWORK SERVICES MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 72 EUROPE: MANAGED NETWORK SERVICES MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 73 UK: MANAGED NETWORK SERVICES MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 74 UK: MANAGED NETWORK SERVICES MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 75 UK: MANAGED NETWORK SERVICES MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 76 UK: MANAGED NETWORK SERVICES MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 77 GERMANY: MANAGED NETWORK SERVICES MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 78 GERMANY: MANAGED NETWORK SERVICES MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 79 GERMANY: MANAGED NETWORK SERVICES MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 80 GERMANY: MANAGED NETWORK SERVICES MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 81 ASIA PACIFIC: MANAGED NETWORK SERVICES MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 82 ASIA PACIFIC: MANAGED NETWORK SERVICES MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 83 ASIA PACIFIC: MANAGED NETWORK SERVICES MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 84 ASIA PACIFIC: MANAGED NETWORK SERVICES MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 85 ASIA PACIFIC: MANAGED NETWORK SERVICES MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 86 ASIA PACIFIC: MANAGED NETWORK SERVICES MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 87 CHINA: MANAGED NETWORK SERVICES MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 88 CHINA: MANAGED NETWORK SERVICES MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 89 CHINA: MANAGED NETWORK SERVICES MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 90 CHINA: MANAGED NETWORK SERVICES MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 91 INDIA: MANAGED NETWORK SERVICES MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 92 INDIA: MANAGED NETWORK SERVICES MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 93 INDIA: MANAGED NETWORK SERVICES MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 94 INDIA: MANAGED NETWORK SERVICES MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 95 MIDDLE EAST & AFRICA: MANAGED NETWORK SERVICES MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 96 MIDDLE EAST & AFRICA: MANAGED NETWORK SERVICES MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 97 MIDDLE EAST & AFRICA: MANAGED NETWORK SERVICES MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 98 MIDDLE EAST & AFRICA: MANAGED NETWORK SERVICES MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 99 MIDDLE EAST & AFRICA: MANAGED NETWORK SERVICES MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 100 MIDDLE EAST & AFRICA: MANAGED NETWORK SERVICES MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 101 MIDDLE EAST: MANAGED NETWORK SERVICES MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 102 MIDDLE EAST: MANAGED NETWORK SERVICES MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 103 MIDDLE EAST: MANAGED NETWORK SERVICES MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 104 MIDDLE EAST: MANAGED NETWORK SERVICES MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 105 MIDDLE EAST: MANAGED NETWORK SERVICES MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 106 MIDDLE EAST: MANAGED NETWORK SERVICES MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 107 KSA: MANAGED NETWORK SERVICES MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 108 KSA: MANAGED NETWORK SERVICES MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 109 LATIN AMERICA: MANAGED NETWORK SERVICES MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 110 LATIN AMERICA: MANAGED NETWORK SERVICES MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 111 LATIN AMERICA: MANAGED NETWORK SERVICES MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 112 LATIN AMERICA: MANAGED NETWORK SERVICES MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 113 LATIN AMERICA: MANAGED NETWORK SERVICES MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 114 LATIN AMERICA: MANAGED NETWORK SERVICES MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 115 MANAGED NETWORK SERVICES MARKET: DEGREE OF COMPETITION

- TABLE 116 REGIONAL FOOTPRINT

- TABLE 117 TYPE FOOTPRINT

- TABLE 118 VERTICAL FOOTPRINT

- TABLE 119 DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 120 MANAGED NETWORK SERVICES MARKET: PRODUCT LAUNCHES, JANUARY 2020–DECEMBER 2023

- TABLE 121 MANAGED NETWORK SERVICES MARKET: DEALS, JANUARY 2020–DECEMBER 2023

- TABLE 122 CISCO: BUSINESS OVERVIEW

- TABLE 123 CISCO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 124 CISCO: PRODUCT/SOLUTION/SERVICE LAUNCHES

- TABLE 125 CISCO: DEALS

- TABLE 126 ERICSSON: BUSINESS OVERVIEW

- TABLE 127 ERICSSON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 128 ERICSSON: PRODUCT/SOLUTION/SERVICE LAUNCHES

- TABLE 129 ERICSSON: DEALS

- TABLE 130 AT&T: BUSINESS OVERVIEW

- TABLE 131 AT&T: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 132 AT&T: DEALS

- TABLE 133 BT GROUP: BUSINESS OVERVIEW

- TABLE 134 BT GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 135 BT GROUP: PRODUCT/SOLUTION/SERVICE LAUNCHES

- TABLE 136 BT GROUP: DEALS

- TABLE 137 VERIZON: BUSINESS OVERVIEW

- TABLE 138 VERIZON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 139 VERIZON: PRODUCT/SOLUTION/SERVICE LAUNCHES

- TABLE 140 VERIZON: DEALS

- TABLE 141 IBM: BUSINESS OVERVIEW

- TABLE 142 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 143 IBM: DEALS

- TABLE 144 HUAWEI: BUSINESS OVERVIEW

- TABLE 145 HUAWEI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 146 HUAWEI: PRODUCT/SOLUTION/SERVICE LAUNCHES

- TABLE 147 HUAWEI: DEALS

- TABLE 148 TELEFÓNICA: BUSINESS OVERVIEW

- TABLE 149 TELEFONICA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 150 TELEFONICA: DEALS

- TABLE 151 NTT: BUSINESS OVERVIEW

- TABLE 152 NTT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 153 NTT: PRODUCT/SOLUTION/SERVICE LAUNCHES

- TABLE 154 NTT: DEALS

- TABLE 155 NTT: EXPANSIONS

- TABLE 156 T-SYSTEMS: BUSINESS OVERVIEW

- TABLE 157 T-SYSTEMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 158 T-SYSTEMS: DEALS

- TABLE 159 NETWORK MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

- TABLE 160 NETWORK MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 161 NETWORK MANAGEMENT SYSTEM MARKET, BY DEPLOYMENT TYPE, 2016–2021 (USD MILLION)

- TABLE 162 NETWORK MANAGEMENT SYSTEM MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

- TABLE 163 NETWORK MANAGEMENT SYSTEM MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

- TABLE 164 NETWORK MANAGEMENT SYSTEM MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 165 NETWORK MANAGEMENT SYSTEM MARKET, BY END USER, 2016–2021 (USD MILLION)

- TABLE 166 NETWORK MANAGEMENT SYSTEM MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 167 NETWORK AS A SERVICE MARKET, BY TYPE, 2016–2021 (USD MILLION)

- TABLE 168 NETWORK AS A SERVICE MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 169 NETWORK AS A SERVICE MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

- TABLE 170 NETWORK AS A SERVICE MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 171 NETWORK AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

- TABLE 172 NETWORK AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 173 NETWORK AS A SERVICE MARKET, BY END USER, 2016–2021 (USD MILLION)

- TABLE 174 NETWORK AS A SERVICE MARKET, BY END USER, 2022–2027 (USD MILLION)

- FIGURE 1 RESEARCH DESIGN

- FIGURE 2 RESEARCH METHODOLOGY: APPROACH

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE): REVENUE OF MANAGED NETWORK SERVICES MARKET

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY- APPROACH 1 BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE OF MANAGED NETWORK SERVICES VENDORS

- FIGURE 5 DATA TRIANGULATION METHODOLOGY

- FIGURE 6 MANAGED NETWORK SERVICES MARKET TO WITNESS SIGNIFICANT GROWTH DURING FORECAST PERIOD

- FIGURE 7 MANAGED NETWORK SERVICES MARKET: HOLISTIC VIEW

- FIGURE 8 RISING IT COMPLEXITY DUE TO DIGITAL TRANSFORMATION TO FUEL GROWTH OF MANAGED NETWORK SERVICES

- FIGURE 9 TOP SEGMENTS IN MARKET IN 2023

- FIGURE 10 MANAGED WAN SEGMENT ESTIMATED TO LEAD MARKET IN 2023

- FIGURE 11 BFSI SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 12 US AND BFSI SEGMENTS TO ESTIMATED HOLD LARGEST MARKET SHARES IN 2023

- FIGURE 13 MANAGED NETWORK SERVICES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 14 BRIEF HISTORY OF MANAGED NETWORK SERVICES

- FIGURE 15 KEY PLAYERS IN MANAGED NETWORK SERVICES MARKET ECOSYSTEM

- FIGURE 16 MANAGED NETWORK SERVICES MARKET: VALUE CHAIN ANALYSIS

- FIGURE 17 LIST OF MAJOR PATENTS FOR MANAGED NETWORK SERVICES

- FIGURE 18 AVERAGE SELLING PRICE OF KEY PLAYERS, BY SERVICE

- FIGURE 19 MANAGED NETWORK SERVICES MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 20 REVENUE SHIFT IN MANAGED NETWORK SERVICES MARKET

- FIGURE 21 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- FIGURE 22 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- FIGURE 23 TELECOM MARKET: INVESTMENT AND FUNDING SCENARIO, 2015-2020

- FIGURE 24 MANAGED NETWORK SECURITY SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 25 HEALTHCARE VERTICAL TO RECORD HIGHEST GROWTH RATE

- FIGURE 26 MANAGED NETWORK SERVICES MARKET: REGIONAL SNAPSHOT

- FIGURE 27 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 28 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 29 REVENUE ANALYSIS OF KEY PLAYERS IN MANAGED NETWORK SERVICES MARKET, 2020–2022 (USD BILLION)

- FIGURE 30 MANAGED NETWORK SERVICES MARKET SHARE ANALYSIS, BY KEY PLAYER, 2022

- FIGURE 31 MANAGED NETWORK SERVICES MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 32 COMPANY FOOTPRINT

- FIGURE 33 MANAGED NETWORK SERVICES MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 34 BRAND/PRODUCT COMPARISON

- FIGURE 35 VALUATION AND FINANCIAL METRICS OF KEY MANAGED NETWORK SERVICE VENDORS

- FIGURE 36 CISCO: COMPANY SNAPSHOT

- FIGURE 37 ERICSSON: COMPANY SNAPSHOT

- FIGURE 38 AT&T: COMPANY SNAPSHOT

- FIGURE 39 BT GROUP: COMPANY SNAPSHOT

- FIGURE 40 VERIZON: COMPANY SNAPSHOT

- FIGURE 41 IBM: COMPANY SNAPSHOT

- FIGURE 42 HUAWEI: COMPANY SNAPSHOT

- FIGURE 43 TELEFÓNICA: COMPANY SNAPSHOT

- FIGURE 44 NTT: COMPANY SNAPSHOT

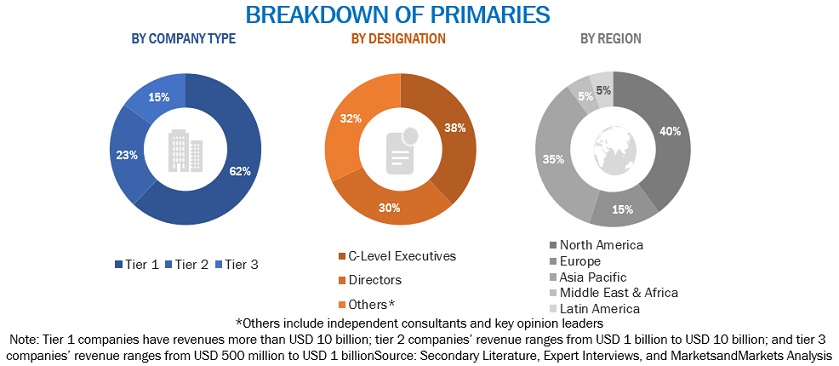

The research study involved four major activities in estimating the managed network services market size. Exhaustive secondary research has been done to collect important information about the market and peer markets. The next step has been to validate these findings, assumptions, and sizing with the help of primary research with industry experts across the value chain. Both top-down and bottom-up approaches have been used to estimate the market size. Post which the market breakdown and data triangulation have been adopted to estimate the market sizes of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information for the study. The secondary sources included annual reports, press releases, investor presentations of companies, white papers, certified publications, and articles from recognized associations and government publishing sources. Secondary research was mainly used to obtain key information about industry insights, the market’s monetary chain, the overall pool of key players, market classification, and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from the market and technology-oriented perspectives.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for the report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations providing managed network services. The primary sources from the demand side included end users, such as Chief Information Officers (CIOs), consultants, service professionals, technicians and technologists, and managers at public and investor-owned utilities.

In the market engineering process, top-down and bottom-up approaches and several data triangulation methods were extensively used to perform market estimation and market forecasting for the overall market segments and subsegments listed in the report. Extensive qualitative and quantitative analyses were performed on the complete market engineering process to list key information/insights throughout the report.

After the complete market engineering (including calculations for market statistics, market breakup, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information. Primary research was undertaken to identify the segmentation types, industry trends, key players, the competitive landscape of different market players, and key market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key strategies.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the market engineering process, top-down and bottom-up approaches and multiple data triangulation methods were used to estimate and validate the size of the managed network services market and other dependent submarkets. The research methodology used to estimate the market sizes includes the following:

- Initially, MarketsandMarkets focuses on top-line investments and spending in the ecosystems. Further, significant developments in the critical market area have been considered.

- Tracking the recent and upcoming developments in the managed network services market that include investments, R&D activities, product launches, collaborations, mergers and acquisitions, and partnerships, as well as forecasting the market size based on these developments and other critical parameters.

- Conduct multiple discussions with key opinion leaders to know about diverse types of authentications and brand protection offerings used and the applications for which they are used to analyze the breakup of the scope of work carried out by major companies.

- Segmenting the overall market into various market segments

- Validating the estimates at every level through discussions with key opinion leaders, such as chief executives (CXOs), directors, and operation managers, and finally with the domain experts at MarketsandMarkets

Market Size Estimation Methodology-Bottom-up approach

To know about the assumptions considered for the study, Request for Free Sample Report

Market Size Estimation Methodology-top-down approach

Data Triangulation

The managed network services market has been split into segments and sub-segments after arriving at the overall market size from the abovementioned estimation process. Where applicable, data triangulation and market breakdown procedures have been used to complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments. The data has been triangulated by studying various factors and trends from both the demand and supply sides.

The managed network services market size has been validated using top-down and bottom-up approaches.

Market Definition

Managed network services refer to outsourcing/offloading network-related operations of organizations to an expert third-party organization such as Managed Service Providers (MSPs). MSPs are responsible for a few or entire networking needs, including monitoring and management of network infrastructure components, network security management, networking applications, and functions. They also offer value-added services apart from managing networks, thus looking after organizations’ IT services and processes, helping them stay focused on their core business uninterrupted.

Stakeholders

- Global managed service providers

- Cloud Service Providers (CSPs)

- Independent Software Vendors (ISVs)

- System integrators

- Value-added Resellers (VARs)

- Managed Service Providers (MSPs)

- Chief Financial Officers (CFOs)

- Information Technology (IT) directors

- Small and Medium-sized Enterprises (SMEs)

- IT strategy consultants

- Managed services consulting vendors

- Technology partners

- Research organizations

- Enterprise users

- Technology providers

Report Objectives

- To determine and forecast the global managed network services market based on type, vertical, and region from 2023 to 2028, and analyze the various macroeconomic and microeconomic factors that affect the market growth.

- To forecast the size of the market segments concerning five central regions: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the managed network services market.

- Analyze each submarket concerning individual growth trends, prospects, and contributions to the overall market.

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the market.

- To profile the key market players; provide a comparative analysis based on business overviews, regional presence, product offerings, business strategies, and key financials; and illustrate the market’s competitive landscape.

- Track and analyze competitive developments in the market, such as mergers and acquisitions, product developments, partnerships and collaborations, and Research and Development (R&D) activities.

Available Customizations

With the given market data, MarketsandMarkets offers customizations per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further break-up of the Asia Pacific market into countries contributing 75% to the regional market size

- Further break-up of the North American market into countries contributing 75% to the regional market size

- Further break-up of the Latin American market into countries contributing 75% to the regional market size

- Further break-up of the Middle East African market into countries contributing 75% to the regional market size

- Further break-up of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Managed Network Services Market

Gather insights into how big the managed service market is for MSP's who provide private connectivity, like MPLS.

Interested in the Components segmentation of this market for our planning exercise.

Interested in market share data globally and in US for LAN WAN infrastructure managed service provider.