Aircraft Tires Market by Type (Radial-ply and Bias-ply), Aircraft Type (Business and General Aviation, Commercial Aviation, Military Aviation), Platform (Fixed-wing and Rotary-wing aircraft), Position, End-User, and Region - Global Forecast to 2027

Updated on : Oct 22, 2024

The Aircraft Tires Market size is projected to reach USD 1.6 Billion by 2027, it is expected to grow at a CAGR of 2.9% during the forecast period. Aircraft Tires comprises of the rubber components on an aircraft wheel and landing gear that manage taxiing, landing and take-off operations and secure passenger safety.

Advanced aircraft tires are being developed to increase the aircraft's efficiency and safety by enhancing situational awareness through wireless sensing. The adoption of aircraft tires is driven by the demand for integration of light-weight and fuel-efficient tires onboard an aircraft, thereby saving weight and reducing operational and maintenance costs for end users.

To know about the assumptions considered for the study, Request for Free Sample Report

Aircraft Tires Market Dynamics:

Driver: Large existing and growing commercial and military aviation fleets

The commercial and military aircraft fleet of various countries is growing. There is tremendous growth in the fleet size of commercial airlines, including narrow body aircraft, wide body aircraft, and regional transport aircraft, in various countries. This can be attributed to the global demand for air travel, especially in the emerging economies of Asia Pacific and Middle East. According to Boeing, the growth rate of commercial fleets is projected to be 3.1% between 2022 and 2040, and the growth rate of airline traffic is projected to be 4.0% during the same period. The commercial fleet in the Asia Pacific region is expected to grow at the highest rate of 4.2%.

Airline traffic in Latin America is projected to grow at the highest rate of 4.8% during the forecast period due to the increasing number of reputed airline groups reshaping the airline industry. It is projected that over the next 20 years, the highest number of aircraft deliveries will take place in Asia Pacific due to the regional economic growth, market liberalization, new technology-enhanced airplanes expanding further market opportunities, and successful evolution of new business models.

Restraint: Stringent design and manufacturing regulations pertaining to Aircraft Tires

Aerospace component manufacturers all around the globe must adhere to the strict regulations set by various aviation councils of the world. Some of these regulations are as follows:

- Federal Aviation Administration (US), Technical Standard Order: Aircraft Tires (TSO-C62) makes marking tire specifications such as plant code, brand name, production number, skid depth (marked to the nearest hundred), speed rating (miles per hour), etc. mandatorily on an aircraft tire. Manufacturers must put a red dot-shaped balance marker on the tire, which serves as a visual cue to keep them lightweight on the sidewall above the bead.

- The Tire and Rim Association (US) Aircraft Yearbook requires the ply rating indicated on the tire, which must match the specified load rating.

- Federal Aviation Administration (US), Advisory Circular for Inspection, Retread, Repair and Alterations of Aircraft Tires (AC145-4)

- ETSO-C62 (EASA, European Technical Standard Order)

- It is exceedingly challenging to design and build aircraft tires that adhere to all the requirements set forth by various agencies. All tires must complete rigorous tests requiring expensive equipment to obtain certification. For example, aircraft tires must pass a heating test where they have to withstand a temperature of 1480C for about 1 hour. A variety of testing tools must be used on an aircraft tire before it can receive official certification.

- These regulations and standards set by the aviation federation authorities around the globe tend to increase the turnaround time involved in the manufacturing process of aircraft tires.

Opportunity: Growth in UAM and AAM markets

Urban air mobility (UAM) is the use of tiny, highly automated aircraft to carry people or freight at lower altitudes in urban and suburban regions that have been created in response to traffic congestion. It typically refers to established and developing technology, including conventional helicopters, Vertical Take-Off and Landing (VTOL) aircraft, electrically propelled e-VTOL aircraft, and unmanned aerial vehicles (UAVs). By 2030, 60% of the world's population will live in cities, which are currently experiencing severe traffic jams. Thus, the demand for efficient air traffic and airspace is growing. Urban Air Mobility and Advanced Air Mobility solutions have shown immense potential to tackle the constrain of congestions. The rise in usage of these mobility solutions opens up the opportunity for developing advanced tires that could fit the requirement of these aerial vehicles.

Kumho Tire Inc. Co, South Korea in 2022 has received the Red Dot Design Award for its airborne tire designed specifically for the Urban Advanced Mobility (UAM) sector. Its unique mix of revolving wheel devices and magnetic field suspension allows it to create enough power to maneuver an airplane on the ground without additional propulsion. The technology used in this scenario is similar to that used in magnetic levitation train systems.

Challenge: Reductions in weight and cost

Landing gear and tire components have gained increased importance due to the development of heavy transport and military aircraft with high-performance characteristics. Improved tire cord materials, rubber compounds, and tire structural design have led to a steady decrease in the tire to aircraft weight ratio. However, as modern aircraft tire operations become more demanding, the strength limits of tire materials are being monitored more closely. In order to test the strength limits of tire material, methods for predicting the strength limit of aircraft tires on some rational basis other than indoor dynamometer testing are required.

Although significant advances have been made in calculating stresses imposed on cord structures due to load carrying and inflation pressure, the parameter of tire temperature build up has been left untouched. Tire temperature build up is the major cause of tire failure, and no analytical technique has been developed for predicting aircraft tire internal temperatures rationally.

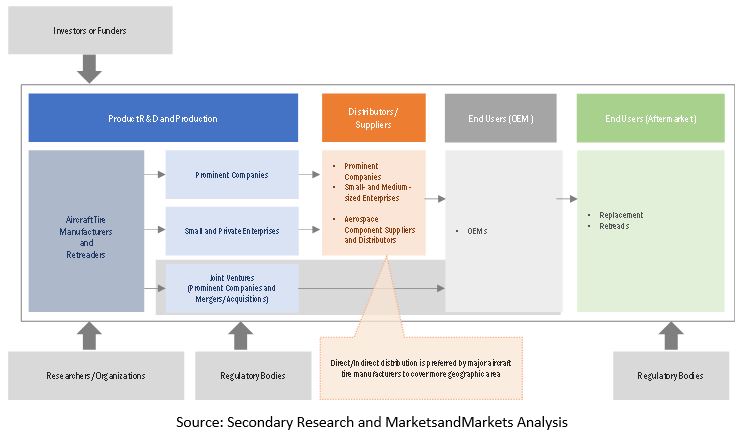

Aircraft Tires Market Ecosystem

Prominent companies that provide aircraft tires, private and small enterprises, distributors/suppliers/retailers, and end customers (airlines, air forces, and MROs) are the key stakeholders in the aircraft tires market ecosystem. Investors, funders, academic researchers, distributors, service providers, and defence procurement authorities are the major influencers in the aircraft tires market.

The radial-ply tire segment is estimated to account for the largest share of the Aircraft Tires market during the forecast period

Based on type, the aircraft tires market is segmented into radial-ply and bias-ply tires. The radial-ply segment is estimated to lead the aircraft tires industry during the forecast period due to the superior technical and design advancements in terms of light-weight and durability, enhanced traction and cut-resistance properties and overall increased fuel-efficiency with reduced carbon emissions. Owing to these properties, many airlines have shifted to radial-ply tires instead of bias-ply. Although, bias-ply tires still are a popular choice in the military aircrafts owing to their hard-casing and durability properties.

The commercial aviation segment is estimated to account for the largest share of the Aircraft Tires market during the forecast period

Based on aircraft type, the aircraft tires market is segmented into commercial aviation, business and regional aviation and military aviation. The Commercial Aviation segment is estimated to lead the aircraft tires market during the forecast period due to the expansion of the existing aircraft fleet by major airline players with light-weight and durable tires for better safety and fuel efficiency. The rise in domestic and international passenger levels will be a key contributor to the aircraft tires market.

Fixed-wing segment projected to lead Aircraft Tires market during the forecast period

Based on platform, the aircraft tires market has been segmented into fixed-wing and rotary-wing aircraft. An increase in international air travel and global air passenger traffic is expected to lead to increased demand for fixed-wing aircraft, thereby contributing to the growth of the aircraft tires market. Fixed-wing aircrafts have the capability of conducting flight operations at high altitudes and long-range distances without the need of frequent refuelling. This particular aspect proves essential in conducting aircraft operations for long-hauls.

Retreading segment is expected to account for the largest share in 2022

Based on End User, the aircraft tires market has been segmented into OEMs, Replacement and Retreading. The OEM segment is forecasted to have the highest CAGR during 2022 to 2027 owing to the increase in aircraft deliveries around the globe. Retreading segment is set to account for the largest market share during the same period owing to its rising popularity in terms of cost and operational efficiency. The retreading process also promotes sustainable manufacturing process in terms of reduced carbon emission and low raw material requirement throughout. Regulations and norms surrounding the retreading of aircraft tires promote a safe and stringent process that would increase the reliability of the segment.

Main Landing Gear segment is expected to have the higher market share during the forecast period

Based on Position, the aircraft tires market has been segmented as Main landing gear and Nose landing gear tires. Main landing gear tires refer to those tires that are deployed at the middle or belly section of the aircraft and are used for distribution of load of the aircraft on the ground. Nose landing gear tires are situated at the frontal section and provide the necessary functions of steering the aircraft while it is on the ground. Both main and nose landing gear tires are essential to carry out the landing and take-off operations of the aircraft. Main landing gear tires segment will account for the larger market share of the aircraft tires market for the forecasted period. This can be attributed to the rise in demand for narrow and wide body aircrafts which generally deploy about 4 to 20 tires for the main landing gear. The number of main landing gear tires is directly proportional to the size of the aircraft.

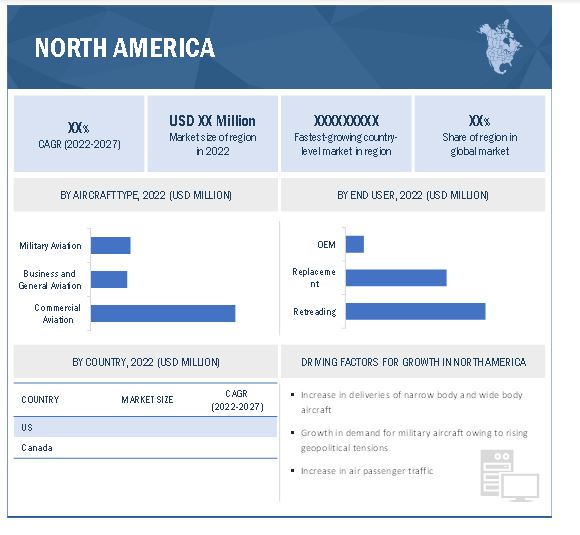

North America is projected to account for the largest share in 2022

North America accounted for the largest market share in 2022 due to increase in by domestic players in advanced aircraft tires systems. The last five years, the US’ aerospace and aviation sector has increased its spending owing to the US government’s focus on the safety of air passengers. The US is likewise investing in the advancement of aircraft tires. Major US-based market players, such as Goodyear Tire and Rubber Co. are significantly investing in the development of alternative sources of natural rubber that would help in reducing their dependency on exports. These factors contribute to the growth of the Aircraft Tires market in the region.

To know about the assumptions considered for the study, download the pdf brochure

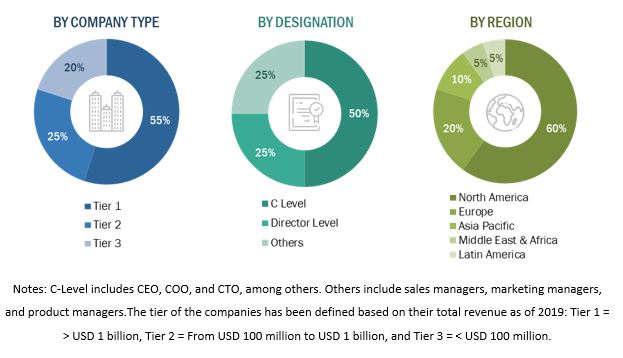

The break-up of profile of primary participants in the Aircraft Tires market:

- By Company Type: Tier 1 – 55%, Tier 2 – 25%, and Tier 3 – 20%

- By Designation: C Level – 50%, Director Level – 25%, Others-25%

- By Region: North America – 60%, Europe – 20%, Asia Pacific – 10%, Middle East – 5%, and Latin America – 5%.

Top Aircraft Tires Companies - Key Market Players

The Aircraft Tires Companies are dominated by a few globally established players such as Michelin (France), Goodyear Tire and Rubber Company (US), Bridgestone Corporation (Japan), Dunlop Aircraft Tyres Ltd. (UK), and Qingdao Sentury Tires Company Limited (China).

Aircraft Tires Market Report Scope:

|

Report Metric |

Details |

| Estimated Market Size | USD 1.4 Billion |

| Revenue Forecast in 2027 | USD 1.6 Billion |

| Growth Rate | 2.9% |

|

Forecast period |

2022-2027 |

|

Market size available for years |

2018-2027 |

|

Base year considered |

2021 |

|

Forecast units |

Value (USD Million/USD Billion) |

|

Segments covered |

By Type, Aircraft Type, Platform, End User, Position and By Region |

|

Geographies covered |

|

|

Companies covered |

Michelin (France), Goodyear Tire and Rubber Company (US), Bridgestone Corporation (Japan), Dunlop Aircraft Tyres Ltd. (UK), Qingdao Sentury Tires Company Limited (China), Wilkerson Aircraft Tires (US), Petlas Tire Corporation (Turkey), Aviation Tires and Treads, LLC (US) and Specialty Tires of America (US) among others |

This research report categorizes the Aircraft Tires Market based on System, Platform, Fit, and Region.

Aircraft Tires Market, By Type

- Radial-ply Tires

- Bias-ply Tires

Aircraft Tires Market, By Aircraft Type

- Commercial Aviation

- Military Aviation

- Business and General Aviation

Aircraft Tires Market, By Platform

- Fixed-wing aircraft

- Rotary-wing aircraft

Aircraft Tires Market, By End User

- OEMs

- Replacement

- Retreading

Aircraft Tires Market, By Position

- Main-landing Tire

- Nose-landing Tire

Aircraft Tires Market, By Region

- North America

- Europe

- Asia Pacific

- Middle East

- Rest of the World

Recent Developments

- In September 2022, Kumho Tyres (South Korea) received the Red Dot Design award in Germany for its ‘Airborne Tire’- an electric tire for urban air mobility solutions. The tire employs the same concept of functioning which is used for magnetic levitation train systems. The tire provides a feasible and optimal solution for the urban air mobility sector which is set to see a rise in the coming few years.

- In April 2022, Goodyear Tire and Rubber Co., (US) entered into a multi-million-dollar program along with the US Department of Defense, the Air Force Research Lab and BioMADE in order to research and develop on an alternative source of natural rubber to be used as the raw material for the manufacturing of aircraft tires. This program is aimed at reducing the dependency of the US on exports of natural rubber from foreign countries.

- In June 2019, Michelin (France) conducted successful trials of connected aircraft tire- PresSense in partnership Safran Group S.A. (France). PresSense consists of wireless-sensing technology to measure and transfer real-time data to the ground-staff. The sensor is capable of measuring the pressure parametric of the tire and relay it to the ground staff.

Frequently Asked Questions (FAQs):

What is the current size of the Aircraft Tires Market?

The Aircraft Tires Market size is projected to grow from USD 1.4 Billion in 2022 to USD 1.6 Billion by 2027, at a CAGR of 2.9% from 2022 to 2027.

Who are the winners in the Aircraft Tires Market?

Major players operating in the Aircraft Tires market include Michelin (France), Goodyear Tire and Rubber Company (US), Bridgestone Corporation (Japan), Dunlop Aircraft Tyres Ltd. (UK) and Qingdao Sentury Tires Company Limited (China).

What are some of the technological advancements in the market?

The Aircraft Tires market is being revolutionized by the advent of alternative sources of natural rubber, composite-based tire materials, wireless-sensing technologies, solutions for the Urban Air Mobility sector, development of light-weight and fuel-efficient technologies, that are designed to elevate the level of safety in an aircraft while providing longer tread life.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 33)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION AND SCOPE

1.3 STUDY SCOPE

1.3.1 AIRCRAFT TIRES MARKET SEGMENTATION

1.3.2 REGIONAL SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

1.4.1 USD EXCHANGE RATES

1.5 INCLUSIONS AND EXCLUSIONS

TABLE 1 AIRCRAFT TIRES MARKET: INCLUSIONS AND EXCLUSIONS

1.6 LIMITATIONS

1.7 MARKET STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 38)

2.1 RESEARCH DATA

FIGURE 1 RESEARCH PROCESS FLOW

FIGURE 2 AIRCRAFT TIRES MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key primary sources

2.2 DEMAND- AND SUPPLY-SIDE ANALYSIS

2.2.1 INTRODUCTION

2.2.2 DEMAND-SIDE INDICATORS

2.2.2.1 Increasing demand for new commercial aircraft

2.2.3 SUPPLY-SIDE INDICATORS

2.2.3.1 Alternative materials to reduce dependency on natural rubber

2.3 MARKET SIZE ESTIMATION

2.3.1 AIRCRAFT TIRES MARKET: SEGMENTS AND SUBSEGMENTS

2.4 RESEARCH APPROACH AND METHODOLOGY

2.4.1 BOTTOM-UP APPROACH

2.4.1.1 Aircraft tires market: Bottom-up approach

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.4.2 AIRCRAFT TIRES MARKET: TOP-DOWN APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.5 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 5 DATA TRIANGULATION

2.6 GROWTH RATE ASSUMPTIONS

2.7 ASSUMPTIONS FOR RESEARCH STUDY

2.8 RISKS

3 EXECUTIVE SUMMARY (Page No. - 47)

FIGURE 6 RADIAL PLY TIRES PROJECTED TO LEAD MARKET FROM 2022 TO 2027

FIGURE 7 COMMERCIAL AVIATION SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

FIGURE 8 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SHARE IN 2022

FIGURE 9 RETREADING TIRES SEGMENT ESTIMATED TO ACCOUNT FOR LARGEST MARKET SHARE IN 2022

4 PREMIUM INSIGHTS (Page No. - 50)

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN AIRCRAFT TIRES MARKET

FIGURE 10 INCREASING DEMAND FOR LIGHTWEIGHT FUEL-EFFICIENT TIRES TO DRIVE MARKET DURING FORECAST PERIOD

4.2 AIRCRAFT TIRES MARKET, BY END USER

FIGURE 11 RETREADING SEGMENT TO HAVE LARGEST MARKET SHARE DURING FORECAST PERIOD

4.3 AIRCRAFT TIRES MARKET, BY AIRCRAFT TYPE

FIGURE 12 COMMERCIAL AVIATION SEGMENT PROJECTED TO LEAD MARKET FROM 2022 TO 2027

4.4 AIRCRAFT TIRES MARKET, BY TYPE

FIGURE 13 RADIAL PLY SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 53)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 14 MARKET DYNAMICS OF AIRCRAFT TIRES MARKET

5.2.1 DRIVERS

5.2.1.1 Large existing and growing commercial and military aviation fleets

TABLE 2 REGIONAL OUTLOOK OF AIR TRAFFIC GROWTH, FLEET GROWTH, AND AIRCRAFT DELIVERIES

5.2.1.2 Growth in air travel

5.2.1.3 Energy efficiency and reduced carbon emissions

5.2.2 RESTRAINTS

5.2.2.1 Stringent aviation regulations

5.2.2.2 High cost of tires

5.2.3 OPPORTUNITIES

5.2.3.1 High growth in emerging markets

5.2.3.2 Growth of UAM and AAM solutions

5.2.4 CHALLENGES

5.2.4.1 Reductions in weight and cost

5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

FIGURE 15 REVENUE SHIFTS IN AIRCRAFT TIRES MARKET

5.3.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR AVIATION TIRE MANUFACTURERS

5.4 TRADE ANALYSIS

5.4.1 IMPORT SCENARIO OF AIRCRAFT TIRES-2021

5.4.2 EXPORT SCENARIO OF AIRCRAFT TIRES -2021

5.5 PRICING ANALYSIS

TABLE 3 AVERAGE SELLING PRICE RANGE: AVIATION TIRES MARKET (BY TYPE)

5.6 MARKET ECOSYSTEM

5.6.1 PROMINENT COMPANIES

5.6.2 PRIVATE AND SMALL ENTERPRISES

5.6.3 END USERS

FIGURE 16 MARKET ECOSYSTEM MAP: AIRCRAFT TIRES

TABLE 4 AIRCRAFT TIRES MARKET ECOSYSTEM

5.7 VALUE CHAIN ANALYSIS

FIGURE 17 VALUE CHAIN ANALYSIS: AIRCRAFT TIRES MARKET

5.8 TECHNOLOGY ANALYSIS

5.8.1 MATERIAL INNOVATION

5.9 CASE STUDY ANALYSIS

5.9.1 ENHANCED TREAD PATTERNS TO IMPROVE TIRE LIFE

5.10 PORTER’S FIVE FORCES MODEL

FIGURE 18 AIRCRAFT TIRES MARKET: PORTER’S FIVE FORCES ANALYSIS

5.10.1 AIRCRAFT TIRES MARKET: PORTER’S FIVE FORCES ANALYSIS

5.10.2 THREAT OF NEW ENTRANTS

5.10.3 THREAT OF SUBSTITUTES

5.10.4 BARGAINING POWER OF SUPPLIERS

5.10.5 BARGAINING POWER OF BUYERS

5.10.6 INTENSITY OF COMPETITIVE RIVALRY

5.11 KEY STAKEHOLDERS AND BUYING CRITERIA

5.11.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 19 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR AIRCRAFT TIRES

TABLE 5 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR AIRCRAFT TIRES (%)

5.11.2 BUYING CRITERIA

FIGURE 20 KEY BUYING CRITERIA FOR AIRCRAFT TIRES

TABLE 6 KEY BUYING CRITERIA FOR AIRCRAFT TIRES

5.12 KEY CONFERENCES AND EVENTS IN 2022–2023

TABLE 7 AIRCRAFT TIRES MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

5.13 TARIFF REGULATORY LANDSCAPE FOR AEROSPACE INDUSTRY

TABLE 8 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 9 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 10 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 11 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

6 INDUSTRY TRENDS (Page No. - 71)

6.1 INTRODUCTION

6.2 SUPPLY CHAIN ANALYSIS

FIGURE 21 SUPPLY CHAIN ANALYSIS

6.3 INDUSTRY TRENDS

6.3.1 INCREASING PREFERENCE FOR RADIAL TIRES

6.3.2 DEVELOPMENT OF INTELLIGENT AIRCRAFT TIRES

6.3.3 DEVELOPMENT OF ECONOMICAL AND ENVIRONMENT-FRIENDLY AIRCRAFT TIRES

6.4 IMPACT OF MEGA TRENDS

6.5 INNOVATIONS AND PATENT REGISTRATIONS

TABLE 12 INNOVATIONS AND PATENT REGISTRATIONS

7 AIRCRAFT TIRES, BY TYPE (Page No. - 76)

7.1 INTRODUCTION

FIGURE 22 RADIAL TIRES TO LEAD MARKET FROM 2022 TO 2027

TABLE 13 AIRCRAFT TIRES MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 14 AIRCRAFT TIRE MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 15 AIRCRAFT TIRE MARKET, BY TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 16 AIRCRAFT TIRES MARKET, BY TYPE, 2022–2027 (THOUSAND UNITS)

7.2 RADIAL PLY

7.3 BIAS PLY

8 AIRCRAFT TIRES MARKET, BY AIRCRAFT TYPE (Page No. - 80)

8.1 INTRODUCTION

FIGURE 23 COMMERCIAL AVIATION SEGMENT PROJECTED TO HAVE HIGHEST MARKET SHARE FROM 2022 TO 2027

TABLE 17 AIRCRAFT TIRES MARKET, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

TABLE 18 MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

TABLE 19 MARKET, BY AIRCRAFT TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 20 MARKET, BY AIRCRAFT TYPE, 2022–2027 (THOUSAND UNITS)

8.2 COMMERCIAL AVIATION

FIGURE 24 WIDE BODY SEGMENT PROJECTED TO HAVE HIGHEST MARKET SHARE DURING FORECAST PERIOD

TABLE 21 AIRCRAFT TIRES MARKET, BY COMMERCIAL AVIATION, 2018–2021 (USD MILLION)

TABLE 22 AIRCRAFT TIRESMARKET, BY COMMERCIAL AVIATION, 2022–2027 (USD MILLION)

8.2.1 NARROW BODY

8.2.1.1 Rising domestic travel to increase demand

8.2.2 WIDE BODY

8.2.2.1 Increased focus on long-haul routes to drive demand

8.2.3 REGIONAL TRANSPORT AVIATION

8.2.3.1 Links underserved and unserved tier II cities

8.3 BUSINESS AND GENERAL AVIATION

FIGURE 25 BUSINESS JETS TO ACQUIRE HIGHEST GROWTH RATE FROM 2022 TO 2027

TABLE 23 AIRCRAFT TIRES MARKET, BY BUSINESS AND GENERAL AVIATION, 2018–2021 (USD MILLION)

TABLE 24 AIRCRAFT TIRE MARKET, BY BUSINESS AND GENERAL AVIATION, 2022–2027 (USD MILLION)

8.3.1 BUSINESS JETS

8.3.1.1 Growth of private aviation companies to drive demand

8.3.2 LIGHT & ULTRALIGHT AIRCRAFT

8.3.2.1 Reduced operating and maintenance costs

8.4 MILITARY AVIATION

FIGURE 26 COMBAT AIRCRAFT SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

TABLE 25 AIRCRAFT TIRES MARKET, BY MILITARY AVIATION, 2018–2021 (USD MILLION)

TABLE 26 AIRCRAFT TIRE MARKET, BY MILITARY AVIATION, 2022–2027 (USD MILLION)

8.4.1 COMBAT AIRCRAFT

8.4.1.1 Backed by development projects and higher military spending

8.4.2 TRANSPORT AIRCRAFT

8.4.2.1 Growing military use to drive demand

8.4.3 SPECIAL MISSION AIRCRAFT

8.4.3.1 Enhanced warfare tactics and strategies

8.4.4 HELICOPTERS

8.4.4.1 Increased focus on military applications and border security

8.4.5 TRAINER AIRCRAFT

8.4.5.1 Increasing complexity of modern aircraft

9 AIRCRAFT TIRES MARKET, BY PLATFORM (Page No. - 89)

9.1 INTRODUCTION

FIGURE 27 FIXED-WING SEGMENT TO HAVE HIGHEST MARKET SHARE FROM 2022 TO 2027

TABLE 27 AIRCRAFT TIRES MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 28 AIRCRAFT TIRES MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

9.2 FIXED-WING

9.2.1 DRIVEN BY INCREASED AVIATION TRAFFIC AND FLEET SIZE

9.3 ROTARY-WING

9.3.1 RISING POPULARITY DUE TO OPERATIONAL CAPABILITIES

10 AIRCRAFT TIRES MARKET, BY END USER (Page No. - 92)

10.1 INTRODUCTION

FIGURE 28 OEM PROJECTED TO HAVE HIGHEST GROWTH RATE DURING FORECAST PERIOD

TABLE 29 AIRCRAFT TIRES MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 30 MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 31 MARKET, BY END USER, 2018–2021 (THOUSAND UNITS)

TABLE 32 MARKET, BY END USER, 2022–2027 (THOUSAND UNITS)

10.2 ORIGINAL EQUIPMENT MANUFACTURER (OEM)

10.2.1 INCREASING NEED FOR NEW AIRCRAFT DRIVES GROWTH

10.3 REPLACEMENT

10.3.1 FREQUENT REPLACEMENT DUE TO INCREASED COMPLEXITY OF OPERATIONS AND LANDING CYCLES

10.4 RETREADING

10.4.1 INEXPENSIVE AND CLEANER ALTERNATIVE TO NEW TIRES

11 AIRCRAFT TIRES MARKET, BY POSITION (Page No. - 96)

11.1 INTRODUCTION

FIGURE 29 MAIN LANDING GEAR PROJECTED TO LEAD MARKET DURING FORECAST PERIOD

TABLE 33 AIRCRAFT TIRES MARKET, BY POSITION, 2018–2021 (USD MILLION)

TABLE 34 MARKET, BY POSITION, 2022–2027 (USD MILLION)

TABLE 35 MARKET, BY POSITION, 2018–2021 (THOUSAND UNITS)

TABLE 36 MARKET, BY POSITION, 2022–2027 (THOUSAND UNITS)

11.2 NOSE LANDING GEAR

11.2.1 PROVIDES STABLE OPERATIONS

11.3 MAIN LANDING GEAR

11.3.1 HANDLES HARSH OPERATIONAL CONDITIONS

12 REGIONAL ANALYSIS (Page No. - 100)

12.1 INTRODUCTION

FIGURE 30 NORTH AMERICA ESTIMATED TO ACCOUNT FOR LARGEST MARKET SHARE IN 2022

TABLE 37 AIRCRAFT TIRES MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 38 AIRCRAFT TIRE MARKET, BY REGION, 2022–2027 (USD MILLION)

12.2 NORTH AMERICA

12.2.1 PESTLE ANALYSIS: NORTH AMERICA

FIGURE 31 NORTH AMERICA: AIRCRAFT TIRES MARKET SNAPSHOT

TABLE 39 NORTH AMERICA: AIRCRAFT TIRE MARKET, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

TABLE 40 NORTH AMERICA: AIRCRAFT TIRES MARKET, BY AIRCRAFT TYPE 2022–2027 (USD MILLION)

TABLE 41 NORTH AMERICA: COMMERCIAL AVIATION AIRCRAFT TIRE MARKET, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

TABLE 42 NORTH AMERICA: COMMERCIAL AVIATION AIRCRAFT TIRE MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

TABLE 43 NORTH AMERICA: BUSINESS AND GENERAL AVIATION AIRCRAFT TIRES MARKET, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

TABLE 44 NORTH AMERICA: BUSINESS AND GENERAL AVIATION AIRCRAFT TIRE MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

TABLE 45 NORTH AMERICA: MILITARY AVIATION AIRCRAFT TIRES MARKET, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

TABLE 46 NORTH AMERICA: MILITARY AVIATION AIRCRAFT TIRE MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

TABLE 47 NORTH AMERICA: AIRCRAFT TIRES MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 48 NORTH AMERICA: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 49 NORTH AMERICA: MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 50 NORTH AMERICA: MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 51 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 52 NORTH AMERICA: AIRCRAFT TIRES MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

12.2.2 US

12.2.2.1 Presence of major industrial OEMs and small players

TABLE 53 US: AIRCRAFT TIRES MARKET, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

TABLE 54 US: MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

TABLE 55 US: MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 56 US: MARKET, BY END USER, 2022–2027 (USD MILLION)

12.2.3 CANADA

12.2.3.1 Increased focus on developing advanced fleet for military

TABLE 57 CANADA: AIRCRAFT TIRES MARKET, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

TABLE 58 CANADA: AIRCRAFT TIRE MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

TABLE 59 CANADA: AIRCRAFT TIRES MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 60 CANADA: AIRCRAFT TIRE MARKET, BY END USER, 2022–2027 (USD MILLION)

12.3 EUROPE

12.3.1 PESTLE ANALYSIS: EUROPE

FIGURE 32 EUROPE: AIRCRAFT TIRES MARKET SNAPSHOT

TABLE 61 EUROPE: MARKET, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

TABLE 62 EUROPE: MARKET, BY AIRCRAFT TYPE 2022–2027 (USD MILLION)

TABLE 63 EUROPE: COMMERCIAL AVIATION AIRCRAFT TIRES MARKET, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

TABLE 64 EUROPE: COMMERCIAL AVIATION AIRCRAFT TIRE MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

TABLE 65 EUROPE: BUSINESS AND GENERAL AVIATION AIRCRAFT TIRES MARKET, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

TABLE 66 EUROPE: BUSINESS AND GENERAL AVIATION AIRCRAFT TIRE MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

TABLE 67 EUROPE: MILITARY AVIATION AIRCRAFT TIRES MARKET, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

TABLE 68 EUROPE: MILITARY AVIATION AIRCRAFT TIRE MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

TABLE 69 EUROPE: AIRCRAFT TIRES MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 70 EUROPE: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 71 EUROPE: MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 72 EUROPE: MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 73 EUROPE: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 74 EUROPE: AIRCRAFT TIRES MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

12.3.2 GERMANY

12.3.2.1 Rise in passenger traffic and procurement of advanced fighter jets

TABLE 75 GERMANY: AIRCRAFT TIRES MARKET, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

TABLE 76 GERMANY: MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

TABLE 77 GERMANY: MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 78 GERMANY: MARKET, BY END USER, 2022–2027 (USD MILLION)

12.3.3 UK

12.3.3.1 Ongoing technological developments and expansion of commercial aircraft fleets

TABLE 79 UK: AIRCRAFT TIRES MARKET, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

TABLE 80 UK: MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

TABLE 81 UK: MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 82 UK: MARKET, BY END USER, 2022–2027 (USD MILLION)

12.3.4 FRANCE

12.3.4.1 Increased competition in airline industry

TABLE 83 FRANCE: AIRCRAFT TIRES MARKET, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

TABLE 84 FRANCE: MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

TABLE 85 FRANCE: MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 86 FRANCE: AIRCRAFT TIRES MARKET, BY END USER, 2022–2027 (USD MILLION)

12.3.5 RUSSIA

12.3.5.1 Emphasis on increasing manufacturing capability of commercial aircraft

TABLE 87 RUSSIA: MARKET, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

TABLE 88 RUSSIA: AIRCRAFT TIRES MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

TABLE 89 RUSSIA: AIRCRAFT TIRES MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 90 RUSSIA: MARKET, BY END USER, 2022–2027 (USD MILLION)

12.3.6 IRELAND

12.3.6.1 Increased passenger traffic to drive market

TABLE 91 IRELAND: AIRCRAFT TIRES MARKET, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

TABLE 92 IRELAND: MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

TABLE 93 IRELAND: MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 94 IRELAND: MARKET, BY END USER, 2022–2027 (USD MILLION)

12.3.7 SPAIN

12.3.7.1 Increased tourism activities

TABLE 95 SPAIN: AIRCRAFT TIRES MARKET, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

TABLE 96 SPAIN: MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

TABLE 97 SPAIN: MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 98 SPAIN: MARKET, BY END USER, 2022–2027 (USD MILLION)

12.3.8 REST OF EUROPE

12.3.8.1 Growing air passenger traffic

TABLE 99 REST OF EUROPE: AIRCRAFT TIRES MARKET, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

TABLE 100 REST OF EUROPE: AIRCRAFT TIRE MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

TABLE 101 REST OF EUROPE: AIRCRAFT TIRES MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 102 REST OF EUROPE: AIRCRAFT TIRE MARKET, BY END USER, 2022–2027 (USD MILLION)

12.4 ASIA PACIFIC

12.4.1 PESTLE ANALYSIS: ASIA PACIFIC

FIGURE 33 ASIA PACIFIC: AIRCRAFT TIRES MARKET SNAPSHOT

TABLE 103 ASIA PACIFIC: MARKET, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

TABLE 104 ASIA PACIFIC: MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

TABLE 105 ASIA PACIFIC: COMMERCIAL AVIATION AIRCRAFT TIRES MARKET, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

TABLE 106 ASIA PACIFIC: COMMERCIAL AVIATION AIRCRAFT TIRES MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

TABLE 107 ASIA PACIFIC: BUSINESS AND GENERAL AVIATION AIRCRAFT TIRE MARKET, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

TABLE 108 ASIA PACIFIC: BUSINESS AND GENERAL AVIATION AIRCRAFT TIRE MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

TABLE 109 ASIA PACIFIC: MILITARY AVIATION AIRCRAFT TIRES MARKET, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

TABLE 110 ASIA PACIFIC: MILITARY AVIATION AIRCRAFT TIRE MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

TABLE 111 ASIA PACIFIC: AIRCRAFT TIRES MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 112 ASIA PACIFIC: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 113 ASIA PACIFIC: MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 114 ASIA PACIFIC: MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 115 ASIA PACIFIC: MARKET, BY COUNTRY 2018–2021 (USD MILLION)

TABLE 116 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

12.4.2 CHINA

12.4.2.1 Increased investment in helicopter medical services

TABLE 117 CHINA: AIRCRAFT TIRES MARKET, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

TABLE 118 CHINA: AIRCRAFT TIRE MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

TABLE 119 CHINA: AIRCRAFT TIRES MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 120 CHINA: AIRCRAFT TIRE MARKET, BY END USER, 2022–2027 (USD MILLION)

12.4.3 INDIA

12.4.3.1 Improved domestic connectivity

TABLE 121 INDIA: AIRCRAFT TIRES MARKET, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

TABLE 122 INDIA: MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

TABLE 123 INDIA: MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 124 INDIA: MARKET, BY END USER, 2022–2027 (USD MILLION)

12.4.4 JAPAN

12.4.4.1 Expanding military and commercial fleets

TABLE 125 JAPAN: AIRCRAFT TIRES MARKET, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

TABLE 126 JAPAN: MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

TABLE 127 JAPAN: MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 128 JAPAN: MARKET, BY END USER, 2022–2027 (USD MILLION)

12.4.5 SOUTH KOREA

12.4.5.1 Rising air traffic and cargo operations

TABLE 129 SOUTH KOREA: AIRCRAFT TIRES MARKET, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

TABLE 130 SOUTH KOREA: MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

TABLE 131 SOUTH KOREA: MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 132 SOUTH KOREA: MARKET, BY END USER, 2022–2027 (USD MILLION)

12.4.6 AUSTRALIA

12.4.6.1 Procurement of different types of aircraft

TABLE 133 AUSTRALIA: AIRCRAFT TIRES MARKET, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

TABLE 134 AUSTRALIA: MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

TABLE 135 AUSTRALIA: MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 136 AUSTRALIA: MARKET, BY END USER, 2022–2027 (USD MILLION)

12.4.7 REST OF ASIA PACIFIC

12.4.7.1 Government support for developing advanced avionics systems

TABLE 137 REST OF ASIA PACIFIC: AIRCRAFT TIRES MARKET, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

TABLE 138 REST OF ASIA PACIFIC: AIRCRAFT TIRE MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

TABLE 139 REST OF ASIA PACIFIC: AIRCRAFT TIRE MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 140 REST OF ASIA PACIFIC: AIRCRAFT TIRE MARKET, BY END USER, 2022–2027 (USD MILLION)

12.5 MIDDLE EAST

12.5.1 PESTLE ANALYSIS: MIDDLE EAST

FIGURE 34 MIDDLE EAST: AIRCRAFT TIRES MARKET SNAPSHOT

TABLE 141 MIDDLE EAST: AIRCRAFT TIRE MARKET, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

TABLE 142 MIDDLE EAST: MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

TABLE 143 MIDDLE EAST: COMMERCIAL AVIATION AIRCRAFT TIRES MARKET, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

TABLE 144 MIDDLE EAST: COMMERCIAL AVIATION AIRCRAFT TIRE MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

TABLE 145 MIDDLE EAST: BUSINESS AND GENERAL AVIATION AIRCRAFT TIRE MARKET, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

TABLE 146 MIDDLE EAST: BUSINESS AND GENERAL AVIATION AIRCRAFT TIRES MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

TABLE 147 MIDDLE EAST: MILITARY AVIATION AIRCRAFT TIRE MARKET, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

TABLE 148 MIDDLE EAST: MILITARY AVIATION AIRCRAFT TIRES MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

TABLE 149 MIDDLE EAST: AIRCRAFT TIRES MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 150 MIDDLE EAST: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 151 MIDDLE EAST: MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 152 MIDDLE EAST: MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 153 MIDDLE EAST: MARKET, BY COUNTRY 2018–2021 (USD MILLION)

TABLE 154 MIDDLE EAST: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

12.5.2 UAE

12.5.2.1 Increasing demand for private planes

TABLE 155 UAE: AIRCRAFT TIRES MARKET, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

TABLE 156 UAE: MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

TABLE 157 UAE: MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 158 UAE: MARKET, BY END USER, 2022–2027 (USD MILLION)

12.5.3 SAUDI ARABIA

12.5.3.1 Modernization of existing fleets

TABLE 159 SAUDI ARABIA: AIRCRAFT TIRES MARKET, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

TABLE 160 SAUDI ARABIA: AIRCRAFT TIRE MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

TABLE 161 SAUDI ARABIA: AIRCRAFT TIRES MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 162 SAUDI ARABIA: AIRCRAFT TIRE MARKET, BY END USER, 2022–2027 (USD MILLION)

12.5.4 TURKEY

12.5.4.1 Rising military and commercial fleets

TABLE 163 TURKEY: AIRCRAFT TIRES MARKET, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

TABLE 164 TURKEY: MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

TABLE 165 TURKEY: MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 166 TURKEY: MARKET, BY END USER, 2022–2027 (USD MILLION)

12.5.5 REST OF MIDDLE EAST

12.5.5.1 Market expansion due to growing tourism sector

TABLE 167 REST OF MIDDLE EAST: AIRCRAFT TIRES MARKET, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

TABLE 168 REST OF MIDDLE EAST: MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

TABLE 169 REST OF MIDDLE EAST: MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 170 REST OF MIDDLE EAST: MARKET, BY END USER, 2022–2027 (USD MILLION)

12.6 REST OF THE WORLD

12.6.1 PESTLE ANALYSIS: REST OF THE WORLD

FIGURE 35 REST OF THE WORLD: AIRCRAFT TIRES MARKET SNAPSHOT

TABLE 171 REST OF THE WORLD: AIRCRAFT TIRE MARKET, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

TABLE 172 REST OF THE WORLD: AIRCRAFT TIRE MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

TABLE 173 REST OF THE WORLD: COMMERCIAL AVIATION AIRCRAFT TIRES MARKET, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

TABLE 174 REST OF THE WORLD: COMMERCIAL AVIATION AIRCRAFT TIRES MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

TABLE 175 REST OF THE WORLD: BUSINESS AND GENERAL AVIATION AIRCRAFT TIRE MARKET, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

TABLE 176 REST OF THE WORLD: BUSINESS AND GENERAL AVIATION AIRCRAFT TIRE MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

TABLE 177 REST OF THE WORLD: MILITARY AVIATION AIRCRAFT TIRE MARKET, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

TABLE 178 REST OF THE WORLD: MILITARY AVIATION AIRCRAFT TIRES MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

TABLE 179 REST OF THE WORLD: MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 180 REST OF THE WORLD: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 181 REST OF THE WORLD: MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 182 REST OF THE WORLD: AIRCRAFT TIRES MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 183 REST OF THE WORLD: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 184 REST OF THE WORLD: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

12.6.2 BRAZIL

12.6.2.1 Increasing demand for modern narrow body aircraft

TABLE 185 BRAZIL: AIRCRAFT TIRES MARKET, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

TABLE 186 BRAZIL: BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

TABLE 187 BRAZIL: MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 188 BRAZIL: AIRCRAFT TIRES MARKET, BY END USER, 2022–2027 (USD MILLION)

12.6.3 MEXICO

12.6.3.1 Domestic airline demand for commercial aircraft

TABLE 189 MEXICO: AIRCRAFT TIRES MARKET, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

TABLE 190 MEXICO: AIRCRAFT TIRE MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

TABLE 191 MEXICO: MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 192 MEXICO: MARKET, BY END USER, 2022–2027 (USD MILLION)

12.6.4 SOUTH AFRICA

12.6.4.1 Increased use of private jets and expanding tourism industry

TABLE 193 SOUTH AFRICA: AIRCRAFT TIRES MARKET, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

TABLE 194 SOUTH AFRICA: MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

TABLE 195 SOUTH AFRICA: MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 196 SOUTH AFRICA: MARKET, BY END USER, 2022–2027 (USD MILLION)

13 COMPETITIVE LANDSCAPE (Page No. - 158)

13.1 INTRODUCTION

13.2 MARKET SHARE ANALYSIS, 2021

TABLE 197 DEGREE OF COMPETITION

FIGURE 36 MARKET SHARE OF TOP PLAYERS IN AIRCRAFT TIRES MARKET, 2021 (%)

13.3 REVENUE ANALYSIS OF TOP 5 MARKET PLAYERS, 2021

FIGURE 37 REVENUE ANALYSIS OF TOP 5 MARKET PLAYERS IN AIRCRAFT TIRES MARKET

13.4 COMPANY EVALUATION QUADRANT

13.4.1 STARS

13.4.2 EMERGING LEADERS

13.4.3 PERVASIVE PLAYERS

13.4.4 PARTICIPANTS

FIGURE 38 AIRCRAFT TIRES MARKET COMPETITIVE LEADERSHIP MAPPING, 2021

TABLE 198 COMPANY PRODUCT FOOTPRINT

TABLE 199 COMPANY FOOTPRINT, BY SOLUTIONS

TABLE 200 COMPANY REGION FOOTPRINT

13.5 STARTUPS/SME EVALUATION QUADRANT

13.5.1 PROGRESSIVE COMPANIES

13.5.2 RESPONSIVE COMPANIES

13.5.3 DYNAMIC COMPANIES

13.5.4 STARTING BLOCKS

FIGURE 39 AIRCRAFT TIRES MARKET STARTUPS/SME COMPETITIVE LEADERSHIP MAPPING, 2021

13.5.5 COMPETITIVE BENCHMARKING

TABLE 201 AIRCRAFT TIRES MARKET: DETAILED LIST OF KEY STARTUPS/SMES

13.6 COMPETITIVE SCENARIO

13.6.1 DEALS

TABLE 202 DEALS, 2018–2022

13.6.2 PRODUCT LAUNCHES

14 COMPANY PROFILES (Page No. - 170)

14.1 INTRODUCTION

14.2 MANUFACTURERS

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

14.2.1 BRIDGESTONE CORPORATION

TABLE 204 BRIDGESTONE CORPORATION: BUSINESS OVERVIEW

FIGURE 40 BRIDGESTONE CORPORATION: COMPANY SNAPSHOT

TABLE 205 BRIDGESTONE CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 206 BRIDGESTONE CORPORATION: DEALS

14.2.2 GOODYEAR TIRE AND RUBBER COMPANY

TABLE 207 GOODYEAR TIRE AND RUBBER COMPANY: BUSINESS OVERVIEW

FIGURE 41 GOODYEAR TIRE AND RUBBER COMPANY: COMPANY SNAPSHOT

TABLE 208 GOODYEAR TIRE AND RUBBER COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 209 GOODYEAR TIRE AND RUBBER COMPANY: PRODUCT LAUNCHES

TABLE 210 GOODYEAR TIRE AND RUBBER COMPANY: DEALS

14.2.3 MICHELIN

TABLE 211 MICHELIN: BUSINESS OVERVIEW

FIGURE 42 MICHELIN: COMPANY SNAPSHOT

TABLE 212 MICHELIN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 213 MICHELIN: PRODUCT LAUNCHES

TABLE 214 MICHELIN: DEALS

14.2.4 DUNLOP AIRCRAFT TYRES LTD.

TABLE 215 DUNLOP AIRCRAFT TYRES LTD.: BUSINESS OVERVIEW

TABLE 216 DUNLOP AIRCRAFT TYRES LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 217 DUNLOP AIRCRAFT TYRES LTD.: DEALS

14.2.5 QINGDAO SENTURY TIRE CO. LTD.

TABLE 218 QINGDAO SENTURY TIRE CO. LTD.: BUSINESS OVERVIEW

FIGURE 43 QINGDAO SENTURY TIRE CO. LTD.: COMPANY SNAPSHOT

TABLE 219 QINGDAO SENTURY TIRE CO. LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 220 QINGDAO SENTURY TIRE CO. LTD.: DEALS

14.2.6 SPECIALTY TIRES OF AMERICA, INC.

TABLE 221 SPECIALTY TIRES OF AMERICA, INC.: BUSINESS OVERVIEW

TABLE 222 SPECIALTY TIRES OF AMERICA, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

14.2.7 PETLAS TIRE CORPORATION

TABLE 223 PETLAS TIRE CORPORATION: BUSINESS OVERVIEW

14.2.8 AVIATION TIRES AND TREADS, LLC

TABLE 224 AVIATION TIRES AND TREADS, LLC: BUSINESS OVERVIEW

TABLE 225 AVIATION TIRES AND TREADS, LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

14.2.9 PGZ STOMIL POZNAN S.A.

TABLE 226 PGZ STOMIL POZNAN S.A.: BUSINESS OVERVIEW

14.2.10 GUILIN LANYU AIRCRAFT TIRE DEVELOPMENT CO. LTD.

TABLE 227 GUILIN LANYU AIRCRAFT TIRE DEVELOPMENT CO. LTD.: BUSINESS OVERVIEW

TABLE 228 GUILIN LANYU AIRCRAFT TIRE DEVELOPMENT CO. LTD.: DEALS

14.3 DISTRIBUTORS

14.3.1 DESSER AEROSPACE

TABLE 229 DESSER AEROSPACE: BUSINESS OVERVIEW

TABLE 230 DESSER AEROSPACE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 231 DESSER AEROSPACE: DEALS

14.3.2 WILKERSON AIRCRAFT TIRES

TABLE 232 WILKERSON AIRCRAFT TIRES: BUSINESS OVERVIEW

14.3.3 WATTS AVIATION AIRCRAFT TIRES

TABLE 233 WATTS AVIATION AIRCRAFT TIRES: BUSINESS OVERVIEW

TABLE 234 WATTS AVIATION AIRCRAFT TIRES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

14.3.4 AIRCRAFT SPRUCE AND SPECIALTY

TABLE 235 AIRCRAFT SPRUCE AND SPECIALTY: BUSINESS OVERVIEW

14.3.5 BOEING DISTRIBUTION SERVICES INC. (FORMERLY AVIALL)

TABLE 236 BOEING DISTRIBUTION SERVICES INC.: BUSINESS OVERVIEW

TABLE 237 BOEING DISTRIBUTION SERVICES INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

15 APPENDIX (Page No. - 199)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 CUSTOMIZATION OPTIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

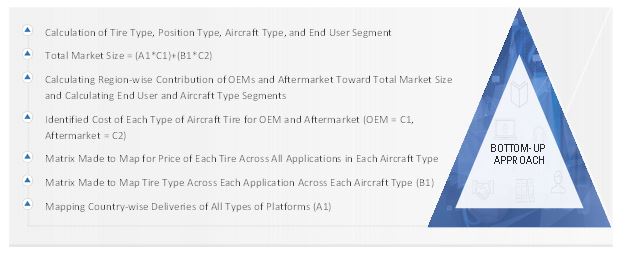

The study involved four major activities in estimating the current market size for the Aircraft Tires market. Exhaustive secondary research was conducted to collect information on the market, the peer markets, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation procedures were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as D&B Hoovers, Bloomberg, BusinessWeek, and different magazines were referred to identify and collect information for this study. Secondary sources also included annual reports, press releases & investor presentations of companies, certified publications, articles by recognized authors, and simulators databases.

Primary Research

The Aircraft Tires market comprises several stakeholders, such as raw material providers, aircraft tires manufacturers and suppliers, and regulatory organizations in the supply chain. While the demand side of this market is characterized by various end users, the supply side is characterized by technological advancements in aircraft tires systems. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the aircraft tires market. These methods were also used extensively to estimate the size of various subsegments of the market. The research methodology used to estimate the market size includes the following:

- Key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Market size estimation methodology: Bottom-up approach

The bottom-up approach was employed to arrive at the overall size of the Aircraft Tires market from the demand for Aircraft Tires systems by the end users in each country, and the average cost of integration for both line-fit and retrofit installation was multiplied by new aircraft deliveries and MRO fleet, respectively. These calculations led to the estimation of the overall market size.

Market size estimation methodology: Top-down approach

In the top-down approach, the overall market size was used to estimate the size of the individual markets (mentioned in market segmentation) through percentage splits obtained from secondary and primary research.

The most appropriate and immediate parent market size was used to calculate the specific market segments to implement the top-down approach. The bottom-up approach was also implemented to validate the market segment revenues obtained.

Market shares were then estimated for each company to verify the revenue shares used earlier in the bottom-up approach. With data triangulation procedure and data validation through primaries, the overall parent market size and each market size were determined and confirmed in this study. The data triangulation procedure used for this study is explained in the market breakdown and triangulation section.

Data Triangulation

After arriving at the overall market size-using the market size estimation process explained above-the market was split into several segments and subsegments. Data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides of the aircraft tires market.

Report Objectives

- To identify and analyze key drivers, restraints, challenges, and opportunities influencing the growth of the aircraft tires market

- To analyze the impact of macro and micro indicators on the market

- To forecast the market size of segments for five regions, namely, North America, Europe, Asia Pacific, Middle East, and Rest of the World, along with major countries in each of these regions

- To strategically analyze micro markets with respect to individual technological trends, prospects, and their contribution to the overall market

- To strategically profile key market players and comprehensively analyze their market ranking and core competencies

- To provide a detailed competitive landscape of the market, along with an analysis of business and corporate strategies, such as contracts, agreements, partnerships, expansions, and new product developments

- To identify detailed financial positions, key products, unique selling points, and key developments of leading companies in the market

Data Triangulation

After arriving at the overall market size-using the market size estimation process explained above-the market was split into several segments and subsegments. Data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides of the aircraft tires market.

Report Objectives

- To identify and analyze key drivers, restraints, challenges, and opportunities influencing the growth of the aircraft tires market

- To analyze the impact of macro and micro indicators on the market

- To forecast the market size of segments for five regions, namely, North America, Europe, Asia Pacific, Middle East, and Rest of the World, along with major countries in each of these regions

- To strategically analyze micro markets with respect to individual technological trends, prospects, and their contribution to the overall market

- To strategically profile key market players and comprehensively analyze their market ranking and core competencies

- To provide a detailed competitive landscape of the market, along with an analysis of business and corporate strategies, such as contracts, agreements, partnerships, expansions, and new product developments

- To identify detailed financial positions, key products, unique selling points, and key developments of leading companies in the market

Available customizations

Along with the market data, MarketsandMarkets offers customizations as per the specific needs of companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the market segments at country-level

Company Information

- Detailed analysis and profiling of additional market players (up to 6)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Aircraft Tires Market

I’m getting into the aircraft manufacturing industry. So, I need more research on the market forecast in South Africa and Africa as a whole by 2020.